Comvest Credit Partners Provides $175 Million Senior Credit Facility to Raven Engineered Films

02 June 2022 - 11:00PM

Comvest Credit Partners (“Comvest”), a leading provider of flexible

financing solutions to middle-market companies, has acted as

Administrative Agent in providing a $175 million senior secured

credit facility (the “Financing”) to Raven Engineered Films

(“Raven”), a Sioux Falls, S.D.-based specialty plastics

manufacturer. The Financing was used to support the acquisition of

Raven in a corporate carve-out from CNH Industrial (NYSE: CNHI /

MI: CNHI) by Industrial Opportunity Partners (IOP), a private

equity firm.

Founded in 1956, Raven is a leading provider and installer of

highly engineered polymer protective sheeting products used in a

variety of agriculture, construction, geomembrane, and industrial

applications in major markets worldwide. Raven produces covers,

liners, films and other products for critical resource protection

needs that require precise custom fabrications.

“Raven is a highly regarded company in the engineered films

market,” said Greg Reynolds, Partner, Co-Head of Direct Lending, at

Comvest. “Comvest was pleased to work alongside management and IOP

to deliver a flexible, needs-responsive and comprehensive debt

financing solution on a compressed timeline.”

“In addition to our deep industrials sector expertise, this

transaction demonstrates Comvest’s ability as a single-source

provider of significant credit facilities to middle-market North

American manufacturers with attractive growth prospects,” said Dan

Lee, Partner, at Comvest. “We believe Raven remains poised for

continued strong growth and look forward to working with management

and to building our relationship with IOP.”

About Raven Engineered Films (Raven)Raven

manufactures and supplies highly engineered polymer films and

sheeting to major markets throughout the United States and abroad.

For more information, please visit https://ravenefd.com

About Industrial Opportunity Partners (IOP) IOP

is an Evanston, Ill.-based private equity firm dedicated to

creating value through investing in manufacturing and value-added

distribution businesses with sales between $50 million and $500

million. For more information, please visit www.iopfund.com

About Comvest Credit PartnersComvest Credit

Partners focuses on providing flexible financing solutions to

middle-market companies. Comvest provides senior secured,

unitranche, second lien, and mezzanine capital to sponsored and

non-sponsored companies in support of growth, acquisitions,

buyouts, refinancings, and recapitalizations. Credit facilities

typically range from $25 million to $250 million-plus for companies

with revenues greater than $20 million. Comvest has offices

located in West Palm Beach, Chicago and New York. For more

information, please visit www.comvest.com/direct-lending

About Comvest PartnersCAbout Comvest Partners

Comvest Partners is a private investment firm providing equity and

debt capital to middle-market companies across the U.S. Since its

founding in 2000, Comvest has invested over $8 billion. Today,

Comvest has over $7.6 billion of assets under management. Through

extensive capital resources and a broad network of industry

relationships, Comvest Partners offers companies financial

sponsorship, critical strategic and operational support, and

business development assistance. For more information, please visit

www.comvest.com

For more information, please contact:Greg

Reynolds, Partner, Co-Head of Direct Lending, Comvest Credit

Partners – G.Reynolds@comvest.com

Dan Lee, Partner, Comvest Credit Partners –

D.Lee@comvest.com

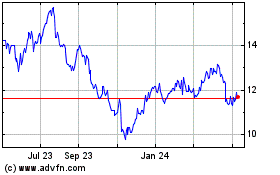

CNH Industrial NV (NYSE:CNHI)

Historical Stock Chart

From Mar 2024 to Apr 2024

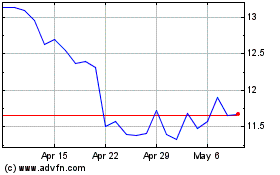

CNH Industrial NV (NYSE:CNHI)

Historical Stock Chart

From Apr 2023 to Apr 2024