Achieved fourth quarter net product revenue of

$32.5M representing 52% growth compared to Q4 2021

Achieved full-year net product revenue of

$109.3M representing 38% annual growth compared to 2021 on a pro

forma basis

Ended 2022 with $122.0M in cash, cash

equivalents, and short-term investments realizing $50M in synergies

in 2022 from the Strongbridge acquisition

Announced research collaboration and option

agreement with Horizon Therapeutics for XeriJect® formulation of

TEPEZZA®

Provides 2023 guidance: total revenues of

$135M-$165M; cash utilization from operating activities of

$57M-$77M; year-end cash, cash equivalents, and short-term

investments of $45M-$65M

Projects cash flow breakeven in the fourth

quarter of 2023

Hosting conference call and webcast today at

8:30 a.m. ET

Xeris Biopharma Holdings, Inc. (Nasdaq: XERS), a growth-oriented

biopharmaceutical company committed to improving patients’ lives by

developing and commercializing innovative products across a range

of therapies, today announced financial results for the fourth

quarter and full-year 2022 and provided 2023 financial

guidance.

“Xeris had another record-breaking quarter to finish 2022

achieving net product revenue growth of 52% compared to last year

and delivering 38% full-year net product revenue growth compared to

2021 on a pro forma basis,” said Paul R. Edick, Chairman and CEO of

Xeris Biopharma. "We enter 2023 well positioned to capitalize on

that momentum with the continued growth of our commercial products,

additional revenue from existing and potentially new partnerships

and collaborations, advancement of our levothyroxine clinical

program, and the continuing disciplined management of our cash.

These key factors give us confidence that we are on track to

achieve cash flow breakeven by year-end and position us to deliver

continued growth and become a self-sustaining enterprise that does

not require us to raise new capital to fund operations.”

Fourth Quarter Highlights and Recent

Events

Three Months Ended December

31,

Change

2022

2021

$

%

Product revenue (in thousands):

Gvoke

$

14,932

$

10,996

$

3,936

35.8

Keveyis

13,801

10,363

3,438

33.2

Recorlev

3,806

—

3,806

nm

Product revenue, net

32,539

21,359

11,180

52.3

Royalty, contract, and other revenue

605

70

535

nm

Total revenue

$

33,144

$

21,429

$

11,715

54.7

Commercial Products

- Gvoke®: Fourth quarter 2022 net revenue was $14.9

million as compared to $11.0 million in the fourth quarter of 2021,

an increase of approximately 36%. Gvoke prescriptions topped 41,000

for the first time, growing more than 42% compared to the same

period in 2021. Momentum has continued at the start of 2023 as

Gvoke’s NRx market share of the retail glucagon market exceeded 28%

at the end of February.

- Keveyis®: Fourth quarter net revenue was $13.8 million,

an increase of approximately 33% compared to the same period in

2021, driven by higher patient demand coupled with an increase in

net pricing.

- Recorlev®: Fourth quarter net revenue was $3.8 million

driven primarily by increases in the number of patients on therapy.

Xeris recently announced that the FDA granted orphan-drug

exclusivity for Recorlev. As the first approval of levoketoconazole

(Recorlev) for Cushing’s syndrome, Xeris is entitled to seven years

of orphan-drug market exclusivity from its FDA approval date of

December 30, 2021.

Pipeline and Partnership Programs

- XeriSol® levothyroxine (XP-8121): In October, Xeris

reported positive topline results from its Phase 1 study of

XP-8121. Based on feedback from the FDA, the Company anticipates

initiating a Phase 2 study in patients in mid-2023.

- XeriJect® teprotumumab: In November, Xeris announced a

research collaboration and option agreement with Horizon

Therapeutics to develop an ultra-concentrated, ready-to-use,

sub-cutaneous injection of teprotumumab, known as brand name

TEPEZZA® in the U.S., using Xeris’ proprietary formulation

technology platform, XeriJect™. Xeris received an upfront payment

of $2.75 million in the fourth quarter and will be entitled to

receive a payment of $6.0 million on successful achievement of the

target formulation. If the commercial option is exercised by

Horizon, Xeris would also be entitled to future development,

regulatory and sales-based milestones, and royalties based on

future sales.

Full-year 2022 Revenue

Results

Years Ended December

31,

Change

2022

2021

$

%

Product revenue (in thousands):

Gvoke

$

52,527

$

38,917

$

13,610

35.0

Keveyis

49,307

10,363

38,944

nm

Recorlev

7,429

—

7,429

nm

Product revenue, net

109,263

49,280

59,983

121.7

Royalty, contract and other revenue

985

310

675

nm

Total revenue

$

110,248

$

49,590

$

60,658

122.3

Gvoke®: Net revenue was $52.5 million, a 35% increase,

for the full year 2022 when compared to full year 2021. Total Gvoke

prescriptions grew to over 145,000, or 54%, in 2022 compared to

2021. The growth in product demand was partially offset by a

decrease in net pricing.

Keveyis®: Net revenue was $49.3 million for the full year

2022, an increase of 23% from the same period ended December 31,

2021 on a pro forma basis. This growth is driven by an increase in

patient demand and an increase in net pricing.

Recorlev®: Net revenue was $7.4 million since its

commercial launch in Q1 2022.

Fourth Quarter and Full-year 2022 Other

Results

Cost of goods sold increased $1.4 million for the three

months ended December 31, 2022, and $9.3 million for the full-year

2022. These increases when compared to the same periods in 2021

were attributable to sales growth.

Research and development expenses decreased $5.1 million

for the three months ended December 31, 2022 and $4.2 million for

the full-year 2022, respectively, when compared to the same periods

in 2021. The decreases in both periods were primarily driven by

lower overall product development costs.

Selling, general and administrative expenses decreased

$19.8 million for the three months ended December 31, 2022 when

compared to the same period in 2021. The decrease was primarily

driven by the incremental transaction and restructuring costs of

the Strongbridge acquisition in Q4 of last year.

Full-year 2022 expenses increased $12.0 million when compared to

the same period in 2021. Personnel-related costs increased by $24.9

million primarily to support Keveyis, acquired in October 2021,

Recorlev, launched in 2022, as well as an expansion of our Gvoke

sales force. The increases were partially offset by lower

transaction and restructuring costs in 2022 related to the

Strongbridge acquisition when compared to 2021.

Net Loss for the three months ended December 31, 2022,

was $12.9 million, or $0.10 per share, and a net loss of $94.7

million, or $0.70 per share, for the full year ended December 31,

2022.

Cash, cash equivalents, and short-term investments at

December 31, 2022 was $122.0 million compared to $102.4 million at

December 31, 2021. Total shares outstanding at February 28, 2023

was 137,288,602.

2023 Financial Guidance

Full-year 2023 financial guidance consists of the following:

- Combined total revenue for Gvoke, Keveyis, Recorlev, and Other1

Revenue of $135 million to $165 million

- Cash utilization from operating activities of $57 million to

$77 million

- Year-end cash, cash equivalents, and short-term investments of

$45 million to $65 million

- Cash flow breakeven in the fourth quarter

1 Revenues from current and/or new

partnerships or collaborations

Conference Call and Webcast Details

Xeris will host a conference call and webcast today, Wednesday,

March 8, 2023 at 8:30 a.m. Eastern Time.

To pre-register for the call, please go to the following link:

https://www.netroadshow.com/events/login?show=f5b64cf1&confId=46221

After registering, a confirmation email will be sent, including

dial-in details and a unique code for entry. The Company recommends

registering a minimum of ten minutes prior to the start of the

call. Following the conference call, a replay will be available

until Wednesday, March 22, 2023, at US:1 929 458 6194, US Toll

Free: 1 866 813 9403, UK: 0204 525 0658, Canada: 1 226 828 7578, or

all other locations: +44 204 525 0658 Access Code: 047278.

To join the webcast, please visit “Events” on investor relations

page of the Company’s website at www.xerispharma.com or use this

link: https://events.q4inc.com/attendee/393793349

About Xeris

Xeris (Nasdaq: XERS) is a growth-oriented biopharmaceutical

company committed to improving patients’ lives by developing and

commercializing differentiated and innovative products across a

range of therapies. Xeris has three commercially available

products: Gvoke®, a ready-to-use liquid glucagon for the treatment

of severe hypoglycemia; Keveyis®, a proven therapy for primary

periodic paralysis; and Recorlev® for the treatment of endogenous

Cushing’s syndrome. Xeris has a diverse pipeline of development and

partnered programs using its formulation sciences, XeriSol™ and

XeriJect™, to support long-term product development and commercial

success.

Xeris Biopharma Holdings is headquartered in Chicago, IL. For

more information, visit www.xerispharma.com, or follow us on

Twitter, LinkedIn, or Instagram.

Forward-Looking Statements

Any statements in this press release about future expectations,

plans and prospects for Xeris Biopharma Holdings, Inc. including

statements regarding the financial outlook for 2023, including

projections regarding year-end 2023 cash estimates and total

revenue, the Company’s expectations regarding its cash flow

breakeven timeline, the market and therapeutic potential of its

products and product candidates, continued growth of Gvoke, Keveyis

and Recorlev, continued use of Xeris’ formulation sciences in

development and partnered programs, potentially new partnerships

and collaborations, expectations regarding clinical data or results

from planned clinical trials, the timing of clinical trials,

including advancement of its levothyroxine clinical program and a

related Phase 2 study in 2023, the potential utility of its

formulation platforms, cash management, becoming a self-sustaining

enterprise, and other statements containing the words “will,”

“would,” “continue,” “expect,” “anticipate” and similar

expressions, constitute forward-looking statements within the

meaning of The Private Securities Litigation Reform Act of 1995.

These forward-looking statements are based on numerous assumptions

and assessments made in light of Xeris’ experience and perception

of historical trends, current conditions, business strategies,

operating environment, future developments, geopolitical factors

and other factors it believes appropriate. By their nature,

forward-looking statements involve known and unknown risks and

uncertainties because they relate to events and depend on

circumstances that will occur in the future. The various factors

that could cause Xeris’ actual results, performance or

achievements, industry results and developments to differ

materially from those expressed in or implied by such

forward-looking statements, include the impact of COVID-19 on its

business operations and clinical activities, its financial position

and need for financing, including to fund its product development

programs or commercialization efforts, whether its products will

achieve and maintain market acceptance, its reliance on third-party

suppliers, including single-source suppliers, its reliance on third

parties to conduct clinical trials, the ability of its product

candidates to compete successfully with existing and new drugs, and

its and collaborators’ ability to protect its intellectual property

and proprietary technology. No assurance can be given that such

expectations will be realized and persons reading this

communication are, therefore, cautioned not to place undue reliance

on these forward-looking statements. Additional information about

potential impacts of COVID-19, financial, operational, economic,

competitive, regulatory, governmental, technological, and other

factors that may affect Xeris is set forth in the "Risk Factors"

section of Xeris’ most recently filed Quarterly Report on Form 10-Q

filed with the Securities and Exchange Commission, the contents of

which are not incorporated by reference into, nor do they form part

of, this communication. Forward-looking statements in this

communication are based on information available to us, as of the

date of this communication and, while believed to be reasonable,

actual results may differ materially. Subject to any obligations

under applicable law, we do not undertake any obligation to update

any forward-looking statement whether as a result of new

information, future developments or otherwise, or to conform any

forward-looking statement to actual results, future events, or to

changes in expectations.

XERIS BIOPHARMA HOLDINGS,

INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(in thousands, except share and

per share data)

Three Months Ended December

31,

Twelve Months Ended December

31,

2022

2021

2022

2021

Product revenue, net

$

32,539

$

21,359

$

109,263

$

49,280

Royalty, contract and other revenue

605

70

985

310

Total revenue

33,144

21,429

110,248

49,590

Costs and expenses:

Cost of goods sold, excluding amortization

of intangible assets

6,291

4,889

22,634

13,318

Research and development

4,955

10,082

20,966

25,160

Selling, general and administrative

34,357

54,179

137,745

125,718

Amortization of intangible assets

2,711

550

10,843

550

Total costs and expenses

48,314

69,700

192,188

164,746

Loss from operations

(15,170

)

(48,271

)

(81,940

)

(115,156

)

Other expense

1,902

(2,519

)

(14,144

)

(7,569

)

Net loss before benefit from income

taxes

(13,268

)

(50,790

)

(96,084

)

(122,725

)

Benefit from income taxes

338

—

1,424

—

Net loss

$

(12,930

)

$

(50,790

)

$

(94,660

)

$

(122,725

)

Net loss per common share - basic and

diluted

$

(0.10

)

$

(0.42

)

$

(0.70

)

$

(1.55

)

Weighted average common shares outstanding

- basic and diluted

135,986,345

121,548,995

135,628,721

79,027,062

XERIS BIOPHARMA HOLDINGS,

INC.

CONSOLIDATED BALANCE

SHEETS

(in thousands)

December 31, 2022

December 31, 2021

Assets

Current assets:

Cash and cash equivalents

$

121,966

$

67,271

Short-term investments

—

35,162

Trade accounts receivable, net

30,830

17,456

Inventory

24,735

18,118

Prepaid expenses and other current

assets

9,287

4,589

Total current assets

186,818

142,596

Property and equipment, net

5,516

6,627

Goodwill

120,607

131,450

Operating lease right-of-use assets

22,859

22,859

Intangible assets, net

3,992

—

Other assets

4,730

829

Total assets

$

344,522

$

304,361

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

4,606

8,924

Current operating lease liabilities

1,580

—

Other accrued liabilities

36,786

49,088

Accrued trade discounts and rebates

16,818

15,041

Accrued returns reserve

11,173

4,000

Current portion of contingent value

rights

—

—

Other current liabilities

2,658

1,987

Total current liabilities

73,621

79,040

Long-term debt, net of unamortized debt

issuance costs

187,075

88,067

Contingent value rights

25,688

22,531

Supply agreement liability, less current

portion

—

5,991

Deferred rent

—

6,883

Non-current operating lease

liabilities

9,402

—

Deferred tax liabilities

3,518

4,942

Other liabilities

31

1,676

Total liabilities

299,335

209,130

Total stockholders’ equity

45,187

95,231

Total liabilities and stockholders’

equity

$

344,522

$

304,361

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230308005167/en/

Investor Contact Allison Wey Senior Vice President,

Investor Relations and Corporate Communications

awey@xerispharma.com 312-736-1237

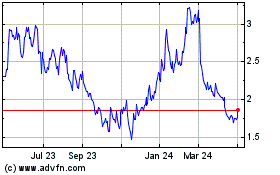

Xeris Biopharma (NASDAQ:XERS)

Historical Stock Chart

From Mar 2024 to Apr 2024

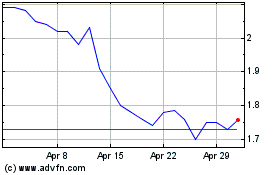

Xeris Biopharma (NASDAQ:XERS)

Historical Stock Chart

From Apr 2023 to Apr 2024