Destra Multi-Alternative Fund Announces Launch of Monthly Distribution Program

27 February 2025 - 1:00AM

Business Wire

The Destra Multi-Alternative Fund (the “Fund” or “DMA”), a

closed-end fund traded on the New York Stock Exchange under the

symbol DMA, is pleased to announce that its Board of Trustees have

approved a monthly distribution policy for shareholders beginning

in March of 2025 and have declared per share dividends for March,

April, and May 2025. These announcements are detailed below:

March

April

May

DMA

$0.0725

$0.0725

$0.0725

Payment Date

3/31/2025

4/30/2025

5/30/2025

Record Date

3/20/2025

4/17/2025

5/19/2025

“The approval of monthly distributions by our Board of Trustees

reflects our steady financial improvement and our commitment to

delivering on shareholder value,” said Robert A. Watson, CFP®,

President of the Fund. “The distribution rate of $0.0725 cents per

share, which the Board has approved for the next three months,

reflects an ~8% annualized rate at the NAV as of February 24th of

$10.88 per share and that corresponds to an ~10.22% annualized rate

at the closing MKT price on the same date of $8.52.”

“We are pleased by the steady progress we have been able to

make, shifting more and more of the Fund’s portfolio into more

liquid, dynamic alpha seeking hedging strategies that we have

developed over many years here at Validex,” said Mark Scalzo,

Portfolio Manager and CIO of Validex Global Investing, the Fund’s

Sub-Adviser.

The Fund offers a Dividend Reinvestment Plan (“DRP”).

Shareholders who hold their shares at a broker dealer and would

like to participate in the DRP should contact their broker dealer

to set their reinvestment preferences. Shareholders who hold their

shares directly with the Fund will have all dividends declared on

the shares automatically reinvested in additional shares by the

Fund’s plan agent, Equiniti Trust Company, LLC (“EQ”), unless the

shareholder elects otherwise by contacting EQ. Shareholders who

elect not to participate in the DRP will receive all dividends and

other distributions in cash, paid by check and mailed directly to

the shareholder of record. Shareholders may obtain more information

on the shareholder services offered to the Fund by calling EQ at

the Fund’s dedicated toll free number 800-591-8238.

A portion of each distribution may be treated as paid from

sources other than net investment income, including but not limited

to short-term capital gain, long-term capital gain, or return of

capital. As required by Section 19(a) of the Investment Company Act

of 1940 and Rule 19a-1 thereunder, a notice will be distributed to

shareholders in the event that a portion of a monthly distribution

is derived from sources other than undistributed net investment

income. The final determination of the source and tax

characteristics of these distributions will depend upon the Fund’s

investment experience during its fiscal year and will be made after

the Fund’s fiscal year end. The Fund will send shareholders a Form

1099-DIV for the calendar year that will define how to report these

distributions for federal income tax purposes, but shareholders

should consult their own tax advisers regarding their specific tax

situations and to obtain a complete understanding of the tax

consequences. For further information regarding the Fund’s

distributions, please visit www.destracapital.com.

About Destra Multi-Alternative Fund

Destra Multi-Alternative Fund (NYSE: DMA) is a core alternative

solution that seeks to achieve long-term performance non-correlated

to the broad stock and bond markets. It invests primarily in

alternative strategies and asset classes including real estate,

direct private equity, alternative credit, and hedge

strategies.

About Destra Capital Advisors

Destra Capital Advisors LLC, based in Bozeman, MT, serves as

Investment Adviser and Secondary Market Servicing agent to the

Fund. Validus Growth Investors LLC (dba Validex Global Investing)

serves as the Investment Sub-Adviser to the Fund.

Shares of the Fund can be purchased on the New York Stock

Exchange through any securities broker.

Information regarding the Fund and Destra Capital Advisors can

be found at www.destracapital.com

Please contact Destra Capital Advisors LLC, the Fund’s

marketing, and investor support services agent, at

DMA@destracapital.com or call (877) 855-3434 if you have any

questions regarding DMA.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250226524343/en/

Destra Capital Advisors LLC DMA@destracapital.com (877)

855-3434

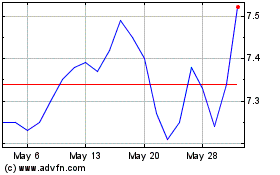

Destra Multi Alternative (NYSE:DMA)

Historical Stock Chart

From Jan 2025 to Feb 2025

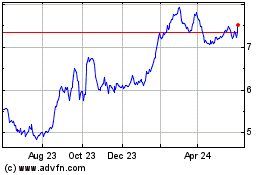

Destra Multi Alternative (NYSE:DMA)

Historical Stock Chart

From Feb 2024 to Feb 2025