Amended Statement of Beneficial Ownership (sc 13d/a)

28 September 2021 - 7:11AM

Edgar (US Regulatory)

|

SECURITIES AND EXCHANGE COMMISSION

|

|

|

|

|

|

Washington, D.C. 20549

|

|

|

_______________

|

|

|

|

|

|

SCHEDULE 13D/A

|

|

|

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

RULE 13d-2(a)

|

|

|

|

Under the Securities Exchange Act of 1934

|

|

(Amendment No. 5)

|

|

|

|

Canadian National

Railway Company

|

|

(Name of Issuer)

|

|

|

|

Common Shares, No

Par Value

|

|

(Title of Class of Securities)

|

|

|

|

136375102

|

|

(CUSIP Number)

|

|

|

|

Mr. Christopher Hohn

|

|

TCI Fund Management Limited

|

|

7 Clifford St

|

|

London W1S 2FT, United Kingdom

|

|

44 20 7440 2330

with a copy to:

Eleazer Klein, Esq.

Schulte Roth & Zabel LLP

919 Third Avenue

New York, New York 10022

(212) 756-2000

|

|

(Name, Address and Telephone Number of Person

|

|

Authorized to Receive Notices and Communications)

|

|

|

|

September 27,

2021

|

|

(Date of Event which Requires

|

|

Filing of this Schedule)

|

If the filing person has previously filed

a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of

Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box. ☐

NOTE: Schedules filed in paper format shall include a signed original

and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

(Page 1 of 5 Pages)

--------------------------

The information required on the remainder of this cover page shall not

be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

CUSIP No. 136375102

|

SCHEDULE 13D/A

|

Page 2 of 5 Pages

|

|

1

|

NAME OF REPORTING PERSON

TCI Fund Management Limited

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ¨

(b) ¨

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

AF

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United Kingdom

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED VOTING POWER

36,699,825

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

10

|

SHARED DISPOSITIVE POWER

36,699,825

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

36,699,825

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) (see Item 5)

5.2%

|

|

14

|

TYPE OF REPORTING PERSON

CO

|

|

|

|

|

|

|

|

CUSIP No. 136375102

|

SCHEDULE 13D/A

|

Page 3 of 5 Pages

|

|

1

|

NAME OF REPORTING PERSON

Christopher Hohn

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ¨

(b) ¨

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

AF

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United Kingdom

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED VOTING POWER

36,699,825

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

10

|

SHARED DISPOSITIVE POWER

36,699,825

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

36,699,825

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) (see Item 5)

5.2%

|

|

14

|

TYPE OF REPORTING PERSON

IN

|

|

|

|

|

|

|

|

CUSIP No. 136375102

|

SCHEDULE 13D/A

|

Page 4 of 5 Pages

|

The following constitutes Amendment No. 5

to the Schedule 13D filed by the undersigned (“Amendment No. 5”). This Amendment No. 5 amends the Schedule 13D as specifically

set forth herein. Capitalized terms used herein and not otherwise defined in this Amendment No. 5 have the meanings set forth in the Schedule

13D.

|

Item 4.

|

PURPOSE OF TRANSACTION.

|

|

Item 4 of the Schedule 13D is hereby amended and supplemented as follows:

|

|

|

|

On September 27, 2021, the Reporting Persons filed an information circular with respect to the Special Meeting (the “Circular”)

with the relevant Canadian securities regulatory authorities and listing exchanges. The Reporting Persons intend to solicit

proxies from shareholders of the Issuer for the following purposes: (i) to approve the removal of Robert Pace, Kevin G. Lynch, James

E. O’Connor and Laura Stein from the Board, as well as the removal of any person appointed to the Board after September

16, 2021 that is serving as a director of the Issuer at the time of the Special Meeting; (ii) to approve the appointment of the Nominees to the Board; and (iii) to transact such other business as may properly be brought

before the Special Meeting. The Reporting Persons expect to issue a supplement or amendment to the Circular containing

additional details concerning the Special Meeting and instructions for the completion of proxies and voting instruction forms to

be provided by the Reporting Persons for use at the Special Meeting. A copy of the Circular is filed herewith as Exhibit 7

and is incorporated by reference herein.

|

|

Item 7.

|

MATERIAL TO BE FILED AS EXHIBITS.

|

|

Item 7 of the Schedule 13D is hereby amended and supplemented by the addition of the following:

|

|

|

|

Exhibit 7: Circular, dated September 27, 2021

|

|

CUSIP No. 136375102

|

SCHEDULE 13D/A

|

Page 5 of 5 Pages

|

SIGNATURES

After reasonable inquiry and to the best of

my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: September 27, 2021

|

TCI Fund Management Limited

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Christopher Hohn

|

|

|

|

Name: Christopher Hohn

|

|

|

|

Title: Managing Director

|

|

|

|

|

|

|

|

/s/ Christopher Hohn

|

|

|

|

Christopher Hohn

|

|

|

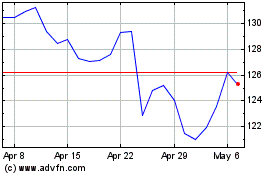

Canadian National Railway (NYSE:CNI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Canadian National Railway (NYSE:CNI)

Historical Stock Chart

From Apr 2023 to Apr 2024