Key Terms

| Issuer: |

JPMorgan Chase & Co. |

| Payment at Maturity: |

On the Maturity Date, we will pay you the outstanding principal amount of your notes plus any accrued and unpaid interest. |

| Interest: |

We will pay you interest on each Interest Payment Date based on the applicable Interest Rate and the applicable Day Count Fraction, subject to the Interest Accrual Convention described below and in the accompanying product supplement. |

| Initial Interest Period(s): |

The Interest Periods beginning on and including the Original Issue Date and ending on but excluding May 25, 2023 |

| Initial Interest Rate: |

6.00% per annum |

| Interest Periods: |

The period beginning on and including the Original Issue Date and ending on but excluding the first Interest Payment Date, and each successive period beginning on and including an Interest Payment Date and ending on but excluding the next succeeding Interest Payment Date, subject to the Interest Accrual Convention described below and in the accompanying product supplement |

| Interest Payment Dates: |

Interest on the notes will be payable in arrears on the 25th calendar day of each month, beginning on June 25th, 2022 to and including the Maturity Date (each, an “Interest Payment Date”), subject to the Business Day Convention and Interest Accrual Convention described below and in the accompanying product supplement. |

| Interest Rate: |

With respect to each Initial Interest Period, a rate per annum equal to the Initial Interest Rate, and, notwithstanding anything to the contrary in the accompanying product supplement, with respect to each Interest Period thereafter, a rate per annum equal to the CPI Rate, as determined on the applicable Determination Date, provided that this rate will not be less than the Minimum Interest Rate |

| Minimum Interest Rate: |

0.00% per annum |

| CPI Rate: |

For any Determination Date, the CPI Rate will be calculated as follows:

CPIt-2 - CPIt-14

CPIt-14

where: “CPIt-2” means, with respect to that Determination

Date, the published level of the Consumer Price Index for the calendar month that is two (2) calendar months immediately preceding the

calendar month in which that Determination Date falls, which we refer to as the “reference month”; and

“CPIt-14” means, with respect to that Determination

Date, the published level of the Consumer Price Index for the calendar month that is fourteen (14) calendar months immediately preceding

the calendar month in which that Determination Date falls. |

| CPI or Consumer Price Index: |

The non-seasonally adjusted U.S. City Average All Items Consumer Price Index for All Urban Consumers, as published on the Bloomberg Professional® service (“Bloomberg”) page “CPURNSA” (or any successor source) or any successor index, as determined by the calculation agent in accordance with the procedures set forth under “The Underlyings — Base Rates — CPI Rate” in the accompanying product supplement. |

| Determination Date: |

For each Interest Period after the Initial Interest Periods, the second business day immediately preceding the beginning of that Interest Period. For example, July 21, 2022 (which is two business days immediately prior to July 25, 2022) is the Determination Date of the CPI Rate with respect to interest due and payable on August 25, 2022. On the July 2022 Determination Date, interest will be based on year-over-year change in CPI between May 2021 and May 2022. |

| Pricing Date: |

May 23, 2022, subject to the Business Day Convention |

| Original Issue Date: |

May 25, 2022, subject to the Business Day Convention (Settlement Date) |

| Maturity Date: |

May 25, 2029, subject to the Business Day Convention |

| Other Key Terms: |

See “Additional Key Terms” in this pricing supplement. |

Investing in the notes involves a number of risks. See

“Risk Factors” beginning on page S-2 of the accompanying prospectus supplement, “Risk Factors” beginning on page

PS-11 of the accompanying product supplement and “Selected Risk Considerations” beginning on page PS-2 of this pricing supplement.

Neither the Securities and Exchange Commission (the “SEC”)

nor any state securities commission has approved or disapproved of the notes or passed upon the accuracy or the adequacy of this pricing

supplement or the accompanying product supplement, prospectus supplement and prospectus. Any representation to the contrary is a criminal

offense.

| |

Price to Public (1) |

Fees and Commissions (2) |

Proceeds to Issuer |

| Per note |

$1,000 |

$ |

$ |

| Total |

$ |

$ |

$ |

(1) The price to the public includes the estimated cost of

hedging our obligations under the notes through one or more of our affiliates.

(2) J.P. Morgan Securities LLC, which we refer to as JPMS,

acting as agent for JPMorgan Chase & Co., will pay all of the selling commissions it receives from us to other affiliated or unaffiliated

dealers. In no event will these selling commissions exceed $2.50 per $1,000 principal amount note. See “Plan of Distribution (Conflicts

of Interest)” in the accompanying product supplement.

The notes are not bank deposits, are not insured by the

Federal Deposit Insurance Corporation or any other governmental agency and are not obligations of, or guaranteed by, a bank.

Additional Terms Specific to

the Notes

You may revoke your offer to purchase the notes at any time prior

to the time at which we accept such offer by notifying the applicable agent. We reserve the right to change the terms of, or reject any

offer to purchase, the notes prior to their issuance. In the event of any changes to the terms of the notes, we will notify you and you

will be asked to accept such changes in connection with your purchase. You may also choose to reject such changes in which case we may

reject your offer to purchase.

You should read this pricing supplement together with the accompanying

prospectus, as supplemented by the accompanying prospectus supplement relating to our Series E medium-term notes of which these notes

are a part, and the more detailed information contained in the accompanying product supplement. This pricing supplement, together with

the documents listed below, contains the terms of the notes and supersedes all other prior or contemporaneous oral statements as well

as any other written materials including preliminary or indicative pricing terms, correspondence, trade ideas, structures for implementation,

sample structures, fact sheets, brochures or other educational materials of ours. You should carefully consider, among other things, the

matters set forth in the “Risk Factors” sections of the accompanying prospectus supplement and the accompanying product supplement,

as the notes involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting

and other advisers before you invest in the notes.

You may access these documents on the SEC website at www.sec.gov as

follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

| · | Prospectus supplement and prospectus, each dated April 8,

2020: |

http://www.sec.gov/Archives/edgar/data/19617/000095010320007214/crt_dp124361-424b2.pdf

Our Central Index Key, or CIK, on the SEC website is 19617. As used

in this pricing supplement, “we,” “us” and “our” refer to JPMorgan Chase & Co.

Additional Key Terms

| Business Day: |

Any day other than a day on which banking institutions in the City of New York are authorized or required by law, regulation or executive order to close or a day on which transactions in U.S. dollars are not conducted. |

| Business Day Convention: |

Following |

| Interest Accrual Convention: |

Unadjusted |

| Day Count Convention: |

30/360 |

| CUSIP: |

48128G6Z8 |

Selected Purchase Considerations

| · | PRESERVATION OF CAPITAL AT MATURITY — Regardless

of the year-over-year change in the CPI, we will pay you at least the principal amount of your notes if you hold the notes to maturity.

Because the notes are our unsecured and unsubordinated obligations, payment of any amount on the notes is subject to our ability to

pay our obligations as they become due. |

| · | PERIODIC INTEREST PAYMENTS — The notes offer

periodic interest payments on each Interest Payment Date. With respect to the Initial Interest Periods, your notes will pay an annual

interest rate equal to the Initial Interest Rate, and for the applicable Interest Periods thereafter, your notes will pay an interest

rate per annum equal to the CPI Rate as determined on the applicable Determination Date, provided that this rate will not be less

than the Minimum Interest Rate. The yield on the notes may be less than the overall return you would receive from a conventional debt

security that you could purchase today with the same maturity as the notes. |

| · | POTENTIAL INFLATION PROTECTION — For each Interest

Period after the Initial Interest Periods, the Interest Rate on the notes will be a rate per annum equal to the CPI Rate as determined

on the applicable Determination Date, provided that this rate will not be less than the Minimum Interest Rate. In no event will

the Interest Rate for any Interest Period be less than the Minimum Interest Rate. |

| · | TAX TREATMENT — You should review carefully the

section entitled "Material U.S. Federal Income Tax Consequences" in this pricing supplement and the section entitled “Material

U.S. Federal Income Tax Consequences” in the accompanying product supplement and consult your tax adviser regarding the U.S. federal

income tax consequences of an investment in the notes. |

| · | INSOLVENCY AND RESOLUTION CONSIDERATIONS — The

notes constitute “loss-absorbing capacity” within the meaning of the final rules (the “TLAC rules”) issued by

the Board of Governors of the Federal Reserve System (the “Federal Reserve”) on December 15, 2016 regarding, among other things,

the minimum levels of unsecured external long-term debt and other loss-absorbing capacity that certain U.S. bank holding companies, including

JPMorgan Chase & Co., are required to maintain. Such debt must satisfy certain eligibility criteria under the TLAC rules. If JPMorgan

Chase & Co. were to enter into resolution, either in a proceeding under Chapter 11 of the U.S. Bankruptcy Code or in a receivership

administered by the Federal Deposit Insurance Corporation (the “FDIC”) under Title II of the Dodd-Frank Wall Street Reform

and Consumer Protection Act of 2010 (the “Dodd-Frank Act”), holders of the notes and other debt and equity securities of JPMorgan

Chase & Co. will absorb the losses of JPMorgan Chase & Co. and its affiliates. |

Under Title I of the Dodd-Frank Act and applicable rules

of the Federal Reserve and the FDIC, JPMorgan Chase & Co. is required to submit periodically to the Federal Reserve and the FDIC a

detailed plan (the “resolution plan”) for the rapid and orderly resolution of JPMorgan Chase & Co. and its material subsidiaries

under the U.S. Bankruptcy Code and other applicable insolvency laws in the event of material financial distress or failure. JPMorgan Chase

& Co.’s preferred resolution strategy under its resolution plan contemplates that only JPMorgan Chase & Co. would enter

bankruptcy proceedings under Chapter 11 of the U.S. Bankruptcy Code pursuant to a “single point of entry”

| JPMorgan Structured Investments — | PS- 1 |

| Floating Rate Notes Linked to the Consumer Price Index | |

recapitalization strategy. JPMorgan Chase & Co.’s subsidiaries

would be recapitalized as needed so that they could continue normal operations or subsequently be wound down in an orderly manner. As

a result, JPMorgan Chase & Co.’s losses and any losses incurred by its subsidiaries would be imposed first on holders of JPMorgan

Chase & Co.’s equity securities and thereafter on unsecured creditors, including holders of the notes and other securities of

JPMorgan Chase & Co. Claims of holders of the notes and those other debt securities would have a junior position to the claims of

creditors of JPMorgan Chase & Co.’s subsidiaries and to the claims of priority (as determined by statute) and secured creditors

of JPMorgan Chase & Co. Accordingly, in a resolution of JPMorgan Chase & Co. under Chapter 11 of the U.S. Bankruptcy Code, holders

of the notes and other debt securities of JPMorgan Chase & Co. would realize value only to the extent available to JPMorgan Chase

& Co. as a shareholder of JPMorgan Chase Bank, N.A. and its other subsidiaries and only after any claims of priority and secured creditors

of JPMorgan Chase & Co. have been fully repaid. If JPMorgan Chase & Co. were to enter into a resolution, none of JPMorgan Chase

& Co., the Federal Reserve or the FDIC is obligated to follow JPMorgan Chase & Co.’s preferred resolution strategy under

its resolution plan.

The FDIC has similarly indicated that a single point

of entry recapitalization model could be a desirable strategy to resolve a systemically important financial institution, such as JPMorgan

Chase & Co., under Title II of the Dodd-Frank Act (“Title II”). Pursuant to that strategy, the FDIC would use its power

to create a “bridge entity” for JPMorgan Chase & Co.; transfer the systemically important and viable parts of JPMorgan

Chase & Co.’s business, principally the stock of JPMorgan Chase & Co.’s main operating subsidiaries and any intercompany

claims against such subsidiaries, to the bridge entity; recapitalize those subsidiaries using assets of JPMorgan Chase & Co. that

have been transferred to the bridge entity; and exchange external debt claims against JPMorgan Chase & Co. for equity in the bridge

entity. Under this Title II resolution strategy, the value of the stock of the bridge entity that would be redistributed to holders of

the notes and other debt securities of JPMorgan Chase & Co. may not be sufficient to repay all or part of the principal amount and

interest on the notes and those other securities. To date, the FDIC has not formally adopted a single point of entry resolution strategy,

and it is not obligated to follow such a strategy in a Title II resolution of JPMorgan Chase & Co.

Selected Risk Considerations

An investment in the notes involves significant risks. These risks

are explained in more detail in the “Risk Factors” sections of the accompanying prospectus supplement and the accompanying

product supplement.

Risks Relating to the Notes Generally

| · | THE NOTES ARE NOT ORDINARY DEBT SECURITIES BECAUSE, OTHER

THAN DURING THE INITIAL INTEREST PERIODS, THE INTEREST RATE ON THE NOTES IS A FLOATING RATE AND MAY BE EQUAL TO THE MINIMUM INTEREST RATE

— With respect to the Initial Interest Periods, your notes will pay a rate equal to the Initial Interest Rate, and for the applicable

Interest Periods thereafter, your notes will pay a rate per annum equal to the CPI Rate as determined on the applicable Determination

Date (which is based on the year-over-year change in the level of the CPI), provided that this rate will not be less than the Minimum

Interest Rate. If the CPI for the same month in successive years does not increase, which is likely to occur when there is little or no

inflation, you will not receive an interest payment for the applicable Interest Period (other than the Initial Interest Periods). If the

CPI for the same month in successive years decreases, which is likely to occur when there is deflation, you will also not receive an interest

payment for the applicable Interest Period (other than the Initial Interest Periods). If the Interest Rate for an Interest Period after

the Initial Interest Periods is equal to the Minimum Interest Rate, which will occur if the CPI Rate on the applicable Determination Date

is less than or equal to 0.00% per annum, no interest will be payable with respect to that Interest Period. Accordingly, if the

CPI Rate on the Determination Dates for some or all of the Interest Periods after the Initial Interest Periods is less than or equal to

0.00% per annum, you may not receive any interest payments for an extended period over the term of the notes. |

| · | AFTER THE INITIAL INTEREST PERIODS, THE INTEREST RATE ON

THE NOTES IS BASED ON THE CPI RATE — The amount of interest, if any, payable on the notes will depend on a number of factors

that could affect the levels of the CPI Rate, and in turn, could affect the value of the notes. These factors include (but are not limited

to) the expected volatility of the CPI Rate, interest and yield rates in the market generally, the performance of capital markets, monetary

policies, fiscal policies, regulatory or judicial events, inflation, general economic conditions and public expectations with respect

to such factors. These and other factors may have a negative impact on the CPI Rate and on the value of the notes in the secondary market.

The effect that any single factor may have on the CPI Rate may be partially offset by other factors. We cannot predict the factors that

may cause the CPI Rate, and consequently the Interest Rate for an Interest Period (other than an Initial Interest Period), to increase

or decrease. A decrease in the CPI Rate will result in a reduction of the applicable Interest Rate used to calculate the Interest for

any Interest Period (after the Initial Interest Periods). |

| · | FLOATING RATE NOTES DIFFER FROM FIXED RATE NOTES —

After the Initial Interest Periods, the rate of interest on your notes will be variable and determined based on the CPI Rate, provided

that this rate will not be less than the Minimum Interest Rate, which may be less than returns otherwise payable on notes issued by us

with similar maturities. You should consider, among other things, the overall potential annual percentage rate of interest to maturity

of the notes as compared to other investment alternatives. |

| · | CREDIT RISK OF JPMORGAN CHASE & CO. — The

notes are subject to the credit risk of JPMorgan Chase & Co., and our credit ratings and credit spreads may adversely affect the market

value of the notes. Investors are dependent on JPMorgan Chase & Co.’s ability to pay all amounts due on the notes. Any actual

or potential change in our creditworthiness or credit spreads, as determined by the market for taking our credit risk, is likely to adversely

affect the value of the notes. If we were to default on our payment obligations, you may not receive any amounts owed to you under the

notes and you could lose your entire investment. |

| · | LACK OF

LIQUIDITY — The notes will not be listed on any

securities exchange. JPMS intends to offer to purchase the notes in the secondary market but is not required to do so. Even if there is

a secondary market, it may not provide enough liquidity to allow you to trade or sell the notes easily. Because other dealers are not

likely to make a secondary market for the notes, the price at which you may be able to trade your notes is likely to depend on the price,

if any, at which JPMS is willing to buy the notes. |

| JPMorgan Structured Investments — | PS- 2 |

| Floating Rate Notes Linked to the Consumer Price Index | |

Risks Relating to Conflicts of Interest

| · | POTENTIAL CONFLICTS — We and our affiliates play

a variety of roles in connection with the issuance of the notes, including acting as calculation agent and as an agent of the offering

of the notes and hedging our obligations under the notes. In performing these duties, our economic interests and the economic interests

of the calculation agent and other affiliates of ours are potentially adverse to your interests as an investor in the notes. In addition,

our business activities, including hedging and trading activities for our own accounts or on behalf of customers, could cause our economic

interests to be adverse to yours and could adversely affect any payment on the notes and the value of the notes. It is possible that hedging

or trading activities of ours or our affiliates in connection with the notes could result in substantial returns for us or our affiliates

while the value of the notes declines. Please refer to “Risk Factors — Risks Relating to Conflicts of Interest” in the

accompanying product supplement for additional information about these risks. |

Risks Relating to Secondary Market Prices of the

Notes

| · | CERTAIN BUILT-IN COSTS ARE LIKELY TO AFFECT ADVERSELY THE

VALUE OF THE NOTES PRIOR TO MATURITY — While the payment at maturity described in this pricing supplement is based on the full

principal amount of your notes, the original issue price of the notes includes the agent’s commission and the estimated cost of

hedging our obligations under the notes through one or more of our affiliates. As a result, the price, if any, at which JPMS will

be willing to purchase notes from you in secondary market transactions, if at all, will likely be lower than the original issue price

and any sale prior to the Maturity Date could result in a substantial loss to you. This secondary market price will also be affected

by a number of factors aside from the agent’s commission and hedging costs, including those referred to under “Many Economic

and Market Factors Will Impact the Value of the Notes” below. |

The notes are not designed to be short-term trading

instruments. Accordingly, you should be able and willing to hold your notes to maturity.

| · | MANY ECONOMIC AND MARKET FACTORS

WILL IMPACT THE VALUE OF THE NOTES — In addition

to the level of the CPI on any day, the value of the notes will be affected by a number of economic and market factors that may either

offset or magnify each other, including, but not limited to: |

| · | any

actual or potential change in our creditworthiness or credit spreads; |

| · | the

actual and expected volatility of the CPI; |

| · | the

time to maturity of the notes; |

| · | interest

and yield rates in the market generally, as well as the volatility of those rates; |

| · | fluctuations

in the prices of various consumer goods and energy resources; |

| · | inflation

and expectations concerning inflation; and |

| · | a

variety of economic, financial, political, regulatory or judicial events. |

Risks Relating to the CPI Rate

| · | THE

CPI AND THE WAY THE BUREAU OF LABOR STATISTICS OF THE U.S. LABOR DEPARTMENT (THE “BLS”) CALCULATES THE CPI MAY CHANGE IN

THE FUTURE — There can be no assurance that the BLS will not change the method by which it calculates the CPI. In addition,

changes in the way the CPI is calculated could reduce the level of the CPI and lower the interest payable with respect to the notes after

the Initial Interest Periods. Accordingly, the amount of interest payable on the notes after the Initial Interest Periods, and therefore

the value of the notes, may be significantly reduced. If the CPI is discontinued or substantially altered, a successor index may be employed

to calculate the interest payable on the notes after the Initial Interest Periods and that substitution may adversely affect the value

of the notes. |

| · | THE

INTEREST RATE ON THE NOTES AFTER THE INITIAL INTEREST PERIODS MAY NOT REFLECT ACTUAL LEVELS OF INFLATION AFFECTING HOLDERS OF THE NOTES

— The CPI is just one measure of inflation and may not reflect the actual levels of inflation affecting holders of the notes.

Further, the CPI Rate for any Interest Period after the Initial Interest Periods is based on the lagging percentage change in the level

of the CPI over a specified period. Accordingly, an investment in the notes may not fully offset any inflation actually experienced by

any holder of the notes. |

| JPMorgan Structured Investments — | PS- 3 |

| Floating Rate Notes Linked to the Consumer Price Index | |

Hypothetical Interest Rates

Based on Historical CPI Levels

Provided below are historical levels of the CPI from January 2011 to

April 2022. Also provided below are the hypothetical Interest Rates for a hypothetical Interest Period that is not an Initial Interest

Period) in the calendar months from January 2013 to July 2022 that would have resulted from the year-over-year change in the historical

levels of the CPI presented below, subject to the Minimum Interest Rate. We obtained the historical information included below from Bloomberg,

without independent verification.

The historical levels of the CPI should not be taken as an indication

of future levels of the CPI, and no assurance can be given as to the level of the CPI for any reference month. The hypothetical Interest

Rates for a hypothetical Interest Period that is not an Initial Interest Period set forth below are intended to illustrate the effect

of general trends in the CPI on the amount of interest payable to you on the notes after the Initial Interest Periods and assume that

the change in the CPI will be measured on a year-over-year basis. However, the CPI may not increase or decrease over the term of the notes

in accordance with any of the trends depicted by the historical information in the table below, and the size and frequency of any fluctuations

in the CPI level over the term of the notes, which we refer to as the volatility of the CPI, may be significantly different than the historical

volatility of the CPI. Additionally, for ease of presentation, the hypothetical Interest Rates set forth below have only been calculated

to the third decimal point and rounded to the nearest second decimal point, which is different from the rounding convention applicable

to the notes. As a result, the hypothetical Interest Rates depicted in the table below should not be taken as an indication of the actual

Interest Rates that will be payable with regard to the Interest Periods after the Initial Interest Periods over the term of the notes.

| Historical Levels of CPI |

Hypothetical Interest Rates Payable |

| |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

| January |

220.223 |

226.665 |

230.280 |

233.916 |

233.707 |

236.916 |

242.839 |

247.867 |

251.712 |

257.971 |

261.582 |

281.148 |

2.16% |

0.96% |

1.66% |

0.17% |

1.64% |

2.04% |

2.52% |

1.76% |

1.18% |

6.22% |

| February |

221.309 |

227.663 |

232.166 |

234.781 |

234.722 |

237.111 |

243.603 |

248.991 |

252.776 |

258.678 |

263.014 |

283.716 |

1.76% |

1.24% |

1.32% |

0.50% |

1.69% |

2.20% |

2.18% |

2.05% |

1.17% |

6.81% |

| March |

223.467 |

229.392 |

232.773 |

236.293 |

236.119 |

238.132 |

243.801 |

249.554 |

254.202 |

258.115 |

264.877 |

287.504 |

1.74% |

1.50% |

0.76% |

0.73% |

2.07% |

2.11% |

1.91% |

2.29% |

1.36% |

7.04% |

| April |

224.906 |

230.085 |

232.531 |

237.072 |

236.599 |

239.261 |

244.524 |

250.546 |

255.548 |

256.389 |

267.054 |

289.109 |

1.59% |

1.58% |

0.00% |

1.37% |

2.50% |

2.07% |

1.55% |

2.49% |

1.40% |

7.48% |

| May |

225.964 |

229.815 |

232.945 |

237.900 |

237.805 |

240.229 |

244.733 |

251.588 |

256.092 |

256.394 |

269.195 |

|

1.98% |

1.13% |

0.00% |

1.02% |

2.74% |

2.21% |

1.52% |

2.33% |

1.68% |

7.87% |

| June |

225.722 |

229.478 |

233.504 |

238.343 |

238.638 |

241.018 |

244.955 |

251.989 |

256.143 |

257.797 |

271.696 |

|

1.47% |

1.51% |

0.00% |

0.85% |

2.38% |

2.36% |

1.86% |

1.54% |

2.62% |

8.54% |

| July |

225.922 |

229.104 |

233.596 |

238.250 |

238.654 |

240.628 |

244.786 |

252.006 |

256.571 |

259.101 |

273.003 |

|

1.06% |

1.95% |

0.00% |

1.13% |

2.20% |

2.46% |

2.00% |

0.33% |

4.16% |

8.26% |

| August |

226.545 |

230.379 |

233.877 |

237.852 |

238.316 |

240.849 |

245.519 |

252.146 |

256.558 |

259.918 |

273.567 |

|

1.36% |

2.13% |

0.00% |

1.02% |

1.87% |

2.80% |

1.79% |

0.12% |

4.99% |

|

| September |

226.889 |

231.407 |

234.149 |

238.031 |

237.945 |

241.428 |

246.819 |

252.439 |

256.759 |

260.280 |

274.310 |

|

1.75% |

2.07% |

0.12% |

1.00% |

1.63% |

2.87% |

1.65% |

0.65% |

5.39% |

|

| October |

226.421 |

231.317 |

233.546 |

237.433 |

237.838 |

241.729 |

246.663 |

252.885 |

257.346 |

260.388 |

276.589 |

|

1.96% |

1.99% |

0.17% |

0.83% |

1.73% |

2.95% |

1.81% |

0.99% |

5.37% |

|

| November |

226.230 |

230.221 |

233.069 |

236.151 |

237.336 |

241.353 |

246.669 |

252.038 |

257.208 |

260.229 |

277.948 |

|

1.52% |

1.70% |

0.20% |

1.06% |

1.94% |

2.70% |

1.75% |

1.31% |

5.25% |

|

| December |

225.672 |

229.601 |

233.049 |

234.812 |

236.525 |

241.432 |

246.524 |

251.233 |

256.974 |

260.474 |

278.802 |

|

1.18% |

1.66% |

0.00% |

1.46% |

2.23% |

2.28% |

1.71% |

1.37% |

5.39% |

|

Hypothetical Example of Calculation of the

CPI Rate

The following example illustrates how the CPI Rate is calculated for

a particular Interest Period after the Initial Interest Periods. The hypothetical CPI Rate in the following example is for illustrative

purposes only and may not correspond to the actual CPI Rate for any Interest Period after the Initial Interest Periods applicable to a

purchaser of the notes. The numbers appearing in the following examples have been rounded for ease of analysis.

On the Determination Date occurring in June 2022, the relevant CPI

Rate is calculated based on the percent change in the CPI for the one-year period from April 2021 (267.054) to April 2022 (289.109) as

follows:

| JPMorgan Structured Investments — | PS- 4 |

| Floating Rate Notes Linked to the Consumer Price Index | |

Hypothetical Interest Rate for an Interest Period

(Other Than an Initial Interest Period)

The following table illustrates the Interest Rate determination for

an Interest Period (other than an Initial Interest Period) for a hypothetical range of performance of the CPI Rate and reflects the Minimum

Interest Rate set forth on the cover of this pricing supplement. The hypothetical CPI Rate and interest payments set forth in the following

examples are for illustrative purposes only and may not be the actual CPI Rate or interest payment applicable to a purchaser of the notes.

Hypothetical CPI Rate

|

|

Hypothetical Interest Rate

for Years 2 to 7* |

| 9.00% |

|

9.00% |

| 8.00% |

|

8.00% |

| 7.00% |

|

7.00% |

| 6.00% |

|

6.00% |

| 5.00% |

|

5.00% |

| 4.00% |

|

4.00% |

| 3.00% |

|

3.00% |

| 2.00% |

|

2.00% |

| 1.00% |

|

1.00% |

| 0.00% |

|

0.00% |

| -0.10% |

|

0.00% |

| -0.50% |

|

0.00% |

| -1.00% |

|

0.00% |

| -2.00% |

|

0.00% |

*The Interest Rate cannot be less than the Minimum Interest Rate of

0.00% per annum with respect to years 2 to 7.

Hypothetical

Examples of Interest Rate Calculation for an Interest Period (Other Than an Initial Interest Period)

The

following examples illustrate how the hypothetical Interest Rate is calculated for a particular Interest Period occurring after the Initial

Interest Periods and assume that that the Day Count Fraction for the applicable Interest Period is equal to 30/360. The actual Day Count

Fraction for an Interest Period will be calculated in the manner set forth in the accompanying product supplement. The hypothetical Interest

Rates in the following examples are for illustrative purposes only and may not correspond to the actual Interest Rate for any Interest

Period applicable to a purchaser of the notes. The numbers appearing in the following examples have been rounded for ease of analysis.

Example 1: After the Initial Interest Periods, with respect to a

particular Interest Period, the CPI Rate is 2.00% on the applicable Determination Date. The Interest Rate applicable to this Interest

Period is 2.00% per annum.

The corresponding interest payment per $1,000 principal amount note

is calculated as follows:

$1,000 × 2.00% × (30/360) = $1.67

Example 2: After the Initial Interest Periods, with respect to a

particular Interest Period, the CPI Rate is -2.00% on the applicable Determination Date. Because the CPI Rate of -2.00% is less than

the Minimum Interest Rate of 0.00% per annum, the Interest Rate for this Interest Period is 0.00% per annum and no interest is payable

with respect to this Interest Period.

The hypothetical payments on the notes shown above apply only if

you hold the notes for their entire term. These hypotheticals do not reflect fees or expenses that would be associated with

any sale in the secondary market. If these fees and expenses were included, the hypothetical payments shown above would likely be

lower.

| JPMorgan Structured Investments — | PS- 5 |

| Floating Rate Notes Linked to the Consumer Price Index | |

What Is the Consumer Price Index?

The Consumer Price Index for purposes of the notes is the non-seasonally

adjusted U.S. City Average All Items Consumer Price Index for All Urban Consumers (“CPI”), reported monthly by the Bureau

of Labor Statistics of the U.S. Department of Labor (“BLS”) and published on Bloomberg screen CPURNSA or any successor source,

as determined by the calculation agent in accordance with the procedures set forth under “The Underlyings — Base Rates —

CPI Rate” in the accompanying product supplement. The CPI for a particular month is published during the following month.

The CPI is a measure of the average change in consumer prices over

time for a fixed market basket of goods and services, including food and beverages, housing, apparel, transportation, medical care, recreation,

and education and communication, and other goods and services. In calculating the CPI, price changes for the various items are averaged

together with weights that represent their importance in the spending of urban households in the United States. The contents of the market

basket of goods and services and the weights assigned to the various items are updated periodically by the BLS to take into account changes

in consumer expenditure patterns. The CPI is expressed in relative terms in relation to a time base reference period for which the level

is set at 100.0. The base reference period for these notes is the 1982-1984 average.

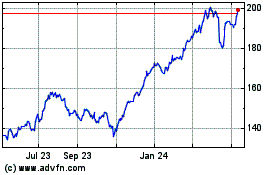

Historical Information

The following graph sets forth the monthly historical performance of

the year-over-year change in the CPI from January 2017 through April 2022. We obtained the rates used to construct the graph below from

Bloomberg, without independent verification.

The year-over-year change in the CPI for the month of April 2022 (as

compared to April 2021) was 8.26% based on Bloomberg page “CPI YOY.” The actual CPI Rate for any Determination Date will be

determined in the manner described in “Key Terms — CPI Rate” in this pricing supplement and not by reference to the

Bloomberg page “CPI YOY.”

The historical year-over-year change in CPI should not be taken as

an indication of future results, and no assurance can be given as to the CPI Rate on any Determination Date. There can be no assurance

that the performance of the CPI Rate will result in an Interest Rate for any Interest Period (after the Initial Interest Periods) that

is greater than the Minimum Interest Rate.

| JPMorgan Structured Investments — | PS- 6 |

| Floating Rate Notes Linked to the Consumer Price Index | |

Supplemental Use of Proceeds

Notwithstanding anything to the contrary in the accompanying product

supplement, we will contribute the net proceeds that we receive from the sale of the notes offered by this pricing supplement to our “intermediate

holding company” subsidiary, JPMorgan Chase Holdings LLC, which will use those net proceeds for general corporate purposes. General

corporate purposes may include investments in our subsidiaries, payments of dividends to us, extensions of credit to us or our subsidiaries

or the financing of possible acquisitions or business expansion. Interest on our debt securities (including interest on the notes offered

by this pricing supplement) and dividends on our equity securities, as well as redemptions or repurchases of our outstanding securities,

will be made using amounts we receive as dividends or extensions of credit from JPMorgan Chase Holdings LLC or as dividends from JPMorgan

Chase Bank, N.A.

Material U.S. Federal Income Tax Consequences

You should review carefully the section entitled “Material

U.S. Federal Income Tax Consequences,” and in particular the subsection thereof entitled “Tax Consequences to U.S. Holders—Notes

Treated as Contingent Payment Debt Instruments” in the accompanying product supplement no. 1-II. Unlike a traditional debt instrument

that provides for periodic payments of interest at a single fixed rate, with respect to which a cash-method investor generally recognizes

income only upon receipt of stated interest, we intend to treat the notes as “contingent payment debt instruments” for U.S.

federal income tax purposes. Assuming this treatment is respected, as discussed in that subsection, you generally will be required to

accrue original issue discount (“OID”) on your notes in each taxable year at the “comparable yield,” as determined

by us, subject to certain adjustments to reflect the difference between the actual and projected amounts of any payments you receive during

the year, with the result that your taxable income in any year may differ significantly from the aggregate amount of the Interest Payments

you receive in that year. Upon sale or exchange (including at maturity), you will recognize taxable income or loss equal to the difference

between the amount received from the sale or exchange, and your adjusted basis in the note, which generally will equal the cost thereof,

increased by the amount of OID you have accrued in respect of the note and decreased by the amount of any prior projected payments in

respect of the note. You generally must treat any income as interest income and any loss as ordinary loss to the extent of previous net

interest inclusions, and the balance as capital loss. The deductibility of capital losses is subject to limitations. The discussions herein

and in the accompanying product supplement do not address the consequences to taxpayers subject to special tax accounting rules under

Section 451(b) of the Code. Purchasers who are not initial purchasers of notes at their issue price should consult their tax advisers

with respect to the tax consequences of an investment in notes, including the treatment of the difference, if any, between the basis in

their notes and the notes’ adjusted issue price.

The discussions in the preceding paragraphs, when read in combination

with the section entitled “Material U.S. Federal Income Tax Consequences” (and in particular the subsection thereof entitled

“— Tax Consequences to U.S. Holders— Notes Treated as Contingent Payment Debt Instruments”) in the accompanying

product supplement, constitute the full opinion of Davis Polk & Wardwell LLP regarding the material U.S. federal income tax consequences

of owning and disposing of notes.

Comparable Yield and Projected Payment Schedule

We will determine the comparable yield for the notes and will provide

that comparable yield, and the related projected payment schedule, in the pricing supplement for the notes, which we will file with the

SEC. If the notes had been issued on May 20, 2022 and we had determined the comparable yield on that date, it would have been an annual

rate of 3.80%, compounded monthly. The actual comparable yield that we will determine for the notes may be higher or lower than 3.80%,

and will depend upon a variety of factors, including actual market conditions and our borrowing costs for debt instruments of comparable

maturities. Neither the comparable yield nor the projected payment schedule constitutes a representation by us regarding the actual

amount of any payment that we will make on the notes.

| JPMorgan Structured Investments — | PS- 7 |

| Floating Rate Notes Linked to the Consumer Price Index | |

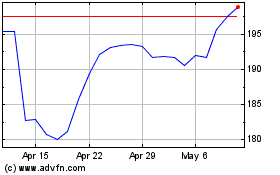

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Mar 2024 to Apr 2024

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Apr 2023 to Apr 2024