Intercontinental Exchange 2Q Revenue Rises as Exchange Services Grow

04 August 2022 - 10:26PM

Dow Jones News

By Will Feuer

Intercontinental Exchange Inc. posted higher second-quarter

revenue as an increase in revenue in its exchanges and fixed-income

segments offset a decrease in its mortgage-related operations.

The exchange operator and mortgage-data provider posted net

income attributable to the company of $555 million, compared with

$1.25 billion a year earlier. Earnings came to 99 cents a share,

compared with $2.22 a share.

In the year-ago period, Intercontinental Exchange booked a $1.23

billion gain on the company's divestment of its stake in

cryptocurrency exchange Coinbase Global Inc., driving the

year-over-year drop.

Excluding certain items, the owner of the New York Stock

Exchange and other major exchanges logged adjusted earnings of

$1.32 a share. Analysts surveyed by FactSet expected adjusted

earnings of $1.27 a share.

Revenue rose to $2.41 billion from $2.13 billion a year ago.

Exchange revenue rose 11% to $1.01 billion. Fixed-income and

data-services revenue rose 12% to $512 million. Mortgage-technology

revenue slid 13% to $297 million, the company said.

Write to Will Feuer at Will.Feuer@wsj.com

(END) Dow Jones Newswires

August 04, 2022 08:11 ET (12:11 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

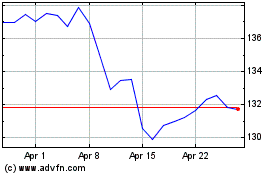

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Apr 2023 to Apr 2024