ZimVie Inc. (Nasdaq: ZIMV), a global life sciences leader in the

dental market, today reported financial results for the quarter and

year ended December 31, 2024. Management will host a corresponding

conference call today, February 26, 2025, at 4:30 p.m. Eastern

Time.

“2024 was a transformational year for ZimVie. We

became a pure play dental company and reshaped our financial

profile, reducing net debt[1] by more than $290 million. We

also streamlined our organization through corporate cost reduction,

introduced manufacturing and supply chain efficiency initiatives,

and increased Adjusted EBITDA margins by over 4 percentage points

in the fourth quarter of 2024 compared to the fourth quarter of

2023 despite a softer end market,” said Vafa Jamali, President and

Chief Executive Officer. “We continue to be optimistic about the

long-term drivers of the dental implant market, supported by the

continued success of our training and education programs in 2024. I

believe ZimVie is well positioned to take advantage of the growth

in the dental implant and digital solutions market for 2025 and

beyond.”

Fourth Quarter 2024 Financial Results: Continuing

Operations

Third party net sales for the fourth quarter of

2024 were $111.5 million, a decrease of 1.4% on a reported basis

and 0.9% in constant currency[1], versus the fourth quarter of

2023.

Net loss for the fourth quarter of 2024 was

$(9.7) million, an improvement of $12.5 million versus a net loss

of $(22.2) million in the fourth quarter of 2023. Net loss margin

for the fourth quarter of 2024 was (8.7)% of third party net sales,

an improvement of 1,090 basis points versus a net loss margin of

(19.6)% in the fourth quarter of 2023.

Adjusted net income[1] for the fourth quarter of

2024 was $7.6 million, an increase of $5.0 million versus the

fourth quarter of 2023.

Basic and diluted EPS were $(0.35) and adjusted

diluted EPS[1] was $0.27 for the fourth quarter of 2024.

Weighted average shares outstanding for both basic and adjusted

diluted EPS was 27.6 million.

Adjusted EBITDA[1] for the fourth quarter of

2024 was $18.4 million, or 16.5% of third party net sales, an

increase of $4.5 million, or 420 basis points, versus the fourth

quarter of 2023.

Full Year 2024 Financial Results: Continuing

Operations

Third party net sales for the full year 2024

were $449.7 million, a decrease of 1.6% on a reported basis and

1.2% in constant currency[1], versus the full year 2023.

Net loss for the full year 2024 was $(33.8)

million, an improvement of $22.2 million versus a net loss of

$(56.0) million for the full year 2023. Net loss margin for the

full year 2024 was (7.5)% of third party net sales, an improvement

of 480 basis points versus a net loss margin of (12.3)% for the

full year 2023.

Adjusted net income[1] for the full year 2024

was $17.0 million, an increase of $11.1 million versus the full

year 2023.

Basic and diluted EPS were $(1.23) and adjusted

diluted EPS[1] was $0.62 for the full year 2024. Weighted

average shares outstanding for both basic and adjusted diluted EPS

was 27.4 million.

Adjusted EBITDA[1] for the full year 2024 was

$60.0 million, or 13.3% of third party net sales, an increase of

$9.2 million, or 220 basis points, versus the full year 2023.

Full Year 2025 Continuing Operations Financial

Guidance:

|

Projected Year Ending December 31, 2025 |

Guidance |

Reported Growth |

ConstantCurrency

Growth[2] |

|

Net Sales |

$445M to $460M |

(1%) to 2% |

Flat to 3% |

|

Adjusted EBITDA [2] |

$65M to $70M |

8% to 17% |

8% to 17% |

|

Adjusted

EPS[2] |

$0.80 to $0.95 |

29% to 53% |

31% to 55% |

[1] This is a non-GAAP financial measure. Refer

to “Note on Non-GAAP Financial Measures” and the reconciliations in

this release for further information.[2] This is a non-GAAP

financial measure for which a reconciliation to the most directly

comparable GAAP financial measure is not available without

unreasonable efforts. Refer to “Forward-Looking Non-GAAP Financial

Measures” in this release, which identifies the information that is

unavailable without unreasonable efforts and provides additional

information. It is probable that this forward-looking non-GAAP

financial measure may be materially different from the

corresponding GAAP financial measure.

Conference Call

ZimVie will host a conference call today,

February 26, 2025, at 4:30 p.m. ET to discuss its fourth quarter

and full year 2024 financial results. To access the call, please

register online at

https://investor.zimvie.com/events-presentations/event-calendar. A

live and archived audio webcast will also be available on this

site.

About ZimVie

ZimVie is a global life sciences leader in the

dental market that develops, manufactures, and delivers a

comprehensive portfolio of products and solutions designed to

support dental tooth replacement and restoration procedures. From

its headquarters in Palm Beach Gardens, Florida, and additional

facilities around the globe, ZimVie works to improve smiles,

function, and confidence in daily life by offering comprehensive

tooth replacement solutions, including trusted dental implants,

biomaterials, and digital workflow solutions. As a worldwide leader

in this space, ZimVie is committed to advancing clinical science

and technology foundational to restoring daily life. For more

information about ZimVie, please visit us at www.ZimVie.com. Follow

@ZimVie on Twitter, Facebook, LinkedIn, or Instagram.

Note on Non-GAAP Financial Measures

This press release includes non-GAAP financial

measures that differ from financial measures calculated in

accordance with U.S. generally accepted accounting principles

(“GAAP”). These non-GAAP financial measures may not be comparable

to similar measures reported by other companies and should be

considered in addition to, and not as a substitute for, or superior

to, other measures prepared in accordance with GAAP.

Net debt is provided in this release for certain periods and is

calculated by subtracting cash and cash equivalents on a GAAP basis

from the non-current portion of debt on a GAAP basis, as detailed

in the reconciliations presented later in this press release.

Sales change information in this release is

presented on a GAAP (reported) basis and on a constant currency

basis. Constant currency percentage changes exclude the effects of

foreign currency exchange rates. They are calculated by translating

current and prior-period sales from Continuing Operations at the

same predetermined exchange rate. The translated results are then

used to determine year-over-year percentage increases or

decreases.

Net income (loss) and diluted earnings (loss)

per share in this release are presented on a GAAP (reported) basis

and on an adjusted basis. Adjusted net income (loss) and adjusted

diluted earnings (loss) per share exclude the effects of certain

items, which are detailed in the reconciliations of these non-GAAP

financial measures to the most directly comparable GAAP financial

measures presented later in this press release.

Adjusted EBITDA is a non-GAAP financial measure

provided in this release for certain periods and is calculated by

excluding certain items from net income (loss) from Continuing

Operations on a GAAP basis, as detailed in the reconciliations

presented later in this press release. Adjusted EBITDA margin is

Adjusted EBITDA divided by third party net sales from Continuing

Operations for the applicable period.

Adjusted cost of products sold (excluding

intangible asset amortization). adjusted R&D and adjusted

SG&A (on an actual basis and as a percentage of sales) are

non-GAAP financial measures provided in this presentation for

certain periods and are calculated by excluding the effects of

certain items from cost of products sold (excluding intangible

asset amortization), R&D and SG&A, respectively, on a GAAP

basis. as detailed in the reconciliations presented later in this

presentation.

Reconciliations of these non-GAAP measures to

the most directly comparable GAAP financial measures are included

in this press release.

Management uses non-GAAP financial measures

internally to evaluate the performance of the business.

Additionally, management believes these non-GAAP measures provide

meaningful incremental information to investors to consider when

evaluating the performance of the company. Management believes

these measures offer the ability to make period-to-period

comparisons that are not impacted by certain items that can cause

dramatic changes in reported income, but that do not impact the

fundamentals of our operations. The non-GAAP measures enable the

evaluation of operating results and trend analysis by allowing a

reader to better identify operating trends that may otherwise be

masked or distorted by these types of items that are excluded from

the non-GAAP measures.

Forward-Looking Non-GAAP Financial Measures

This press release also includes certain

forward-looking non-GAAP financial measures for the year ending

December 31, 2025. We calculate forward-looking non-GAAP financial

measures based on internal forecasts that omit certain amounts that

would be included in GAAP financial measures. We have not provided

quantitative reconciliations of these forward-looking non-GAAP

financial measures to the most directly comparable forward-looking

GAAP financial measures because the excluded items are not

available on a prospective basis without unreasonable efforts. For

example, the timing of certain transactions is difficult to predict

because management’s plans may change. In addition, the company

believes such reconciliations would imply a degree of precision and

certainty that could be confusing to investors. It is probable that

these forward-looking non-GAAP financial measures may be materially

different from the corresponding GAAP financial measures.

Cautionary Note Regarding Forward-Looking

Statements

This press release contains forward-looking

statements within the meaning of federal securities laws,

including, among others, any statements about our expectations,

plans, intentions, strategies, or prospects. We generally use the

words “may,” “will,” “expects,” “believes,” “anticipates,” “plans,”

“estimates,” “projects,” “assumes,” “guides,” “targets,”

“forecasts,” “sees,” “seeks,” “should,” “could,” “would,”

“predicts,” “potential,” “strategy,” “future,” “opportunity,” “work

toward,” “intends,” “guidance,” “confidence,” “positioned,”

“design,” “strive,” “continue,” “track,” “look forward to,”

“optimistic” and similar expressions to identify forward-looking

statements. All statements other than statements of historical or

current fact are or may be deemed to be forward-looking statements.

Such statements are based upon the current beliefs, expectations,

and assumptions of management and are subject to significant risks,

uncertainties, and changes in circumstances that could cause actual

outcomes and results to differ materially from the forward-looking

statements. These risks, uncertainties and changes in circumstances

include, but are not limited to: dependence on new product

development, technological advances and innovation; shifts in the

product category or regional sales mix of our products and

services; supply and prices of raw materials and products,

including impacts from tariffs; pricing pressures from competitors,

customers, dental practices and insurance providers; changes in

customer demand for our products and services caused by demographic

changes or other factors; challenges relating to changes in and

compliance with governmental laws and regulations affecting our

U.S. and international businesses, including regulations of the

U.S. Food and Drug Administration and foreign government

regulators, such as more stringent requirements for regulatory

clearance of products; competition; the impact of healthcare reform

measures; reductions in reimbursement levels by third-party payors;

cost containment efforts sponsored by government agencies,

legislative bodies, the private sector and healthcare group

purchasing organizations, including the volume-based procurement

process in China; control of costs and expenses; dependence on a

limited number of suppliers for key raw materials and outsourced

activities; the ability to obtain and maintain adequate

intellectual property protection; breaches or failures of our

information technology systems or products, including by

cyberattack, unauthorized access or theft; the ability to retain

the independent agents and distributors who market our products;

our ability to attract, retain and develop the highly skilled

employees we need to support our business; the effect of mergers

and acquisitions on our relationships with customers, suppliers and

lenders and on our operating results and businesses generally; a

determination by the Internal Revenue Service that the distribution

of our shares of common stock by Zimmer Biomet Holdings, Inc. in

2022 (the "distribution") or certain related transactions should be

treated as taxable transactions; financing transactions undertaken

in connection with the separation and risks associated with

additional indebtedness; the impact of the separation on our

businesses and the risk that the separation and the results thereof

may be more difficult, time consuming and/or costly than expected,

which could impact our relationships with customers, suppliers,

employees and other business counterparties; restrictions on

activities following the distribution in order to preserve the

tax-free treatment of the distribution; the ability to form and

implement alliances; changes in tax obligations arising from tax

reform measures, including European Union rules on state aid, or

examinations by tax authorities; product liability, intellectual

property and commercial litigation losses; changes in general

industry and market conditions, including domestic and

international growth rates; changes in general domestic and

international economic conditions, including inflation and interest

rate and currency exchange rate fluctuations; and the effects of

global pandemics and other adverse public health developments on

the global economy, our business and operations and the business

and operations of our suppliers and customers, including the

deferral of elective procedures and our ability to collect accounts

receivable. You are cautioned not to rely on these forward-looking

statements, since there can be no assurance that these

forward-looking statements will prove to be accurate.

Forward-looking statements speak only as of the date they are made,

and we expressly disclaim any intention or obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events, or otherwise.

Media Contact Information:

ZimVieGrace Flowers •

Grace.Flowers@ZimVie.com(561) 319-6130

Investor Contact Information:

Gilmartin Group LLCWebb Campbell •

Webb@gilmartinir.com

| |

|

ZIMVIE INC. CONSOLIDATED STATEMENT OF

OPERATIONS (in thousands, except per share

data) |

| |

|

|

(unaudited)For the Three MonthsEnded

December 31, |

|

For the Years Ended December

31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net Sales |

|

|

|

|

|

|

|

|

Third party, net |

$ |

111,521 |

|

|

$ |

113,066 |

|

|

$ |

449,749 |

|

|

$ |

457,197 |

|

|

Related party, net |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

236 |

|

| Total Net

Sales |

|

111,521 |

|

|

|

113,066 |

|

|

|

449,749 |

|

|

|

457,433 |

|

| Cost of products sold,

excluding intangible asset amortization |

|

(38,707 |

) |

|

|

(42,573 |

) |

|

|

(162,303 |

) |

|

|

(166,819 |

) |

| Related party cost of products

sold, excluding intangible asset amortization |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(231 |

) |

| Intangible asset

amortization |

|

(5,994 |

) |

|

|

(6,134 |

) |

|

|

(24,053 |

) |

|

|

(26,512 |

) |

| Research and development |

|

(6,621 |

) |

|

|

(6,893 |

) |

|

|

(26,905 |

) |

|

|

(26,162 |

) |

| Selling, general and

administrative |

|

(58,564 |

) |

|

|

(62,909 |

) |

|

|

(238,589 |

) |

|

|

(248,964 |

) |

| Restructuring and other cost

reduction initiatives |

|

(2,017 |

) |

|

|

717 |

|

|

|

(5,681 |

) |

|

|

(4,489 |

) |

| Acquisition, integration,

divestiture and related |

|

(5,948 |

) |

|

|

(10,548 |

) |

|

|

(12,882 |

) |

|

|

(15,195 |

) |

|

Operating expenses |

|

(117,851 |

) |

|

|

(128,340 |

) |

|

|

(470,413 |

) |

|

|

(488,372 |

) |

| Operating

Loss |

|

(6,330 |

) |

|

|

(15,274 |

) |

|

|

(20,664 |

) |

|

|

(30,939 |

) |

|

Other income, net |

|

2,748 |

|

|

|

1,515 |

|

|

|

8,908 |

|

|

|

326 |

|

|

Interest income |

|

2,111 |

|

|

|

583 |

|

|

|

7,050 |

|

|

|

2,512 |

|

|

Interest expense |

|

(4,120 |

) |

|

|

(5,559 |

) |

|

|

(18,887 |

) |

|

|

(22,746 |

) |

|

Loss from continuing operations before income taxes |

|

(5,591 |

) |

|

|

(18,735 |

) |

|

|

(23,593 |

) |

|

|

(50,847 |

) |

|

Provision for income taxes from continuing operations |

|

(4,077 |

) |

|

|

(3,428 |

) |

|

|

(10,237 |

) |

|

|

(5,202 |

) |

| Net Loss from

Continuing Operations of ZimVie Inc. |

|

(9,668 |

) |

|

|

(22,163 |

) |

|

|

(33,830 |

) |

|

|

(56,049 |

) |

|

Income (loss) from discontinued operations, net of tax |

|

(2,097 |

) |

|

|

(312,689 |

) |

|

|

8,005 |

|

|

|

(337,233 |

) |

| Net Loss of ZimVie

Inc. |

$ |

(11,765 |

) |

|

$ |

(334,852 |

) |

|

$ |

(25,825 |

) |

|

$ |

(393,282 |

) |

|

|

|

|

|

|

|

|

|

| Basic (Loss) Earnings

Per Common Share: |

|

|

|

|

|

|

|

|

Continuing operations |

$ |

(0.35 |

) |

|

$ |

(0.83 |

) |

|

$ |

(1.23 |

) |

|

$ |

(2.12 |

) |

|

Discontinued operations |

|

(0.08 |

) |

|

|

(11.76 |

) |

|

|

0.29 |

|

|

|

(12.75 |

) |

|

Net Loss |

$ |

(0.43 |

) |

|

$ |

(12.59 |

) |

|

$ |

(0.94 |

) |

|

$ |

(14.87 |

) |

|

|

|

|

|

|

|

|

|

| Diluted (Loss)

Earnings Per Common Share |

|

|

|

|

|

|

|

|

Continuing operations |

$ |

(0.35 |

) |

|

$ |

(0.83 |

) |

|

$ |

(1.23 |

) |

|

$ |

(2.12 |

) |

|

Discontinued operations |

|

(0.08 |

) |

|

|

(11.76 |

) |

|

|

0.29 |

|

|

|

(12.75 |

) |

|

Net Loss |

$ |

(0.43 |

) |

|

$ |

(12.59 |

) |

|

$ |

(0.94 |

) |

|

$ |

(14.87 |

) |

|

|

|

|

|

|

|

|

|

|

ZIMVIE INC. CONSOLIDATED BALANCE

SHEETS (in thousands, except per share

data) |

| |

| |

As of December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| ASSETS |

|

|

|

| Current

Assets: |

|

|

|

|

Cash and cash equivalents |

$ |

74,974 |

|

|

$ |

71,511 |

|

|

Accounts receivable, net |

|

65,211 |

|

|

|

65,168 |

|

|

Inventories |

|

75,018 |

|

|

|

79,600 |

|

|

Prepaid expenses and other current assets |

|

23,295 |

|

|

|

23,825 |

|

|

Current assets of discontinued operations |

|

18,787 |

|

|

|

242,773 |

|

|

Total Current Assets |

|

257,285 |

|

|

|

482,877 |

|

|

Property, plant and equipment, net |

|

47,268 |

|

|

|

54,167 |

|

|

Goodwill |

|

257,605 |

|

|

|

262,111 |

|

|

Intangible assets, net |

|

92,734 |

|

|

|

114,354 |

|

|

Note receivable |

|

64,643 |

|

|

|

— |

|

|

Other assets |

|

26,611 |

|

|

|

26,747 |

|

|

Noncurrent assets of discontinued operations |

|

7,528 |

|

|

|

265,089 |

|

| Total

Assets |

$ |

753,674 |

|

|

$ |

1,205,345 |

|

| LIABILITIES AND

EQUITY |

|

|

|

| Current

Liabilities: |

|

|

|

|

Accounts payable |

$ |

32,958 |

|

|

$ |

27,785 |

|

|

Income taxes payable |

|

3,263 |

|

|

|

2,863 |

|

|

Other current liabilities |

|

62,905 |

|

|

|

67,108 |

|

|

Current liabilities of discontinued operations |

|

34,818 |

|

|

|

75,858 |

|

|

Total Current Liabilities |

|

133,944 |

|

|

|

173,614 |

|

|

Deferred income taxes |

|

— |

|

|

|

265 |

|

|

Lease liability |

|

8,218 |

|

|

|

9,080 |

|

|

Other long-term liabilities |

|

9,232 |

|

|

|

9,055 |

|

|

Non-current portion of debt |

|

220,451 |

|

|

|

508,797 |

|

|

Noncurrent liabilities of discontinued operations |

|

122 |

|

|

|

95,041 |

|

| Total

Liabilities |

|

371,967 |

|

|

|

795,852 |

|

| Commitments and

Contingencies |

|

|

|

| Stockholders'

Equity: |

|

|

|

|

Common stock, $0.01 par value, 150,000 shares authorized Shares,

issued and outstanding, of 27,677 and 27,076, respectively |

|

277 |

|

|

|

271 |

|

|

Preferred stock, $0.01 par value, 15,000 shares authorized, 0

shares issued and outstanding |

|

— |

|

|

|

— |

|

|

Additional paid in capital |

|

938,630 |

|

|

|

922,996 |

|

|

Accumulated deficit |

|

(466,639 |

) |

|

|

(440,814 |

) |

|

Accumulated other comprehensive loss |

|

(90,561 |

) |

|

|

(72,960 |

) |

| Total Stockholders'

Equity |

|

381,707 |

|

|

|

409,493 |

|

| Total Liabilities and

Stockholders' Equity |

$ |

753,674 |

|

|

$ |

1,205,345 |

|

| |

|

|

|

|

ZIMVIE INC.CONSOLIDATED STATEMENTS OF CASH

FLOWS (in thousands) |

| |

| |

For the Years Ended December 31, |

|

|

|

2024 |

|

|

2023 |

|

| Cash flows provided by

operating activities: |

|

|

|

Net loss of ZimVie Inc. |

$ |

(25,825 |

) |

$ |

(393,282 |

) |

|

Adjustments to reconcile net loss to net cash provided by operating

activities: |

|

|

|

Depreciation and amortization |

|

34,312 |

|

|

121,686 |

|

|

Share-based compensation |

|

16,592 |

|

|

27,020 |

|

|

Deferred income tax provision |

|

(4,243 |

) |

|

(17,088 |

) |

|

Loss on disposal of fixed assets |

|

5,518 |

|

|

2,996 |

|

|

Other non-cash items |

|

4,985 |

|

|

3,245 |

|

|

Gain on sale of spine disposal group |

|

(11,079 |

) |

|

— |

|

|

Adjustment of spine disposal group to fair value |

|

(11,143 |

) |

|

289,456 |

|

|

Changes in operating assets and liabilities: |

|

|

|

Income taxes |

|

3,253 |

|

|

(15,054 |

) |

|

Accounts receivable |

|

(4,202 |

) |

|

21,083 |

|

|

Related party receivables |

|

— |

|

|

8,483 |

|

|

Inventories |

|

6,443 |

|

|

25,446 |

|

|

Prepaid expenses and other current assets |

|

(3,015 |

) |

|

5,340 |

|

|

Accounts payable and accrued liabilities |

|

8,323 |

|

|

(24,759 |

) |

|

Related party payable |

|

— |

|

|

(13,176 |

) |

|

Other assets and liabilities |

|

(5,745 |

) |

|

(4,248 |

) |

|

Net cash provided by operating activities |

|

14,174 |

|

|

37,148 |

|

| Cash flows provided by (used

in) investing activities: |

|

|

|

Additions to instruments |

|

(1,330 |

) |

|

(5,978 |

) |

|

Additions to other property, plant and equipment |

|

(5,352 |

) |

|

(6,509 |

) |

|

Proceeds from sale of spine disposal group, net of cash

disposed |

|

290,918 |

|

|

— |

|

|

Other investing activities |

|

(1,940 |

) |

|

(2,687 |

) |

|

Net cash provided by (used in) investing

activities |

|

282,296 |

|

|

(15,174 |

) |

| Cash flows used in financing

activities: |

|

|

|

Proceeds from debt |

|

— |

|

|

4,760 |

|

|

Payments on debt |

|

(290,000 |

) |

|

(29,304 |

) |

|

Payments related to tax withholding for share-based

compensation |

|

(2,825 |

) |

|

(3,402 |

) |

|

Proceeds from stock plan activity |

|

1,872 |

|

|

2,280 |

|

|

Business combination contingent consideration payments |

|

(3,712 |

) |

|

— |

|

|

Net cash used in financing activities |

|

(294,665 |

) |

|

(25,666 |

) |

| Effect of exchange rates on

cash and cash equivalents |

|

(13,001 |

) |

|

1,859 |

|

|

Decrease in cash and cash equivalents |

|

(11,196 |

) |

|

(1,833 |

) |

| Cash and cash equivalents,

beginning of year |

|

87,768 |

|

|

89,601 |

|

| Cash and cash equivalents, end

of period |

$ |

76,572 |

|

$ |

87,768 |

|

|

Presentation includes cash of both continuing and discontinued

operations |

RECONCILIATION OF NET DEBT Continuing

Operations ($ in thousands)

|

|

As of December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| Non-current portion of

debt |

$ |

220,451 |

|

|

$ |

508,797 |

|

| Less: Cash and cash

equivalents |

|

(74,974 |

) |

|

|

(71,511 |

) |

| Net Debt |

$ |

145,477 |

|

|

$ |

437,286 |

|

RECONCILIATION OF CONSTANT CURRENCY NET SALES

Continuing Operations ($ in

thousands)

|

|

For the Three Months Ended December

31, |

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

Change (%) |

|

ForeignExchangeImpact |

ConstantCurrency %Change |

|

United States |

$ |

64,402 |

|

|

$ |

65,383 |

|

|

(1.5 |

%) |

|

0.0 |

% |

(1.5 |

%) |

|

International |

|

47,119 |

|

|

|

47,683 |

|

|

(1.2 |

%) |

|

(1.2 |

%) |

(0.0 |

%) |

| Total Dental Third

Party Sales |

|

111,521 |

|

|

|

113,066 |

|

|

(1.4 |

%) |

|

(0.5 |

%) |

(0.9 |

%) |

| Related Party Net Sales |

|

- |

|

|

|

- |

|

|

0.0 |

% |

|

0.0 |

% |

0.0 |

% |

| Total Dental Net

Sales |

$ |

111,521 |

|

|

$ |

113,066 |

|

|

(1.4 |

%) |

|

(0.5 |

%) |

(0.9 |

%) |

|

|

For the Years Ended December

31, |

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

Change (%) |

|

ForeignExchangeImpact |

ConstantCurrency %Change |

|

United States |

$ |

266,816 |

|

|

$ |

269,557 |

|

|

(1.0 |

%) |

|

0.0 |

% |

(1.0 |

%) |

|

International |

|

182,933 |

|

|

|

187,640 |

|

|

(2.5 |

%) |

|

(1.0 |

%) |

(1.5 |

%) |

| Total Dental Third

Party Sales |

|

449,749 |

|

|

|

457,197 |

|

|

(1.6 |

%) |

|

(0.4 |

%) |

(1.2 |

%) |

| Related Party Net Sales |

|

- |

|

|

|

236 |

|

|

(100.0 |

%) |

|

0.0 |

% |

(100.0 |

%) |

| Total Dental Net

Sales |

$ |

449,749 |

|

|

$ |

457,433 |

|

|

(1.7 |

%) |

|

(0.4 |

%) |

(1.3 |

%) |

| |

|

|

|

|

|

|

|

|

RECONCILIATION OF ADJUSTED NET INCOME AND DILUTED

EPS Continuing Operations (in thousands, except

per share data)

| |

For the Three Months Ended December 31, 2024 |

|

|

Net Sales |

Cost ofproducts

sold,excludingintangibleassetamortization |

Operatingexpenses,excludingcost

ofproductssold |

Operating(Loss)Income |

Net(Loss)Income |

Diluted EPS |

|

Reported |

$ |

111,521 |

|

$ |

(38,707 |

) |

$ |

(79,144 |

) |

$ |

(6,330 |

) |

$ |

(9,668 |

) |

$ |

(0.35 |

) |

| Restructuring and other cost

reduction initiatives [1] |

|

- |

|

|

- |

|

|

2,017 |

|

|

2,017 |

|

|

2,017 |

|

|

0.07 |

|

| Acquisition, integration,

divestiture and related [2] |

|

- |

|

|

- |

|

|

5,948 |

|

|

5,948 |

|

|

5,948 |

|

|

0.22 |

|

| Intangible asset

amortization |

|

- |

|

|

- |

|

|

5,994 |

|

|

5,994 |

|

|

5,994 |

|

|

0.22 |

|

| European union medical device

regulation [3] |

|

- |

|

|

- |

|

|

766 |

|

|

766 |

|

|

766 |

|

|

0.03 |

|

| Other charges [4] |

|

- |

|

|

(289 |

) |

|

- |

|

|

(289 |

) |

|

(289 |

) |

|

(0.01 |

) |

| Litigation settlement [5] |

|

- |

|

|

- |

|

|

1,095 |

|

|

1,095 |

|

|

1,095 |

|

|

0.04 |

|

| Share-based compensation

modification [6] |

|

- |

|

|

- |

|

|

283 |

|

|

283 |

|

|

283 |

|

|

0.01 |

|

| Tax effect of above

adjustments & other [7] |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

1,419 |

|

|

0.04 |

|

| Adjusted |

$ |

111,521 |

|

$ |

(38,996 |

) |

$ |

(63,041 |

) |

$ |

9,484 |

|

$ |

7,565 |

|

$ |

0.27 |

|

| |

For the Three Months Ended December 31, 2023 |

|

|

Net Sales |

Cost ofproducts

sold,excludingintangibleassetamortization |

Operatingexpenses,excludingcost

ofproductssold |

Operating(Loss)Income |

Net(Loss)Income |

Diluted EPS |

|

Reported |

$ |

113,066 |

|

$ |

(42,573 |

) |

$ |

(85,767 |

) |

$ |

(15,274 |

) |

$ |

(22,163 |

) |

$ |

(0.83 |

) |

| Restructuring and other cost

reduction initiatives [1] |

|

- |

|

|

- |

|

|

(717 |

) |

|

(717 |

) |

|

(717 |

) |

|

(0.03 |

) |

| Acquisition, integration,

divestiture and related [2] |

|

- |

|

|

- |

|

|

10,548 |

|

|

10,548 |

|

|

10,548 |

|

|

0.41 |

|

| Intangible asset

amortization |

|

- |

|

|

- |

|

|

6,134 |

|

|

6,134 |

|

|

6,134 |

|

|

0.23 |

|

| European union medical device

regulation [3] |

|

- |

|

|

- |

|

|

347 |

|

|

347 |

|

|

347 |

|

|

0.01 |

|

| Other charges [4] |

|

- |

|

|

278 |

|

|

286 |

|

|

564 |

|

|

564 |

|

|

0.02 |

|

| Spin-related share-based

compensation expense [8] |

|

- |

|

|

- |

|

|

5,335 |

|

|

5,335 |

|

|

5,335 |

|

|

0.20 |

|

| Tax effect of above

adjustments & other [7] |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

2,524 |

|

|

0.09 |

|

| Adjusted |

$ |

113,066 |

|

$ |

(42,295 |

) |

$ |

(63,834 |

) |

$ |

6,937 |

|

$ |

2,572 |

|

$ |

0.10 |

|

| |

|

[1] Restructuring activities to better position the organization

and the expenses incurred were primarily related to employee

termination benefits and professional fees. [2]

Acquisition, integration, divestiture and related expenses for the

three months ended December 31, 2024 include the write-off of

software costs incurred prior to the separation that were

determined in the fourth quarter of 2024 to be unusable for

ZimVie's current enterprise resource planning software system plans

($4.9 million), as well as professional services fees ($0.6

million) and stranded costs ($0.4 million) related to the sale of

the spine segment. Acquisition, integration, divestiture and

related expenses for the three months ended December 31, 2023

include professional services fees ($10.0 million) related to the

sale of the spine segment and rebranding costs ($0.4 million)

related to the separation from our former parent.[3] Expenses

incurred for initial compliance with the European Union (“EU”)

Medical Device Regulation (“MDR”) for previously-approved

products.[4] Inventory write-offs resulting from restructuring

activities and property, plant, and equipment step-up amortization

from prior acquisitions.[5] Legal expenses associated with the

defense of claims that are outside the ordinary course of

business.[6] Net impact to share-based compensation expense of

converting outstanding restricted stock units (“RSUs”) with

performance-based metrics based on the consolidated results of the

spine and dental segments into time-based RSUs following the sale

of the spine segment.[7] Reflects the tax effect of the adjustments

from reported to adjusted, as well as an adjustment for

management’s expectation of ZimVie’s statutory tax rate based on

current tax law and adjusted pre-tax income.[8] Spin-related

share-based compensation expense from grants provided due to the

successful separation from Zimmer Biomet. |

|

|

| |

For the Year Ended December 31, 2024 |

|

|

Net Sales |

Cost ofproducts

sold,excludingintangibleassetamortization |

Operatingexpenses,excludingcost

ofproductssold |

Operating(Loss)Income |

Net(Loss)Income |

Diluted EPS |

|

Reported |

$ |

449,749 |

|

$ |

(162,303 |

) |

$ |

(308,110 |

) |

$ |

(20,664 |

) |

$ |

(33,830 |

) |

$ |

(1.23 |

) |

| Restructuring and other cost

reduction initiatives [1] |

|

- |

|

|

- |

|

|

5,681 |

|

|

5,681 |

|

|

5,681 |

|

|

0.21 |

|

| Acquisition, integration,

divestiture and related [2] |

|

- |

|

|

- |

|

|

12,882 |

|

|

12,882 |

|

|

12,882 |

|

|

0.47 |

|

| Intangible asset

amortization |

|

- |

|

|

- |

|

|

24,053 |

|

|

24,053 |

|

|

24,053 |

|

|

0.88 |

|

| European union medical device

regulation [3] |

|

- |

|

|

- |

|

|

1,884 |

|

|

1,884 |

|

|

1,884 |

|

|

0.07 |

|

| Other charges [4] |

|

- |

|

|

1,144 |

|

|

- |

|

|

1,144 |

|

|

1,144 |

|

|

0.04 |

|

| Litigation settlement [5] |

|

- |

|

|

- |

|

|

1,095 |

|

|

1,095 |

|

|

1,095 |

|

|

0.04 |

|

| Share-based compensation

modification [6] |

|

- |

|

|

- |

|

|

(238 |

) |

|

(238 |

) |

|

(238 |

) |

|

(0.01 |

) |

| Tax effect of above

adjustments & other [7] |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

4,281 |

|

|

0.15 |

|

| Adjusted |

$ |

449,749 |

|

$ |

(161,159 |

) |

$ |

(262,753 |

) |

$ |

25,837 |

|

$ |

16,952 |

|

$ |

0.62 |

|

| |

For the Year Ended December 31, 2023 |

|

|

Net Sales |

Cost ofproducts

sold,excludingintangibleassetamortization |

Operatingexpenses,excludingcost

ofproductssold |

Operating(Loss)Income |

Net(Loss)Income |

Diluted EPS |

|

Reported |

$ |

457,433 |

|

$ |

(167,050 |

) |

$ |

(321,322 |

) |

$ |

(30,939 |

) |

$ |

(56,049 |

) |

$ |

(2.12 |

) |

| Restructuring and other cost

reduction initiatives [1] |

|

- |

|

|

- |

|

|

4,489 |

|

|

4,489 |

|

|

4,489 |

|

|

0.17 |

|

| Acquisition, integration,

divestiture and related [2] |

|

- |

|

|

- |

|

|

15,195 |

|

|

15,195 |

|

|

15,195 |

|

|

0.57 |

|

| Intangible asset

amortization |

|

- |

|

|

- |

|

|

26,512 |

|

|

26,512 |

|

|

26,512 |

|

|

1.00 |

|

| Related party |

|

(236 |

) |

|

231 |

|

|

- |

|

|

(5 |

) |

|

(5 |

) |

|

- |

|

| European union medical device

regulation [3] |

|

- |

|

|

- |

|

|

2,574 |

|

|

2,574 |

|

|

2,574 |

|

|

0.10 |

|

| Other charges [4] |

|

- |

|

|

1,143 |

|

|

1,145 |

|

|

2,288 |

|

|

2,288 |

|

|

0.09 |

|

| Spin-related share-based

compensation expense [8] |

|

- |

|

|

- |

|

|

7,679 |

|

|

7,679 |

|

|

7,679 |

|

|

0.29 |

|

| Tax effect of above

adjustments & other [7] |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

3,152 |

|

|

0.12 |

|

| Adjusted |

$ |

457,197 |

|

$ |

(165,676 |

) |

$ |

(263,728 |

) |

$ |

27,793 |

|

$ |

5,835 |

|

$ |

0.22 |

|

| |

|

[1] Restructuring activities to better position the organization

and the expenses incurred were primarily related to employee

termination benefits and professional fees. [2]

Acquisition, integration, divestiture and related expenses for the

year ended December 31, 2024 include the write-off of software

costs incurred prior to the separation that were determined in the

fourth quarter of 2024 to be unusable for ZimVie's current

enterprise resource planning software system plans ($4.9 million)

and professional services fees ($2.4 million) related to the

evaluation of strategic alternatives for our portfolio, as well as

professional services fees ($3.9 million) and stranded costs ($1.5

million) related to the sale of the spine segment. Acquisition,

integration, divestiture and related expenses for the year ended

December 31, 2023 include professional services fees ($11.6

million) related to the sale of our spine segment, as well as

professional services fees ($1.8 million), rebranding costs ($0.9

million) and information technology costs ($0.7 million) related to

the separation from our former parent.[3] Expenses incurred for

initial compliance with the EU MDR for previously-approved

products.[4] Inventory write-offs resulting from restructuring

activities and property, plant, and equipment step-up amortization

from prior acquisitions.[5] Legal expenses associated with the

defense of claims that are outside the ordinary course of

business.[6] Net impact to share-based compensation expense of

converting outstanding RSUs with performance-based metrics based on

the consolidated results of the spine and dental segments into

time-based RSUs following the sale of the spine segment.[7]

Reflects the tax effect of the adjustments from reported to

adjusted, as well as an adjustment for management’s expectation of

ZimVie’s statutory tax rate based on current tax law and adjusted

pre-tax income.[8] Spin-related share-based compensation expense

from grants provided due to the successful separation from Zimmer

Biomet. |

RECONCILIATION OF ADJUSTED EBITDA:

Continuing Operations ($ in thousands)

| |

For the Three MonthsEnded December 31, |

|

For the YearsEnded December

31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net Sales |

|

|

|

|

|

|

|

|

Total Third Party Sales |

$ |

111,521 |

|

|

$ |

113,066 |

|

|

$ |

449,749 |

|

|

$ |

457,197 |

|

|

Related Party Sales |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

236 |

|

| Total Net

Sales |

$ |

111,521 |

|

|

$ |

113,066 |

|

|

$ |

449,749 |

|

|

$ |

457,433 |

|

| Net Loss |

$ |

(9,668 |

) |

|

$ |

(22,163 |

) |

|

$ |

(33,830 |

) |

|

$ |

(56,049 |

) |

|

Interest expense, net |

|

2,009 |

|

|

|

4,976 |

|

|

|

11,837 |

|

|

|

20,234 |

|

|

Income tax provision |

|

4,077 |

|

|

|

3,428 |

|

|

|

10,237 |

|

|

|

5,202 |

|

|

Depreciation and amortization |

|

8,358 |

|

|

|

7,908 |

|

|

|

33,168 |

|

|

|

34,507 |

|

| EBITDA |

|

4,776 |

|

|

|

(5,851 |

) |

|

|

21,412 |

|

|

|

3,894 |

|

|

Share-based compensation |

|

4,118 |

|

|

|

9,316 |

|

|

|

15,879 |

|

|

|

23,476 |

|

|

Restructuring and other cost reduction initiatives [1] |

|

2,017 |

|

|

|

(717 |

) |

|

|

5,681 |

|

|

|

4,489 |

|

|

Acquisition, integration, divestiture and related [2] |

|

5,948 |

|

|

|

10,548 |

|

|

|

12,882 |

|

|

|

15,195 |

|

|

Related party gain |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(5 |

) |

|

European Union medical device regulation [3] |

|

766 |

|

|

|

347 |

|

|

|

1,884 |

|

|

|

2,574 |

|

|

Litigation settlement [4] |

|

1,095 |

|

|

|

- |

|

|

|

1,095 |

|

|

|

- |

|

|

Other charges [5] |

|

(289 |

) |

|

|

278 |

|

|

|

1,144 |

|

|

|

1,143 |

|

| Adjusted

EBITDA |

$ |

18,431 |

|

|

$ |

13,921 |

|

|

$ |

59,977 |

|

|

$ |

50,766 |

|

|

Net Loss Margin [6] |

|

(8.7% |

) |

|

|

(19.6% |

) |

|

|

(7.5% |

) |

|

|

(12.3% |

) |

|

Adjusted EBITDA Margin [7] |

|

16.5% |

|

|

|

12.3% |

|

|

|

13.3% |

|

|

|

11.1% |

|

|

|

| [1] Restructuring

activities to better position our organization for future success

based on the current business environment and sale of the spine

business, primarily related to employee termination benefits and

professional fees.[2] Acquisition, integration, divestiture and

related expenses for the three months and year ended December 31,

2024 include the write-off of software costs incurred prior to the

separation that were determined in the fourth quarter of 2024 to be

unusable for ZimVie's current enterprise resource planning software

system plans ($4.9 million and $4.9 million, respectively) and

professional services fees ($0 and $2.4 million, respectively)

related to the evaluation of strategic alternatives for our

portfolio, as well as professional services fees ($0.6 million and

$3.9 million, respectively) and stranded costs ($0.4 million and

$1.5 million, respectively) related to the sale of the spine

segment. Acquisition, integration, divestiture and related expenses

for the three months and year ended December 31, 2023 include

professional services fees ($10.0 million and $11.6 million,

respectively) related to the sale of our spine segment, as well as

professional services fees ($0 and $1.8 million, respectively),

rebranding costs ($0.4 million and $0.9 million, respectively) and

information technology costs ($0 and $0.7 million, respectively)

related to the separation from our former parent.[3] Expenses

incurred for initial compliance with the EU MDR for

previously-approved products.[4] Legal expenses associated with the

defense of claims that are outside the ordinary course of

business.[5] Inventory write-offs resulting from restructuring

activities and property, plant, and equipment step-up amortization

from prior acquisitions.[6] Net Loss Margin is calculated as Net

Loss divided by third party net sales for the applicable period.[7]

Adjusted EBITDA Margin is Adjusted EBITDA divided by third party

net sales for the applicable period. |

RECONCILIATION OF ADJUSTED COST OF PRODUCTS SOLD

(excluding intangible asset amortization), R&D and

SG&A: Continuing Operations ($ in

thousands)

| |

Three Months EndedDecember 31, |

|

Percentage of Third Party Net Sales |

|

Years Ended December 31, |

|

Percentage of Third Party Net Sales |

| |

|

2024 |

|

|

|

2023 |

|

|

2024 |

|

2023 |

|

|

2024 |

|

|

|

2023 |

|

|

2024 |

|

2023 |

|

Cost of products sold, excluding intangible asset

amortization |

$ |

(38,707 |

) |

|

$ |

(42,573 |

) |

|

(34.7 |

%) |

|

(37.7 |

%) |

|

$ |

(162,303 |

) |

|

$ |

(166,819 |

) |

|

(36.1 |

%) |

|

(36.5 |

%) |

|

Other charges [1] |

|

(289 |

) |

|

|

278 |

|

|

(0.3 |

%) |

|

0.3 |

% |

|

|

1,144 |

|

|

|

1,143 |

|

|

0.3 |

% |

|

0.3 |

% |

| Adjusted cost of

products sold, excluding intangible asset

amortization |

$ |

(38,996 |

) |

|

$ |

(42,295 |

) |

|

(35.0 |

%) |

|

(37.4 |

%) |

|

$ |

(161,159 |

) |

|

$ |

(165,676 |

) |

|

(35.8 |

%) |

|

(36.2 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2024 |

|

|

|

2023 |

|

|

2024 |

|

2023 |

|

|

2024 |

|

|

|

2023 |

|

|

2024 |

|

2023 |

| Research and

development |

$ |

(6,621 |

) |

|

$ |

(6,893 |

) |

|

(5.9 |

%) |

|

(6.1 |

%) |

|

$ |

(26,905 |

) |

|

$ |

(26,162 |

) |

|

(6.0 |

%) |

|

(5.7 |

%) |

|

European union medical device regulation [2] |

|

766 |

|

|

|

347 |

|

|

0.7 |

% |

|

0.3 |

% |

|

|

1,884 |

|

|

|

2,574 |

|

|

0.4 |

% |

|

0.5 |

% |

|

Share-based compensation modification [3] |

|

21 |

|

|

|

- |

|

|

0.0 |

% |

|

0.0 |

% |

|

|

(25 |

) |

|

|

- |

|

|

0.0 |

% |

|

0.0 |

% |

|

Spin-related share-based compensation expense [4] |

|

- |

|

|

|

80 |

|

|

0.0 |

% |

|

0.1 |

% |

|

|

- |

|

|

|

320 |

|

|

0.0 |

% |

|

0.1 |

% |

| Adjusted research and

development |

$ |

(5,834 |

) |

|

$ |

(6,466 |

) |

|

(5.2 |

%) |

|

(5.7 |

%) |

|

$ |

(25,046 |

) |

|

$ |

(23,268 |

) |

|

(5.6 |

%) |

|

(5.1 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2024 |

|

|

|

2023 |

|

|

2024 |

|

2023 |

|

|

2024 |

|

|

|

2023 |

|

|

2024 |

|

2023 |

| Selling, general and

administrative |

$ |

(58,564 |

) |

|

$ |

(62,909 |

) |

|

(52.5 |

%) |

|

(55.6 |

%) |

|

$ |

(238,589 |

) |

|

$ |

(248,964 |

) |

|

(53.0 |

%) |

|

(54.5 |

%) |

| Other charges [1] |

|

- |

|

|

|

286 |

|

|

0.0 |

% |

|

0.3 |

% |

|

|

- |

|

|

|

1,145 |

|

|

0.0 |

% |

|

0.3 |

% |

| Litigation settlement [5] |

|

1,095 |

|

|

|

- |

|

|

1.0 |

% |

|

0.0 |

% |

|

|

1,095 |

|

|

|

- |

|

|

0.2 |

% |

|

0.0 |

% |

|

Share-based compensation modification [3] |

|

262 |

|

|

|

- |

|

|

0.2 |

% |

|

0.0 |

% |

|

|

(213 |

) |

|

|

- |

|

|

(0.1 |

%) |

|

0.0 |

% |

|

Spin-related share-based compensation expense [4] |

|

- |

|

|

|

5,255 |

|

|

0.0 |

% |

|

4.6 |

% |

|

|

- |

|

|

|

7,359 |

|

|

0.0 |

% |

|

1.6 |

% |

| Adjusted selling,

general and administrative |

$ |

(57,207 |

) |

|

$ |

(57,368 |

) |

|

(51.3 |

%) |

|

(50.7 |

%) |

|

$ |

(237,707 |

) |

|

$ |

(240,460 |

) |

|

(52.9 |

%) |

|

(52.6 |

%) |

| |

| [1] Inventory

write-offs resulting from restructuring activities and property,

plant, and equipment step-up amortization from prior

acquisitions.[2] Expenses incurred for initial compliance with the

EU MDR for previously-approved products.[3] Net impact to

share-based compensation expense of converting outstanding RSUs

with performance-based metrics based on the consolidated results of

the spine and dental segments to time-based RSUs following the sale

of the spine segment.[4] Spin-related share-based compensation

expense from grants provided due to the successful separation from

Zimmer Biomet.[5] Legal expenses associated with the defense of

claims that are outside the ordinary course of business. |

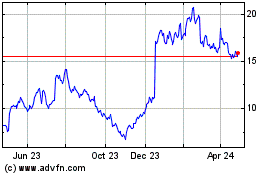

ZimVie (NASDAQ:ZIMV)

Historical Stock Chart

From Jan 2025 to Feb 2025

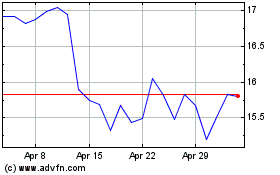

ZimVie (NASDAQ:ZIMV)

Historical Stock Chart

From Feb 2024 to Feb 2025