Dycom Industries, Inc. (NYSE: DY) announced today its results for

the second quarter ended July 27, 2024. Contract revenues

increased 15.5% to $1.203 billion for the quarter ended

July 27, 2024, compared to $1.042 billion in the

year ago quarter. On an organic basis, contract revenues increased

9.2% after excluding $65.9 million of contract revenues from

acquired businesses that were not owned during the year ago

quarter.

Non-GAAP Adjusted EBITDA increased to $158.3 million, or

13.2% of contract revenues, for the quarter ended

July 27, 2024, compared to $130.8 million, or 12.6%

of contract revenues, in the year ago quarter.

On a GAAP basis, net income increased to $68.4 million, or

$2.32 per common share diluted, for the quarter ended

July 27, 2024, compared to $60.2 million, or $2.03 per

common share diluted, in the year ago quarter. Non-GAAP Adjusted

Net Income was $72.5 million, or $2.46 per common share

diluted for the quarter ended July 27, 2024.

During the quarter ended July 27, 2024, the Company

amended its credit agreement to, among other things, expand term

loan capacity and extend the maturity to January 2029.

Year-to-Date Highlights

Contract revenues increased 12.4% to $2.345 billion for the

six months ended July 27, 2024, compared to

$2.087 billion for the comparable year ago period. On an

organic basis, contract revenues increased 5.8% after excluding

$137.2 million of contract revenues from acquired businesses

that were not owned during the comparable year ago period.

Non-GAAP Adjusted EBITDA increased to $289.2 million, or 12.3%

of contract revenues, for the six months ended

July 27, 2024, compared to $244.3 million, or 11.7% of

contract revenues, for the comparable year ago period.

On a GAAP basis, net income increased to $131.0 million, or

$4.44 per common share diluted, for the six months ended

July 27, 2024, compared to $111.8 million, or $3.76

per common share diluted, for the comparable year ago period.

Non-GAAP Adjusted Net Income was $135.0 million, or $4.58 per

common share diluted for the six months ended

July 27, 2024.

During the six months ended July 27, 2024, the Company

purchased 210,000 shares of its own common stock in open market

transactions for $29.8 million at an average price of $141.84 per

share.

Outlook

For the quarter ending October 26, 2024, the Company

expects total contract revenues to increase mid- to high single

digit as a percentage of contract revenues, compared to $1.136

billion for the quarter ended October 28, 2023. Included in the

expectation for the current quarter is approximately $75 million of

acquired revenues, compared to the prior year period that included

$45.2 million of acquired revenues and $26.5 million of revenues

from the impacts of a change order and the closeout of several

projects.

Non-GAAP Adjusted EBITDA as a percentage of contract revenues

for the quarter ending October 26, 2024 is expected to

increase approximately 25 to 50 basis points compared to 12.9% for

the quarter ended October 28, 2023, after excluding 1.8% of

incremental benefit in EBITDA margin from the impacts of a change

order and the closeout of several projects reported in the prior

year period.

For additional information regarding the Company’s outlook,

please see the presentation materials available on the Company’s

website posted in connection with the conference call discussed

below.

Use of Non-GAAP Financial Measures

The Company reports its financial results in accordance with

U.S. generally accepted accounting principles (GAAP). In quarterly

results releases, trend schedules, conference calls, slide

presentations, and webcasts, the Company may use or discuss

Non-GAAP financial measures, as defined by Regulation G of the

Securities and Exchange Commission. See Reconciliation of Non-GAAP

Financial Measures to Comparable GAAP Financial Measures in the

press release tables that follow.

Conference Call Information and Other Selected

Data

The Company will host a conference call to discuss fiscal 2025

second quarter results on Wednesday, August 21,

2024 at 9:00 a.m. ET. Interested parties may participate

in the question and answer session of the conference call by

registering at

https://register.vevent.com/register/BI792f883035104fca9ba48d0d4da25061.

Upon registration, participants will receive a dial-in number and

unique PIN to access the call. Participants are encouraged to join

approximately ten minutes prior to the scheduled start time.

For all other attendees, a live listen-only audio webcast of the

call, including an accompanying slide presentation, can be accessed

directly at https://edge.media-server.com/mmc/p/rk4t4eoj. A replay

of the live webcast and the related materials will be available on

the Company's Investor Center website at

https://dycomind.com/investors for approximately 120 days

following the event.

About Dycom Industries, Inc.

Dycom is a leading provider of specialty contracting services to

the telecommunications infrastructure and utility industries

throughout the United States. These services include program

management; planning; engineering and design; aerial, underground,

and wireless construction; maintenance; and fulfillment services.

Additionally, Dycom provides underground facility locating services

for various utilities, including telecommunications providers, and

other construction and maintenance services for electric and gas

utilities.

Forward Looking Information

This press release contains forward-looking statements within

the meaning of the 1995 Private Securities Litigation Reform Act.

These forward-looking statements include those related to the

outlook for the quarter ending October 26, 2024,

including, but not limited to, those statements found under the

“Outlook” section of this press release. Forward-looking statements

are based on management’s expectations, estimates and projections,

are made solely as of the date these statements are made, and are

subject to both known and unknown risks and uncertainties that may

cause the actual results and occurrences discussed in these

forward-looking statements to differ materially from those

referenced or implied in the forward-looking statements contained

in this press release. The most significant of these known risks

and uncertainties are described in the Company’s Form 10-K, Form

10-Q, and Form 8-K reports (including all amendments to those

reports) and include future economic conditions and trends

including the potential impacts of an inflationary economic

environment, changes to customer capital budgets and spending

priorities, the availability and cost of materials, equipment and

labor necessary to perform our work, the adequacy of the Company’s

insurance and other reserves and allowances for doubtful accounts,

whether the carrying value of the Company’s assets may be impaired,

the future impact of any acquisitions or dispositions, adjustments

and cancellations of the Company’s projects, the impact to the

Company’s backlog from project cancellations or postponements, the

impacts of pandemics and public health emergencies, the impact of

varying climate and weather conditions, the anticipated outcome of

other contingent events, including litigation or regulatory actions

involving the Company, the adequacy of our liquidity, the

availability of financing to address our financials needs, the

Company’s ability to generate sufficient cash to service its

indebtedness, the impact of restrictions imposed by the Company’s

credit agreement, and other risks and uncertainties detailed from

time to time in the Company’s filings with the Securities and

Exchange Commission. The Company does not undertake any obligation

to update its forward-looking statements.

For more information, contact:Callie Tomasso,

Vice President Investor RelationsEmail:

investorrelations@dycomind.comPhone: (561) 627-7171

---Tables Follow---

|

|

|

DYCOM INDUSTRIES, INC. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(Dollars in thousands) |

|

Unaudited |

| |

|

|

|

| |

July 27, 2024 |

|

January 27, 2024 |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

|

Cash and equivalents |

$ |

19,564 |

|

|

$ |

101,086 |

|

|

Accounts receivable, net |

|

1,507,475 |

|

|

|

1,243,256 |

|

|

Contract assets |

|

74,229 |

|

|

|

52,211 |

|

|

Inventories |

|

101,248 |

|

|

|

108,565 |

|

|

Income tax receivable |

|

5,826 |

|

|

|

2,665 |

|

|

Other current assets |

|

52,323 |

|

|

|

42,253 |

|

|

Total current assets |

|

1,760,665 |

|

|

|

1,550,036 |

|

| |

|

|

|

| Property and equipment,

net |

|

482,996 |

|

|

|

444,909 |

|

| Operating lease right-of-use

assets |

|

79,975 |

|

|

|

76,348 |

|

| Goodwill and other intangible

assets, net |

|

429,548 |

|

|

|

420,945 |

|

| Other assets |

|

26,211 |

|

|

|

24,647 |

|

|

Total assets |

$ |

2,779,395 |

|

|

$ |

2,516,885 |

|

| |

|

|

|

| LIABILITIES AND STOCKHOLDERS’

EQUITY |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

233,533 |

|

|

$ |

222,121 |

|

|

Current portion of debt |

|

— |

|

|

|

17,500 |

|

|

Contract liabilities |

|

34,754 |

|

|

|

39,122 |

|

|

Accrued insurance claims |

|

51,165 |

|

|

|

44,466 |

|

|

Operating lease liabilities |

|

33,310 |

|

|

|

32,015 |

|

|

Income taxes payable |

|

— |

|

|

|

3,861 |

|

|

Other accrued liabilities |

|

158,341 |

|

|

|

147,219 |

|

|

Total current liabilities |

|

511,103 |

|

|

|

506,304 |

|

| |

|

|

|

| Long-term debt |

|

942,368 |

|

|

|

791,415 |

|

| Accrued insurance claims -

non-current |

|

55,206 |

|

|

|

49,447 |

|

| Operating lease liabilities -

non-current |

|

46,190 |

|

|

|

44,110 |

|

| Deferred tax liabilities, net

- non-current |

|

43,943 |

|

|

|

49,562 |

|

| Other liabilities |

|

22,136 |

|

|

|

21,391 |

|

|

Total liabilities |

|

1,620,946 |

|

|

|

1,462,229 |

|

| |

|

|

|

| Total stockholders’

equity |

|

1,158,449 |

|

|

|

1,054,656 |

|

|

Total liabilities and stockholders’ equity |

$ |

2,779,395 |

|

|

$ |

2,516,885 |

|

| |

|

|

|

|

|

|

DYCOM INDUSTRIES, INC. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(Dollars in thousands, except share amounts) |

|

Unaudited |

| |

|

|

|

|

|

|

|

| |

Quarter |

|

Quarter |

|

Six Months |

|

Six Months |

| |

Ended |

|

Ended |

|

Ended |

|

Ended |

| |

July 27, 2024 |

|

July 29, 2023 |

|

July 27, 2024 |

|

July 29, 2023 |

|

Contract revenues |

$ |

1,203,059 |

|

|

$ |

1,041,535 |

|

|

$ |

2,345,482 |

|

|

$ |

2,087,009 |

|

| |

|

|

|

|

|

|

|

| Costs of earned revenues,

excluding depreciation and amortization |

|

952,882 |

|

|

|

830,409 |

|

|

|

1,874,518 |

|

|

|

1,683,775 |

|

| General and

administrative1 |

|

99,583 |

|

|

|

84,832 |

|

|

|

194,138 |

|

|

|

167,188 |

|

| Depreciation and

amortization |

|

46,572 |

|

|

|

37,993 |

|

|

|

91,777 |

|

|

|

75,265 |

|

|

Total |

|

1,099,037 |

|

|

|

953,234 |

|

|

|

2,160,433 |

|

|

|

1,926,228 |

|

| |

|

|

|

|

|

|

|

| Interest expense, net |

|

(14,657 |

) |

|

|

(12,277 |

) |

|

|

(27,490 |

) |

|

|

(23,649 |

) |

| Loss on debt

extinguishment2 |

|

(965 |

) |

|

|

— |

|

|

|

(965 |

) |

|

|

— |

|

| Other income, net |

|

6,419 |

|

|

|

5,731 |

|

|

|

15,669 |

|

|

|

10,722 |

|

| Income before income

taxes |

|

94,819 |

|

|

|

81,755 |

|

|

|

172,263 |

|

|

|

147,854 |

|

| |

|

|

|

|

|

|

|

| Provision for income

taxes3 |

|

26,419 |

|

|

|

21,509 |

|

|

|

41,309 |

|

|

|

36,085 |

|

| |

|

|

|

|

|

|

|

| Net income |

$ |

68,400 |

|

|

$ |

60,246 |

|

|

$ |

130,954 |

|

|

$ |

111,769 |

|

| |

|

|

|

|

|

|

|

| Earnings per common

share: |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Basic earnings per common

share |

$ |

2.35 |

|

|

$ |

2.05 |

|

|

$ |

4.50 |

|

|

$ |

3.81 |

|

| |

|

|

|

|

|

|

|

| Diluted earnings per common

share |

$ |

2.32 |

|

|

$ |

2.03 |

|

|

$ |

4.44 |

|

|

$ |

3.76 |

|

| |

|

|

|

|

|

|

|

| Shares used in

computing earnings per common share: |

|

|

|

|

| |

|

|

|

|

|

|

|

|

Basic |

|

29,096,224 |

|

|

|

29,328,218 |

|

|

|

29,105,081 |

|

|

|

29,348,700 |

|

| |

|

|

|

|

|

|

|

|

Diluted |

|

29,435,895 |

|

|

|

29,610,946 |

|

|

|

29,508,906 |

|

|

|

29,708,025 |

|

| |

|

|

|

|

|

|

|

|

|

|

DYCOM INDUSTRIES, INC. AND SUBSIDIARIES |

|

RECONCILIATION OF NON-GAAP FINANCIAL

MEASURESTO COMPARABLE GAAP FINANCIAL

MEASURES |

|

(Dollars in thousands) |

|

Unaudited |

| |

|

|

|

|

|

|

|

| CONTRACT

REVENUES, NON-GAAP ORGANIC CONTRACT REVENUES, AND GROWTH

% |

| |

|

|

|

|

|

|

|

| |

Quarter |

|

Quarter |

|

Six Months |

|

Six Months |

| |

Ended |

|

Ended |

|

Ended |

|

Ended |

| |

July 27, 2024 |

|

July 29, 2023 |

|

July 27, 2024 |

|

July 29, 2023 |

|

Contract Revenues - GAAP |

$ |

1,203,059 |

|

|

$ |

1,041,535 |

|

|

$ |

2,345,482 |

|

|

$ |

2,087,009 |

|

|

Contract Revenues - GAAP Growth % |

|

15.5 |

% |

|

|

|

|

12.4 |

% |

|

|

| |

|

|

|

|

|

|

|

| Contract Revenues - GAAP |

$ |

1,203,059 |

|

|

$ |

1,041,535 |

|

|

$ |

2,345,482 |

|

|

$ |

2,087,009 |

|

| Revenues from acquired

businesses4 |

|

(65,913 |

) |

|

|

— |

|

|

|

(137,150 |

) |

|

|

— |

|

| Non-GAAP Organic Contract

Revenues |

$ |

1,137,146 |

|

|

$ |

1,041,535 |

|

|

$ |

2,208,332 |

|

|

$ |

2,087,009 |

|

|

Non-GAAP Organic Contract Revenues Growth % |

|

9.2 |

% |

|

|

|

|

5.8 |

% |

|

|

| |

|

|

|

|

|

|

|

| NET

INCOME AND NON-GAAP ADJUSTED EBITDA |

| |

|

|

|

|

|

|

|

| |

Quarter |

|

Quarter |

|

Six Months |

|

Six Months |

| |

Ended |

|

Ended |

|

Ended |

|

Ended |

| |

July 27, 2024 |

|

July 29, 2023 |

|

July 27, 2024 |

|

July 29, 2023 |

| Reconciliation of net income

to Non-GAAP Adjusted EBITDA: |

|

|

|

|

|

|

|

|

Net income |

$ |

68,400 |

|

|

$ |

60,246 |

|

|

$ |

130,954 |

|

|

$ |

111,769 |

|

|

Interest expense, net |

|

14,657 |

|

|

|

12,277 |

|

|

|

27,490 |

|

|

|

23,649 |

|

|

Provision for income taxes |

|

26,419 |

|

|

|

21,509 |

|

|

|

41,309 |

|

|

|

36,085 |

|

|

Depreciation and amortization |

|

46,572 |

|

|

|

37,993 |

|

|

|

91,777 |

|

|

|

75,265 |

|

|

Earnings Before Interest, Taxes, Depreciation & Amortization

("EBITDA") |

|

156,048 |

|

|

|

132,025 |

|

|

|

291,530 |

|

|

|

246,768 |

|

|

Gain on sale of fixed assets |

|

(8,160 |

) |

|

|

(7,558 |

) |

|

|

(20,564 |

) |

|

|

(15,374 |

) |

|

Stock-based compensation expense |

|

9,482 |

|

|

|

6,323 |

|

|

|

17,305 |

|

|

|

12,942 |

|

|

Loss on debt extinguishment2 |

|

965 |

|

|

|

— |

|

|

|

965 |

|

|

|

— |

|

|

Non-GAAP Adjusted EBITDA |

$ |

158,335 |

|

|

$ |

130,790 |

|

|

$ |

289,236 |

|

|

$ |

244,336 |

|

|

Non-GAAP Adjusted EBITDA % of contract revenues |

|

13.2 |

% |

|

|

12.6 |

% |

|

|

12.3 |

% |

|

|

11.7 |

% |

| |

|

|

|

|

|

|

|

|

|

|

DYCOM INDUSTRIES, INC. AND SUBSIDIARIES |

|

RECONCILIATION OF NON-GAAP FINANCIAL

MEASURESTO COMPARABLE GAAP FINANCIAL MEASURES

(CONTINUED) |

|

(Dollars in thousands, except share amounts) |

|

Unaudited |

| |

|

|

|

|

|

|

|

| NET

INCOME, NON-GAAP ADJUSTED NET INCOME, DILUTED EARNINGS PER COMMON

SHARE, AND NON-GAAP ADJUSTED DILUTED EARNINGS PER COMMON

SHARE |

| |

|

|

|

|

|

|

|

| |

Quarter |

|

Quarter |

|

Six Months |

|

Six Months |

| |

Ended |

|

Ended |

|

Ended |

|

Ended |

| |

July 27, 2024 |

|

July 29, 2023 |

|

July 27, 2024 |

|

July 29, 2023 |

| Reconciliation of net income

to Non-GAAP Adjusted Net Income: |

|

|

|

|

|

|

|

|

Net income |

$ |

68,400 |

|

|

$ |

60,246 |

|

|

$ |

130,954 |

|

|

$ |

111,769 |

|

| |

|

|

|

|

|

|

|

| Pre-Tax Adjustments: |

|

|

|

|

|

|

|

|

Loss on debt extinguishment2 |

|

965 |

|

|

|

— |

|

|

|

965 |

|

|

|

— |

|

|

Stock-based compensation modification5 |

|

2,231 |

|

|

|

— |

|

|

|

2,231 |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

| Tax Adjustments: |

|

|

|

|

|

|

|

|

Tax impact of pre-tax adjustments |

|

899 |

|

|

|

— |

|

|

|

899 |

|

|

|

— |

|

| Total adjustments, net of

tax |

|

4,095 |

|

|

|

— |

|

|

|

4,095 |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

| Non-GAAP Adjusted Net

Income |

$ |

72,495 |

|

|

$ |

60,246 |

|

|

$ |

135,049 |

|

|

$ |

111,769 |

|

| |

|

|

|

|

|

|

|

| Reconciliation of diluted

earnings per common share to Non-GAAP Adjusted Diluted Earnings per

Common Share: |

|

|

|

|

|

|

|

| GAAP diluted earnings per

common share |

$ |

2.32 |

|

|

$ |

2.03 |

|

|

$ |

4.44 |

|

|

$ |

3.76 |

|

|

Total adjustments, net of tax |

|

0.14 |

|

|

|

— |

|

|

|

0.14 |

|

|

|

— |

|

| Non-GAAP Adjusted Diluted

Earnings per Common Share |

$ |

2.46 |

|

|

$ |

2.03 |

|

|

$ |

4.58 |

|

|

$ |

3.76 |

|

| |

|

|

|

|

|

|

|

| Shares used in computing

Non-GAAP Adjusted Diluted Earnings per Common Share |

|

29,435,895 |

|

|

|

29,610,946 |

|

|

|

29,508,906 |

|

|

|

29,708,025 |

|

| |

|

|

|

|

|

|

|

| Amounts in table

above may not add due to rounding. |

| |

DYCOM INDUSTRIES, INC. AND

SUBSIDIARIESRECONCILIATION OF NON-GAAP FINANCIAL

MEASURESTO COMPARABLE GAAP FINANCIAL MEASURES

(CONTINUED)

Explanation of Non-GAAP Financial Measures

The Company reports its financial results in accordance with

U.S. generally accepted accounting principles (GAAP). In the

Company’s quarterly results releases, trend schedules, conference

calls, slide presentations, and webcasts, it may use or discuss

Non-GAAP financial measures, as defined by Regulation G of the

Securities and Exchange Commission. The Company believes that the

presentation of certain Non-GAAP financial measures in these

materials provides information that is useful to investors because

it allows for a more direct comparison of the Company’s performance

for the period reported with the Company’s performance in prior

periods. The Company cautions that Non-GAAP financial measures

should be considered in addition to, but not as a substitute for,

the Company’s reported GAAP results. Management defines the

Non-GAAP financial measures used as follows:

- Non-GAAP Organic Contract Revenues - contract revenues from

businesses that are included for the entire period in both the

current and prior year periods, excluding contract revenues from

storm restoration services. Non-GAAP Organic Contract Revenue

change percentage is calculated as the change in Non-GAAP Organic

Contract Revenues from the comparable prior year period divided by

the comparable prior year period Non-GAAP Organic Contract

Revenues. Management believes Non-GAAP Organic Contract Revenues is

a helpful measure for comparing the Company’s revenue performance

with prior periods.

- Non-GAAP Adjusted EBITDA - net income before interest,

taxes, depreciation and amortization, gain on sale of fixed assets,

stock-based compensation expense, and certain non-recurring items.

Management believes Non-GAAP Adjusted EBITDA is a helpful

measure for comparing the Company’s operating performance with

prior periods as well as with the performance of other companies

with different capital structures or tax rates.

- Non-GAAP Adjusted Net Income - GAAP net income before certain

non-recurring items and the related tax impact. Management believes

Non-GAAP Adjusted Net Income is a helpful measure for comparing the

Company’s operating performance with prior periods.

- Non-GAAP Adjusted Diluted Earnings per Common Share - Non-GAAP

Adjusted Net Income divided by weighted average diluted shares

outstanding.

Management excludes or adjusts each of the items identified

below from Non-GAAP Adjusted Net Income and Non-GAAP Adjusted

Diluted Earnings per Common Share:

- Stock-based compensation modification - During the quarter

ended July 27, 2024, the Company announced its CEO

succession plan and transition. In connection with this transition,

the Company incurred stock-based compensation modification expense.

The Company excludes the impact of the modification because the

Company believes it is not indicative of its underlying results or

ongoing operations.

- Loss on debt extinguishment - Loss on debt extinguishment

includes the write-off of deferred financing fees in connection

with the amendment of the Company’s credit agreement during the

quarter ended July 27, 2024. Management believes

excluding the loss on debt extinguishment from the Company’s

Non-GAAP financial measures assists investors’ overall

understanding of the Company’s current financial performance and

provides management with a consistent measure for assessing the

current and historical financial results.

- Tax impact of pre-tax adjustments - The tax impact of pre-tax

adjustments reflects the Company’s estimated tax impact of specific

adjustments and the effective tax rate used for financial planning

for the applicable period.

Notes

1 Includes stock-based compensation expense of $9.5 million

and $6.3 million for the quarters ended

July 27, 2024 and

July 29, 2023, respectively, and $17.3 million

and $12.9 million for the six months ended

July 27, 2024 and July 29, 2023,

respectively.

2 During quarter ended July 27, 2024, the Company

recognized a loss on debt extinguishment of approximately

$1.0 million in connection with the amendment of its credit

agreement.

3 Provision for income taxes includes benefits resulting from

the vesting and exercise of share-based awards of approximately

$0.1 million for each of the quarters ended

July 27, 2024 and July 29, 2023, and

approximately $6.0 million and $2.8 million for the six

months ended July 27, 2024 and July 29, 2023,

respectively.

4 Amounts represent contract revenues from acquired businesses

that were not owned for the full period in both the current and

comparable prior periods.

5 During the quarter ended July 27, 2024, the Company

announced its CEO succession plan and transition. In connection

with this transition, the Company will incur approximately $11.4

million of stock-based compensation modification expense through

the current CEO’s retirement date of November 30, 2024 related to

previously issued equity awards. Of this total, approximately

$2.2 million was recognized during the quarter ended

July 27, 2024.

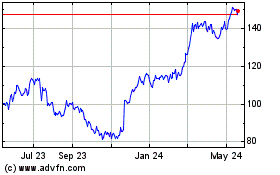

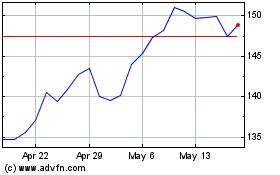

Dycom Industries (NYSE:DY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Dycom Industries (NYSE:DY)

Historical Stock Chart

From Feb 2024 to Feb 2025