XPEL, Inc. (Nasdaq: XPEL) a global provider of protective films

and coatings, today announced results for the quarter ended March

31, 2023.

First Quarter 2023 Highlights:

- Revenues increased 19.5% to $85.8 million in the first

quarter.

- Gross margin percentage improved to 41.9% in the first quarter,

a new high for the Company.

- Net income grew 46.5% to $11.4 million, or $0.41 per share,

compared to $7.8 million, or $0.28 per share, in the same quarter

of 2022.

- EBITDA (Earnings Before Interest, Taxes, Depreciation and

Amortization) grew 43.9% to $17.1 million, or 19.9% of revenues

compared to $11.9 million in first quarter 2022.1

Ryan Pape, President and Chief Executive Officer of XPEL,

commented, “We’re off to a great start in 2023 with solid first

quarter results. We continue to see good momentum in our business

and remain focused on driving growth as we move through 2023.”

For the Quarter Ended March 31, 2023:

Revenues. Revenues increased approximately $14.0 million or

19.5% to $85.8 million as compared to $71.9 million in the first

quarter of the prior year.

Gross Margin. Gross margin was 41.9% compared to 38.6% in the

first quarter of 2022.

Expenses. Operating expenses increased to $21.0 million, or

24.5% of sales, compared to $17.7 million, or 24.6% of sales in the

prior year period.

Net income. Net income was $11.4 million, or $0.41 per basic and

diluted share, versus net income of $7.8 million, or $0.28 per

basic and diluted share in the first quarter of 2022.

EBITDA. EBITDA (Earnings Before Interest, Taxes, Depreciation,

and Amortization) was $17.1 million, or 19.9% of sales, as compared

to $11.9 million, or 16.5% of sales in the prior year.1

Conference Call Information

The Company will host a conference call and webcast today, May

9, 2023 at 11:00 a.m. Eastern Time to discuss the Company’s first

quarter 2023 results.

To access the live webcast, please visit the XPEL, Inc. website

at www.xpel.com/investor.

To participate in the call by phone, dial (888) 506-0062

approximately five minutes prior to the scheduled start time.

International callers please dial (973) 528-0011. Callers should

use access code: 760015.

A replay of the teleconference will be available until June 8,

2023 and may be accessed by dialing (877) 481-4010. International

callers may dial (919) 882-2331. Callers should use conference ID:

48243.

About XPEL, Inc.

XPEL is a leading provider of protective films and coatings,

including automotive paint protection film, surface protection

film, automotive and architectural window films, and ceramic

coatings. With a global footprint, a network of trained installers

and proprietary DAP software, XPEL is dedicated to exceeding

customer expectations by providing high-quality products, leading

customer service, expert technical support and world-class

training. XPEL, Inc. is publicly traded on Nasdaq under the symbol

“XPEL”.

1See reconciliation of non-GAAP financial measures below.

Safe harbor statement

This release includes forward-looking statements regarding XPEL,

Inc. and its business, which may include, but is not limited to,

anticipated use of proceeds from capital transactions, expansion

into new markets, and execution of the company's growth strategy.

Often, but not always, forward-looking statements can be identified

by the use of words such as "plans," "is expected," "expects,"

"scheduled," "intends," "contemplates," "anticipates," "believes,"

"proposes" or variations (including negative variations) of such

words and phrases, or state that certain actions, events or results

"may," "could," "would," "might" or "will" be taken, occur or be

achieved. Such statements are based on the current expectations of

the management of XPEL. The forward-looking events and

circumstances discussed in this release may not occur by certain

specified dates or at all and could differ materially as a result

of known and unknown risk factors and uncertainties affecting the

company, performance and acceptance of the company's products,

economic factors, competition, the equity markets generally and

many other factors beyond the control of XPEL. Without limitation,

the risks and uncertainties affecting XPEL are described in XPEL’s

most recent Form 10-K (including Item 1A Risk Factors) filed with

the SEC. Although XPEL has attempted to identify important factors

that could cause actual actions, events or results to differ

materially from those described in forward-looking statements,

there may be other factors that cause actions, events or results to

differ from those anticipated, estimated or intended. No

forward-looking statement can be guaranteed. Except as required by

applicable securities laws, forward-looking statements speak only

as of the date on which they are made and XPEL undertakes no

obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events,

or otherwise.

XPEL Inc.

Condensed Consolidated

Statements of Income (Unaudited)

(In thousands except per share

data)

Three Months Ended

March 31,

2023

2022

Revenue

Product revenue

$

67,308

$

58,098

Service revenue

18,534

13,766

Total revenue

85,842

71,864

Cost of Sales

Cost of product sales

42,180

38,194

Cost of service

7,702

5,953

Total cost of sales

49,882

44,147

Gross Margin

35,960

27,717

Operating Expenses

Sales and marketing

6,675

6,311

General and administrative

14,354

11,369

Total operating expenses

21,029

17,680

Operating Income

14,931

10,037

Interest expense

523

220

Foreign currency exchange (gain) loss

(9

)

5

Income before income taxes

14,417

9,812

Income tax expense

2,984

2,009

Net income

$

11,433

$

7,803

Earnings per share

Basic

$

0.41

$

0.28

Diluted

$

0.41

$

0.28

Weighted Average Number of Common

Shares

Basic

27,616

27,613

Diluted

27,626

27,613

XPEL Inc.

Condensed Consolidated Balance

Sheets

(In thousands except per share

data)

(Unaudited)

(Audited)

March 31,

2023

December 31,

2022

Assets

Current

Cash and cash equivalents

$

8,330

$

8,056

Accounts receivable, net

21,353

14,726

Inventory, net

84,594

80,575

Prepaid expenses and other current

assets

6,035

3,464

Total current assets

120,312

106,821

Property and equipment, net

15,311

14,203

Right-of-use lease assets

15,624

15,309

Intangible assets, net

28,485

29,294

Other non-current assets

1,116

972

Goodwill

26,819

26,763

Total assets

$

207,667

$

193,362

Liabilities

Current

Current portion of notes payable

$

—

$

77

Current portion lease liabilities

4,261

3,885

Accounts payable and accrued

liabilities

20,541

22,970

Income tax payable

2,828

470

Total current liabilities

27,630

27,402

Deferred tax liability, net

1,935

2,049

Other long-term liabilities

1,105

1,070

Borrowings on line of credit

28,000

26,000

Non-current portion of lease

liabilities

12,240

12,119

Total liabilities

70,910

68,640

Commitments and Contingencies (Note

11)

Stockholders’ equity

Preferred stock, $0.001 par value;

authorized 10,000,000; none issued and outstanding

—

—

Common stock, $0.001 par value;

100,000,000 shares authorized; 27,616,064 issued and

outstanding

28

28

Additional paid-in-capital

11,376

11,073

Accumulated other comprehensive loss

(1,904

)

(2,203

)

Retained earnings

127,257

115,824

Total stockholders’ equity

136,757

124,722

Total liabilities and stockholders’

equity

$

207,667

$

193,362

Reconciliation of Non-GAAP Financial Measure

EBITDA is a non-GAAP financial measure. EBITDA is defined as net

income (loss) plus interest expense, net, plus income tax expense

plus depreciation expense and amortization expense. EBITDA should

be considered in addition to, not as a substitute for, or superior

to, financial measures calculated in accordance with GAAP. It is

not a measurement of our financial performance under GAAP and

should not be considered as alternatives to revenue or net income,

as applicable, or any other performance measures derived in

accordance with GAAP and may not be comparable to other similarly

titled measures of other businesses. EBITDA has limitations as an

analytical tool and you should not consider it in isolation or as a

substitute for analysis of our operating results as reported under

GAAP.

EBITDA does not reflect the impact of certain cash charges

resulting from matters we consider not to be indicative of ongoing

operations and other companies in our industry may calculate EBITDA

differently than we do, limiting its usefulness as a comparative

measure.

EBITDA Reconciliation

(In thousands)

(Unaudited)

Three Months Ended

March 31,

2023

2022

Net Income

11,433

7,803

Interest

523

220

Taxes

2,984

2,009

Depreciation

972

756

Amortization

1,161

1,076

EBITDA

17,073

11,864

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230509005313/en/

Investor Relations: John Nesbett/Jennifer Belodeau IMS Investor

Relations Phone: (203) 972-9200 Email:

xpel@imsinvestorrelations.com

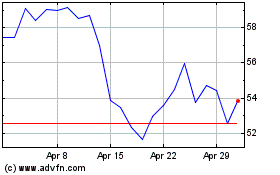

XPEL (NASDAQ:XPEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

XPEL (NASDAQ:XPEL)

Historical Stock Chart

From Apr 2023 to Apr 2024