Current Report Filing (8-k)

14 September 2022 - 6:16AM

Edgar (US Regulatory)

0000051143

false

Capital stock, par value $.20 per share

IBM

CHX

0000051143

2022-09-13

2022-09-13

0000051143

us-gaap:CommonStockMember

exch:XCHI

2022-09-13

2022-09-13

0000051143

us-gaap:CommonStockMember

exch:XNYS

2022-09-13

2022-09-13

0000051143

ibm:Notes1.25PercentDue2023Member

exch:XNYS

2022-09-13

2022-09-13

0000051143

ibm:Notes0.375PercentDue2023Member

exch:XNYS

2022-09-13

2022-09-13

0000051143

ibm:Notes1.125PercentDue2024Member

exch:XNYS

2022-09-13

2022-09-13

0000051143

ibm:Notes2.875PercentDue2025Member

exch:XNYS

2022-09-13

2022-09-13

0000051143

ibm:Notes0.950PercentDue2025Member

exch:XNYS

2022-09-13

2022-09-13

0000051143

ibm:Notes0.875PercentDue2025Member

exch:XNYS

2022-09-13

2022-09-13

0000051143

ibm:Notes0.300PercentDue2026Member

exch:XNYS

2022-09-13

2022-09-13

0000051143

ibm:Notes1.250PercentDue2027Member

exch:XNYS

2022-09-13

2022-09-13

0000051143

ibm:Notes0.300PercentDue2028Member

exch:XNYS

2022-09-13

2022-09-13

0000051143

ibm:Notes1.750PercentDue2028Member

exch:XNYS

2022-09-13

2022-09-13

0000051143

ibm:Notes1.500PercentDue2029Member

exch:XNYS

2022-09-13

2022-09-13

0000051143

ibm:Notes0.875PercentDue2030Member

exch:XNYS

2022-09-13

2022-09-13

0000051143

ibm:Notes1.250PercentDue2034Member

exch:XNYS

2022-09-13

2022-09-13

0000051143

ibm:Notes1.750PercentDue2031Member

exch:XNYS

2022-09-13

2022-09-13

0000051143

exch:XNYS

ibm:Notes0.650PercentDue2032Member

2022-09-13

2022-09-13

0000051143

exch:XNYS

ibm:Notes1.200PercentDie2040Member

2022-09-13

2022-09-13

0000051143

ibm:Debentures7.00PercentDue2025Member

exch:XNYS

2022-09-13

2022-09-13

0000051143

ibm:Debentures6.22PercentDue2027Member

exch:XNYS

2022-09-13

2022-09-13

0000051143

ibm:Debentures6.50PercentDue2028Member

exch:XNYS

2022-09-13

2022-09-13

0000051143

ibm:Debentures5.875PercentDue2032Member

exch:XNYS

2022-09-13

2022-09-13

0000051143

ibm:Debentures7.00PercentDue2045Member

exch:XNYS

2022-09-13

2022-09-13

0000051143

ibm:Debentures7.125PercentDue2096Member

exch:XNYS

2022-09-13

2022-09-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

| Title of each class |

Capital stock, par value $.20 per share |

| Trading

symbol |

IBM |

|

Common Stock |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT PURSUANT TO SECTION 13 OR 15 (d)

OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: September 13, 2022

(Date of earliest

event reported)

INTERNATIONAL

BUSINESS MACHINES CORPORATION

(Exact name of registrant

as specified in its charter)

| New York |

|

001-2360 |

|

13-0871985 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS employee |

| of incorporation) |

|

File No.) |

|

Indemnification No.) |

One New Orchard Road

|

|

|

| Armonk,

New York |

|

10504 |

| (Address of principal executive offices) |

|

(Zip Code) |

914-499-1900

(Registrant’s telephone number, including area code)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange

on which registered |

| Capital stock, par value $.20 per share |

|

IBM |

|

New York Stock Exchange |

| |

|

|

|

NYSE Chicago |

| 1.250% Notes due 2023 |

|

IBM 23A |

|

New York Stock Exchange |

| 0.375% Notes due 2023 |

|

IBM 23B |

|

New York Stock Exchange |

| 1.125% Notes due 2024 |

|

IBM 24A |

|

New York Stock Exchange |

| 2.875% Notes due 2025 |

|

IBM 25A |

|

New York Stock Exchange |

| 0.950% Notes due 2025 |

|

IBM 25B |

|

New York Stock Exchange |

| 0.875% Notes due 2025 |

|

IBM 25C |

|

New York Stock Exchange |

| 0.300% Notes due 2026 |

|

IBM 26B |

|

New York Stock Exchange |

| 1.250% Notes due 2027 |

|

IBM 27B |

|

New York Stock Exchange |

| 0.300% Notes due 2028 |

|

IBM 28B |

|

New York Stock Exchange |

| 1.750% Notes due 2028 |

|

IBM 28A |

|

New York Stock Exchange |

| 1.500% Notes due 2029 |

|

IBM 29 |

|

New York Stock Exchange |

| 0.875% Notes due 2030 |

|

IBM 30 |

|

New York Stock Exchange |

| 1.750% Notes due 2031 |

|

IBM 31 |

|

New York Stock Exchange |

| 0.650% Notes due 2032 |

|

IBM 32A |

|

New York Stock Exchange |

| 1.250% Notes due 2034 |

|

IBM 34 |

|

New York Stock Exchange |

| 1.200% Notes due 2040 |

|

IBM 40 |

|

New York Stock Exchange |

| 7.00% Debentures due 2025 |

|

IBM 25 |

|

New York Stock Exchange |

| 6.22% Debentures due 2027 |

|

IBM 27 |

|

New York Stock Exchange |

| 6.50% Debentures due 2028 |

|

IBM 28 |

|

New York Stock Exchange |

| 5.875% Debentures due 2032 |

|

IBM 32D |

|

New York Stock Exchange |

| 7.00% Debentures due 2045 |

|

IBM 45 |

|

New York Stock Exchange |

| 7.125% Debentures due 2096 |

|

IBM 96 |

|

New York Stock Exchange |

Indicate by check mark

whether the registrar is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230 405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§12b-2 of this chapter).

Emerging growth company

¨

If an emerging growth

company indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01. Other Events.

On September 7, 2022, International Business Machines

Corporation (“IBM” or the “Company”) and State Street Global Advisors Trust Company, as independent fiduciary

of the IBM Personal Pension Plan (the “Plan”), entered into two separate commitment agreements, one with The Prudential Insurance

Company of America (“Prudential”) and one with Metropolitan Life Insurance Company (collectively, the “Insurers”)

under which the Plan agreed to purchase nonparticipating single premium group annuity contracts that will transfer to the Insurers approximately

$16 billion of the Plan’s defined benefit pension obligations related to certain pension benefits that began to be paid prior to

2016.

The purchase of the group annuity contracts closed

on September 13, 2022. The contracts cover approximately 100,000 IBM participants and beneficiaries (the “Transferred Participants”).

Under the group annuity contracts, each Insurer has made an irrevocable commitment, and will be solely responsible, to pay 50% of the

pension benefits of each Transferred Participant that are due on and after January 1, 2023. Prudential will be the lead administrator.

The transaction will result in no changes to the amount of benefits payable to the Transferred Participants.

The purchase of the group annuity contracts was

funded directly by assets of the Plan and required no cash or asset contributions of the Company. As a result of the transaction, the

Company expects to recognize a one-time non-cash pre-tax pension settlement charge of approximately $5.9 billion ($4.4 billion net of

tax) in the third quarter of 2022. The actual charge will depend on finalization of the actuarial and other assumptions. The pre-tax charge

was not included in the GAAP forward-looking information released on July 18, 2022. This charge will not impact the Company’s third

quarter or full year 2022 operating (non-GAAP) profit or free cash flow.

Forward-Looking Statements

Certain statements contained in this Form 8-K

may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (“Reform

Act”). Forward-looking statements are based on the company’s current assumptions regarding future business and financial performance.

These statements by their nature address matters that are uncertain to different degrees. The company may also make forward-looking statements

in other reports filed with the Securities and Exchange Commission (SEC), in materials delivered to stockholders and in press releases.

In addition, the company’s representatives may from time to time make oral forward-looking statements. Forward-looking statements

provide current expectations of future events based on certain assumptions and include any statement that does not directly relate to

any historical or current fact. Words such as “anticipates,” “believes,” “expects,” “estimates,”

“intends,” “plans,” “projects,” and similar expressions, may identify such forward-looking statements.

Any forward-looking statement in this Form 8-K speaks only as of the date on which it is made. Except as required by law, the company

assumes no obligation to update or revise any forward-looking statements.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. |

|

Description |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

Date: September 13, 2022

| |

INTERNATIONAL BUSINESS MACHINES CORPORATION |

| |

|

| |

By: |

/s/Frank Sedlarcik |

| |

|

Frank Sedlarcik |

| |

|

Vice President, Assistant General Counsel and Secretary |

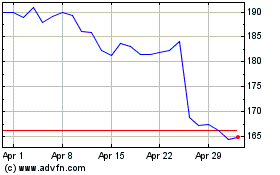

International Business M... (NYSE:IBM)

Historical Stock Chart

From Mar 2024 to Apr 2024

International Business M... (NYSE:IBM)

Historical Stock Chart

From Apr 2023 to Apr 2024