0001559865false00015598652025-02-262025-02-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): February 26, 2025

EVERTEC, Inc.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

| | | | | | | | | | | |

| Puerto Rico | | 66-0783622 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. employer

identification number) |

| | |

| Cupey Center Building, | Road 176, Kilometer 1.3, | | |

| San Juan, | Puerto Rico | | 00926 |

| (Address of principal executive offices) | | (Zip Code) |

(787) 759-9999

(Registrant’s telephone number, including area code)

Not applicable

(Former name, former address and former fiscal year, if changed since last report)

COMMISSION FILE NUMBER 001-35872

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | EVTC | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 26, 2025 the Company issued a press release announcing its preliminary results for the fourth quarter ended December 31, 2024. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

Note: The information contained in this Item 2.02 (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| EVERTEC, Inc. |

| (Registrant) |

| | |

| Date: February 26, 2025 | By: | /s/ Joaquin A. Castrillo-Salgado |

| | Name: Joaquin A. Castrillo-Salgado |

| | Title: Chief Financial Officer |

EXHIBIT INDEX

| | | | | | | | |

| Number | | Exhibit |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Exhibit 99.1

EVERTEC REPORTS FOURTH QUARTER AND FULL YEAR 2024 RESULTS

Announces 2025 outlook

Announces acquisition of Nubity

SAN JUAN, PUERTO RICO – February 26, 2025 – EVERTEC, Inc. (NYSE: EVTC) (“Evertec” or the “Company”) today announced results for the fourth quarter and full year ended December 31, 2024.

Fourth Quarter 2024 Highlights and Recent Highlights

•Revenue increased 11% to $216.4 million, approximately 14.5% on a constant currency basis

•GAAP Net Income attributable to common shareholders increased 249.0% to $40.1 million, and increased 264.7% to $0.62 per diluted share

•Adjusted EBITDA increased 24% to $88.6 million and Adjusted earnings per common share increased 40.3% to $0.87

•Closed on acquisition of 100% of Nubity, Inc. ("Nubity") on November 19th

Full Year 2024 Highlights

•Revenue grew 22% to $845.5 million, approximately 23.5% on a constant currency basis

•GAAP Net Income attributable to common shareholders was $112.6 million an increase of 41%, or $1.73 per diluted share

•Adjusted EBITDA was $340.2 million an increase of 17% and Adjusted earnings per common share increased by 16.3% to $3.28

•$95.2 million returned to shareholders through share repurchases and dividends

•Closed on the acquisition of Grandata and Nubity

•Completed a $70 million accelerated share repurchase program

Mac Schuessler, President and Chief Executive Officer stated "In 2024, we achieved record revenues by delivering strong results in our core markets while successfully integrating our largest acquisition, Sinqia. We continued to execute on our capital deployment plan, completing the acquisition of Nubity and Grandata as well as repurchasing our stock through the accelerated share repurchase program completed in 2024. Our focus for 2025 will be on optimizing margin, continuing to allocate capital thoughtfully and driving organic revenue growth.”

Fourth Quarter 2024 Results

Revenue. Total revenue for the quarter ended December 31, 2024 was $216.4 million, an increase of 11.2%, compared with $194.6 million in the prior year quarter as a result of organic growth across all of the Company's segments, the contribution from an additional month of Sinqia and the contribution from the Grandata and Nubity acquisitions. Merchant acquiring revenue benefited from an improvement in spread and sales volume growth and Payments Puerto Rico revenue continues to benefit from growth in transactions and ATH Movil. Revenue in Latin America reflected the contribution from acquisitions, continued organic growth across the region and incremental volumes from our GetNet Chile relationship which led to the recognition of a one-time incremental revenue in the quarter of $0.6 million. Business Solutions revenue increased as a result of projects completed throughout the year.

Net Income attributable to common shareholders. For the quarter ended December 31, 2024, GAAP Net Income attributable to common shareholders was $40.1 million or $0.62 per diluted share, an increase of $28.6 million, compared with $11.5 million or $0.17 per diluted share in the prior year. The increase was driven by the increase in revenues, the impact from a $8.9 million

net gain in the quarter related to the sale of tax credits, lower selling, general and administrative expenses, lower depreciation and amortization and the benefit from a lower effective tax rate. These variances are partially offset by an increase in cost of revenues resulting from the incremental expenses related to the acquisitions completed throughout the year, an increase in costs of sales mainly related to the projects completed in Business Solutions and higher interest expense as a result of the incremental debt raised to finance the Sinqia acquisition.

Adjusted EBITDA and Adjusted EBITDA Margin. For the quarter ended December 31, 2024, Adjusted EBITDA was $88.6 million, an increase of $16.9 million when compared to the prior year quarter, driven by the increase in revenues and the contribution from the acquisitions. Adjusted EBITDA margin (Adjusted EBITDA as a percentage of total revenue) increased approximately 410 basis points to 40.9% compared with 36.8% in the prior year, as we drive incremental revenue and continue to focus on managing expenses.

Adjusted Net Income and Adjusted earnings per common share. For the quarter ended December 31, 2024, Adjusted Net Income was $56.0 million, an increase of 37% compared with $40.8 million in the prior year, almost entirely related to the increase in Adjusted EBITDA and a lower adjusted effective tax rate. Adjusted earnings per common share was $0.87, an increase of 40% compared with $0.62 in the prior year driven by the factors explained for Adjusted Net Income and a lower share count as a result of repurchases completed in 2024.

Full Year 2024 Results

Revenue. Total revenue for the year ended December 31, 2024 was $845.5 million, an increase of 22% compared with $694.7 million in the prior year. This reflects contributions from acquisitions and organic growth across all segments. The Latin America segment experienced a full-year contribution from the Sinqia acquisition completed in Q4 2023, with additional contributions from the Grandata and Nubity acquisitions completed in Q4 2024, along with organic growth in the region. Merchant acquiring revenue saw improvements due to better spread and sales volume growth. Payments Puerto Rico revenue increased due to ongoing transaction volume growth and contributions from ATH Movil Business. Business Solutions revenue benefited from completed projects, mainly for Popular.

Net Income attributable to common shareholders. For the year ended December 31, 2024, GAAP Net Income attributable to common shareholders was $112.6 million, or $1.73 per diluted share, an increase compared with $79.7 million or $1.21 per diluted share in the prior year, primarily driven by the higher revenues and the benefit from a lower effective tax rate. These were partially offset by higher depreciation and amortization and interest expense. The prior year also included the negative impact from the loss on foreign currency swap related to the Sinqia acquisition. Cost of revenues and selling, general and administrative expenses both increased primarily due to an increase in personnel costs driven by the added headcount from acquisitions. Interest expense increased from the prior year due to the same reason explained above for the quarter.

Adjusted EBITDA and Adjusted EBITDA Margin. For the year ended December 31, 2024, Adjusted EBITDA was $340.2 million, an increase of 17% compared to the prior year. The increase in Adjusted EBITDA primarily reflects the contribution from the Sinqia acquisition and the increase in revenues discussed above, partially offset by an increase in operating expenses. Adjusted EBITDA margin (Adjusted EBITDA as a percentage of total revenues) decreased 180 basis points to 40.2% compared with 42.0% in the prior year. The decrease in Adjusted EBITDA margin primarily reflects the addition of Sinqia, which contributes at a lower margin, as well as the impact of the $6.3 million adjustment for GetNet Chile in the prior year, compared with $2.4 million in the current year, which is 100% accretive to margin.

Adjusted Net Income and Adjusted earnings per common share. For the year ended December 31, 2023, Adjusted Net Income was $213.2 million, an increase of 15% compared with $185.5 million in the prior year. The increase was driven by the higher adjusted EBITDA and a decrease in Non-GAAP tax expense, partially offset by higher operating depreciation and amortization and higher cash interest expense, due to the incremental debt raised for the Sinqia acquisition. Adjusted earnings per common share were $3.28, an increase of 16.3% compared with $2.82 in the prior year. The increase was driven by the increase in Adjusted Net Income and a lower share count that reflects the impact from the share repurchases completed throughout the year.

Business Acquisition

On November 19, 2024, the Company acquired 100% of the share capital of Nubity. Nubity is a cloud services provider based in Mexico, specializing in AWS cloud infrastructure management, DevOps, and cloud-native application solutions for clients across Latin America. This transaction enhances our existing product offering and helps enable the Company to address our customer’s needs more fully. The Company plans on leveraging its existing client base in Puerto Rico and Latin America to accelerate the growth of this acquisition.

Stock Repurchase

For the full year 2024, the Company repurchased 2.4 million shares of its common stock at an average price of $34.90 for a total of $82.3 million. At December 31, 2024, the Company's share repurchase program had approximately $138 million remaining and authorized for future use through December 31, 2025. The Company may repurchase shares in the open market, through accelerated share repurchase programs, 10b5-1 plans, or in privately negotiated transactions, subject to business opportunities and other factors.

2025 Outlook

The Company's financial outlook for 2025 is as follows:

•Total consolidated revenue between $889 million and $899 million representing approximately 5.1% to 6.3% growth compared with $845 million in 2024 on a GAAP basis, or approximately 5.5% to 6.7% on a constant currency basis

•Adjusted earnings per common share between $3.34 to $3.45 representing approximately 1.8% to 5.2% growth as compared to $3.28 in 2024, or approximately 2.6% to 6.0% on a constant currency basis

•Capital expenditures are anticipated to be approximately $85 million

•Effective tax rate of approximately 6% to 7%

Earnings Conference Call and Audio Webcast

The Company will host a conference call to discuss its fourth quarter and full year 2024 financial results today at 4:30 p.m. ET. Hosting the call will be Mac Schuessler, President and Chief Executive Officer, and Joaquin Castrillo, Chief Financial Officer. The conference call can be accessed live over the phone by dialing (888) 338-7153 or for international callers by dialing (412) 317-5117. A replay will be available one hour after the end of the conference call and can be accessed by dialing (877) 344-7529 or (412) 317-0088 for international callers; the pin number is 1193493. The replay will be available through Wednesday, March 5, 2025. The call will be webcast live from the Company’s website at www.evertecinc.com under the Investor Relations section or directly at http://ir.evertecinc.com. A supplemental slide presentation that accompanies this call and webcast can be found on the investor relations website at ir.evertecinc.com and will remain available after the call.

About Evertec

EVERTEC, Inc. (NYSE: EVTC) is a leading full-service transaction processor and financial technology provider in Latin America, Puerto Rico and the Caribbean, providing a broad range of merchant acquiring, payment services and business process management services. Evertec owns and operates the ATH® network, one of the leading personal identification number (“PIN”) debit networks in Latin America. In addition, the Company manages a system of electronic payment networks and offers a comprehensive suite of services for core banking, cash processing and fulfillment in Puerto Rico, that process approximately six billion transactions annually. The Company also offers financial technology outsourcing in all the regions it serves. Based in Puerto Rico, the Company operates in 26 Latin American countries and serves a diversified customer base of leading financial institutions, merchants, corporations and government agencies with “mission-critical” technology solutions. For more information, visit www.evertecinc.com.

Use of Non-GAAP Financial Information

The non-GAAP measures referenced in this earnings release are supplemental measures of the Company’s performance and are not required by, or presented in accordance with, accounting principles generally accepted in the United States of America (“GAAP”). They are not measurements of the Company’s financial performance under GAAP and should not be considered as alternatives to total revenue, net income or any other performance measures derived in accordance with GAAP or as alternatives to cash flows from operating activities, as indicators of operating performance or as measures of the Company’s liquidity. In addition to GAAP measures, management uses these non-GAAP measures to focus on the factors the Company believes are pertinent to the daily management of the Company’s operations and believes that they are also frequently used by analysts, investors and other stakeholders to evaluate companies in our industry. These measures have certain limitations in that they do not include the impact of certain expenses that are reflected in our condensed consolidated statements of operations that are necessary to run our business. Other companies, including other companies in our industry, may not use these measures or may calculate these measures differently than as presented herein, limiting their usefulness as comparative measures.

Reconciliations of the non-GAAP measures to the most directly comparable GAAP measure are included at the end of this earnings release. These non-GAAP measures include EBITDA, Adjusted EBITDA, Adjusted Net Income and Adjusted Earnings per common share, each as defined below.

EBITDA is defined as earnings before interest, taxes, depreciation and amortization.

Adjusted EBITDA is defined as EBITDA further adjusted to exclude certain non-cash items and unusual expenses such as: share-based compensation, restructuring related expenses, fees and expenses from corporate transactions such as M&A activity and financing, equity investment income net of dividends received, and the impact from unrealized gains and losses on foreign currency remeasurement for assets and liabilities in non-functional currency. This measure is reported to the chief operating decision maker for purposes of making decisions about allocating resources to the segments and assessing their performance. For this reason, Adjusted EBITDA, as it relates to the Company's segments, is presented in conformity with Accounting Standards Codification 280, Segment Reporting, and is excluded from the definition of non-GAAP financial measures under the Securities and Exchange Commission's Regulation G and Item 10(e) of Regulation S-K. The Company's presentation of Adjusted EBITDA is substantially consistent with the equivalent measurements that are contained in the secured credit facilities in testing EVERTEC Group’s compliance with covenants therein such as the secured leverage ratio.

Adjusted Net Income is defined as Adjusted EBITDA less: operating depreciation and amortization expense, defined as GAAP Depreciation and amortization less amortization of intangibles related to acquisitions such as customer relationships, trademarks, non-compete agreements, among others; cash interest expense defined as GAAP interest expense, less GAAP interest income adjusted to exclude non-cash amortization of debt issue costs, premium and accretion of discount; income tax expense which is calculated on adjusted pre-tax income using the applicable GAAP tax rate, adjusted for uncertain tax position releases, tax true-ups, windfall from share-based compensation, unrealized gains and losses from foreign currency remeasurement, among others; and non-controlling interests, net of amortization for intangibles created as part of the purchase.

Adjusted Earnings per common share is defined as Adjusted Net Income divided by diluted shares outstanding.

The Company uses Adjusted Net Income to measure the Company's overall profitability because the Company believes it better reflects the comparable operating performance by excluding the impact of the non-cash amortization and depreciation that was created as a result of merger and acquisition activity. In addition, in evaluating EBITDA, Adjusted EBITDA, Adjusted Net Income and Adjusted Earnings per common share, you should be aware that in the future the Company may incur expenses such as those excluded in calculating them.

Forward-Looking Statements

Certain statements in this earnings release constitute “forward-looking statements” within the meaning of, and subject to the protection of, the Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements contained in this press release other than statements of historical facts, including, without limitation, statements regarding our future results of operations and financial position, including our guidance for fiscal year 2025; our business strategies; objectives of management for future operations, including, among others, statements regarding our expected growth, international expansion and future capital expenditures; and expectations for and anticipated benefits of acquisitions, are forward looking statements. Words such as “believes,” “expects,” “anticipates,” “intends,” “projects,” “estimates,” and “plans” and similar expressions of future or conditional verbs such as “will,” “should,” “would,” “may,” and “could” are generally forward-looking in nature and not historical facts.

Various factors that could cause actual future results and other future events to differ materially from those estimated by management include, but are not limited to: our reliance on our relationship with Popular, Inc. (“Popular”) for a significant portion of our revenues pursuant to our second Amended and Restated Master Services Agreement (“A&R MSA”) with them, and as it may impact our ability to grow our business; our ability to renew our client contracts on terms favorable to us, including but not limited to the current term and any extension of the A&R MSA with Popular; our dependence on our processing systems, technology infrastructure, security systems and fraudulent payment detection systems, as well as on our personnel and certain third parties with whom we do business, and the risks to our business if our systems are hacked or otherwise compromised; our ability to develop, install and adopt new software, technology and computing systems; a decreased client base due to consolidations and/or failures in the financial services industry; the credit risk of our merchant clients, for which we may also be liable; the continuing market position of the ATH network; a reduction in consumer confidence, whether as a result of a global economic downturn or otherwise, which leads to a decrease in consumer spending; our dependence on credit card associations, including any adverse changes in credit card association or network rules or fees; changes in the regulatory environment and changes in macroeconomic, market, international, legal, tax, political, or administrative conditions, including inflation or the risk of recession; the geographical concentration of our business in Puerto Rico, including our business with the government of Puerto Rico and its instrumentalities, which are facing severe political and fiscal challenges; additional adverse changes in the general economic conditions in Puerto Rico, whether as a result of the government’s debt crisis or otherwise, including the continued migration of Puerto Ricans to the U.S. mainland, which could negatively affect our customer base, general consumer spending, our cost of operations and our ability to hire and retain qualified employees;

operating an international business in Latin America, Puerto Rico and the Caribbean, in jurisdictions with potential political and economic instability; the impact of foreign exchange rates on operations; our ability to protect our intellectual property rights against infringement and to defend ourselves against claims of infringement brought by third parties; our ability to comply with U.S. federal, state, local and foreign regulatory requirements; evolving industry standards and adverse changes in global economic, political and other conditions; our level of indebtedness and the impact of rising interest rates, restrictions contained in our debt agreements, including the secured credit facilities, as well as debt that could be incurred in the future; our ability to protect our IT systems and prevent a cybersecurity attack or breach to our information security; the possibility that we could lose our preferential tax rate in Puerto Rico; our ability to integrate Sinqia S.A. (“Sinqia”) successfully into the Company or to achieve expected accretion to our earnings per common share; any loss of personnel or customers in connection with the acquisition of Sinqia; any possibility of future catastrophic hurricanes, earthquakes and other potential natural disasters affecting our main markets in Latin America, Puerto Rico and the Caribbean; and the other factors set forth under "Part 1, Item 1A. Risk Factors," in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 filed with the Securities and Exchange Commission (the "SEC") on February 29, 2024, as any such factors may be updated from time to time in the Company’s filings with the SEC, including in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, to be filed with the SEC. The Company undertakes no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events unless it is required to do so by law.

Investor Contact

Beatriz Brown-Sáenz

(787) 773-5442

IR@evertecinc.com

EVERTEC, Inc.

Schedule 1: Unaudited Consolidated Statements of Income and Comprehensive (Loss) Income

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Quarter ended December 31, | | Year ended December 31, |

| (Dollar amounts in thousands, except share data) | | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues | | $ | 216,395 | | | $ | 194,621 | | | $ | 845,486 | | | $ | 694,709 | |

| | | | | | | | |

| Operating costs and expenses | | | | | | | | |

| Cost of revenues, exclusive of depreciation and amortization shown below | | 103,990 | | | 98,607 | | | 406,416 | | | 336,756 | |

| Selling, general and administrative expenses | | 37,648 | | | 44,338 | | | 145,558 | | | 128,172 | |

| Depreciation and amortization | | 26,795 | | | 29,941 | | | 127,846 | | | 93,621 | |

| Total operating costs and expenses | | 168,433 | | | 172,886 | | | 679,820 | | | 558,549 | |

| Income from operations | | 47,962 | | | 21,735 | | | 165,666 | | | 136,160 | |

| Non-operating income (expenses) | | | | | | | | |

| Interest income | | 3,058 | | | 3,350 | | | 13,332 | | | 8,512 | |

| Interest expense | | (17,381) | | | (15,329) | | | (74,733) | | | (32,321) | |

| | | | | | | | |

| Loss on foreign currency remeasurement | | (2,034) | | | (939) | | | (5,198) | | | (8,276) | |

| Gain (loss) on foreign currency swap | | — | | | 5,160 | | | — | | | (24,065) | |

| Earnings of equity method investment | | 1,032 | | | 1,148 | | | 4,298 | | | 4,976 | |

| Other income (loss), net | | 9,777 | | | (2,387) | | | 16,261 | | | 367 | |

| Total non-operating expenses | | (5,548) | | | (8,997) | | | (46,040) | | | (50,807) | |

| Income before income taxes | | 42,414 | | | 12,738 | | | 119,626 | | | 85,353 | |

| Income tax expense | | 1,747 | | | 931 | | | 4,847 | | | 5,477 | |

| Net income | | 40,667 | | | 11,807 | | | 114,779 | | | 79,876 | |

| Less: Net income attributable to non-controlling interests | | 605 | | | 328 | | | 2,159 | | | 154 | |

| Net income attributable to EVERTEC, Inc.’s common stockholders | | 40,062 | | | 11,479 | | | 112,620 | | | 79,722 | |

| Other comprehensive (loss) income, net of tax | | | | | | | | |

| Foreign currency translation adjustments | | (77,378) | | | 28,902 | | | (152,851) | | | 38,328 | |

| Gain (loss) on cash flow hedges | | 8,481 | | | (7,357) | | | (74) | | | (3,618) | |

| Unrealized (loss) income on change in fair value of debt securities available-for-sale | | (3) | | | 16 | | | (7) | | | (15) | |

| Other comprehensive (loss) income, net of tax | | $ | (68,900) | | | $ | 21,561 | | | $ | (152,932) | | | $ | 34,695 | |

| Total comprehensive (loss) income attributable to EVERTEC, Inc.’s common stockholders | | $ | (28,838) | | | $ | 33,040 | | | $ | (40,312) | | | $ | 114,417 | |

| Net income per common share: | | | | | | | | |

| Basic | | $ | 0.63 | | | $ | 0.18 | | | $ | 1.75 | | | $ | 1.23 | |

| Diluted | | $ | 0.62 | | | $ | 0.17 | | | $ | 1.73 | | | $ | 1.21 | |

| Shares used in computing net income per common share: | | | | | | | | |

| Basic | | 63,613,215 | | | 65,067,316 | | | 64,286,725 | | | 64,932,114 | |

| Diluted | | 64,650,434 | | | 66,273,215 | | | 65,077,535 | | | 65,814,317 | |

EVERTEC, Inc.

Schedule 2: Unaudited Consolidated Balance Sheets | | | | | | | | | | | | | | |

| (Dollar amounts in thousands, except share data) | | December 31, 2024 | | December 31, 2023 |

| Assets | | | | |

| Current Assets: | | | | |

| Cash and cash equivalents | | $ | 273,645 | | | $ | 295,600 | |

| Restricted cash | | 24,594 | | | 23,073 | |

| Accounts receivable, net | | 137,501 | | | 126,510 | |

| Settlement assets | | 31,942 | | | 51,467 | |

| Prepaid expenses and other assets | | 61,383 | | | 64,704 | |

| Total current assets | | 529,065 | | | 561,354 | |

| Debt securities available-for-sale, at fair value | | 913 | | | 2,095 | |

| Equity securities, at fair value | | 4,976 | | | 9,413 | |

| Investment in equity investees | | 29,472 | | | 21,145 | |

| Property and equipment, net | | 62,059 | | | 62,453 | |

| | | | |

| Operating lease right-of-use asset | | 10,131 | | | 14,796 | |

| Goodwill | | 726,901 | | | 791,700 | |

| Other intangible assets, net | | 430,885 | | | 518,070 | |

| Deferred tax asset | | 33,877 | | | 47,847 | |

| Derivative asset | | 4,338 | | | 4,385 | |

| | | | |

| Other long-term assets | | 24,994 | | | 27,005 | |

| Total assets | | $ | 1,857,611 | | | $ | 2,060,263 | |

| Liabilities and stockholders’ equity | | | | |

| Current Liabilities: | | | | |

| Accrued liabilities | | $ | 124,553 | | | $ | 129,160 | |

| Accounts payable | | 58,729 | | | 66,516 | |

| Contract liability | | 25,274 | | | 21,055 | |

| Income tax payable | | 8,981 | | | 3,402 | |

| Current portion of long-term debt | | 23,867 | | | 23,867 | |

| | | | |

| | | | |

| Current portion of operating lease liability | | 6,229 | | | 6,693 | |

| Settlement liabilities | | 32,027 | | | 47,620 | |

| | | | |

| Total current liabilities | | 279,660 | | | 298,313 | |

| Long-term debt | | 925,062 | | | 946,816 | |

| Deferred tax liability | | 44,810 | | | 87,916 | |

| Contract liability - long term | | 55,003 | | | 41,825 | |

| | | | | | | | | | | | | | |

| Operating lease liability - long-term | | 4,924 | | | 9,033 | |

| Derivative liability | | 1,351 | | | 900 | |

| | | | |

| Other long-term liabilities | | 27,540 | | | 40,084 | |

| Total liabilities | | 1,338,350 | | | 1,424,887 | |

| | | | |

| Redeemable non-controlling interests | | 43,460 | | | 36,968 | |

| Stockholders’ equity | | | | |

| Preferred stock, par value $0.01; 2,000,000 shares authorized; none issued | | — | | | — | |

Common stock, par value $0.01; 206,000,000 shares authorized; 63,614,077 shares issued and outstanding at December 31, 2024 (December 31, 2023 - 65,450,799) | | 636 | | | 654 | |

| Additional paid-in capital | | 7,003 | | | 36,527 | |

| Accumulated earnings | | 599,608 | | | 538,903 | |

| Accumulated other comprehensive (loss) income, net of tax | | (134,723) | | | 18,209 | |

| Total EVERTEC, Inc. stockholders’ equity | | 472,524 | | | 594,293 | |

| Non-controlling interest | | 3,277 | | | 4,115 | |

| Total equity | | 475,801 | | | 598,408 | |

| Total liabilities and equity | | $ | 1,857,611 | | | $ | 2,023,295 | |

EVERTEC, Inc.

Schedule 3: Unaudited Consolidated Statements of Cash Flows

| | | | | | | | | | | | | | | | |

| | | Years ended December 31, | | |

| (In thousands) | | 2024 | | 2023 | | |

| Cash flows from operating activities | | | | | | |

| Net income | | $ | 114,779 | | | $ | 79,876 | | | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | |

| Depreciation and amortization | | 127,846 | | | 93,621 | | | |

| Amortization of debt issue costs and accretion of discount | | 4,739 | | | 2,307 | | | |

| Operating lease amortization | | 7,063 | | | 6,252 | | | |

| | | | | | |

| | | | | | |

| Loss on extinguishment of debt | | — | | | 1,433 | | | |

| | | | | | |

| Deferred tax benefit | | (26,726) | | | (16,144) | | | |

| Share-based compensation | | 30,275 | | | 25,732 | | | |

| | | | | | |

| Gain from sale of assets | | (2,571) | | | — | | | |

| Loss on disposition of property and equipment and impairment of software | | 2,603 | | | 969 | | | |

| Earnings of equity method investments | | (4,298) | | | (4,976) | | | |

| Dividends received from equity method investment | | 3,364 | | | 3,497 | | | |

| Loss on foreign currency remeasurement | | 5,198 | | | 8,276 | | | |

| Other, net | | (529) | | | 1,809 | | | |

| (Increase) decrease in assets: | | | | | | |

| Accounts receivable, net | | (11,225) | | | (6,850) | | | |

| | | | | | |

| Prepaid expenses and other assets | | (865) | | | (16,862) | | | |

| Other long-term assets | | 1,288 | | | (5,383) | | | |

| (Decrease) increase in liabilities: | | | | | | |

| Accrued liabilities and accounts payable | | (6,602) | | | 46,523 | | | |

| | | | | | |

| Income tax payable | | 6,199 | | | (6,631) | | | |

| Contract liability | | 14,199 | | | 8,074 | | | |

| Operating lease liabilities | | (7,359) | | | (5,723) | | | |

| Other long-term liabilities | | 2,681 | | | (4,606) | | | |

| Total adjustments | | 145,280 | | | 131,318 | | | |

| Net cash provided by operating activities | | 260,059 | | | 211,194 | | | |

| Cash flows from investing activities | | | | | | |

| Additions to software | | (63,044) | | | (63,524) | | | |

| Acquisition of customer relationship | | — | | | — | | | |

| Acquisitions, net of cash acquired | | (34,030) | | | (417,566) | | | |

| Property and equipment acquired | | (25,384) | | | (21,452) | | | |

| | | | | | | | | | | | | | | | |

| Proceeds from sales of property and equipment | | 5 | | | 24 | | | |

| Purchase of certificates of deposit | | — | | | — | | | |

| Proceeds from maturities of available-for-sale debt securities | | 1,102 | | | 1,048 | | | |

| Acquisition of available-for-sale debt securities | | (793) | | | (962) | | | |

| Purchase of equity securities | | (132) | | | — | | | |

| Investment in equity method investee | | (2,000) | | | (5,500) | | | |

| Sale of investments | | 5,994 | | | — | | | |

| Net cash used in investing activities | | (118,282) | | | (507,932) | | | |

| Cash flows from financing activities | | | | | | |

| | | | | | |

| Debt issuance and repricing costs | | (1,215) | | | (10,481) | | | |

| Proceeds from issuance of long-term debt | | — | | | 651,000 | | | |

| Net (decrease) increase in short-term borrowings | | — | | | (20,000) | | | |

| Repayments of short-terms borrowings for purchase of equipment and software | | (2,479) | | | (7,175) | | | |

| Dividends paid | | (12,873) | | | (13,025) | | | |

| Withholding taxes paid on share-based compensation | | (9,970) | | | (5,956) | | | |

| Repurchase of common stock | | (82,293) | | | (36,096) | | | |

| Repayment of long-term debt | | (23,867) | | | (154,280) | | | |

| Repayment of other financing agreement | | (8,134) | | | (717) | | | |

| Settlement activity, net | | (8,641) | | | 13,096 | | | |

| Other financing activities, net | | (3,088) | | | — | | | |

| Net cash (used in) provided by financing activities | | (152,560) | | | 416,366 | | | |

| Effect of foreign exchange rate on cash, cash equivalents and restricted cash | | (18,292) | | | 8,439 | | | |

| Net (decrease) increase in cash, cash equivalents and restricted cash | | (29,075) | | | 128,067 | | | |

| Cash, cash equivalents, restricted cash, and cash included in settlement assets at beginning of the period | | 343,724 | | | 215,657 | | | |

| Cash, cash equivalents, restricted cash, and cash included in settlement assets at end of the period | | $ | 314,649 | | | $ | 343,724 | | | |

| Reconciliation of cash, cash equivalents, restricted cash, and cash included in settlement assets | | | | | | |

| Cash and cash equivalents | | $ | 273,645 | | | $ | 295,600 | | | |

| Restricted cash | | 24,594 | | | 23,073 | | | |

| Cash and cash equivalents included in settlement assets | | 16,410 | | | 25,051 | | | |

| Cash, cash equivalents, restricted cash, and cash included in settlement assets | | $ | 314,649 | | | $ | 343,724 | | | |

EVERTEC, Inc.

Schedule 4: Unaudited Segment Information

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended December 31, 2024 |

| (In thousands) | Payment

Services -

Puerto Rico & Caribbean | | Latin America Payments and Solutions | | Merchant

Acquiring, net | | Business

Solutions | | Total Reportable Segments | | Corporate and Other (1) | | Total |

| | | | | | | | | | | | | |

| Revenues | $ | 54,764 | | | $ | 77,870 | | | $ | 46,645 | | | $ | 62,408 | | | $ | 241,687 | | | $ | (25,292) | | | $ | 216,395 | |

| Adjusted EBITDA | 31,328 | | | 25,144 | | | 19,937 | | | 24,357 | | | 100,766 | | | (12,156) | | | 88,610 | |

(1)Corporate and Other consists of corporate overhead, certain leveraged activities, other non-operating expenses and intersegment eliminations. Intersegment revenue eliminations predominantly reflect the $14.4 million processing fee from Payments Services - Puerto Rico & Caribbean to Merchant Acquiring, intercompany software developments and transaction processing of $6.4 million from Latin America Payments and Solutions to both Payment Services - Puerto Rico & Caribbean and Business Solutions, and transaction processing and monitoring fees of $4.4 million from Payment Services - Puerto Rico & Caribbean to Latin America Payments and Solutions.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended December 31, 2023 |

| (In thousands) | Payment

Services -

Puerto Rico & Caribbean | | Latin America Payments and Solutions | | Merchant

Acquiring, net | | Business

Solutions | | Total Reportable Segments | | Corporate and Other (1) | | Total |

| | | | | | | | | | | | | |

| Revenues | $ | 52,408 | | | $ | 65,955 | | | $ | 40,214 | | | $ | 57,772 | | | $ | 216,349 | | | $ | (21,728) | | | $ | 194,621 | |

| Adjusted EBITDA | 30,851 | | | 18,251 | | | 14,423 | | | 20,016 | | | 83,541 | | | (11,843) | | | 71,698 | |

(1)Corporate and Other consists of corporate overhead, certain leveraged activities, other non-operating expenses and intersegment eliminations. Intersegment revenue eliminations predominantly reflect the $13.0 million processing fee from Payments Services - Puerto Rico & Caribbean to Merchant Acquiring, intercompany software developments and transaction processing of $4.3 million from Latin America Payments and Solutions to both Payment Services- Puerto Rico & Caribbean and Business Solutions, and transaction processing and monitoring fees of $4.4 million from Payment Services - Puerto Rico & Caribbean to Latin America Payments and Solutions.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2024 |

| (In thousands) | Payment

Services -

Puerto Rico & Caribbean | | Latin America Payments and Solutions | | Merchant

Acquiring, net | | Business

Solutions | | Total Reportable Segments | | Corporate and Other (1) | | Total |

| | | | | | | | | | | | | |

| Revenues | $ | 214,749 | | | $ | 302,784 | | | $ | 180,500 | | | $ | 243,975 | | | $ | 942,008 | | | $ | (96,522) | | | $ | 845,486 | |

| Adjusted EBITDA | 121,390 | | | 79,681 | | | 72,632 | | | 102,669 | | | 376,372 | | | (36,144) | | | 340,228 | |

(1)Corporate and Other consists of corporate overhead, certain leveraged activities, other non-operating expenses and intersegment eliminations. Intersegment revenue eliminations predominantly reflect the $57.6 million processing fee from Payments Services - Puerto Rico & Caribbean to Merchant Acquiring, intercompany software developments and transaction processing of $21.1 million from Latin America Payments and Solutions to both Payment Services - Puerto Rico & Caribbean and Business Solutions, and transaction processing and monitoring fees of $17.8 million from Payment Services - Puerto Rico & Caribbean to Latin America Payments and Solutions.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2023 |

| (In thousands) | Payment

Services -

Puerto Rico & Caribbean | | Latin America Payments and Solutions | | Merchant

Acquiring, net | | Business

Solutions | | Total Reportable Segments | | Corporate and Other (1) | | Total |

| | | | | | | | | | | | | |

| Revenues | $ | 203,232 | | | $ | 186,503 | | | $ | 162,366 | | | $ | 226,960 | | | $ | 779,061 | | | $ | (84,352) | | | $ | 694,709 | |

| Adjusted EBITDA | 118,266 | | | 60,158 | | | 60,992 | | | 86,880 | | | $ | 326,296 | | | (34,325) | | | 291,971 | |

(1)Corporate and Other consists of corporate overhead, certain leveraged activities, other non-operating expenses and intersegment eliminations. Intersegment revenue eliminations predominantly reflect the $52.9 million processing fee from Payments Services - Puerto Rico & Caribbean to Merchant Acquiring, intercompany software developments and transaction processing of $17.1 million from Latin America Payments and Solutions to both Payment Services- Puerto Rico & Caribbean and Business Solutions, and transaction processing and monitoring fees of $14.3 million from Payment Services - Puerto Rico & Caribbean to Latin America Payments and Solutions.

EVERTEC, Inc.

Schedule 5: Reconciliation of GAAP to Non-GAAP Operating Results

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Quarter ended December 31, | | Year ended December 31, |

| (Dollar amounts in thousands, except share data) | | 2024 | | 2023 | | 2024 | | 2023 |

| Net income | | $ | 40,667 | | | $ | 11,807 | | | $ | 114,779 | | | $ | 79,876 | |

| Income tax expense | | 1,747 | | | 931 | | | 4,847 | | | 5,477 | |

| Interest expense, net | | 14,323 | | | 11,979 | | | 61,401 | | | 23,809 | |

| Depreciation and amortization | | 26,795 | | | 29,941 | | | 127,846 | | | 93,621 | |

| EBITDA | | 83,532 | | | 54,658 | | | 308,873 | | | 202,783 | |

| | | | | | | | |

Equity income(1) | | (1,032) | | | (1,148) | | | (1,270) | | | (1,945) | |

Compensation and benefits (2) | | 8,458 | | | 7,796 | | | 31,644 | | | 29,312 | |

Transaction, refinancing and other fees (3) | | (4,382) | | | 9,453 | | | (4,217) | | | 53,545 | |

Loss on foreign currency remeasurement (4) | | 2,034 | | | 939 | | | 5,198 | | | 8,276 | |

| Adjusted EBITDA | | 88,610 | | | 71,698 | | | 340,228 | | | 291,971 | |

Operating depreciation and amortization (5) | | (15,735) | | | (14,648) | | | (61,467) | | | (52,913) | |

Cash interest expense, net (6) | | (13,182) | | | (12,711) | | | (56,931) | | | (24,286) | |

Income tax expense (7) | | (3,073) | | | (3,183) | | | (6,371) | | | (29,038) | |

Non-controlling interest (8) | | (616) | | | (353) | | | (2,217) | | | (257) | |

| Adjusted Net Income | | $ | 56,004 | | | $ | 40,803 | | | $ | 213,242 | | | $ | 185,477 | |

| Net income per common share (GAAP): | | | | | | | | |

| Diluted | | $ | 0.62 | | | $ | 0.17 | | | $ | 1.73 | | | $ | 1.21 | |

| Adjusted earnings per common share (Non-GAAP): | | | | | | | | |

| Diluted | | $ | 0.87 | | | $ | 0.62 | | | $ | 3.28 | | | $ | 2.82 | |

| Shares used in computing adjusted earnings per common share: | | | | | | | | |

| Diluted | | 64,650,434 | | | 66,273,215 | | | 65,077,535 | | | 65,814,317 | |

1)Represents the elimination of non-cash equity earnings from our equity investments, net of dividends received.

2)Primarily represents share-based compensation and severance payments.

3)Represents fees and expenses associated with corporate transactions as defined in the Credit Agreement, recorded as part of selling, general and administrative expenses, the elimination of multi-year non recurring gains recognized in connection with the sale of tax credits, realized gains from the change in fair market value of equity securities and the foreign currency swap loss.

4)Represents non-cash unrealized gains (losses) on foreign currency remeasurement for assets and liabilities denominated in non-functional currencies.

5)Represents operating depreciation and amortization expense, which excludes amounts generated as a result of merger and acquisition activity.

6)Represents interest expense, less interest income, as they appear on the consolidated statements of income and comprehensive income (loss), adjusted to exclude non-cash amortization of the debt issue costs, premium and accretion of discount.

7)Represents income tax expense calculated on adjusted pre-tax income using the applicable GAAP tax rate, adjusted for certain discrete items.

8)Represents the non-controlling equity interests, net of amortization for intangibles created as part of the purchase.

EVERTEC, Inc.

Schedule 6: Outlook Summary and Reconciliation to Non-GAAP Adjusted Earnings per Share

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | Outlook 2024 | | 2024 |

| (Dollar amounts in millions, except per share data) | | Low | | | | High | | |

| Revenues | | $ | 889 | | | to | | $ | 899 | | | $ | 845 | |

| Earnings per Share (EPS) (GAAP) | | $ | 1.93 | | | to | | $ | 2.05 | | | $ | 1.73 | |

| Per share adjustment to reconcile GAAP EPS to Non-GAAP Adjusted EPS: | | | | | | | | |

Share-based comp, non-cash equity earnings and other (1) | | 0.88 | | | | | 0.88 | | | 0.48 | |

Merger and acquisition related depreciation and amortization (2) | | 0.58 | | | | | 0.58 | | | 1.02 | |

Non-cash interest expense (3) | | 0.04 | | | | | 0.04 | | | 0.07 | |

Tax effect of non-gaap adjustments (4) | | (0.09) | | | | | (0.10) | | | (0.02) | |

| | | | | | | | |

| Total adjustments | | 1.41 | | | | | 1.40 | | | 1.55 | |

| Adjusted EPS (Non-GAAP) | | $ | 3.34 | | | to | | $ | 3.45 | | | $ | 3.28 | |

| Shares used in computing adjusted earnings per common share | | | | | | 65.0 | | | 65.1 | |

(1)Represents share-based compensation, the elimination of non-cash equity earnings from equity investments, severance and other adjustments to reconcile GAAP EPS to Non-GAAP EPS.

(2)Represents depreciation and amortization expenses amounts generated as a result of M&A activity.

(3)Represents non-cash amortization of the debt issue costs, premium and accretion of discount.

(4)Represents income tax expense on non-GAAP adjustments using the applicable GAAP tax rate (anticipated at approximately 6% to 7%).

v3.25.0.1

Document and Entity Information Document

|

Feb. 26, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 26, 2025

|

| Entity Registrant Name |

EVERTEC, Inc.

|

| Entity Incorporation, State or Country Code |

PR

|

| Entity File Number |

001-35872

|

| Entity Central Index Key |

0001559865

|

| Amendment Flag |

false

|

| Entity Tax Identification Number |

66-0783622

|

| Entity Address, Address Line One |

Cupey Center Building,

|

| Entity Address, Address Line Two |

Road 176, Kilometer 1.3,

|

| Entity Address, City or Town |

San Juan,

|

| Entity Address, Country |

PR

|

| Entity Address, Postal Zip Code |

00926

|

| City Area Code |

787

|

| Local Phone Number |

759-9999

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

EVTC

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

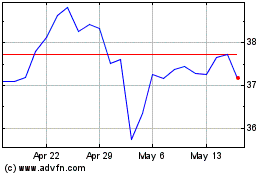

Evertec (NYSE:EVTC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Evertec (NYSE:EVTC)

Historical Stock Chart

From Feb 2024 to Feb 2025