XWELL, Inc. (Nasdaq: XWEL), a leading global health and wellness

holding company, today reported results for the third quarter

ending September 30, 2022.

Business Highlights:We’re

continuing to evolve our organization and, reflecting the Company’s

commitment to better serve clients, optimize efficiencies, and

deliver long-term growth, management has recently:

- Rebranded to XWELL, reflecting the

Company’s wellness evolution

- Reopened a refreshed XpresSpa®

location at JFK’s Terminal 4

- Opened a new Treat™ location in

Salt Lake City International Airport

- Opened three XpresSpa locations at

Turkey’s Istanbul Airport, with two additional Istanbul locations

expected to open by year-end, and additional growth in Abu Dhabi in

2023

- Scaled new retail products,

integrated innovative health and wellness technologies, and

introducing a new XWELL Loyalty Rewards Program, each designed to

drive customer engagement, strengthen brand presence, and increase

foot traffic

- Continued to support and expand the

Centers for Disease Control and Prevention (CDC) traveler-based

genomic surveillance program through its partnership with Ginkgo

Bioworks

- Reduced cash operating costs by $1

million a month; shuttered five unprofitable XpresCheck® locations

during the third quarter with plans to close another seven during

the fourth quarter

- Retained the services of Benchmark

to help identify potential acquisition targets

“We’re aggressively

executing on our strategic objectives and, since the end of the

second quarter, have continued to make meaningful progress

expanding internationally, rolling out our new retail strategy,

adding new customers, and reducing infrastructure costs,” commented

Scott Milford, XWELL’s Chief Executive Officer. “We also recently

introduced our new corporate identity, XWELL, further aligning our

focus and reflecting our position as a global health and wellness

authority for people on the go.”

Mr. Milford added,

“Looking ahead, we believe the Company is entering 2023 as a leaner

business with a path to returned profitability. We’re well

positioned to achieve our growth goals and I’m quite excited about

our path ahead."

Third Quarter Business

Update

XpresSpa®There are currently 20

operating XpresSpa domestic locations. Internationally, there are 9

XpresSpa locations currently operating. These consist of three at

Dubai International Airport in the UAE, three at Schiphol Amsterdam

Airport in the Netherlands, and three at Istanbul Airport in

Turkey. We expect to open another two locations in Istanbul by

year-end. This expansion allows XWELL the opportunity to further

leverage its expertise in providing premium wellness services to

more international passengers who appreciate health and wellness

services and are willing to spend more in pursuit of their

well-being.

Bolstered by renewed interest in wellness

services among travelers, along with a willingness to spend

additional dollars on products and services that will improve their

well-being while they travel, the Company is executing its new

retail strategy to drive more foot traffic into its airport

locations and augment its on-line presence. This includes bringing

new technologies and trends, including new tech-forward equipment,

adding new products in-store and on-line, as well as deploying

plans to refresh the look and appearance of some XpresSpa

locations.

Treat™Treat is a travel health

and wellness brand and a fully integrated concept blending

technology with traditional brick and mortar offerings to provide a

holistic approach to physical and mental well-being for travelers.

Treat’s on-site centers are currently located at JFK International

Airport in New York, Phoenix Sky Harbor International Airport in

Arizona, and Salt Lake City International Airport in Utah.

The Treat teams provide travel-related

diagnostic testing for virus, cold, flu and other illnesses as well

as hydration therapy, IV drips, and vitamin injections. Travelers

can purchase time blocks to use the Company’s wellness rooms to

engage in interactive services like self-guided yoga, meditation,

and low impact weight exercises or to relax and unplug from the

hectic pace of the airport and renew themselves before or after

their trip. Treat also offers a website (www.treat.com) and mobile

app to complement the offering with relevant health and wellness

content designed to help people on the go with information that

could impact their travel.

XpresCheck®XWELL’s XpresTest,

Inc. subsidiary (“XpresCheck”) provides medical diagnostic testing

services, including COVID-19 testing for its customers.

As previously discussed, as countries have

continued to relax their testing requirements, testing volumes at

the Company’s XpresCheck locations have decreased. Based on the

evolution of testing globally, and the creation of longer term

biosurveillance efforts coupled with the current performance of its

XpresCheck segment, the Company is closing unprofitable XpresCheck

locations without compromising its biosurveillance

apparatus.

During the third quarter, the Company closed

five unprofitable XpresCheck locations and commenced plans to close

another seven locations during the fourth quarter. Looking ahead to

2023, the Company expects to operate two XpresCheck locations and

five biosurveillance stations serving the XpresCheck business.

Biosurveillance Partnership with Ginkgo

BioworksIn late 2021, in collaboration with the Centers

for Disease Control and Prevention (“CDC”) and Ginkgo Bioworks,

XpresCheck began conducting biosurveillance monitoring aimed at

identifying existing and new SARS-CoV-2 variants at four major U.S.

airports (JFK International Airport, Newark Liberty International

Airport, San Francisco International Airport, and

Hartsfield-Jackson Atlanta International Airport).

During the third quarter of 2022, XpresCheck, in

partnership with Ginkgo Bioworks (and in continuation of their

support to the CDC’s traveler-based SARS-CoV-2 genomic surveillance

program) were awarded a new contract. The partnership is expected

to support public health and biosecurity services totaling

approximately $16 million, with an overall potential to reach $61

million based on CDC program options and public health priorities.

As COVID-19 sublineages and other biological threats continue to

emerge, the partners plan to expand the program footprint

incorporate innovative modalities and offerings, such as monitoring

of wastewater from aircraft lavatories.

HyperPointeIn January 2022, the

Company announced and closed on the acquisition of GCG Connect, LLC

d/b/a HyperPointe. HyperPointe is a leading digital healthcare and

data analytics relationship marketing agency, servicing the global

healthcare and pharmaceutical industry. HyperPointe has significant

experience in patient and healthcare professional marketing and

deep technological experience with CXM (customer experience

management) and data analytics.

Since June 2020, HyperPointe’s management team

and suite of services and technology have been utilized to develop

and deploy the technological infrastructure necessary to scale the

growth of our XpresCheck business. HyperPointe’s experience in this

space continues to serve the XpresCheck business and will play a

critical role in the expansion of ongoing biosurveillance efforts

created in partnership with Ginkgo Bioworks and the CDC.

Share Repurchase ProgramAs of

November 9, 2022, approximately 0.8 million shares remain available

under the Company’s 25-million share repurchase program that was

announced on August 31, 2021 and subsequently increased on May 20,

2022.

Year-to-date, the Company has repurchased

approximately 19.5 million shares. During the third quarter of

2022, the Company continued to execute on its share repurchase

program, repurchasing approximately 11.0 million shares at average

price of $1.03 per share, for a total of $11.4 million.

Liquidity and Financial

ConditionAs of September 30, 2022, the Company had cash

and cash equivalents, excluding restricted cash, of $49.4 million

and no long-term debt.

Summary of Third Quarter 2022 Financial

ResultsTotal revenue during the three months ended

September 30, 2022, was $10.7 million compared to $26.8 million in

the corresponding period in 2021. The revenue for the quarter

primarily consisted of $4.0 million in revenue from our reopened

XpresSpa locations and Treat locations, $4.3 million from

XpresCheck locations, $1.8 million in revenue from our

biosurveillance partnership, and $0.7 million from HyperPointe.

Cost of SalesCost of sales decreased to $9.3

million in the third quarter of 2022 from $13.7 million in the

prior year third quarter, primarily as a result of the Company

closing underperforming XpresCheck locations during the

quarter.

General and Administrative ExpensesGeneral and

administrative expenses were $6.4 million in the three months ended

September 30, 2022, compared to $5.2 million for the year ago

comparable period. The increase was primarily due to certain

non-recurring credits that were recorded in the third quarter of

2021.

Income from OperationsLoss from operations was

$7.65 million in the third quarter of 2022 compared to income from

operations of $7.1 million in the prior year third quarter.

Net Income Attributable to Common

ShareholdersNet loss attributable to common shareholders was $7.2

million in the third quarter of 2022 compared to net income

attributable to common shareholders of $5.6 million in the prior

year third quarter.

XpresCheck Operational

Metrics

Total Patients

by Quarter

|

Q1 2021 |

37,589 |

|

Q2 2021 |

92,415 |

|

Q3 2021 |

113,212 |

|

Q4 2021 |

104,805 |

|

Q1 2022 |

78,976 |

|

Q2 2022 |

30,601 |

|

Q3 2022 |

18,452 |

Total Rapid

Test (Antigen

and PCR) /

Percent of Total

Patients by

Quarter

|

Q1 2021 |

27,651 |

74% |

|

Q2 2021 |

75,788 |

82% |

|

Q3 2021 |

110,376 |

97% |

|

Q4 2021 |

103,000 |

98% |

|

Q1 2022 |

78,524 |

99% |

|

Q2 2022 |

30,746 |

100% |

|

Q3 2022 |

18,441 |

100% |

Rapid PCR

Tests / Percent

of Total Rapid

Tests by

Quarter

|

Q1 2021 |

114 |

0% |

|

Q2 2021 |

32,382 |

43% |

|

Q3 2021 |

74,090 |

67% |

|

Q4 2021 |

101,526 |

99% |

|

Q1 2022 |

78,261 |

99% |

|

Q2 2022 |

30,690 |

100% |

|

Q3 2022 |

18,440 |

100% |

Non-GAAP Financial

Metrics

Adjusted EBITDAOn a non-GAAP basis, Adjusted

EBITDA was $(4.56 million) during the third quarter 2022, compared

to Adjusted EBITDA of $8.7 million in the prior year third

quarter.

We define Adjusted EBITDA as earnings before

interest, taxes, depreciation and amortization expense, non-cash

charges, and stock-based compensation expense.

We consider Adjusted EBITDA to be an important

indicator for the performance of our operating business,

XpresCheck. In particular, we believe that it is useful for

analysts and investors to understand that Adjusted EBITDA excludes

certain transactions not related to core cash operating activities,

which are primarily related to XpresCheck. We believe that

excluding these transactions allows investors to meaningfully

analyze the performance of core cash operations.

A reconciliation of operating loss presented in

accordance with GAAP for the three-month periods ended September

30, 2022 and 2021 to Adjusted EBITDA (loss) is presented in the

table below:

| |

Three months

ended September 30, |

| |

2022 |

|

2021 |

| Income (loss)

from operations |

$ |

(7,654) |

|

7,057 |

| Add back: |

|

|

|

|

|

Depreciation and amortization |

|

1,564 |

|

852 |

|

Impairment of long-lived assets |

|

677 |

|

--- |

|

Loss on disposal of assets, net |

|

325 |

|

--- |

|

Impairment of operating lease right-of-use assets |

|

38 |

|

--- |

|

Stock-based compensation expense |

|

483 |

|

790 |

| Adjusted EBITDA /(Loss) |

$ |

(4,567) |

|

8,699 |

| |

|

|

|

|

Webcast and

Conference Call

Today

XWELL will host a webcast and conference call at

4:30 p.m. Eastern Time today. We encourage investors and all

interested parties to listen via webcast as there is a limited

capacity to access the conference call by dialing 1-201-689-8263.

To submit a question, please email ir@xwell.com.

The live and later archived webcast can be

accessed from the Investor Relations section of the Company’s

website at http://xwell.com. Visitors to the website should select

the “Investors” tab and navigate to the “Events” link to access the

webcast.

About XWELL, Inc.

XWELL, Inc. (Nasdaq: XWEL) is a leading

global health and wellness holding company operating four brands:

XpresSpa®, Treat™, XpresCheck® and HyperPointe.

- XpresSpa is a leading airport

retailer of wellness services and related products, with 29

locations in 14 airports globally.

- Treat is a travel health and

wellness brand and a fully integrated concept blending technology

with traditional brick and mortar offerings to provide a holistic

approach to physical and mental well-being for travelers, currently

located in three airports.

- XpresCheck is a leading provider of

COVID-19 screening and diagnostic testing in partnership with the

CDC and Concentric by Ginkgo, conducting biosurveillance monitoring

in its airport locations to identify new SARS-CoV2 variants of

interest and concern as well as other pathogens entering the

country from across the world.

- HyperPointe is a leading digital

healthcare and data analytics relationship company serving the

global healthcare industry.

Forward-Looking Statements

This press release may contain "forward-looking"

statements within the meaning of Section 27A of the Securities Act

of 1933, and Section 21E of the Securities Exchange Act of 1934.

These include statements preceded by, followed by or that otherwise

include the words "believes," "expects," "anticipates,"

"estimates," "projects," "intends," "should," "seeks," "future,"

"continue," or the negative of such terms, or other comparable

terminology. Forward-looking statements relating to expectations

about future results or events are based upon information available

to XWELL as of today's date and are not guarantees of the future

performance of the Company, and actual results may vary materially

from the results and expectations discussed. Additional information

concerning these and other risks is contained in the Company’s

Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and

Current Reports on Form 8-K, and other Securities and Exchange

Commission filings (which reports were filed under the Company’s

former name, XpresSpa Group, Inc., prior to its previously

announced name change effective October 25, 2022). All subsequent

written and oral forward-looking statements concerning XWELL, or

other matters and attributable to XWELL or any person acting on its

behalf are expressly qualified in their entirety by the cautionary

statements above. XWELL does not undertake any obligation to

publicly update any of these forward-looking statements to reflect

events or circumstances that may arise after the date hereof.

MediaHeather

Tidwell MWW htidwell@mww.com

Investor RelationsJoseph

CalabreseMWWir@xwell.com

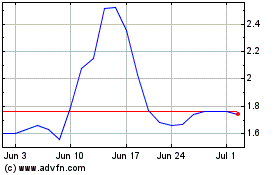

XWELL (NASDAQ:XWEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

XWELL (NASDAQ:XWEL)

Historical Stock Chart

From Apr 2023 to Apr 2024