Workday Stock Falls After Loss Doubles; Adjusted. EPS Falls Short

27 May 2022 - 7:33AM

Dow Jones News

By Will Feuer

Shares of Workday Inc. fell more than 9% in after-hours trading

after the human resources cloud-software company posted

first-quarter adjusted earnings that came up short of expectations

and modestly raised some aspects of its full-year guidance.

The company posted a quarterly loss of $102.2 million, or 41

cents a share, compared with $46.5 million, or 19 cents a share, a

year earlier. Analysts surveyed by FactSet were expecting a loss of

44 cents a share.

Stripping out stock-based compensation and other one-time items,

adjusted earnings came in at 83 cents a share. Analysts surveyed by

FactSet were expecting adjusted earnings of 85 cents a share.

Total revenues rose 22% to $1.43 billion, matching analysts'

expectations, according to FactSet.

The company modestly raised its fiscal 2023 subscription revenue

guidance to a range of $5.537 billion to $5.557 billion, up from

the range of $5.530 billion to $5.550 billion it had offered in

February.

The company said it expects current-quarter subscription revenue

of $1.353 billion to $1.355 billion. According to FactSet, analysts

were expecting second-quarter subscription revenue of $1.353

billion.

Workday maintained its adjusted operating margin guidance of

18.5% for the year.

The stock tumbled after results, falling 9% to $153 a share.

Shares were down more than 38% so far this year, before the

after-hours drop.

Write to Will Feuer at Will.Feuer@wsj.com

(END) Dow Jones Newswires

May 26, 2022 17:18 ET (21:18 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

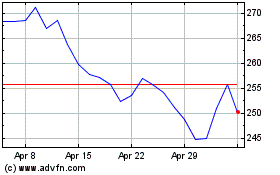

Workday (NASDAQ:WDAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

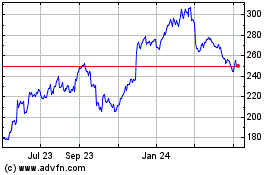

Workday (NASDAQ:WDAY)

Historical Stock Chart

From Apr 2023 to Apr 2024