World Acceptance Corporation (NASDAQ: WRLD) today reported

financial results for its third quarter of fiscal 2022 and nine

months ended December 31, 2021.

Third quarter highlights

During its third quarter, the Company experienced exceptional

growth in both loan balances and the customer base. While this

growth initially depresses current earnings due to the day one

provisioning for anticipated credit losses under the current

accounting standards, it positions the Company well for the future

as these customers continue to generate revenue over the long

term.

Some highlights from the third quarter include:

- Gross loans outstanding of $1.61 billion, a Q3 increase of

$211.3 million, or 15.1% and 27.0% increase from same quarter prior

year

- Total revenues of $148.6 million, a 13.5% increase from the

same quarter prior year

- Net income of $7.3 million, a $7.2 million decrease from $14.5

million in same quarter prior year

- Net income per diluted share of $1.14, a $1.11 decrease from

$2.25 per share in same quarter prior year

Portfolio results

Gross loans outstanding increased to $1.61 billion as of

December 31, 2021, a 27.0% increase from the $1.26 billion of gross

loans outstanding as of December 31, 2020. During the most recent

quarter, gross loans outstanding increased 15.1%, or $211.3

million, the largest growth and rate of growth during the third

fiscal quarter in company history. The largest third quarter growth

prior to this year was the $155.2 million increase during the third

fiscal quarter of 2021. During the quarter, we saw an increase in

borrowing from new, current, and former customers that exceeded

comparable pre-pandemic volumes as the economy continued to reopen

and federal economic stimulus waned. We have seen increased demand

for new customer applications in the third quarter of fiscal

2022.

Our customer base increased by 4.4% year-over-year as of

December 31, 2021, compared to a 18.3% decrease for the comparable

period ended December 31, 2020. During the quarter ended December

31, 2021, the number of unique borrowers in the portfolio increased

by 7.7% compared to an increase of 8.4% during the quarter ended

December 31, 2020. As a result of the expanded emphasis on our

larger loan offerings, the average gross loan balance increased

7.3% from the period ended September 30, 2021, to $1,895; a 23.0%

increase from the period ended December 31, 2020.

The following table includes the change in the volume of loan

origination balances by customer type for the following comparative

quarterly periods:

Q3 FY 2022 vs. Q3 FY 2021

Q3 FY 2021 vs. Q3 FY 2020

Q3 FY 2022 vs. Q3 FY 2020

New Customers

73.5%

(21.7)%

35.8%

Former Customers

15.6%

8.3%

25.2%

Refinance Customers

21.1%

(9.7)%

9.3%

As of December 31, 2021, we had 1,202 open branches. For

branches open throughout both periods, same store gross loans

increased 28.8% in the twelve-month period ended December 31, 2021,

compared to a 7.6% decrease for the twelve-month period ended

December 31, 2020. For branches open throughout both periods, the

customer base over the twelve-month period ended December 31, 2021,

increased 5.4% compared to a 18.0% decrease for the twelve months

ended December 31, 2020.

Three-month financial results

Net income for the third quarter of fiscal 2022 decreased by

$7.2 million to $7.3 million compared to $14.5 million for the same

quarter of the prior year. Net income per diluted share decreased

to $1.14 per share in the third quarter of fiscal 2022 compared to

$2.25 per share for the same quarter of the prior year. Net income

was significantly impacted by an increase in the day one provision

under the accounting standards for credit losses that is directly

related to the growth in loan balances and increase in

delinquency.

Earnings per share for the most recent quarter benefited from

our share repurchase program. The Company repurchased 93,722 shares

of its common stock on the open market at an aggregate purchase

price of approximately $19.3 million during the third quarter of

fiscal 2022. This follows a repurchase of 195,436 shares in the

first fiscal half of fiscal 2022 at an aggregate purchase price of

approximately $31.1 million and the repurchase of 1,129,875 shares

in fiscal 2021 at an aggregate purchase price of approximately

$102.4 million. The Company had approximately 6.1 million common

shares outstanding excluding approximately 0.6 million unvested

restricted shares as of December 31, 2021. As of December 31, 2021,

the Company had the ability to repurchase approximately $46.1

million of additional shares under its current share repurchase

program and, subject to board approval, could repurchase

approximately $84.4 million of shares under the terms of its debt

facilities.

Total revenues for the third quarter of fiscal 2022 increased to

$148.6 million, a 13.5% increase from $130.9 million for the same

quarter of the prior year. Interest and fee income increased 11.5%,

from $114.9 million in the third quarter of fiscal 2021 to $128.1

million in the third quarter of fiscal 2022 due to an increase in

loans outstanding. Insurance income increased by 24.9% to $14.4

million in the third quarter of fiscal 2022 compared to $11.6

million in the third quarter of fiscal 2021. The large loan

portfolio increased from 39.5% of the overall portfolio as of

December 31, 2020, to 49.5% as December 31, 2021. This resulted in

lower interest and fee yields but higher insurance sales in the

most recent quarter, given that the sale of insurance products is

limited to large loans in several states in which we operate. Other

income increased by 32.9% to $6.0 million in the third quarter of

fiscal 2022 compared to $4.5 million in the third quarter of fiscal

2021. Sales of our motor club product increased by $1.5 million as

sales opportunities increased, similar to our insurance products,

with the increase in large loan originations.

Accounts 61 days or more past due increased to 6.4% on a recency

basis at December 31, 2021, compared to 5.2% at December 31, 2020.

Total delinquency on a recency basis increased to 10.4% at December

31, 2021, compared to 8.9% at December 31, 2020. Our allowance for

credit losses as a percent of net loans receivable was 11.4% at

December 31, 2021, compared to 12.2% at December 31, 2020. The

increase in delinquency was expected given the increase in new,

shorter tenured borrowers in recent months. The delinquency rates

remain in line with historical delinquency trends as of the end of

the third quarter.

On April 1, 2020, the Company replaced its incurred loss

methodology with a current expected credit loss ("CECL")

methodology to accrue for expected losses. This change in

accounting methodology requires us to create a larger provision for

credit losses on the day we originate the loan compared to the

prior methodology. The provision for credit losses increased $27.6

million, or 95.6%, to $56.5 million from $28.9 million when

comparing the third quarter of fiscal 2022 to the third quarter of

fiscal 2021. The provision for credit losses increased during the

most recent quarter primarily due to significant loan growth and

the increase in loans 90 days past due. The same quarter in the

prior year also included a $6.5 million release of a pandemic

related reserve. Net charge-offs as a percentage of average net

loans receivables on an annualized basis increased from 11.6% in

the third quarter of fiscal 2021 to 13.8% in the third quarter of

fiscal 2022. The increases in delinquency and charge-offs were

expected due to the increase in new and shorter tenured customers

in the most recent fiscal second and third quarters.

The table below is updated to use the customer tenure based

methodology that aligns with our CECL methodology. After

experiencing rapid portfolio growth during fiscal years 2019 and

2020, primarily in new customers, our gross loan balance

experienced pandemic related declines in fiscal 2021 before

rebounding in the most recent three quarters. The tables below

illustrate the changes in the portfolio weighting as well as the

relative impact on charge-offs within the vintages over the last

five years.

Gross Loan Balance By Customer

Tenure at Origination

As of

Less Than 2 Years

More Than 2 Years

Total

12/31/2016

$302,649,934

$762,474,846

$1,065,124,780

12/31/2017

$336,582,487

$790,836,894

$1,127,419,381

12/31/2018

$426,884,909

$832,020,730

$1,258,905,639

12/31/2019

$489,940,306

$882,877,242

$1,372,817,549

12/31/2020

$413,509,916

$851,073,804

$1,264,583,720

12/31/2021

$527,433,398

$1,078,703,853

$1,606,137,251

Year-Over-Year Growth

(Decline) in Gross Loan Balance by Customer Tenure at

Origination

12 Month Period Ended

Less Than 2 Years

More Than 2 Years

Total

12/31/2016

$(28,470,684)

$(30,604,893)

$(59,075,578)

12/31/2017

$33,932,553

$28,362,048

$62,294,601

12/31/2018

$90,302,422

$41,183,836

$131,486,258

12/31/2019

$63,055,398

$50,856,512

$113,911,910

12/31/2020

$(76,430,390)

$(31,803,439)

$(108,233,829)

12/31/2021

$111,759,945

$229,793,585

$341,553,531

Portfolio Mix by Customer

Tenure at Origination

As of

Less Than 2 Years

More Than 2 Years

12/31/2016

28.4%

71.6%

12/31/2017

29.9%

70.1%

12/31/2018

33.9%

66.1%

12/31/2019

35.7%

64.3%

12/31/2020

32.7%

67.3%

12/31/2021

32.8%

67.2%

While the mix of less than two year customer balances is

relatively consistent with December 31, 2020, there has been a

significant increase in the shortest tenured customers within this

cohort. The 0-5 month customer bucket has increased from 8.6% of

the overall portfolio as of December 31, 2020, to 13.8% of the

portfolio as of December 31, 2021. The 0-5 month customer is our

riskiest customer.

The table below includes the charge-off rate of each vintage

(the actual gross charge-off balance in the subsequent twelve

months divided by the starting gross loan balance) indexed to the

December 31, 2017, vintage.

Actual Gross Charge-off Rate

During Following 12 Months; Indexed to 12/31/2017 Vintage

12 Months Beginning

Less Than 2 Years

More Than 2 Years

Total

12/31/2016

1.52

0.80

1.00

12/31/2017

1.58

0.76

1.00

12/31/2018

1.73

0.77

1.09

12/31/2019

1.71

0.77

1.10

12/31/2020

1.49

0.59

0.89

The decrease in overall charge-off rate over the last twelve

months has been seen across all tenure buckets, primarily driven by

stronger performance from COVID-19 related stimulus and

unemployment benefits. The lower tenure bucket has also benefited

from improved underwriting practices on new borrowers.

General and administrative (“G&A”) expenses decreased $3.7

million, or 4.7%, to $74.2 million in the third quarter of fiscal

2022 compared to $77.9 million in the same quarter of the prior

fiscal year. As a percentage of revenues, G&A expenses

decreased from 59.5% during the third quarter of fiscal 2021 to

50.0% during the third quarter of fiscal 2022. G&A expenses per

average open branch decreased by 2.4% when comparing the third

quarter of fiscal 2022 to the third quarter fiscal 2021.

Personnel expense decreased $2.3 million, or 5.0%, during the

third quarter of fiscal 2022 as compared to the third quarter of

fiscal 2021. Salary expense decreased approximately $0.1 million,

or 0.2%, in the quarter ended December 31, 2021, compared to the

quarter ended December 31, 2020. Our headcount as of December 31,

2021, decreased 5.9% compared to December 31, 2020. Benefit expense

decreased approximately $2.1 million, or 20.5%, when comparing the

quarterly periods ended December 31, 2021 and 2020. Incentive

expense decreased $0.2 million, or 1.8%, in the third quarter of

fiscal 2022 compared to third quarter of fiscal 2021.

Occupancy and equipment expense decreased $2.4 million, or

16.2%, when comparing the quarterly periods ended December 31, 2021

and 2020. The prior year includes a $2.1 million write down of

signage as a result of rebranding our offices in the prior year

quarter and we did not have any similar expense this year.

Advertising expense remained flat in the third quarter of fiscal

2022 compared to the third quarter of fiscal 2021. The Company

anticipated an increase in demand during the quarter and increased

marketing accordingly. However, marketing spend remained neutral

despite this increase as the Company shifted to lower cost

channels.

Other expense increased $1.0 million in the third quarter of

fiscal 2022 compared to the third quarter of fiscal 2021.

Interest expense for the quarter ended December 31, 2021,

increased by $2.9 million from the corresponding quarter of the

previous year. Interest expense increased due to an increase in

average debt outstanding and a 3.7% increase in the effective

interest rate from 6.1% to 6.3%. The average debt outstanding

increased from $475.7 million to $640.8 million when comparing the

quarters ended December 31, 2020 and 2021. The Company’s debt to

equity ratio increased to 1.8:1 at December 31, 2021, compared to

1.5:1 at December 31, 2020. The Company had outstanding debt of

$720.3 million as of December 31, 2021.

Other key return ratios for the third quarter of fiscal 2022

included a 7.4% return on average assets and a return on average

equity of 20.1% (both on a trailing twelve-month basis).

Nine-Month Results

Net income for the nine months ended December 31, 2021,

decreased $7.9 million to $35.5 million compared to $43.4 million

for the same period of the prior year. This resulted in net income

of $5.53 per diluted share for the nine months ended December 31,

2021, compared to $6.44 per diluted share in the prior-year-period.

Total revenues for the first nine months of fiscal 2022 increased

9.7% to $416.1 million compared to $379.3 million during the

corresponding period of the previous year due to an increase in

loans outstanding. Annualized net charge-offs as a percent of

average net loans decreased from 14.7% during the first nine months

of fiscal 2021 to 12.0% for the first nine months of fiscal

2022.

About World Acceptance Corporation (World Finance)

Founded in 1962, World Acceptance Corporation (NASDAQ: WRLD), is

a people-focused finance company that provides personal installment

loan solutions and personal tax preparation and filing services to

over one million customers each year. Headquartered in Greenville,

South Carolina, the Company operates more than 1,200

community-based World Finance branches across 16 states. The

Company primarily serves a segment of the population that does not

have ready access to credit, however, unlike many other lenders in

this segment, we strive to work with our customers to understand

their broader financial pictures, ensure they have the ability and

stability to make payments, and help them achieve their financial

goals. In fiscal 2021, the Company helped more than 225,000

individuals improve their credit score out of subprime and deep

subprime. For more information, visit www.loansbyworld.com.

Third quarter conference call

The senior management of World Acceptance Corporation will be

discussing these results in its quarterly conference call to be

held at 10:00 a.m. Eastern Time today. A simulcast of the

conference call will be available on the Internet at

https://services.choruscall.com/mediaframe/webcast.html?webcastid=4rOLtPbS.

The call will be available for replay on the Internet for

approximately 30 days.

During the conference call, the Company may discuss and answer

questions concerning business and financial developments and trends

that have occurred after quarter-end. The Company’s responses to

questions, as well as other matters discussed during the conference

call, may contain or constitute information that has not been

disclosed previously.

Cautionary Note Regarding Forward-looking Information

This press release may contain various “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, that represent the Company’s current

expectations or beliefs concerning future events. Statements other

than those of historical fact, as well as those identified by words

such as “anticipate,” “estimate,” intend,” “plan,” “expect,”

“project,” “believe,” “may,” “will,” “should,” “would,” “could,”

“probable” and any variation of the foregoing and similar

expressions are forward-looking statements. Such forward-looking

statements are inherently subject to risks and uncertainties. The

Company’s actual results and financial condition may differ

materially from those indicated in the forward-looking statements.

Therefore, you should not rely on any of these forward-looking

statements. Important factors that could cause actual results or

performance to differ from the expectations expressed or implied in

such forward-looking statements include the following: the ongoing

impact of the COVID-19 pandemic and the mitigation efforts by

governments and related effects on our financial condition,

business operations and liquidity, our customers, our employees,

and the overall economy; recently enacted, proposed or future

legislation and the manner in which it is implemented; changes in

the U.S. tax code; the nature and scope of regulatory authority,

particularly discretionary authority, that may be exercised by

regulators, including, but not limited to, U.S. Consumer Financial

Protection Bureau, and individual state regulators having

jurisdiction over the Company; the unpredictable nature of

regulatory proceedings and litigation; employee misconduct or

misconduct by third parties; uncertainties associated with

management turnover and the effective succession of senior

management; media and public characterization of consumer

installment loans; labor unrest; the impact of changes in

accounting rules and regulations, or their interpretation or

application, which could materially and adversely affect the

Company’s reported consolidated financial statements or necessitate

material delays or changes in the issuance of the Company’s audited

consolidated financial statements; the Company's assessment of its

internal control over financial reporting; changes in interest

rates; the impact of inflation; risks relating to the acquisition

or sale of assets or businesses or other strategic initiatives,

including increased loan delinquencies or net charge-offs, the loss

of key personnel, integration or migration issues, the failure to

achieve anticipated synergies, increased costs of servicing,

incomplete records, and retention of customers; risks inherent in

making loans, including repayment risks and value of collateral;

cybersecurity threats, including the potential misappropriation of

assets or sensitive information, corruption of data or operational

disruption; our dependence on debt and the potential impact of

limitations in the Company’s amended revolving credit facility or

other impacts on the Company's ability to borrow money on favorable

terms, or at all; the timing and amount of revenues that may be

recognized by the Company; changes in current revenue and expense

trends (including trends affecting delinquency and charge-offs);

the impact of extreme weather events and natural disasters; changes

in the Company’s markets and general changes in the economy

(particularly in the markets served by the Company).

These and other factors are discussed in greater detail in Part

I, Item 1A,“Risk Factors” in the Company’s most recent annual

report on Form 10-K for the fiscal year ended March 31, 2021 as

filed with the SEC and the Company’s other reports filed with, or

furnished to, the SEC from time to time. World Acceptance

Corporation does not undertake any obligation to update any

forward-looking statements it makes. The Company is also not

responsible for updating the information contained in this press

release beyond the publication date, or for changes made to this

document by wire services or Internet services.

WORLD ACCEPTANCE CORPORATION

AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

(unaudited and in thousands,

except per share amounts)

Three months ended December

31,

Nine months ended December

31,

2021

2020

2021

2020

Revenues:

Interest and fee income

$

128,147

$

114,886

$

355,435

$

333,632

Insurance income, net and other income

20,425

16,060

60,622

45,621

Total revenues

148,572

130,946

416,057

379,253

Expenses:

Provision for credit losses

56,459

28,857

128,768

80,608

General and administrative expenses:

Personnel

44,384

46,700

136,362

138,155

Occupancy and equipment

12,614

15,058

39,156

41,755

Advertising

6,848

6,660

15,902

14,528

Amortization of intangible assets

1,276

1,377

3,736

4,045

Other

9,107

8,079

27,412

26,292

Total general and administrative

expenses

74,229

77,874

222,568

224,775

Interest expense

10,166

7,305

22,381

18,759

Total expenses

140,854

114,036

373,717

324,142

Income before income taxes

7,718

16,910

42,340

55,111

Income taxes

391

2,418

6,802

11,711

Net income

$

7,327

$

14,492

$

35,538

$

43,400

Net income per common share, diluted

$

1.14

$

2.25

$

5.53

$

6.44

Weighted average diluted shares

outstanding

6,404

6,452

6,424

6,744

WORLD ACCEPTANCE CORPORATION

AND SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

(unaudited and in thousands)

December 31, 2021

March 31, 2021

December 31, 2020

ASSETS

Cash and cash equivalents

$

18,668

$

15,746

$

9,691

Gross loans receivable

1,606,111

1,104,746

1,264,530

Less:

Unearned interest, insurance and fees

(433,432

)

(279,364

)

(335,056

)

Allowance for credit losses

(133,281

)

(91,722

)

(113,467

)

Loans receivable, net

1,039,398

733,660

816,007

Operating lease right-of-use assets,

net

86,098

90,056

93,144

Finance lease right-of-use assets, net

708

1,014

1,116

Property and equipment, net

24,531

25,326

25,266

Deferred income taxes, net

34,808

24,993

26,507

Other assets, net

37,596

31,422

28,897

Goodwill

7,371

7,371

7,371

Intangible assets, net

21,027

23,538

24,886

Assets held for sale

—

1,144

1,144

Total assets

$

1,270,205

$

954,270

$

1,034,029

LIABILITIES &

SHAREHOLDERS' EQUITY

Liabilities:

Senior notes payable

$

425,174

$

405,008

$

539,600

Senior unsecured notes payable, net

295,143

—

—

Income taxes payable

1,591

11,576

853

Operating lease liability

87,677

91,133

93,648

Finance lease liability

146

585

737

Accounts payable and accrued expenses

51,068

41,040

40,329

Total liabilities

860,799

549,342

675,167

Shareholders' equity

409,406

404,928

358,862

Total liabilities and shareholders'

equity

$

1,270,205

$

954,270

$

1,034,029

WORLD ACCEPTANCE CORPORATION

AND SUBSIDIARIES

SELECTED CONSOLIDATED

STATISTICS

(unaudited and in thousands,

except percentages and branches)

Three months ended December

31,

Nine months ended December

31,

2021

2020

2021

2020

Gross loans receivable

$

1,606,111

$

1,264,530

$

1,606,111

$

1,264,530

Average gross loans receivable (1)

1,493,234

1,175,251

1,319,026

1,133,065

Net loans receivable (2)

1,172,679

929,474

1,172,679

929,474

Average net loans receivable (3)

1,094,014

865,480

970,992

839,491

Expenses as a percentage of total

revenue:

Provision for credit losses

38.0

%

22.0

%

30.9

%

21.3

%

General and administrative

50.0

%

59.5

%

53.5

%

59.3

%

Interest expense

6.8

%

5.6

%

5.4

%

4.9

%

Operating income as a % of total revenue

(4)

12.0

%

18.5

%

15.6

%

19.5

%

Loan volume (5)

976,118

782,995

2,531,815

1,893,502

Net charge-offs as percent of average net

loans receivable on an annualized basis

13.8

%

11.6

%

12.0

%

14.7

%

Return on average assets (trailing 12

months)

7.4

%

6.6

%

7.4

%

6.6

%

Return on average equity (trailing 12

months)

20.1

%

17.4

%

20.1

%

17.4

%

Branches opened or acquired (merged or

closed), net

—

(2

)

(3

)

(13

)

Branches open (at period end)

1,202

1,230

1,202

1,230

_______________________________________________________

(1) Average gross loans receivable have

been determined by averaging month-end gross loans receivable over

the indicated period, excluding tax advances.

(2) Net loans receivable is defined as

gross loans receivable less unearned interest and deferred

fees.

(3) Average net loans receivable have been

determined by averaging month-end gross loans receivable less

unearned interest and deferred fees over the indicated period,

excluding tax advances.

(4) Operating income is computed as total

revenues less provision for credit losses and general and

administrative expenses.

(5) Loan volume includes all loan balances

originated by the Company. It does not include loans purchased

through acquisitions.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220125005249/en/

John L. Calmes, Jr. Chief Financial and Strategy Officer (864)

298-9800

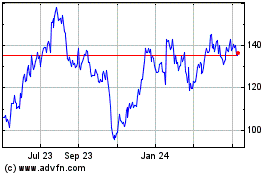

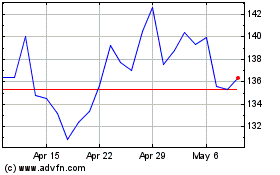

World Acceptance (NASDAQ:WRLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

World Acceptance (NASDAQ:WRLD)

Historical Stock Chart

From Apr 2023 to Apr 2024