United States Securities and Exchange Commission

Washington, D.C. 20549

NOTICE OF EXEMPT SOLICITATION

Pursuant to Rule 14a-103

Name of the Registrant: FedEx Corporation

Name of persons relying on exemption: Clean Yield Asset Management

Address of persons relying on exemption: 16 Beaver Meadow Rd, Norwich,

VT 05055

Written materials are submitted pursuant to Rule 14a-6(g) (1) promulgated

under the Securities Exchange Act of 1934. Submission is not required of this filer under the terms of the Rule but is made voluntarily

in the interest of public disclosure and consideration of these important issues.

PROXY MEMORANDUM

| TO: | FedEx Corporation Shareholders |

| RE: | Item No. 6 (“Report on Alignment Between Company Values and Electioneering Contributions”) |

| CONTACT: | Molly Betournay, molly<at>cleanyield.com |

This is not a solicitation of authority to vote your proxy. Please

DO NOT send us your proxy card; Clean Yield Asset Management is not able to vote your proxies, nor does this communication contemplate

such an event. Clean Yield Asset Management urges shareholders to vote for Item No. 6 following the instructions provided on management's

proxy mailing.

Clean Yield Asset Management urges shareholders to vote YES

on Item No. 6 on the FedEx Corporation 2022 proxy ballot. The resolved clause states:

Shareholders request that FedEx publish an annual report,

at reasonable expense, disclosing whether incongruencies between political and electioneering expenditures and company values were identified

during the preceding year, and disclosing or summarizing any actions taken regarding pausing or terminating support for organizations

or politicians, and the types of incongruent policy advocacy triggering those decisions.

About Clean Yield Asset Management

Clean Yield Asset Management (“Clean Yield”) is an investment

firm based in Norwich, VT, specializing in socially responsible asset management. We have filed this shareholder proposal on behalf of

our client, Rachel Hexter-Fried, a long-term shareholder in FedEx Corporation because it is apparent that many recipients of the company’s

political contributions actively support policies that run contrary to some of FedEx’s corporate responsibility initiatives. We

believe that these inconsistencies may put shareholder value at risk.

FedEx Political Contributions and the Incongruency Problem

Shortly after the January 6 insurrection at the Capitol, news outlets

reported that FedEx was reviewing its contributions. The company has not disclosed the results of this review or how this review may influence

contributions going forward. A lack of transparency regarding the outcomes of this review could call into question the authenticity and

rigor of such a review or concern for the issue at hand.

In contrast, the annual review we propose would institutionalize greater

transparency and accountability in FedEx’s political spending process. The proposal cites several examples that support the case

for the annual report requested in the Resolved clause.

Contributing to candidates and organizations that undermine democracy

and stability

As noted in the proposal, following the January 6, 2021 attack on the

Capitol, FedEx stated “We condemn the violence that occurred in Washington, D.C., and fully support the results of the U.S. general

election.” Yet FedEx subsequently contributed $149,500 to 56 members of Congress who challenged the certification of the 2020 presidential

results that day.1 (https://bit.ly/33crKM0)

Relatedly, since 2020, FedEx has given $20,000 to the Republic Attorney

Generals Association (RAGA); about two-thirds of RAGA’s member attorneys general signed on to a brief urging the Supreme Court to

throw out the election results from four states, and its self-described policy branch ran a robo-calling effort urging “patriots”

to “march to Congress” and “stop the steal.” A number of companies and organizations have discontinued their affiliations

with RAGA (https://popular.info/p/after-riot-major-corporations-suspend).

Contributions to these candidates and organizations are out of step

with Fedex’s stated aim of engaging in the political process with the goal of “promoting and protecting the economic future

of the company and our stockholders and employees.” They also undermine Fedex’ statement condemning the violence on January

6th and its support for the results of the election.

Contributing to candidates and organizations that that oppose diversity,

equity, and inclusion

FedEx has stated that it “supports an inclusive workplace culture

and is committed to the education, recruitment, development and advancement of diverse team members worldwide, and we are recognized for

our commitment to those efforts.” FedEx has supported gender diversity by sponsoring women’s and working parents’ employee

resource groups, and providing maternity leave, financial assistance with adoptions, and a work-life balance program.

1 https://www.accountable.us/corporate-donations-tracker/

Accessed September 9, 2022.

Yet based on public data analyzed by the Sustainable Investments Institute,

it is estimated that in the 2016-2020 election cycles, FedEx and FedExPAC made political donations totaling over $4 million to politicians

and political organizations working to weaken access to reproductive healthcare, which undermines the ability of employees to manage their

fertility.

Giving to state and federal anti-choice candidates from 2020 through

the present exceeds half a million dollars and, in that period, the company has contributed approximately $675,000 to anti-choice 527s,

federal party and leadership PACs, and state PACs.

FedEx also contributed $150,000 in 2018 to the Republican Governors

Association (RGA), a 527 organization that donated millions toward state party affiliate organizations that supported Georgia Governor

Brian Kemp and Iowa Governor Kim Reynolds, who in 2021 signed into law two of the nation’s most restrictive voter suppression

laws. These bills will hit the Black community especially hard and have been dubbed “the new Jim Crow.” (“Corporate

Enablers: Who are the Leading Bankrollers of Voter Suppression Legislation?” Center for Political Accountability, 2021 at https://www.politicalaccountability.net/cpa-reports/).

* * * *

In addition to the conflicts discussed above, there are other patterns

of spending by FedEx that underscore the utility of the requested report as a tool for risk reduction and accountability:

| · | In 2019, Popular.Info wrote about FedEx’s $1.2 million in contributions

to 75 anti-LGBTQ politicians in the previous two years (see “These 9 Pride-celebrating companies donated millions to anti-gay

Congress members,” LGBTQNation.com, June 23, 2019 at https://bit.ly/3c8vfoQ).

Additionally, according to Popular.Info, FedEx has contributed $10,000 to several of the sponsors of a Tennessee bill aimed at dismantling

same-sex marriage in the state by proposing a new form of marriage that can only exist between a man and a woman. (https://popular.info/p/tennessee-republicans-pushing-to)

These donations conflict with FedEx’s aspirations to provide a supportive environment for its LGBTQ employees (see the FedEx web

page, “Investing in Inclusion: LGBTQ”, https://bit.ly/3iFOW9s).

|

| · | FedEx’s CEO has stated that the company has “a

responsibility to take bold action in addressing climate challenges” and has committed to reaching carbon neutral operations globally

by 2040 (https://newsroom.fedex.com/newsroom/sustainability2021/).

Yet FedEx is a member of the US Chamber of Commerce, which has long and

consistently lobbied to roll back specific US climate regulations and promoted regulatory frameworks that would significantly slow a transition

away from a GHG emission-intense energy mix (https://www.ceres.org/practicingRPE/fedex).

|

The Supreme Court has interpreted the constitution as permitting political

spending by corporations, but it has also emphasized the rights of investors to use shareholder democracy to ensure accountability for

this spending. In our highly polarized political environment, shareholders must insist upon a more responsible and coherent political

spending strategy. The Proponent believes FedEx’s reputation is at risk, regardless of boilerplate disclaimers asserting that

contributions do not imply an endorsement of all of the recipients’ views.

Why a YES Vote is Warranted

The examples above vividly illustrate why we believe FedEx is doing

a disservice to its shareholders and broader stakeholders by failing to align its political expenditures with its policies and values.

FedEx’s statement of opposition to our proposal mostly references

the company’s current governance and transparency mechanisms while evading the concerns raised in the proposal. The main arguments

advanced are that (1) political engagement is important for FedEx in order to promote and protect the interests of FedEx, its stakeholders,

and employees, (2) that “participation in the political process and as a member of various trade associations comes with the understanding

that we may not always agree with all of the positions of the recipients, organizations, or organizations’ other members”

but that these groups “advance positions consistent with company interests”, and (3) that FedEx also provides extensive information

about its political involvement.

Simply asserting that the company does not agree with all of a candidate

or association’s views is not equivalent to a statement by management explaining glaring incongruities in donations, some of which

might threaten to overwhelm the benefits to the company associated with company donations. Such a disclaimer does not negate or respond

to investor concern about the existence and impact of incongruent contributions, nor the need for an annual assessment.

Nor has FedEx published the analysis requested in the proposal, an

“annual report analyzing the congruency of political and electioneering expenditures during the preceding year against publicly

stated company values and policies, with a further recommendation that such report also contain management’s analysis of risks to

our company’s brand, reputation, or shareholder value of expenditures in conflict with publicly stated company values.” Under

the framework of the Proposal, it does not rest with investors to determine which donations were incongruent; rather the company should

explain the incongruency of specific donations, and what overriding considerations cause it to provide and even perpetuate donations despite

incongruent voting records of any donation recipients.

Further, while the company claims to provide extensive reporting on

its political involvement, this reporting fails to cover the specific issue raised in this proposal. The proposed report would address

how incongruences are identified and how they are handled. The company’s current reporting around alignment, which states that “to

ensure alignment of legislative and regulatory priorities with business objectives, our Government and Regulatory Affairs Department is

aligned with the corporation’s business and regional leadership teams and is directly engaged in their core strategic processes”

(https://investors.fedex.com/esg/governance-policies/Political-Activity-and-Contributions/default.aspx)

simply indicates that there is internal communication between departments. It does not, however, indicate how misalignments, such

as the ones identified in the proposal, are identified and addressed, nor does it explain whether systems are in place to prevent future

misalignment. Due to this lack of detail and explanation, which the proposal would address, the company’s assertion in its statement

of opposition that the Board’s Governance, Safety and Public Policy Committee “reviews and discusses with FedEx’s Vice

President, General Counsel and Secretary….the steps management has taken to identify, assess, and manage risks relating to the

company’s political activities and expenditures” means little. What steps has management taken to identify, assess and manage

these risks?

It is worth noting that FedEx’s overall political spending transparency

and accountability mechanisms lag behind those of its industry peers, according to the 2021 CPA-Zicklin Index of Corporate Political Disclosure

and Accountability (see https://politicalaccountability.net/index). (Deficiencies

noted in that report concern failure to disclose trade association payments that may be used for political purposes; failure to disclose

a list of the amounts and recipients of payments made by trade associations or other tax-exempt organizations of which it is a member;

and failure to publish a detailed report on a semiannual basis.)

In a 2021 speech, Acting SEC Chair Allison Herren Lee reaffirmed the

salience of political spending disclosure to investment decision-making:

[P]olitical spending disclosure

is inextricably linked to ESG issues. Consider for instance research showing that many companies that have made carbon neutral pledges,

or otherwise state they support climate-friendly initiatives, have donated substantial sums to candidates with climate voting records

inconsistent with such assertions. Consider also companies that made noteworthy pledges to alter their political spending practices in

response to racial justice protests, and whether, without political spending disclosure requirements, investors can adequately test these

claims, or would have held corporate managers accountable for those risks before they materialized. Political spending disclosure is key

to any discussion of sustainability.

(See “A Climate for Change: Meeting

Investor Demand for Climate and ESG Information at the SEC,” March 15, 2021 at https://bit.ly/3vXEH6D.)

FedEx’s opposition statement in the proxy evades the central

issue raised by our proposal: the risk of potential damage to company reputation, shareholder value, and broader stakeholder interests

that steadily accrues when corporate and PAC dollars subsidize recipients whose activities undermine FedEx’s corporate values.

In an environment in which corporate political activity is closely

scrutinized by numerous observers and stakeholders, we believe that FedEx would be wise to incorporate these “lived” or implicit

values, into its criteria for determining which recipients are eligible for political contributions. FedEx is correct to consider recipients’

capacity to further the company’s purpose and “advance positions consistent with company interests”

- but the Proponent contends that it is unwise risk management to neglect those recipients’ responsibility for accelerating harmful

developments such as the examples articulated in the proposal and discussed above. For example, is it enough for FedEx to assert that

it “may not always

agree with all of the positions

of the recipients, organizations,

or organizations' other members,” to explain away its support for the dozens of members of Congress who voted against certifying

the presidential election results on January 6, 2021?

Inconsistency can pose risks to corporate reputation, brand, and market

share by leaving companies vulnerable to charges of hypocrisy or indifference to the environment or the social welfare of their employees

or the communities in which they operate. A recent survey of 2,200 global executives worldwide noted the following:

Corporate reputation is an invaluable asset with appreciable

impact on a company’s bottom line. On average, global executives attribute 63% of their company’s market value to their company’s

overall reputation.

(See The State of Corporate Reputation in 2020: Everything Matters

Now, Weber Shandwick and KRC Research, 2020 at https://bit.ly/3rabGRw.)

Corporate political involvement does not enjoy widespread public support

and may detract from corporate reputation. According to polling conducted by Morning Consult in October2020, 59% said companies should

work to ensure fair elections, but only 30% felt they should play a role in getting politicians elected (see “What Consumers Want

Companies to Say and Do in a Year Like No Other,” Morning Consult, October 2020 at https://bit.ly/2PhK2V8).

* * * *

For these reasons, we believe that the requested review and disclosure

called for in our proposal will motivate FedEx to make political expenditures that do not erode shareholder value by diminishing the company’s

reputation, brand, values, and corporate responsibility initiatives. We urge you to cast a YES vote on Item No. 6.

Appendix: FedEx’s contributions to members of Congress

who voted against certification of the presidential election results on January 6, 2021

Total: $149,500

Adrian Smith (NE-3) - $1,000

Beth Van Duyne (TX-24) - $3,500

Bob Gibbs (OH-7) - $5,000

Brian Babin (TX-36) - $2,000

Brian Mast (FL-18) - $2,000

Carlos Gimenez (FL-26) - $4,500

Carol Miller (WV-3) - $3,000

Chuck Fleischmann (TN-3) - $2,500

Daniel Webster (FL-11) - $5,000

David Kustoff (TN-8) - $5,000

David Rouzer (NC-7) - $5,000

David Schweikert (AZ-6) - $3,500

Debbie Lesko (AZ-8) - $2,000

Devin Nunes (CA-22) - $2,500

Diana Harshbarger (TN-1) - $1,500

Doug LaMalfa (CA-1) - $2,000

Elise Stefanik (NY-21) - $7,500

Garret Graves (LA-6) - $6,000

Gary Palmer (AL-6) - $1,500

Greg Pence (IN-6) - $2,500

Greg Steube (FL-17) - $2,000

Guy Reschenthaler (PA-14) - $1,000

Jackie Walorski (IN-2) - $1,500

Jacob LaTurner (KS-2) - $2,000

Jason Smith (MO-8) - $2,500

Jefferson Van Drew (NJ-2) - $1,000

Jodey Arrington (TX-19) - $2,000

John Carter (TX-31) - $1,000 |

|

John Kennedy (LA) - $1,000

Kevin Hern (OK-1) - $2,500

Kevin McCarthy (CA-23) - $5,000

Lisa McClain (MI-10) - $1,000

Lloyd Smucker (PA-11) - $4,000

Mario Diaz-Balart (FL-25) - $1,000

Mark Green (TN-7) - $2,500

Michael Burgess (TX-26) - $1,000

Michael Guest (MS-3) - $3,500

Michelle Fischbach (MN-7) - $2,000

Mike Bost (IL-12) - $2,000

Mike Kelly (PA-16) - $1,000

Nicole Malliotakis (NY-11) - $2,500

Pete Sessions (TX-17) - $1,000

Randy Weber (TX-14) - $2,000

Richard Hudson (NC-8) - $4,500

Rick Crawford (AR-1) - $5,000

Robert Aderholt (AL-4) - $2,000

Ron Estes (KS-4) - $2,500

Sam Graves (MO-6) - $5,000

Stephanie Bice (OK-5) - $3,000

Steve Scalise (LA-1) - $5,000

Tim Burchett (TN-2) - $2,500

Tom Rice (SC-7) - $2,500

Tracey Mann (KS-1) - $1,000

Troy Nehls (TX-22) - $1,000

Virginia Foxx (NC-5) - $1,000

William Timmons (SC-4) - $2,000 |

Sources

Reports

Funding the Bans, Equity Forward, 2019 at https://bit.ly/3c6e9Ii

Conflicted Consequences, Center for Political Accountability,

2020 at https://bit.ly/3f4DPa0

Corporate

Enablers: Who are the Leading Bankrollers of Voter Suppression Legislation? Center for Political Accountability, 2021 at

https://www.politicalaccountability.net/cpa-reports/

Bankrolling the Disenfranchisers, Public Citizen, 2021 at https://bit.ly/3ra8Qfk

Political Spending & Reproductive Health Rights, Sustainable

Investments Institute, September 28, 2020 at https://bit.ly/2PeEnzh

News sources

“U.S. Businesses Say One Thing on Climate Change, But Their Campaign

Giving Says Another,” Bloomberg Green, October 23, 2020, at https://bloom.bg/393c6CI.

“These

9 Pride-celebrating companies donated millions to anti-gay Congress members,” LGBTQNation.com, June 23, 2019.

Speeches

“A Climate for Change: Meeting Investor Demand for Climate and

ESG Information at the SEC,” Acting SEC Commissioner Allison Herren Lee, March 15, 2021, at https://bit.ly/3vXEH6D.

7

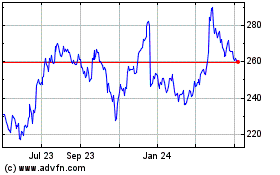

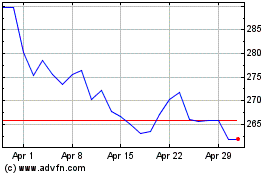

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024