XP Inc. (Nasdaq: XP), a leading, technology-driven platform and

a trusted provider of low-fee financial products and services in

Brazil, announced today its 4Q22 KPIs. The Portuguese version of

this release can be accessed in the Press Release section on the IR

website. Additional KPI details and historical data can be found in

our financial spreadsheet.

Investments

Client Assets (in R$ billion)

Client Assets totaled R$946 billion as of December 31, up 16%

YoY and 2% QoQ. Year-over-year growth was driven by R$155 billion

net inflows and R$24 billion of market depreciation.

Net Inflow

XP Total Net Inflow was R$155 billion in 2022, or R$12.9

billion per month, despite a tough year, with interest rates in

Brazil increasing by 450bps, reaching 13.75% at year end.

In 4Q22, Net Inflow was R$31 billion, down 11% QoQ and

36% YoY. Retail Net Inflow was R$29 billion, or R$9.6 billion per

month, down 11% QoQ. Corporate Net Inflow was R$2.2 billion, down

13% QoQ.

Active Clients

Active clients grew 2% QoQ and 14% YoY, totaling 3.9

million in 4Q22.

IFA Network

Our network reached 12.3 thousand IFAs in 4Q22, up 6% QoQ and

20% YoY. Throughout 2022, more than two thousand advisors were

added on a net basis, which demonstrates the strength of our value

proposition, and that the quality of the platform continues to

attract entrepreneurs even during tougher cycles for investment

activity.

The growth of our ecosystem through well-trained financial

advisors is key to continue to disrupt the highly concentrated

investment industry in Brazil, especially when interest rates and

risk-aversion begin to improve.

Retail Daily Average Trades1

Retail DATs totaled 2.7 million in 4Q22, up 8% YoY and up 16%

QoQ, in line with recent market trends.

NPS (Net Promoter Score)

Our NPS, a widely known survey methodology used to measure

customer satisfaction, was 73 in December 2022. Maintaining a high

NPS score remains a priority for XP since our business model is

built around client experience. The NPS calculation as of a given

date reflects the average scores in the prior six months.

Retirement Plans

Retirement Plans Client Assets[2] (in R$ billion)

As per public data published by Susep, XPV&P continued to be

#1 in net portability for individual retirement plans in

2022, as of November, while our Market Share still stood at

3.8%. Total Client Assets achieved R$61 billion in 4Q22, up

27% YoY. Assets from XPV&P, our proprietary insurer, grew over

43% YoY.

Cards

Cards TPV

Total TPV in 2022 was R$25 billion, a growth of

141% YoY, with an increase in penetration and in total

eligible client base – we officially launched the Rico Credit and

Debit cards in the second semester of 2022.

In 4Q22, Total TPV reached R$8.2 billion, an 86%

growth YoY, and 24% growth versus 3Q22.

Active Credit and Debit Cards

Total active cards were 688 thousand in 4Q22, a growth of

33% QoQ and 184% YoY. We ended 4Q22 with 402 thousand

active digital accounts, representing a penetration of 10%

of total active clients.

Credit

Credit Portfolio3 (in R$ billion)

Total Credit portfolio reached R$17.1 billion as of December

2022, expanding 5% QoQ and 67% YoY. Over 90% of our credit

portfolio is collateralized with investments in our platform. The

average maturity of our credit book was 3.0 years, with a 90-day

Non-Performing Loan (NPL) ratio of 0.1%.

__________________________

1 Daily Average Trades, including Stocks, Listed Funds, Options

and Futures.

2 Total Retirement Plans Clients’ Assets includes assets from XP

Vida e Previdência and from third party funds distributed in our

platform.

3 From 3Q22 onwards, the credit portfolio is disclosed gross

(versus previously net) of loan loss provisions, also

retroactively, not including Intercompany transactions and Credit

Card related loans and receivables.

Non-GAAP Measures

This release includes certain non-GAAP financial information We

believe that such information is meaningful and useful in

understanding the activities and business metrics of the Company’s

operations. We also believe that these non-GAAP financial measures

reflect an additional way of viewing aspects of the Company’s

business that, when viewed with our International Financial

Reporting Standards results, as issued by the International

Accounting Standards Board, provide a more complete understanding

of factors and trends affecting the Company’s business.

Furthermore, investors regularly rely on non-GAAP financial

measures to assess operating performance and such measures may

highlight trends in the Company’s business that may not otherwise

be apparent when relying on financial measures calculated in

accordance with IFRS. We also believe that certain non-GAAP

financial measures are frequently used by securities analysts,

investors, and other interested parties in the evaluation of public

companies in the Company’s industry, many of which present these

measures when reporting their results. The non-GAAP financial

information is presented for informational purposes and to enhance

understanding of the IFRS financial statements. The non-GAAP

measures should be considered in addition to results prepared in

accordance with IFRS, but not as a substitute for, or superior to,

IFRS results. As other companies may determine or calculate this

non-GAAP financial information differently, the usefulness of these

measures for comparative purposes is limited.

About XP

XP is a leading, technology-driven platform and a trusted

provider of low-fee financial products and services in Brazil. XP’s

mission is to disintermediate the legacy models of traditional

financial institutions by:

- Educating new classes of investors;

- Democratizing access to a wider range of financial

services;

- Developing new financial products and technology applications

to empower clients; and

- Providing high-quality customer service and client experience

in the industry in Brazil.

XP provides customers with two principal types of offerings, (i)

financial advisory services for retail clients in Brazil,

high-net-worth clients, international clients and corporate and

institutional clients, and (ii) an open financial product platform

providing access to over 800 investment products including equity

and fixed income securities, mutual and hedge funds, structured

products, life insurance, pension plans, real-estate investment

funds (REITs) and others from XP, its partners and competitors.

Forward Looking Statements

This press release contains "forward-looking statements" within

the meaning of the "safe harbor" provisions of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements are made as of the date they were first issued and were

based on current expectations, estimates, forecasts and projections

as well as the beliefs and assumptions of management. Words such as

"expect," "anticipate," "should," "believe," "hope," “aim,”

"target," "project," "goals," "estimate," "potential," "predict,"

"may," "will," "might," "could," "intend," variations of these

terms or the negative of these terms and similar expressions are

intended to identify these statements. Forward-looking statements

are subject to a number of risks and uncertainties, many of which

involve factors or circumstances that are beyond XP Inc’s control.

XP, Inc’s actual results could differ materially from those stated

or implied in forward-looking statements due to several factors,

including but not limited to: competition, change in clients,

regulatory measures, a change the external forces among other

factors.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230117006118/en/

Investor Contact: ir@xpi.com.br IR Website:

investors.xpinc.com

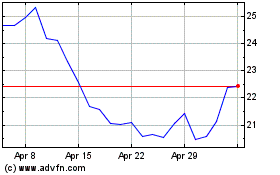

XP (NASDAQ:XP)

Historical Stock Chart

From Mar 2024 to Apr 2024

XP (NASDAQ:XP)

Historical Stock Chart

From Apr 2023 to Apr 2024