Achieved profitability milestone with third

quarter adjusted net income1 of $1.2M

Reported third quarter 2024 revenues2 of

$76.6M with 77% year-over-year growth of exome and genome test

revenue

Expanded third quarter 2024 adjusted gross

margins2 to 64%

Raising guidance to deliver between $284M

and $290M in FY 2024 revenue

GeneDx to host conference call today at 8:30

a.m. ET

GeneDx Holdings Corp. (Nasdaq: WGS), a leader in delivering

improved health outcomes through genomic insights, today reported

its financial results for the third quarter of 2024.

“We delivered 77% growth on exome and genome revenues in Q3 and

have reached the point of profitability, a significant milestone in

our company’s history,” said Katherine Stueland, CEO of GeneDx.

“Our advancements in genomics are redefining the standard of care,

setting new industry standards for clinical utility and economic

efficiency, and shortening the time to a diagnosis for thousands of

families. With an ever-growing number of families eligible for our

services, our growth outlook is healthy and sustainable. We

continue to bring life-changing impact to the pediatric outpatient

and NICU settings, and we are now establishing the foundation for

clinically-actionable, responsible, and scalable genomic newborn

screening.”

“Once again, our quarterly performance exceeded our top and

bottom-line expectations. The third quarter marked our 10th

consecutive quarter of cash flow improvement and we achieved

positive adjusted net income ahead of our prior target,” said Kevin

Feeley, CFO of GeneDx. “With our industry-leading technology and a

massive market opportunity ahead, GeneDx will continue to couple

financial discipline with strategic investment to accelerate the

business and provide answers for even more families in need.”

Third Quarter 2024 Financial Results (Unaudited)1,2

Revenues

- Revenues from continuing operations grew to $76.6 million, an

increase of 52% year-over-year and 11% sequentially.

- Total company revenues were $76.9 million.

- Exome and genome test revenue grew to $60.0 million, an

increase of 77% year-over-year and 18% sequentially.

Exome and genome volume

- Exome and genome test results volume grew to 19,262, an

increase of 46% year-over-year and 7% sequentially.

- Exome and genome represented 33% of all test results, up from

23% in the third quarter of 2023 and up from 31% in the second

quarter of 2024.

Gross margin

- Adjusted gross margin from continuing operations expanded to

64%, up from 48% in the third quarter of 2023 and up from 62% in

the second quarter of 2024.

- Total company gross margin was 62%.

Operating expenses

- Adjusted total operating expenses were $46.6 million, a

decrease of 2% year-over-year and an increase of 4% sequentially.

- Total GAAP operating expenses were $54.8 million.

Net Income (Loss)

- Adjusted net income improved to $1.2 million, an improvement of

106% year-over-year and 143% sequentially.

- GAAP net loss was $8.3 million.

Cash burn and cash position

- Total net use of cash was $5.0 million in the third quarter of

2024, an improvement of 88% year-over-year and 17%

sequentially.

- Cash, cash equivalents, marketable securities and restricted

cash was $117.4 million as of September 30, 2024, inclusive of

proceeds of $14.6 million, net of fees, from the issuance of

418,653 shares of Class A common stock in connection with sales

pursuant to our “at-the-market” offering during the third quarter

of 2024.

GeneDx Full Year 2024 Guidance

GeneDx has updated full year 2024 guidance. Management expects

GeneDx to:

- Drive full year 2024 revenues2 between $284 and $290 million

(previous guidance was between $255 and $265 million);

- Expand full year 2024 adjusted gross margin2 profile to at

least 62% (previous guidance was at least 60%);

- Use between $60 to $65 million of net cash for full year 2024

(previous guidance was between $65 to $70 million)

- Adjusted gross margin, adjusted total operating expenses and

adjusted net income (loss) are non-GAAP financial measures. See

appendix for a reconciliation of GAAP to Non-GAAP figures

presented.

- Revenue and gross margin results from continuing operations,

which we believe are representative of our ongoing business

strategy exclude any revenue and cost of goods sold of the exited

Legacy Sema4 diagnostic testing business for the current and all

comparative periods. Total company results are labeled accordingly

and include GeneDx’s continuing operations and the financial

impacts of exited Legacy Sema4 business activities for the current

and all comparative periods.

Third Quarter 2024 Business Highlights

Driving sustainable growth and expanding access for more patient

populations

- Achieved over 700,000 clinical exomes and genomes sequenced,

with over 100,000 completed in the last six months alone

- Accelerated adoption of whole exome sequencing (WES) and whole

genome sequencing (WGS) coverage by state Medicaid programs,

bringing total states covering exome or genome sequencing in the

pediatric outpatient setting to 30

- Indiana - WES and WGS (July 2024)

- Connecticut - WGS (July 2024)

- Texas - WGS (September 2024)

- Florida - WGS (October 2024)

- The Centers for Medicare & Medicaid Services issued

“historic guidance” to state Medicaid agencies, underscoring their

obligation to provide all medically necessary services under the

Early and Periodic Screening, Diagnostic, and Treatment (EPSDT)

benefit

- Under EPSDT, every Medicaid-enrolled child under 21 is entitled

to services that meet their unique medical needs. This includes

diagnostics like exome and genome sequencing - some of the most

powerful tools we have to unlock appropriate care, treatments, and

crucial support systems for these children.

- Expanded the Epilepsy Partnership Program, a first-of-its-kind

patient access program that is increasing access to exome and

genome sequencing for pediatric epilepsy patients, by including an

additional biopharma partner

- Collaborated with researchers from Wellcome Sanger Institute to

release data from the largest and most diverse study to date, with

data from more than 30,000 patients, on how recessive genetic

changes contribute to developmental disorders in children

- On September 23, 2024, findings from the study were published

in Nature Genetics, showcasing that most new recessive

developmental disorder diagnoses lie within known genes.

- The publication is further evidence of our commitment to the

important role of diversity in genomics and belief that serving a

more diverse patient population drives more definitive diagnoses

for patients of all backgrounds.

Demonstrating genome leadership in the neonatal inventive care

unit (NICU)

- Launched improvements to our rapid whole genome sequencing

product, including cheek swabs for more accessible sample

collection, and shortened turnaround times to as soon as five

days

- Progressed initiative to launch Epic Aura in the first half of

2025, which will seamlessly integrate GeneDx exome and genome

testing into the ordering and resulting workflows of many of the

largest health systems across the country

Leaders in genomic newborn screening (gNBS)

- Conducted more gNBS than any other lab in the United States and

successfully executed multi-site implementation strategies across

diverse patient populations, positioning GeneDx as the clear leader

set to revolutionize the standard approach to NBS

- On October 8, 2024, data was presented at the International

Conference on Newborn Sequencing (ICoNS) showcasing that GeneDx has

now provided genomic newborn screenings for more than 14,000

infants through its participation in the groundbreaking GUARDIAN

and Early Check research studies. Today, that number exceeds

15,000.

- Revealed limitations of traditional newborn screening methods

and showcased the promise of advanced genomic technology to deliver

equitable health care for all children

- On October 24, 2024, findings from the GUARDIAN study were

published in JAMA (Journal of the American Medical Association), a

leading peer-reviewed medical journal.

- GUARDIAN goes beyond the typical newborn screening panel of

about 60 conditions to now over 450-early onset genetic conditions

with established effective interventions.

- Over the initial 11-month period, 4,000 newborns were enrolled

and 3.7% of newborns had positive screenings.

- By referencing our internal database, one of the largest of its

kind enriched for rare disease, we find that the average age of

diagnosis for children with these same conditions ranges from 7-11

years.

- Of the newborns with true positive findings, 92% had a

confirmed diagnosis for a condition not included in traditional

NBS.

- The study highlights the wide acceptance of more advanced and

modernized NBS, with 72% of families approached for the study

consenting to participate.

Webcast and Conference Call Details

GeneDx will host a conference call today, October 29, 2024, at

8:30 a.m. Eastern Time. Investors interested in listening to the

conference call are required to register online. A live and

archived webcast of the event will be available on the “Events”

section of the GeneDx investor relations website at

https://ir.genedx.com/.

Forward-Looking Statements

This press release contains certain forward-looking statements

within the meaning of the federal securities laws, including

statements regarding our future performance and our market

opportunity, including our expected full year 2024 reported revenue

guidance, our expectations regarding our adjusted gross margin

profile in 2024, and our use of net cash in 2024. These

forward-looking statements generally are identified by the words

“believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,”

“strategy,” “future,” “opportunity,” “plan,” “may,” “should,”

“will,” “would,” “will be,” “will continue,” “will likely result,”

and similar expressions. Forward-looking statements are

predictions, projections and other statements about future events

that are based on current expectations and assumptions and, as a

result, are subject to risks and uncertainties. Many factors could

cause actual future events to differ materially from the

forward-looking statements in this press release, including but not

limited to: (i) our ability to implement business plans, goals and

forecasts, and identify and realize additional opportunities, (ii)

the risk of downturns and a changing regulatory landscape in the

highly competitive healthcare industry, (iii) the size and growth

of the market in which we operate, (iv) our ability to pursue our

new strategic direction, and (v) our ability to enhance our

artificial intelligence tools that we use in our clinical

interpretation platform. The foregoing list of factors is not

exhaustive. You should carefully consider the foregoing factors and

the other risks and uncertainties described in the “Risk Factors”

section of our Annual Report on Form 10-K for the fiscal year ended

December 31, 2023, filed with the U.S. Securities and Exchange

Commission (the “SEC”) on February 23, 2024 and other documents

filed by us from time to time with the SEC. These filings identify

and address other important risks and uncertainties that could

cause actual events and results to differ materially from those

contained in the forward-looking statements. Forward-looking

statements speak only as of the date they are made. Readers are

cautioned not to put undue reliance on forward-looking statements,

and we assume no obligation and do not intend to update or revise

these forward-looking statements, whether as a result of new

information, future events, or otherwise. We do not give any

assurance that we will achieve our expectations.

About GeneDx

At GeneDx (Nasdaq: WGS), we believe that everyone deserves

personalized, targeted medical care—and that it all begins with a

genetic diagnosis. Fueled by one of the world’s largest rare

disease data sets, our industry-leading exome and genome tests

translate complex genomic data into clinical answers that unlock

personalized health plans, accelerate drug discovery, and improve

health system efficiencies. It all starts with a single test. For

more information, please visit genedx.com and connect with us on

LinkedIn, X, Facebook, and Instagram.

Volume and revenue in the table below include the combination of

the Legacy GeneDx diagnostic business with the data and information

business of Legacy Sema4.

Volume & Revenue

3Q24

2Q24

1Q24

4Q23

3Q23

Volumes

Whole exome, whole genome

19,262

18,017

16,592

15,663

13,216

Hereditary cancer

4,672

5,482

6,868

8,240

8,556

Other panels

35,095

34,204

31,763

33,692

35,861

Total

59,029

57,703

55,223

57,595

57,633

Revenue ($ millions)

Whole exome, whole genome

$

60.0

$

50.7

$

44.0

$

39.2

$

34.0

Hereditary cancer

3.3

3.8

5.5

5.5

4.5

Other panels

13.8

13.3

10.7

11.2

10.6

Data information

(0.5

)

1.1

1.3

2.2

1.3

Total

$

76.6

$

68.9

$

61.5

$

58.1

$

50.4

Unaudited Select Financial Information (in thousands)

Three months ended September

30, 2024

Three months ended June 30,

2024

GeneDx

Legacy Sema4

Total

GeneDx

Legacy Sema4

Total

Revenue

$76,622

$252

$76,874

$68,924

$1,590

$70,514

Adjusted cost of services

27,370

—

27,370

26,523

145

26,668

Adjusted gross profit

$49,252

$252

$49,504

$42,401

$1,445

$43,846

Adjusted gross margin %

64.3%

100.0%

64.4%

61.5%

90.9%

62.2%

Three months ended September

30, 2023

GeneDx

Legacy Sema4

Total

Revenue

$50,350

$2,953

$53,303

Adjusted cost of services

26,079

225

26,304

Adjusted gross profit

$24,271

$2,728

$26,999

Adjusted gross margin %

48.2%

92.4%

50.7%

Three months ended September

30, 2024

Reported

Depreciation and

amortization

Stock-based compensation

expense

Restructuring costs

Change in FV of financial

liabilities

Charges related to business

exit

Other

Adjusted

Diagnostic test revenue

$

77,418

$

—

$

—

$

—

$

—

$

—

$

—

$

77,418

Other revenue

(544

)

—

—

—

—

—

—

(544

)

Total revenue

76,874

—

—

—

—

—

—

76,874

Cost of services

29,045

(1,495

)

(174

)

(6

)

—

—

—

27,370

Gross profit

47,829

1,495

174

6

—

—

—

49,504

Gross margin

62.2

%

64.4

%

Research and development

11,665

(222

)

(537

)

—

—

—

—

10,906

Selling and marketing

17,025

(1,225

)

(394

)

(55

)

—

—

—

15,351

General and administrative

26,145

(2,987

)

(2,531

)

(308

)

—

—

—

20,319

Impairment loss

—

—

—

—

—

—

—

—

Other, net

774

—

—

—

—

—

—

774

Loss from operations

(7,780

)

5,929

3,636

369

—

—

—

2,154

Interest income (expense), net

(843

)

—

—

—

—

—

—

(843

)

Other income (expense), net

264

—

—

—

880

—

(1,327

)

(183

)

Income tax benefit

47

—

—

—

—

—

—

47

Net income (loss)

$

(8,312

)

$

5,929

$

3,636

$

369

$

880

$

—

$

(1,327

)

$

1,175

Three months ended September

30, 2023

Reported

Depreciation and

amortization

Stock-based compensation

expense

Restructuring costs

Change in FV of financial

liabilities

Charges related to business

exit

Other

Adjusted

Diagnostic test revenue

$

51,955

$

—

$

—

$

—

$

—

$

—

$

—

$

51,955

Other revenue

1,348

—

—

—

—

—

—

1,348

Total revenue

53,303

—

—

—

—

—

—

53,303

Cost of services

28,044

(1,613

)

(75

)

(52

)

—

—

—

26,304

Gross profit

25,259

1,613

75

52

—

—

—

26,999

Gross margin

47.4

%

50.7

%

Research and development

14,288

(283

)

533

(970

)

—

—

—

13,568

Selling and marketing

16,763

(1,225

)

115

(415

)

—

—

—

15,238

General and administrative

26,099

(5,551

)

(1,004

)

(754

)

—

—

—

18,790

Impairment loss

8,282

—

—

—

—

(8,282

)

—

—

Other, net

2,794

—

—

—

—

(1,014

)

—

1,780

Loss from operations

(42,967

)

8,672

431

2,191

—

9,296

—

(22,377

)

Interest income (expense), net

1,053

—

—

—

—

—

—

1,053

Other income (expense), net

(544

)

—

—

—

(590

)

—

1,134

—

Income tax benefit

172

—

—

—

—

—

—

172

Net loss

$

(42,286

)

$

8,672

$

431

$

2,191

$

(590

)

$

9,296

$

1,134

$

(21,152

)

Three months ended June 30,

2024

Reported

Depreciation and

amortization

Stock-based compensation

expense

Restructuring costs

Change in FV of financial

liabilities

Charges related to business

exit

Other

Adjusted

Diagnostic test revenue

$

69,439

$

—

$

—

$

—

$

—

$

—

$

—

$

69,439

Other revenue

1,075

—

—

—

—

—

—

1,075

Total revenue

70,514

—

—

—

—

—

—

70,514

Cost of services

27,562

(808

)

(86

)

—

—

—

—

26,668

Gross profit

42,952

808

86

—

—

—

—

43,846

Gross margin

60.9

%

62.2

%

Research and development

10,902

(211

)

(347

)

(35

)

—

—

—

10,309

Selling and marketing

16,585

(1,225

)

(368

)

(63

)

—

—

—

14,929

General and administrative

25,170

(2,974

)

(2,307

)

(150

)

—

—

—

19,739

Impairment loss

—

—

—

—

—

—

—

—

Other, net

874

—

—

—

—

—

—

874

Loss from operations

(10,579

)

5,218

3,108

248

—

—

—

(2,005

)

Interest income (expense), net

(894

)

—

—

—

—

—

—

(894

)

Other income (expense), net

(17,890

)

—

—

—

4,409

—

13,450

(31

)

Income tax benefit

190

—

—

—

—

—

—

190

Net loss

$

(29,173

)

$

5,218

$

3,108

$

248

$

4,409

$

—

$

13,450

$

(2,740

)

GeneDx Holdings Corp.

Condensed Consolidated Balance Sheets (in thousands,

except share and per share amounts)

September 30, 2024

(Unaudited)

December 31, 2023

Assets:

Current assets:

Cash and cash equivalents

$

57,894

$

99,681

Marketable securities

58,566

30,467

Accounts receivable

38,220

32,371

Due from related parties

260

445

Inventory, net

10,770

8,777

Prepaid expenses and other current

assets

20,300

10,598

Total current assets

186,010

182,339

Operating lease right-of-use assets

24,936

26,900

Property and equipment, net

31,452

32,479

Intangible assets, net

162,106

172,625

Other assets (1)

4,336

4,413

Total assets

$

408,840

$

418,756

Liabilities and Stockholders’

Equity:

Current liabilities:

Accounts payable and accrued expenses

$

56,416

$

37,456

Due to related parties

727

1,379

Short-term lease liabilities

3,698

3,647

Other current liabilities

16,501

16,336

Total current liabilities

77,342

58,818

Long-term debt, net of current portion

52,034

52,688

Long-term lease liabilities

60,369

62,938

Other liabilities

13,540

14,735

Deferred taxes

1,054

1,560

Total liabilities

204,339

190,739

Stockholders’ Equity:

Preferred stock

—

—

Class A common stock

2

2

Additional paid-in capital

1,561,493

1,527,778

Accumulated deficit

(1,357,912

)

(1,300,188

)

Accumulated other comprehensive income

918

425

Total stockholders’ equity

204,501

228,017

Total liabilities and stockholders’

equity

$

408,840

$

418,756

(1) Other assets includes $987 thousand of

restricted cash as of both September 30, 2024 and December 31,

2023.

GeneDx Holdings Corp.

Condensed Consolidated Statements of Operations (Unaudited)

(in thousands, except share and per share amounts)

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Revenue

Diagnostic test revenue

$

77,418

$

51,955

$

207,961

$

140,440

Other revenue

(544

)

1,348

1,849

4,708

Total revenue

76,874

53,303

209,810

145,148

Cost of services

29,045

28,044

81,618

85,896

Gross profit

47,829

25,259

128,192

59,252

Research and development

11,665

14,288

34,134

46,018

Selling and marketing

17,025

16,763

49,695

45,397

General and administrative

26,145

26,099

73,760

107,129

Impairment loss

—

8,282

—

10,402

Other operating expenses, net

774

2,794

2,622

5,259

Loss from operations

(7,780

)

(42,967

)

(32,019

)

(154,953

)

Non-operating income (expenses), net

Change in fair value of warrants and

earn-out contingent liabilities

(880

)

590

(11,390

)

684

Interest (expense) income, net

(843

)

1,053

(2,334

)

2,092

Other income (expense), net

1,144

(1,134

)

(12,300

)

1,668

Total non-operating income (expense),

net

(579

)

509

(26,024

)

4,444

Loss before income taxes

(8,359

)

(42,458

)

$

(58,043

)

$

(150,509

)

Income tax benefit

47

172

319

515

Net loss

$

(8,312

)

$

(42,286

)

$

(57,724

)

$

(149,994

)

Weighted average shares outstanding of

Class A common stock

27,095,986

25,788,747

26,593,877

23,777,327

Basic and diluted net loss per share,

Class A common stock

$

(0.31

)

$

(1.64

)

$

(2.17

)

$

(6.31

)

GeneDx Holdings Corp.

Condensed Consolidated Statements of Cash Flows (Unaudited)

(in thousands)

Nine months ended September

30,

2024

2023

Operating activities

Net loss

$

(57,724

)

$

(149,994

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization expense

16,395

27,640

Stock-based compensation expense

6,293

586

Change in fair value of warrants and

contingent liabilities

11,390

(684

)

Deferred tax benefit

(319

)

(515

)

Provision for excess and obsolete

inventory

137

3,634

Legal reserves

12,123

—

Change in third party payor reserves

737

(6,848

)

Gain on sale of assets

—

(2,954

)

Gain on debt forgiveness

—

(2,750

)

Impairment loss

—

10,402

Other

2,639

1,071

Change in operating assets and

liabilities:

Accounts receivable

(5,850

)

10,726

Inventory

(2,131

)

682

Accounts payable and accrued expenses

(7,807

)

(39,913

)

Other assets and liabilities

(1,196

)

(1,372

)

Net cash used in operating activities

(25,313

)

(150,289

)

Investing activities

Consideration on escrow paid for Legacy

GeneDx acquisition

—

(12,144

)

Purchases of property and equipment

(2,441

)

(2,874

)

Proceeds from sales of assets

—

3,887

Purchases of marketable securities

(52,725

)

(43,935

)

Proceeds from sales of marketable

securities

598

—

Proceeds from maturities of marketable

securities

24,955

16,665

Development of internal-use software

assets

—

(461

)

Net cash used in investing activities

(29,613

)

(38,862

)

Financing activities

Proceeds from offerings, net of issuance

costs

14,589

143,002

Exercise of stock options

247

266

Long-term debt principal payments

(198

)

(2,000

)

Finance lease payoff and principal

payments

(1,499

)

(2,133

)

Net cash provided by financing

activities

13,139

139,135

Net decrease in cash, cash equivalents and

restricted cash

(41,787

)

(50,016

)

Cash, cash equivalents and restricted

cash, at beginning of period

100,668

138,303

Cash, cash equivalents and restricted

cash, at end of period (1)

$

58,881

$

88,287

Supplemental disclosures of cash flow

information

Cash paid for interest

$

6,068

$

1,116

Cash paid for taxes

$

910

$

1,178

Stock consideration paid for purchase of

business

$

—

$

6,692

Stock consideration paid pursuant to

exercise of Perceptive warrant

$

12,586

$

—

Purchases of property and equipment in

accounts payable and accrued expenses

$

2,612

$

1,220

Assets acquired under capital leases

obligations

$

689

$

—

(1) Cash, cash equivalents and restricted

cash at September 30, 2024 excludes marketable securities of $58.6

million.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241029161441/en/

Investor Relations Contact: Investors@GeneDx.com Media

Contact: Press@GeneDx.com

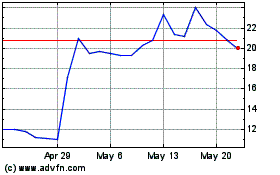

GeneDx (NASDAQ:WGS)

Historical Stock Chart

From Oct 2024 to Dec 2024

GeneDx (NASDAQ:WGS)

Historical Stock Chart

From Dec 2023 to Dec 2024