Current Report Filing (8-k)

21 May 2022 - 6:08AM

Edgar (US Regulatory)

false000001961700000196172022-05-172022-05-170000019617us-gaap:CommonStockMember2022-05-172022-05-170000019617jpm:DepositarySharesOneFourHundredthInterestinaShareof5.75NonCumulativePreferredStockSeriesDDMember2022-05-172022-05-170000019617jpm:DepositarySharesOneFourHundredthInterestinaShareof6.00NonCumulativePreferredStockSeriesEEMember2022-05-172022-05-170000019617jpm:DepositarySharesOneFourHundredthInterestinaShareof4.75NonCumulativePreferredStockSeriesGGMember2022-05-172022-05-170000019617jpm:DepositarySharesEachRepresentingAOneFourHundredthInterestInAShareOf455NonCumulativePreferredStockSeriesJJMember2022-05-172022-05-170000019617jpm:DepositarySharesEachRepresentingAOneFourHundredthInterestInAShareOf4625NonCumulativePreferredStockSeriesLLMember2022-05-172022-05-170000019617jpm:DepositarySharesEachRepresentingAOneFourHundredthInterestInAShareOf420NonCumulativePreferredStockSeriesMMMember2022-05-172022-05-170000019617jpm:AlerianMLPIndexETNsDueMay242024Member2022-05-172022-05-170000019617jpm:GuaranteeOfCallableStepUpFixedRateNotesDueJune102032OfJPMorganChaseFinancialCompanyLLCMember2022-05-172022-05-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): May 17, 2022

JPMorgan Chase & Co.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | 1-5805 | 13-2624428 |

(State or other jurisdiction of

incorporation or organization) | (Commission File Number) | (I.R.S. employer

identification no.) |

| | | | |

| 383 Madison Avenue, | | | |

| New York, | New York | | | 10179 |

| (Address of principal executive offices) | | | (Zip Code) |

Registrant’s telephone number, including area code: (212) 270-6000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock | JPM | The New York Stock Exchange |

Depositary Shares, each representing a one-four hundredth interest in a share of 5.75% Non-Cumulative Preferred Stock, Series DD | JPM PR D | The New York Stock Exchange |

Depositary Shares, each representing a one-four hundredth interest in a share of 6.00% Non-Cumulative Preferred Stock, Series EE | JPM PR C | The New York Stock Exchange |

Depositary Shares, each representing a one-four hundredth interest in a share of 4.75% Non-Cumulative Preferred Stock, Series GG | JPM PR J | The New York Stock Exchange |

| Depositary Shares, each representing a one-four hundredth interest in a share of 4.55% Non-Cumulative Preferred Stock, Series JJ | JPM PR K | The New York Stock Exchange |

| Depositary Shares, each representing a one-four hundredth interest in a share of 4.625% Non-Cumulative Preferred Stock, Series LL | JPM PR L | The New York Stock Exchange |

| Depositary Shares, each representing a one-four hundredth interest in a share of 4.20% Non-Cumulative Preferred Stock, Series MM | JPM PR M | The New York Stock Exchange |

| Alerian MLP Index ETNs due May 24, 2024 | AMJ | NYSE Arca, Inc. |

| Guarantee of Callable Step-Up Fixed Rate Notes due June 10, 2032 of JPMorgan Chase Financial Company LLC | JPM/32 | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.07 Submission of Matters to a Vote of Security Holders.

(a) Registrant held its Annual Meeting of Shareholders on Tuesday, May 17, 2022; 2,468,848,141 shares were represented in person or by proxy, or 83.98% of the total shares outstanding.

(b) The results of the shareholder voting on the proposals presented were as follows:

MANAGEMENT PROPOSALS

Proposal 1 - Shareholders elected the 10 director nominees named in the Proxy Statement. All director nominees received at least 92.18% of the votes cast.

| | | | | | | | | | | | | | |

| Name | For | Against | Abstain | Broker Non-Votes |

| Linda B. Bammann | 1,935,111,208 | | 163,403,502 | | 4,983,522 | | 365,349,909 | |

| Stephen B. Burke | 1,933,343,178 | | 163,898,420 | | 6,256,634 | | 365,349,909 | |

| Todd A. Combs | 1,999,245,454 | | 98,143,092 | | 6,109,686 | | 365,349,909 | |

| James S. Crown | 1,980,571,134 | | 116,037,510 | | 6,889,588 | | 365,349,909 | |

| James Dimon | 1,949,753,518 | | 141,885,433 | | 11,859,281 | | 365,349,909 | |

| Timothy P. Flynn | 2,046,396,859 | | 51,253,626 | | 5,847,747 | | 365,349,909 | |

| Mellody Hobson | 2,052,513,156 | | 45,964,520 | | 5,020,556 | | 365,349,909 | |

| Michael A. Neal | 2,032,709,284 | | 65,130,925 | | 5,658,023 | | 365,349,909 | |

| Phebe N. Novakovic | 2,068,216,949 | | 29,988,874 | | 5,292,409 | | 365,349,909 | |

| Virginia M. Rometty | 1,972,585,701 | | 125,183,754 | | 5,728,777 | | 365,349,909 | |

Proposal 2 - Shareholders did not approve the advisory resolution to approve executive compensation

| | | | | | | | | | | |

| For | Against | Abstain | Broker Non-Votes |

| 652,188,238 | 1,440,436,189 | 10,873,805 | 365,349,909 |

| 31.00 | % | 68.47 | % | 0.51 | % | |

Proposal 3 - Shareholders approved the ratification of independent registered public accounting firm

| | | | | | | | | | | |

| For | Against | Abstain | Broker Non-Votes |

| 2,289,221,864 | 174,154,263 | 5,472,014 | |

| 92.72 | % | 7.05 | % | 0.22 | % | |

SHAREHOLDER PROPOSALS

Proposal 4 - Shareholders did not approve the proposal on fossil fuel financing

| | | | | | | | | | | |

| For | Against | Abstain | Broker Non-Votes |

| 209,858,579 | 1,860,351,074 | 33,288,579 | 365,349,909 |

| 9.97 | % | 88.44 | % | 1.58 | % | |

Proposal 5 - Shareholders did not approve the proposal on special shareholder meeting improvement

| | | | | | | | | | | |

| For | Against | Abstain | Broker Non-Votes |

| 978,582,611 | 1,114,111,716 | 10,803,905 | 365,349,909 |

| 46.52 | % | 52.96 | % | 0.51 | % | |

Proposal 6 - Shareholders did not approve the proposal on independent board chairman

| | | | | | | | | | | |

| For | Against | Abstain | Broker Non-Votes |

| 833,359,241 | 1,261,534,233 | 8,604,758 | 365,349,909 |

| 39.61 | % | 59.97 | % | 0.4 | % | |

Proposal 7 - Shareholders did not approve the proposal on board diversity

| | | | | | | | | | | |

| For | Against | Abstain | Broker Non-Votes |

| 86,210,945 | 2,001,964,029 | 15,323,258 | 365,349,909 |

| 4.09 | % | 95.17 | % | 0.72 | % | |

Proposal 8 - Shareholders did not approve the proposal on conversion to public benefit corporation

| | | | | | | | | | | |

| For | Against | Abstain | Broker Non-Votes |

| 15,602,821 | 2,074,883,359 | 13,012,052 | 365,349,909 |

| 0.74 | % | 98.63 | % | 0.61 | % | |

Proposal 9 - Shareholders did not approve the proposal on setting absolute contraction targets

| | | | | | | | | | | |

| For | Against | Abstain | Broker Non-Votes |

| 322,043,503 | 1,747,997,240 | 33,457,489 | 365,349,909 |

| 15.3 | % | 83.09 | % | 1.59 | % | |

Item 9.01 Financial Statements and Exhibits

(d) Exhibit

| | | | | | | | |

| | |

| Exhibit No. | | Description of Exhibit |

| | |

| 101 | | Pursuant to Rule 406 of Regulation S-T, the cover page is formatted in Inline XBRL (Inline eXtensible Business Reporting Language). |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document and included in Exhibit 101). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | |

| JPMorgan Chase & Co. |

| (Registrant) |

| | | | | |

| By: | /s/ John H. Tribolati |

| John H. Tribolati |

| Corporate Secretary |

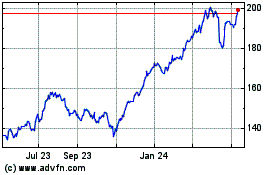

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Mar 2024 to Apr 2024

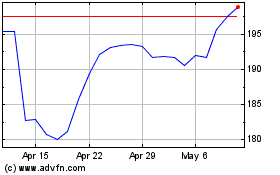

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Apr 2023 to Apr 2024