Coca-Cola Stock: Is This Dividend King on the S&P 500 a Buy?

28 October 2021 - 9:44PM

Finscreener.org

Investing in blue-chip dividend

stocks is an excellent way for investors to derive passive income,

given that interest rates are near record lows. Generally, a

dividend-paying company generates consistent profits, steady cash

flows and may also be part of a mature industry. These companies

have a wide economic moat and a loyal customer base increasing

their ability to pay out excess profits to investors in the form of

dividends.

These factors also make blue-chip

dividend paying companies a less risky investment. One such stock

that has a long history of dividend payments in beverage

giant Coca-Cola (NYSE:

KO). Also part of Warren

Buffett’s portfolio, Coca-Cola offers investors a forward yield of

3.1% while generating predictable cash flows and robust profit

margins. Let’s see if KO stock should be on the radar of dividend

investors right now.

Coca-Cola stock is up 50% in the last five

years

Let’s see how Coca-Cola has

performed in recent years, compared to the S&P 500. In the

last year, KO stock is up 10.8% and it has gained 50% in the last

five years. Since October 2011, Coca-Cola stock has returned 121%

to investors. Comparatively, the S&P 500 has returned 33.6%,

133% and 350% to investors in the last one-year, five-year and

10-year period respectively.

Coca-Cola is one of the most

famous brands in the world and has a large portfolio of beverage

products. Despite a challenging 2020, Coca-Cola generated $11.5

billion

in free cash flow

while its revenue fell to $33

billion last year from $37.22 billion in 2019.

The free cash flow is an

important metric as it provides investors insights into a company’s

ability to maintain and even increase dividend payments. Further, a

company can also choose to repay debt, reinvest capital to expand

its business or buyback shares with the excess cash. One reason for

Coca-ColaU+02019s stellar cash flow metrics is its pre-tax margin

that averaged over 24% in the last decade.

Coca-Cola’s sales were impacted

amid COVID-19 as several of its business avenues such as theme

parks, restaurants, stadiums and theaters were shut. As economies

have reopened this year, analysts expect sales to rise by 14.9% to

$38 billion in 2021 and by 5.7% to $40 billion in 2022. Wall Street

also expects Coca-Cola to increase its adjusted earnings at an

annual rate of 10% in the next five years.

What next for KO stock?

Given the company’s forecasts and

a market cap of $237 billion, KO stock is valued at a forward price

to sales multiple of 6.2x and a price to earnings ratio of 24x

which might seem steep for a mature business. But its revenue

increase this year as well as earnings expansion might continue to

benefit investors as analysts expect KO stock to touch $62 in the

next 12-months. After accounting for its dividend yield, annual

returns may be close to 20%.

Coca-Cola also has an enviable

history of dividend increases. Its annual dividend per share has

increased from $0.25 to $1.68 in the last three decades. In fact,

Coca-Cola is a Dividend King that has increased payouts for 59

consecutive years.

A key driver of KO stock will be

the company’s

upcoming earnings results this week. Analysts expect Coca-Cola to report

revenue of $9.75 billion and adjusted earnings of $0.58 per share

in the September quarter. In case, Coca-Cola can beat consensus

estimates and provide a better-than-expected guidance, the stock

should gain significant momentum in the next trading

sessions.

The verdict

Coca-Cola is a stock that will

help you generate inflation-beating returns over time, but it might

struggle to outpace the S&P 500 consistently. Its low beta

of 0.64 makes the stock extremely attractive to risk-averse

investors right now.

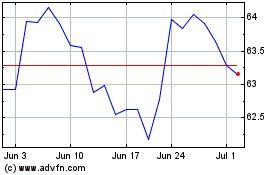

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024