UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2022.

Commission File Number 333-

Zenvia Inc.

(Exact name of registrant as specified in its charter)

N/A

(Translation of registrant’s name into English)

Avenida Paulista, 2300, 18th Floor, Suites 182 and

184

São Paulo, São Paulo, 01310-300

Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form

20-F x Form 40-F ¨

Indicate by check

mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check

mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

ZENVIA announces agreement with SenseData to extend payments

Amounts due at the end 2023 were diluted over

two years

São Paulo, December 21, 2022 – Zenvia Inc. (NASDAQ: ZENV)

(the “Company”), the leading cloud-based CX platform in Latin America, empowering companies to transform their customer journeys,

today announced the successful renegotiation of its remaining payments linked to the SenseData acquisition.

Shay Chor, Zenvia’s CFO, stated: “With this agreement with

SenseData, we close the year with all earn out payments extended, positively impacting our funding gap and significantly reducing payments

until the end of 2023. This allows us to focus on our profitability path and improving the company’s capital structure while maximizing

cashflow.”

The payment of R$23.7 million, due at the end of December 2022, was

reduced to R$18.0 million, with the remaining amount to be paid in 12 fixed installments over 2023, and subject to accrued interests in

line with Zenvia’s current bank financing costs. Also, for 2023, the total amount of remaining payments will continue to be related

to the achievements of gross profit targets, as defined in the original agreement. Zenvia agreed to pay a fixed amount of R$20 million

in December 2023, with the remaining amount to be paid in 24 instalments, subject to accrued interests in line with Zenvia’s current

bank financing costs. SenseData´s founding partners will continue to manage the company as per the original agreement, until the

end of 2023.

With the conclusion of this transaction, the total earnout for the acquisition

of Sirena, D1, Movidesk and SenseData to be paid until the end of 2023 was reduced from estimated BRL 444 million to BRL 81 million, with

the balance to be paid in installments until the end of 2026.

Contacts

|

Investor Relations

Caio Figueiredo

Fernando Schneider

ir@zenvia.com |

Media Relations – Grayling

Lucia Domville – (646) 824-2856 – lucia.domville@grayling.com

Fabiane Goldstein – (954) 625-4793 – fabiane.goldstein@grayling.com

|

About ZENVIA

ZENVIA is driven by the purpose of empowering

companies to create unique experiences for end-consumers through its unified CX SaaS end-to-end platform. ZENVIA empowers companies to

transform their existing customer experience from non-scalable, physical and impersonal interactions into highly scalable, digital-first

and hyper-contextualized experiences across the customer journey. ZENVIA’s unified end-to-end CX SaaS platform provides a combination

of (i) SaaS focused on campaigns, sales teams, customer service and engagement, (ii) tools, such as software application programming interfaces,

or APIs, chatbots, single customer views, journey designers, documents composer and authentication and (iii) channels, such as SMS, Voice,

WhatsApp, Instagram and Webchat. Its comprehensive platform assists customers across multiple use cases, including marketing campaigns,

customer acquisition, customer onboarding, warnings, customer services, fraud control, cross-selling and customer retention, among others.

ZENVIA's shares are traded on Nasdaq, under the ticker ZENV.

Forward-Looking Statements

These forward-looking statements are made as of the date they were first

issued and were based on current expectations, estimates, forecasts, and projections, as well as the beliefs and assumptions of management.

Words such as "expect," "anticipate," "should," "believe," "hope," "target,"

"project," "goals," "estimate," "potential," "predict," "may," "will,"

"might," "could," "intend," variations of these terms or the negative of these terms and similar expressions

are intended to identify these statements. Forward-looking statements are subject to a number of risks and uncertainties, many of which

involve factors or circumstances that are beyond Zenvia’s control. Zenvia’s actual results could differ materially from those

stated or implied in forward-looking statements due to several factors, including but not limited to: our ability to innovate and respond

to technological advances, changing market needs and customer demands, our ability to successfully acquire new businesses as customers,

acquire customers in new industry verticals and appropriately manage international expansion, substantial and increasing competition in

our market, compliance with applicable regulatory and legislative developments and regulations, the dependence of our business on our

relationship with certain service providers, among other factors.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

Date: December 21, 2022

| |

Title: Chief Executive Officer |

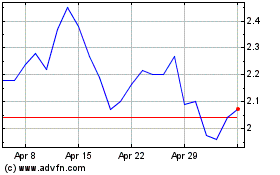

Zenvia (NASDAQ:ZENV)

Historical Stock Chart

From Mar 2024 to Apr 2024

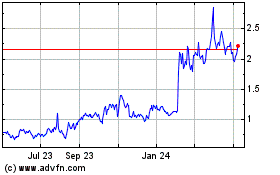

Zenvia (NASDAQ:ZENV)

Historical Stock Chart

From Apr 2023 to Apr 2024