Element Fleet Management and Blackstone Announce Strategic Funding Relationship

27 February 2025 - 11:00PM

Business Wire

Initial transaction includes approximately CAD $500 million

portfolio

Element Fleet Management Corp. (TSX:EFN) ("Element"), the

largest publicly traded, pure-play automotive fleet manager in the

world, and funds managed by Blackstone Credit & Insurance,

through its Infrastructure & Asset-Based Credit group

(“Blackstone”), today announced the establishment of a strategic

funding relationship involving a portfolio of Canadian fleet lease

receivables valued at approximately CAD $500 million.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250227048575/en/

Through this strategic arrangement, Element benefits from

substantial off-balance sheet treatment, diversifying and

optimizing its funding profile while validating the high quality of

its asset origination platform and supporting the company’s

continued growth.

“Element is committed to optimizing our funding strategies to

support our growth objectives,” said Heath Valkenburg, Incoming EVP

& Chief Financial Officer at Element. “This strategic

relationship with Blackstone enhances our ability to serve our

clients and capitalize on emerging opportunities in the

market.”

“We are pleased to provide Element with capital that helps them

better support their client base with a valuable financing tool for

companies around the globe,” said Aneek Mamik, Head of Financial

Services for Asset Based Finance at Blackstone Credit &

Insurance. “This transaction shows how we can support diverse

sectors of the real economy through our asset-based finance efforts

– where we have strong momentum and a unique platform.”

About Blackstone Credit & Insurance

Blackstone Credit & Insurance (“BXCI”) is one of the world’s

leading credit investors. Our investments span the credit markets,

including private investment grade, asset-based lending, public

investment grade and high yield, sustainable resources,

infrastructure debt, collateralized loan obligations, direct

lending, and opportunistic credit. We seek to generate attractive

risk-adjusted returns for institutional and individual investors by

providing companies with the capital needed to strengthen and grow

their businesses.

About Element Fleet Management

Element Fleet Management (TSX: EFN) is the largest publicly

traded pure-play automotive fleet manager in the world. As a

Purpose-driven company, we provide a full range of sustainable and

intelligent mobility solutions to optimize and enhance fleet

performance for our clients across North America, Australia, and

New Zealand. Our services address every aspect of our clients’

fleet requirements, from vehicle acquisition, maintenance, route

optimization, risk management, and remarketing, to advising on

decarbonization efforts, integration of electric vehicles and

managing the complexity of gradual fleet electrification. Clients

benefit from Element's expertise as one of the largest fleet

solutions providers in its markets, offering economies of scale and

insight used to reduce operating costs and enhance efficiency and

performance. At Element, we maximize our clients’ fleet so they can

focus on growing their business.

This press release contains certain forward-looking statements

and forward-looking information regarding Element, its business and

the fleet industry, which are based upon Element’s current

expectations, estimates, projections, assumptions and beliefs. In

some cases, words such as “plan”, “expect”, “intend”, “believe”,

“anticipate”, “estimate”, “may”, “could”, “predict”, “project”,

“model”, “forecast”, “will”, “potential”, “target, “by”, “proposed”

and other similar words, or statements that certain events or

conditions “may” or “will” occur are intended to identify

forward-looking statements and forward-looking information. These

statements are not guarantees of future performance and involve

known and unknown risks, uncertainties and other factors that may

cause actual results or events to differ materially from those

anticipated in the forward-looking statements or information.

Forward-looking statements and information in this news release may

include, but are not limited to, statements with respect to, among

other things, Element’s expectations regarding its future

relationship with Blackstone and Element’s expectations regarding

its growth and its ability to fund such growth. By their nature,

these statements require us to make assumptions and are subject to

inherent risks and uncertainties that may be general or specific,

which give rise to the possibility that our predictions, forecasts,

projections, expectations or conclusions will not prove to be

accurate, that our assumptions may not be correct. External factors

outside of Element’s reasonable control may impact our ability to

achieve our goals and expectations, including industry dynamics,

economic conditions, legislation and regulatory actions, the

failure of third parties to comply with their obligations to us and

our affiliates or associates, and client decisions and preferences.

These and other factors may cause actual results to differ

materially from the expectations expressed in the forward-looking

statements and may require Element to adjust its initiatives and

activities. The forward-looking statements in this news release

speak only as of the date hereof and are presented for the purpose

of assisting our stakeholders and others in understanding our

objectives and strategic priorities and may not be appropriate for

other purposes. We do not undertake to update any forward-looking

statement except as required by law. In addition, a discussion of

some of the material risks affecting Element and its business

appears under the heading “Risk Management & Risk Factors” in

Element’s Management Discussion and Analysis for the twelve-month

period ended December 31, 2024 and under the heading “Risk Factors”

in Element’s Annual Information Form for the year ended December

31, 2024, as well as Element’s other filings with the Canadian

securities regulatory authorities, which have been filed on SEDAR+

and can be accessed on Element’s profile on www.sedarplus.ca.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250227048575/en/

Element Rocco Colella Director, Investor Relations (437)

349-3796 rcolella@elementcorp.com Blackstone Thomas Clements

Thomas.Clements@blackstone.com 646.482.6088

Blackstone (NYSE:BX)

Historical Stock Chart

From Jan 2025 to Feb 2025

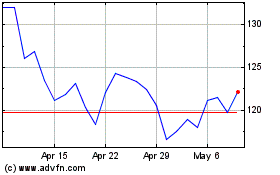

Blackstone (NYSE:BX)

Historical Stock Chart

From Feb 2024 to Feb 2025