Bunge Global SA (NYSE: BG) today reported third quarter 2024

results

- Q3 GAAP diluted EPS of $1.56 vs. $2.47 in the prior year;

$2.29 vs. $2.99 on an adjusted basis excluding certain

gains/charges and mark-to-market timing differences

- Solid performances in Agribusiness and Refined and Specialty

Oils; however, results were down from the prior year reflecting the

current global margin environment

- Continued to advance Viterra integration planning and other

growth priorities, including closing the sale of the sugar &

bioenergy joint venture

- Repurchased $200 million of common shares during Q3,

bringing the YTD total to $600 million

- Adjusted full-year EPS outlook now expected to be at least

$9.25

Greg Heckman, Bunge’s Chief Executive Officer, commented, “Our

team delivered a strong third quarter, staying nimble and

leveraging our global platform to capture opportunities against

shifting market dynamics around the world. We made progress on key

priorities, including closing the sale of the BP Bunge Bioenergia

joint venture and delivering value to our shareholders through

share repurchases. At the same time, we continued to advance

integration planning for our announced combination with Viterra,

and have made progress toward the remaining regulatory

approvals.

“The third quarter has again proven the value of our global

footprint, operating model and approach, which underscores the

benefit of further diversification across geographies and crops

that our combination with Viterra will bring.”

Three Months Ended

September 30,

Nine Months Ended

September 30,

(US$ in millions, except per share

data)

2024

2023

2024

2023

Net income attributable to

Bunge

$

221

$

373

$

535

$

1,627

Net income per share-diluted

(6)

$

1.56

$

2.47

$

3.73

$

10.71

Mark-to-market timing differences (a)

$

0.16

$

0.14

$

1.91

$

(1.29

)

Certain (gains) & charges (b)

$

0.57

$

0.38

$

1.42

$

0.55

Adjusted Net income per share-diluted

(c)(6)

$

2.29

$

2.99

$

7.06

$

9.97

Core Segment EBIT (c) (d)

$

539

$

711

$

1,437

$

2,674

Mark-to-market timing differences (a)

3

34

343

(261

)

Certain (gains) & charges (b)

19

(10

)

19

(29

)

Adjusted Core Segment EBIT (c)

$

561

$

735

$

1,799

$

2,384

Corporate and Other EBIT (c)

$

(138

)

$

(182

)

$

(421

)

$

(417

)

Certain (gains) & charges (b)

62

68

185

102

Adjusted Corporate and Other EBIT

(c)

$

(76

)

$

(114

)

$

(236

)

$

(315

)

Non-core Segment EBIT (c) (e)

$

6

$

55

$

9

$

125

Certain (gains) & charges (b)

—

—

—

—

Adjusted Non-core Segment EBIT

(c)

$

6

$

55

$

9

$

125

Total Segment EBIT (c)

$

407

$

584

$

1,025

$

2,382

Mark-to-market timing differences (a)

3

34

343

(261

)

Certain (gains) & charges (b)

81

58

204

73

Adjusted Total Segment EBIT (c)

$

491

$

676

$

1,572

$

2,194

(a)

Mark-to-market timing impact of

certain commodity and freight contracts, readily marketable

inventories ("RMI"), and related hedges associated with committed

future operating capacity. See note 3 in the Additional Financial

Information section of this release for details.

(b)

Certain (gains) & charges

included in Total Segment EBIT and Net income attributable to

Bunge. See Additional Financial Information for details.

(c)

Core Segment EBIT, Adjusted Core

Segment EBIT, Corporate and Other EBIT, Adjusted Corporate and

Other EBIT, Non-core Segment EBIT, Adjusted Non-core Segment EBIT,

Total Segment EBIT, Adjusted Total Segment EBIT, and Adjusted Net

income per share-diluted are non-GAAP financial measures.

Reconciliations to the most directly comparable U.S. GAAP measures

are included in the tables attached to this press release and the

accompanying slide presentation posted on Bunge's website.

(d)

Core Segment earnings before

interest and tax ("Core Segment EBIT") comprises the aggregate

earnings before interest and tax (“EBIT”) of Bunge’s Agribusiness,

Refined and Specialty Oils and Milling reportable segments, and

excludes Bunge's Sugar & Bioenergy reportable segment and

Corporate and Other activities.

(e)

Non-core Segment EBIT comprises

Bunge’s Sugar & Bioenergy reportable segment EBIT, which

reflects Bunge's share of the results of its 50/50 joint venture

with BP p.l.c. On June 19, 2024, Bunge entered into a definitive

share purchase agreement to sell its 50% ownership share in BP

Bunge Bioenergia. Further, on October 1, 2024, the transaction

closed in accordance with the terms of the share purchase

agreement.

Core Segments

Agribusiness

Three Months Ended

Nine Months Ended

(US$ in millions, except per share

data)

Sep 30, 2024

Sep 30, 2023

Sep 30, 2024

Sep 30, 2023

Volumes (in thousand metric

tons)

19,892

18,854

60,663

55,497

Net Sales

$

9,292

$

10,082

$

28,689

$

31,809

Gross Profit

$

392

$

645

$

1,135

$

2,450

Selling, general and administrative

expense

$

(147

)

$

(145

)

$

(452

)

$

(428

)

Foreign exchange (losses) gains –

net

$

20

$

(52

)

$

(81

)

$

(77

)

EBIT attributable to noncontrolling

interests

$

4

$

(9

)

$

14

$

(29

)

Other income (expense) - net

$

79

$

36

$

188

$

54

Income (loss) from affiliates

$

(26

)

$

(14

)

$

(66

)

$

(19

)

Segment EBIT

$

322

$

461

$

738

$

1,951

Mark-to-market timing differences

25

21

394

(264

)

Certain (gains) & charges

19

(10

)

19

(29

)

Adjusted Segment EBIT

$

366

$

472

$

1,151

$

1,658

Certain (gains) & charges, Net income

(loss) attributable to Bunge

$

19

$

(9

)

$

19

$

(25

)

Certain (gains) & charges, Earnings

per share

$

0.13

$

(0.06

)

$

0.13

$

(0.17

)

Processing (2)

Three Months Ended

Nine Months Ended

(US$ in millions)

Sep 30, 2024

Sep 30, 2023

Sep 30, 2024

Sep 30, 2023

Processing EBIT

$

219

$

430

$

521

$

1,653

Mark-to-market timing differences

53

(2

)

427

(281

)

Certain (gains) & charges

19

(4

)

19

(18

)

Adjusted Processing EBIT

$

291

$

424

$

967

$

1,354

Higher results in South America and Europe soy crush were more

than offset by lower results in North America, Asia and Europe

softseeds.

Merchandising (2)

Three Months Ended

Nine Months Ended

(US$ in millions)

Sep 30, 2024

Sep 30, 2023

Sep 30, 2024

Sep 30, 2023

Merchandising EBIT

$

103

$

31

$

217

$

298

Mark-to-market timing differences

(28

)

23

(33

)

17

Certain (gains) & charges

—

(6

)

—

(11

)

Adjusted Merchandising EBIT

$

75

$

48

$

184

$

304

Higher results were driven by improved performance in our

financial services, ocean freight and global oils businesses more

than offsetting lower results in global grains.

Refined & Specialty Oils

Three Months Ended

Nine Months Ended

(US$ in millions, except per share

data)

Sep 30, 2024

Sep 30, 2023

Sep 30, 2024

Sep 30, 2023

Volumes (in thousand metric

tons)

2,334

2,278

6,829

6,636

Net Sales

$

3,158

$

3,601

$

9,519

$

11,090

Gross Profit

$

338

$

352

$

1,012

$

1,027

Selling, general and administrative

expense

$

(103

)

$

(98

)

$

(303

)

$

(291

)

Foreign exchange (losses) gains –

net

$

(8

)

$

(2

)

$

(21

)

$

8

EBIT attributable to noncontrolling

interests

$

(13

)

$

(6

)

$

(31

)

$

(17

)

Other income (expense) - net

$

(14

)

$

(19

)

$

(46

)

$

(50

)

Segment EBIT

$

200

$

227

$

611

$

677

Mark-to-market timing differences

(18

)

3

(32

)

(6

)

Certain (gains) & charges

—

—

—

—

Adjusted Segment EBIT

$

182

$

230

$

579

$

671

Certain (gains) & charges, Net income

(loss) attributable to Bunge

$

—

$

—

$

—

$

—

Certain (gains) & charges, Earnings

per share

$

—

$

—

$

—

$

—

Refined & Specialty Oils Summary

Higher results in Asia were more than offset by lower results in

North and South America. Results in Europe were in line with last

year.

Milling

Three Months Ended

Nine Months Ended

(US$ in millions, except per share

data)

Sep 30, 2024

Sep 30, 2023

Sep 30, 2024

Sep 30, 2023

Volumes (in thousand metric

tons)

961

890

2,806

2,555

Net Sales

$

407

$

479

$

1,189

$

1,484

Gross Profit

$

43

$

50

$

169

$

121

Selling, general and administrative

expense

$

(25

)

$

(25

)

$

(74

)

$

(70

)

Other income (expense) - net

$

(1

)

$

(2

)

$

(4

)

$

(5

)

Segment EBIT

$

17

$

23

$

88

$

46

Mark-to-market timing differences

(4

)

10

(19

)

9

Certain (gains) & charges

—

—

—

—

Adjusted Segment EBIT

$

13

$

33

$

69

$

55

Certain (gains) & charges, Net income

(loss) attributable to Bunge

$

—

$

—

$

—

$

—

Certain (gains) & charges, Earnings

per share

$

—

$

—

$

—

$

—

Milling Summary

Slightly higher results in North America were more than offset

by lower results in South America where high raw material costs

pressured margins.

Corporate and Other

Three Months Ended

Nine Months Ended

(US$ in millions, except per share

data)

Sep 30, 2024

Sep 30, 2023

Sep 30, 2024

Sep 30, 2023

Gross Profit

$

(2

)

$

(4

)

$

(7

)

$

(11

)

Selling, general and administrative

expense

$

(161

)

$

(178

)

$

(494

)

$

(430

)

Foreign exchange (losses) gains –

net

$

2

$

6

$

3

$

5

Other income (expense) - net

$

23

$

(7

)

$

74

$

34

Income (loss) from affiliates

$

—

$

—

$

1

$

(17

)

Corporate and Other EBIT

$

(138

)

$

(182

)

$

(421

)

$

(417

)

Certain (gains) & charges

62

68

185

102

Adjusted Corporate and Other

EBIT

$

(76

)

$

(114

)

$

(236

)

$

(315

)

Certain (gains) & charges, Net income

(loss) attributable to Bunge

$

62

$

67

$

185

$

109

Certain (gains) & charges, Earnings

per share

$

0.44

$

0.44

$

1.29

$

0.72

Corporate

Three Months Ended

Nine Months Ended

(US$ in millions)

Sep 30, 2024

Sep 30, 2023

Sep 30, 2024

Sep 30, 2023

Corporate EBIT

$

(154

)

$

(155

)

$

(462

)

$

(381

)

Certain (gains) & charges

62

48

185

66

Adjusted Corporate EBIT

$

(92

)

$

(107

)

$

(277

)

$

(315

)

Other

Three Months Ended

Nine Months Ended

(US$ in millions)

Sep 30, 2024

Sep 30, 2023

Sep 30, 2024

Sep 30, 2023

Other EBIT

$

16

$

(27

)

$

41

$

(36

)

Certain (gains) & charges

—

20

—

36

Adjusted Other EBIT

$

16

$

(7

)

$

41

$

—

Corporate and Other Summary

The decrease in Corporate expenses was primarily driven by lower

performance-based compensation. Higher Other results were related

to Bunge Ventures and our captive insurance program.

Non-core Segments

Sugar & Bioenergy

Three Months Ended

Nine Months Ended

(US$ in millions, except per share

data)

Sep 30, 2024

Sep 30, 2023

Sep 30, 2024

Sep 30, 2023

Net Sales

$

38

$

56

$

130

$

192

Gross Profit

$

1

$

2

$

3

$

4

Income (loss) from affiliates

$

6

$

53

$

8

$

119

Segment EBIT

$

6

$

55

$

9

$

125

Certain (gains) & charges

—

—

—

—

Adjusted Segment EBIT

$

6

$

55

$

9

$

125

Certain (gains) & charges, Net income

(loss) attributable to Bunge

$

—

$

—

$

—

$

—

Certain (gains) & charges, Earnings

per share

$

—

$

—

$

—

$

—

Sugar & Bioenergy Summary

Higher sugar and ethanol volumes were more than offset by higher

operating costs and lower ethanol prices. Lower results also

reflected foreign exchange translation losses on U.S. dollar

denominated debt in the quarter compared to translation gains in

the prior year.

Cash Flow

Nine Months Ended

Sep 30, 2024

Sep 30, 2023

Cash provided by (used for) operating

activities

$

847

$

1,860

Certain reconciling items to Adjusted

funds from operations (4)

436

75

Adjusted funds from operations (4)

$

1,283

$

1,935

Cash provided by operations in the nine months ended September

30, 2024 was $847 million compared to $1,860 million in the same

period last year. The reduction of cash from operations was

primarily driven by lower reported net income. Adjusted funds from

operations (FFO) was $1,283 million compared to $1,935 million in

the prior year.(4)

Income Taxes

For the nine months ended September 30, 2024, income tax expense

was $236 million compared to $495 million in the prior year. The

decrease was primarily due to lower pre-tax income in 2024.

Taking into account year-to-date results, the current margin

environment and forward curves, and the loss of income due to the

sale of our ownership in the sugar & bioenergy joint venture,

we now expect full-year 2024 adjusted EPS to be at least $9.25.

In Agribusiness, full-year results are forecasted to be up

slightly from our previous outlook, reflecting the better than

expected third quarter, but down compared to last year.

In Refined and Specialty Oils, full-year results are expected to

be up from our previous outlook, but down compared to last year’s

record performance.

In Milling, full-year results are expected to be down from our

previous outlook reflecting the lower than expected third quarter,

but up from last year.

In Corporate and Other, full-year results are expected to be

similar to our previous outlook.

In Non-Core, full-year results are expected to be down

considerably from our previous outlook due to the lower than

expected third quarter and the loss of income from the sale of our

ownership in the joint venture, which closed on October 1,

2024.

Additionally, the Company currently expects the following for

2024: an adjusted annual effective tax rate range of 22% to 24%;

net interest expense in the range of $285 to $305 million; capital

expenditures in the upper end of the range of $1.2 to $1.4 billion;

and depreciation and amortization of approximately $450

million.

- Conference Call and Webcast Details

Bunge Global SA’s management will host a conference call at 8:00

a.m. Eastern (7:00 a.m. Central) on Wednesday, October 30, 2024 to

discuss the Company’s results.

Additionally, a slide presentation to accompany the discussion

of results will be posted on www.bunge.com.

To access the webcast, go to “Events & Presentations” under

“News & Events” in the “Investor Center” section of the

company’s website. Select “Q3 2024 Bunge Global SA Conference Call”

and follow the prompts. Please go to the website at least 15

minutes prior to the call to register and download any necessary

audio software.

To listen to the call, please dial 1-844-735-3666. If you are

located outside the United States or Canada, dial 1-412-317-5706.

Please dial in five to 10 minutes before the scheduled start time.

The call will also be webcast live at www.bunge.com.

A replay of the call will be available later in the day on

October 30, 2024, continuing through November 30, 2024. To listen

to it, please dial 1-877-344-7529 in the United States,

1-855-669-9658 in Canada, or 1-412-317-0088 in other locations.

When prompted, enter confirmation code 3084987.

At Bunge (NYSE: BG), our purpose is to connect farmers to

consumers to deliver essential food, feed and fuel to the world.

With more than two centuries of experience, unmatched global scale

and deeply rooted relationships, we work to strengthen global food

security, increase sustainability where we operate, and help

communities prosper. As the world’s leader in oilseed processing

and a leading producer and supplier of specialty plant-based oils

and fats, we value our partnerships with farmers to bring quality

products from where they’re grown to where they’re consumed. At the

same time, we collaborate with our customers to develop tailored

and innovative solutions to meet evolving dietary needs and trends

in every part of the world. Our Company has its registered office

in Geneva, Switzerland and its corporate headquarters in St. Louis,

Missouri. We have approximately 23,000 dedicated employees working

across approximately 300 facilities located in more than 40

countries.

We routinely post important information for investors on our

website, www.bunge.com, in the "Investors" section. We may use this

website as a means of disclosing material, non-public information

and for complying with our disclosure obligations under Regulation

FD. Accordingly, investors should monitor the Investors section of

our website, in addition to following our press releases, U.S.

Securities and Exchange Commission ("SEC") filings, public

conference calls, presentations and webcasts. The information

contained on, or that may be accessed through, our website is not

incorporated by reference into, and is not a part of, this

document.

- Cautionary Statement Concerning Forward Looking

Statements

The Private Securities Litigation Reform Act of 1995 provides a

"safe harbor" for forward looking statements to encourage companies

to provide prospective information to investors. This press release

includes forward looking statements that reflect our current

expectations and projections about our future results, performance,

prospects and opportunities. Forward looking statements include all

statements that are not historical in nature. We have tried to

identify these forward looking statements by using words including

"may," "will," "should," "could," "expect," "anticipate,"

"believe," "plan," "intend," "estimate," "continue" and similar

expressions. These forward looking statements are subject to a

number of risks, uncertainties, assumptions and other factors that

could cause our actual results, performance, prospects or

opportunities to differ materially from those expressed in, or

implied by, these forward looking statements. The following

factors, among others, could cause actual results to differ from

these forward looking statements:

- the impact on our employees, operations, and facilities from

the war in Ukraine and the resulting economic and other sanctions

imposed on Russia, including the impact on us resulting from the

continuation and/or escalation of the war and sanctions against

Russia;

- the effect of weather conditions and the impact of crop and

animal disease on our business;

- the impact of global and regional economic, agricultural,

financial and commodities market, political, social and health

conditions;

- changes in government policies and laws affecting our business,

including agricultural and trade policies, financial markets

regulation and environmental, tax and biofuels regulation;

- the impact of seasonality;

- the impact of government policies and regulations;

- the outcome of pending regulatory and legal proceedings;

- our ability to complete, integrate and benefit from

acquisitions, divestitures, joint ventures and strategic alliances,

including without limitation Bunge’s pending business combination

with Viterra Limited (“Viterra”);

- the impact of industry conditions, including fluctuations in

supply, demand and prices for agricultural commodities and other

raw materials and products that we sell and use in our business,

fluctuations in energy and freight costs and competitive

developments in our industries;

- the effectiveness of our capital allocation plans, funding

needs and financing sources;

- the effectiveness of our risk management strategies;

- operational risks, including industrial accidents, natural

disasters, pandemics or epidemics, wars and cybersecurity

incidents;

- changes in foreign exchange policy or rates;

- the impact of our dependence on third parties;

- our ability to attract and retain executive management and key

personnel; and

- other factors affecting our business generally.

The forward looking statements included in this release are made

only as of the date of this release, and except as otherwise

required by federal securities law, we do not have any obligation

to publicly update or revise any forward looking statements to

reflect subsequent events or circumstances.

You should refer to "Item 1A. Risk Factors" in our Annual Report

on Form 10-K for the year ended December 31, 2023 filed with the

SEC on February 22, 2024.

- Additional Financial Information

Certain gains and (charges), quarter-to-date

The following table provides a summary of certain gains and

(charges) that may be of interest to investors, including a

description of these items and their effect on Net income (loss)

attributable to Bunge, Earnings per share diluted and Segment EBIT

for the three month periods ended September 30, 2024 and 2023.

(US$ in millions, except per share

data)

Net Income (Loss)

Attributable to

Bunge

Earnings

Per Share

Diluted (6)

Segment

EBIT

Three Months Ended September

30,

2024

2023

2024

2023

2024

2023

Core Segments:

$

(19

)

$

9

$

(0.13

)

$

0.06

$

(19

)

$

10

Agribusiness

$

(19

)

$

9

$

(0.13

)

$

0.06

$

(19

)

$

10

Impairment of equity method investment

(19

)

—

(0.13

)

—

(19

)

—

Ukraine-Russia War

—

9

—

0.06

—

10

Refined and Specialty Oils

$

—

$

—

$

—

$

—

$

—

$

—

Milling

$

—

$

—

$

—

$

—

$

—

$

—

Corporate and Other:

$

(62

)

$

(67

)

$

(0.44

)

$

(0.44

)

$

(62

)

$

(68

)

Acquisition and integration costs

(62

)

(47

)

(0.44

)

(0.31

)

(62

)

(48

)

Impairment of equity method and other

investments

—

(20

)

—

(0.13

)

—

(20

)

Non-core Segment:

$

—

$

—

$

—

$

—

$

—

$

—

Sugar & Bioenergy

$

—

$

—

$

—

$

—

$

—

$

—

Total

$

(81

)

$

(58

)

$

(0.57

)

$

(0.38

)

$

(81

)

$

(58

)

See Definition and Reconciliation of

Non-GAAP Measures.

Core Segments

Agribusiness

EBIT for the three months ended September 30, 2024 included a

$19 million impairment charge, in Income (loss) from affiliates,

related to a minority investment in North America.

EBIT for the three months ended September 30, 2023 included a

mark-to-market gain of $10 million, in Cost of goods sold, related

to inventory recovered from our Mykolaiv and other facilities in

Ukraine. The circumstances allowing for recovery of these

inventories did not exist and were unforeseeable when the inventory

reserves were initially recorded in 2022 in conjunction with the

Ukraine-Russia war.

Corporate and Other

The following is a summary of acquisition and integration costs

related to the announced business combination agreement with

Viterra recorded in the Company's Condensed Consolidated Statements

of Income (Loss).

Three Months Ended

(US$ in millions)

Sep 30, 2024

Sep 30, 2023

Cost of goods sold

$

(5

)

$

—

Selling, general and administrative

expenses

(57

)

(48

)

Interest expense

(5

)

(1

)

Income tax (expense) benefit

5

2

Net income (loss)

$

(62

)

$

(47

)

EBIT for the three months ended September 30, 2023 included a

$20 million impairment charge, in Other Income (expense) - net,

related to the full impairment of a long-term investment held in

Other non-current assets.

Certain gains and (charges), year-to-date

The following table provides a summary of certain gains and

(charges) that may be of interest to investors, including a

description of these items and their effect on Net income (loss)

attributable to Bunge, Earnings per share diluted and Segment EBIT

for the nine month periods ended September 30, 2024 and 2023.

(US$ in millions, except per share

data)

Net Income (Loss)

Attributable to

Bunge

Earnings

Per Share

Diluted (6)

Segment

EBIT

Nine months ended September 30,

2024

2023

2024

2023

2024

2023

Core Segments:

$

(19

)

$

25

$

(0.13

)

$

0.17

$

(19

)

$

29

Agribusiness

$

(19

)

$

25

$

(0.13

)

$

0.17

$

(19

)

$

29

Impairment of equity method investment

(19

)

—

(0.13

)

—

(19

)

—

Ukraine-Russia War

—

25

—

0.17

—

29

Refined and Specialty Oils

$

—

$

—

$

—

$

—

$

—

$

—

Milling

$

—

$

—

$

—

$

—

$

—

$

—

Corporate and Other:

$

(185

)

$

(109

)

$

(1.29

)

$

(0.72

)

$

(185

)

$

(102

)

Acquisition and integration costs

(185

)

(73

)

(1.29

)

(0.48

)

(185

)

(66

)

Impairment of equity method and other

investments

—

(36

)

—

(0.24

)

—

(36

)

Non-core Segment:

$

—

$

—

$

—

$

—

$

—

$

—

Sugar & Bioenergy

$

—

$

—

$

—

$

—

$

—

$

—

Total

$

(204

)

$

(84

)

$

(1.42

)

$

(0.55

)

$

(204

)

$

(73

)

Core Segments

Agribusiness

EBIT for the nine months ended September 30, 2024 included a $19

million impairment charge, in Income (loss) from affiliates,

related to a minority investment in North America.

EBIT for the nine months ended September 30, 2023 included a

mark-to-market gain of $29 million, in Cost of goods sold, related

to inventory recovered from our Mykolaiv and other facilities in

Ukraine. The circumstances allowing for recovery of these

inventories did not exist and were unforeseeable when the inventory

reserves were initially recorded in 2022 in conjunction with the

Ukraine-Russia war.

Corporate and Other

The following is a summary of acquisition and integration costs

related to the announced business combination agreement with

Viterra recorded in the Company's Condensed Consolidated Statements

of Income (Loss).

Nine Months Ended

(US$ in millions)

Sep 30, 2024

Sep 30, 2023

Cost of goods sold

$

(5

)

$

—

Selling, general and administrative

expenses

(180

)

(66

)

Interest expense

(13

)

(12

)

Income tax (expense) benefit

13

5

Net income (loss)

$

(185

)

$

(73

)

EBIT for the nine months ended September 30, 2023 included a $20

million impairment charge, in Other Income (expense) - net, related

to the full impairment of a long-term investment held in Other

non-current assets.

EBIT for the nine months ended September 30, 2023 included a $16

million impairment charge, in Income (loss) from affiliates,

related to a minority investment in Australian Plant Proteins, a

start-up manufacturer of novel protein ingredients.

- Consolidated Earnings Data (Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

(US$ in millions, except per share

data)

2024

2023

2024

2023

Net sales

$

12,908

$

14,227

$

39,566

$

44,604

Cost of goods sold

(12,136

)

(13,182

)

(37,254

)

(41,013

)

Gross profit

772

1,045

2,312

3,591

Selling, general and administrative

expenses

(437

)

(447

)

(1,325

)

(1,220

)

Foreign exchange (losses) gains – net

14

(47

)

(101

)

(64

)

Other income (expense) – net

87

8

212

35

Income (loss) from affiliates

(20

)

39

(58

)

83

EBIT attributable to noncontrolling

interest (a) (1)

(9

)

(14

)

(15

)

(43

)

Total Segment EBIT

407

584

1,025

2,382

Interest income

33

38

112

121

Interest expense

(127

)

(133

)

(358

)

(374

)

Income tax (expense) benefit

(89

)

(114

)

(236

)

(495

)

Noncontrolling interest share of interest

and tax (a) (1)

(3

)

(2

)

(8

)

(7

)

Net income (loss) attributable to Bunge

(1)

$

221

$

373

$

535

$

1,627

Net income (loss) attributable to Bunge

shareholders - diluted (6)

$

1.56

$

2.47

$

3.73

$

10.71

Weighted–average shares outstanding -

diluted (6)

142

151

144

152

(a) The line items "EBIT attributable to

noncontrolling interest" and "Noncontrolling interest share of

interest and tax" when combined, represent consolidated Net

(income) loss attributable to noncontrolling interests and

redeemable noncontrolling interests on a U.S. GAAP basis of

presentation.

- Condensed Consolidated Balance Sheets (Unaudited)

September 30,

December 31,

(US$ in millions)

2024

2023

Assets

Cash and cash equivalents

$

2,836

$

2,602

Trade accounts receivable, net

2,100

2,592

Inventories (a)

7,465

7,105

Other current assets

3,518

4,051

Total current assets

15,919

16,350

Property, plant and equipment, net

5,115

4,541

Operating lease assets

937

926

Goodwill and other intangible assets,

net

840

887

Investments in affiliates

1,136

1,280

Other non-current assets

1,320

1,388

Total assets

$

25,267

$

25,372

Liabilities and Equity

Short-term debt

$

755

$

797

Current portion of long-term debt

663

5

Trade accounts payable

3,211

3,664

Current operating lease obligations

288

308

Other current liabilities

2,774

2,913

Total current liabilities

7,691

7,687

Long-term debt

4,777

4,080

Non-current operating lease

obligations

595

566

Other non-current liabilities

1,046

1,224

Total liabilities

14,109

13,557

Redeemable noncontrolling

interest

2

1

Total equity

11,156

11,814

Total liabilities, redeemable

noncontrolling interest and equity

$

25,267

$

25,372

(a) Includes RMI of $6,195 million and

$5,837 million at September 30, 2024 and December 31, 2023,

respectively. Of the total RMI, $4,759 million and $4,242 million

can be attributable to merchandising activities at September 30,

2024 and December 31, 2023, respectively.

- Condensed Consolidated Statements of Cash Flows

(Unaudited)

Nine Months Ended

September 30,

(US$ in millions)

2024

2023

Operating Activities

Net income (loss) (1)

$

558

$

1,677

Adjustments to reconcile net income (loss)

to cash provided by (used for) operating activities:

Impairment charges

36

56

Foreign exchange (gain) loss on net

debt

39

(151

)

Depreciation, depletion and

amortization

345

317

Share-based compensation expense

49

51

Deferred income tax expense (benefit)

(43

)

115

Results from affiliates

39

(100

)

Other, net

48

65

Changes in operating assets and

liabilities, excluding the effects of acquisitions:

Trade accounts receivable

382

306

Inventories

(557

)

933

Secured advances to suppliers

146

(228

)

Trade accounts payable and accrued

liabilities

(386

)

(690

)

Advances on sales

(179

)

(227

)

Net unrealized (gain) loss on derivative

contracts

533

(247

)

Margin deposits

(152

)

(111

)

Recoverable and income taxes, net

(148

)

(19

)

Marketable securities

7

(17

)

Other, net

130

130

Cash provided by (used for) operating

activities

847

1,860

Investing Activities

Payments made for capital expenditures

(887

)

(805

)

Proceeds from investments

739

21

Payments for investments

(872

)

(26

)

Settlement of net investment hedges

(4

)

(57

)

Proceeds from beneficial interest in

securitized trade receivables

—

85

Proceeds from sales of businesses and

property, plant and equipment

6

165

Proceeds from investments in

affiliates

103

—

Payments for investments in affiliates

(23

)

(136

)

Other, net

(19

)

107

Cash provided by (used for) investing

activities

(957

)

(646

)

Financing Activities

Net borrowings (repayments) of short-term

debt

(6

)

416

Net proceeds (repayments) of long-term

debt

1,284

121

Debt issuance costs

(24

)

(25

)

Repurchases of registered or common

shares

(600

)

(466

)

Dividends paid to registered or common

shareholders

(287

)

(287

)

Contributions from (Return of capital to)

noncontrolling interest

41

40

Other, net

(32

)

(12

)

Cash provided by (used for) financing

activities

376

(213

)

Effect of exchange rate changes on cash

and cash equivalents, and restricted cash

—

40

Net increase (decrease) in cash and

cash equivalents, and restricted cash

266

1,041

Cash and cash equivalents, and

restricted cash - beginning of period

2,623

1,152

Cash and cash equivalents, and

restricted cash - end of period

$

2,889

$

2,193

- Definition and Reconciliation of Non-GAAP Measures

This earnings release contains certain "non-GAAP financial

measures" as defined in Regulation G of the Securities Exchange Act

of 1934. Bunge has reconciled these non-GAAP financial measures to

the most directly comparable U.S. GAAP measures below. These

measures may not be comparable to similarly titled measures used by

other companies.

Total Segment EBIT and Adjusted Total Segment EBIT

Bunge uses segment earnings before interest and tax (“Segment

EBIT”) to evaluate the operating performance of its individual

segments. Segment EBIT excludes EBIT attributable to noncontrolling

interests. Bunge also uses Core Segment EBIT, Non-core Segment

EBIT, Corporate and Other EBIT and Total Segment EBIT to evaluate

the operating performance of Bunge’s Core reportable segments,

Non-core reportable segments and Total reportable segments together

with Corporate and Other. Core Segment EBIT is the aggregate of the

earnings before interest and taxes of each of Bunge’s Agribusiness,

Refined and Specialty Oils, and Milling segments. Non-core Segment

EBIT is the earnings before interest and taxes of Bunge’s Sugar

& Bioenergy segment. Total Segment EBIT is the aggregate of the

earnings before interest and taxes of Bunge’s Core and Non-core

reportable segments, together with its Corporate and Other

activities.

Adjusted Core Segment EBIT, Adjusted Non-Core Segment EBIT,

Adjusted Corporate and Other EBIT and Adjusted Total Segment EBIT,

are calculated by excluding temporary mark-to-market timing

differences, as defined in note 3 below, and certain gains and

(charges), as described in "Additional Financial Information"

above, from Core Segment EBIT, Non-Core Segment EBIT, Corporate and

Other EBIT, and Total Segment EBIT, respectively.

Core Segment EBIT, Non-core Segment EBIT, Corporate and Other

EBIT, Total Segment EBIT, Adjusted Core Segment EBIT, Adjusted

Non-core Segment EBIT, Adjusted Corporate and Other EBIT and

Adjusted Total Segment EBIT are non-GAAP financial measures and are

not intended to replace Net income (loss) attributable to Bunge,

the most directly comparable U.S. GAAP financial measure. Bunge's

management believes these non-GAAP measures are a useful measure of

its operating profitability, since the measures allow for an

evaluation of segment performance without regard to their financing

methods or capital structure. For this reason, operating

performance measures such as these non-GAAP measures are widely

used by analysts and investors in Bunge's industries. These

non-GAAP measures are not a measure of consolidated operating

results under U.S. GAAP and should not be considered as an

alternative to Net income (loss) or any other measure of

consolidated operating results under U.S. GAAP.

Net Income (loss) attributable to Bunge to Adjusted Net

Income (loss) attributable to Bunge

Adjusted Net Income (loss) excludes temporary mark-to-market

timing differences, as defined in note 3 below, and certain gains

and (charges), as described in "Additional Financial Information"

above, and is a non-GAAP financial measure. This measure is not a

measure of Net income (loss) attributable to Bunge, the most

directly comparable U.S. GAAP financial measure. It should not be

considered as an alternative to Net Income (loss) attributable to

Bunge, Net Income (loss), or any other measure of consolidated

operating results under U.S. GAAP. Bunge's management believes

Adjusted Net income (loss) is a useful measure of the Company's

profitability.

We also have presented projected Adjusted Net income per share

for 2024. This information is provided only on a non-GAAP basis

without reconciliation to projected Net Income per share for 2024,

the mostly directly comparable U.S. GAAP measure. The most directly

comparable GAAP measure has not been provided due to the inability

to quantify certain amounts necessary for such reconciliation,

including but not limited to potentially significant future market

price movements over the remainder of the year.

Below is a reconciliation of Net income (loss) attributable to

Bunge, to Total Segment EBIT, and Adjusted Total Segment EBIT:

Three Months Ended

September 30,

Nine Months Ended

September 30,

(US$ in millions)

2024

2023

2024

2023

Net income (loss) attributable to

Bunge

$

221

$

373

$

535

$

1,627

Interest income

(33

)

(38

)

(112

)

(121

)

Interest expense

127

133

358

374

Income tax expense (benefit)

89

114

236

495

Noncontrolling interest share of interest

and tax

3

2

8

7

Total Segment EBIT

$

407

$

584

$

1,025

$

2,382

Agribusiness EBIT

$

322

$

461

$

738

$

1,951

Refined and Specialty Oils EBIT

200

227

611

$

677

Milling EBIT

17

23

88

$

46

Core Segment EBIT

$

539

$

711

$

1,437

$

2,674

Corporate and Other EBIT

$

(138

)

$

(182

)

$

(421

)

$

(417

)

Sugar & Bioenergy EBIT

$

6

$

55

$

9

$

125

Non-Core Segment EBIT

$

6

$

55

$

9

$

125

Total Segment EBIT

$

407

$

584

$

1,025

$

2,382

Mark-to-market timing difference

3

34

343

(261

)

Certain (gains) & charges

81

58

204

73

Adjusted Total Segment EBIT

$

491

$

676

$

1,572

$

2,194

Below is a reconciliation of Net income (loss) attributable to

Bunge, to Adjusted Net income (loss) attributable to Bunge:

Three Months Ended

September 30,

Nine Months Ended

September 30,

(US$ in millions, except per share

data)

2024

2023

2024

2023

Net income (loss) attributable to

Bunge

$

221

$

373

$

535

$

1,627

Adjustment for Mark-to-market timing

difference

22

21

274

(196

)

Adjusted for Certain (gains) and

charges:

Acquisition and integration costs

62

47

185

73

Impairment of equity method and other

investments

19

20

19

36

Ukraine-Russia war

—

(9

)

—

(25

)

Adjusted Net income (loss) attributable

to Bunge (a)

$

324

$

452

$

1,013

$

1,515

Weighted-average shares outstanding -

diluted (b)(6)

142

151

144

152

Adjusted Net income (loss) per share -

diluted (6)

$

2.29

$

2.99

$

7.06

$

9.97

(a) As of July 1, 2024, Bunge changed its

methodology for calculating non-GAAP interim period Adjusted

Effective Tax Rate (“Adjusted ETR”). This change has no impact on

Bunge’s methodology for calculating the non-GAAP forecasted and

actual annual Adjusted ETR. Management believes the new methodology

is better aligned to the interim period US GAAP ETR calculation,

and represents an improvement over the prior method, which

calculated tax on items excluded from Adjusted Net Income (loss)

attributable to Bunge on a discrete basis in each interim period.

The cumulative YTD impact of the methodology change through June

30, 2024 was $19 million and is included in Adjusted Net income

(loss) attributable to Bunge for the three months ended September

30, 2024.

(b) There were less than 1 million

anti-dilutive contingently issuable restricted stock units excluded

from the weighted-average number of shares outstanding for each of

the three and nine months ended September 30, 2024 and

2023.

Adjusted Annual Effective Tax Rate

Adjusted Annual Effective Tax Rate is calculated as projected

Income tax expense for 2024 adjusted for projected income tax

related to certain gains and charges and mark-to-market timing

differences divided by projected income before income taxes

adjusted by these same excluded items. This information is provided

only on a non-GAAP basis without reconciliation to the projected

Annual Effective Tax Rate, the most directly comparable U.S. GAAP

measure, due to the inability to quantify the amounts necessary to

calculate projected net income per share, as described above. The

information necessary to prepare the comparable U.S. GAAP

presentation could result in significant adjustments from Adjusted

Annual Effective Tax Rate. The Adjusted Annual Effective Tax Rate

is used by management and can be useful to investors to review the

Company's consolidated effective tax rate on a consistent

basis.

Adjusted Funds From Operations

Adjusted FFO is calculated by excluding from Cash provided by

(used for) operating activities, foreign exchange gain (loss) on

net debt, working capital changes, net (income) loss attributable

to noncontrolling interests and redeemable noncontrolling

interests, and mark-to-market timing differences after tax.

Adjusted FFO is a non-GAAP financial measure and is not intended to

replace Cash provided by (used for) operating activities, the most

directly comparable U.S. GAAP financial measure. Bunge's management

believes the presentation of this measure allows investors to view

its cash generating performance using the same measure that

management uses in evaluating financial and business performance

and trends without regard to foreign exchange gains and losses,

working capital changes and mark-to-market timing differences. This

non-GAAP measure is not a measure of consolidated cash flow under

U.S. GAAP and should not be considered as an alternative to Cash

provided by (used for) operating activities, Net increase

(decrease) in cash and cash equivalents, and restricted cash, or

any other measure of consolidated cash flow under U.S. GAAP.

(1)

A reconciliation of Net income

(loss) attributable to Bunge, to Net income (loss) is as

follows:

Three months ended September

30,

Nine months ended September

30,

(US$ in millions)

2024

2023

2024

2023

Net income (loss) attributable to

Bunge

$

221

$

373

$

535

$

1,627

EBIT attributable to noncontrolling

interest

9

14

15

43

Noncontrolling interest share of interest

and tax

3

2

8

7

Net income (loss)

$

233

$

389

$

558

$

1,677

(2)

The Processing business included

in our Agribusiness segment consists of: global oilseed processing

activities, which principally include the origination and crushing

of oilseeds (including soybeans, canola, rapeseed and sunflower

seed) into protein meals and vegetable oils; the distribution of

oilseeds, oilseed products and fertilizer products through our port

terminals and transportation assets (including trucks, railcars,

barges and ocean vessels); fertilizer production; and biodiesel

production, which is partially conducted through joint

ventures.

The Merchandising business

included in our Agribusiness segment primarily consists of: global

grain origination activities, which principally include the

purchasing, cleaning, drying, storing and handling of corn, wheat

and barley at our network of grain elevators; global trading and

distribution of grains and oils; logistical services for the

distribution of these commodities to our customer markets through

our port terminals and transportation assets (including trucks,

railcars, barges and ocean vessels); and financial services and

activities for customers from whom we purchase commodities, and

other third parties.

(3)

Mark-to-market timing difference

comprises the estimated net temporary impact resulting from

unrealized period-end gains/losses associated with the fair

valuation of certain forward contracts, RMI, and related futures

contracts associated with our committed future operating capacity.

The impact of these mark-to-market timing differences, which is

expected to reverse over time due to the forward contracts, RMI,

and related futures contracts being part of an economically-hedged

position, is not representative of the operating performance of our

business.

(4)

A reconciliation of Cash provided

by (used for) operating activities to Adjusted funds from

operations (FFO) is as follows:

Nine months ended September

30,

(US$ in millions)

2024

2023

Cash provided by (used for) operating

activities

$

847

$

1,860

Foreign exchange gain (loss) on net

debt

(39

)

151

Working capital changes

224

170

Net (income) loss attributable to

noncontrolling interests and redeemable noncontrolling

interests

(23

)

(50

)

Mark-to-Market timing difference, after

tax

274

(196

)

Adjusted FFO

$

1,283

$

1,935

(5)

We have not presented a

comparable U.S. GAAP financial measure for any full-year 2024

outlook financial measures presented on an adjusted, non-GAAP basis

because the information necessary for such presentation is

unavailable at this time. The information necessary to prepare the

comparable U.S. GAAP presentation could result in significant

differences from the non-GAAP financial measures presented in this

release. Please see “Definition and Reconciliation of Non-GAAP

Measures” for more information.

(6)

On November 1, 2023, Bunge Global

SA completed the change of its jurisdiction of incorporation of its

group holding company from Bermuda to Switzerland (the

"Redomestication"). The Redomestication, which was approved by

Bunge Limited shareholders on October 5, 2023, was effected

pursuant to a scheme of arrangement under Bermuda law. Each common

share of Bunge Limited was cancelled in exchange for an equal

number and par value of registered shares of Bunge Global SA (the

"registered shares"). References to the terms "share," "common

share," or "registered share" refer to Bunge Limited common shares

prior to the Redomestication and Bunge Global SA registered shares

after the Redomestication, unless otherwise specified.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030566569/en/

Investor Contact: Ruth Ann Wisener Bunge Global SA

636-292-3014 ruthann.wisener@bunge.com Media Contact: Bunge

News Bureau Bunge Global SA 636-292-3022 news@bunge.com

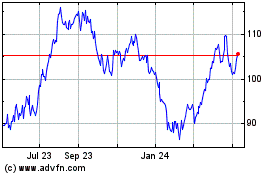

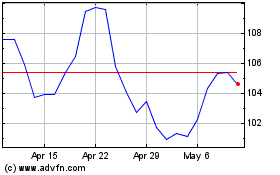

Bunge Global (NYSE:BG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Bunge Global (NYSE:BG)

Historical Stock Chart

From Dec 2023 to Dec 2024