Delivers solid results in Q4; initiates FY25

guidance

Fourth-quarter fiscal year 2024

- Revenue of $1.70 billion, up 0.8% reported and down 0.3%

core(1) from the fourth quarter of 2023.

- GAAP net income of $351 million; earnings per share (EPS) of

$1.22, down 25% from the fourth quarter of 2023.

- Non-GAAP(2) net income of $418 million; EPS of $1.46, up 6%

from the fourth quarter of 2023.

Full fiscal year 2024

- Revenue of $6.51 billion, down 4.7% on a reported basis and

down 4.7% core(1) year-over-year.

- GAAP net income of $1.289 billion; EPS of $4.43, up 6%

year-over-year.

- Non-GAAP(2) net income of $1.539 billion; EPS of $5.29, down 3%

year-over-year.

Fiscal year 2025 and first-quarter outlook

- Fiscal year revenue is expected in the range of $6.790 billion

to $6.870 billion, representing a range of up 4.3% to 5.5% on a

reported basis and 2.5% to 3.5% core(1). Non-GAAP(3) earnings are

expected in the range of $5.54 to $5.61 per share.

- Fiscal first-quarter revenue guidance is expected in the range

of $1.650 billion to $1.680 billion, a decline of 0.5% to an

increase of 1.3% reported and a decline of 2.0% to 0.2% core(1).

Non-GAAP(3) earnings are expected in the range of $1.25 to $1.28

per share.

Agilent Technologies Inc. (NYSE: A) today reported revenue of

$1.70 billion for the fourth quarter ended October 31, 2024, an

increase of 0.8% reported and a decline of 0.3% core(1) compared to

the fourth quarter of 2023.

Fourth-quarter GAAP net income was $351 million, or $1.22 per

share. This compares with $475 million, or $1.62 per share, in the

fourth quarter of fiscal year 2023. Non-GAAP(2) net income was $418

million, or $1.46 per share during the quarter, compared with $404

million or $1.38 per share during the fourth quarter a year

ago.

“The Agilent team again executed well and delivered solid

results in the fourth quarter as the markets continued to recover,”

said Agilent President and CEO Padraig McDonnell. “Our new

market-based, customer-first strategy combined with our

transformation – which includes the new organizational structure

announced today – will position us to capture even more growth

opportunities as the market improves. I look forward to sharing

more about these exciting developments during our Analyst and

Investor Day in December.”

Financial Highlights

In the first quarter of 2024, Agilent implemented certain

changes to its segment reporting structure. Prior period segment

information has been recast to reflect these changes. These changes

have no impact on Agilent’s consolidated financial statements.

Life Sciences and Applied Markets Group

Agilent’s Life Sciences and Applied Markets Group (LSAG)

reported fourth-quarter revenue of $833 million, a decline of 1%

reported and 1% core(1) year-over-year. LSAG’s operating margin for

the quarter was 28.0%. Full-year revenue of $3.22 billion declined

8% reported and 8% core(1) over last year. LSAG’s operating margin

for the year was 27.3%.

Agilent CrossLab Group

The Agilent CrossLab Group (ACG) reported fourth-quarter revenue

of $426 million, an increase of 5% reported and 5% core(1)

year-over-year. ACG’s operating margin for the quarter was 32.6%.

Full-year revenue of $1.64 billion increased 5% reported and 5%

core(1) over last year. ACG’s operating margin for the year was

31.9%.

Diagnostics and Genomics Group

The Diagnostics and Genomics Group (DGG) reported fourth-quarter

revenue of $442 million, a decrease of 1% reported and 3% core(1)

year-over-year. DGG’s operating margin for the quarter was 21.2%.

Full-year revenue of $1.65 billion declined 6% reported and 6%

core(1) over last year. DGG’s operating margin for the year was

19.4%.

Full Year 2025 and First-Quarter Outlook

Full-year revenue outlook is expected in the range of $6.790

billion to $6.870 billion, representing a range of up 4.3% to 5.5%

reported and 2.5% to 3.5% core(1). Non-GAAP(3) EPS is expected in

the range of $5.54 to $5.61 per share.

The outlook for first-quarter revenue is expected to be in the

range of $1.650 billion to $1.680 billion, a decline of 0.5% to an

increase of 1.3% reported and a decline of 2.0% to 0.2% core(1).

Non-GAAP(3) EPS is expected in the range of $1.25 to $1.28 per

share.

The outlook is based on forecasted currency exchange rates.

Conference Call

Agilent’s management will present additional details regarding

the company’s fourth-quarter 2024 financial results on a conference

call with investors today at 1:30 p.m. PT. This event will be

broadcast live online in listen-only mode. To listen to the

webcast, select the “Q4 2024 Agilent Technologies Inc. Earnings

Conference Call” link on the Agilent Investor Relations website.

The replay of the call will remain on the company site for 90

days.

Organizational Structure Announcement

Agilent today also announced a new organizational structure, an

important step in the company’s transformation to become nimbler

and more customer centric. Read the announcement. Agilent will

share more information about the company’s evolved market-focused

strategy and transformation at its Investor Day in New York City on

Dec. 17, 2024. See details here.

About Agilent Technologies

Agilent Technologies Inc. (NYSE: A) is a global leader in

analytical and clinical laboratory technologies, delivering

insights and innovation that help our customers bring great science

to life. Agilent’s full range of solutions includes instruments,

software, services, and expertise that provide trusted answers to

our customers' most challenging questions. The company generated

revenue of $6.51 billion in fiscal year 2024 and employs

approximately 18,000 people worldwide. Information about Agilent is

available at www.agilent.com. To receive the latest Agilent news,

subscribe to the Agilent Newsroom. Follow Agilent on LinkedIn and

Facebook.

Forward-Looking Statements

This news release contains forward-looking statements as defined

in the Securities Exchange Act of 1934 and is subject to the safe

harbors created therein. The forward-looking statements contained

herein include, but are not limited to, information regarding

Agilent’s growth prospects, business, financial results, revenue,

non-GAAP earnings guidance for Q1 and fiscal year 2025, and the

effects of its new organizational structure, operational

transformation and market-focused strategy. These forward-looking

statements involve risks and uncertainties that could cause

Agilent’s results to differ materially from management’s current

expectations. Such risks and uncertainties include, but are not

limited to, unforeseen changes in the strength of Agilent’s

customers’ businesses; unforeseen changes in the demand for current

and new products, technologies, and services; unforeseen changes in

the currency markets; customer purchasing decisions and timing; and

the risk that Agilent is not able to realize the savings expected

from integration and restructuring activities. In addition, other

risks that Agilent faces in running its operations include the

ability to execute successfully through business cycles; the

ability to meet and achieve the benefits of its operational

transformation, market-focused strategy and cost-reduction goals

and otherwise successfully adapt its cost structures to continuing

changes in business conditions; ongoing competitive, pricing and

gross-margin pressures; the risk that its cost-cutting initiatives

will impair its ability to develop products and remain competitive

and to operate effectively; the impact of geopolitical

uncertainties and global economic conditions on its operations, its

markets and its ability to conduct business; the ability to improve

asset performance to adapt to changes in demand; the ability of its

supply chain to adapt to changes in demand; the ability to

successfully introduce new products at the right time, price and

mix; the ability of Agilent to successfully integrate recent

acquisitions; the ability of Agilent to successfully comply with

certain complex regulations; and other risks detailed in Agilent’s

filings with the Securities and Exchange Commission, including its

quarterly report on Form 10-Q for the fiscal quarter ended July 31,

2024. Forward-looking statements are based on the beliefs and

assumptions of Agilent’s management and on currently available

information. Agilent undertakes no responsibility to publicly

update or revise any forward-looking statement.

(1) Core revenue growth excludes the impact of currency and

acquisitions and divestitures within the past 12 months. Core

revenue is a non-GAAP measure. Reconciliations between GAAP revenue

and core revenue for Q4 fiscal year 2024 and full fiscal year 2024

are set forth on pages 6 and 7 of the attached tables along with

additional information regarding the use of this non-GAAP measure.

Core revenue growth rate as projected for Q1 fiscal year 2025 and

full fiscal year 2025 excludes the impact of currency and

acquisitions and divestitures within the past 12 months. Most of

the excluded amounts pertain to events that have not yet occurred

and are not currently possible to estimate with a reasonable degree

of accuracy and could differ materially. Therefore, no

reconciliation to GAAP amounts has been provided for the

projection.

(2) Non-GAAP net income and non-GAAP earnings per share

primarily exclude the impacts of restructuring and other related

costs, asset impairments, intangibles amortization,

transformational initiatives, acquisition and integration costs and

net (gain) loss on equity securities. Agilent also excludes any tax

benefits or expenses that are not directly related to ongoing

operations, and which are either isolated or are not expected to

occur again with any regularity or predictability. A reconciliation

between non-GAAP net income and GAAP net income is set forth on

page 4 of the attached tables along with additional information

regarding the use of this non-GAAP measure.

(3) Non-GAAP earnings per share as projected for Q1 fiscal year

2025 and full fiscal year 2025 exclude primarily the estimated

impacts of non-cash intangibles amortization, transformational

initiatives, and acquisition and integration costs. Agilent also

excludes any tax benefits or expenses that are not directly related

to ongoing operations, and which are either isolated or are not

expected to occur again with any regularity or predictability. Most

of these excluded amounts pertain to events that have not yet

occurred and are not currently possible to estimate with a

reasonable degree of accuracy and could differ materially.

Therefore, no reconciliation to GAAP amounts has been provided.

Future amortization of intangibles is expected to be approximately

$28 million per quarter.

AGILENT TECHNOLOGIES,

INC.

CONDENSED CONSOLIDATED

STATEMENT OF OPERATIONS

(In millions, except per share

data)

(Unaudited)

PRELIMINARY

Three Months Ended

Years Ended

October 31,

October 31,

2024

2023

2024

2023

Net revenue

$

1,701

$

1,688

$

6,510

$

6,833

Costs and expenses: Cost of products and services

785

773

2,975

3,368

Research and development

111

114

479

481

Selling, general and administrative

397

393

1,568

1,634

Total costs and expenses

1,293

1,280

5,022

5,483

Income from operations

408

408

1,488

1,350

Interest income

24

17

80

51

Interest expense

(32

)

(22

)

(96

)

(95

)

Other income (expense), net

1

17

49

33

Income before taxes

401

420

1,521

1,339

Provision for (benefit from) income taxes

50

(55

)

232

99

Net income

$

351

$

475

$

1,289

$

1,240

Net income per share: Basic

$

1.23

$

1.63

$

4.44

$

4.22

Diluted

$

1.22

$

1.62

$

4.43

$

4.19

Weighted average shares used in computing net income per

share: Basic

286

292

290

294

Diluted

287

293

291

296

The preliminary income statement is estimated based on our

current information. Page 1

AGILENT TECHNOLOGIES,

INC.

CONDENSED CONSOLIDATED BALANCE

SHEET

(In millions, except par value

and share data)

(Unaudited)

PRELIMINARY

October 31,

October 31,

2024

2023

ASSETS Current assets: Cash and cash equivalents

$

1,329

$

1,590

Accounts receivable, net

1,324

1,291

Inventory

972

1,031

Other current assets

334

274

Total current assets

3,959

4,186

Property, plant and equipment, net

1,778

1,270

Goodwill

4,477

3,960

Other intangible assets, net

547

475

Long-term investments

175

164

Other assets

910

708

Total assets

$

11,846

$

10,763

LIABILITIES AND EQUITY Current liabilities: Accounts

payable

$

540

$

418

Employee compensation and benefits

368

371

Deferred revenue

544

505

Short-term debt

45

—

Other accrued liabilities

398

309

Total current liabilities

1,895

1,603

Long-term debt

3,345

2,735

Retirement and post-retirement benefits

130

103

Other long-term liabilities

578

477

Total liabilities

5,948

4,918

Total Equity: Stockholders' equity: Preferred stock; $0.01

par value; 125,000,000 shares authorized; none issued and

outstanding

—

—

Common stock; $0.01 par value, 2,000,000,000 shares authorized;

285,193,011 shares at October 31, 2024 and 292,123,241 shares at

October 31, 2023, issued and outstanding

3

3

Additional paid-in-capital

5,450

5,387

Retained earnings

750

782

Accumulated other comprehensive loss

(305

)

(327

)

Total stockholders' equity

5,898

5,845

Total liabilities and stockholders' equity

$

11,846

$

10,763

The preliminary balance sheet is estimated based on our

current information. Page 2

AGILENT TECHNOLOGIES,

INC.

CONDENSED CONSOLIDATED

STATEMENT OF CASH FLOWS

(In millions)

(Unaudited)

PRELIMINARY

Years Ended

October 31,

October 31,

2024

2023

Cash flows from operating activities: Net income

$

1,289

$

1,240

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization

257

271

Share-based compensation

129

111

Deferred taxes

(64

)

(56

)

Excess and obsolete inventory related charges

45

40

Net (gain) loss on equity securities

5

41

Asset impairment charges

8

277

Change in fair value of contingent consideration

—

1

Net gain on divestiture of business

—

(43

)

Other non-cash (income) expense, net

(1

)

6

Changes in assets and liabilities: Accounts receivable, net

7

132

Inventory

34

(33

)

Accounts payable

103

(171

)

Employee compensation and benefits

(12

)

(91

)

Other assets and liabilities

(49

)

47

Net cash provided by operating activities (a)

1,751

1,772

Cash flows from investing activities: Payments to acquire

property, plant and equipment

(378

)

(298

)

Proceeds from sale of equity securities

—

5

Payments to acquire equity securities

(5

)

(8

)

Proceeds from convertible note

—

4

Payments in exchange for convertible note

(13

)

(12

)

Proceeds from divestiture of business

—

50

Payments to acquire businesses and intangible assets, net of cash

acquired

(862

)

(51

)

Net cash used in investing activities

(1,258

)

(310

)

Cash flows from financing activities: Proceeds from issuance

of common stock under employee stock plans

77

67

Payment of taxes related to net share settlement of equity awards

(30

)

(54

)

Payments for repurchase of common stock

(1,150

)

(575

)

Payment of excise taxes related to repurchases of common stock

(3

)

—

Payments of dividends

(274

)

(265

)

Proceeds from issuance of long-term debt

1,197

—

Repayments of long-term debt

(180

)

—

Payments of debt issuance costs

(9

)

—

Net proceeds from (repayment of) short-term debt

(380

)

(35

)

Payment for contingent consideration

—

(68

)

Net cash used in financing activities

(752

)

(930

)

Effect of exchange rate movements

(2

)

5

Net increase (decrease) in cash, cash equivalents and

restricted cash

(261

)

537

Cash, cash equivalents and restricted cash at beginning of

period

1,593

1,056

Cash, cash equivalents and restricted cash at end of period

$

1,332

$

1,593

Reconciliation of cash, cash equivalents and

restricted cash to the condensed consolidated balance sheet:

Cash and cash equivalents

$

1,329

$

1,590

Restricted cash, included in other assets

3

3

Total cash, cash equivalents and restricted cash

$

1,332

$

1,593

(a) Cash payments included in operating activities:

Income tax payments, net of refunds received

$

314

$

199

Interest payments, net of capitalized interest

$

80

$

89

The preliminary cash flow is estimated based on our current

information. Page 3

AGILENT TECHNOLOGIES,

INC.

NON-GAAP NET INCOME AND

DILUTED EPS RECONCILIATIONS

(In millions, except per share

data)

(Unaudited)

PRELIMINARY

Three Months Ended

Years Ended

October 31,

October 31,

2024

2023

2024

2023

Net Income

Diluted EPS

Net Income

Diluted EPS

Net Income

Diluted EPS

Net Income

Diluted EPS

GAAP net income

$

351

$

1.22

$

475

$

1.62

$

1,289

$

4.43

$

1,240

$

4.19

Non-GAAP adjustments: Restructuring and other related costs

5

0.02

46

0.16

76

0.26

46

0.16

Asset impairments

—

—

—

—

8

0.03

277

0.94

Intangible amortization

25

0.09

27

0.09

102

0.35

139

0.47

Transformational initiatives

6

0.02

(6

)

(0.02

)

11

0.04

25

0.08

Acquisition and integration costs

7

0.02

4

0.01

12

0.04

16

0.05

Business exit and divestiture costs (gain)

—

—

(43

)

(0.15

)

—

—

(43

)

(0.15

)

Net loss on equity securities

12

0.04

27

0.09

10

0.03

42

0.14

Pension settlement loss

2

0.01

4

0.01

2

0.01

4

0.01

Change in fair value of contingent consideration

—

—

—

—

—

—

1

—

Other

13

0.05

(11

)

(0.03

)

17

0.06

20

0.07

Adjustment for taxes (a)

(3

)

(0.01

)

(119

)

(0.40

)

12

0.04

(158

)

(0.52

)

Non-GAAP net income

$

418

$

1.46

$

404

$

1.38

$

1,539

$

5.29

$

1,609

$

5.44

(a) The adjustment for taxes excludes tax expense (benefits)

that management believes are not directly related to on-going

operations and which are either isolated, temporary or cannot be

expected to occur again with any regularity or predictability such

as the realized gain/loss due to sale of a business, windfall

benefits on stock compensation, and the impact of R&D

capitalization under section 174 of the Tax Cuts and Jobs Act of

2017. For the three months ended October 31, 2024, management used

a non-GAAP effective tax rate of 11.25%. For the fiscal year ended

October 31, 2024, management used a non-GAAP effective tax rate of

12.50%. For the three months and fiscal year ended October 31,

2023, management used a non-GAAP effective tax rate of 13.75%.

We provide non-GAAP net income and non-GAAP net income per

share amounts in order to provide meaningful supplemental

information regarding our operational performance and our prospects

for the future. These supplemental measures exclude, among other

things, charges related to restructuring and other related costs,

asset impairments, amortization of intangibles, transformational

initiatives, acquisition and integration costs, business exit and

divestiture costs (gain), net (gain) loss on equity securities,

pension settlement loss and change in fair value of contingent

consideration.

Restructuring and other related costs

include incremental expenses incurred in the period associated with

restructuring programs, usually aimed at changes in business and/or

cost structure. Such costs may include one-time termination

benefits, facility-related costs and contract termination fees.

Asset impairments include assets that have been

written down to their fair value.

Transformational

initiatives include expenses associated with targeted cost

reduction activities such as manufacturing transfers including

costs to move manufacturing, site consolidations, legal entity and

other business reorganizations, insourcing or outsourcing of

activities. Such costs may include move and relocation costs,

one-time termination benefits and other one-time reorganization

costs. Included in this category are also expenses associated with

company programs to transform our product lifecycle management

(PLM) system and human resources and financial systems.

Acquisition and integration costs include all incremental

expenses incurred to effect a business combination. Such

acquisition costs may include advisory, legal, tax, accounting,

valuation, and other professional or consulting fees. Such

integration costs may include expenses directly related to

integration of business and facility operations, the transfer of

assets and intellectual property, information technology systems

and infrastructure and other employee-related costs.

Business exit and divestiture costs (gain) include costs and

gain associated with business divestitures.

Net (gain)

loss on equity securities relates to the realized and unrealized

mark-to-market adjustments for our marketable and non-marketable

equity securities. Pension settlement loss relates to

the relief of the US Retirement Plan pension obligation due to

increased lump sum payouts over a specified accounting

threshold. Change in fair value of contingent

consideration represents changes in the fair value estimate of

acquisition-related contingent consideration.

Other

includes certain legal costs and settlements, special compliance

costs, acceleration of stock-based compensation expense and other

miscellaneous adjustments. Our management uses non-GAAP

measures to evaluate the performance of our core businesses, to

estimate future core performance and to compensate employees. Since

management finds this measure to be useful, we believe that our

investors benefit from seeing our results “through the eyes” of

management in addition to seeing our GAAP results. This information

facilitates our management’s internal comparisons to our historical

operating results as well as to the operating results of our

competitors. Our management recognizes that items such as

amortization of intangibles can have a material impact on our cash

flows and/or our net income. Our GAAP financial statements

including our statement of cash flows portray those effects.

Although we believe it is useful for investors to see core

performance free of special items, investors should understand that

the excluded items are actual expenses that may impact the cash

available to us for other uses. To gain a complete picture of all

effects on the company’s profit and loss from any and all events,

management does (and investors should) rely upon the GAAP income

statement. The non-GAAP numbers focus instead upon the core

business of the company, which is only a subset, albeit a critical

one, of the company’s performance. Readers are reminded that

non-GAAP numbers are merely a supplement to, and not a replacement

for, GAAP financial measures. They should be read in conjunction

with the GAAP financial measures. It should be noted as well that

our non-GAAP information may be different from the non-GAAP

information provided by other companies. The preliminary

non-GAAP net income and diluted EPS reconciliation is estimated

based on our current information.

Page 4

AGILENT TECHNOLOGIES,

INC.

SEGMENT INFORMATION

(In millions, except where

noted)

(Unaudited)

PRELIMINARY

Quarter-over-Quarter

Life Sciences and Applied Markets Group

Q4'24

Q4'23

Revenue

$

833

$

839

Gross Margin, %

59.1

%

59.5

%

Income from Operations

$

233

$

240

Operating margin, %

28.0

%

28.6

%

Diagnostics and Genomics Group

Q4'24

Q4'23

Revenue

$

442

$

445

Gross Margin, %

51.5

%

53.7

%

Income from Operations

$

94

$

101

Operating margin, %

21.2

%

22.7

%

Agilent CrossLab Group

Q4'24

Q4'23

Revenue

$

426

$

404

Gross Margin, %

50.9

%

50.4

%

Income from Operations

$

139

$

128

Operating margin, %

32.6

%

31.7

%

Year-over-Year

Life Sciences and Applied Markets Group

FY24

FY23

Revenue

$

3,215

$

3,510

Gross Margin, %

59.7

%

60.3

%

Income from Operations

$

877

$

1,049

Operating margin, %

27.3

%

29.9

%

Diagnostics and Genomics Group

FY24

FY23

Revenue

$

1,651

$

1,755

Gross Margin, %

52.4

%

53.4

%

Income from Operations

$

320

$

363

Operating margin, %

19.4

%

20.7

%

Agilent CrossLab Group

FY24

FY23

Revenue

$

1,644

$

1,568

Gross Margin, %

50.9

%

49.3

%

Income from Operations

$

524

$

463

Operating margin, %

31.9

%

29.5

%

Income from operations reflect the results of our reportable

segments under Agilent's management reporting system which are not

necessarily in conformity with GAAP financial measures. Income from

operations of our reporting segments exclude, among other things,

charges related to restructuring and other related costs, asset

impairments, amortization of intangibles, transformational

initiatives and acquisition and integration costs. Readers

are reminded that non-GAAP numbers are merely a supplement to, and

not a replacement for, GAAP financial measures. They should be read

in conjunction with the GAAP financial measures. It should be noted

as well that our non-GAAP information may be different from the

non-GAAP information provided by other companies. The

preliminary segment information is estimated based on our current

information. Page 5

AGILENT TECHNOLOGIES,

INC.

RECONCILIATIONS OF REVENUE BY

SEGMENT

EXCLUDING ACQUISITIONS,

DIVESTITURES AND THE IMPACT OF CURRENCY ADJUSTMENTS (CORE)

(in millions)

(Unaudited)

PRELIMINARY

Year-over-Year

GAAP

Year-over-Year

GAAP Revenue by Segment

Q4'24

Q4'23

% Change

Life Sciences and Applied Markets Group

$

833

$

839

(1%)

Diagnostics and Genomics Group

442

445

(1%)

Agilent CrossLab Group

426

404

5%

Agilent

$

1,701

$

1,688

1%

Non-GAAP (excluding

Acquisitions & Divestitures)

Year-over-Year at Constant

Currency (a)

Year-over-Year

Year-over-Year

Percentage Point Impact from

Currency

Current Quarter Currency

Impact (b)

Non GAAP Revenue by Segment

Q4'24

Q4'23

% Change

% Change

Life Sciences and Applied Markets Group

$

833

$

839

(1%)

(1%)

—

$

5

Diagnostics and Genomics Group

432

445

(3%)

(3%)

—

3

Agilent CrossLab Group

426

404

5%

5%

—

1

Agilent (Core)

$

1,691

$

1,688

—

—

—

$

9

We compare the year-over-year change in revenue excluding

the effect of recent acquisitions and divestitures and foreign

currency rate fluctuations to assess the performance of our

underlying business. (a) The constant currency

year-over-year growth percentage is calculated by recalculating all

periods in the comparison period at the foreign currency exchange

rates used for accounting during the last month of the current

quarter and then using those revised values to calculate the

year-over-year percentage change. (b) The dollar impact from

the current quarter currency impact is equal to the total

year-over-year dollar change less the constant currency

year-over-year change. The preliminary reconciliation of

GAAP revenue adjusted for recent acquisitions and divestitures and

impact of currency is estimated based on our current information.

Page 6

AGILENT TECHNOLOGIES,

INC.

RECONCILIATIONS OF REVENUE BY

SEGMENT

EXCLUDING ACQUISITIONS,

DIVESTITURES AND THE IMPACT OF CURRENCY ADJUSTMENTS (CORE)

(in millions)

(Unaudited)

PRELIMINARY

Year-over-Year

GAAP

Year-over-Year

GAAP Revenue by Segment

FY24

FY23

% Change

Life Sciences and Applied Markets Group

$

3,215

$

3,510

(8%)

Diagnostics and Genomics Group

1,651

1,755

(6%)

Agilent CrossLab Group

1,644

1,568

5%

Agilent

$

6,510

$

6,833

(5%)

Non-GAAP (excluding

Acquisitions & Divestitures)

Year-over-Year at Constant

Currency (a)

Year-over-Year

Year-over-Year

Percentage Point Impact from

Currency

Current Quarter Currency

Impact (b)

Non GAAP Revenue by Segment

FY24

FY23

% Change

% Change

Life Sciences and Applied Markets Group

$

3,215

$

3,510

(8%)

(8%)

—

$

(5)

Diagnostics and Genomics Group

1,641

1,748

(6%)

(6%)

—

2

Agilent CrossLab Group

1,644

1,568

5%

5%

—

(4)

Agilent (Core)

$

6,500

$

6,826

(5%)

(5%)

—

$

(7)

We compare the year-over-year change in

revenue excluding the effect of recent acquisitions and

divestitures and foreign currency rate fluctuations to assess the

performance of our underlying business. (a) The constant

currency year-over-year growth percentage is calculated by

recalculating all periods in the comparison period at the foreign

currency exchange rates used for accounting during the last month

of the current quarter and then using those revised values to

calculate the year-over-year percentage change. (b) The

dollar impact from the current year currency impact is equal to the

total year-over-year dollar change less the constant currency

year-over-year change. The preliminary reconciliation of

GAAP revenue adjusted for recent acquisitions and divestitures and

impact of currency is estimated based on our current information.

Page 7

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241125015693/en/

Investor Contact: Parmeet Ahuja +1 408-345-8948

parmeet_ahuja@agilent.com Media Contact: Sarah Litton +1

408-361-0405 Sarah.litton@agilent.com

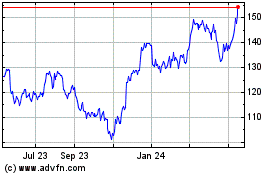

Agilent Technologies (NYSE:A)

Historical Stock Chart

From Oct 2024 to Dec 2024

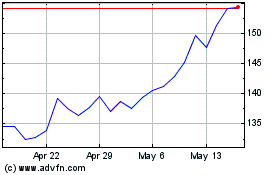

Agilent Technologies (NYSE:A)

Historical Stock Chart

From Dec 2023 to Dec 2024