- Revenue of $3,814 million

- GAAP Net Income of $363 million, Adjusted EBITDA of $887

million

- GAAP Diluted Earnings per Share of $1.97, Adjusted Diluted

Earnings per Share of $2.64

- R&D Solutions quarterly bookings of $2.7 billion,

representing a book-to-bill ratio of 1.27x

- R&D Solutions contracted backlog of $30.6 billion, up

7.7 percent reported and 8.1 percent at constant currency

year-over-year

- Full-year 2024 guidance updated for revenue to be between

$15,425 million and $15,525 million, Adjusted EBITDA between $3,705

million and $3,765 million, and Adjusted Diluted Earnings per Share

between $11.10 and $11.30

IQVIA Holdings Inc. (“IQVIA”) (NYSE:IQV), a leading global

provider of advanced analytics, technology solutions, and clinical

research services to the life sciences industry, today reported

financial results for the quarter ended June 30, 2024.

Second-Quarter 2024 Operating Results

Revenue for the second quarter of $3,814 million increased 2.3

percent on a reported basis and 3.5 percent at constant currency,

compared to the second quarter of 2023. Technology & Analytics

Solutions (TAS) revenue of $1,495 million increased 2.7 percent on

a reported basis and 3.8 percent at constant currency. Research

& Development Solutions (R&DS) revenue of $2,147 million

increased 2.4 percent on a reported basis and 3.3 percent at

constant currency. Excluding the impact of pass throughs, R&DS

revenue grew 3.5 percent on a reported basis. Contract Sales &

Medical Solutions (CSMS) revenue of $172 million decreased 2.3

percent on a reported basis and increased 2.8 percent at constant

currency.

As of June 30, 2024, R&DS contracted backlog, including

reimbursed expenses, was $30.6 billion, growing 7.7 percent

year-over-year and 8.1 percent at constant currency. The company

expects approximately $7.8 billion of this backlog to convert to

revenue in the next twelve months. The second-quarter book-to-bill

ratio was 1.27x. For the twelve months ended June 30, 2024, the

book-to-bill ratio was 1.26x.

“IQVIA delivered second quarter results at the high-end of our

guidance, driven mainly by better-than-expected TAS performance,"

stated Ari Bousbib, chairman and CEO of IQVIA. "The team is focused

on strong operational execution. In the quarter, profit margin

expanded, free cash flow was strong, and Adjusted Diluted EPS grew

8.6 percent. The R&DS segment continued to perform well and

again delivered strong bookings, reflecting demand for IQVIA’s

highly differentiated solutions. Forward-looking indicators, such

as RFP flow and qualified pipeline, remain healthy. TAS performance

in the quarter provides a smoother path to our full-year total

company and segment targets."

Second-quarter GAAP Net Income was $363 million and GAAP Diluted

Earnings per Share was $1.97. Adjusted Net Income was $487 million

and Adjusted Diluted Earnings per Share was $2.64. Adjusted EBITDA

was $887 million, up 2.7 percent year-over-year.

First-Half 2024 Operating Results

Revenue for the first six months of 2024 was $7,551 million, up

2.3 percent on a reported basis and 3.2 percent at constant

currency, compared to the first six months of 2023. TAS revenue was

$2,948 million, representing growth of 1.7 percent on a reported

basis and 2.4 percent at constant currency. R&DS revenue was

$4,242 million, up 2.9 percent on a reported basis and 3.6 percent

at constant currency. CSMS revenue was $361 million, up 0.8 percent

on a reported basis and 5.0 percent at constant currency.

GAAP Net Income was $651 million and GAAP Diluted Earnings per

Share was $3.53. Adjusted Net Income was $955 million and Adjusted

Diluted Earnings per Share was $5.18. Adjusted EBITDA was $1,749

million.

Financial Position

As of June 30, 2024, cash and cash equivalents were $1,545

million and debt was $13,258 million, resulting in net debt of

$11,713 million. IQVIA’s Net Leverage Ratio was 3.25x trailing

twelve-month Adjusted EBITDA. For the second quarter, Operating

Cash Flow was $588 million and Free Cash Flow was $445 million.

Full-Year 2024 Guidance

The company updated its full-year 2024 guidance for revenue to

be between $15,425 million and $15,525 million, Adjusted EBITDA

between $3,705 million and $3,765 million, and Adjusted Diluted

Earnings per Share between $11.10 and $11.30.

All financial guidance assumes foreign currency exchange rates

as of July 18, 2024 remain in effect for the forecast period.

Webcast & Conference Call Details

IQVIA will host a conference call at 9:00 a.m. Eastern Time

today to discuss its second-quarter 2024 results and its

third-quarter and full-year 2024 guidance. To listen to the event

and view the presentation slides via webcast, join from the IQVIA

Investor Relations website at http://ir.iqvia.com. To participate

in the conference call, interested parties must register in advance

by clicking on this link. Following registration, participants will

receive a confirmation email containing details on how to join the

conference call, including the dial-in and a unique passcode and

registrant ID. At the time of the live event, registered

participants connect to the call using the information provided in

the confirmation email and will be placed directly into the

call.

About IQVIA

IQVIA (NYSE:IQV) is a leading global provider of advanced

analytics, technology solutions, and clinical research services to

the life sciences industry. IQVIA creates intelligent connections

across all aspects of healthcare through its analytics,

transformative technology, big data resources, extensive domain

expertise and network of partners. IQVIA Connected Intelligence™

delivers actionable insights and powerful solutions with speed and

agility — enabling customers to accelerate the clinical development

and commercialization of innovative medical treatments that improve

healthcare outcomes for patients. With approximately 88,000

employees, IQVIA conducts operations in more than 100

countries.

IQVIA is a global leader in protecting individual patient

privacy. The company uses a wide variety of privacy-enhancing

technologies and safeguards to protect individual privacy while

generating and analyzing information on a scale that helps

healthcare stakeholders identify disease patterns and correlate

with the precise treatment path and therapy needed for better

outcomes. IQVIA’s insights and execution capabilities help biotech,

medical device and pharmaceutical companies, medical researchers,

government agencies, payers and other healthcare stakeholders tap

into a deeper understanding of diseases, human behaviors and

scientific advances, in an effort to advance their path toward

cures. To learn more, visit www.iqvia.com.

Cautionary Statements Regarding Forward-Looking

Statements

This press release contains “forward-looking statements” within

the meaning of the federal securities laws, including Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, including, without

limitation, our full-year 2024 guidance. In this context,

forward-looking statements often address expected future business

and financial performance and financial condition, and often

contain words such as “expect,” “assume,” “anticipate,” “intend,”

“plan,” “forecast,” “believe,” “seek,” “see,” “will,” “would,”

“target,” similar expressions, and variations or negatives of these

words that are intended to identify forward-looking statements,

although not all forward-looking statements contain these

identifying words. Actual results may differ materially from our

expectations due to a number of factors, including, but not limited

to, the following: business disruptions caused by natural

disasters, pandemics such as the COVID-19 (coronavirus) outbreak,

including any variants, and the public health policy responses to

the outbreak, and international conflicts or other disruptions

outside of our control such as the current situation in Ukraine and

Russia; most of our contracts may be terminated on short notice,

and we may lose or experience delays with large client contracts or

be unable to enter into new contracts; the market for our services

may not grow as we expect; we may be unable to successfully develop

and market new services or enter new markets; imposition of

restrictions on our use of data by data suppliers or their refusal

to license data to us; any failure by us to comply with

contractual, regulatory or ethical requirements under our

contracts, including current or future changes to data protection

and privacy laws; breaches or misuse of our or our outsourcing

partners’ security or communications systems; failure to meet our

productivity or business transformation objectives; failure to

successfully invest in growth opportunities; our ability to protect

our intellectual property rights and our susceptibility to claims

by others that we are infringing on their intellectual property

rights; the expiration or inability to acquire third party licenses

for technology or intellectual property; any failure by us to

accurately and timely price and formulate cost estimates for

contracts, or to document change orders; hardware and software

failures, delays in the operation of our computer and

communications systems or the failure to implement system

enhancements; the rate at which our backlog converts to revenue;

our ability to acquire, develop and implement technology necessary

for our business; consolidation in the industries in which our

clients operate; risks related to client or therapeutic

concentration; government regulators or our customers may limit the

number or scope of indications for medicines and treatments or

withdraw products from the market, and government regulators may

impose new regulatory requirements or may adopt new regulations

affecting the biopharmaceutical industry; the risks associated with

operating on a global basis, including currency or exchange rate

fluctuations and legal compliance, including anti-corruption laws;

risks related to changes in accounting standards; general economic

conditions in the markets in which we operate, including financial

market conditions, inflation, and risks related to sales to

government entities; the impact of changes in tax laws and

regulations; and our ability to successfully integrate, and achieve

expected benefits from, our acquired businesses. For a further

discussion of the risks relating to our business, see the “Risk

Factors” in our annual report on Form 10-K for the fiscal year

ended December 31, 2023, filed with the Securities and Exchange

Commission (the "SEC"), as such factors may be amended or updated

from time to time in our subsequent periodic and other filings with

the SEC, which are accessible on the SEC’s website at www.sec.gov.

These factors should not be construed as exhaustive and should be

read in conjunction with the other cautionary statements that are

included in this release and in our filings with the SEC. We assume

no obligation to update any such forward-looking statement after

the date of this release, whether as a result of new information,

future developments or otherwise.

Note on Non-GAAP Financial Measures

This release includes information based on financial measures

that are not recognized under generally accepted accounting

principles in the United States ("GAAP"), such as Adjusted EBITDA,

Adjusted Net Income, Adjusted Diluted Earnings per Share, Gross

Leverage Ratio, Net Leverage Ratio and Free Cash Flow. Non-GAAP

financial measures are presented only as a supplement to the

company’s financial statements based on GAAP. Non-GAAP financial

information is provided to enhance understanding of the company’s

financial performance, but none of these non-GAAP financial

measures are recognized terms under GAAP, and non-GAAP measures

should not be considered in isolation from, or as a substitute

analysis for, the company’s results of operations as determined in

accordance with GAAP. The company uses non-GAAP measures in its

operational and financial decision making, and believes that it is

useful to exclude certain items in order to focus on what it

regards to be a more meaningful indicator of the underlying

operating performance of the business. For example, the company

excludes all the amortization of intangible assets associated with

acquired customer relationships and backlog, databases, non-compete

agreements, trademarks and trade names from non-GAAP expense and

income measures as such amounts can be significantly impacted by

the timing and size of acquisitions. Although we exclude

amortization of acquired intangible assets from our non-GAAP

expenses, we believe that it is important for investors to

understand that revenue generated from such intangibles is included

within revenue in determining net income. As a result, internal

management reports feature non-GAAP measures which are also used to

prepare strategic plans and annual budgets and review management

compensation. The company also believes that investors may find

non-GAAP financial measures useful for the same reasons, although

investors are cautioned that non-GAAP financial measures are not a

substitute for GAAP disclosures.

The non-GAAP financial measures are not presented in accordance

with GAAP. Please refer to the schedules attached to this release

for reconciliations of non-GAAP financial measures contained herein

to the most directly comparable GAAP measures. Our full-year 2024

guidance measures (other than revenue) are provided on a non-GAAP

basis without a reconciliation to the most directly comparable GAAP

measure because the company is unable to predict with a reasonable

degree of certainty certain items contained in the GAAP measures

without unreasonable efforts. For the same reasons, the company is

unable to address the probable significance of the unavailable

information. Such items include, but are not limited to,

acquisition related expenses, restructuring and related expenses,

stock-based compensation and other items not reflective of the

company's ongoing operations.

Non-GAAP measures are frequently used by securities analysts,

investors and other interested parties in their evaluation of

companies comparable to the company, many of which present non-GAAP

measures when reporting their results. Non-GAAP measures have

limitations as an analytical tool. They are not presentations made

in accordance with GAAP, are not measures of financial condition or

liquidity and should not be considered as an alternative to profit

or loss for the period determined in accordance with GAAP or

operating cash flows determined in accordance with GAAP. Non-GAAP

measures are not necessarily comparable to similarly titled

measures used by other companies. As a result, you should not

consider such performance measures in isolation from, or as a

substitute analysis for, the company’s results of operations as

determined in accordance with GAAP.

IQVIAFIN

Table 1

IQVIA HOLDINGS INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

(preliminary and unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

(in millions, except per share

data)

2024

2023

2024

2023

Revenues

$

3,814

$

3,728

$

7,551

$

7,380

Cost of revenues, exclusive of

depreciation and amortization

2,488

2,443

4,932

4,841

Selling, general and administrative

expenses

509

482

1,017

995

Depreciation and amortization

269

259

533

512

Restructuring costs

28

20

43

37

Income from operations

520

524

1,026

995

Interest income

(12

)

(4

)

(23

)

(10

)

Interest expense

163

169

329

310

Other income, net

(67

)

(16

)

(56

)

(42

)

Income before income taxes and equity in

earnings (losses) of unconsolidated affiliates

436

375

776

737

Income tax expense

75

81

124

152

Income before equity in earnings (losses)

of unconsolidated affiliates

361

294

652

585

Equity in earnings (losses) of

unconsolidated affiliates

2

3

(1

)

1

Net income

$

363

$

297

$

651

$

586

Earnings per share attributable to common

stockholders:

Basic

$

1.99

$

1.61

$

3.58

$

3.17

Diluted

$

1.97

$

1.59

$

3.53

$

3.12

Weighted average common shares

outstanding:

Basic

182.2

184.4

182.0

185.1

Diluted

184.3

186.7

184.3

187.6

Table 2

IQVIA HOLDINGS INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(preliminary and unaudited)

(in millions, except per share

data)

June 30, 2024

December 31, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

1,545

$

1,376

Trade accounts receivable and unbilled

services, net

3,255

3,381

Prepaid expenses

191

141

Income taxes receivable

41

32

Investments in debt, equity and other

securities

133

120

Other current assets and receivables

457

546

Total current assets

5,622

5,596

Property and equipment, net

503

523

Operating lease right-of-use assets

265

296

Investments in debt, equity and other

securities

106

105

Investments in unconsolidated

affiliates

181

134

Goodwill

14,477

14,567

Other identifiable intangibles, net

4,608

4,839

Deferred income taxes

158

166

Deposits and other assets, net

478

455

Total assets

$

26,398

$

26,681

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable and accrued expenses

$

3,313

$

3,564

Unearned income

1,811

1,799

Income taxes payable

185

116

Current portion of long-term debt

1,167

718

Other current liabilities

144

294

Total current liabilities

6,620

6,491

Long-term debt, less current portion

12,091

12,955

Deferred income taxes

149

202

Operating lease liabilities

192

223

Other liabilities

632

698

Total liabilities

19,684

20,569

Commitments and contingencies

Stockholders’ equity:

Common stock and additional paid-in

capital, 400.0 shares authorized as of June 30, 2024 and December

31, 2023, $0.01 par value, 258.0 shares issued and 182.3 shares

outstanding as of June 30, 2024; 257.2 shares issued and 181.5

shares outstanding as of December 31, 2023

11,061

11,028

Retained earnings

5,343

4,692

Treasury stock, at cost, 75.7 and 75.7

shares as of June 30, 2024 and December 31, 2023, respectively

(8,741

)

(8,741

)

Accumulated other comprehensive loss

(949

)

(867

)

Total stockholders’ equity

6,714

6,112

Total liabilities and stockholders’

equity

$

26,398

$

26,681

Table 3

IQVIA HOLDINGS INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(preliminary and unaudited)

Six Months Ended June

30,

(in millions)

2024

2023

Operating activities:

Net income

$

651

$

586

Adjustments to reconcile net income to

cash provided by operating activities:

Depreciation and amortization

533

512

Amortization of debt issuance costs and

discount

11

8

Stock-based compensation

104

125

Losses (earnings) from unconsolidated

affiliates

1

(1

)

Gain on investments, net

(12

)

(10

)

Benefit from deferred income taxes

(80

)

(70

)

Changes in operating assets and

liabilities:

Change in accounts receivable, unbilled

services and unearned income

187

(134

)

Change in other operating assets and

liabilities

(285

)

(197

)

Net cash provided by operating

activities

1,110

819

Investing activities:

Acquisition of property, equipment and

software

(288

)

(324

)

Acquisition of businesses, net of cash

acquired

(221

)

(444

)

Purchases of marketable securities,

net

—

(4

)

Investments in unconsolidated affiliates,

net of payments received

(49

)

(13

)

Investments in debt and equity

securities

(2

)

(36

)

Proceeds from sale of property, equipment

and software

25

—

Other

—

3

Net cash used in investing activities

(535

)

(818

)

Financing activities:

Proceeds from issuance of debt

—

1,250

Payment of debt issuance costs

—

(18

)

Repayment of debt and principal payments

on finance leases

(86

)

(77

)

Proceeds from revolving credit

facility

375

1,559

Repayment of revolving credit facility

(585

)

(1,784

)

Payments related to employee stock

incentive plans

(60

)

(58

)

Repurchase of common stock

—

(619

)

Contingent consideration and deferred

purchase price payments

(10

)

(71

)

Net cash (used in) provided by financing

activities

(366

)

182

Effect of foreign currency exchange rate

changes on cash

(40

)

(17

)

Increase in cash and cash equivalents

169

166

Cash and cash equivalents at beginning of

period

1,376

1,216

Cash and cash equivalents at end of

period

$

1,545

$

1,382

Table 4

IQVIA HOLDINGS INC. AND

SUBSIDIARIES

NET INCOME TO ADJUSTED EBITDA

RECONCILIATION

(preliminary and unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

(in millions)

2024

2023

2024

2023

Net Income

$

363

$

297

$

651

$

586

Provision for income taxes

75

81

124

152

Depreciation and amortization

269

259

533

512

Interest expense, net

151

165

306

300

(Income) loss in unconsolidated

affiliates

(2

)

(3

)

1

(1

)

Stock-based compensation

48

50

104

125

Other income, net (1)

(66

)

(37

)

(45

)

(52

)

Restructuring and related expenses (2)

39

30

61

60

Acquisition related expenses

10

22

14

33

Adjusted EBITDA

$

887

$

864

$

1,749

$

1,715

(1) Reflects certain non-operating income

items, revaluations of contingent consideration and certain

non-recurring expenses.

(2) Reflects restructuring costs as well

as accelerated expenses related to lease exits.

Table 5

IQVIA HOLDINGS INC. AND

SUBSIDIARIES

NET INCOME TO ADJUSTED NET

INCOME RECONCILIATION

(preliminary and unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

(in millions, except per share

data)

2024

2023

2024

2023

Net Income

$

363

$

297

$

651

$

586

Provision for income taxes

75

81

124

152

Purchase accounting amortization (1)

133

132

262

255

(Income) loss in unconsolidated

affiliates

(2

)

(3

)

1

(1

)

Stock-based compensation

48

50

104

125

Other income, net (2)

(66

)

(37

)

(45

)

(52

)

Restructuring and related expenses (3)

39

30

61

60

Acquisition related expenses

10

22

14

33

Adjusted Pre Tax Income

$

600

$

572

$

1,172

$

1,158

Adjusted tax expense

(113

)

(118

)

(217

)

(242

)

Adjusted Net Income

$

487

$

454

$

955

$

916

Adjusted earnings per share

attributable to common stockholders:

Basic

$

2.67

$

2.46

$

5.25

$

4.95

Diluted

$

2.64

$

2.43

$

5.18

$

4.88

Weighted average common shares

outstanding:

Basic

182.2

184.4

182.0

185.1

Diluted

184.3

186.7

184.3

187.6

(1) Reflects all the amortization of

acquired intangible assets.

(2) Reflects certain non-operating income

items, revaluations of contingent consideration and certain

non-recurring expenses.

(3) Reflects restructuring costs as well

as accelerated expenses related to lease exits.

Table 6

IQVIA HOLDINGS INC. AND

SUBSIDIARIES

NET CASH PROVIDED BY OPERATING

ACTIVITIES TO FREE CASH FLOW RECONCILIATION

(preliminary and unaudited)

(in millions)

Three Months Ended June 30,

2024

Six Months Ended June 30,

2024

Net Cash provided by Operating

Activities

$

588

$

1,110

Acquisition of property, equipment and

software

(143

)

(288

)

Free Cash Flow

$

445

$

822

Table 7

IQVIA HOLDINGS INC. AND

SUBSIDIARIES

CALCULATION OF GROSS AND NET

LEVERAGE RATIOS

AS OF JUNE 30, 2024

(preliminary and unaudited)

(in millions)

Gross Debt, net of Unamortized Discount

and Debt Issuance Costs, as of June 30, 2024

$

13,258

Net Debt as of June 30, 2024

$

11,713

Adjusted EBITDA for the twelve months

ended June 30, 2024

$

3,603

Gross Leverage Ratio (Gross Debt/LTM

Adjusted EBITDA)

3.68

x

Net Leverage Ratio (Net Debt/LTM Adjusted

EBITDA)

3.25

x

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240722784620/en/

Kerri Joseph, IQVIA Investor Relations (kerri.joseph@iqvia.com)

+1.610.244.3020

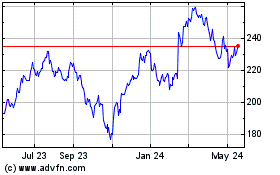

IQVIA (NYSE:IQV)

Historical Stock Chart

From Oct 2024 to Nov 2024

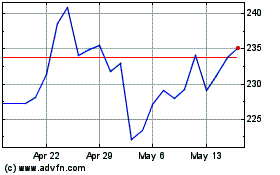

IQVIA (NYSE:IQV)

Historical Stock Chart

From Nov 2023 to Nov 2024