UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 11-K

ý ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2021

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File No. 001-02217

THE COCA-COLA COMPANY 401(k) PLAN

(Full title of the plan)

(Name of issuer of the securities held pursuant to the plan)

One Coca-Cola Plaza

Atlanta, Georgia 30313

(Address of the plan and address of issuer's principal executive offices)

THE COCA-COLA COMPANY 401(k) PLAN

| | | | | |

| Table of Contents |

| Page |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Supplemental Schedule: |

| |

| |

| |

| Exhibit: |

| |

| |

Report of Independent Registered Public Accounting Firm

To the Administrator and Plan Participants of The Coca-Cola Company 401(k) Plan

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of The Coca-Cola Company 401(k) Plan (the “Plan”) as of December 31, 2021 and 2020 and the related statement of changes in net assets available for benefits for the year ended December 31, 2021, and the related notes (collectively referred to as the financial statements). In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2021 and 2020, and the changes in net assets available for benefits for the year ended December 31, 2021, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of management. Our responsibility is to express an opinion on these financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Information

The supplemental information contained in the Schedule H, line 4i - Schedule of Assets (Held at End of Year) as of December 31, 2021 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the

Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

We have served as the Plan’s auditor since 1985.

/s/ Banks, Finley, White & Co.

Atlanta, Georgia

June 22, 2022

THE COCA-COLA COMPANY 401(k) PLAN

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

December 31, 2021 and 2020

| | | | | | | | |

| 2021 | 2020 |

| ASSETS | | |

| Investments in Master Trust, at fair value (Note 3) | $ | 3,540,104,720 | | $ | 3,427,176,220 | |

| Investments in Master Trust, at contract value (Note 3) | 253,783,138 | | 291,208,820 | |

| Notes receivable from participants | 27,801,567 | | 34,084,337 | |

| Due from broker | 155,404 | | — | |

| Net assets available for benefits | $ | 3,821,844,829 | | $ | 3,752,469,377 | |

Refer to Notes to Financial Statements.

THE COCA-COLA COMPANY 401(k) PLAN

STATEMENT OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

Year Ended December 31, 2021

| | | | | |

Additions to net assets attributed to: | |

| Investment income from the Master Trust | $ | 495,317,286 | |

| Interest income from notes receivable from participants | 1,279,876 | |

| Participant contributions | 77,266,999 | |

| Participant rollover contributions | 18,202,457 | |

| Employer contributions | 28,594,181 | |

| Total additions | 620,660,799 | |

| |

Deductions from net assets attributed to: | |

| Distributions to participants | 561,904,419 | |

| Administrative expenses | 2,168,067 | |

| Total deductions | 564,072,486 | |

| |

| Net increase in net assets before transfers | 56,588,313 | |

| |

| Transfers from other plans | 12,787,139 | |

| Net increase in net assets available for benefits | 69,375,452 | |

| |

| Net assets available for benefits: | |

| Beginning of year | 3,752,469,377 | |

| End of year | $ | 3,821,844,829 | |

Refer to Notes to Financial Statements.

THE COCA-COLA COMPANY 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS

Note 1 – Description of Plan

The following description of The Coca-Cola Company 401(k) Plan (the “Plan”) provides only general information. Participants should refer to the Summary Plan Description for a more comprehensive description of the Plan’s provisions.

General

The Plan was originally adopted effective July 1, 1960 and was amended and restated effective January 1, 2016. The Plan is a defined contribution pension plan covering employees of The Coca-Cola Company and its participating subsidiaries (the “Company”). Eligible employees may begin participating in the Plan upon hire with the Company. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”).

Administration

The Plan is administered by The Coca-Cola Company Benefits Committee (the “Committee”) which, as Plan Administrator, has substantial control of and discretion over the administration of the Plan. Transamerica Retirement Solutions provides recordkeeping services for the Plan. The Northern Trust Company (the “Trustee”) provides trust services for the Plan.

Plan Amendments

In response to the COVID-19 pandemic, the Plan was amended to adopt certain provisions of the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”) for qualified individuals, as defined in the CARES Act. Effective from April 20, 2020 to December 31, 2020, the following provisions were adopted:

(a) Qualified individuals may receive a distribution up to $100,000. The amendment resulted in additional participant distributions of approximately $33.3 million during 2020. There were no participant distributions related to the CARES Act in 2021.

(b) Qualified individuals may suspend any loan repayments until December 31, 2020. Any suspended loan payments resumed in January 2021. The term of any loan suspended shall be extended by the same term for which the loan was suspended, and the loan balance and future payments shall be adjusted for interest accrued during the suspension. Qualified individuals were also permitted to apply for one additional loan, if applicable.

Contributions

The Plan allows participants to contribute their compensation in line with applicable Internal Revenue Code (the “Code”) limitations. The Company matches participant contributions equal to 100% of the first 1% of compensation and 50% of the next 5% of compensation, for a maximum Company match of 3.5% of compensation. All Company contributions are initially invested in common stock of The Coca-Cola Company. All contributions are invested as directed by participants.

Vesting

Participants are immediately vested in their salary deferral contributions and related earnings, while Company contributions and related earnings are vested after two years of service.

Forfeitures

Forfeited accounts are generally used to reduce employer contributions or pay administrative expenses of the Plan. The forfeited account balances were $1,009,539 and $1,358,485 as of December 31, 2021 and 2020, respectively. The Plan used $912,475 and $113,633 of cumulative forfeitures to reduce employer contributions during 2021 and 2020, respectively.

THE COCA-COLA COMPANY 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS

Participant Accounts

Each participant’s account is credited with the participant’s contributions, employer contributions, if any, rollover contributions, if any, and allocations of Plan investment results; however, each account is also charged with an allocation of administrative expenses. Participant accounts are updated daily to reflect transactions affecting account balances. Allocations are based on participant earnings on account balances, as defined. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account balance.

Notes Receivable from Participants

Participants may borrow from their account balances subject to certain limitations. Participant loans may be funded from a combination of all vested account balances. The following applies to participant loans:

(a) The maximum amount that a participant may borrow is the lesser of 50% of their account balance or $50,000 (or 100% for qualified individuals who took a loan between April 20, 2020 and September 22, 2020). The $50,000 maximum (or $100,000 for qualified individuals who took a loan between April 20, 2020 and September 22, 2020) is reduced by the participant’s highest outstanding loan balance on any loans during the preceding 12 months. No more than two loans are allowed from the Plan at a time (effective April 20, 2020 to September 22, 2020, qualified individuals were eligible to apply for one additional loan even if the participant had two loans outstanding).

(b) The minimum loan amount is $1,000.

(c) The loan interest rate is the prime rate as published in The Wall Street Journal on the 1st business day of the month the loan is requested.

(d) The loan repayment period is limited to five years for a general purpose loan and 15 years for a loan used to purchase or build a principal residence.

Employee Stock Ownership Plan

The portion of the Plan invested in common stock of The Coca-Cola Company is designated as an employee stock ownership plan (“ESOP”) within the meaning of Code Section 4975(e)(7). Participants invested in common stock of The Coca-Cola Company may elect to receive their entire dividend amount as a cash payment made directly to them rather than have the dividend amount reinvested in their Plan account. The total amount of dividends paid directly to participants was $2,775,731 during 2021.

Payment of Benefits

Upon retirement, termination or disability, participants may elect to receive payment from the Plan in a lump-sum distribution, installments or in partial payments (a portion paid in a lump sum, and the remainder paid later). Participants may elect in-service distributions from after-tax and rollover account balances, or after attaining age 59½ from all vested account balances. Participants may elect to receive payment of the portion of their accounts invested in common stock of The Coca-Cola Company in shares rather than cash (“in-kind distributions”). Participants may also request an in-service distribution for the purpose of a financial hardship from certain vested account balances.

Plan Termination

The Company, by action of the Committee, reserves the right to, at any time and for any reason, terminate the Plan or completely discontinue contributions to the Plan. The Plan shall be terminated or contributions shall be discontinued by a written instrument approved by the Committee by resolution.

In the event of the Plan’s termination, if no successor plan is established or maintained, lump-sum distributions shall be made in accordance with the terms of the Plan as in effect at the time of the Plan’s termination or as thereafter amended. To the extent any assets of the Trust represent amounts allocated to a Code Section 415 suspense account, such amounts may revert to the Company. The Plan Administrator’s authority shall continue beyond the Plan’s termination date until all Trust assets have been liquidated and distributed.

THE COCA-COLA COMPANY 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS

Note 2 – Summary of Significant Accounting Policies

Basis of Accounting

The accompanying financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires Plan management to make estimates that affect certain reported amounts and disclosures. Actual results may differ from those estimates.

Valuation of Investments

The Plan’s investments are stated at fair value in accordance with Accounting Standards Codification Topic 820 “Fair Value Measurements and Disclosures” (“ASC 820”). See Note 3 for fair value measurements.

Notes Receivable from Participants

Participant loans, which are classified as receivables, are stated at the unpaid principal balance plus any accrued but unpaid interest.

Investment Transactions and Income

Investment transactions are recorded on a trade-date basis. Dividend income is recorded on the ex-dividend date. Interest is recognized on an accrual basis. Brokerage commissions on purchases and sales of common stock are considered transaction costs and are recorded as an increase to the cost basis of shares purchased and/or reduction of proceeds on a sale of shares. The net appreciation or depreciation in fair value of investments consists of realized gains and losses and changes in unrealized gains or losses on investments during the year. Realized gains and losses on investments are determined based on average cost. Unrealized gains or losses on investments are based on changes in the market values or fair values of such investments.

Payment of Benefits

Distributions to participants are recorded when payment is made. In-kind distributions are recorded based on the market value of the shares at the date of distribution

Administrative Expenses

Certain administrative expenses were paid by the Plan, as permitted by the Plan document. All other administrative expenses were paid by the Company.

Plan Mergers

Effective October 13, 2021, the following plans were merged into the Plan: Fuze 401(k) Plan, glaceau 401(k) Plan, NeXstep 401(k) Plan and Honest Tea 401(k) Plan. As a result of the mergers, the Plan's net assets available for benefits increased by $12,787,139, which was fully comprised of investments and no participant loans.

THE COCA-COLA COMPANY 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS

Note 3 – The Coca-Cola Company Master Trust for 401(k) Plans

The Plan participates in The Coca-Cola Company Master Trust for 401(k) Plans (the “Master Trust”) with similar retirement plans sponsored by the Company and certain other subsidiaries of the Company, whereby investments are held collectively for all plans by the Trustee. Each participating plan’s investment in the Master Trust is equal to the sum of its participant account balances in relation to total Master Trust investments. The Plan’s investments include retirement target date funds, equity and fixed income index funds, actively managed equity and fixed income funds, synthetic guaranteed investment contracts, and common stock of The Coca-Cola Company. The investment structures include mutual funds, collective trust funds, Master Trust investment funds, and direct ownership of common stock of The Coca-Cola Company.

The Plan’s interest in the net assets of the Master Trust was 100% and approximately 99.7% at December 31, 2021 and December 31, 2020, respectively. This was determined by comparing the Plan’s investment in the Master Trust to total net assets in the Master Trust.

The following table summarizes net assets for the Plan and the Master Trust as of December 31, 2021 and 2020:

| | | | | | | | | | | | | | |

| 2021 Plan's Portion of Master Trust Assets | 2021 Master Trust | 2020 Plan's Portion of Master Trust Assets | 2020 Master Trust |

| Collective trust funds | $ | 1,866,129,864 | | $ | 1,866,129,864 | | $ | 1,746,184,974 | | $ | 1,752,798,466 | |

| Registered investment companies | — | | — | | 10,343,908 | | 10,424,604 | |

| Master Trust investment funds | 543,054,666 | | 543,054,666 | | 532,266,143 | | 537,153,524 | |

| Common stock | 1,130,920,190 | | 1,130,920,190 | | 1,138,381,195 | | 1,138,381,195 | |

| Investments at fair value | 3,540,104,720 | | 3,540,104,720 | | 3,427,176,220 | | 3,438,757,789 | |

| Due from broker | 155,404 | | 155,404 | | — | | — | |

| Fully benefit-responsive investment | | | | |

| contract at contract value | 253,783,138 | | 253,783,138 | | 291,208,820 | | 291,652,416 | |

| Notes receivable from participants | 27,801,567 | | 27,801,567 | | 34,084,337 | | 34,110,272 | |

| Master Trust net assets | $ | 3,821,844,829 | | $ | 3,821,844,829 | | $ | 3,752,469,377 | | $ | 3,764,520,477 | |

THE COCA-COLA COMPANY 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS

The change in net assets of the Master Trust for the year ended December 31, 2021 was as follows:

| | | | | |

| 2021 |

| Additions to net assets attributed to: | |

| Net appreciation in fair value of investments | $ | 463,828,588 | |

| Interest and dividends | 32,982,238 | |

| Investment income | 496,810,826 | |

| Interest income from notes receivable from participants | 1,279,876 | |

| Participant contributions | 77,266,999 | |

| Participant rollover contributions | 18,202,457 | |

| Employer contributions | 28,594,181 | |

| Total additions | 622,154,339 | |

| |

| Deductions from net assets attributed to: | |

| Distributions to participants | 562,657,654 | |

| Administrative expenses | 2,172,333 | |

| Total deductions | 564,829,987 | |

| |

| Net increase in net assets available for benefits | $ | 57,324,352 | |

Fair Value Measurements

ASC 820 defines fair value as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. ASC 820 also established a fair value hierarchy that prioritizes the inputs used to measure fair value. This hierarchy requires entities to maximize the use of observable inputs and minimize the use of unobservable inputs. The three levels of inputs used to measure fair value are as follows:

Level 1 – Quoted prices in active markets for identical assets or liabilities.

Level 2 – Observable inputs other than quoted prices included in Level 1, such as quoted prices for similar assets and liabilities in active markets; quoted prices for identical or similar assets and liabilities in markets that are not active; or other inputs that are observable or can be corroborated by observable market data.

Level 3 – Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities. This includes certain pricing models, discounted cash flow methodologies and similar techniques that use significant unobservable inputs.

THE COCA-COLA COMPANY 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS

The Master Trust assets, measured at fair value on a recurring basis (at least annually) as of December 31, 2021, were as follows:

| | | | | | | | | | | |

| Quoted Prices in Active Markets for Identical Assets | Investments Using Net Asset Value Practical Expedient | Total |

Common stock (A) | $ | 1,130,920,190 | | $ | — | | $ | 1,130,920,190 | |

Collective trust funds (B) | — | | 1,866,129,864 | | 1,866,129,864 | |

Master Trust investment funds (C) | — | | 543,054,666 | | 543,054,666 | |

| Total Master Trust assets | $ | 1,130,920,190 | | $ | 2,409,184,530 | | $ | 3,540,104,720 | |

(A) Investments in common stock are in shares of The Coca-Cola Company and are valued using the quoted market price multiplied by the number of shares owned as of the measurement date.

(B) The underlying investments held in the collective trust funds are equity or debt securities held to replicate the performance of a specific equity or bond market index. The collective trust funds are valued at the publicly quoted net asset value (“NAV”) per share as determined by the manager of the funds multiplied by the number of shares held as of the measurement date. These funds have no redemption restrictions.

(C) The Master Trust investment funds include the US Large Cap Active Equity Fund, the US Small-Mid Cap Active Equity Fund, and the US Core-Plus Active Fixed Income Fund. The total value is calculated by multiplying the NAV per share by the number of shares held as of the measurement date. The underlying investments include common stock, preferred stock, mutual funds, collective trust funds and a short-term investment account. These funds have no redemption restrictions.

THE COCA-COLA COMPANY 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS

The Master Trust assets, measured at fair value on a recurring basis (at least annually) as of December 31, 2020, were as follows:

| | | | | | | | | | | |

| Quoted Prices in Active Markets for Identical Assets | Investments Using Net Asset Value Practical Expedient | Total |

Common stock (A) | $ | 1,138,381,195 | | $ | — | | $ | 1,138,381,195 | |

Registered investment companies (B) | 10,424,604 | | — | | 10,424,604 | |

Collective trust funds (C) | — | | 1,752,798,466 | | 1,752,798,466 | |

Master Trust investment funds (D) | — | | 537,153,524 | | 537,153,524 | |

| Total Master Trust assets | $ | 1,148,805,799 | | $ | 2,289,951,990 | | $ | 3,438,757,789 | |

(A) Investments in common stock are in shares of The Coca-Cola Company and are valued using the quoted market price multiplied by the number of shares owned as of the measurement date.

(B) Investments in registered investment companies are valued at the publicly quoted NAV of each fund. The total value is calculated by multiplying the NAV per share by the number of shares held as of the measurement date.

(C) The underlying investments held in the collective trust funds are equity or debt securities held to replicate the performance of a specific equity or bond market index. The collective trust funds are valued at the NAV per share as determined by the manager of the funds multiplied by the number of shares held as of the measurement date. These funds have no redemption restrictions.

(D) The Master Trust investment funds include the US Large Cap Active Equity Fund, the US Small-Mid Cap Active Equity Fund, and the US Core-Plus Active Fixed Income Fund. The total value is calculated by multiplying the NAV per share by the number of shares held as of the measurement date. The underlying investments include common stock, preferred stock, mutual funds, collective trust funds and a short-term investment account. These funds have no redemption restrictions.

The Plan’s valuation methods used to measure fair value of its investments may produce fair values that may not be indicative of a future sale, or reflective of future fair values. The use of different methods to determine the fair value of investments could result in different estimates of fair value at the reporting date. There have been no changes in the methodologies used at December 31, 2021 and 2020.

During 2021 and 2020, there were no Level 2 or Level 3 investments.

THE COCA-COLA COMPANY 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS

Synthetic Guaranteed Investment Contracts

The Master Trust has a separate account (the “account”) which invests primarily in wrapper contracts (also known as synthetic guaranteed investment contracts) as well as an insurance company separate account and cash equivalents. The contracts within the account are fully benefit-responsive and are therefore reported at contract value on the statements of net assets available for benefits. Contract value represents contributions made under the contracts, plus earnings, less withdrawals and administrative expenses. As of December 31, 2021, the account consisted of $245,330,960 of wrapper contracts and $8,452,178 of cash equivalents.

In a wrapper contract structure, the underlying investments are owned by the account and held in trust for Plan participants. These contracts wrap a diversified portfolio primarily comprised of corporate bonds, government bonds, and collective trust funds. The account purchases wrapper contracts from an insurance company or bank. The wrapper contracts amortize the realized and unrealized gains and losses on the underlying fixed income investments, typically over the duration of the investments, through adjustments to the future interest crediting rate (which is the rate earned by participants in the account for the underlying investments). The issuers of the wrapper contracts provide assurances that the adjustments to the interest crediting rate do not result in a future crediting rate that is less than zero.

Examples of events that would permit a wrapper contract issuer to terminate a wrapper contract upon short notice include the Plan’s loss of its qualified status, uncured material breaches of responsibilities, or material and adverse changes to the provisions of the Plan. If one of these events was to occur, the wrapper contract issuer could terminate the wrapper contract at the market value of the underlying investments.

Transactions with Parties-in-Interest

The Plan does not consider Company contributions as party-in-interest transactions. Fees paid during the year for investment management, auditing and other professional services rendered by parties-in-interest were based on customary and reasonable rates for such services. Certain investments managed by The Northern Trust Company, the Trustee as defined by the Plan, qualify as party-in-interest transactions.

As of December 31, 2021 and 2020, the Master Trust held 19,100,155 and 20,758,227 shares of common stock of The Coca-Cola Company with a fair value of $1,130,920,190 and $1,138,381,195, respectively. During the year ended December 31, 2021, the Master Trust had the following transactions relating to common stock of

The Coca-Cola Company:

| | | | | | | | |

| Shares | Fair Value |

| Purchases | 1,118,013 | | $ | 30,174,016 | |

| Sales | 2,305,235 | | $ | 123,513,730 | |

| In-kind distributions | 470,851 | | $ | 24,900,016 | |

| Dividends received | N/A | $ | 30,195,448 | |

Note 4 – Risks and Uncertainties

The Plan invests in various investment securities. Investment securities are exposed to various risks such as interest rate, market and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants' account balances and the amounts reported in the statements of net assets available for benefits.

THE COCA-COLA COMPANY 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS

Note 5 – Income Tax Status

The Plan has received a determination letter from the Internal Revenue Service dated September 2, 2017, stating that the Plan is qualified under Section 401(a) of the Code and, therefore, the related trust is exempt from taxation. The Plan was amended subsequent to receipt of the determination letter. Once qualified, the Plan is required to operate in conformity with the Code to maintain its qualification. The Committee and the Company’s tax counsel believe the Plan is being operated in compliance with the applicable requirements of the Code and, therefore, believe the Plan, as amended, is qualified and the related trust is tax exempt.

U.S. GAAP require Plan management to evaluate tax positions taken by the Plan. The financial statement effects of a tax position are recognized when the position is more likely than not, based on the technical merits, to be sustained upon examination by the IRS. The Plan Administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2021, there are no uncertain positions taken or expected to be taken. The Plan has recognized no interest or penalties related to uncertain tax positions. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

Note 6 – Nonexempt Transactions

During 2021 and 2020, there were no nonexempt transactions.

THE COCA-COLA COMPANY 401(k) PLAN

EIN: 58-0628465 PN: 002

Schedule H, Line 4i – Schedule of Assets (Held at End of Year)

December 31, 2021

| | | | | | | | | | | |

| (a) | (b) Identity of issue, borrower, lessor or similar party | (c) Description of investment, including maturity date, rate of interest, collateral, par, or maturity value | (e) Current

value |

| * | Participants | Loans with interest rates ranging from 3.25% to 7.50%. Maturities through 2037. | $ | 27,801,567 | |

* Parties-in-interest

Note: Column (d) cost is not required for participant-directed investments.

EXHIBIT INDEX

SIGNATURES

The Plan. Pursuant to the requirements of the Securities Exchange Act of 1934, The Coca-Cola Company Benefits Committee has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | | THE COCA-COLA COMPANY 401(k) PLAN

(Name of Plan) |

| | |

| | /s/ SILVINA KIPPKE |

| Date: | June 22, 2022 | Silvina Kippke

Chairperson, The Coca-Cola Company Benefits Committee |

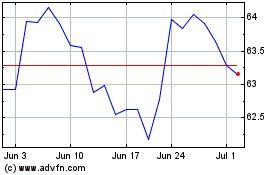

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024