McEwen Mining Inc. (NYSE: MUX) (TSX:

MUX) is pleased to announce that its 48%-owned

McEwen Copper Inc. has secured an agreement with

YPF Luz to power its large Los Azules copper project with 100%

renewable energy. This exclusive agreement covers the supply of

renewable energy through a high-voltage transmission line, with YPF

Luz responsible for its development and financing.

YPF Luz and McEwen Copper have signed a

Memorandum of Understanding (MOU) that allows the companies to

negotiate the exclusive energy supply for the Los Azules project in

the San Juan province using renewable energy sources. The agreement

also includes connecting the project to the Argentine

Interconnection System (SADI) via a high-voltage transmission line,

the design, construction, and financing of which will be carried

out by YPF Luz. The energy to be supplied will be sourced

from YPF Luz’s renewable assets connected to SADI.

Michael Meding, VP of McEwen Copper and General

Manager of the Los Azules project, stated:

“Los Azules will play a critical role for

Argentina and the world by significantly contributing

to decarbonization. The geological potential of the project will

position San Juan on the international map

of resources for

the energy

transition, and

in this context,

YPF Luz is

a strategic ally to help us achieve our goal of being 100%

renewable.”

Martín Mandarano, CEO of YPF Luz, added:

“We are happy to take this new step with

McEwen Copper and contribute to enabling sustainable copper

production, which is fundamental for the energy transition. This

agreement demonstrates our commitment to providing

comprehensive energy

solutions tailored

to the needs

of each client,

in this case

with electrical works that allow the project to be powered

by reliable and renewable energy.”

The MOU strengthens the alliance between the two

companies, which began in early 2023 with an initial agreement to

explore solutions for ensuring the power supply to Los Azules.

ABOUT YPF LUZ

YPF Luz (YPF Energía Eléctrica S.A.) is an

Argentine company, a leader in power generation, operating since

2013. It currently has more than 15 assets in 7 provinces, with an

installed capacity of 3.2 GW, from which it generates energy for

the wholesale and industrial markets. It is building an additional

418 MW of solar and wind energy in projects located in the

provinces of Córdoba, Mendoza, and Buenos Aires. YPF Luz’s mission

is to generate profitable, efficient, and sustainable energy,

optimizing natural resources for the production of thermal and

renewable energy.

ABOUT MCEWEN COPPER

McEwen Copper is a well-funded, private company

that owns 100% of the large, advanced-stage Los Azules copper

project, located in the San Juan province, Argentina. McEwen Copper

is a 48.3%-owned private subsidiary of McEwen Mining, which trades

under the ticker MUX on NYSE and TSX.

Los Azules is being designed to be distinctly

different from a conventional copper mine by consuming

significantly less water, emitting much lower carbon, progressing

towards carbon neutral by 2038, and being powered by 100% renewable

electricity once in operation. The updated Preliminary Economic

Assessment (PEA) released in June 2023 projects a long life of

mine, short payback period, low production cost per pound, high

annual copper production, and a 21.2% after-tax IRR.

Los Azules is one of the largest and most

promising copper projects globally, with significant production

potential that will position McEwen Copper as a leader in providing

critical metals for the global energy transition. The project is

being developed in partnership with strategic partners such as

Stellantis, a global leader in vehicle manufacturing, and Nuton, a

subsidiary of Rio Tinto specialized in advanced technologies for

efficient and sustainable copper extraction.

ABOUT MCEWEN MINING

McEwen Mining is a gold and silver producer with

operations in Nevada, Canada, Mexico, and Argentina. McEwen Mining

also owns a 48.3% interest in McEwen Copper, which is developing

the large, advanced-stage Los Azules copper project in Argentina.

The Company’s objective is to improve the productivity and life of

its assets with the goal of increasing the share price and

providing investor yield. Rob McEwen, Chairman and Chief Owner, has

a personal investment in the companies of US$225 million. His

annual salary is US$1.

CAUTION CONCERNING FORWARD-LOOKING

STATEMENTS

This news release contains certain

forward-looking statements and information, including

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. The forward-looking

statements and information expressed, as at the date of this news

release, McEwen Mining Inc.'s (the "Company") estimates, forecasts,

projections, expectations, or beliefs as to future events and

results. Forward-looking statements and information are necessarily

based upon a number of estimates and assumptions that, while

considered reasonable by management, are inherently subject to

significant business, economic and competitive uncertainties, risks

and contingencies, and there can be no assurance that such

statements and information will prove to be accurate. Therefore,

actual results and future events could differ materially from those

anticipated in such statements and information. Risks and

uncertainties that could cause results or future events to differ

materially from current expectations expressed or implied by the

forward-looking statements and information include, but are not

limited to, effects of the COVID-19 pandemic, fluctuations in the

market price of precious metals, mining industry risks, political,

economic, social and security risks associated with foreign

operations, the ability of the corporation to receive or receive in

a timely manner permits or other approvals required in connection

with operations, risks associated with the construction of mining

operations and commencement of production and the projected costs

thereof, risks related to litigation, the state of the capital

markets, environmental risks and hazards, uncertainty as to

calculation of mineral resources and reserves, and other risks.

Readers should not place undue reliance on forward-looking

statements or information included herein, which speak only as of

the date hereof. The Company undertakes no obligation to reissue or

update forward-looking statements or information as a result of new

information or events after the date hereof except as may be

required by law. See McEwen Mining's Annual Report on Form 10-K for

the fiscal year ended December 31, 2023, and other filings with the

Securities and Exchange Commission, under the caption "Risk

Factors", for additional information on risks, uncertainties and

other factors relating to the forward-looking statements and

information regarding the Company. All forward-looking statements

and information made in this news release are qualified by this

cautionary statement.

The NYSE and TSX have not reviewed and do not

accept responsibility for the adequacy or accuracy of the contents

of this news release, which has been prepared by management of

McEwen Mining Inc.

Want News Fast?

Subscribe to our email list by clicking

here:https://www.mcewenmining.com/contact-us/#section=followUs

and receive news as it happens!

|

|

|

|

|

|

|

|

|

|

WEB SITE |

|

SOCIAL MEDIA |

|

|

|

|

|

www.mcewenmining.com |

|

McEwen Mining |

Facebook: |

facebook.com/mcewenmining |

|

|

|

|

|

LinkedIn: |

linkedin.com/company/mcewen-mining-inc- |

|

|

|

CONTACT INFORMATION |

|

X: |

x.com/mcewenmining |

|

|

|

150 King Street West |

|

Instagram: |

instagram.com/mcewenmining |

|

|

|

Suite 2800, PO Box 24 |

|

|

|

|

|

|

|

Toronto, ON, Canada |

|

McEwen Copper |

Facebook: |

facebook.com/ mcewencopper |

|

|

|

M5H 1J9 |

|

LinkedIn: |

linkedin.com/company/mcewencopper |

|

|

|

|

|

X: |

x.com/mcewencopper |

|

|

|

Relationship with Investors: |

|

Instagram: |

instagram.com/mcewencopper |

|

|

|

(866)-441-0690 Toll free line |

|

|

|

|

|

|

|

(647)-258-0395 |

|

Rob McEwen |

Facebook: |

facebook.com/mcewenrob |

|

|

|

Mihaela Iancu ext. 320 |

|

LinkedIn: |

linkedin.com/in/robert-mcewen-646ab24 |

|

|

|

info@mcewenmining.com |

|

X: |

x.com/robmcewenmux |

|

|

|

|

|

|

|

|

|

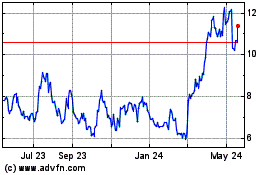

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Nov 2024 to Dec 2024

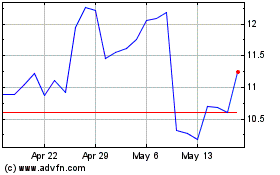

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Dec 2023 to Dec 2024