As filed with the Securities and Exchange Commission on June 9, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

X4 PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware

(State or other jurisdiction of incorporation or organization) | | 27-3181608

(I.R.S. Employer Identification Number) |

61 North Beacon Street, 4th Floor

Boston, Massachusetts 02134

(857) 529-8300

(Address, including zip code, and telephone number, including area code of registrant’s principal executive offices)

Paula Ragan, Ph.D.

Chief Executive Officer

c/o X4 Pharmaceuticals, Inc.

61 North Beacon Street, 4th Floor

Boston, Massachusetts 02134

(857) 529-8300

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | |

Daniel I. Goldberg Eric Blanchard Courtney T. Thorne

Cooley LLP

55 Hudson Yards New York, NY 1001-2157 (212) 479 6000 |

From time to time after the effective date of this Registration Statement

(Approximate date of commencement of proposed sale to the public)

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | |

Large accelerated filer | Accelerated filer |

Non-accelerated filer | Smaller reporting company ☒ |

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The Selling Stockholders may not sell these securities or accept an offer to buy these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and it is not soliciting offers to buy these securities in any jurisdiction where such offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JUNE 9, 2023

PROSPECTUS

Up to 42,784,203 Shares of Common Stock

Offered by the Selling Stockholders

This prospectus relates to the resale from time to time of up to 42,784,203 shares of common stock, par value $0.001 per share, of X4 Pharmaceuticals, Inc. (the “Common Stock”) by the selling stockholders listed on page 10 (the “Selling Stockholders”), including their pledgees, assignees, donees, transferees or their respective successors-in-interest, which consist of (i) 34,521,046 outstanding shares of our Common Stock held by the Selling Stockholders and (ii) 8,263,157 shares of our Common Stock issuable upon the exercise of outstanding pre-funded warrants to purchase shares of our Common Stock held by the Selling Stockholders. We will not receive any proceeds from the sale of the shares offered by this prospectus, except the exercise price of $0.001 per share of any of the pre-funded warrants exercised for cash.

We have agreed, pursuant to a registration rights agreement that we have entered into with the Selling Stockholders, to bear all of the expenses incurred in connection with the registration of these shares. The Selling Stockholders will pay or assume discounts, commissions, fees of underwriters, selling brokers or dealer managers and similar expenses, if any, incurred for the sale of these shares of our Common Stock.

The Selling Stockholders identified in this prospectus, or their pledgees, assignees, donees, transferees or their respective successors-in-interest, may offer the shares from time to time on terms to be determined at the time of sale through ordinary brokerage transactions or through any other means described in this prospectus under the caption “Plan of Distribution.” The shares may be sold at fixed prices, at prevailing market prices, at prices related to prevailing market prices or at negotiated prices. For a list of the Selling Stockholders, see the section entitled “Selling Stockholders” on page 10.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

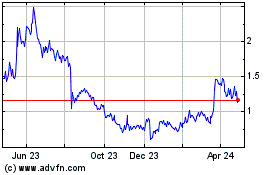

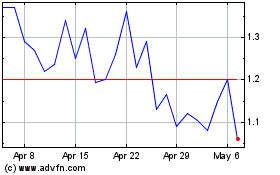

Our Common Stock is traded on the Nasdaq Capital Market under the symbol “XFOR.” On June 6, 2023, the last reported sale price of our Common Stock was $2.19 per share. You are urged to obtain current market quotations for our Common Stock.

Investing in our Common Stock involves a high degree of risk. You should carefully read and consider the section entitled “Risk Factors” on page 8, the risk factors included in our periodic reports filed with the Securities and Exchange Commission (“SEC”), in any applicable prospectus supplement and in any other documents we file with the SEC. NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is , 2023.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

We urge you to read carefully this prospectus, together with the information incorporated herein by reference as described under the heading “Where You Can Find Additional Information,” before buying any of the securities being offered.

You should rely only on the information contained or incorporated by reference in this prospectus and the applicable prospectus supplement or in any amendment to this prospectus. Neither we nor the Selling Stockholders have authorized anyone to provide you with different information, and if anyone provides, or has provided you, with different or inconsistent information, you should not rely on it. The Selling Stockholders are offering to sell, and seeking offers to buy, shares of our Common Stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus, as well as the information filed previously with the SEC, and incorporated herein by reference, is accurate only as of the date of the document containing the information, regardless of the time of delivery of this prospectus or any applicable prospectus supplement or any sale of our Common Stock.

A prospectus supplement may add to, update or change the information contained in this prospectus. You should read both this prospectus and any applicable prospectus supplement together with additional information described below under the heading “Where You Can Find Additional Information.”

In this prospectus, references to “X4 Pharmaceuticals,” “X4,” the “Company,” the registrant,” “we,” “us,” and “our” refer to X4 Pharmaceuticals, Inc., formerly Arsanis, Inc., and its subsidiaries. The phrase “this prospectus” refers to this prospectus and any applicable prospectus supplement, unless the context requires otherwise.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and any applicable prospectus supplement or free writing prospectus, including the documents incorporated by reference herein and therein, contain forward-looking statements. These are based on our management’s current beliefs, expectations and assumptions about future events, conditions and results and on information currently available to us. Discussions containing these forward-looking statements may be found, among other places, in the sections entitled “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in the documents incorporated by reference herein.

Any statements in this prospectus, or incorporated herein, about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and are forward-looking statements. Within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (“the Exchange Act”), these forward-looking statements include statements regarding:

•the initiation, timing, progress and results of our current and future preclinical studies and clinical trials and related preparatory work and the period during which the results of the trials will become available, as well as our research and development programs;

•the potential benefits, including clinical utility, that may be derived from any of our product candidates;

•the timing of and our ability to obtain and maintain regulatory approval of our existing product candidates or any product candidates that we may develop in the future, and any related restrictions, limitations, or warnings in the label of any approved product candidates;

•our plans to research, develop, manufacture and commercialize our product candidates;

•the timing of our regulatory filings for our product candidates, along with regulatory developments in the United States and other foreign countries;

•the size and growth potential of the markets for our product candidates, if approved, and the rate and degree of market acceptance of our product candidates, including reimbursement that may be received from payors;

•the benefits of U.S. Food and Drug Administration and European Commission designations, including, without limitation, Fast Track, Orphan Drug and Breakthrough Therapy;

•our commercialization, marketing and manufacturing capabilities and strategy;

•our ability to attract and retain qualified employees and key personnel;

•our competitive position and the development of and projections relating to our competitors or our industry;

•our expectations regarding our ability to obtain and maintain intellectual property protection;

•the success of competing therapies that are or may become available;

•our estimates and expectations regarding future operations, financial position, revenues, costs, expenses, uses of cash, capital requirements or our need for additional financing;

•our ability to continue as a going concern;

•our plans to in-license, acquire, develop and commercialize additional product candidates;

•the impact of laws and regulations;

•our plans to identify additional product candidates with significant commercial potential that are consistent with our commercial objectives;

•our ability to raise additional capital;

•our strategies, prospects, plans, expectations or objectives; and

•other risks and uncertainties, including those listed under the caption “Risk Factors” in our most recent Annual Report on Form 10-K, our most recent Quarterly Report on Form 10-Q, and other filings we make with the SEC.

In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “intend,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “predict,” “potential,” “continue,” “likely,” and similar expressions (including their use in the negative) intended to identify forward-looking statements. These forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these risks and uncertainties, you should not place undue reliance on these forward-looking statements. We discuss many of these risks in greater detail under the heading “Risk Factors” in our SEC filings, and may provide additional information in any applicable prospectus supplement. Also, these forward-looking statements represent our estimates and assumptions only as of the date of the document containing the applicable statement.

We qualify all of the forward-looking statements in the foregoing documents by these cautionary statements. Unless required by law, we undertake no obligation to update or revise any forward-looking statements to reflect new information or future events or developments. Thus, you should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements. Before deciding to purchase our Common Stock, you should carefully consider the risk factors incorporated by reference herein, in addition to the other information set forth in this prospectus and in the documents incorporated by reference herein.

PROSPECTUS SUMMARY

This summary highlights important features of this offering and the information included or incorporated by reference in this prospectus. This summary does not contain all of the information you should consider before investing in our Common Stock. You should carefully read this prospectus, any applicable prospectus supplement and the information incorporated by reference in this prospectus and any applicable prospectus supplement before you invest in our Common Stock.

Company Overview

We are a late clinical-stage biopharmaceutical company discovering and developing novel therapeutics for the treatment of rare diseases and those with limited treatment options, with a focus on conditions resulting from dysfunction of the immune system.

Our lead clinical candidate is mavorixafor, a small molecule antagonist of chemokine receptor CXCR4 that is being developed as an oral, once-daily therapy. Due to its ability to increase the mobilization of mature, functional white blood cells from the bone marrow into the bloodstream, we believe that mavorixafor has the potential to provide therapeutic benefit across a variety of chronic neutropenic disorders, including WHIM (Warts, Hypogammaglobulinemia, Infections, and Myelokathexis) syndrome, a rare, primary immunodeficiency.

In November 2022, we announced positive top-line data from our global, pivotal, Phase 3 clinical trial, referred to as the 4WHIM trial, evaluating the safety and efficacy of mavorixafor in people with WHIM syndrome. In May 2023, we announced additional data from the 4WHIM trial, focusing on the impact of mavorixafor on the rate, severity and duration of infections in trial participants. We are currently preparing a U.S. New Drug Application (“NDA”) seeking approval of oral, once-daily mavorixafor in the treatment of people aged 12 years and older with WHIM syndrome. This NDA submission is expected early in the second half of 2023.

Mavorixafor has received multiple special designations from global regulatory authorities in WHIM syndrome, including Breakthrough Therapy Designation, Fast Track Designation, and Rare Pediatric Designation in the United States, and Orphan Drug Status in both the United States and European Union. In addition, upon approval of an NDA, we are eligible to receive a Priority Review Voucher as a result of mavorixafor’s Rare Pediatric Designation in the United States.

We are also currently advancing mavorixafor in a Phase 2 clinical trial in people with certain chronic neutropenic disorders following positive results from a Phase 1b clinical trial of mavorixafor in people with idiopathic, cyclic, or congenital neutropenia. Participants are now being enrolled in this Phase 2 clinical trial and we expect to provide an update on clinical results in the second or third quarter of 2023. We also expect to provide clarity on the scope and timing of our planned Phase 3 chronic neutropenia clinical program in the second or third quarter of 2023.

To date, we have not generated revenue from product sales and do not expect to generate significant revenue from the sale of our products in the foreseeable future. If our development efforts for our product candidates are successful and result in regulatory approval, we may generate revenue in the future from product sales. We cannot predict if, when, or to what extent we will generate revenue from the commercialization and sale of our product candidates. We may never succeed in obtaining regulatory approval for any of our product candidates.

Private Placement

Securities Purchase Agreement

On May 15, 2023, we entered into a Securities Purchase Agreement (the “Purchase Agreement”) with the purchasers named therein (the “Purchasers”), pursuant to which we agreed to sell and issue to the Purchasers in a private placement (the “Private Placement”) (i) an aggregate of 34,521,046 shares of Common Stock at a purchase price of $1.52 per share, which represents the closing price of the Common Stock reported on the Nasdaq Capital Market on May 15, 2023 and (ii) with respect to certain Purchasers, in lieu of such shares of Common Stock, pre-funded warrants (the “Pre-Funded Warrants”) to purchase an aggregate of 8,263,157 shares of Common Stock at a purchase price of $1.519 per Pre-Funded Warrant. On May 18, 2023, we closed the Private Placement and issued an aggregate of 34,521,046 shares of Common Stock and Pre-Funded Warrants to purchase an aggregate of 8,263,157 shares of Common Stock.

Each Pre-Funded Warrant has an exercise price equal to $0.001 per share. The Pre-Funded Warrants are exercisable at any time after their original issuance and will not expire until exercised in full. The Pre-Funded Warrants provide that a holder of Pre-Funded Warrants will not have the right to exercise any portion of its Pre-Funded Warrants if such holder,

together with its affiliates, would beneficially own in excess of 4.99% or 9.99% of the number of shares of Common Stock outstanding immediately after giving effect to such exercise (the “Beneficial Ownership Limitation”); provided, however,

that each holder may increase or decrease the Beneficial Ownership Limitation by giving 61 days’ notice to us, but not to any percentage in excess of 19.99%.

The shares of Common Stock issued to the Purchasers, and the shares of common stock Common Stock issuable upon the exercise of the Pre-Funded Warrants, were not initially registered under the Securities Act or any state securities laws. We have relied on the exemption from the registration requirements afforded by Regulation D under the Securities Act. In connection with their execution of the Purchase Agreement, each of the Purchasers represented to us that such Purchaser is an “accredited investor” as defined in Regulation D of the Securities Act and that the securities purchased by such Purchaser were being acquired solely for its own account and for investment purposes and not with a view to its future sale or distribution.

Registration Rights Agreement

On May 15, 2023, in connection with the Private Placement, we entered into a Registration Rights Agreement with the Purchasers (the “Registration Rights Agreement”), pursuant to which we agreed to (i) promptly following the closing date of the Private Placement, and in no event later than thirty (30) days from the date of the Registration Rights Agreement, file a registration statement with the SEC to cover the resale of the shares of Common Stock, including those shares of Common Stock issuable upon exercise of the Pre-Funded Warrants, issued to the Purchasers pursuant to the Purchase Agreement (collectively, the “Shares”), (ii) to use commercially reasonable efforts to cause such registration statement to become effective as soon as practicable and (iii) to keep such registration statement effective until the date the Shares covered by such registration statement have been sold or may be resold pursuant to Rule 144 without restriction. In the event that such registration statement is not filed or declared effective within the timeframes set forth in the Registration Rights Agreement or, after the registration statement has been declared effective by the SEC, sales cannot be made pursuant to the registration statement for any reason including by reason of a stop order or our failure to update such registration statement, subject to certain limited exceptions, then we have agreed to make pro rata payments to each Purchaser as liquidated damages in an amount equal to 1% of the aggregate amount invested by each such Purchaser in the Shares per 30-day period or pro rata for any portion thereof for each such month during which such event continues, subject to certain caps set forth in the Registration Rights Agreement.

The registration statement of which this prospectus is a part relates to the offer and resale of the shares of Common Stock issued to the Purchasers pursuant to the Purchase Agreement, including the shares issuable upon exercise of the Pre-Funded Warrants. When we refer to the Selling Stockholders in this prospectus, we are referring to the Purchasers named in this prospectus as the Selling Stockholders and, as applicable, any donees, pledgees, assignees, transferees or other successors-in-interest selling the Shares received after the date of this prospectus from the Selling Stockholders as a gift, pledge, or other non-sale related transfer.

Corporate Information

Prior to March 13, 2019, we were a clinical-stage biopharmaceutical company known as Arsanis, Inc. that had historically been focused on applying monoclonal antibody immunotherapies to address serious infectious diseases. Arsanis, Inc. was originally incorporated in the State of Delaware in August 2010.

On March 13, 2019, we completed our business combination with X4 Therapeutics, Inc. (formerly X4 Pharmaceuticals, Inc.) in accordance with the terms of an Agreement and Plan of Merger, dated as of November 26, 2018, as amended on December 20, 2018 and March 8, 2019 (the “Merger Agreement”), that we entered into with X4 Therapeutics, Inc. and Artemis AC Corp., a Delaware corporation and our wholly owned subsidiary (“Merger Sub”). Pursuant to the terms of the Merger Agreement, Merger Sub merged with and into X4 Therapeutics, Inc., with X4 Therapeutics, Inc. continuing as our wholly owned subsidiary and the surviving corporation of the merger, which transaction we refer to as the Merger. At the closing of the Merger, we issued shares of our Common Stock to X4 Therapeutics, Inc. stockholders based on an agreed upon exchange ratio, and each option or warrant to purchase X4 Therapeutics, Inc. capital stock became an option or warrant, respectively, to purchase our Common Stock, subject to adjustment in accordance with the agreed upon exchange ratio. Following the closing of the Merger, we effected a 1-for-6 reverse stock split of our Common Stock, our name was changed to X4 Pharmaceuticals, Inc., the business of X4 Therapeutics, Inc. became our business, and we became a clinical-stage biopharmaceutical company focused on the discovery, development and commercialization of novel therapeutics for the treatment of rare diseases. In connection with the closing of the Merger, our stock began trading on the Nasdaq Capital Market under the symbol “XFOR” on March 14, 2019.

Our principal executive offices are located at 61 North Beacon Street, 4th Floor, Boston, Massachusetts 02134, and our telephone number is (857) 529-8300. Our website is located at http://www.x4pharma.com. We do not incorporate by reference into this prospectus the information on, or accessible through, our website, and you should not consider it as part of this prospectus.

THE OFFERING

| | | | | |

| Common Stock Offered by the Selling Stockholders | Up to 42,784,203 Shares |

| Use of Proceeds | We will not receive any proceeds from the sale of the Shares covered by this prospectus, except with respect to amounts received by us due to the exercise of Pre-Funded Warrants. |

| Nasdaq Capital Market Symbol | XFOR |

RISK FACTORS

An investment in our Common Stock involves a high degree of risk. Prior to making a decision about investing in our Common Stock, you should consider carefully the specific risk factors discussed in the sections entitled “Risk Factors” contained in our most recent Quarterly Report on Form 10-Q for the quarter ended March 31, 2023, as filed with the SEC on May 4, 2023, which are incorporated in this prospectus by reference in their entirety, as well as any amendment or updates to our risk factors reflected in subsequent filings with the SEC, including any prospectus supplement hereto. These risks and uncertainties are not the only risks and uncertainties we face. Additional risks and uncertainties not presently known to us, or that we currently view as immaterial, may also impair our business. If any of the risks or uncertainties described in our SEC filings or any additional risks and uncertainties actually occur, our business, financial condition, results of operations and cash flow could be materially and adversely affected. In that case, the trading price of our Common Stock could decline and you might lose all or part of your investment.

USE OF PROCEEDS

We are filing the registration statement of which this prospectus forms a part to permit the holders of the Shares of our Common Stock described in the section entitled “Selling Stockholders” to resell such Shares. We are not selling any securities under this prospectus, and we will not receive any proceeds from the sale or other disposition of shares of our Common Stock held by the Selling Stockholders, except with respect to amounts received by us due to the exercise of the Pre-Funded Warrants.

The Selling Stockholders will pay any underwriting discounts and commissions and expenses incurred by the Selling Stockholders for brokerage, accounting, tax or legal services or any other expenses incurred by the Selling Stockholders in disposing of these Shares. We will bear all other costs, fees and expenses incurred in effecting the registration of the Shares covered by this prospectus, including, without limitation, all registration and filing fees, Nasdaq listing fees and fees and expenses of our counsel and our accountants.

SELLING STOCKHOLDERS

This prospectus covers the sale or other disposition by the Selling Stockholders of up to the total number of shares of our Common Stock that were issued to the Selling Stockholders pursuant to the Purchase Agreement, plus the total number of shares of our Common Stock issuable upon exercise of the Pre-Funded Warrants and the Warrants issued to the Selling Stockholders pursuant to the Purchase Agreement, without giving effect to the Beneficial Ownership Limitation described under “Prospectus Summary—Private Placement—Securities Purchase Agreement.” The table below sets forth, to our knowledge, information concerning the beneficial ownership of shares of our Common Stock by the Selling Stockholders as of May 19, 2023. The information in the table below with respect to the Selling Stockholders has been obtained from the respective Selling Stockholders. When we refer to the “Selling Stockholders” in this prospectus, or, if required, a post-effective amendment to the registration statement of which this prospectus is a part, we mean the Selling Stockholders listed in the table below as offering Shares, as well as their respective pledgees, assignees, donees, transferees or successors-in-interest. Throughout this prospectus, when we refer to the shares of our Common Stock being registered on behalf of the Selling Stockholders, we are referring to the shares of our Common Stock and the shares underlying the Pre-Funded Warrants issued to the Selling Stockholders pursuant to the Purchase Agreement, without giving effect to the Beneficial Ownership Limitation described above. The Selling Stockholders may sell all, some or none of the shares of Common Stock subject to this prospectus. See “Plan of Distribution” below as it may be supplemented and amended from time to time.

The number of shares of Common Stock beneficially owned prior to the offering for each Selling Stockholder includes all shares of our Common Stock beneficially held by such Selling Stockholder as of May 19, 2023, which includes (i) all shares of our Common Stock purchased by such Selling Stockholder in the Private Placement and (ii) all of the shares of Common Stock issuable upon exercise of the Pre-Funded Warrants purchased by such Selling Stockholder in the Private Placement, subject to the Beneficial Ownership Limitation described under “Prospectus Summary-Private Placement-Securities Purchase Agreement.” The percentages of shares owned before and after the offering are based on 158,684,870 shares of Common Stock outstanding as of May 19, 2023, which includes the outstanding shares of Common Stock offered by this prospectus but does not include any shares of Common Stock offered by this prospectus that are issuable pursuant to the Pre-Funded Warrants, and are deemed outstanding in the table below because they are beneficially owned by a Selling Stockholder.

Other than as stated above, beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to our Common Stock. Generally, a person “beneficially owns” shares of our Common Stock if the person has or shares with others the right to vote those shares or to dispose of them, or if the person has the right to acquire voting or disposition rights within 60 days. In computing the number of shares of our Common Stock beneficially owned by a Selling Stockholder and the percentage ownership of such Selling Stockholder, we deemed outstanding shares of Common Stock issuable upon the exercise of pre-funded warrants (regardless of whether or not such pre-funded warrants were acquired in the Private Placement) and/or warrants, as applicable, held by that Selling Stockholder that are exercisable within 60 days of May 19, 2023. We did not deem these shares outstanding, however, for the purpose of computing the percentage ownership of any other Selling Stockholder. The inclusion of any shares in this table does not constitute an admission of beneficial ownership for any Selling Stockholder named below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Shares of

Common Stock

Beneficially Owned

Prior to Offering | | Number of

Shares of

Common Stock

Being Offered(1) | | Shares of

Common Stock

to be Beneficially

Owned After

Offering(2) |

| Name of Selling Stockholder | | Number | | Percentage | Number | | Percentage |

Entities affiliated with Bain Capital Life Sciences(3) | | 16,195,831 | | 9.99 | % | | 3,289,473 | | 16,560,922 | | 9.99 | % |

Growth Equity Opportunities 18 VGE, LLC(4) | | 15,948,714 | | 9.99 | % | | 8,223,684 | | 16,861,442 | | 9.99 | % |

OrbiMed Private Investments IV, LP (5) | | 11,494,437 | | 7.0 | % | | 1,315,789 | | 10,178,648 | | 6.2 | % |

Entities affiliated with Acorn Bioventures(6) | | 7,950,293 | | 5.0 | % | | 3,289,473 | | 8,123,059 | | 5.0 | % |

Entities affiliated with Empery Asset Management LP(7) | | 7,181,183 | | 4.4 | % | | 2,631,577 | | 4,549,606 | | 2.8 | % |

Integrated Core Strategies (US) LLC(8) | | 6,310,442 | | 4.0 | % | | 1,973,684 | | 4,336,758 | | 2.7 | % |

Entities affiliated with Tri Locum(9) | | 5,672,781 | | 3.5 | % | | 3,947,368 | | 1,725,413 | | 1.1 | % |

CVI Investments, Inc.(10) | | 4,660,227 | | 2.9 | % | | 2,350,000 | | 2,310,227 | | 1.4 | % |

Stonepine Capital, LP(11) | | 4,605,263 | | 2.9 | % | | 4,605,263 | | — | | — |

Adage Capital Partners LP(12) | | 4,276,315 | | 2.7 | % | | 4,276,315 | | — | | — |

Schonfeld EXT Master Fund LP(13) | | 3,431,583 | | 2.2 | % | | 909,350 | | 2,522,233 | | 1.6 | % |

Parkman HP Master Fund LP (14) | | 1,577,186 | | 1.0 | % | | 340,650 | | 1,236,536 | | * |

Lytton-Kambara Foundation(15) | | 3,515,166 | | 1.3 | % | | 657,894 | | 1,493,636 | | * |

Citadel CEMF Investments Ltd.(16) | | 3,000,000 | | 1.9 | % | | 3,000,000 | | — | | — |

Entities affiliated with Kingdon(17) | | 1,973,683 | | 1.2 | % | | 1,973,683 | | — | | — |

* Less than one percent.

(1) The number of shares of our Common Stock in the column “Number of Shares of Common Stock Being Offered” represents all of the shares of our Common Stock that a Selling Stockholder may offer and sell from time to time under this prospectus.

(2) We do not know when or in what amounts a Selling Stockholder may offer shares for sale. The Selling Stockholders might not sell any or might sell all of the shares offered by this prospectus. Because the Selling Stockholders may offer all or some of the shares pursuant to this offering, and because there are currently no agreements, arrangements or understandings with respect to the sale of any of the shares, we cannot estimate the number of the shares that will be held by the Selling Stockholders after completion of the offering. However, for purposes of this table, we have assumed that, after completion of the offering, none of the shares covered by this prospectus will be held by the Selling Stockholders, including Common Stock issuable upon exercise of the Pre-Funded Warrants issued in the Private Placement.

(3) The shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” consist of (i) 968,012 and 2,321,461 shares of Common Stock purchased by BCLS I Investco, LP (“BCLS Investco I”) and BCLS II Investco, LP (“BCLS Investco II”), respectively, in the Private Placement, (ii) 2,522,176 additional shares of Common Stock previously purchased by BCLS Investco I, (iii) 6,948,620 additional shares of Common Stock previously purchased by BCLS Investco II, and (iv) an aggregate of 3,435,562 shares of Common Stock issuable to BCLS Investco I and BCLS Investco II upon the exercise of pre-funded warrants and/or warrants held by BCLS Investco I and BCLS Investco II. In addition to the foregoing shares, as of May 19, 2023, BCLS Investco I and BCLS Investco II held pre-funded warrants and warrants to purchase an aggregate of 17,820,064 shares of Common Stock, which are not included in the shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” because they are subject to limitations on exercisability if such exercise would result in BCLS Investco I or BCLS Investco II beneficially owning more than 9.99% of our outstanding Common Stock. The shares reported under “Number of Shares of Common Stock Being Offered” consist of 968,012 and 2,321,461 shares of Common Stock purchased by BCLS Investco I and BCLS Investco II, respectively, in the Private Placement. The shares reported under “Number of Shares of Common Stock to be Beneficially Owned After Offering” consist of (i) 2,522,176 shares of Common Stock held by BCLS Investco I, (ii) 6,948,620 shares of Common Stock held by BCLS Investco II and (iii) an aggregate of 7,090,126 shares of Common Stock issuable to BCLS Investco I and BCLS Investco II upon the exercise of pre-funded warrants and/or warrants held by BCLS Investco I and BCLS Investco II.. Bain Capital Life Sciences Investors, LLC (“BCLSI”) is the ultimate general partner of each of BCLS Investco I and BCLS Investco II. As a result, BCLSI may be deemed to share voting and dispositive power with respect to the shares of Common Stock beneficially owned by each of BCLS Investco I and BCLS Investco II. The address of each of BCLS Investco I and BCLS Investco II is c/o Bain Capital Life Sciences, LP, 200 Clarendon Street, Boston, MA 02116.

(4) The shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” consist of (i) 3,250,000 shares of Common Stock purchased in the Private Placement, (ii) an aggregate of 11,736,793 additional shares of Common Stock previously purchased and (iii) 961,921 shares of Common Stock issuable upon the exercise of the Pre-Funded Warrants purchased in the Private Placement. The shares underlying the following pre-funded warrants and warrants are not included in the shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” because they are subject to limitations on exercisability if such exercise would result in Growth Equity Opportunities 18 VGE, LLC beneficially owning more than 4.99% or 9.99% of our outstanding Common Stock: (a) 4,011,763 shares of Common Stock issuable upon exercise of the Pre-Funded Warrants purchased in the Private Placement, (b) 13,332,032 shares of

Common Stock issuable upon exercise of pre-funded warrants previously purchased, (c) 13,705,189 shares of Common Stock issuable upon the exercise of warrants previously purchased and (d) 5,681,818 shares of Common Stock issuable upon the exercise of our Class C warrants, two of which are exercisable into one share of Common Stock, previously purchased. The shares reported under “Number of Shares of Common Stock Being Offered” consist of the shares of Common Stock, including the shares of Common Stock issuable upon exercise of the Pre-Funded Warrants, purchased by Growth Equity Opportunities 18 VGE, LLC in the Private Placement, without giving effect to the Beneficial Ownership Limitation. The shares reported under “Number of Shares of Common Stock to be Beneficially Owned After Offering” consist of (i) an aggregate of 11,736,793 shares of Common Stock held by Growth Equity Opportunities 18 VGE, LLC prior to the Private Placement and (ii) 5,124,649 shares of Common Stock issuable upon the exercise of pre-funded warrants previously purchased by Growth Equity Opportunities 18 VGE, LLC, excluding shares underlying the other pre-funded warrants and warrants that are not exercisable due to the Beneficial Ownership Limitation. Growth Equity Opportunities 18 VGE, LLC is wholly owned by NEA 18 Venture Growth Equity, L.P. (“NEA 18 VGE”). The sole general partner of NEA 18 VGE is NEA Partners 18 VGE, L.P. (“NEA Partners 18 VGE”). The sole general partner of NEA Partners 18 VGE is NEA VGE 18 GP, LLC (“NEA VGE 18 LLC”). The managers of NEA VGE 18 are Scott D. Sandell, Anthony A. Florence, Jr., Mohamad Makhzoumi, Ali Behbahani, Carmen Chang, Edward T. Mathers, Paul E. Walker and Rick C. Yang. NEA VGE 18 and its managers may be deemed to beneficially own the securities held by Growth Equity Opportunities 18 VGE, LLC. Each of NEA VGE 18 and its managers disclaims beneficial ownership of any of the shares of our Common Stock they may be deemed to beneficially own except to the extent of their respective pecuniary interest therein. The address of Growth Equity Opportunities 18 VGE, LLC, NEA 18 VGE, NEA Partners 18 VGE, NEA VGE 18 and Scott Sandell is New Enterprise Associates, 1954 Greenspring Drive, Suite 600, Timonium, MD 21093.The address of the principal business office of Ali Behbahani and Edward Mathers is New Enterprise Associates, 5425 Wisconsin Avenue, Suite 800, Chevy Chase, MD 20815. The address of the principal business office of Carmen Chang, Mohamad Makhzoumi, Paul Walker and Rick Yang is New Enterprise Associates, 2855 Sand Hill Road, Menlo Park, California 94025. The address of the principal business office of Florence is New Enterprise Associates, 104 5th Avenue, 19th Floor, New York, NY 10001.

(5) The shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” consist of (i) 1,315,789 shares of Common Stock purchased by OrbiMed Private Investments IV, LP (“OPI IV”) in the Private Placement, (ii) 7,133,515 additional shares of Common Stock previously purchased by OPI IV and (iii) an aggregate of 4,360,922 shares of Common Stock issuable upon exercise of certain warrants previously purchased by OPI IV. OrbiMed Capital GP IV LLC (“GP IV”) is the general partner of OPI IV. OrbiMed Advisors LLC (“OrbiMed Advisors”) is the managing member of GP IV. By virtue of such relationships, GP IV and OrbiMed Advisors may be deemed to have voting and investment power with respect to the shares held by OPI IV and as a result, may be deemed to have beneficial ownership of such shares. OrbiMed Advisors exercises investment and voting power through a management committee comprised of Carl L. Gordon, Sven H. Borho, and W. Carter Neild. Each of Messrs. Gordon, Borho, and Neild disclaims beneficial ownership of the shares held by OPI IV, except to the extent of their respective pecuniary interest therein. Dr. Gordon previously was a member of our Board of Directors. The address for each of OPI IV, GP IV, OrbiMed Advisors, and Messrs. Gordon, Borho, and Neild is c/o OrbiMed Advisors LLC, 601 Lexington Avenue, 54th Floor, New York, NY 10022.

(6) The shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” consist of (i) 3,046,472 shares of Common Stock previously purchased by Acorn Bioventures I, (ii) 4,264,178 shares of Common Stock previously purchased by Acorn Bioventures II (together with Acorn Bioventures I, the “Acorn Bioventures Entities”) and (iii) 639,643 shares of Common Stock issuable upon exercise of the Pre-Funded Warrants purchased by Acorn Bioventures I in the Private Placement. The shares underlying the following Pre-Funded Warrants purchased in the Private Placement are not included in the shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” because they are subject to limitations on exercisability if such exercise would result in the Acorn Bioventures entities beneficially owning more than 4.99% of our outstanding Common Stock: (a) 741,936 shares of Common Stock issuable upon exercise of the Pre-Funded Warrants purchased by Acorn Bioventures I in the Private Placement and (b) 1,907,894 shares of Common Stock issuable upon exercise of the Pre-Funded Warrants purchased by Acorn Bioventures II in the Private Placement. In addition, the shares underlying the following pre-funded warrants and warrants (collectively, the “Previous Acorn Warrants”) previously purchased by the Acorn Bioventures Entities are not included in the shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” because they are subject to limitations on exercisability if such exercise would result in the Acorn Bioventures Entities beneficially owning more than 4.99% of our outstanding Common Stock: (a) 137,112 shares of Common Stock issuable upon the exercise of pre-funded warrants previously purchased by Acorn Bioventures I, (b) 189,344 shares of Common Stock issuable upon the exercise of pre-funded warrants previously purchased by Acorn Bioventures II, (c) 2,876,837 shares of Common Stock issuable upon the exercise of warrants previously purchased by Acorn Bioventures I, (d) 3,972,776 shares of Common Stock issuable upon the exercise of warrants previously purchased by Acorn Bioventures II, (e) 763,636 shares of Common Stock issuable upon the exercise of our Class C warrants, two of which are exercisable into one share of Common Stock, previously purchased by Acorn Bioventures I and (f) 1,054,546 shares of Common Stock issuable upon the exercise of our Class C warrants, two of which are exercisable into one share of Common Stock, previously purchased by Acorn Bioventures II. The shares reported under “Number of Shares of Common Stock Being Offered” represent the shares of Common Stock issuable upon exercise of the Pre-Funded Warrants purchased by the Acorn Bioventures Entities in the Private Placement without giving effect to the Beneficial Ownership Limitation. The shares reported under “Shares of Common Stock Beneficially Owned After the Offering” include 812,409 shares of Common Stock issuable upon exercise of the Previous Acorn Warrants that would be exercisable following the disposition by the Acorn Bioventures Entities of all of the shares registered for sale under this prospectus, giving effect to the Beneficial Ownership Limitation of 4.99%. Isaac Manke and Anders Hove have voting and investment control over the shares of Common Stock held by Acorn Bioventures I and Acorn Bioventures II. Isaac Manke and Anders Hove have voting and investment control over the shares of Common Stock held by Acorn Bioventures I and Acorn Bioventures II. The address of Acorn Bioventures I and Acorn Bioventures II is 420 Lexington Ave, Suite 2626, New York, NY 11027.

(7) The shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” consist of (i) 1,500,803 shares of Common Stock purchased by Empery Asset Master, LTD (“EAM”) in the Private Placement, (ii) 486,476 shares of Common Stock purchased by Empery Tax Efficient, LP (“ETE”) in the Private Placement, (iii) 644,298 shares of Common Stock purchased by Empery Tax Efficient III, LP (“ETE III”) in the Private Placement, (iv) 499,826 shares of Common Stock issuable upon the exercise of warrants previously purchased by EAM, (v) 150,746 shares of Common Stock issuable upon the exercise of warrants previously purchased by ETE, (vi) 262,670 shares of Common Stock issuable upon the exercise of warrants previously purchased by ETE III, (vii) 2,405,070 shares of Common Stock issuable upon the exercise of our Class C warrants, two of which are exercisable into one share of Common Stock, previously purchased by EAM, (viii) 733,617 shares of Common Stock issuable upon the exercise of our Class C warrants previously

purchased by ETE and (ix) 497,677 shares of Common Stock issuable upon the exercise of our Class C warrants previously purchased by ETE III. Empery Asset Management LP, the authorized agent of each of EAM, ETE and ETE III, has discretionary authority to vote and dispose of the securities held by EAM, ETE and ETE III, as applicable, and may be deemed to be the beneficial owner of such securities. Martin Hoe and Ryan Lane, in their capacity as investment managers of Empery Asset Management LP, may also be deemed to have investment discretion and voting power over the securities held by EAM, ETE and ETE III. EAM, ETE, ETE III, Mr. Hoe and Mr. Lane each disclaim any beneficial ownership of such securities. The address of each of EAM, ETE, ETE III, Empery Asset Management LP, Mr. Hoe and Mr. Lane is c/o Empery Asset Management, LP, One Rockefeller Plaza, Suite 1205, New York City, NY 10020.

(8) The shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” consist of (i) 1,973,684 shares of Common Stock purchased by Integrated Core Strategies (US) LLC in the Private Placement, (ii) 2,811,069 additional shares of Common Stock previously purchased by Integrated Core Strategies (US) LLC, (iii) 418,390 shares of Common Stock, 161,912 shares of Common Stock, 892,086 shares of Common Stock, 625 shares of Common Stock and 52,676 shares of Common Stock held by ICS Opportunities II LLC, ICS Opportunities, Ltd., Integrated Assets II LLC, Integrated Assets III LLC and Integrated Assets, Ltd., respectively, all of which are affiliates of Integrated Core Strategies (US) LLC. The securities listed above may be deemed to be beneficially owned by Millennium Management LLC, Millennium Group Management LLC and Israel Englander and/or other investment managers that may be controlled by Millennium Group Management LLC (the managing member of Millennium Management LLC) and Mr. Englander (the sole voting trustee of the managing member of Millennium Group Management LLC). The foregoing should not be construed in and of itself as an admission by Millennium Management LLC, Millennium Group Management LLC or Mr. Englander as to the beneficial ownership of the securities held by such entities. The address for Integrated Core Strategies (US) LLC is c/o Millennium Management LLC, 399 Park Avenue, New York, New York 10022.

(9) The shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” consist of (i) 839,921 shares of Common Stock purchased by Tri Locum Healthcare Master Fund LP (“Tri Locum Master Fund”) in the Private Placement, (ii) 2,035,934 shares of Common Stock purchased by New Holland Tactical Alpha Fund LP (“New Holland”) in the Private Placement, (iii) 1,071,513 shares of Common Stock purchased by 405 MSTV I LP (“MSTV I”), (iv) 125,905 additional shares of Common Stock held by Tri Locum Master Fund, (v) 305,182 additional shares of Common Stock held by New Holland, (vi) 160,629 additional shares of Common Stock held by MSTV I, (vii) 303,052 shares of Common Stock issuable upon the exercise of our Class C warrants, two of which are exercisable into one share of Common Stock, held by Tri Locum Master Fund, (viii) 543,963 shares of Common Stock issuable upon the exercise of our Class C warrants, two of which are exercisable into one share of Common Stock, held by New Holland and (ix) 286,682 shares of Common Stock issuable upon the exercise of our Class C warrants, two of which are exercisable into one share of Common Stock, held by MSTV I. Prashanth Jayaram, CEO of Tri Locum Partners LP, has voting or investment control over the securities held by each of Tri Locum Master Fund, New Holland and MSTV I. The address of each of Tri Locum Master Fund, New Holland and MSTV I is c/o Tri Locum Partners LP, 287 Park Avenue South, 2nd Floor, New York, NY 10010.

(10) The shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” consist of (i) 2,350,000 shares of Common Stock purchased by CVI Investments, Inc. (“CVI”) in the Private Placement, (ii) 37,500 shares of Common Stock issuable upon the exercise of our Class A warrants held by CVI and (iii) 2,272,727 shares of Common Stock issuable upon the exercise of our Class C warrants held by CVI. Heights Capital Management, Inc., the authorized agent of CVI, has discretionary authority to vote and dispose of the shares held by CVI and may be deemed to be the beneficial owner of these shares. Martin Kobinger, in his capacity as Investment Manager of Heights Capital Management, Inc., may also be deemed to have investment discretion and voting power over the shares held by CVI. Mr. Kobinger disclaims any such beneficial ownership of the shares. CVI is affiliated with one or more FINRA members, none of whom is currently expected to participate in the sale pursuant to this prospectus. The address of CVI is c/o Heights Capital Management, Inc., 101California Street, Suite 3250, San Francisco, CA 94111.

(11) The shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” represent 4,605,263 shares of Common Stock purchased in the Private Placement. The shares held by Stonepine Capital, LP may be deemed to be beneficially owned by Jon Plexico and Tim Lynch. Each of Mr. Plexico and Mr. Lynch disclaims beneficial ownership of the securities except to the extent of their respective pecuniary interests therein. The address of Stonepine Capital, LP is c/o Stonepine Capital Management, 919 NW Bond Street, Suite 204, Bend OR 97703.

(12) The shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” represent 4,276,315 shares of Common Stock purchased in the Private Placement. Adage Capital Management, L.P. has investment control over the securities held by Adage Capital Partners LP. Bob Atchinson and Phillip Gross are the managing members of Adage Capital Advisors, L.L.C., which is the managing member of Adage Capital Partners GP, L.L.C., which is the general partner of Adage Capital Management, L.P., and each such person or entity, as the case may be, has shared voting and/or investment power over the securities held by Adage Capital Partners, LP and may be deemed the beneficial owner of such shares, and each such person or entity, as the case may be, disclaims beneficial ownership of such securities except to the extent of their respective pecuniary interest therein. The address of Adage Capital Partners LP is 200 Clarendon Street, 52nd Floor, Boston, MA 02116.

(13) The shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” consist of (i) 909,350 shares of Common Stock purchased in the Private Placement, (ii) 1,909,409 additional shares of Common Stock previously purchased and (iii) 612,824 shares of Common Stock issuable upon exercise of certain warrants previously purchased. The shares held by Schonfeld EXT Master Fund LP may be deemed to be beneficially owned by Gregory Martinez. Mr. Martinez disclaims beneficial ownership of the securities except to the extent of his pecuniary interests therein. The address of Schonfeld EXT Master Fund LP is 590 Madison Ave, 23rd Floor, New York, NY 10022.

(14) The shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” consist of (i) 340,650 shares of Common Stock purchased in the Private Placement, (ii) 712,184 additional shares of Common Stock previously purchased and (iii) 524,352 shares of Common Stock issuable upon exercise of certain warrants previously purchased. The shares held by Parkman HP Master Fund LP may be deemed to be beneficially owned by Gregory Martinez, Managing Member, GP of Parkman HP Master Fund LP. Mr. Martinez disclaims beneficial ownership of the securities except to the extent of his pecuniary interests therein. The address of Parkman HP Master Fund LP is 700 Canal Street, 2nd Floor, Stamford, CT 06902.

(15) The shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” consist of (i) 657,894 shares of Common Stock purchased in the Private Placement, (ii) 130,000 additional shares of Common Stock previously purchased and (iii) 1,363,636 shares of Common Stock issuable upon exercise of certain warrants previously purchased. Laurence Lytton has voting and investment control over the shares of Common Stock held by the Lytton-Kambara Foundation. The address of the Lytton-Kambara Foundation is c/o Laurence Lytton, 467 Central Park West, 17A, New York, NY 10025.

(16) The shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” represent 3,000,000 shares of Common Stock purchased in the Private Placement. Citadel Advisors LLC is the portfolio manager of Citadel CEMF Investments Ltd. Citadel Advisors Holdings LP is the sole member of Citadel Advisors LLC. Citadel GP LLC is the General Partner of Citadel Advisors Holdings LP. Kenneth Griffin owns a controlling interest in Citadel GP LLC. Mr. Griffin, as the owner of a controlling interest in Citadel GP LLC, may be deemed to have shared power to vote and/or shared power to dispose of the securities held by Citadel CEMF Investments Ltd. This disclosure shall not be construed as an admission that Mr. Griffin or any of the Citadel related entities listed above is the beneficial owner of any of our securities other than the securities actually owned by such person (if any). The address of Citadel CEMF Investments Ltd. is Southeast Financial Center, 200 S. Biscayne Blvd., Suite 3300, Miami, FL 33131.

(17) The shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” consist of (i) 1,677,631 shares of Common Stock purchased by M. Kingdon Offshore Master Fund, LP in the Private Placement and (ii) 296,052 shares of Common Stock purchased by Kingdon Healthcare Master Fund, LP in the Private Placement. Mark Kingdon, as the managing member of Kingdon GP, LLC and Kingdon GP II, LLC, which is the general partner of M. Kingdon Offshore Master Fund, LP and Kingdon Healthcare Master Fund, LP, respectively, has voting or investment control over the securities held by M. Kingdon Offshore Master Fund, LP and Kingdon Healthcare Master Fund, LP. The address of M. Kingdon Offshore Master Fund, LP and Kingdon Healthcare Master Fund, LP, respectively is c/o Kingdon Capital Management, LLC, 152 W. 57th Street, 50th Floor, New York, NY 10019.

Relationships with Selling Stockholders

As discussed in greater detail above under the section titled “Prospectus Summary—Private Placement,” in May 2023, we entered into the Purchase Agreement with the Selling Stockholders, pursuant to which we sold and issued shares of our Common Stock and Pre-Funded Warrants to purchase our Common Stock. We also entered into the Registration Rights Agreement with the Selling Stockholders, pursuant to which we agreed to file a registration statement with the SEC to cover the resale by the Selling Stockholders of the shares of our Common Stock, including the shares of Common Stock issuable upon exercise of the Pre-Funded Warrants, issued pursuant to the Purchase Agreement.

None of the Selling Stockholders has had a material relationship with us or any of our predecessors or affiliates within the past three years, other than as a result of the ownership of our shares of Common Stock or other securities.

None of the Selling Stockholders has held any position or office with us or our affiliates within the last three years. Carl Gordon, who serves on the investment committee of OrbiMed Advisors, served on the Board of Directors of Arsanis, Inc., our predecessor, from 2010 to March 13, 2019.

PLAN OF DISTRIBUTION

The Selling Stockholders, which as used herein includes donees, pledgees, transferees or other successors-in-interest selling shares of Common Stock or interests in shares of Common Stock received after the date of this prospectus from a Selling Stockholder as a gift, pledge, partnership distribution or other transfer, may, from time to time, sell, transfer or otherwise dispose of any or all of their shares of Common Stock or interests in shares of Common Stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

The Selling Stockholders may use any one or more of the following methods when disposing of shares or interests therein:

•ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

•block trades in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction;

•purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

•an exchange distribution in accordance with the rules of the applicable exchange;

•privately negotiated transactions;

•distributions to members, partners, stockholders or other equityholders of the selling stockholders;

•short sales effected after the date the registration statement of which this prospectus is a part is declared effective by the SEC;

•through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

•broker-dealers may agree with the Selling Stockholders to sell a specified number of such shares at a stipulated price per share;

•a combination of any such methods of sale; and

•any other method permitted by applicable law.

The Selling Stockholders may, from time to time, pledge or grant a security interest in some or all of the shares of Common Stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of Common Stock, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3), under Rule 144 or other applicable provision of the Securities Act of 1933, as amended (the “Securities Act”), amending the list of Selling Stockholders to include the pledgee, transferee or other successors in interest as Selling Stockholders under this prospectus. The Selling Stockholders also may transfer the shares of Common Stock in other circumstances, in which case the transferees, pledgees, donees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

In connection with the sale of our Common Stock or interests therein, the Selling Stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the Common Stock in the course of hedging the positions they assume. The Selling Stockholders may also sell shares of our Common Stock short and deliver these securities to close out their short positions, or loan or pledge the Common Stock to broker-dealers that in turn may sell these securities. The Selling Stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The aggregate proceeds to the Selling Stockholders from the sale of the Common Stock offered by them will be the purchase price of the Common Stock less discounts or commissions, if any. Each of the Selling Stockholders reserves the right to accept and, together with their agents from time to time, to reject, in whole or in part, any proposed purchase of Common Stock to be made directly or through agents. We will not receive any of the proceeds from this offering. Upon any exercise of the Pre-Funded Warrants by payment of cash, however, we will receive the exercise price of $0.001 per share pursuant to the Pre-Funded Warrants.

The Selling Stockholders also may resell all or a portion of the shares in open market transactions in reliance upon Rule 144 under the Securities Act, provided that the Selling Stockholders meet the criteria and conforms to the requirements of that rule. A Selling Stockholder that is an entity may elect to make an in-kind distribution of shares of Common Stock to its members, partners, stockholders or other equityholders pursuant to the registration statement of which this prospectus forms a part by delivering a prospectus. To the extent that such members, partners, stockholders or other equityholders are not affiliates of ours, such members, partners, stockholders or other equityholders would thereby receive freely tradable shares of Common Stock pursuant to a distribution pursuant to the registration statement of which this prospectus forms a part.

To the extent required, the shares of our Common Stock to be sold, the names of the Selling Stockholders, the respective purchase prices and public offering prices, the names of any agents or dealers, and any applicable commissions or discounts with respect to a particular offer will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this prospectus. Selling Stockholders are not obligated to notify the Company of any changes to the number of securities held or owned by the Selling Stockholders or their affiliates.

In order to comply with the securities laws of some states, if applicable, the Common Stock may be sold in these jurisdictions only through registered or licensed brokers or dealers. In addition, in some states the Common Stock may not be sold unless it has been registered or qualified for sale or an exemption from registration or qualification requirements is available and is complied with.

We have advised the Selling Stockholders that the anti-manipulation rules of Regulation M under the Securities Exchange Act of 1934, as amended, may apply to sales of shares in the market and to the activities of the Selling Stockholders and their affiliates. In addition, to the extent applicable, we will make copies of this prospectus (as it may be supplemented or amended from time to time) available to the Selling Stockholders for the purpose of satisfying the prospectus delivery requirements of the Securities Act. The Selling Stockholders may indemnify any broker-dealer that participates in transactions involving the sale of the shares against certain liabilities, including liabilities arising under the Securities Act.

We have agreed to indemnify the Selling Stockholders against liabilities, including liabilities under the Securities Act and state securities laws, relating to the registration of the shares offered by this prospectus.

We have agreed with the Selling Stockholders to use commercially reasonable efforts to cause the registration statement of which this prospectus constitutes a part effective and to remain continuously effective until the earlier of (1) such time as all of the shares covered by this prospectus have been disposed of pursuant to and in accordance with such registration statement or (2) the date on which all of the shares may be sold without restriction pursuant to Rule 144 of the Securities Act.

LEGAL MATTERS

The validity of the Shares to be offered for resale by the Selling Stockholders under this prospectus will be passed upon for us by Cooley LLP, New York, New York.

EXPERTS

The financial statements incorporated in this prospectus by reference to the Annual Report on Form 10-K for the year ended December 31, 2022 have been so incorporated in reliance on the report (which contains an explanatory paragraph relating to the Company’s ability to continue as a going concern as described in Note 1 to the financial statements) of PricewaterhouseCoopers LLP, an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus is part of a registration statement that we filed with the SEC. This prospectus omits some information contained in the registration statement in accordance with SEC rules and regulations. You should review the information and exhibits in the registration statement for further information about us and our consolidated subsidiaries and our securities. Statements in this prospectus concerning any document we filed as an exhibit to the registration statement or that we otherwise filed with the SEC are not intended to be comprehensive and are qualified by reference to these filings. You should review the complete document to evaluate these statements. You can obtain a copy of the registration statement from the SEC’s website.

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at http://www.sec.gov.

We make available, free of charge, through our investor relations website, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, statements of changes in beneficial ownership of securities and amendments to those reports and statements as soon as reasonably practicable after they are filed with the SEC. The address for our website is www.x4pharma.com. Information contained in or accessible through our website does not constitute a part of this prospectus and is not incorporated by reference in this prospectus.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” information into this prospectus, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The SEC file number for the documents incorporated by reference in this prospectus is 001-38295. The documents incorporated by reference into this prospectus contain important information that you should read about us.

The following documents are incorporated by reference into this document:

•Our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (the “2022 Annual Report”), filed with the SEC on March 21, 2023, including the information specifically incorporated by reference in the 2022 Annual Report from our definitive proxy statement for the 2023 Annual Meeting of Stockholders, filed with the SEC on April 25, 2023, as supplemented by a supplemental proxy statement for the 2023 Annual Meeting of Stockholders, filed with the SEC on April 27, 2023; •Our Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2023, filed with the SEC on May 4, 2023; •Our Current Reports on Form 8-K filed with the SEC on January 6, 2023, March 10, 2023, and May 16, 2023 (in each case, except for information contained therein which is furnished rather than filed); and

•The description of our Common Stock set forth in the registration statement on Form 8-A registering our Common Stock under Section 12 of the Exchange Act, which was filed with the SEC on November 15, 2017, including any amendments or reports filed for purposes of updating such description, including Exhibit 4.17 to the 2022 Annual Report.

We also incorporate by reference into this prospectus all documents (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are related to such items) that are filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (i) after the date of the initial filing of the registration statement of which this prospectus forms a part and prior to effectiveness of the registration statement, or (ii) after the date of this prospectus but prior to the termination of the offering. These documents include periodic reports, such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as proxy statements.

We will provide to each person, including any beneficial owner, to whom a prospectus is delivered, without charge upon written or oral request, a copy of any or all of the documents that are incorporated by reference into this prospectus but not delivered with the prospectus, including exhibits that are specifically incorporated by reference into such documents. You should direct any requests for documents to X4 Pharmaceuticals, Inc., Attn: Investor Relations, 61 North Beacon Street, 4th Floor, Boston, Massachusetts 02134.

Any statement contained in this prospectus or contained in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed to be modified or superseded to the extent that a statement contained in this prospectus or any subsequently filed supplement to this prospectus, or document deemed to be incorporated by reference into this prospectus, modifies or supersedes such statement.

Up to 42,784,203 Shares

Common Stock

_______________________________________

PROSPECTUS

_______________________________________

, 2023

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following table sets forth the various expenses to be incurred in connection with the sale and distribution of the securities being registered hereby, all of which will be borne by the Registrant (except any underwriting discounts and commissions and expenses incurred by the Selling Stockholders for brokerage, accounting, tax or legal services or any other expenses incurred by the Selling Stockholders in disposing of the shares). All amounts shown are estimates except the SEC registration fee.

| | | | | | | | |

SEC registration fee | | $ | 10,702.64 | |

Accountants’ fees and expenses | | 20,000.00 | |

Legal fees and expenses | | 65,000.00 | |

Miscellaneous expenses | | 10,000.00 | |

| | |

Total | | $ | 105,702.64 | |

| | |

Item 15. Indemnification of Officers and Directors

Subsection (a) of Section 145 of the General Corporation Law of the State of Delaware (the “DGCL”), empowers a corporation to indemnify any person who was or is a party or who is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of the corporation) by reason of the fact that the person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by the person in connection with such action, suit or proceeding if the person acted in good faith and in a manner the person reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe the person's conduct was unlawful.

Subsection (b) of Section 145 empowers a corporation to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason of the fact that the person acted in any of the capacities set forth above, against expenses (including attorneys’ fees) actually and reasonably incurred by the person in connection with the defense or settlement of such action or suit if the person acted in good faith and in a manner the person reasonably believed to be in or not opposed to the best interests of the corporation, except that no indemnification shall be made in respect of any claim, issue or matter as to which such person shall have been adjudged to be liable to the corporation unless and only to the extent that the Court of Chancery or the court in which such action or suit was brought shall determine upon application that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses which the Court of Chancery or such other court shall deem proper.

Section 145 further provides that to the extent a director or officer of a corporation has been successful on the merits or otherwise in the defense of any action, suit or proceeding referred to in subsections (a) and (b) of Section 145, or in defense of any claim, issue or matter therein, such person shall be indemnified against expenses (including attorneys’ fees) actually and reasonably incurred by such person in connection therewith; that indemnification provided for by Section 145 shall not be deemed exclusive of any other rights to which the indemnified party may be entitled; and the indemnification provided for by Section 145 shall, unless otherwise provided when authorized or ratified, continue as to a person who has ceased to be a director, officer, employee or agent and shall inure to the benefit of such person’s heirs, executors and administrators. Section 145 also empowers the corporation to purchase and maintain insurance on behalf of any person who is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against any liability asserted against such person and incurred by such person in any such capacity, or arising out of his status as such, whether or not the corporation would have the power to indemnify such person against such liabilities under Section 145.

Section 102(b)(7) of the DGCL provides that a corporation’s certificate of incorporation may contain a provision eliminating or limiting the personal liability of a director to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director, provided that such provision shall not eliminate or limit the liability of a director (i) for any breach of the director’s duty of loyalty to the corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii)

under Section 174 of the DGCL or (iv) for any transaction from which the director derived an improper personal benefit.

We have entered into indemnification agreements with each of our directors and executive officers, in addition to the indemnification provided for in our restated certificate, and intend to enter into indemnification agreements with any new directors in the future.

We have purchased and intend to maintain insurance on behalf of any person who is or was a director or officer of X4 Pharmaceuticals against any loss arising from any claim asserted against him or her and incurred by him or her in any such capacity, subject to certain exclusions. Certain of our non-employee directors may, through their relationships with their employers, be insured and/or indemnified against certain liabilities in their capacity as members of our board of directors.