UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT TO RUEE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2025

Commission File No. 001-37596

FERRARI N.V.

(Translation of Registrant’s Name Into

English)

Via Abetone Inferiore n.4

1-41053 Maranello (MO)

Italy

Tel. No.:+39 0536 949111

(Address of Principal Executive Offices)

(Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

The documents attached hereto as Exhibit 99.1

and Exhibit 99.2 are hereby incorporated by reference into the registration statement on Form F-3 (No. 333-285251) of

Ferrari N.V. and shall be a part thereof from the date on which such documents are furnished, to the extent not superseded by documents

or reports subsequently filed or furnished.

The following exhibits are furnished herewith:

Exhibit 99.1

Press release issued by Ferrari N.V. dated February 26, 2025.

Exhibit 99.2:

Commitment Letter, by and between Ferrari N.V. and Exor N.V., dated as of February 25, 2025.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: February 26, 2025 |

FERRARI N.V. |

| |

|

| |

By: |

/s/ Antonio Picca Piccon |

| |

Name: |

Antonio Picca Piccon |

| |

Title: |

Chief Financial Officer |

Exhibit 99.1

FERRARI : ANNOUNCEMENT OF THE SEVENTH TRANCHE OF THE MULTI-YEAR SHARE

REPURCHASE PROGRAM BY PARTICIPATING AS A PURCHASER IN EXOR’S ACCELERATED BOOKBUILD OFFERING

| · | Ferrari, following the accelerated bookbuild offering announced by Exor on

February 26, 2025, intends to repurchase up to 10% of Exor’s total offering up to a maximum of Euro 300 million |

| · | This share repurchase is to be considered as a part of Ferrari’s multi-year

Euro 2.0 billion share buyback program as announced during our 2022 CMD. It will constitute the seventh tranche and it will be financed

by Ferrari’s cash on hand |

| · | On February 20, 2025, Ferrari completed the sixth tranche announced

on December 5, 2024 |

Maranello (Italy), February 26, 2025

– Ferrari N.V. (NYSE/EXM: RACE) (“Ferrari” or the “Company”) announces that, following

the accelerated bookbuild offering (“ABO”) of Ferrari shares made today by Exor N.V. (“Exor”),

it intends to participate in the offering by repurchasing up to 10% of Exor’s total offering for up to a maximum of Euro 300 million.

The transaction will be executed by participating in the ABO announced by Exor at the same price per share determined in the offering.

This transaction represents the seventh tranche

of the multi-year share buyback program of approximately Euro 2.0 billion announced during our 2022 Capital Markets Day (the “Program”)

and it falls within the limitations of the share buyback mandate approved at the April 17, 2024 Annual General Meeting of Shareholders,

duly communicated to the market, which authorized the purchase of up to 10% of the Company’s common shares during the eighteen-month

period following such Shareholders’ Meeting.

Details of the repurchase transactions carried

out under the seventh tranche will be disclosed to the market as required by applicable regulation.

The repurchase will be financed by Ferrari’s

cash on hand and it will not affect Ferrari’s ability to execute its strategic plan and its financing capabilities.

In addition, Ferrari informs that the Company

has purchased, under the Euro 150 million sixth tranche of the Program announced on December 5, 2024 (the “Sixth Tranche”),

the following common shares - reported in aggregate form, on a daily basis – on the Euronext Milan (EXM and on the New York Stock

Exchange (NYSE):

Ferrari N.V.

Amsterdam, The Netherlands |

Registered Office:

Via Abetone Inferiore N. 4,

I – 41053 Maranello (MO) Italy |

Dutch trade registration number:

64060977 |

corporate. ferrari.com |

| | |

EXM | | |

NYSE | | |

Total | |

Trading

Date

(d/m/y) | |

Number of

common

shares

purchased | | |

Average

price per

share

excluding

fees

(€) | | |

Consideration

excluding fees

(€) | | |

Number of

common

shares

purchased | | |

Average

price per

share

excluding

fees

($) | | |

Consideration

excluding fees

($) | | |

Consideration

excluding fees

(€)* | | |

Number of

common

shares

purchased | | |

Average

price per

share

excluding

fees

(€)* | | |

Consideration

excluding fees

(€)* | |

| 17/02/2025 | |

| 1,946 | | |

| 486.3676 | | |

| 946,471.40 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,946 | | |

| 486.3676 | | |

| 946,471.40 | |

| 18/02/2025 | |

| 15,576 | | |

| 487.9137 | | |

| 7,599,743.50 | | |

| 6,954 | | |

| 503.1803 | | |

| 3,499,115.81 | | |

| 3,349,397.73 | | |

| 22,530 | | |

| 485.9805 | | |

| 10,949,141.23 | |

| 19/02/2025 | |

| 9,185 | | |

| 482.5296 | | |

| 4,432,034.60 | | |

| 8,898 | | |

| 500.9449 | | |

| 4,457,407.72 | | |

| 4,272,002.80 | | |

| 18,083 | | |

| 481.3381 | | |

| 8,704,037.40 | |

| 20/02/2025 | |

| 9,181 | | |

| 481.0669 | | |

| 4,416,675.40 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 9,181 | | |

| 481.0669 | | |

| 4,416,675.40 | |

| Total | |

| 35,888 | | |

| 484.7003 | | |

| 17,394,924.90 | | |

| 15,852 | | |

| 501.9255 | | |

| 7,956,523.53 | | |

| 7,621,400.53 | | |

| 51,740 | | |

| 483.5007 | | |

| 25,016,325.43 | |

(*) translated at the European Central Bank EUR/USD

exchange reference rate as of the date of each purchase

With the purchases described above the Company

has completed the Sixth Tranche of the Program.

The total consideration for such Sixth Tranche

of the Program was:

| · | Euro 129,999,862.70 for No. 305,959 common

shares purchased on the EXM |

| · | USD 20,925,681.06 (Euro 19,999,658.42*) for No. 44,844

common shares purchased on the NYSE. |

As of February 25, 2025, the Company held

in treasury 15,119,211 common shares equal to 5.88% of the total issued share capital including the common shares and the special voting

shares, net of shares assigned under the Company’s equity incentive plan.

From the start of the Program until February 25,

2025, the Company has purchased a total of 4,296,447 own common shares on EXM and NYSE, including transactions for Sell to Cover, for

a total consideration of Euro 1,322,735,977.17.

A comprehensive overview of the transactions carried

out under the Program, as well as the details of the above transactions, are available on Ferrari’s corporate website under the

Buyback Programs section (https://www.ferrari.com/en-EN/corporate/buyback-programs).

A registration statement on Form F-3 (including a prospectus)

relating to the offering of Ferrari’s common shares by Exor has been filed with the U.S. Securities and Exchange Commission (the

“SEC”) on February 26, 2025. Copies of the prospectus can be accessed for free through the SEC’s website at www.sec.gov.

Alternatively, copies may be obtained from: J.P. Morgan Securities LLC, c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood,

NY 11717, or by email at prospectus-eq_fi@jpmchase.com and postsalemanualrequests@broadridge.com; Goldman Sachs & Co. LLC, Prospectus

Department, 200 West Street, New York, NY 10282, telephone: 1-866-471-2526, facsimile: 212-902-9316, or by email at Prospectus-ny@ny.email.gs.com.

This press release contains information that

qualifies, or may qualify, as inside information as defined in article 7(1) of Regulation (EU) 596/2014 of 16 April 2014 (the

Market Abuse Regulation).

This notice does not constitute an offer to

sell or a solicitation of an offer to buy securities in any jurisdiction where such offer or solicitation would be unlawful.

You should not reply to this announcement.

Any reply e-mail communication, including those you generate by using the “Reply” function on your email software, will be

ignored or rejected.

This communication is addressed in any member state of the European

Economic Area only to those persons who are qualified investors in such member state (“Qualified Investors”) within the meaning

of Regulation (EU) 2017/1129 and such other persons as this announcement may be addressed on legal grounds, and no person that is not

a Qualified Investor may act or rely on this announcement or any of its contents.

This communication is directed only at (i) persons

who are outside the United Kingdom, (ii) investment professionals falling within Article 19(5) of the Financial Services

and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) or (iii) high net worth entities, and other persons

to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order (all such persons together

being referred to as “relevant persons”). Any investment activity to which this communication relates will only be available

to, and will only be engaged in with, relevant persons. Any person who is not a relevant person should not act or rely on this communication.

Exhibit 99.2

Commitment

letter

THIS

Commitment Letter IS DATED 25 February 2025 AND MADE BETWEEN:

| (1) | Ferrari N.V., a Dutch entity, with seat in Amsterdam,

the Netherlands, Trade Register number 64060977, (the "Company"); and |

| (2) | Exor N.V., a Dutch entity, with seat in Amsterdam,

the Netherlands, Trade Register number 64236277 (the "Seller"). |

The parties included under (1) and (2) together

referred to as "Parties" and each of them a "Party".

BACKGROUND:

| (A) | The issued share capital of the Company consists of common shares with a nominal value of EUR 0.01 (the

''Common Shares'') and of special voting shares with a nominal value of EUR 0.01 (the ''SVS'' and together with the Common

Shares in the share capital of the Company, the ''Shares''). The Common Shares are listed on Euronext Milan and on the New York

Stock Exchange. |

| (B) | The Seller holds 44,435,280 Common Shares and 44,435,280 SVS on the date of this commitment letter (the

''Letter''). The Seller is considering selling a limited portion of its stake in the Company by selling a number of Common Shares in an

accelerated bookbuild offering process (co-)led by at least one internationally reputable investment bank (the "ABO").

The Seller has invited the Company to participate in the ABO, should the Seller decide to proceed with it. |

THE PARTIES AGREE AS FOLLOWS:

| 1 | COMMITMENT, ALLOCATION AND SETTLEMENT |

| 1.1.1 | The Company intends to participate in the ABO and hereby irrevocably commits to submit an order in the

book, at a price per share equal to the clearing price determined via the ABO with due regard to the closing price of the Common Shares

on Euronext Milan on the date of pricing of the ABP and as applicable to all other participants in the ABO (the "Offering Price"),

for such number of Common Shares (the "Committed Shares") equal to the lower of (i) ten percent (10%) of the aggregate

number of Common Shares sold in the ABO and (ii) a number of Common Shares equal to an aggregate purchase price of EUR 300 million

divided by the Offering Price, with the number of Common Shares to be repurchased by the Company being rounded down to the nearest whole

number (the "Commitment"), subject to the limits of the Repurchase Authorization (as defined below) and as further specified

and on the terms set forth in this Letter. |

| 1.1.2 | The Seller undertakes to allocate the full amount of the Commitment to the Company at the Offering Price

in the event the ABO is completed, with due observance of and within the limits of the Repurchase Authorization (as defined below). |

| 1.1.3 | The Company's Commitment and repurchase of Committed Shares is subject to the limits of the current repurchase

authorization granted by the general meeting of the Company on 17 April 2024 to its board of directors, pursuant to which the Company's

board of directors is authorized to repurchase Common Shares representing up to 10% of the Company's issued Common Shares, whereby the

price to be paid by the Company for each Committed Share shall be subject to: (i) a minimum of EUR 0.01 per Committed Share and (ii) a

maximum equal to 110% of the market price of the shares on the New York Stock Exchange and/or the Euronext Milan (as the case may be),

the market price being the average of the highest price on each of the five days of trading prior to the date on which the acquisition

is made, as shown in the Official Price List of the New York Stock Exchange and/or the Euronext Milan (as the case may be) (the ''Repurchase

Authorization''). |

| 1.1.4 | The bank(s) executing the ABO on behalf of the Seller shall not charge any fees or expenses to the

Company in connection with the purchase order in the ABO and shall transfer or procure the transfer of the Committed Shares to the Company

at the Offering Price. |

| 1.1.5 | For the avoidance of doubt, the Company's Commitment is conditional upon the launch of the ABO by the

Seller. The Seller shall promptly and without delay inform the Company when and if it will decide to proceed with the ABO so that the

Company will be able to issue its press release and inform promptly and without delay the market of its participation in the ABO. In addition,

nothing in this Letter shall oblige the Seller to proceed with any transaction involving the sale of the Common Shares, including an ABO,

to the Company. Any such decision shall be determined by the Seller in its sole discretion and as mentioned above promptly communicated

to the Company. |

| 1.1.6 | The sale and repurchase of the Common Shares by the Company will be settled in accordance with the terms

of the ABO, on a T+2 basis. |

| 1.1.7 | Immediately upon pricing of the ABO, the Seller will send a notice, or procure a notice is sent on behalf

of the Seller, to the Company indicating the Offering Price, the number of Common Shares allocated to it (the “Company Shares”)

and the total amount to be paid by the Company to the Seller in euro (in the form set out the Annex to this Letter). |

The Company will issue its own press

release relating to its participation in the ABO following the Seller announcement of the ABO. In addition, the Seller may, subject to

proper arrangements on confidentiality being in place, communicate the existence, nature conditions of the Commitment to potential investors

as part of the wall-cross exercise to be conducted as part of its evaluation to launch the ABO or not.

The obligations of the Company and the

Seller under this Letter shall terminate on the earlier of:

| (a) | the Seller notifying the Company that it cancels the ABO that was launched by the Seller; and |

provided that Clause 4 (Governing

law) shall survive such termination.

This Letter and any non-contractual

obligations arising out of or in connection with it are governed exclusively by Dutch law.

[SIGNATURES TO FOLLOW ON THE NEXT PAGE]

THIS

commitment letter HAS BEEN SIGNED ON THE DATE STATED AT THE BEGINNING OF THIS commitment letter BY:

| /s/ Antonio Picca Piccon |

|

| Ferrari N.V. |

|

| By: Antonio Picca Piccon |

|

| Title: Chief Financial Officer |

|

THIS

commitment letter HAS BEEN SIGNED ON THE DATE STATED AT THE BEGINNING OF THIS commitment letter BY:

| /s/

Guido de Boer |

|

| Exor N.V. |

|

| By: Guido de Boer |

|

| Title: Chief Financial Officer |

|

Annex – Form of pricing notice

[…]

Pursuant

to Clause 1.1.7, of the commitment letter dated [●]

2025 between [●] and [●]

(the “Commitment Letter”), it is hereby confirmed on behalf of the Seller that:

| - | The Offering Price is EUR [●]; |

| - | The number of Company Shares allocated to the Company is [●]; and |

| - | The total amount to be paid by the Company to the Seller through the ABO in euro is [●]. |

The Seller confirms that the allocation has been

made in compliance with Clause 1.1.3 of the Commitment Letter.

The Seller will separately provide settlement

details.

Terms defined in the Commitment Letter shall have

the same meanings herein.

[…]

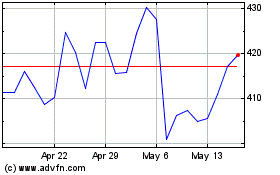

Ferrari NV (NYSE:RACE)

Historical Stock Chart

From Jan 2025 to Feb 2025

Ferrari NV (NYSE:RACE)

Historical Stock Chart

From Feb 2024 to Feb 2025