false

0001698990

0001698990

2024-11-12

2024-11-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date

of earliest event reported): November 12, 2024

Magnolia

Oil & Gas Corporation

(Exact

name of registrant as specified in its charter)

Delaware

(State or other jurisdiction

of incorporation) |

001-38083

(Commission

File Number) |

81-5365682

(I.R.S. Employer

Identification Number) |

Nine

Greenway Plaza, Suite 1300

Houston,

Texas 77046

(Address of principal executive

offices, including zip code)

(713)

842-9050

Registrant’s telephone number,

including area code

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Class

A Common Stock, par value $0.0001 Per Share |

MGY |

New

York Stock Exchange |

On November 12, 2024, Magnolia Oil & Gas Operating

LLC (“Magnolia”) and Magnolia Oil & Gas Finance Corp. (“Finance Corp.” and, together with Magnolia,

the “Issuers”), issued a press release in accordance with Rule 135c under the Securities Act of 1933, as amended

(the “Securities Act”), announcing that the Issuers have priced the previously announced private offering of $400

million in aggregate principal amount of 6.875% senior unsecured notes due 2032 (the “Notes”). A copy of the press

release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information contained in this Current Report on Form 8-K,

including Exhibit 99.1, does not constitute an offer to sell, or a solicitation of an offer to buy, any of the Notes in the offering

or any other securities of the Issuers, and none of such information shall constitute an offer, solicitation or sale of securities in

any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities

laws of any such jurisdiction.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MAGNOLIA

OIL & GAS CORPORATION |

| |

|

| Date: November 12,

2024 |

By: |

/s/

Timothy D. Yang |

| |

Name:

|

Timothy

D. Yang |

| |

Title:

|

Executive

Vice President, General Counsel, Corporate Secretary and Land |

Exhibit 99.1

Press Release

Magnolia Oil & Gas Operating LLC

Announces Pricing of Offering of $400 Million

Senior Notes

HOUSTON,

TX, November 12, 2024 – Magnolia Oil & Gas Operating LLC (“Magnolia Operating”) and Magnolia

Oil & Gas Finance Corp., a subsidiary of Magnolia Operating, (“Finance Corp.” and, together with Magnolia Operating,

the “Issuers”) announced today the pricing of their previously announced private offering (the “Notes Offering”)

of $400 million in aggregate principal amount of 6.875% senior unsecured notes due 2032 (the “Notes”).

The closing of the Notes Offering is expected to occur on November 26,

2024, and is conditioned upon the satisfaction of customary closing conditions. The Issuers intend to use the net proceeds from the offering

to repurchase and redeem the outstanding 6.00% Senior Notes due 2026 (the “2026 Notes”) in full.

The Notes have not been registered under the Securities Act of 1933,

as amended (the “Securities Act”), or any state securities laws and, unless so registered, may not be offered or sold in the

United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities

Act and applicable state securities laws. The Issuers plan to offer and sell the securities only to qualified institutional buyers pursuant

to Rule 144A under the Securities Act and to non-U.S. persons in transactions outside the United States pursuant to Regulation S

under the Securities Act.

This press release is neither an offer to sell nor a solicitation of

an offer to buy the Notes or any other security of the Issuers, and shall not constitute an offer

to sell or a solicitation of an offer to buy, or a sale, of the Notes or any other security of the Issuers in any jurisdiction in which

such offer, solicitation or sale is unlawful. This press release does not constitute a notice of redemption under the optional redemption

provisions of the indenture governing the 2026 Notes. The Notes Offering is being made solely pursuant to a private offering memorandum

and only to such persons and in such jurisdictions as are permitted under applicable law.

About Magnolia

Magnolia (MGY) is a publicly traded oil and gas exploration and production

company with operations primarily in South Texas in the core of the Eagle Ford Shale and Austin Chalk formations. Magnolia focuses on

generating value for shareholders by delivering steady, moderate annual production growth resulting from its disciplined and efficient

philosophy toward capital spending. Magnolia strives to generate high pre-tax margins and consistent free cash flow allowing for strong

cash returns to our shareholders.

Forward-Looking Statements

The

information in this press release includes forward-looking statements within the meaning of Section 27A of the Securities Act and

Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of present or historical fact

included in this press release, regarding, without limitation, the proposed offering and the intended use of proceeds, including to fund

the redemption of the 2026 Notes, Magnolia Oil & Gas Corporation’s (“Magnolia”) strategy, future operations,

budgets, projected revenues, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management

are forward-looking statements. When used in this press release, the words “could,” “should,” “will,”

“may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,”

“project,” “believe,” “plan,” “continue,” the negative of such terms and other similar

expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying

words. These forward-looking statements are based on management’s current expectations and assumptions about future events, as

well as information currently available to our management. Except as otherwise required by applicable law, Magnolia disclaims any duty

to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or

circumstances after the date of this press release. Magnolia cautions you that these forward-looking statements are subject to all of

the risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Magnolia, incident to

the development, production, gathering and sale of oil, natural gas and natural gas liquids. In addition, Magnolia cautions you that

the forward-looking statements contained in this press release are subject to the following factors: (i) changes in applicable laws,

regulations or policy, including those following the change in presidential administrations; (ii) the market prices of oil, natural

gas, NGLs and other products or services; (iii) the supply and demand for oil, natural gas, NGLs and other products or services,

including impacts of actions taken by OPEC and other state-controlled oil companies; (iv) production and reserve levels; (v) the

timing and extent of Magnolia’s success in discovering, developing, producing and estimating reserves; (vi) geopolitical and

business conditions in key regions of the world; (vii) drilling risks; (viii) economic and competitive conditions; (ix) the

availability of capital resources; (x) capital expenditures and other contractual obligations; (xi) weather conditions; (xii) inflation

rates; (xiii) the availability of goods and services; (xiv) cyber attacks; (xv) the occurrence of property acquisitions

or divestitures; (xvi) the integration of acquisitions; (xvii) the securities or capital markets and related risks such as

general credit, liquidity, market and interest-rate risks; (xviii) the outcome of any legal proceedings that may be instituted against

Magnolia; and (xix) the impact of any natural disasters or public health emergencies. Should one or more of the risks or uncertainties

described in this press release occur, or should underlying assumptions prove incorrect, actual results and plans could differ materially

from those expressed in any forward-looking statements. Additional information concerning these and other factors that may impact the

operations and projections discussed herein can be found in Magnolia’s filings with the Securities and Exchange Commission, including

its Annual Report on Form 10-K for the fiscal year ended December 31, 2023. Magnolia’s SEC filings are available publicly

on the SEC’s website at www.sec.gov.

Contacts

Investors

Tom Fitter

713-331-4802

tfitter@mgyoil.com

Media

Art Pike

713-842-9057

apike@mgyoil.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

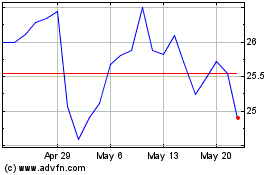

Magnolia Oil and Gas (NYSE:MGY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Magnolia Oil and Gas (NYSE:MGY)

Historical Stock Chart

From Nov 2023 to Nov 2024