McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is

pleased to report on the progress at the Fox Complex, where we are

advancing a new mine on the Stock Property. Production is planned

to start in the second half of 2025. Pre-construction activities of

the Stock portal have commenced, which will allow access to mining

of the three gold zones, West, Main and East. In addition, the

portal will provide cost-effective underground drill platforms to

enable testing for expected depth extensions of these three zones.

Recent exploration resulted in a 29% increase in the estimated gold

resources for Stock’s East Zone. The Fox Complex is comprised of

several properties, including Stock, and has Measured and Indicated

gold resources of

1,905,000 ounces at average

grade of 4.20 g/t Au and Inferred gold resources of

549,000

gold ounces at average grade of 3.60 g/t Au.

Stock Ramp to Access Future

Production

The Stock Property hosts the Stock Mill and the

former Stock Mine, which produced 137,000 ounces of

gold from an underground operation between 1989 and 2005.

Our exploration has successfully defined three deposits at Stock -

the East, Main and West zones. This mineralization has been found

on a three-kilometer-long mineralized trend situated along the

prolific Destor-Porcupine Fault.

Pre-construction activities have commenced at

the portal with the removal of overburden. Underground development

is expected to begin in Q3. The Stock Ramp will connect the West

Zone and the East Zone to the existing historical underground

workings of the Main Zone.

Stock is expected to provide increased gold

production at a lower cost per ounce than our current production

from the Froome Mine. The advantages of mining at Stock compared to

Froome are significant and the reasons are three-fold: one, there

is a significantly lower transportation or haulage cost. The Froome

mine is deeper and located 35 kilometers from the Stock Mill, while

the gold at Stock is at shallower depths and right next to the

Mill; two, increased gold production due to expected higher mill

throughput, as a result of the Stock material having a lower

(softer) work index compared to what is currently being processed

from the Froome Mine; and three, the bulk of Stock is free of

royalties, whereas Froome is not.

Mining will start in the East Zone, with a

recently increased resource, and provide early production and cash

flow. Our plan for the Stock development is to concurrently drive

the Stock Ramp to the East Zone along with the ramps to the Main

and West Zones. This approach will allow for multiple sources of

mineralization to be accessed from the Stock Ramp.

Figure 1 is a project wide

longitudinal section at Stock, illustrating the proposed ramp

development (shown as purple straight lines) and mining horizons

(shapes in blue) associated with the West, Main and East Zones.

Figure 1. Longitudinal Section for the

Stock Deposit (Looking North)

Figure 1 illustrates three principal plunge

directions for mineralization at the Stock Zones. The following

historic drill intercepts located towards the lower end of these

plunges suggest the gold mineralization could continue at depth:

6.1 g/t Au over 5.6 m (S23-291),

4.3 g/t Au over 20.4 m (S21-202)

and 2.7 g/t Au over 11.2 m

(S19-31).

Fox Complex’s Large Resource

Base

Total Fox Complex Resources are now at

1,905,000 gold ounces of Measured and Indicated

mineralization at an average grade of 4.20 g/t Au and

549,000 gold ounces of Inferred mineralization at

an average grade of 3.60 g/t Au. These resources are

sourced from several deposits, as listed in Figure

2.

Table 1. Fox Complex Resources (May 20,

2024)

|

Fox Complex Resources (May 20, 2024) |

Measured |

Indicated |

Inferred |

|

Tonnes (000s t) |

Grade(g/t) |

Contained Au (oz) |

Tonnes (000s t) |

Grade(g/t) |

Contained Au (oz) |

Tonnes (000s t) |

Grade(g/t) |

Contained Au (oz) |

|

Black Fox |

304 |

5.80 |

57,000 |

91 |

5.44 |

16,000 |

149 |

5.33 |

26,000 |

|

Froome |

568 |

3.99 |

73,000 |

284 |

3.95 |

36,000 |

143 |

3.44 |

16,000 |

|

Grey Fox |

- |

- |

- |

7,566 |

4.80 |

1,168,000 |

1,685 |

4.35 |

236,000 |

|

Stock - West & Main |

- |

- |

- |

1,938 |

3.31 |

206,000 |

1,386 |

2.96 |

132,000 |

|

Stock - East Zone |

- |

- |

- |

866 |

2.70 |

75,000 |

579 |

2.66 |

50,000 |

|

Stock Project Total |

- |

- |

- |

2,804 |

3.12 |

281,000 |

1,965 |

2.87 |

181,000 |

|

Tamarack |

- |

- |

- |

1,055 |

1.63 |

55,000 |

- |

- |

- |

|

Davidson-Tisdale |

200 |

7.25 |

47,000 |

75 |

6.42 |

15,000 |

105 |

4.35 |

15,000 |

|

Fuller |

- |

- |

- |

1,149 |

4.25 |

157,000 |

693 |

3.41 |

76,000 |

|

Total Fox Complex Resources |

1,072 |

5.11 |

176,000 |

13,024 |

4.13 |

1,729,000 |

4,740 |

3.60 |

549,000 |

Note:These resource estimates

conform with the CIM (Canadian Institute of Mining, Metallurgy and

Petroleum) guidelines for Reasonable Prospects for Eventual

Economic Extraction (RPEEE), ensuring that only material that has a

realistic potential to be mined economically is reported as a

resource.

Stock: Growing the Gold Resource

Base

Table 1 shows that the overall

Stock resource (West Zone + Main Zone + East Zone) now contains

281,000 gold ounces of Indicated mineralization at

a grade of 3.12 g/t Au and 181,000 gold ounces of

Inferred mineralization at a grade of 2.87 g/t Au, an increase in

total gold ounces of nearly 7% from the Dec 31,

2023 resource.

Recent Drill Results From the East

Zone

The 2024 infill drilling campaign at the East

Zone was mainly executed within the two previously identified

plunge directions (see Figure 2), yielding

positive results and showing strong continuity between drillhole

intercepts. Mineralization associated with the steeper of the two

plunge directions below the 250 meters elevation will be more

accessible for drilling from future underground drill platforms, at

a lower cost per meter.

The intercepts highlighted in yellow in

Figure 2, including: 5.9 g/t Au

over 13.5 m (SEZ24-108), 6.1 g/t

Au over 7.8 m (SEZ24-105), 6.7

g/t Au over 6.3 m (SEZ24-111), are well

above the East Zone’s current average Indicated resource grade of

about 2.7 g/t Au.

Figure 2. Longitudinal Section for the

East Zone at Stock (Looking North)

The 2024 drilling campaign at the East Zone was

completed in early Q2. The intercepts highlighted in Figure

2 are included in Table 2 below.

Table 2. Key Results From Recent

Drilling at the East Zone

|

Hole ID |

From(m) |

To (m) |

Core Length(m) |

True Width (m) |

Au Uncapped (g/t) |

Au x TW Uncapped

(Gxm) |

|

SEZ24-104 |

82.1 |

89.8 |

7.6 |

6.7 |

3.0 |

20.1 |

|

SEZ24-105 |

106.6 |

116.8 |

10.1 |

7.8 |

6.1 |

47.6 |

|

SEZ24-107 |

227.4 |

252.0 |

24.7 |

18.0 |

3.1 |

55.8 |

|

SEZ24-108 |

113.8 |

134.4 |

20.7 |

13.4 |

5.9 |

79.2 |

|

SEZ24-109 |

109.6 |

117.4 |

7.8 |

6.4 |

3.9 |

24.8 |

|

SEZ24-111 |

72.2 |

79.0 |

6.8 |

6.3 |

6.7 |

42.4 |

|

SEZ24-115 |

127.8 |

134.9 |

7.1 |

5.1 |

5.2 |

26.8 |

|

SEZ24-116 |

211.4 |

219.2 |

7.8 |

6.8 |

3.3 |

22.4 |

|

SEZ24-117 |

227.1 |

233.9 |

6.7 |

5.5 |

3.1 |

17.1 |

|

SEZ24-118A |

198.3 |

205.3 |

6.9 |

6.3 |

4.2 |

26.6 |

|

SEZ24-124 |

257.0 |

264.1 |

7.1 |

5.2 |

3.0 |

15.7 |

|

SEZ24-125 |

221.1 |

230.0 |

8.9 |

6.1 |

3.1 |

18.9 |

|

And |

259.0 |

270.3 |

11.3 |

7.8 |

4.5 |

35.2 |

The above results were incorporated into the

East Zone resource estimate dated May 20, 2024, and amounted to

75,000 gold ounces Indicated and 50,000

gold ounces Inferred, as shown in Table 3

below.

Table 3. East Zone Resource Update (from

Dec 31, 2023 to May 20, 2024)

|

Resource Dates for East Zone |

Category |

Tonnes(000s t) |

Au Grade(g/t) |

Gold(oz) |

|

Dec 31, 2023 |

Indicated |

1,232 |

2.40 |

95,000 |

|

Inferred |

21 |

2.32 |

2,000 |

|

May 20, 2024 |

Indicated |

866 |

2.70 |

75,000 |

|

Inferred |

579 |

2.66 |

50,000 |

“The start of production at Stock will

coincide with production decreasing at the Froome mine. Permit

applications to mine the Grey Fox deposit will follow the start of

mining at Stock. The growth of our gold resources and the prospect

of a long mine life are becoming clear and are a direct result of

our intense focus and large investments in exploration,”

said Rob McEwen, Chairman and Chief Owner.

Technical Information

Technical information pertaining to the Fox

Complex exploration contained in this news release has been

prepared under the supervision of Sean Farrell, P.Geo., Chief

Exploration Geologist, who is a Qualified Person as defined by

Canadian Securities Administrators National Instrument 43-101

"Standards of Disclosure for Mineral Projects."

The technical information related to resource

estimates in this news release has been reviewed and approved by

Luke Willis, P.Geo., McEwen Mining’s Director of Resource Modelling

and a Qualified Person as defined by SEC S-K 1300 and Canadian

Securities Administrators National Instrument 43-101 "Standards of

Disclosure for Mineral Projects."

Exploration drill core samples at the Stock

Complex were submitted as 1/2 core. Analyses reported herein were

performed by the photon assay method at the accredited laboratory

MSA Labs in Timmins, Ontario, Canada (ISO 9001 & ISO

10725).

Notes on the Updated Resource at the East

Zone:

- Effective date of the updated Mineral Resource estimate is 20

May 2024. The QP for the estimate is Mr. Carson Cybolsky, P.Geo, an

employee of McEwen Mining.

- Mineral Resources are reported using the 2014 CIM Definition

Standards and in accordance with the CIM Best Practice Guidelines

(2019). Mineral Resources that are not Mineral Reserves do not have

demonstrated economic viability.

- Mineral Resources are reported above an economic cut-off grade

of 1.95 g/t gold assuming underground extraction methods and based

on costs per tonne of US$60.80 for mining, US$18.50 for process,

US$7.98 for G&A, metallurgical recovery of 94%, and a gold

price of US$1,725/oz.

- Mineral Resources include the ‘must take’ minor material below

cut-off grade which is interlocked with blocks above the cut-off

grade within the mineable shape optimizer stopes.

- Figures may not sum due to rounding.

For a list of drilling results at Stock

since Feb 28, 2024, including hole location and alignment, click

here:https://www.mcewenmining.com/files/doc_news/archive/2024/2024_06_StockDrillResults.xlsx

CAUTION CONCERNING FORWARD-LOOKING

STATEMENTS

This news release contains certain

forward-looking statements and information, including

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. The forward-looking

statements and information expressed, as at the date of this news

release, McEwen Mining Inc.'s (the "Company") estimates, forecasts,

projections, expectations or beliefs as to future events and

results. Forward-looking statements and information are necessarily

based upon a number of estimates and assumptions that, while

considered reasonable by management, are inherently subject to

significant business, economic and competitive uncertainties, risks

and contingencies, and there can be no assurance that such

statements and information will prove to be accurate. Therefore,

actual results and future events could differ materially from those

anticipated in such statements and information. Risks and

uncertainties that could cause results or future events to differ

materially from current expectations expressed or implied by the

forward--looking statements and information include, but are not

limited to, effects of the COVID-19 pandemic, fluctuations in the

market price of precious metals, mining industry risks, political,

economic, social and security risks associated with foreign

operations, the ability of the corporation to receive or receive in

a timely manner permits or other approvals required in connection

with operations, risks associated with the construction of mining

operations and commencement of production and the projected costs

thereof, risks related to litigation, the state of the capital

markets, environmental risks and hazards, uncertainty as to

calculation of mineral resources and reserves, and other risks.

Readers should not place undue reliance on forward-looking

statements or information included herein, which speak only as of

the date hereof. The Company undertakes no obligation to reissue or

update forward-looking statements or information as a result of new

information or events after the date hereof except as may be

required by law. See McEwen Mining's Annual Report on Form 10-K for

the fiscal year ended December 31, 2023, and other filings with the

Securities and Exchange Commission, under the caption "Risk

Factors", for additional information on risks, uncertainties and

other factors relating to the forward-looking statements and

information regarding the Company. All forward-looking statements

and information made in this news release are qualified by this

cautionary statement.

The NYSE and TSX have not reviewed and do not

accept responsibility for the adequacy or accuracy of the contents

of this news release, which has been prepared by management of

McEwen Mining Inc.

ABOUT MCEWEN MINING

McEwen Mining is a gold and silver producer with

operations in Nevada, Canada, Mexico and Argentina. In addition, it

owns approximately 47.7% of McEwen Copper which owns the large,

advanced-stage Los Azules copper project in Argentina.

Rob McEwen, Chairman and Chief Owner, has a personal

investment in the company of US$220 million.

Want News Fast?

Subscribe to our email list by clicking

here:https://www.mcewenmining.com/contact-us/#section=followUs

and receive news as it happens!

|

|

|

|

|

|

|

|

|

|

WEB SITE |

|

SOCIAL

MEDIA |

|

|

|

|

|

www.mcewenmining.com |

|

McEwen Mining |

Facebook: |

facebook.com/mcewenmining |

|

|

|

|

|

LinkedIn: |

linkedin.com/company/mcewen-mining-inc- |

|

|

|

CONTACT

INFORMATION |

|

Twitter: |

twitter.com/mcewenmining |

|

|

|

150 King Street West |

|

Instagram: |

instagram.com/mcewenmining |

|

|

|

Suite 2800, PO Box 24 |

|

|

|

|

|

|

|

Toronto, ON, Canada |

|

McEwen Copper |

Facebook: |

facebook.com/

mcewencopper |

|

|

|

M5H 1J9 |

|

LinkedIn: |

linkedin.com/company/mcewencopper |

|

|

|

|

|

Twitter: |

twitter.com/mcewencopper |

|

|

|

Relationship with

Investors: |

|

Instagram: |

instagram.com/mcewencopper |

|

|

|

(866)-441-0690 - Toll free line |

|

|

|

|

|

|

|

(647)-258-0395 |

|

Rob

McEwen |

Facebook: |

facebook.com/mcewenrob |

|

|

|

Mihaela Iancu ext. 320 |

|

LinkedIn: |

linkedin.com/in/robert-mcewen-646ab24 |

|

|

|

info@mcewenmining.com |

|

Twitter: |

twitter.com/robmcewenmux |

|

|

|

|

|

|

|

|

|

Photos accompanying this announcement are available

at:https://www.globenewswire.com/NewsRoom/AttachmentNg/af6f5cde-005f-49c6-84ca-36f956a0f0e5https://www.globenewswire.com/NewsRoom/AttachmentNg/b3b2963b-c086-4c09-9b02-a54e26d4a68b

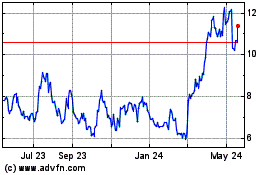

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Nov 2024 to Dec 2024

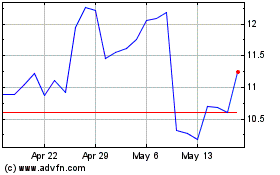

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Dec 2023 to Dec 2024