CRH (NYSE: CRH), a leading provider of building materials

solutions, today reported fourth quarter and full year 2024

financial results.

Key Highlights

Summary Financials

Q4 2024

Change

FY 2024

Change

Total revenues

$8.9bn

+2%

$35.6bn

+2%

Net income

$0.7bn

+24%

$3.5bn

+15%

Net income margin

8.0%

+140bps

9.9%

+110bps

Adjusted EBITDA*

$1.8bn

+12%

$6.9bn

+12%

Adjusted EBITDA margin*

20.0%

+170bps

19.5%

+180bps

Basic EPS

$1.03

+4%

$5.06

+16%

Basic EPS pre-impairment*

$1.45

+12%

$5.48

+18%

Net cash provided by operating

activities

$5.0bn

(1%)

Return on net segment assets

15.3%

+90bps

Return on Net Assets*

15.5%

+20bps

- Industry-leading performance driven by unmatched scale and

differentiated strategy

- Strong Q4 and FY; another year of double-digit growth in

Adjusted EBITDA* and EPS

- 11th consecutive year of margin expansion1 underpinned by

commercial and operational excellence

- Significant portfolio activity; $5.0 billion invested in

value-accretive M&A

- $1.1 billion invested in growth capex; capitalizing on

attractive organic growth opportunities

- Increasing quarterly dividend to $0.37 (+6% y/y); commencing

new $0.3 billion quarterly share buyback

- Significant financial capacity to support future growth and

value creation

- Positive outlook for FY 2025; supportive underlying trends

across key markets expected to continue

- Expect FY 2025 Net income of $3.7 billion to $4.1 billion;

Adjusted EBITDA* of $7.3 billion to $7.7 billion

Jim Mintern, Chief Executive Officer, said:

"2024 was a strong year for CRH, driven by our

customer-connected solutions strategy and leading positions of

scale in attractive, higher-growth markets. We delivered another

year of double-digit profit growth and an 11th consecutive year of

margin expansion, reflecting a continued focus on commercial

management and operational excellence across the organization. The

strength of our balance sheet enabled us to invest $5 billion in 40

value-accretive acquisitions while also returning $3 billion of

cash to shareholders through dividends and share buybacks. The

outlook for our business remains positive, underpinned by favorable

demand and positive pricing momentum, leaving us well positioned

for another year of growth and value creation ahead."

________________________________________

* Represents a non-GAAP measure. See

'Non-GAAP Reconciliation and Supplementary Information' on pages 14

to 16.

1 Based on IFRS financial reporting to

2022 and U.S. GAAP for 2023 & 2024.

Performance Overview

Three months ended December 31, 2024

Fourth quarter 2024 total revenues of $8.9 billion (Q4 2023:

$8.7 billion) were 2% ahead of 2023. Net income was 24% ahead of

2023 at $0.7 billion (Q4 2023: $0.6 billion) and Adjusted EBITDA*

of $1.8 billion (Q4 2023: $1.6 billion) was 12% ahead, driven by

pricing progress, operational efficiencies and contributions from

acquisitions. Organic Adjusted EBITDA* was 10% ahead of Q4 2023.

CRH’s net income margin of 8.0% (Q4 2023: 6.6%) and Adjusted EBITDA

margin* of 20.0% (Q4 2023: 18.3%) were ahead of the prior year

period. CRH's basic earnings per share for the fourth quarter was

4% higher than the prior year at $1.03 (Q4 2023: $0.99). Basic

earnings per share pre-impairment* was 12% higher than the prior

year at $1.45 (Q4 2023: $1.30).

- Americas Materials Solutions' total revenues were 1%

behind the fourth quarter of 2023, as price increases and

contributions from acquisitions were offset by lower activity

levels due to weather disruption in certain regions. Adjusted

EBITDA was 20% ahead of the prior year period, driven by strong

pricing, operational efficiencies and good cost management.

- Americas Building Solutions' total revenues were 2%

ahead of the prior year period, primarily driven by contributions

from acquisitions as well as growth in energy and water markets.

Adjusted EBITDA was 9% lower than the prior year period, impacted

by adverse weather and against a strong prior year

comparative.

- International Solutions' total revenues were 7% ahead of

Q4 2023 driven by pricing progress and contributions from

acquisitions. Adjusted EBITDA was 9% ahead of the prior year

period, driven by commercial excellence measures, lower energy

costs and operational efficiencies.

Year ended December 31, 2024

2024 was another year of industry-leading financial performance

for CRH, underpinned by our differentiated strategy along with

resilient underlying demand in key end-use markets, continued

commercial progress and contributions from acquisitions. Total

revenues of $35.6 billion (2023: $34.9 billion) were 2% ahead of

2023. Net income was 15% ahead of 2023 at $3.5 billion (2023: $3.1

billion) and Adjusted EBITDA* of $6.9 billion (2023: $6.2 billion)

was 12% ahead, reflecting the continued delivery of the Company's

customer-connected solutions strategy, positive pricing, ongoing

cost control and further operational efficiencies. Organic Adjusted

EBITDA* was 10% ahead of 2023. CRH’s net income margin of 9.9%

(2023: 8.8%) and Adjusted EBITDA margin* of 19.5% (2023: 17.7%)

were well ahead of the prior year. CRH's basic earnings per share

was 16% higher than 2023 at $5.06 (2023: $4.36). Basic earnings per

share pre-impairment* was 18% higher than 2023 at $5.48 (2023:

$4.65).

- Americas Materials Solutions' total revenues were 5%

ahead of 2023, primarily driven by price increases across all lines

of business and positive contributions from acquisitions offsetting

the impact of adverse weather. Adjusted EBITDA was 22% ahead,

driven by pricing improvements, operational efficiencies and good

cost management, along with gains on the disposal of certain land

assets.

- Americas Building Solutions' total revenues were 1%

ahead of 2023, with contributions from acquisitions more than

offsetting the adverse weather impact on trading activity. Adjusted

EBITDA was 4% lower than the prior year, impacted by lower activity

levels in certain markets, subdued new-build residential demand and

against a strong prior year comparative.

- International Solutions' total revenues were 1% behind

2023 due to lower activity levels in certain markets and the

divestiture of the European Lime operations which was partly offset

by positive contributions from acquisitions. Adjusted EBITDA was 7%

ahead, driven by commercial excellence measures, lower energy

costs, a continued focus on cost management and operational

efficiencies along with contributions from acquisitions.

Acquisitions and Divestitures

In 2024, CRH completed 40 acquisitions for a total consideration

of $5.0 billion, compared with $0.7 billion in 2023.

The largest acquisition in 2024 was in Americas Materials

Solutions where CRH acquired an attractive portfolio of cement and

readymixed concrete assets and operations in Texas for a total

consideration of $2.1 billion. In addition, Americas Materials

Solutions completed a further 20 acquisitions and Americas Building

Solutions completed 10 acquisitions for a total spend in the

Americas of $3.8 billion. International Solutions completed nine

acquisitions for a total spend of $1.2 billion, including the

acquisition of a majority stake in Adbri Ltd (Adbri), a market

leader in cement and aggregates in Australia.

CRH completed 10 divestitures and realized proceeds from

divestitures and disposal of long-lived assets (including deferred

divestiture consideration received) of $1.4 billion, primarily

related to the divestiture of the European Lime operations. No

divestitures occurred in the prior year.

During the three months ended December 31, 2024, CRH completed

12 acquisitions for a total consideration of $1.1 billion, compared

with $0.1 billion in the same period of 2023. Americas Materials

Solutions completed six acquisitions, Americas Building Solutions

completed three acquisitions and International Solutions completed

three acquisitions.

During the three months ended December 31, 2024, cash proceeds

from divestitures and disposal of long-lived assets were $0.1

billion.

Dividends and Share Buybacks

The Company's continued strong cash generation and financial

flexibility provide the opportunity to continue to return cash to

shareholders, while at the same time investing in the business and

delivering on CRH's strategic growth initiatives.

In line with the Company's policy of consistent long-term

dividend growth and supported by its strong financial position, the

Board approved dividends totaling $1.40 per share in 2024, a 5%

increase on the prior year (2023: $1.33). The Board has also

declared a new quarterly dividend of $0.37 per share, representing

an annualized increase of 6% on 2024. The dividend will be paid

wholly in cash on April 16, 2025, to shareholders registered at the

close of business on March 14, 2025. The ex-dividend date will be

March 14, 2025.

As part of the Company's ongoing share buyback program, CRH

repurchased approximately 15.9 million ordinary shares in 2024 for

a total consideration of $1.3 billion. On February 26, 2025, the

latest tranche of the share buyback program was completed. The

Company is commencing an additional $0.3 billion tranche to be

completed no later than May 2, 2025.

Innovation and Sustainability

CRH is committed to driving profitable growth by providing its

customers with innovative solutions that support the transition to

a more sustainable built environment. The Company's focus on

continuous innovation will better position CRH to respond to the

changing needs of its customers, accelerate and scale new

technologies and drive a positive impact across three global

challenges of water, circularity and decarbonization. CRH continues

to enhance its capabilities to meet these opportunities and

challenges through investment in new technologies, such as FIDO AI,

the artificial intelligence leak detection software company, as

well as new partnerships through the CRH Ventures Accelerator

programs. Through these efforts, CRH continues to develop and

deliver innovative solutions for its customers while making

progress on its industry-leading target to deliver a 30% reduction

in absolute carbon emissions by 2030.

2025 Full Year Outlook

We expect positive underlying demand across our key end-use

markets in 2025, underpinned by significant public investment in

critical infrastructure, combined with increased

re-industrialization activity in key non-residential segments. This

backdrop is expected to support overall demand levels and further

positive pricing across our business.

Our North American businesses expect continued positive momentum

in infrastructure activity, supported by robust state and federal

funding. Non-residential activity continues to benefit from secular

tailwinds in key growth areas. Although the residential sector

continues to be supported by strong long-term demand fundamentals,

the new-build segment is expected to remain subdued while repair

and remodel activity remains resilient.

In our International operations, we expect infrastructure

activity to be underpinned by government and EU funding.

Non-residential construction continues to be aided by onshoring of

supply chains and industrial manufacturing activity. Residential

markets are expected to stabilize with structural demand

fundamentals supporting a gradual recovery.

Assuming normal seasonal weather patterns and absent any major

dislocations in the political or macroeconomic environment, CRH’s

leading positions of scale in attractive higher-growth markets,

together with our strong and flexible balance sheet, are expected

to underpin another year of growth and value creation in 2025.

2025 Guidance (i)

(in $ billions, except per share

data)

Low

High

Net income (ii)

3.7

4.1

Adjusted EBITDA*

7.3

7.7

Diluted EPS (ii)

$5.34

$5.80

Capital expenditure

2.8

3

(i) The 2025 guidance does not assume any

significant one-off or non-recurring items, including the impact of

potential tariffs, impairments or other unforeseen events.

(ii) 2025 net income and diluted EPS are

based on approximately $0.6 billion interest expense, net,

effective tax rate of approximately 23% and a year-to-date average

of approximately 683 million diluted common shares outstanding.

Americas Materials Solutions

Three months ended December 31, 2024

Analysis of Change

in $ millions

Q4 2023

Currency

Acquisitions

Divestitures

Organic

Q4 2024

% change

Total revenues

4,296

(10)

+215

(34)

(201)

4,266

(1%)

Adjusted EBITDA

875

(3)

+52

(14)

+143

1,053

+20%

Adjusted EBITDA margin

20.4%

24.7%

Americas Materials Solutions’ total revenues were 1% behind the

fourth quarter of 2023, as continued positive pricing and

contributions from acquisitions were offset by lower volumes due to

adverse weather in certain regions. Organic total revenues* were 5%

behind the prior year period.

In Essential Materials, total revenues were in line with the

prior year, with good pricing momentum and contributions from

acquisitions offset by lower aggregates volumes. Prices in

aggregates and cement were ahead by 7% and 8%, respectively.

Weather-impacted aggregates volumes declined by 9% while cement

volumes increased by 3%, supported by acquisitions.

In Road Solutions, total revenues were 1% behind the prior year,

as reduced activity levels due to challenging weather offset

improved pricing across all lines of business and ongoing state and

federal funding support. Paving and construction revenues decreased

by 1% with positive growth in the South region offset by lower

activity in weather-impacted regions. Asphalt prices increased by

3% and volumes decreased by 8%, while readymixed concrete prices

increased by 3% and volumes were flat.

Fourth quarter 2024 Adjusted EBITDA for Americas Materials

Solutions of $1.1 billion was 20% ahead of the prior year driven by

commercial progress, disciplined cost management and operational

efficiencies. Organic Adjusted EBITDA* was 16% ahead of the fourth

quarter of 2023. Adjusted EBITDA margin increased by 430bps.

Year ended December 31, 2024

Analysis of Change

in $ millions

2023

Currency

Acquisitions

Divestitures

Organic

2024

% change

Total revenues

15,435

(22)

+641

(112)

+231

16,173

+5%

Adjusted EBITDA

3,059

(6)

+180

(36)

+548

3,745

+22%

Adjusted EBITDA margin

19.8%

23.2%

Americas Materials Solutions’ total revenues were 5% ahead of

the prior year as price increases and contributions from

acquisitions offset lower activity levels which were impacted by

adverse weather. Organic total revenues* were 1% ahead.

In Essential Materials, total revenues were 5% ahead of the

prior year, supported by aggregates and cement pricing, which were

ahead by 10% and 8%, respectively. Aggregates volumes declined by

3% while cement volumes increased by 1% compared to 2023.

In Road Solutions, total revenues increased by 5% driven by

pricing progression and sustained activity levels through continued

state and federal funding support. Asphalt prices increased by 3%

while volumes, impacted by weather, declined 2% against 2023.

Paving and construction revenues increased 5% versus the prior

year. Readymixed concrete pricing was 6% higher than the prior

year, while volumes were 1% ahead.

Adjusted EBITDA for Americas Materials Solutions of $3.7 billion

was 22% ahead of the prior year with growth across all regions.

Positive pricing, disciplined cost management and operational

efficiencies along with gains on land asset sales offset lower

volumes in certain markets. Organic Adjusted EBITDA* was 18% ahead

of 2023. Adjusted EBITDA margin increased by 340bps.

Americas Building Solutions

Three months ended December 31, 2024

Analysis of Change

in $ millions

Q4 2023

Currency

Acquisitions

Divestitures

Organic

Q4 2024

% change

Total revenues

1,470

–

+49

–

(26)

1,493

+2%

Adjusted EBITDA

276

(1)

+6

–

(31)

250

(9%)

Adjusted EBITDA margin

18.8%

16.7%

Americas Building Solutions' total revenues were 2% ahead of the

fourth quarter of 2023, as increased demand in Building &

Infrastructure Solutions and contributions from acquisitions offset

adverse weather impacts. Organic total revenues* were 2% behind the

prior year period.

In Building & Infrastructure Solutions, total revenues were

8% ahead of Q4 2023, supported by increased demand in energy and

water markets.

In Outdoor Living Solutions, total revenues were 3% behind the

prior year period as demand was impacted by adverse weather.

Adjusted EBITDA for Americas Building Solutions was 9% behind

the fourth quarter of 2023 and 11% behind on an organic* basis as

adverse winter weather impacted results. Adjusted EBITDA margin was

210bps behind the prior year period.

Year ended December 31, 2024

Analysis of Change

in $ millions

2023

Currency

Acquisitions

Divestitures

Organic

2024

% change

Total revenues

7,017

(4)

+193

–

(147)

7,059

+1%

Adjusted EBITDA

1,442

(2)

+34

–

(85)

1,389

(4%)

Adjusted EBITDA margin

20.6%

19.7%

In 2024, Americas Building Solutions' total revenues were 1%

ahead of the prior year as positive contributions from acquisitions

were partially offset by subdued new-build residential demand and

adverse weather. Organic total revenues* were 2% behind the prior

year.

In Building & Infrastructure Solutions, total revenues were

2% ahead of the prior year as contributions from acquisitions

offset lower activity levels due to adverse weather conditions and

subdued new-build residential demand.

In Outdoor Living Solutions, total revenues were flat compared

with 2023 as unfavorable weather conditions offset increased sales

into the retail channel.

Adjusted EBITDA for Americas Building Solutions was 4% behind

2023 and 6% behind on an organic* basis as adverse weather and

subdued new-build residential demand impacted performance. Adjusted

EBITDA margin was 90bps behind the prior year.

International Solutions

Three months ended December 31, 2024

Analysis of Change

in $ millions

Q4 2023

Currency

Acquisitions

Divestitures

Organic

Q4 2024

% change

Total revenues

2,919

+16

+371

(160)

(35)

3,111

+7%

Adjusted EBITDA

435

+3

+35

(42)

+42

473

+9%

Adjusted EBITDA margin

14.9%

15.2%

International Solutions’ total revenues were 7% ahead of the

fourth quarter of 2023. Organic total revenues* were 1% behind as

continued pricing progress and volume growth in Central and Eastern

Europe were offset by lower activity in Western Europe, coupled

with continued subdued new-build residential activity within

Building & Infrastructure Solutions and Outdoor Living

Solutions.

In Essential Materials, total revenues were 9% ahead of the

comparable period in 2023 with strong aggregates and cement volumes

as well as positive pricing and contributions from acquisitions.

Aggregates volumes were 15% ahead while cement volumes were 18%

ahead of the comparable period in 2023. Aggregates pricing was 6%

ahead and cement pricing was 4% ahead of Q4 2023.

In Road Solutions, revenues were 9% ahead of the comparable

period in 2023, with volumes and prices in the readymixed concrete

business ahead of 2023 by 26% and 7%, respectively, benefiting from

contributions from acquisitions as well as higher activity levels

in Central and Eastern Europe. Asphalt volumes increased by 8%

while pricing declined by 4% with paving and construction revenues

impacted by lower activity levels in Western Europe.

Within Building & Infrastructure Solutions and Outdoor

Living Solutions, total revenues were 2% behind the comparable

period in 2023 as increased pricing was offset by lower activity

levels.

Adjusted EBITDA in International Solutions was $0.5 billion, 9%

ahead of the fourth quarter of 2023, and 10% ahead on an organic*

basis, primarily driven by increased pricing, lower energy costs

and operational efficiencies. Adjusted EBITDA margin increased by

30bps compared to the prior year period.

Year ended December 31, 2024

Analysis of Change

in $ millions

2023

Currency

Acquisitions

Divestitures

Organic

2024

% change

Total revenues

12,497

+141

+808

(542)

(564)

12,340

(1%)

Adjusted EBITDA

1,675

+17

+100

(136)

+140

1,796

+7%

Adjusted EBITDA margin

13.4%

14.6%

International Solutions’ total revenues were 1% behind the prior

year. Organic total revenues* were 4% behind as positive pricing

momentum and good volume growth in Central and Eastern Europe were

offset by lower volumes in Western Europe as well as lower trading

activities in the Building & Infrastructure Solutions and

Outdoor Living Solutions businesses.

In Essential Materials, total revenues were 2% behind as

continued pricing progress and contributions from acquisitions were

offset by the divestiture of the European Lime operations.

Aggregates volumes were 3% ahead of 2023 with cement volumes 5%

ahead, supported by good growth in Central and Eastern Europe as

well as recent acquisitions. Aggregates pricing was 4% ahead and

overall cement pricing was 3% ahead of 2023.

In Road Solutions, total revenues were 2% ahead of 2023. Volumes

and prices were ahead in the readymixed concrete business by 8% and

3%, respectively, benefiting from volume growth in Central and

Eastern Europe as well as acquisitions in the period. Asphalt

volumes and pricing declined 2% and 1%, respectively. Paving and

construction revenues were behind 2023 due to lower activity levels

in Western Europe.

Total revenues in Building & Infrastructure Solutions and

Outdoor Living Solutions declined by 6% compared with the prior

year, amid continued subdued new-build residential activity.

Adjusted EBITDA in International Solutions was $1.8 billion, 7%

ahead of 2023, and 8% ahead on an organic* basis, primarily driven

by increased pricing, lower energy costs and operational

efficiencies. Adjusted EBITDA margin increased by 120bps compared

with 2023.

Other Financial Items

Depreciation, depletion and amortization charges for the year

ended December 31, 2024 of $1.8 billion were higher than the prior

year (2023: $1.6 billion), primarily due to the impact of

acquisitions.

Arising from CRH’s annual impairment testing process, non-cash

impairment charges of $0.35 billion were recognized in 2024 (2023:

$0.36 billion). These principally resulted from challenging market

conditions in the Architectural Products reporting unit within

International Solutions and the equity method investment in

China.

Gain on disposal of long-lived assets of $237 million was higher

than 2023 (2023: $66 million), mainly related to the disposal of

certain land assets.

Interest income of $143 million (2023: $206 million) was lower

than 2023 primarily due to a lower level of cash deposits. Interest

expense of $612 million (2023: $376 million) was higher than the

prior year primarily due to an increase in gross debt balances and

increased interest rates.

Other nonoperating income (expense), net, was an income of $258

million (2023: $2 million expense), primarily related to gains on

divestitures.

Income before income tax expense and income from equity method

investments was $4.7 billion (2023: $4.0 billion), and the

associated tax charge of $1.1 billion (2023: $0.9 billion)

represented an effective tax rate of 23%, in line with the prior

year (2023: 23%).

Basic earnings per share was 16% higher than 2023 at $5.06

(2023: $4.36) due to a positive operating performance, higher gains

on disposal of long-lived assets and on divestitures as well as

reduced share count as a result of the ongoing share buyback

program. Basic earnings per share pre-impairment* of $5.48 was 18%

higher than the prior year (2023: $4.65).

Balance Sheet and Liquidity

2024 marked another year of strong cash generation for CRH with

net cash provided by operating activities of $5.0 billion, in line

with the prior year (2023: $5.0 billion), as higher income from

operations was offset by working capital outflows.

Total short-term and long-term debt was $14.0 billion at

December 31, 2024 ($11.6 billion at December 31, 2023). During

2024, a net $0.5 billion of commercial paper was issued across the

U.S. Dollar and Euro Commercial Paper Programs. In January 2024,

€600 million of euro-denominated notes were repaid on maturity. In

May 2024, the Company issued $750 million in 5.20% notes due in

2029 and $750 million in 5.40% notes due in 2034. In July 2024, as

part of the Adbri acquisition, $0.5 billion of external debt was

acquired. In December 2024, the Company agreed and drew down a $750

million two-year term loan at a fixed rate of 4.91%.

Net Debt* at December 31, 2024 was $10.5 billion, compared to

$5.4 billion at December 31, 2023. This increase reflects

acquisitions, cash returns to shareholders through dividends and

share buybacks, as well as the purchase of property, plant and

equipment, partially offset by inflows from operating activities

and proceeds from divestitures.

CRH ended 2024 with $3.8 billion of cash and cash equivalents

and restricted cash (2023: $6.4 billion) as well as $3.8 billion of

undrawn committed facilities which are available until 2029. At

year end, the weighted average maturity of the term debt (net of

cash and cash equivalents) was 7.5 years. CRH also has a $4.0

billion U.S. Dollar Commercial Paper Program and a €1.5 billion

Euro Commercial Paper Program available. As of December 31, 2024

there was $1.2 billion of outstanding issued notes under the U.S.

Dollar Commercial Paper Program and $0.3 billion of outstanding

issued notes under the Euro Commercial Paper Program. CRH remains

committed to maintaining its robust balance sheet and expects to

maintain a strong investment-grade credit rating with a BBB+ or

equivalent rating with each of the three main rating agencies.

Conference Call

CRH will host a conference call and webcast presentation at 8:00

a.m. (EST) on Thursday, February 27, 2025 to discuss the 2024

results and 2025 outlook. Registration details are available on

www.crh.com/investors. Upon registration, a link to join the call

and dial-in details will be made available. The accompanying

investor presentation will be available on the investor section of

the CRH website in advance of the conference call, while a

recording of the conference call will be made available

afterwards.

Dividend Timetable

The timetable for payment of the quarterly dividend of $0.37 per

share is as follows:

Ex-dividend Date:

March 14, 2025

Record Date:

March 14, 2025

Payment Date:

April 16, 2025

The default payment currency is U.S. Dollar for shareholders who

hold their ordinary shares through a Depository Trust Company (DTC)

participant. It is also U.S. Dollar for shareholders holding their

ordinary shares in registered form, unless a currency election has

been registered with CRH’s Transfer Agent, Computershare Trust

Company N.A. by 5:00 p.m. (EDT)/9:00 p.m. (GMT) on March 14,

2025.

The default payment currency for shareholders holding their

ordinary shares in the form of Depository Interests is euro. Such

shareholders can elect to receive the dividend in U.S. Dollar or

Pounds Sterling by providing their instructions to the Company’s

Depositary Interest provider, Computershare Investor Services plc,

by 12:00 p.m. (EDT)/4:00 p.m. (GMT) on March 18, 2025.

Appendices

Appendix 1 - Primary Statements

The following financial statements are an extract of the

Company’s Consolidated Financial Statements prepared in accordance

with U.S. GAAP for the three months and the year ended December 31,

2024 and do not present all necessary information for a complete

understanding of the Company's financial condition as of December

31, 2024. The full Consolidated Financial Statements prepared in

accordance with U.S. GAAP for the year ended December 31, 2024,

including notes thereto, will be included in the Company’s Annual

Report on Form 10-K filed with the U.S. Securities and Exchange

Commission (SEC).

Consolidated Statements of Income

(in $ millions, except share and per share

data)

Three months ended

Year ended

December 31

December 31

2024

2023

2024

2023

Product revenues

6,541

6,230

26,699

26,156

Service revenues

2,329

2,455

8,873

8,793

Total revenues

8,870

8,685

35,572

34,949

Cost of product revenues

(3,641)

(3,456)

(14,651)

(14,741)

Cost of service revenues

(2,069)

(2,278)

(8,220)

(8,245)

Total cost of revenues

(5,710)

(5,734)

(22,871)

(22,986)

Gross profit

3,160

2,951

12,701

11,963

Selling, general and administrative

expenses

(1,933)

(1,839)

(7,852)

(7,486)

Gain on disposal of long-lived assets

38

28

237

66

Loss on impairments

(161)

(357)

(161)

(357)

Operating income

1,104

783

4,925

4,186

Interest income

31

68

143

206

Interest expense

(160)

(91)

(612)

(376)

Other nonoperating income (expense),

net

12

(5)

258

(2)

Income before income tax expense and

income from equity method investments

987

755

4,714

4,014

Income tax expense

(143)

(144)

(1,085)

(925)

Loss from equity method investments

(135)

(38)

(108)

(17)

Net income

709

573

3,521

3,072

Net (income) attributable to redeemable

noncontrolling interests

(7)

(7)

(28)

(28)

Net loss (income) attributable to

noncontrolling interests

1

135

(1)

134

Net income attributable to CRH

703

701

3,492

3,178

Earnings per share attributable to

CRH

Basic

$1.03

$0.99

$5.06

$4.36

Diluted

$1.02

$0.99

$5.02

$4.33

Weighted average common shares

outstanding

Basic

678.4

700.5

683.3

723.9

Diluted

683.7

705.3

689.5

729.2

Consolidated Balance Sheets

(in $ millions, except share data)

At December 31

2024

2023

Assets

Current assets:

Cash and cash equivalents

3,720

6,341

Restricted cash

39

–

Accounts receivable, net

4,820

4,507

Inventories

4,755

4,291

Assets held for sale

–

1,268

Other current assets

749

478

Total current assets

14,083

16,885

Property, plant and equipment, net

21,452

17,841

Equity method investments

737

620

Goodwill

11,061

9,158

Intangible assets, net

1,211

1,041

Operating lease right-of-use assets,

net

1,274

1,292

Other noncurrent assets

795

632

Total assets

50,613

47,469

Liabilities, redeemable noncontrolling

interests and shareholders’ equity

Current liabilities:

Accounts payable

3,207

3,149

Accrued expenses

2,248

2,296

Current portion of long-term debt

2,999

1,866

Operating lease liabilities

265

255

Liabilities held for sale

–

375

Other current liabilities

1,577

2,072

Total current liabilities

10,296

10,013

Long-term debt

10,969

9,776

Deferred income tax liabilities

3,105

2,738

Noncurrent operating lease liabilities

1,074

1,125

Other noncurrent liabilities

2,319

2,196

Total liabilities

27,763

25,848

Commitments and contingencies

Redeemable noncontrolling interests

384

333

Shareholders’ equity

Preferred stock, €1.27 par value, 150,000

shares authorized and 50,000 shares issued and outstanding for 5%

preferred stock and 872,000 shares authorized, issued and

outstanding for 7% 'A' preferred stock, as of December 31, 2024,

and December 31, 2023

1

1

Common stock, €0.32 par value,

1,250,000,000 shares authorized; 718,647,277 and 734,519,598 shares

issued and outstanding, as of December 31, 2024, and December 31,

2023, respectively

290

296

Treasury stock, at cost (41,355,384 and

42,419,281 shares as of December 31, 2024, and December 31, 2023,

respectively)

(2,137)

(2,199)

Additional paid-in capital

422

454

Accumulated other comprehensive loss

(1,005)

(616)

Retained earnings

24,036

22,918

Total shareholders’ equity attributable

to CRH shareholders

21,607

20,854

Noncontrolling interests

859

434

Total equity

22,466

21,288

Total liabilities, redeemable

noncontrolling interests and equity

50,613

47,469

Consolidated Statements of Cash Flows

(in $ millions)

For the years ended December 31

2024

2023

Cash Flows from Operating

Activities:

Net income

3,521

3,072

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation, depletion and

amortization

1,798

1,633

Loss on impairments

161

357

Share-based compensation

125

123

Gains on disposals from discontinued

operations, businesses and long-lived assets, net

(431)

(66)

Deferred tax expense (benefit)

180

(64)

Loss from equity method investments

108

17

Pension and other postretirement benefits

net periodic benefit cost

34

31

Non-cash operating lease costs

262

293

Other items, net

14

68

Changes in operating assets and

liabilities, net of effects of acquisitions and divestitures:

Accounts receivable, net

(122)

(164)

Inventories

(224)

(60)

Accounts payable

48

144

Operating lease liabilities

(287)

(276)

Other assets

(69)

25

Other liabilities

(86)

(72)

Pension and other postretirement benefits

contributions

(43)

(44)

Net cash provided by operating

activities

4,989

5,017

Cash Flows from Investing

Activities:

Purchases of property, plant and

equipment, and intangibles

(2,578)

(1,817)

Acquisitions, net of cash acquired

(4,900)

(640)

Proceeds from divestitures

1,001

–

Proceeds from disposal of long-lived

assets

272

104

Dividends received from equity method

investments

44

44

Settlements of derivatives

(9)

(1)

Deferred divestiture consideration

received

83

6

Other investing activities, net

(204)

(87)

Net cash used in investing

activities

(6,291)

(2,391)

Consolidated Statements of Cash Flows

(in $ millions)

For the years ended December 31

2024

2023

Cash Flows from Financing

Activities:

Proceeds from debt issuances

4,001

3,163

Payments on debt

(1,859)

(1,462)

Settlements of derivatives

(36)

7

Payments of finance lease obligations

(57)

(26)

Deferred and contingent acquisition

consideration paid

(21)

(22)

Dividends paid

(1,706)

(940)

Distributions to noncontrolling and

redeemable noncontrolling interests

(53)

(35)

Transactions involving noncontrolling

interests

19

(2)

Repurchases of common stock

(1,482)

(3,067)

Proceeds from exercise of stock

options

8

4

Net cash used in financing

activities

(1,186)

(2,380)

Effect of exchange rate changes on cash

and cash equivalents, including restricted cash

(143)

208

(Decrease)/increase in cash and cash

equivalents, including restricted cash

(2,631)

454

Cash and cash equivalents and restricted

cash at the beginning of year

6,390

5,936

Cash and cash equivalents and

restricted cash at the end of year

3,759

6,390

Supplemental cash flow

information:

Cash paid for interest (including finance

leases)

599

418

Cash paid for income taxes

960

959

Reconciliation of cash and cash

equivalents and restricted cash

Cash and cash equivalents presented in the

Consolidated Balance Sheets

3,720

6,341

Restricted cash presented in the

Consolidated Balance Sheets

39

–

Cash and cash equivalents included in

Assets held for sale

–

49

Total cash and cash equivalents and

restricted cash presented in the Consolidated Statements of Cash

Flows

3,759

6,390

The financial information presented in this report does not

constitute the statutory financial statements for the purposes of

Chapter 4 of Part 6 of the Companies Act 2014. Full statutory

financial statements for the year ended December 31, 2024 prepared

in accordance with International Financial Reporting Standards

(IFRS), upon which the Auditor has given an unqualified audit

report, have not yet been filed with the Registrar of Companies.

Full statutory financial statements for the year ended December 31,

2023, prepared in accordance with IFRS and containing an

unqualified audit report, have been delivered to the Registrar of

Companies.

Appendix 2 - Non-GAAP Reconciliation and Supplementary

Information

CRH uses a number of non-GAAP performance measures to monitor

financial performance. These measures are referred to throughout

the discussion of our reported financial position and operating

performance on a continuing operations basis unless otherwise

defined and are measures which are regularly reviewed by CRH

management. These performance measures may not be uniformly defined

by all companies and accordingly may not be directly comparable

with similarly titled measures and disclosures by other

companies.

Certain information presented is derived from amounts calculated

in accordance with U.S. GAAP but is not itself an expressly

permitted GAAP measure. The non-GAAP performance measures as

summarized below should not be viewed in isolation or as an

alternative to the equivalent GAAP measure.

Adjusted EBITDA: Adjusted EBITDA is defined as earnings

from continuing operations before interest, taxes, depreciation,

depletion, amortization, loss on impairments, gain/loss on

divestitures and unrealized gain/loss on investments, income/loss

from equity method investments, substantial acquisition-related

costs and pension expense/income excluding current service cost

component. It is quoted by management in conjunction with other

GAAP and non-GAAP financial measures to aid investors in their

analysis of the performance of the Company. Adjusted EBITDA by

segment is monitored by management in order to allocate resources

between segments and to assess performance. Adjusted EBITDA

margin is calculated by expressing Adjusted EBITDA as a

percentage of total revenues.

Reconciliation to its nearest GAAP measure is presented

below:

Three months ended December

31

Year ended December 31

in $ millions

2024

2023

2024

2023

Net income

709

573

3,521

3,072

Loss from equity method investments

(i)

135

38

108

17

Income tax expense

143

144

1,085

925

Gain on divestitures and unrealized gains

on investments (ii)

(8)

–

(250)

–

Pension income excluding current service

cost component (ii)

(4)

–

(7)

(3)

Other interest, net (ii)

–

5

(1)

5

Interest expense

160

91

612

376

Interest income

(31)

(68)

(143)

(206)

Depreciation, depletion and

amortization

510

446

1,798

1,633

Loss on impairments (i)

161

357

161

357

Substantial acquisition-related costs

(iii)

1

–

46

–

Adjusted EBITDA

1,776

1,586

6,930

6,176

Total revenues

8,870

8,685

35,572

34,949

Net income margin

8.0%

6.6%

9.9%

8.8%

Adjusted EBITDA margin

20.0%

18.3%

19.5%

17.7%

(i) For the year ended December 31, 2024,

the total impairment loss comprised $0.35 billion, principally

related to the Architectural Products reporting unit within

International Solutions and the equity method investment in China.

For the year ended December 31, 2023, the total impairment loss

comprised $62 million within Americas Materials Solutions and $295

million within International Solutions.

(ii) Gain on divestitures and unrealized

gains on investments, pension income excluding current service cost

component and other interest, net have been included in Other

nonoperating (expense) income, net in the Consolidated Statements

of Income in Item 8. “Financial Statements and Supplementary Data”

in the Annual Report on Form 10-K.

(iii) Represents expenses associated with

non-routine substantial acquisitions, which meet the criteria for

being separately reported in Note 4 “Acquisitions” in Item 8.

“Financial Statements and Supplementary Data” in the Annual Report

on Form 10-K. Expenses in 2024 primarily include legal and

consulting expenses related to these non-routine substantial

acquisitions.

Adjusted EBITDA is not defined by GAAP and should not be

considered as an alternative to earnings measures defined by GAAP.

Reconciliation to its nearest GAAP measure for the mid-point of the

2025 Adjusted EBITDA guidance is presented below:

in $ billions

2025

Mid-Point

Net income

3.9

Income tax expense

1.1

Interest expense, net

0.6

Depreciation, depletion and

amortization

1.9

Adjusted EBITDA

7.5

Return on Net Assets (RONA): Return on Net Assets is a

key internal pre-tax and pre-impairment (which is non-cash) measure

of operating performance throughout the Company and can be used by

management and investors to measure the relative use of assets

between CRH’s segments. The metric measures management’s ability to

generate income from the net assets required to support that

business, focusing on both profit maximization and the maintenance

of an efficient asset base; it encourages effective fixed asset

maintenance programs, good decisions regarding expenditure on

property, plant and equipment and the timely disposal of surplus

assets. It also supports the effective management of the Company’s

working capital base. RONA is calculated by expressing operating

income from continuing operations and operating income from

discontinued operations excluding loss on impairments (which is

non-cash) as a percentage of average net assets. Net assets

comprise total assets by segment (including assets held for sale)

less total liabilities by segment (excluding finance lease

liabilities and including liabilities associated with assets

classified as held for sale) as shown below and detailed in Note 3

“Assets held for sale and discontinued operations” in Item 8.

“Financial Statements and Supplementary Data” in the Annual Report

on Form 10-K and excludes equity method investments and other

financial assets, Net Debt (as defined below) and tax assets and

liabilities. The average net assets for the year is the simple

average of the opening and closing balance sheet figures.

Reconciliation to its nearest GAAP measure is presented

below:

in $ millions

2024

2023

Operating income

A

4,925

4,186

Adjusted for loss on impairments (i)

161

357

Numerator for RONA computation

5,086

4,543

Current year

Segment assets (ii)

45,534

38,868

Segment liabilities (ii)

(9,771)

(10,169)

B

35,763

28,699

Finance lease liabilities

257

117

36,020

28,816

Assets held for sale (iii)

–

1,268

Liabilities associated with assets

classified as held for sale (iii)

–

(375)

36,020

29,709

Prior year

Segment assets (ii)

38,868

38,504

Segment liabilities (ii)

(10,169)

(8,883)

C

28,699

29,621

Finance lease liabilities

117

81

28,816

29,702

Assets held for sale (iii)

1,268

–

Liabilities associated with assets

classified as held for sale (iii)

(375)

–

29,709

29,702

Denominator for RONA computation -

average net assets

32,865

29,706

Return on net segment assets (A divided

by average of B and C)

15.3%

14.4%

RONA

15.5%

15.3%

Total assets as reported in the

Consolidated Balance Sheets

50,613

47,469

Total liabilities as reported in the

Consolidated Balance Sheets

27,763

25,848

(i) Operating income is adjusted for loss

on impairments. For the year ended December 31, 2024, the total

impairment loss comprised $161 million within International

Solutions. For the year ended December 31, 2023, the total

impairment loss comprised $62 million within Americas Materials

Solutions and $295 million within International Solutions.

(ii) Segment assets and liabilities as

disclosed in Note 20 “Segment Information” in Item 8. “Financial

Statements and Supplementary Data” in the Annual Report on Form

10-K.

(iii) Assets held for sale and liabilities

associated with assets classified as held for sale as disclosed in

Note 3 “Assets held for sale and discontinued operations” in Item

8. “Financial Statements and Supplementary Data” in the Annual

Report on Form 10-K.

Net Debt: Net Debt is used by management as it gives

additional insight into the Company’s current debt position less

available cash. Net Debt is provided to enable investors to see the

economic effect of gross debt, related hedges and cash and cash

equivalents in total. Net Debt comprises short and long-term debt,

finance lease liabilities, cash and cash equivalents and current

and noncurrent derivative financial instruments (net).

Reconciliation to its nearest GAAP measure is presented

below:

in $ millions

2024

2023

Short and long-term debt

(13,968)

(11,642)

Cash and cash equivalents (i)

3,720

6,390

Finance lease liabilities

(257)

(117)

Derivative financial instruments (net)

(27)

(37)

Net Debt

(10,532)

(5,406)

(i) 2023 includes $49 million cash and

cash equivalents reclassified as held for sale.

Organic Revenue and Organic Adjusted EBITDA: Because of

the impact of acquisitions, divestitures, currency exchange

translation and other non-recurring items on reported results each

year, CRH uses organic revenue and organic Adjusted EBITDA as

additional performance indicators to assess performance of

pre-existing (also referred to as underlying, like-for-like or

ongoing) operations each year.

Organic revenue and organic Adjusted EBITDA are arrived at by

excluding the incremental revenue and Adjusted EBITDA contributions

from current and prior year acquisitions and divestitures, the

impact of exchange translation, and the impact of any one-off

items. Changes in organic revenue and organic Adjusted EBITDA are

presented as additional measures of revenue and Adjusted EBITDA to

provide a greater understanding of the performance of the Company.

Organic change % is calculated by expressing the organic movement

as a percentage of the prior year (adjusted for currency exchange

effects). A reconciliation of the changes in organic revenue and

organic Adjusted EBITDA to the changes in total revenues and

Adjusted EBITDA by segment, is presented with the discussion within

each segment’s performance in tables contained in the segment

discussion commencing on page 4.

Basic EPS pre‑impairment: Basic EPS pre-impairment is a

measure of the Company's profitability per share from continuing

operations excluding any loss on impairments (which is non-cash)

and the related tax impact of such impairments. It is used by

management to evaluate the Company's underlying profit performance

and its own past performance. Basic EPS information presented on a

pre-impairment basis is useful to investors as it provides an

insight into the Company's underlying performance and

profitability. Basic EPS pre-impairment is calculated as income

from continuing operations adjusted for (i) net (income)

attributable to redeemable noncontrolling interests (ii) net loss

(income) attributable to noncontrolling interests (iii) adjustment

of redeemable noncontrolling interests to redemption value and

excluding any loss on impairments (and the related tax impact of

such impairments) divided by the weighted average number of common

shares outstanding for the year.

Reconciliation to its nearest GAAP measure is presented

below:

in $ millions, except share and per

share data

Q4 2024

Per Share - basic

Q4 2023

Per Share - basic

2024

Per Share - basic

2023

Per Share - basic

Weighted average common shares outstanding

– basic

678.4

700.5

683.3

723.9

Net income

709

$1.05

573

$0.82

3,521

$5.15

3,072

$4.24

Net (income) attributable to redeemable

noncontrolling interests

(7)

($0.01)

(7)

($0.01)

(28)

($0.04)

(28)

($0.04)

Net loss (income) attributable to

noncontrolling interests

1

–

135

$0.19

(1)

–

134

$0.19

Adjustment of redeemable noncontrolling

interests to redemption value

(4)

($0.01)

(6)

($0.01)

(34)

($0.05)

(24)

($0.03)

Net Income for EPS

699

$1.03

695

$0.99

3,458

$5.06

3,154

$4.36

Impairment of property, plant and

equipment and intangible assets

161

$0.24

224

$0.32

161

$0.24

224

$0.30

Tax related to impairment charges

(26)

($0.04)

(9)

($0.01)

(26)

($0.04)

(9)

($0.01)

Impairment of equity method investments

(net of tax)

151

$0.22

–

–

151

$0.22

–

–

Net income for EPS – pre-impairment

(i)

985

$1.45

910

$1.30

3,744

$5.48

3,369

$4.65

(i) Reflective of CRH’s share of

impairment of property, plant and equipment and intangible assets

(2024: $161 million; 2023: $224 million), an impairment of equity

method investments (2024: $190 million; 2023: $nil million) and

related tax effect.

Appendix 3 - Disclaimer/Forward-Looking Statements

In order to utilize the “Safe Harbor” provisions of the United

States Private Securities Litigation Reform Act of 1995, CRH plc is

providing the following cautionary statement.

This document contains statements that are, or may be deemed to

be, forward-looking statements with respect to the financial

condition, results of operations, business, viability and future

performance of CRH and certain of the plans and objectives of CRH.

These forward-looking statements may generally, but not always, be

identified by the use of words such as “will”, “anticipates”,

“should”, “could”, “would”, “targets”, “aims”, “may”, “continues”,

“expects”, “is expected to”, “estimates”, “believes”, “intends” or

similar expressions. These forward-looking statements include all

matters that are not historical facts or matters of fact at the

date of this document.

In particular, the following, among other statements, are all

forward-looking in nature: plans and expectations regarding

customer demand, pricing, costs, underlying drivers for growth in

infrastructure, residential and non-residential markets,

macroeconomic and market trends in regions where CRH operates, and

investments in manufacturing and clean energy initiatives; plans

and expectations regarding government funding initiatives and

priorities; plans and expectations regarding CRH’s decarbonization

targets and sustainability initiatives; plans and expectations

regarding return of cash to shareholders, including the timing and

amount of share buybacks and dividends; plans and expectations

related to growth opportunities, strategic growth initiatives and

value creation; plans and expectations regarding capital

expenditures and capital allocation, net income, Adjusted EBITDA,

earnings per share and its growth, effective tax rate, interest

expense and CRH’s 2025 full year performance; plans and

expectations regarding CRH’s ability to meet its upcoming debt

obligations, CRH’s balance sheet and investment-grade credit

rating; and plans and expectations regarding the timing of

completion of and expected benefits from acquisitions and

divestitures.

By their nature, forward-looking statements involve risk and

uncertainty because they relate to events and depend on

circumstances that may or may not occur in the future and reflect

the Company’s current expectations and assumptions as to such

future events and circumstances that may not prove accurate. You

are cautioned not to place undue reliance on any forward-looking

statements. These forward-looking statements are made as of the

date of this document. The Company expressly disclaims any

obligation or undertaking to publicly update or revise these

forward-looking statements other than as required by applicable

law.

A number of material factors could cause actual results and

developments to differ materially from those expressed or implied

by these forward-looking statements, certain of which are beyond

our control, and which include, among other factors: economic and

financial conditions, including changes in interest rates,

inflation, price volatility and/or labor and materials shortages;

demand for infrastructure, residential and non-residential

construction and our products in geographic markets in which we

operate; increased competition and its impact on prices and market

position; increases in energy, labor and/or other raw materials

costs; adverse changes to laws and regulations, including in

relation to climate change; the impact of unfavorable weather;

investor and/or consumer sentiment regarding the importance of

sustainable practices and products; availability of public sector

funding for infrastructure programs; political uncertainty,

including as a result of political and social conditions in the

jurisdictions CRH operates in, or adverse political developments,

including the ongoing geopolitical conflicts in Ukraine and the

Middle East; failure to complete or successfully integrate

acquisitions or make timely divestments; cyber-attacks and exposure

of associates, contractors, customers, suppliers and other

individuals to health and safety risks, including due to product

failures. Additional factors, risks and uncertainties that could

cause actual outcomes and results to be materially different from

those expressed by the forward-looking statements in this report

include the risks and uncertainties described under “Risk Factors”

in CRH’s Annual Report on Form 10-K for the period ended December

31, 2024 as filed with the SEC and CRH's other filings with the

SEC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250226390295/en/

ir@crh.com media@crh.com

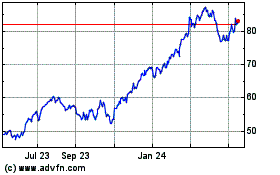

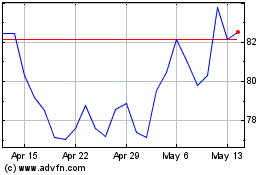

CRH (NYSE:CRH)

Historical Stock Chart

From Jan 2025 to Feb 2025

CRH (NYSE:CRH)

Historical Stock Chart

From Feb 2024 to Feb 2025