Pro Bankruptcy Briefing: J&J Unit Files Bankruptcy Over Talc Claims; Purdue Appeals to Be Heard

16 October 2021 - 12:09AM

Dow Jones News

Good day. Companies are using bankruptcy as a tool to resolve

lawsuits over an ever-broader range of alleged misconduct, from

opioid addiction to sexual abuse and wildfire damage. J&J is

now joining in, turning to chapter 11 to try to settle its

liabilities for tens of thousands of personal-injury claims linked

to talc-based baby powder.

Meanwhile, opponents of Purdue Pharma's bankruptcy plan got a

guarantee that their arguments on appeal will be heard.

Top News

J&J places talc liabilities in chapter 11. Johnson &

Johnson is testing the limits of bankruptcy law to address mass

torts, placing its liabilities for allegedly dangerous talc

products in chapter 11. The move is sure to touch off a

confrontation with plaintiffs' lawyers, who say that bankruptcy

wasn't meant to help solvent companies avoid accountability. At

stake are tens of thousands of injury claims linking J&J's baby

powder to ovarian cancer, mesothelioma and other ailments.

Judge eases officials' concerns on Purdue Pharma appeals. A

federal judge said that Purdue Pharma LP's preparations to leave

bankruptcy won't thwart government authorities' appeals seeking to

overturn a $4.5 billion settlement with members of the Sackler

family who own the company.

Bankruptcy

Drugmaker Teligent files bankruptcy after failed inspection.

Generic drugmaker Teligent Inc. filed for bankruptcy protection

after the Food and Drug Administration flagged problems at the

company's manufacturing plant in Buena, N.J., that led to a recall

and production halt.

Gulf Coast Health Care files for chapter 11. Gulf Coast Health

Care Inc., which operates skilled-nursing facilities in Florida,

Georgia and Mississippi, has filed for bankruptcy, with debts that

include $49 million in rent owed to Omega Healthcare Investors

Inc.

Consumers

Close to 40% of U.S. households say they face financial

difficulties. U.S. households are struggling in many ways over a

year into the coronavirus pandemic, according to new polling. The

results show how the pandemic deepened an already divided economy,

with well-off people and businesses coming out the same or stronger

while many lower-wage workers were thrust into financial

crisis.

"Short-term help is not enough to solve deeply entrenched

inequities."

-- Richard Besser, president and CEO of the Robert Wood Johnson

Foundation

Distress

Banks reap profits from loan-loss reserves. Banks last year set

aside billions of dollars to prepare for a wave of pandemic loan

defaults. Now they are releasing those funds, which flow straight

to the bottom line. Wells Fargo and Bank of America posted banner

third-quarter results, each company boosted by the release of

loan-loss reserves.

In Other News

The Justice Department's bankruptcy watchdog is opposing

drugmaker Mallinckrodt Plc's reorganization plan to settle

thousands of lawsuits over its opioid painkillers, arguing that it

would improperly waive potential legal claims against affiliated

third parties. (Bloomberg)

The Chapter 7 trustee overseeing the dissolution of Kossoff PLLC

is stepping up his fight to gain access to records of the defunct

New York real estate law firm, seeking sanctions against an

insurance company and pressing one of the largest banks in the

world to cooperate. (Reuters)

(END) Dow Jones Newswires

October 15, 2021 08:54 ET (12:54 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

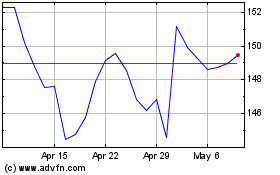

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

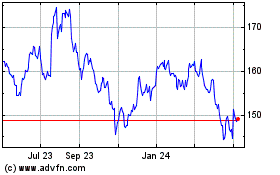

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Apr 2023 to Apr 2024