Zoom Video Communications Shares Down After 3Q Results

24 November 2021 - 4:55AM

Dow Jones News

By Michael Dabaie

Zoom Video Communications Inc. shares were down 18% to $197.91

following the release of third-quarter results.

The video communications platform company after the bell Monday

reported third-quarter revenue of $1.05 billion, up 35% and beating

the FactSet consensus for $1.02 billion. Earnings per share were

$1.11, beating the FactSet consensus of $1.09.

"The growth was primarily driven by strength in our direct and

channel businesses, which grew at twice the rate of our online

business, as well as improved churn in both online and direct

segments," Chief Financial Officer Kelly Steckelberg said during

the company's conference call.

Zoom guided for fourth-quarter revenue of $1.051 billion to

$1.053 billion and adjusted EPS between $1.06 and $1.07.

J.P. Morgan noted that the stock in after-hours trading Monday

was reacting to metrics like billings "that have not been a good

indicator of business health for Zoom."

J.P. Morgan said in its analyst note that revenue for the third

quarter and guidance for fourth quarter came in above its

expectations "even as the expected fade of revenue from under 10

employee and personal use customers continued. We believe this is

the setup that points to bottoming in growth and re-acceleration as

we head through next fiscal year."

"In Q3, customers with more than 10 employees represented 66% of

revenue, up from 64% last quarter and 62% in Q3 of last year. These

trends suggest that our customers with more than 10 employees are

expanding their use of our platform, adding more products and

seats, aligned with our go-to-market strategy," Ms. Steckelberg

said during the conference call.

J.P. Morgan noted fewer customer additions than expected and

low-end customer revenue decline. "Total customers with over 10

employees increased to 512,100 in the quarter, up 18%, below our

expectation of 518,785," J.P. Morgan said. "Customers with 10 or

fewer employees declined as a percentage of total revenue, down to

34% from 38% one year ago and 36% last quarter," the firm said in

an analyst note.

Needham pointed to churn and slowing revenue growth in the

company's fewer-than 10 employee cohort. "We suspect headwinds in

this segment could persist into F1Q22, potentially beyond,

overshadowing solid progress in enterprise," Needham said in a

note.

"With topline growth still weighed down by weakening trends in

the micro segment from pull-forward and temporary pandemic

business, we look for a clear line of sight to the growth trough,"

Needham said. Needham said it suspects Zoom could face additional

quarters of high churn in this micro segment before the more

attractive growth rate in its more-than 10 employee and enterprise

segments becomes more evident.

Mizuho Securities USA reiterated its Buy rating. "Although the

company's post-pandemic durable growth profile remains somewhat

unclear, the company's multiple growth levers (Zoom Phone, Zoom

Rooms, Video Engagement Center) remain integral to hybrid work

environments for the foreseeable future," Mizuho said.

Zoom said that at the end of the third quarter it had 2,507

customers contributing more than $100,000 in trailing 12 months

revenue, up about 94% from the same quarter last fiscal year.

"We expect larger company contributions to be the key to growth,

not the under 10 employee and personal use, so this is a positive

signal," J.P. Morgan said.

Write to Michael Dabaie at michael.dabaie@wsj.com

(END) Dow Jones Newswires

November 23, 2021 12:40 ET (17:40 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

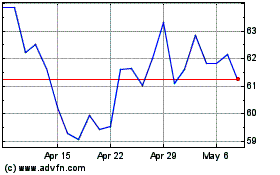

Zoom Video Communications (NASDAQ:ZM)

Historical Stock Chart

From Mar 2024 to Apr 2024

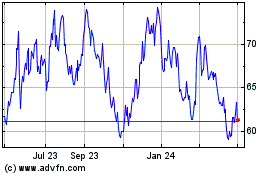

Zoom Video Communications (NASDAQ:ZM)

Historical Stock Chart

From Apr 2023 to Apr 2024