0000910612FYyes00009106122023-06-3000009106122023-01-012023-12-3100009106122024-02-26xbrli:sharesiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2023

Or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM ____________ TO _______________

COMMISSION FILE NO. 1-12494

CBL & ASSOCIATES PROPERTIES, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

Delaware (State or Other Jurisdiction of Incorporation or Organization) |

|

62-1545718 (I.R.S. Employer Identification No.) |

|

|

|

2030 Hamilton Place Blvd., Suite 500 Chattanooga, TN |

|

37421 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: 423.855.0001

Securities registered pursuant to Section 12(b) of the Act:

Securities registered under Section 12(b) of the Act:

|

|

|

|

|

Title of each Class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, $0.001 par value |

|

CBL |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☒ |

Non-accelerated filer |

|

☐ |

|

Smaller Reporting Company |

|

☐ |

|

|

|

|

Emerging growth company |

|

☐ |

|

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

The aggregate market value of the 18,663,002 shares of CBL & Associates Properties, Inc.'s common stock, $0.001 par value, held by non-affiliates of the registrant as of June 30, 2023 was $411,332,564, based on the closing price of $22.04 per share on the New York Stock Exchange on June 30, 2023. (For this computation, the registrant has excluded the market value of all shares of its common stock reported as beneficially owned by executive officers and directors of the registrant; such exclusion shall not be deemed to constitute an admission that any such person is an “affiliate” of the registrant.)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

As of February 26, 2024, 32,273,350 shares of common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of CBL & Associates Properties, Inc.’s Proxy Statement for the 2024 Annual Meeting of Shareholders were incorporated by reference in Part III of the Company's Annual Report on Form 10-K for the year ended December 31, 2023, as originally filed on February 29, 2024.

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (the “Amendment Filing”) to the Annual Report on Form 10-K for the year ended December 31, 2023 (“Annual Report”) of CBL & Associates Properties, Inc. (the “Registrant”), filed with the Securities and Exchange Commission on February 29, 2024 (“Original Filing Date”), is being filed for the purpose of updating Part II, Item 9 of the Annual Report to update management’s report on disclosure controls and procedures contained in Part II, Item 9A, which inadvertently omitted a statement disclosing the conclusions of the Registrant’s principal executive and principal financial officers regarding the effectiveness of the Registrant’s disclosure controls and procedures as of December 31, 2023. This Amendment Filing corrects such omission.

This Amendment Filing also amends Item 15 of Part IV of the Annual Report solely to include as exhibits a new consent of Deloitte & Touche LLP and the certifications required by Rule 13a-14(a) under the Securities Exchange Act of 1934, as amended. Because no financial statements have been included in this Amendment Filing, paragraph 3 of the certifications has been omitted. The Registrant is not including the certifications under Section 906 of the Sarbanes-Oxley Act of 2002 as no financial statements are being filed with this Amendment Filing.

This Amendment No. 1 speaks as of the Original Filing Date of the Annual Report, does not reflect events that may have occurred subsequent to the Original Filing Date, and, apart from the disclosure added as described above, does not modify or update in any way the disclosures made in the original Annual Report.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

None.

ITEM 9A. CONTROLS AND PROCEDURES

Conclusion Regarding Effectiveness of Disclosure Controls and Procedures

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of its effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Under the supervision and with the participation of the Company's management, including its Chief Executive Officer and Chief Financial Officer, the Company has evaluated the effectiveness of its disclosure controls and procedures, as defined in Rule 13a-15(e) under the Securities Exchange Act of 1934, as amended, as of the end of the period covered by this report. Based on that evaluation, the Company’s Chief Executive Officer and Chief Financial Officer concluded that the Company’s disclosure controls and procedures were effective to ensure that the information required to be disclosed by the Company in the reports that the Company files or submits under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported within the time periods specified in the SEC rules and forms, and is accumulated and communicated to our management, including the Company's Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure.

Management's Report on Internal Control over Financial Reporting

Management is responsible for establishing and maintaining adequate internal control over financial reporting, as defined in Rule 13a-15(f) under the Securities Exchange Act of 1934, as amended. The Company assessed the effectiveness of its internal control over financial reporting, based on criteria established in Internal Control – Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission, and concluded that, as of December 31, 2023, the Company maintained effective internal control over financial reporting, as stated in its report which is included herein.

Report of Management on Internal Control over Financial Reporting

Management is responsible for establishing and maintaining adequate internal control over financial reporting. The Company’s internal control over financial reporting is a process designed under the supervision of the Company’s Chief Executive Officer and Chief Financial Officer to provide reasonable assurance regarding the reliability of financial reporting and the preparation of the Company’s financial statements for external reporting purposes in accordance with U.S. generally accepted accounting principles.

Management recognizes that there are inherent limitations in the effectiveness of internal control over financial reporting, including the potential for human error or the circumvention or overriding of internal controls. Accordingly, even effective internal control over financial reporting cannot provide absolute assurance with respect to financial statement preparation. Because of such limitations, there is a risk that material misstatements may not be prevented or detected on a timely basis by internal control over financial reporting. In addition, any projection of the evaluation of effectiveness to future periods is subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the polices or procedures may deteriorate.

Management assessed the effectiveness of the Company’s internal control over financial reporting based on the framework established in Internal Control — Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission and concluded that, as of December 31, 2023, the Company maintained effective internal control over financial reporting.

Deloitte & Touche LLP, the Company’s independent registered public accounting firm, has audited the Company's internal control over financial reporting as of December 31, 2023, as stated in their report which is included below.

Changes in Internal Control over Financial Reporting

There were no changes in the Company's internal control over financial reporting during the quarter ended December 31, 2023 that have materially affected, or are reasonably likely to materially affect, the Company's internal control over financial reporting.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the stockholders and the board of directors of CBL & Associates Properties, Inc.

Opinion on Internal Control over Financial Reporting

We have audited the internal control over financial reporting of CBL & Associates Properties, Inc. and subsidiaries (the “Company”) as of December 31, 2023, based on criteria established in Internal Control —Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). In our opinion, the Company maintained, in all material respects, effective internal control over financial reporting as of December 31, 2023, based on criteria established in Internal Control — Integrated Framework (2013) issued by COSO.

We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), the consolidated financial statements as of and for the year ended December 31, 2023, of the Company and our report dated February 29, 2024, expressed an unqualified opinion on those financial statements.

Basis for Opinion

The Company’s management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting, included in the accompanying Report of Management on Internal Control over Financial Reporting. Our responsibility is to express an opinion on the Company’s internal control over financial reporting based on our audit. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, testing and evaluating the design and operating effectiveness of internal control based on the assessed risk, and performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

Definition and Limitations of Internal Control over Financial Reporting

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

/s/ Deloitte & Touche LLP

Atlanta, Georgia

February 29, 2024

ITEM 9B. OTHER INFORMATION

None.

ITEM 9C. DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS

Not applicable.

PART IV

ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES

The following documents are filed as a part of this Form 10-K/A or incorporated by reference:

(1)Consolidated Financial Statements - The response to this portion of Item 15 is incorporated by reference from the Annual Report, into this Amendment Filing.

(2)Consolidated Financial Statement Schedules - The response to this portion of Item 15 is incorporated by reference from the Annual Report, into this Amendment Filing.

(3)Exhibits - The exhibits on the accompanying exhibit index are filed as part of, or are incorporated by reference into this Amendment Filing.

EXHIBIT INDEX

|

|

|

Exhibit Number |

|

Description |

2.1 |

|

Chapter 11 Plan of Reorganization, dated as of December 29, 2020 (incorporated by reference from the Company’s Current Report on Form 8-K, filed on December 30, 2020). |

|

|

|

2.2 |

|

Findings of Fact, Conclusions of Law, and Order (I) Confirming Third Amended Joint Chapter 11 Plan of CBL & Associates Properties, Inc. and Its Affiliated Debtors and (II) Granting Related Relief, dated August 11, 2021. (filed as Exhibit 2.1 to CBL & Associates Properties, Inc. Current Report on Form 8-K filed on August 12, 2021). |

|

|

|

2.3 |

|

Third Amended Chapter 11 Plan (with technical modifications), as approved by the Bankruptcy Court on August 12, 2021 (incorporated by reference to Exhibit 99.1 to the Company's Current Report on Form 8-K, filed on August 10, 2021). |

|

|

|

3.1 |

|

Second Amended and Restated Certification of Incorporation of CBL & Associates Properties, Inc (incorporated by reference from the Company’s Current Report on Form 8-K, filed on November 2, 2021). |

|

|

|

3.2 |

|

Amendment, dated February 15, 2023, to Fourth Amended and Restated Bylaws of CBL & Associates Properties, Inc. (incorporated by reference from the Company's Current Report on Form 8-K, filed on February 21, 2023). |

|

|

|

3.3 |

|

Fifth Amended and Restated Bylaws of CBL & Associates Properties, Inc. (incorporated by reference from the Company's Annual Report on Form 10-K for the year ended December 31, 2022, filed on March 1, 2023). |

|

|

|

4.1 |

|

See Second Amended and Restated Certificate of Incorporation of the CBL & Associates Properties, Inc and Fifth Amended and Restated Bylaws of CBL & Associates Properties, Inc relating to the Common Stock, Exhibits 3.1 and 3.2 above. |

|

|

|

4.2 |

|

Description of Securities (incorporated by reference from the Company's Annual Report on Form 10-K for the year ended December 31, 2023, filed on February 29, 2024). |

|

|

|

4.3 |

|

Credit Agreement, dated as of June 7, 2022, between the Company, as a borrower and a guarantor, Beal Bank USA, as the initial lender, CLMG CORP., as administrative agent, and the other lenders party thereto, related to the $360 million open-air centers and outparcels loan (incorporated by reference from the Company's Quarterly Report on Form 10-Q, filed on August 15, 2022). |

|

|

|

10.1 |

|

Fifth Amended and Restated Agreement of Limited Partnership of CBL & Associates Limited Partnership, dated November 1, 2021 (incorporated by reference from the Company’s Current Report on Form 8-K, filed on November 2, 2021). |

|

|

|

10.2.1 |

|

Form of Executive Employment Agreements† (incorporated by reference from the Company’s Current Report on Form 8-K, filed on August 19, 2020). |

|

|

|

10.2.2 |

|

Form of Executive Retention Bonus Agreement† (incorporated by reference from the Company’s Current Report on Form 8-K, filed on August 19, 2020). |

|

|

|

10.2.3 |

|

Form of Amended and Restated Retention Bonus Agreement for the Chairman of the Board†. (incorporated by reference from the Company’s Current Report on Form 8-K, filed on November 2, 2020). |

|

|

|

10.2.4 |

|

Form of Amended and Restated Retention Bonus Agreement for the Company’s NEOs Other Than the Chairman of the Board†. (incorporated by reference from the Company’s Current Report on Form 8-K, filed on November 2, 2020). |

|

|

|

|

|

|

Exhibit Number |

|

Description |

10.2.5 |

|

CBL & Associates Properties, Inc. Named Executive Officer Annual Incentive Compensation Plan (AIP) (Fiscal Year 2021)† (incorporated by reference from the Company’s Current Report on Form 8-K, filed on May 18, 2021). |

|

|

|

10.2.6 |

|

Form of Amended and Restated Employment Agreement, entered into May 21, 2021 with certain Company executives† (incorporated by reference from the Company’s Current Report on Form 8-K, filed on May 26, 2021). |

|

|

|

10.2.7 |

|

Form of Second Amended and Restated Retention Bonus Agreement for the Chairman of the Board, entered into May 21, 2021† (incorporated by reference from the Company’s Current Report on Form 8-K, filed on May 26, 2021). |

|

|

|

10.2.8 |

|

Form of Second Amended and Restated Retention Bonus Agreement for the Company's NEOs Other Than the Chairman of the Board, entered into May 21, 2021† (incorporated by reference from the Company’s Current Report on Form 8-K, filed on May 26, 2021). |

|

|

|

10.2.9 |

|

CBL & Associates Properties, Inc. 2021 Equity Incentive Plan† (incorporated by reference from the Company's Current Report on Form 8-K, filed on November 16, 2021). |

|

|

|

10.2.10 |

|

Form of Executive Officer Time-Vested Award Stock Restriction Agreement under CBL & Associates Properties, Inc. 2021 Equity Incentive Plan† (incorporated by reference from the Company's Current Report on Form 8-K, filed on December 21, 2021). |

|

|

|

10.2.11 |

|

Form of 2022 Performance Stock Unit Award Agreement under CBL & Associates Properties, Inc. 2021 Equity Incentive Plan† (incorporated by reference from the Company's Current Report on Form 8-K, filed on February 23, 2022). |

|

|

|

10.2.12 |

|

CBL & Associates Properties, Inc. Named Executive Officer Annual Incentive Compensation Plan (AIP) (Fiscal Year 2023)† (incorporated by reference from the Company’s Current Report on Form 8-K, filed on February 22, 2023). |

|

|

|

10.2.13 |

|

2023 Long Term Incentive Plan under CBL & Associates Properties, Inc. 2021 Equity Incentive Plan † (incorporated by reference from the Company's Current Report on Form 8-K, filed on February 22, 2023). |

|

|

|

10.2.14 |

|

Form of 2023 LTIP Performance Stock Unit Award Agreement under CBL & Associates Properties, Inc. 2021 Equity Incentive Plan † (incorporated by reference from the Company's Current Report on Form 8-K, filed on February 22, 2023). |

|

|

|

10.2.15 |

|

Form of 2023 LTIP Stock Restriction Agreement under CBL & Associates Properties, Inc. 2021 Equity Incentive Plan † (incorporated by reference from the Company's Current Report on Form 8-K, filed on February 22, 2023). |

|

|

|

10.2.16 |

|

Form of Non-Employee Director Annual Award Stock Restriction Agreement under CBL & Associates Properties, Inc. 2021 Equity Incentive Plan † (incorporated by reference from the Company's Annual Report on Form 10-K for the year ended December 31, 2022, filed on March 1, 2023). |

|

|

|

10.2.17 |

|

Form of Second Amended and Restated Employment Agreement entered into November 7, 2023 with certain Company executives [titled Amended and Restated Employment Agreement for the Executive Vice President - Chief Financial Officer] † (incorporated by reference from the Company's Current Report on Form 8-K, filed on November 13, 2023). |

|

|

|

10.2.18 |

|

CBL & Associates Properties, Inc. Named Executive Officer Annual Incentive Compensation Plan (AIP) (Fiscal Year 2024) † (incorporated by reference from the Company's Current Report on Form 8-K, filed on February 13, 2024). |

|

|

|

|

|

|

Exhibit Number |

|

Description |

10.2.19 |

|

2024 Long Term Incentive Plan Under CBL & Associates Properties, Inc. 2021 Equity Incentive Plan † (incorporated by reference from the Company's Current Report on Form 8-K, filed on February 13, 2024). |

|

|

|

10.2.20 |

|

Form of 2024 LTIP Performance Stock Unit Award Agreement under CBL & Associates Properties, Inc. 2021 Equity Incentive Plan † (incorporated by reference from the Company's Current Report on Form 8-K, filed on February 13, 2024). |

|

|

|

10.2.21 |

|

Form of 2024 LTIP Stock Restriction Agreement under CBL & Associates Properties, Inc. 2021 Equity Incentive Plan † (incorporated by reference from the Company's Current Report on Form 8-K, filed on February 13, 2024). |

|

|

|

10.3 |

|

Form of Director and Officer Indemnification Agreement [updated, includes minor modification to, and replaces, version originally filed as an exhibit to the Company's Current Report on Form 8-K filed on November 2, 2021]. |

|

|

|

10.4.1 |

|

CBL & Associates Properties, Inc. Tier III Post-65 Retiree Program† (incorporated by reference from the Company's Current Report on Form 8-K, filed on November 9, 2012). |

|

|

|

10.4.2 |

|

CBL & Associates Properties, Inc. Tier 1 Retiree Program † (incorporated by reference from the Company's Annual Report on Form 10-K for the year ended December 31, 2022, filed on March 1, 2023). |

|

|

|

10.5 |

|

Option Agreement relating to Outparcels (incorporated by reference to Post-Effective Amendment No. 1 to the Company's Registration Statement on Form S-11 (No. 33-67372), as filed with the Commission on January 27, 1994. Exhibit originally filed in paper format and as such, a hyperlink is not available). |

|

|

|

10.6.1 |

|

Contribution Agreement and Joint Escrow Instructions between the Company and the owners of Oak Park Mall named therein, dated as of October 17, 2005 (incorporated by reference from the Company's Current Report on Form 8-K, filed on November 22, 2005). |

|

|

|

10.6.2 |

|

First Amendment to Contribution Agreement and Joint Escrow Instructions between the Company and the owners of Oak Park Mall named therein, dated as of November 8, 2005 (incorporated by reference from the Company's Current Report on Form 8-K, filed on November 22, 2005). |

|

|

|

10.6.3 |

|

Contribution Agreement and Joint Escrow Instructions between the Company and the owners of Eastland Mall named therein, dated as of October 17, 2005 (incorporated by reference from the Company's Current Report on Form 8-K, filed on November 22, 2005). |

|

|

|

10.6.4 |

|

First Amendment to Contribution Agreement and Joint Escrow Instructions between the Company and the owners of Eastland Mall named therein, dated as of November 8, 2005 (incorporated by reference from the Company's Current Report on Form 8-K, filed on November 22, 2005). |

|

|

|

10.6.5 |

|

Purchase and Sale Agreement and Joint Escrow Instructions between the Company and the owners of Hickory Point Mall named therein, dated as of October 17, 2005 (incorporated by reference from the Company's Current Report on Form 8-K, filed on November 22, 2005). |

|

|

|

10.6.6 |

|

Purchase and Sale Agreement and Joint Escrow Instructions between the Company and the owner of Eastland Medical Building, dated as of October 17, 2005 (incorporated by reference from the Company's Current Report on Form 8-K, filed on November 22, 2005). |

|

|

|

10.6.7 |

|

Letter Agreement, dated as of October 17, 2005, between the Company and the other parties to the acquisition agreements listed above for Oak Park Mall, Eastland Mall, Hickory Point Mall and Eastland Medical Building (incorporated by reference from the Company's Current Report on Form 8-K, filed on November 22, 2005). |

|

|

|

|

|

|

Exhibit Number |

|

Description |

10.6.8 |

|

Forms of 2022 Individual and Entity Assignments of Partnership Interests to CBL & Associates Management, Inc. (incorporated by reference from the Company’s Current Report on Form 8-K, filed on March 29, 2022). |

|

|

|

10.7 |

|

Settlement Agreement and Release, by and between the Company, the Operating Partnership, the Management Company, JG Gulf Coast Town Center LLC and Wave Lengths Hair Salons of Florida, Inc. d/b/a Salon Adrian, as approved by the U.S. District Court for the Middle District of Florida on August 22, 2019 (incorporated by reference from the Company’s Quarterly Report on Form 10-Q/A, filed on December 20, 2019). |

|

|

|

10.8.1 |

|

Restructuring Support Agreement, dated as of August 18, 2020, between the Operating Partnership, REIT, Subsidiary Guarantors and Consenting Holders (incorporated by reference from the Company’s Current Report on Form 8-K, filed on August 19, 2020). |

|

|

|

10.8.2 |

|

First Amended and Restated Restructuring Support Agreement, dated as of March 21, 2021, between the Operating Partnership, REIT, Subsidiary Guarantors and Consenting Stakeholders (incorporated by reference from the Company’s Current Report on Form 8-K, filed on March 22, 2021). |

|

|

|

10.8.3 |

|

Plan Term Sheet, dated as of March 21, 2021 (See Exhibit B to Exhibit 10.1) (incorporated by reference from the Company’s Current Report on Form 8-K, filed on March 22, 2021). |

|

|

|

10.9 |

|

Amended and Restated Credit Agreement, dated as of November 1, 2021, among CBL & Associates HoldCo I, LLC, as borrower, CBL & Associates Properties, Inc., CBL & Associates Limited Partnership, the lenders party thereto and Wells Fargo, National Association, as administrative agent (incorporated by reference from the Company’s Current Report on Form 8-K, filed on November 2, 2021). |

|

|

|

10.10 |

|

Collateral Agency and Intercreditor Agreement, dated as of November 1, 2021, among CBL & Associates HoldCo II, LLC, the subsidiary guarantors, certain other subsidiaries of CBL & Associates HoldCo II, LLC, Wilmington Savings Fund Society, FSB, as trustee under the 10% Senior Secured Notes due 2029 and Wilmington Savings Fund Society, FSB, as trustee and exchange agent under the 7.0% Exchangeable Senior Secured Notes due 2028 (incorporated by reference from the Company’s Current Report on Form 8-K, filed on November 2, 2021). |

|

|

|

10.11 |

|

Registration Rights Agreement, dated November 1, 2021, among CBL & Associates Properties, Inc. and the holders of registrable securities party thereto (incorporated by reference from the Company’s Current Report on Form 8-K, filed on November 2, 2021). |

|

|

|

10.12.1 |

|

Employment Agreement for Benjamin W. Jaenicke, dated September 1, 2022 (incorporated by reference to the Company’s Current Report on Form 8-K, filed September 1, 2022). |

|

|

|

10.12.2 |

|

Relocation Allowance Commitment with Benjamin W. Jaenicke, dated September 1, 2022 (incorporated by reference to the Company’s Current Report on Form 8-K filed September 1, 2022). |

|

|

|

10.12.3 |

|

First Amendment, dated February 15, 2023, to Employment Agreement for Benjamin W. Jaenicke dated September 1, 2022 (incorporated by reference to the Company's Current Report on Form 8-K, filed February 22, 2023). |

|

|

|

21 |

|

Subsidiaries of CBL & Associates Properties, Inc. (incorporated by reference from the Company's Annual Report on Form 10-K for the year ended December 31, 2023, filed on February 29, 2024). |

|

|

|

23 |

|

Consent of Deloitte & Touche LLP. |

|

|

|

24 |

|

Power of Attorney (incorporated by reference from the Company's Annual Report on Form 10-K for the year ended December 31, 2023, filed on February 29, 2024). |

|

|

|

|

|

|

Exhibit Number |

|

Description |

31.1 |

|

Certification pursuant to Securities Exchange Act Rule 13a-14(a) by the Chief Executive Officer, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 (incorporated by reference from the Company's Annual Report on Form 10-K for the year ended December 31, 2023, filed on February 29, 2024). |

|

|

|

31.2 |

|

Certification pursuant to Securities Exchange Act Rule 13a-14(a) by the Chief Financial Officer, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 (incorporated by reference from the Company's Annual Report on Form 10-K for the year ended December 31, 2023, filed on February 29, 2024). |

|

|

|

31.3 |

|

Certification pursuant to Securities Exchange Act Rule 13a-14(a) by the Chief Executive Officer, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

|

|

|

31.4 |

|

Certification pursuant to Securities Exchange Act Rule 13a-14(a) by the Chief Financial Officer, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

|

|

|

32.1 |

|

Certification pursuant to Securities Exchange Act Rule 13a-14(b) by the Chief Executive Officer, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 (incorporated by reference from the Company's Annual Report on Form 10-K for the year ended December 31, 2023, filed on February 29, 2024). |

|

|

|

32.2 |

|

Certification pursuant to Securities Exchange Act Rule 13a-14(b) by the Chief Financial Officer as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 (incorporated by reference from the Company's Annual Report on Form 10-K for the year ended December 31, 2023, filed on February 29, 2024). |

|

|

|

97 |

|

CBL & Associates Properties, Inc. Amended and Restated Clawback Policy (incorporated by reference from the Company's Annual Report on Form 10-K for the year ended December 31, 2023, filed on February 29, 2024). |

|

|

|

101.INS |

|

XBRL Instance Document - the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document. (Filed herewith.) |

|

|

|

101.SCH |

|

Inline XBRL Taxonomy Extension Schema With Embedded Linkbase Documents. (Filed herewith.) |

|

|

|

104 |

|

Cover Page Interactive Data File (formatted as Inline XBRL with applicable taxonomy extension information contained in Exhibits 101.*). (Filed herewith.) |

† A management contract or compensatory plan or arrangement required to be filed pursuant to Item 15(b) of this report.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

CBL & ASSOCIATES PROPERTIES, INC. |

(Registrant) |

|

|

By: |

/s/ Benjamin W. Jaenicke |

|

Benjamin W. Jaenicke |

|

Executive Vice President - Chief Financial Officer |

Dated: September 26, 2024

Exhibit 23

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in Registration Statement No. 333-261449 on Form S-8, Registration Statement No. 333-270554 on Form S-8, and Registration Statement No. 333-272563 on Form S-3, of our report dated February 29, 2024, relating to the consolidated financial statements and financial statement schedules of CBL & Associates Properties, Inc. and subsidiaries appearing in the Annual Report on Form 10-K of CBL & Associates Properties, Inc. for the year ended December 31, 2023, and of our report dated February 29, 2024, relating to the effectiveness of CBL & Associates Properties, Inc. and subsidiaries' internal control over financial reporting, appearing in this Annual Report on Form 10-K/A of CBL & Associates Properties, Inc. for the year ended December 31, 2023.

/s/ Deloitte & Touche LLP

Atlanta, Georgia

September 26, 2024

Exhibit 31.3

CERTIFICATION

I, Stephen D. Lebovitz, certify that:

(1)I have reviewed this annual report on Form 10-K of CBL & Associates Properties, Inc.;

(2)Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

(4)The registrant's other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

(a)Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

(b)Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

(c)Evaluated the effectiveness of the registrant's disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

(d)Disclosed in this report any change in the registrant's internal control over financial reporting that occurred during the registrant's most recent fiscal quarter (the registrant's fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting; and

(5)The registrant's other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant's auditors and the audit committee of the registrant's board of directors (or persons performing the equivalent functions):

(a)All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process, summarize and report financial information; and

(b)Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting.

|

Date: September 26, 2024 |

|

/s/ Stephen D. Lebovitz |

Stephen D. Lebovitz, Director and |

Chief Executive Officer |

Exhibit 31.4

CERTIFICATION

I, Benjamin W. Jaenicke, certify that:

(1)I have reviewed this annual report on Form 10-K of CBL & Associates Properties, Inc.;

(2)Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

(4)The registrant's other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

(a)Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

(b)Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

(c)Evaluated the effectiveness of the registrant's disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

(d)Disclosed in this report any change in the registrant's internal control over financial reporting that occurred during the registrant's most recent fiscal quarter (the registrant's fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting; and

(5)The registrant's other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant's auditors and the audit committee of the registrant's board of directors (or persons performing the equivalent functions):

(a)All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process, summarize and report financial information; and

(b)Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting.

|

Date: September 26, 2024 |

|

/s/ Benjamin W. Jaenicke |

Benjamin W. Jaenicke, Executive Vice President - |

Chief Financial Officer |

v3.24.3

Document And Entity Information - USD ($)

|

12 Months Ended |

|

|

Dec. 31, 2023 |

Feb. 26, 2024 |

Jun. 30, 2023 |

| Cover [Abstract] |

|

|

|

| Document Type |

10-K/A

|

|

|

| Amendment Flag |

true

|

|

|

| Amendment Description |

This Amendment No. 1 on Form 10-K/A (the “Amendment Filing”) to the Annual Report on Form 10-K for the year ended December 31, 2023 (“Annual Report”) of CBL & Associates Properties, Inc. (the “Registrant”), filed with the Securities and Exchange Commission on February 29, 2024 (“Original Filing Date”), is being filed for the purpose of updating Part II, Item 9 of the Annual Report to update management’s report on disclosure controls and procedures contained in Part II, Item 9A, which inadvertently omitted a statement disclosing the conclusions of the Registrant’s principal executive and principal financial officers regarding the effectiveness of the Registrant’s disclosure controls and procedures as of December 31, 2023. This Amendment Filing corrects such omission.This Amendment Filing also amends Item 15 of Part IV of the Annual Report solely to include as exhibits a new consent of Deloitte & Touche LLP and the certifications required by Rule 13a-14(a) under the Securities Exchange Act of 1934, as amended. Because no financial statements have been included in this Amendment Filing, paragraph 3 of the certifications has been omitted. The Registrant is not including the certifications under Section 906 of the Sarbanes-Oxley Act of 2002 as no financial statements are being filed with this Amendment Filing.This Amendment No. 1 speaks as of the Original Filing Date of the Annual Report, does not reflect events that may have occurred subsequent to the Original Filing Date, and, apart from the disclosure added as described above, does not modify or update in any way the disclosures made in the original Annual Report.

|

|

|

| Document Period End Date |

Dec. 31, 2023

|

|

|

| Document Fiscal Year Focus |

2023

|

|

|

| Document Fiscal Period Focus |

FY

|

|

|

| Entity Registrant Name |

CBL & ASSOCIATES PROPERTIES, INC.

|

|

|

| Entity Central Index Key |

0000910612

|

|

|

| Entity Current Reporting Status |

Yes

|

|

|

| Entity Voluntary Filers |

No

|

|

|

| Entity Interactive Data Current |

Yes

|

|

|

| Current Fiscal Year End Date |

--12-31

|

|

|

| Entity Filer Category |

Accelerated Filer

|

|

|

| Entity Well-known Seasoned Issuer |

No

|

|

|

| Document Financial Statement Error Correction [Flag] |

false

|

|

|

| Entity Public Float |

|

|

$ 411,332,564

|

| Entity Common Stock, Shares Outstanding |

|

32,273,350

|

|

| Entity Shell Company |

false

|

|

|

| Entity Small Business |

false

|

|

|

| Entity Emerging Growth Company |

false

|

|

|

| ICFR Auditor Attestation Flag |

true

|

|

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

|

|

| Trading Symbol |

CBL

|

|

|

| Security Exchange Name |

NYSE

|

|

|

| Entity File Number |

1-12494

|

|

|

| Entity Incorporation, State or Country Code |

DE

|

|

|

| Entity Tax Identification Number |

62-1545718

|

|

|

| Entity Address, Address Line One |

2030 Hamilton Place Blvd.

|

|

|

| Entity Address, Address Line Two |

Suite 500

|

|

|

| Entity Address, City or Town |

Chattanooga

|

|

|

| Entity Address, State or Province |

TN

|

|

|

| Entity Address, Postal Zip Code |

37421

|

|

|

| City Area Code |

423

|

|

|

| Local Phone Number |

855.0001

|

|

|

| Document Annual Report |

true

|

|

|

| Document Transition Report |

false

|

|

|

| Entity Bankruptcy Proceedings, Reporting Current |

true

|

|

|

| Documents Incorporated by Reference [Text Block] |

Portions of CBL & Associates Properties, Inc.’s Proxy Statement for the 2024 Annual Meeting of Shareholders were incorporated by reference in Part III of the Company's Annual Report on Form 10-K for the year ended December 31, 2023, as originally filed on February 29, 2024.

|

|

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an annual report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentAnnualReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates whether any of the financial statement period in the filing include a restatement due to error correction. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-K

-Number 229

-Section 402

-Subsection w

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 4: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentFinStmtErrorCorrectionFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a transition report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Forms 10-K, 10-Q, 20-F

-Number 240

-Section 13

-Subsection a-1

| Name: |

dei_DocumentTransitionReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionDocuments incorporated by reference. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-23

| Name: |

dei_DocumentsIncorporatedByReferenceTextBlock |

| Namespace Prefix: |

dei_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor registrants involved in bankruptcy proceedings during the preceding five years, the value Yes indicates that the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court; the value No indicates the registrant has not. Registrants not involved in bankruptcy proceedings during the preceding five years should not report this element. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12, 13, 15d

| Name: |

dei_EntityBankruptcyProceedingsReportingCurrent |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.

| Name: |

dei_EntityCommonStockSharesOutstanding |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionIndicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityCurrentReportingStatus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate whether the registrant is one of the following: Large Accelerated Filer, Accelerated Filer, Non-accelerated Filer. Definitions of these categories are stated in Rule 12b-2 of the Exchange Act. This information should be based on the registrant's current or most recent filing containing the related disclosure. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityFilerCategory |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:filerCategoryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-T

-Number 232

-Section 405

| Name: |

dei_EntityInteractiveDataCurrent |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter.

| Name: |

dei_EntityPublicFloat |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityShellCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates that the company is a Smaller Reporting Company (SRC). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntitySmallBusiness |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

| Name: |

dei_EntityVoluntaryFilers |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Is used on Form Type: 10-K, 10-Q, 8-K, 20-F, 6-K, 10-K/A, 10-Q/A, 20-F/A, 6-K/A, N-CSR, N-Q, N-1A. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 405

| Name: |

dei_EntityWellKnownSeasonedIssuer |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_IcfrAuditorAttestationFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

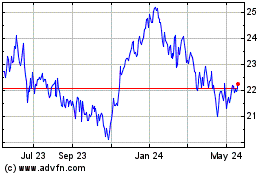

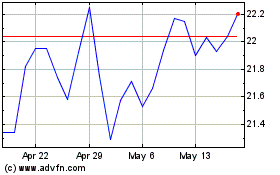

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Oct 2024 to Nov 2024

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Nov 2023 to Nov 2024