0000720005false00007200052025-02-202025-02-200000720005us-gaap:CommonStockMember2025-02-202025-02-200000720005rjf:DepositarySharesSeriesBMember2025-02-202025-02-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

February 20, 2025

Date of Report (date of earliest event reported)

RAYMOND JAMES FINANCIAL, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Florida | 1-9109 | 59-1517485 | |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) | |

| |

880 Carillon Parkway | St. Petersburg | Florida | 33716 | |

(Address of principal executive offices) | | (Zip Code) | |

(727) 567-1000

(Registrant’s telephone number, including area code)

None

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Exchange Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $.01 par value | RJF | New York Stock Exchange |

| Depositary Shares, Each Representing a 1/40th Interest in a Share of 6.375% Fixed-to-Floating Rate Series B Non-Cumulative Perpetual Preferred Stock | RJF PrB | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act (17 CFR 230.405) or Rule 12b-2 of the Exchange Act (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

In accordance with Raymond James Financial, Inc.’s (the “Company”) previously disclosed leadership succession plan, effective at the close of the Annual Shareholders Meeting of the Company on February 20, 2025, Paul C. Reilly stepped down from the chief executive officer (“CEO”) role and was appointed Executive Chair of the Board of Directors. As previously disclosed, Paul M. Shoukry simultaneously assumed the role of CEO, and Jeffrey N. Edwards continues to serve as Lead Independent Director.

The information required by Item 401(b), (d) and (e), and Item 404(a), of Regulation S-K, is set forth in the Company’s Proxy Statement for the Annual Shareholders Meeting held on February 20, 2025, as filed with the Securities and Exchange Commission on January 8, 2025.

In connection with the above, the Board approved a reduction in Mr. Reilly’s 2025 annual base salary from $750,000 to $500,000, effective March 1, 2025.

Item 5.07 Submission of Matters to a Vote of Security Holders

(a), (b) The Annual Meeting of Shareholders of the Company was held on February 20, 2025 (the “2025 Annual Meeting”). Proxies for the meeting were solicited by the Board of Directors (the “Board”) pursuant to Section 14(a) of the Securities Exchange Act of 1934, and there was no solicitation in opposition to the Board’s solicitations. At this meeting, the shareholders were requested to: (1) elect twelve members of the Board, (2) approve, on an advisory (non‑binding) basis, the compensation of our named executive officers as disclosed in the Company’s Definitive Proxy Statement for the 2025 Annual Meeting, filed with the Securities and Exchange Commission on January 8, 2025 (the “Proxy Statement”), and (3) ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2025, all of which matters were described in the Proxy Statement. The following actions were taken by the Company’s shareholders with respect to each of the foregoing items:

1. Election of Directors. All twelve (12) nominees for director were elected by a majority of the votes cast. With respect to each nominee, there were 25,755,179 broker non-votes. The table below sets forth the voting results for each director.

| | | | | | | | | | | | | | | | | | | | |

Director | | Votes Cast “For” | | Votes Cast “Against” | | Abstentions |

Debel, Marlene | | 167,083,319 | | 382,496 | | 234,171 |

| Edwards, Jeffrey N. | | 161,301,412 | | 6,070,189 | | 328,385 |

| Esty, Benjamin C. | | 159,724,331 | | 7,613,930 | | 361,725 |

| Garcia, Art A. | | 162,978,933 | | 4,343,638 | | 377,415 |

| Gates, Anne | | 163,091,562 | | 4,378,981 | | 229,443 |

Johnson, Gordon L. | | 162,794,221 | | 4,575,231 | | 330,534 |

McDaniel, Raymond W., Jr. | | 166,726,024 | | 636,455 | | 337,507 |

McGeary, Roderick C. | | 165,086,220 | | 2,257,728 | | 356,038 |

| Mistarz, Cecily M. | | 167,106,439 | | 341,729 | | 251,818 |

Reilly, Paul C. | | 163,500,034 | | 4,048,359 | | 151,593 |

Seshadri, Raj | | 166,399,344 | | 1,099,151 | | 201,491 |

| Shoukry, Paul M. | | 165,739,441 | | 1,765,526 | | 195,019 |

2. Advisory vote on executive compensation. Our shareholders approved, on an advisory, non-binding basis, the compensation of our named executive officers by the affirmative vote of 89.39% of the votes cast. With respect to this proposal, there were 25,755,179 broker non-votes. The table below sets forth the voting results.

| | | | | | | | | | | | | | |

Votes Cast “For” | | Votes Cast “Against” | | Abstentions |

| 149,425,883 | | 17,719,175 | | 554,928 |

3. To ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm. Our shareholders approved the ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2025 by the affirmative vote of 96.60% of the votes cast. The table below sets forth the voting results, and there were no broker non-votes.

| | | | | | | | | | | | | | |

Votes Cast “For” | | Votes Cast “Against” | | Abstentions |

| 186,771,709 | | 6,554,171 | | 129,285 |

Item 7.01 Regulation FD Disclosure

On February 21, 2025, the Company issued a press release (the “Press Release”) announcing that the Board had declared a quarterly dividend of $0.50 per share for each outstanding share of common stock of the Company. The dividend is payable on April 15, 2025 to shareholders of record on April 1, 2025.

The Press Release also announced that the Board had declared on February 21, 2025 a quarterly cash dividend of $0.3984375 per depositary share of 6.375% Fixed-to-Floating Rate Series B Non-Cumulative Perpetual Preferred Stock (NYSE: RJF PrB), payable April 1, 2025 to shareholders of record on March 14, 2025.

A copy of the Press Release is attached to this Current Report as Exhibit 99.1 and is incorporated herein by reference.

The information in this Item 7.01, including Exhibit 99.1 hereto, is being “furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing of the Company with the Securities and Exchange Commission, whether made before or after the date hereof, regardless of any general incorporation language in such filings (unless the Company specifically states that the information or exhibit in this particular report is incorporated by reference).

Item 9.01 Financial Statements and Exhibits

(d) Exhibits. The following are filed as exhibits to this report:

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| RAYMOND JAMES FINANCIAL, INC. |

| |

| |

Date: February 26, 2025 | By: | /s/ Jonathan W. Oorlog, Jr. |

| | Jonathan W. Oorlog, Jr. |

| | Chief Financial Officer |

| | |

| | |

| | | | | | | | |

| February 21, 2025 | | FOR IMMEDIATE RELEASE |

| | Media Contact: Steve Hollister, 727.567.2824 |

| | Investor Contact: Kristina Waugh, 727.567.7654 |

| | raymondjames.com/news-and-media/press-releases |

RAYMOND JAMES FINANCIAL DECLARES

QUARTERLY DIVIDENDS ON COMMON AND PREFERRED STOCK

ST. PETERSBURG, Fla. – On February 21, 2025, the Raymond James Financial, Inc. (NYSE: RJF) Board of Directors declared a quarterly cash dividend on shares of its common stock of $0.50 per share, payable April 15, 2025 to shareholders of record on April 1, 2025.

The Board declared a quarterly dividend of $0.3984375 per depositary share of 6.375% Fixed-to-Floating Rate Series B Non-Cumulative Perpetual Preferred Stock (NYSE: RJF PrB) payable April 15, 2025, to shareholders of record on March 14, 2025.

About Raymond James Financial, Inc.

Raymond James Financial, Inc. (NYSE: RJF) is a leading diversified financial services company providing private client group, capital markets, asset management, banking and other services to individuals, corporations and municipalities. Total client assets are $1.59 trillion. Public since 1983, the firm is listed on the New York Stock Exchange under the symbol RJF. Additional information is available at www.raymondjames.com.

Forward Looking Statements

Certain statements made in this press release may constitute “forward-looking statements” under the Private Securities Litigation Reform Act of 1995. Forward-looking statements include information concerning future shareholder distributions. Forward-looking statements are not guarantees, and they involve risks, uncertainties and assumptions. Although we make such statements based on assumptions that we believe to be reasonable, there can be no assurance that actual results will not differ materially from those expressed in the forward-looking statements. We caution investors not to rely unduly on any forward-looking statements and urge you to carefully consider the risks described in our filings with the Securities and Exchange Commission (the “SEC”) from time to time, including our most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q, which are available at www.raymondjames.com and the SEC’s website at www.sec.gov. We expressly disclaim any obligation to update any forward-looking statement in the event it later turns out to be inaccurate, whether as a result of new information, future events, or otherwise.

v3.25.0.1

Cover Page

|

Feb. 20, 2025 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 20, 2025

|

| Entity Registrant Name |

RAYMOND JAMES FINANCIAL, INC.

|

| Entity Incorporation, State or Country Code |

FL

|

| Entity File Number |

1-9109

|

| Entity Tax Identification Number |

59-1517485

|

| Entity Address, Address Line One |

880 Carillon Parkway

|

| Entity Address, City or Town |

St. Petersburg

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33716

|

| City Area Code |

727

|

| Local Phone Number |

567-1000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000720005

|

| Amendment Flag |

false

|

| Common Stock, $.01 par value |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $.01 par value

|

| Trading Symbol |

RJF

|

| Security Exchange Name |

NYSE

|

| Depositary Shares, Each Representing a 1/40th Interest in a Share of 6.375% Fixed-to-Floating Rate Series B Non-Cumulative Perpetual Preferred Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares, Each Representing a 1/40th Interest in a Share of 6.375% Fixed-to-Floating Rate Series B Non-Cumulative Perpetual Preferred Stock

|

| Trading Symbol |

RJF PrB

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=rjf_DepositarySharesSeriesBMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

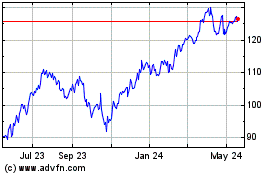

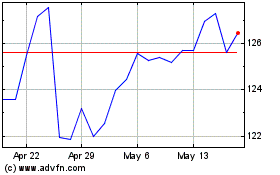

Raymond James Financial (NYSE:RJF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Raymond James Financial (NYSE:RJF)

Historical Stock Chart

From Feb 2024 to Feb 2025