FERRARI PARTICIPATED AS A PURCHASER IN EXOR’S ACCELERATED BOOKBUILD OFFERING

27 February 2025 - 5:39PM

Maranello (Italy), February 27, 2025 – Ferrari N.V. (NYSE/EXM:

RACE) (“Ferrari” or the “Company”) announces that, following the

accelerated bookbuild offering made by Exor N.V. (“Exor”) on

February 26, 2025, the Company has participated in the offering by

agreeing to repurchase 666,666 common shares for a total

consideration of Euro 300 million, at the same price per share

determined by the offering (the “Transaction”). The Transaction is

being financed by Ferrari’s cash on hand.

The Transaction represents the seventh tranche of the multi-year

share buyback program of approximately Euro 2.0 billion announced

during our 2022 Capital Markets Day (the “Program”) and it falls

within the limitations of the share buyback mandate approved at the

April 17, 2024 Annual General Meeting of Shareholders, duly

communicated to the market, which authorized the purchase of up to

10% of the Company’s common shares during the eighteen-month period

following such Shareholders’ Meeting.

The Transaction is expected to settle on March 3, 2025.

Following the Transaction, the Company will continue to execute

the Program consistently with the progress of its Industrial Free

Cash Flow generation.

A comprehensive overview of the transactions carried out under

the buyback program is available on Ferrari’s corporate website

under the Buyback Programs section

(https://www.ferrari.com/en[1]EN/corporate/buyback-programs).

A registration statement on Form F-3 (including a prospectus)

relating to the offering of Ferrari’s common shares by Exor has

been filed with the U.S. Securities and Exchange Commission (the

“SEC”) on February 26, 2025. Copies of the prospectus can be

accessed for free through the SEC’s website at www.sec.gov.

Alternatively, copies may be obtained from: J.P. Morgan Securities

LLC, c/o Broadridge Financial Solutions, 1155 Long Island Avenue,

Edgewood, NY 11717, or by email at prospectus-eq_fi@jpmchase.com

and postsalemanualrequests@broadridge.com; Goldman Sachs & Co.

LLC, Prospectus Department, 200 West Street, New York, NY 10282,

telephone: 1-866-471-2526, facsimile: 212-902-9316, or by email at

Prospectus-ny@ny.email.gs.com. This press release contains

information that qualifies, or may qualify, as inside information

as defined in article 7(1) of Regulation (EU) 596/2014 of 16 April

2014 (the Market Abuse Regulation).This notice does not constitute

an offer to sell or a solicitation of an offer to buy securities in

any jurisdiction where such offer or solicitation would be

unlawful. You should not reply to this announcement. Any

reply e-mail communication, including those you generate by using

the “Reply” function on your email software, will be ignored or

rejected. This communication is addressed in any member state

of the European Economic Area only to those persons who are

qualified investors in such member state (“Qualified Investors”)

within the meaning of Regulation (EU) 2017/1129 and such other

persons as this announcement may be addressed on legal grounds, and

no person that is not a Qualified Investor may act or rely on this

announcement or any of its contents. This communication is

directed only at (i) persons who are outside the United Kingdom,

(ii) investment professionals falling within Article 19(5) of the

Financial Services and Markets Act 2000 (Financial Promotion) Order

2005 (the “Order”) or (iii) high net worth entities, and other

persons to whom it may lawfully be communicated, falling within

Article 49(2)(a) to (d) of the Order (all such persons together

being referred to as “relevant persons”). Any investment activity

to which this communication relates will only be available to, and

will only be engaged in with, relevant persons. Any person who is

not a relevant person should not act or rely on this

communication.

- Ferrari NV - Launch seventh tranche_eng

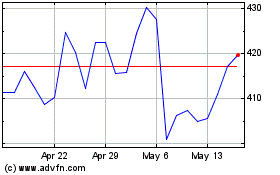

Ferrari NV (NYSE:RACE)

Historical Stock Chart

From Jan 2025 to Feb 2025

Ferrari NV (NYSE:RACE)

Historical Stock Chart

From Feb 2024 to Feb 2025