false

0001035201

0001035201

2024-08-01

2024-08-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report Pursuant to Section 13

or 15(d) of

The Securities Exchange Act of 1934

Date of Report (date of earliest event

reported): August 1, 2024

CALIFORNIA WATER SERVICE GROUP

(Exact name of Registrant as Specified in its

Charter)

Delaware

(State or other jurisdiction

of incorporation) |

1-13883

(Commission file number) |

77-0448994

(I.R.S. Employer

Identification Number) |

1720 North First Street

San Jose, California

(Address of principal executive offices) |

95112

(Zip Code) |

(408) 367-8200

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Shares, par value $0.01

|

|

CWT |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined by Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02. |

Results of Operations and Financial Condition |

On August 1,

2024, California Water Service Group (the “Company”) issued a press release (a copy of which is attached hereto as Exhibit

99.1 and incorporated herein by reference) announcing its financial results for the second quarter of 2024, ended June 30, 2024.

As announced, the Company will host a conference

call on Thursday, August 1, 2024, at 11:00 am EDT to discuss financial results and management’s business outlook. The financial

results announcement contains information about how to access the conference call and webcast. A slide presentation, which includes supplemental

information relating to the Company, will be used by management during the conference call. A copy of the slide presentation is attached

hereto as Exhibit 99.2 and is incorporated by reference herein. The Exhibits will be posted on the Company’s website at www.calwatergroup.com

under the “Investor Relations” tab.

The information furnished pursuant to Item 2.02

of this Current Report shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended,

or the Exchange Act, except as expressly set forth by specific reference in such a filing.

| Item 9.01. |

Financial Statements and Exhibits. |

We hereby furnish the following exhibits, which

shall not be deemed “filed” for the purposes of Section 18 of the Exchange Act, with this report:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CALIFORNIA WATER SERVICE GROUP |

| |

|

|

| Date: August 1, 2024 |

By: |

/s/ James P. Lynch |

| |

Name: |

James P. Lynch |

| |

Title: |

Senior Vice President, Chief Financial Officer and Treasurer |

Exhibit 99.1

California Water Service Group Reports Second

Quarter Results

SAN

JOSE, Calif., August 1, 2024 (GLOBE NEWSWIRE) -- California Water Service Group (“Group” or “Company,”

NYSE: CWT), a leading publicly traded water utility serving California, Hawaii, New Mexico, Washington, and Texas, today reported financial

results for the second quarter of 2024.

Highlights included:

| · | Diluted

earnings per share of $0.70 in Q2 2024, compared to $0.17 in Q2 2023. |

| · | $214.4

million of capital invested in water system infrastructure for the first six months of 2024. |

| · | Declaration

of the 318th consecutive quarterly dividend in the amount of $0.28 per share. |

| · | Filing

of the 2024 General Rate Case (GRC) and Infrastructure Improvement Plans for 2025-2027 with

the California Public Utilities Commission (CPUC). The application also proposes a Low-Use

Water Equity Program, which would decouple revenue from water sales, to assist low-water-using,

lower-income customers. |

| · | Affirmation

of our S&P Global credit rating of A+ Stable for California Water Service Company. |

According to Chairman and Chief Executive

Officer Martin A. Kropelnicki, financial results continued to benefit from the effects of the 2021 California General Rate Case decision

received on March 7, 2024.

“I’m pleased to see the effects

of the 2021 decision on our results. I’m equally pleased with our team’s effort to put together a 2024 California General

Rate Case that reflects our dedication to investing diligently in infrastructure, managing expenses responsibly, and structuring rates

to keep bills affordable for customers. It reflects our continuing commitment to providing a reliable, sustainable water supply for generations

to come,” he said.

Q2 2024 Financial Results

| · | Net

income attributable to Group was $40.6 million in Q2 2024, compared to net income of $9.6

million in Q2 2023. |

| · | Operating

revenue was $244.3 million, compared to $194.0 million in Q2 2023, an increase of $50.3 million. |

| o | Increased

rates added $19.3 million in revenue. |

| o | Increased

accrued unbilled revenue as a result of an increase in customer rates and unbilled days added

$10.4 million. |

| o | Rate

mechanisms approved in the 2021 California GRC added $16.7 million. Reported revenues from

the same quarter in the prior year did not reflect these mechanisms. |

| · | Operating

expenses were $196.1 million in Q2 2024, compared to $178.1 million in Q2 2023, an increase

of $18.0 million. |

| o | Water

production costs increased by $6.8 million to $77.6 million, primarily due to an increase

in wholesale rates and water usage. |

| o | Income

tax expenses increased $8.4 million to $8.7 million, primarily due to the increase in pre-tax

income. |

Year-to-Date 2024 Financial Results

| · | Net

income attributable to Group was $110.5 million for the six-month period ended June 30,

2024, or $1.90 diluted earnings per share, compared to a net loss of $12.7 million, or ($0.23)

per diluted earnings per share, in the same period last year. |

| · | Operating

revenue was $515.0 million for the six months ended June 30, 2024, compared to $325.1

million in the same period in 2023, an increase of $189.9 million. |

| o | A

cumulative adjustment for the impacts of the 2021 California GRC decision added $131.5 million. |

| o | Increased

rates added $31.6 million in revenue. |

| o | Recognition

of $16.0 million of previously deferred WRAM revenue as a result of securing California Extended

Water and Wastewater Arrearages Payment Program funds for the payment of eligible customer

balances. |

| · | Operating

expenses for the six months ended June 30, 2024, were $389.0 million, compared to $326.7

million in the same period in 2023. |

| o | Water

production costs increased by $16.0 million, mostly due to recording a cumulative adjustment

of $9.2 million for the impacts of the 2021 California GRC in 2024 and increases in rates

and water production. |

| o | Other

operations expense increased $10.1 million, primarily due to the recognition of $13.6 million

of costs associated with the revenue deferral decrease. |

| o | Income

taxes increased $29.5 million, due mostly to an increase in pre-tax net operating income

due to the recognition of the 2021 California GRC. |

As a result of the Q1 2024 adoption of the 2021 California GRC, interim

rate relief attributable to 2023 totaling $64.0 million was recognized in 2024 operating revenue, including $18.7 million and $35.4 million

that were attributable to the three and six months ended June 30, 2023, respectively.

Liquidity, Financing, and Capital Investment

As of June 30, 2024, Group maintained

$82.7 million of cash, of which $45.4 million was classified as restricted, and had additional short-term borrowing capacity of $355

million, subject to meeting the borrowing conditions on the Group and Cal Water lines of credit.

Group capital investments during the six-month

period ended June 30, 2024, totaled $214.4 million, represents 56% of Group’s estimated $385 million capital investment target

for 2024.

Cal Water Files Infrastructure Improvement

Plan for 2024 California General Rate Case; Plans to Invest $1.6 Billion in its California Water Systems in Upcoming Three Years

On July 8, 2024, Group’s largest

subsidiary, California Water Service (Cal Water), submitted Infrastructure Improvement Plans for 2025-2027 as part of its triennial GRC

filing. The application to the CPUC also proposes a Low-Use Water Equity Program, which would decouple revenue from water sales, to assist

low-water-using, lower-income customers.

Cal Water proposes to invest more than $1.6

billion in its districts from 2025-2027, including approximately $1.3 billion of newly proposed capital investments, to support its ability

to continue to provide a reliable supply of high-quality water.

To enhance affordability—particularly

for low-use and low-income customers, Cal Water’s application proposes a Low-Use Water Equity Program that would decouple revenue

from water sales across its regulated service areas. The program is designed to work in conjunction with Cal Water’s proposed progressive,

four-tier rate design and sales forecast proposals to keep rates affordable, reinforce conservation goals, and provide the utility an

opportunity to recover its authorized revenue requirement in a timely manner.

In its application, Cal Water has proposed

to change 2024 rates to increase 2026 total revenue by $140.6 million, or 17.1%. Cal Water also proposes rate increases of $74.2 million,

or 7.7%, in 2027; and $83.6 million, or 8.1%, in 2028.

The triennial filing begins an approximately

18-month review process by the CPUC.

Company Hosts Emergency Response Exercises

in Hawaii and Responds to the Butte County Thompson Fire

To enhance

coordination during emergencies, the Company’s Hawaii subsidiary, Hawaii Water Service (Hawaii Water), hosted representatives

from emergency response and regulatory agencies, elected and State offices, utilities, contractors, and other community partners for

Community Emergency Operations Center (EOC) exercises in early July on both Maui and the Big Island.

Attendees of

the Maui exercise, which included both an emergency response course using the Incident Command System and a hands-on disaster simulation,

were Hawaii local and state representatives and representatives from the Maui Police Department, Maui Department of Water Supply,

Hawaiian Electric, and the Hawaii Public Utilities Commission. Attendees of the Hawaii island exercise included representatives from

Hawaii County Fire, Hawaii Wildfire Management Organization (Firewise), Hawaii County Civil Defense, Community Emergency Response Team

(CERT) – Waikoloa, and Hawaii Rural Water Association.

Emergency response training is regularly

conducted throughout the Company. In July, when the Butte County Thompson Fire threatened Oroville, Calif., Cal Water activated emergency

operations, brought in additional resources to help manage the water system and communicate with customers, and embedded with the Butte

County emergency operations center. None of the utility’s assets were impacted during the fire, which burned 3,789 acres over a

six-day period.

Company Continues to Pursue Recovery for

PFAS Contamination Costs

In April, the U.S. Environmental Protection

Agency adopted a new National Primary Drinking Water Regulation to limit certain per- and polyfluoroalkyl substances (PFAS) in drinking

water. Under the new regulation, public water systems across the country are required to monitor for these PFAS by 2027 and to comply

with applicable maximum contaminant levels by 2029.

Although

this regulation faces legal challenges, the Company is proceeding with compliance efforts and believes it is well positioned to comply

within the designated timeline. At the same time, it is vigorously pursuing financial recovery from responsible parties. Group

has submitted its initial claims in the 3M and DuPont class action settlements and will continue to seek cost recovery wherever it is

appropriate to do so.

Separately, the EPA recently designated two of the most common PFAS,

specifically PFOA and PFOS, as hazardous substances under the Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA).

ESG Progress is Highlighted in the Company’s

New ESG Report

In

May, the Company released its 2023 ESG Report and ESG Analyst Download. The ESG Report—which is aligned with

recognized reporting frameworks and standards, including the Sustainability Accounting Standards Board Water Utilities & Services

Industry Standards, the Recommendations of the Task Force on Climate-Related Financial Disclosures, and the Global Reporting Initiative

Standards—details progress made by Group's subsidiaries on the Company's ESG focus areas last year, while the supplemental ESG

Analyst Download provides key ESG data and metrics.

This year's ESG Report highlights both ongoing

efforts to support Group's ESG strategy and objectives along with significant achievements in 2023, such as how the Company is working

to protect the planet, serve customers, and engage the Company’s workforce.

For

additional details, please see Form 10-Q which will be available at https://www.calwatergroup.com/investors/financials-filings-reports/sec-filings

Quarterly Earnings Teleconference

All

stockholders and interested investors are invited to attend the conference call on August 1, 2024 at 8 a.m. PT (11 a.m. ET)

by dialing 1-800-715-9871 or 1-646-307-1963 and keying in ID# 5681819, or you may access the live audio webcast at https://edge.media-server.com/mmc/p/nfn5956c

.. Please join at least 15 minutes in advance to ensure a timely connection to the call. A replay of the call will be

available from 2:00 p.m. ET on Thursday, August 1, 2024, through Monday, September 30, 2024, at 1-800-770-2030 or 1-609-800-9909

and key in ID# 5681819, or by accessing the webcast above. The call will be hosted by Chairman, President and Chief Executive Officer

Martin A. Kropelnicki, Senior Vice President, Chief Financial Officer and Treasurer James P. Lynch, and Vice President Rates and Regulatory

Affairs, Greg A. Milleman. Prior to the call, Cal Water will furnish a slide presentation on its website.

About California Water Service Group

California

Water Service Group is the parent company of regulated utilities California Water Service, Hawaii Water Service, New Mexico Water Service,

and Washington Water Service, as well as Texas Water Service, a utility holding company. Together, these companies provide regulated

and non-regulated water and wastewater service to more than 2.1 million people in California, Hawaii, New Mexico, Washington, and Texas.

California Water Service Group’s common stock trades on the New York Stock Exchange under the symbol “CWT.” Additional

information is available online at www.calwatergroup.com.

This news release contains forward-looking

statements within the meaning established by the Private Securities Litigation Reform Act of 1995 (“PSLRA”). The forward-looking

statements are intended to qualify under provisions of the federal securities laws for “safe harbor” treatment established

by the PSLRA. Forward-looking statements in this news release are based on currently available information, expectations, estimates,

assumptions and projections, and our management’s beliefs, assumptions, judgments and expectations about us, the water utility

industry and general economic conditions. These statements are not statements of historical fact. When used in our documents, statements

that are not historical in nature, including words like will, would, expects, intends, plans, believes, may, could, estimates, assumes,

anticipates, projects, progress, predicts, hopes, targets, forecasts, should, seeks or variations of these words or similar expressions

are intended to identify forward-looking statements. Examples of forward-looking statements in this news release include, but are not

limited to, statements describing Group’s plans and proposal pursuant to Cal Water’s general rate case filed on July 8,

2024, and Group’s expectations regarding compliance with PFAS regulations and pursuit of cost recovery in relation to PFAS contamination.

Forward-looking statements are not guarantees of future performance. They are based on numerous assumptions that we believe are reasonable,

but they are open to a wide range of uncertainties and business risks. Consequently, actual results may vary materially from what is

contained in a forward-looking statement. Factors that may cause actual results to be different than those expected or anticipated include,

but are not limited to: the outcome and timeliness of regulations commissions’ actions concerning rate relief and other matters,

including with respect to the 20224 California GRC; changes in regulatory commissions’ policies and procedures, such as the CPUC’s

decision in 2020 to preclude companies from proposing fully decoupled WRAMs, which impacted the 2021 California GRC Filing; governmental

and regulatory commissions’ decisions, including decisions on proper disposition of property; consequences of eminent domain actions

related to our water systems; increased risk of inverse condemnation losses as a result of climate change and drought; our ability to

renew leases to operate water systems owned by others on beneficial terms; changes in California State Water Resources Control Board

water quality standards; changes in environmental compliance and water quality requirements; electric power interruptions, especially

as a result of public safety power shutoff programs; housing and customer growth; the impact of opposition to rate increases; our ability

to recover costs; availability of water supplies; issues with the implementation, maintenance or security of our information technology

systems; civil disturbances or terrorist threats or acts; the adequacy of our efforts to mitigate physical and cyber security risks and

threats; the ability of our enterprise risk management processes to identify or address risks adequately; labor relations matters as

we negotiate with the unions; changes in customer water use patterns and the effects of conservation, including as a result of drought

conditions; our ability to complete, in a timely manner or at all, successfully integrate and achieve anticipated benefits from announced

acquisitions; the impact of weather, climate change, natural disasters, and actual or threatened public health emergencies, including

disease outbreaks, on our operations, water quality, water availability, water sales and operating results and the adequacy of our emergency

preparedness; restrictive covenants in or changes to the credit ratings on our current or future debt that could increase our financing

costs or affect our ability to borrow, make payments on debt or pay dividends; risks associated with expanding our business and operations

geographically; the impact of stagnating or worsening business and economic conditions, including inflationary pressures, general economic

slowdown or a recession, increasing interest rates, instability of certain financial institutions, changes in monetary policy, adverse

capital markets activity or macroeconomic conditions as a result of the geopolitical conflicts, and the prospect of a shutdown of the

U.S. federal government; the impact of market conditions and volatility on unrealized gains or losses on our non-qualified benefit plan

investments and our operating results; the impact of weather and timing of meter reads on our accrued unbilled revenue; the impact of

evolving legal and regulatory requirements, including emerging environmental, social and governance requirements and our ability to comply

with PFAS regulations; and other risks and unforeseen events described in our Securities and Exchange Commission (“SEC”)

filings. In light of these risks, uncertainties and assumptions, investors are cautioned not to place undue reliance on forward-looking

statements, which speak only as of the date of this news release. When considering forward-looking statements, you should keep in mind

the cautionary statements included in this paragraph, as well as the Annual Report on Form 10-K, Quarterly 10-Q, and other reports

filed from time-to-time with the SEC. We are not under any obligation, and we expressly disclaim any obligation to update or alter any

forward-looking statements, whether as a result of new information, future events or otherwise.

Contact

James P. Lynch

(408) 367-8200 (analysts)

Shannon Dean

(408) 367-8243 (media)

CALIFORNIA WATER SERVICE GROUP

CONDENSED CONSOLIDATED BALANCE SHEETS

Unaudited

(In thousands, except per share data)

| |

June 30,

2024 | | |

December 31,

2023 | |

| ASSETS | |

| | | |

| | |

| Utility plant: | |

| | | |

| | |

| Utility plant | |

$ | 5,141,580 | | |

$ | 4,925,483 | |

| Less accumulated depreciation and amortization | |

| (1,199,399 | ) | |

| (1,152,228 | ) |

| Net utility plant | |

| 3,942,181 | | |

| 3,773,255 | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

| 37,272 | | |

| 39,591 | |

| Restricted cash | |

| 45,403 | | |

| 45,375 | |

| Receivables: | |

| | | |

| | |

| Customers, net | |

| 71,125 | | |

| 59,349 | |

| Regulatory balancing accounts | |

| 5,495 | | |

| 64,240 | |

| Other, net | |

| 17,110 | | |

| 16,431 | |

| Accrued unbilled revenue, net | |

| 48,812 | | |

| 36,999 | |

| Materials and supplies | |

| 17,645 | | |

| 16,170 | |

| Taxes, prepaid expenses, and other assets | |

| 23,948 | | |

| 18,130 | |

| Total current assets | |

| 266,810 | | |

| 296,285 | |

| Other assets: | |

| | | |

| | |

| Regulatory assets | |

| 397,498 | | |

| 257,621 | |

| Goodwill | |

| 37,039 | | |

| 37,039 | |

| Other assets | |

| 227,714 | | |

| 231,333 | |

| Total other assets | |

| 662,251 | | |

| 525,993 | |

| TOTAL ASSETS | |

$ | 4,871,242 | | |

$ | 4,595,533 | |

| CAPITALIZATION AND LIABILITIES | |

| | | |

| | |

| Capitalization: | |

| | | |

| | |

| Common stock, $0.01 par value; 136,000 shares authorized, 58,825 and 57,724 outstanding on June 30, 2024 and December 31, 2023, respectively | |

$ | 588 | | |

$ | 577 | |

| Additional paid-in capital | |

| 929,376 | | |

| 876,583 | |

| Retained earnings | |

| 627,705 | | |

| 549,573 | |

| Accumulated other comprehensive loss | |

| (13,068 | ) | |

| — | |

| Noncontrolling interests | |

| 3,090 | | |

| 3,579 | |

| Total equity | |

| 1,547,691 | | |

| 1,430,312 | |

| Long-term debt, net | |

| 1,051,792 | | |

| 1,052,768 | |

| Total capitalization | |

| 2,599,483 | | |

| 2,483,080 | |

| Current liabilities: | |

| | | |

| | |

| Current maturities of long-term debt, net | |

| 1,183 | | |

| 672 | |

| Short-term borrowings | |

| 245,000 | | |

| 180,000 | |

| Accounts payable | |

| 143,533 | | |

| 157,305 | |

| Regulatory balancing accounts | |

| 12,754 | | |

| 21,540 | |

| Accrued interest | |

| 6,666 | | |

| 6,625 | |

| Accrued expenses and other liabilities | |

| 103,364 | | |

| 64,197 | |

| Total current liabilities | |

| 512,500 | | |

| 430,339 | |

| Deferred income taxes | |

| 363,597 | | |

| 352,762 | |

| Regulatory liabilities | |

| 742,842 | | |

| 683,717 | |

| Pension | |

| 83,266 | | |

| 82,920 | |

| Advances for construction | |

| 199,640 | | |

| 199,448 | |

| Contributions in aid of construction | |

| 289,820 | | |

| 286,491 | |

| Other | |

| 80,094 | | |

| 76,776 | |

| Commitments and contingencies | |

| | | |

| | |

| TOTAL CAPITALIZATION AND LIABILITIES | |

$ | 4,871,242 | | |

$ | 4,595,533 | |

CALIFORNIA WATER SERVICE GROUP

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

Unaudited

(In thousands, except per share data)

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Operating revenue | |

$ | 244,299 | | |

$ | 194,044 | | |

$ | 515,048 | | |

$ | 325,144 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Operations: | |

| | | |

| | | |

| | | |

| | |

| Water production costs | |

| 77,644 | | |

| 70,867 | | |

| 141,829 | | |

| 125,875 | |

| Administrative and general | |

| 32,042 | | |

| 34,975 | | |

| 67,638 | | |

| 70,961 | |

| Other operations | |

| 25,626 | | |

| 25,823 | | |

| 52,551 | | |

| 42,427 | |

| Maintenance | |

| 8,790 | | |

| 7,155 | | |

| 16,800 | | |

| 15,133 | |

| Depreciation and amortization | |

| 32,978 | | |

| 29,824 | | |

| 65,822 | | |

| 59,739 | |

| Income tax expense (benefit) | |

| 8,689 | | |

| 329 | | |

| 24,227 | | |

| (5,315 | ) |

| Property and other taxes | |

| 10,364 | | |

| 9,122 | | |

| 20,121 | | |

| 17,899 | |

| Total operating expenses | |

| 196,133 | | |

| 178,095 | | |

| 388,988 | | |

| 326,719 | |

| Net operating income (loss) | |

| 48,166 | | |

| 15,949 | | |

| 126,060 | | |

| (1,575 | ) |

| Other income and expenses: | |

| | | |

| | | |

| | | |

| | |

| Non-regulated revenue | |

| 5,513 | | |

| 4,485 | | |

| 10,611 | | |

| 9,108 | |

| Non-regulated expenses | |

| (4,125 | ) | |

| (2,957 | ) | |

| (6,079 | ) | |

| (5,232 | ) |

| Other components of net periodic benefit credit | |

| 4,338 | | |

| 4,756 | | |

| 7,611 | | |

| 9,977 | |

| Allowance for equity funds used during construction | |

| 1,819 | | |

| 1,355 | | |

| 3,561 | | |

| 2,759 | |

| Income tax expense on other income and expenses | |

| (1,306 | ) | |

| (1,445 | ) | |

| (2,627 | ) | |

| (3,239 | ) |

| Net other income | |

| 6,239 | | |

| 6,194 | | |

| 13,077 | | |

| 13,373 | |

| Interest expense: | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| 14,840 | | |

| 13,491 | | |

| 30,640 | | |

| 26,309 | |

| Allowance for borrowed funds used during construction | |

| (812 | ) | |

| (795 | ) | |

| (1,570 | ) | |

| (1,624 | ) |

| Net interest expense | |

| 14,028 | | |

| 12,696 | | |

| 29,070 | | |

| 24,685 | |

| Net income (loss) | |

| 40,377 | | |

| 9,447 | | |

| 110,067 | | |

| (12,887 | ) |

| Net loss attributable to noncontrolling interests | |

| (174 | ) | |

| (109 | ) | |

| (401 | ) | |

| (232 | ) |

| Net income (loss) attributable to California Water Service Group | |

$ | 40,551 | | |

$ | 9,556 | | |

$ | 110,468 | | |

$ | (12,655 | ) |

| Earnings (loss) per share of common stock: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.70 | | |

$ | 0.17 | | |

$ | 1.90 | | |

$ | (0.23 | ) |

| Diluted | |

$ | 0.70 | | |

$ | 0.17 | | |

$ | 1.90 | | |

$ | (0.23 | ) |

| Weighted average shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 58,292 | | |

| 56,692 | | |

| 58,013 | | |

| 56,182 | |

| Diluted | |

| 58,325 | | |

| 56,730 | | |

| 58,046 | | |

| 56,182 | |

| Dividends per share of common stock | |

$ | 0.28 | | |

$ | 0.26 | | |

$ | 0.56 | | |

$ | 0.52 | |

Exhibit 99.2

Second Quarter 2024 Earnings Presentation August 1, 2024

2 Today’s Speakers Marty Kropelnicki Chairman & CEO James Lynch Sr. Vice President, CFO & Treasurer Greg Milleman Vice President, Rates & Regulatory Affairs

3 This presentation contains forward - looking statements within the meaning established by the Private Securities Litigation Reform Act of 1995 (“ PSLRA ”). The forward - looking statements are intended to qualify under provisions of the federal securities laws for “safe harbor” treatment established by the PSLRA . Forward - looking statements in this presentation are based on currently available information, expectations, estimates, assumptio ns and projections, and our management’s beliefs, assumptions, judgments and expectations about us, the water utility industry and general economic conditions. These statement s a re not statements of historical fact. When used in our documents, statements that are not historical in nature, including words like will, would, expects, intends, plans, believes, ma y, could, estimates, assumes, anticipates, projects, progress, predicts, hopes, targets, forecasts, should, seeks, commits or variations of these words or similar expressions are in tended to identify forward - looking statements. Examples of forward - looking statements in this presentation include, but are not limited to, statements describing our expectations around c apital investment and depreciation, regulated rate base and customer growth, adequacy of our cash position, the 2024 California General Rate Case (“ GRC ”) filing, strategic investments and acquisitions and our commitment to reduce Scope 1 & 2 GHG emissions. Forward - looking statements are not guarantees of future performance. They are based on numerous assumptions t hat we believe are reasonable, but they are open to a wide range of uncertainties and business risks. Consequently, actual results may vary materially from what is contained in a forward - looking statement. Factors that may cause actual results to be different than those expected or anticipated include, but are not limited to: the outcome and timeliness of regulatory commissions’ actions concerning rate relief and other matters, including with respect to the 2024 California GRC filing; changes in regulatory commissions’ policies and procedures, such as the CPUC’s decision in 2020 to preclude companies from proposing fully decoupled WRAMs , which impacted the 2021 California GRC filing; our ability to invest or apply the proceeds from the issuance of common stock in an accretive manner; governmental and regulatory commissions’ decisions, including decisions on proper disposition of property; con sequences of eminent domain actions relating to our water systems; increased risk of inverse condemnation losses as a result of climate change and drought; our ability to renew lea ses to operate water systems owned by others on beneficial terms; changes in California State Water Resources Control Board water quality standards; changes in environmental co mpliance and water quality requirements; electric power interruptions, especially as a result of public safety power shutoff programs; housing and customer growth; the impact of opposition to rate increases; our ability to recover costs; availability of water supplies; issues with the implementation, maintenance or security of our information technology systems ; c ivil disturbances or terrorist threats or acts; the adequacy of our efforts to mitigate physical and cyber security risks and threats; the ability of our enterprise risk managem ent processes to identify or address risks adequately; labor relations matters as we negotiate with the unions; changes in customer water use patterns and the effects of conservation, in clu ding as a result of drought conditions; our ability to complete, in a timely manner or at all, successfully integrate and achieve anticipated benefits from announced acquisitions; the impact of weather, climate change, natural disasters, and actual or threatened public health emergencies, including disease outbreaks, on our operations, water quality, water availabi lit y, water sales and operating results and the adequacy of our emergency preparedness; restrictive covenants in or changes to the credit ratings on our current or future debt that coul d i ncrease our financing costs or affect our ability to borrow, make payments on debt or pay dividends; risks associated with expanding our business and operations geographically; the impac t o f stagnating or worsening business and economic conditions, including inflationary pressures, general economic slowdown or a recession, increasing interest rates, instabilit y o f certain financial institutions, changes in monetary policy, adverse capital markets activity or macroeconomic conditions as a result of geopolitical conflicts, and the prospect of a shu tdo wn of the U.S. federal government; the impact of market conditions and volatility on unrealized gains or losses on our non - qualified benefit plan investments and our operating results; the impact of weather and timing of meter reads on our accrued unbilled revenue; the impact of evolving legal and regulatory requirements, including emerging environmental, social and governance requirements and our ability to comply with PFAS regulations; and other risks and unforeseen events described in our Securities and Exchange Commission (“SEC”) fili ngs . In light of these risks, uncertainties and assumptions, investors are cautioned not to place undue reliance on forward - looking statements, which speak only as of the date of this news release. When considering forward - looking statements, you should keep in mind the cautionary statements included in this paragraph, as well as the Annual Report on Form 10 - K, Quarter ly Reports on Form 10 - Q, and other reports filed from time - to - time with the SEC. We are not under any obligation, and we expressly disclaim any obligation, to update or alter any for ward - looking statements, whether as a result of new information, future events or otherwise. A credit rating is not a recommendation to buy, sell or hold any securities, may be cha nged at any time by the applicable ratings agency and should be evaluated independently of any other information. Forward - Looking Statements and Other Important Information

4 Highlights from the Period Operating results benefitted from resolution of 2021 CA GRC Company filed 2024 CA GRC / Infrastructure Improvement Plans for 2025 - 2027 CA Supreme Court voided the portion of CPUC decision related to elimination of decoupling, finding CPUC did not follow required process Hawaii Water hosted emergency response exercises with multiple agencies participating Company continued to pursue cost recovery for treatment required to meet new PFAS regulation set by EPA Newly published 2023 ESG Report highlights sustainability progress 1 2 3 4 5 6

5 Second Quarter 2024 Financials (in millions except EPS amounts & % s) Q2 2024 Q2 2023 Variance Operating Revenue $244.3 $194.0 25.9% Operating Expenses $196.1 $178.1 10.1% Net Interest Expense $14.0 $12.7 10.2% Net Income Attributable to CWT $40.6 $9.6 322.9% Diluted Earnings per Share $0.70 $0.17 311.8% Note: Due to adoption of the 2021 CA GRC , Q1 2024 operating revenue included interim rate relief totaling $ 64M attributable to 2023, of which $ 18.7M was attributable to Q2 2023.

Diluted EPS Bridge Q2 2023 to Q2 2024 Reflects regulatory approval of Cal Water’s 2021 GRC in Q1 24 6 $0.00 $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 $0.70 $0.80 $0.90 - $0.04 - $0.02 $0.17 - $0.09 $0.08 $0.26 $ 0.23 $0.14 - $0.03 $0.70

7 Second Quarter 2024 Financials 7 (in millions except EPS amounts & % ) YTD 2024 YTD 2023 Variance Operating Revenue $515.0 $325.1 58.4% Operating Expenses $389.0 $326.7 19.1% Net Interest Expense $29.1 $24.7 17.8% Net Income (loss) Attributable to CWT $110.5 ($12.7) 970% Diluted Earnings (Loss) per Share $1.90 ($0.23) 926% Note: Due to adoption of the 2021 CA GRC , Q1 2024 operating revenue included interim rate relief totaling $ 64M attributable to 2023, of which $ 35.4M was attributable to the year - to - date period ended 6/30/23.

Diluted EPS Bridge YTD 2023 to YTD 2024 Reflects regulatory approval of Cal Water’s 2021 GRC in Q1 24 8 -$0.40 -$0.10 $0.20 $0.50 $0.80 $1.10 $1.40 $1.70 $2.00 $2.30 - $0.08 - $0.06 - $0.23 - $0.13 $0.11 $0.44 $1.82 $0.22 - $0.19 $ 1.90

9 Capital Investment & Depreciation Growth in capital investment outpaces depreciation 2015 - 2023 TOTAL CapEx 3x DEPRECIATION $177 $229 $259 $272 $274 $299 $293 $328 $384 $385 $660 $750 $655 $61 $64 $77 $84 $89 $99 $109 $115 $124 $133 $224 $263 $233 $0 $100 $200 $300 $400 $500 $600 $700 $800 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024* 2025** 2026** 2027** Capital Investment Depreciation (in millions) *Estimates for 2024: Capital Investment through Q2 2024 was $ 214.4M ; depreciation through Q2 2024 was $ 65.8M . **Estimates for 2025 - 2027 are based on amounts requested in the 2024 GRC application in CA plus estimated capital expenditures in other states; these capital expenditures are subject to review and approval by the CPUC and other regulators. Note: Estimates for 2024 - 2027 exclude $ 226.0M of estimated PFAS - related capital investments that will be incurred over multiple years.

10 Regulated Rate Base Growth Estimated to achieve over $3.3 billion by 2027 $1.24 $1.26 $1.61 $1.87 $2.01 $2.20 $2.36 $2.58 $2.93 $3.35 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 2018 2019 2020 2021 2022 2023 2024* 2025** 2026** 2027** (in billions) *2024 rate base estimates include amounts authorized in 2021 GRC plus estimated rate base in other states; these values are n ot yet adopted and are subject to review and approval by the CPUC and other regulators. **2025 - 2027 rate base estimates include amounts requested in the 2024 CA GRC plus estimated rate base in other states; these values are not yet adopted and are subject to review and approval by the CPUC and other regulators. Note: Amounts presented for 2024 - 2027 exclude estimated $ 226.0M in PFAS treatment capital investments that will be incurred over multiple years.

Capital Allocation | Balance Sheet Continued to maintain financial discipline with strong balance sheet, while allocating capital in efficient manner Maintained Board - authorized equity ATM program and used opportunistically to raise incremental funds to support capital growth and investments in the business 11 Strong capital structure of 59.5% equity and 40.5% debt supportive of future capital growth S&P affirmed a global credit rating of A+ Stable for California Water Service Statistics as of June 30, 2024, except dividend data Declared 318 th consecutive quarterly dividend of $0.28 per share

Liquidity Profile Group maintained strong liquidity profile to help execute capital plan and pursue strategic M&A investments • Expect to have adequate cash to support capital investment and growth • Credit facility of $600 million that can be expanded up to $800 million • Extended maturity of credit facilities to March 2028 • Global credit rating A+/stable affirmed at S&P Global • First Mortgage Bonds rated AA - • Strong capital position of 59.5% equity and 40.5% debt Statistics as of June 30, 2024 12 (in millions) $37.3 $45.4 $355.0 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 Unrestricted cash Restricted Cash Available Credit

13 2024 California General Rate Case Filing Filing requests total revenue increases of : • $ 140 . 6 million , or 17 . 1 % , for 2026 • $ 74 . 2 million , or 7 . 7 % , for 2027 • $ 83 . 6 million , or 8 . 1 % , for 2028 13 Investment proposed in/for Cal Water districts from 2025 - 27 $ 1.6B Application proposes Low - Use Water Equity Program that would decouple revenue from water sales to enhance affordability LUWEP Month - long process begun for triennial filing with CPUC 18

Group Hosts Emergency Exercises, Responds to Wildfires Hawaii Emergency Exercises • Hawaii Water hosted emergency response and regulatory agencies, elected and State offices, utilities, contractors, and other community partners for Community EOC exercises in July on Maui and Big Island • Exercises included both emergency response course using Incident Command System and hands - on disaster simulation 14 Thompson, Park & Borel Fires • Cal Water activated EOC in early July when Thompson Fire threatened Oroville service area, again in late July when Park Fire broke out on northeast edge of Chico service area and Borel Fire threatened Kern River Valley systems • Cal Water brought in additional resources to help manage water systems and communicate with customers, embedded with Butte County EOC , and is supporting Kern County EOC • None of utility’s assets impacted during the fires, which burned 3,800 acres (Thompson), 368,000+ acres (Park), and 53,000+ acres (Borel)* • Company continuing to support impacted employees *As of July 30, 2024

EPA adopted new National Primary Drinking Water Regulation to limit certain PFAS in Q2 2024 Group has been preparing for new regulation and believes well positioned to meet requirements before compliance deadlines EPA also designated 2 PFAS as hazardous substances under Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA) Group leading water industry efforts on treatment cost recovery from PFAS manufacturers, recently submitted Phase 1 claim forms in 3M & DuPont class action settlements Group Executing Plan to Meet New PFAS Standards and Continues to Pursue Cost Recovery 15

Acquisitions Group continues to pursue diversification into compelling states including HI, WA, NM & TX • Completed acquisition of Kings Mountain Park Mutual Water Company in Q 2 ; although small, enhances water supply reliability and system resiliency • Anticipated growth opportunities should allow Group to achieve ~ 1 % growth target on average over next 5 years • New customer connections for BVRT have increased average of 20 % year - over - year over the past 5 years 16 ~1% Targeted annual cumulative addition of customers through new business development activities (announced in 2019) 36,000+ Total connections added through acquisitions since 2019

In May, Company released 2023 ESG Report and ESG Analyst Download, which: Aligns with Sustainability Accounting Standards Board Water Utilities & Services Industry Standards References Recommendations of the Task Force on Climate - Related Financial Disclosures ( TCFD ) References Global Reporting Initiative Standards ( GRI ) 2023 ESG Report Published Highlighting environmental, social, and governance efforts and strategic initiatives for 2024 17 Report highlights ongoing efforts to support Group's ESG strategy and objectives along with significant achievements in 2023, including: Invested in employee development $ 728K Contributed to local charities $ 1.5M Of $ 83M in secured state funds applied to eligible customers with past - due pandemic - period balances $ 58M Compliance with primary & secondary water quality standards 100% Gallons saved from water conservation programs implemented in 2023 95M Reduction commitment in Scope 1 & 2 GHG emissions by 2035 (from 2021 base year) 63%

Questions?

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

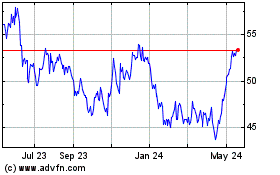

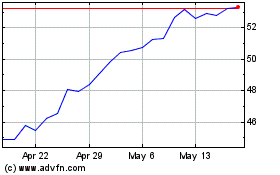

California Water Service (NYSE:CWT)

Historical Stock Chart

From Jan 2025 to Feb 2025

California Water Service (NYSE:CWT)

Historical Stock Chart

From Feb 2024 to Feb 2025