false000181601700018160172024-08-272024-08-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 27, 2024 |

SPIRE GLOBAL, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware |

001-39493 |

85-1276957 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

8000 Towers Crescent Drive Suite 1100 |

|

Vienna, Virginia |

|

22182 |

(Address of principal executive offices) |

|

(Zip code) |

|

Registrant’s telephone number, including area code: (202) 301-5127 |

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

☐ |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Class A common stock, par value of $0.0001 per share |

|

SPIR |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On August 27, 2024, Spire Global, Inc., a Delaware corporation (the “Company”), as borrower, and Spire Global Subsidiary, Inc. and Austin Satellite Design, LLC, as guarantors, entered into the Waiver and Amendment No. 4 to Financing Agreement (the “Waiver and Amendment”) with Blue Torch Finance LLC, a Delaware limited liability company (“Blue Torch”), as administrative agent and collateral agent, and certain lenders, which amends that certain Financing Agreement, dated as of June 13, 2022, as amended by that certain Amendment No. 1 to Financing Agreement dated as of March 21, 2023, that certain Waiver and Amendment No. 2 to Financing Agreement dated as of September 27, 2023, and that certain Amendment No. 3 to Financing Agreement dated as of April 8, 2024 (the “Financing Agreement”), to (a) waive events of default under the Financing Agreement arising out of the maximum debt to EBITDA leverage ratio being greater than the ratio permitted by the Financing Agreement and the failure to deliver the financial statements for the fiscal quarter ended June 30, 2024 required by the Financing Agreement, (b) amend the financial covenants in the Financing Agreement to provide immediate covenant relief from the leverage ratios set forth in the Financing Agreement and extend the duration of the annualized recurring revenue (ARR) leverage ratio through December 31, 2024, and (c) provide for a fourth amendment fee. The fourth amendment fee is in an amount equal to three and a half percent (3.50%) of the aggregate outstanding principal balance of the term loans on the effective date of the Waiver and Amendment, bears interest from the date of the Waiver and Amendment at the Adjusted Term SOFR for a 3-month interest period plus the applicable margin under the Financing Agreement, and shall be paid-in-kind and added to the principal balance of the term loans. If the Financing Agreement is terminated and all amounts due thereunder are paid prior to December 31, 2024, two percent (2.00%) of the fourth amendment fee will be forgiven and cancelled. If the termination of the Financing Agreement and the payment in full of all amounts due thereunder does not occur prior to December 31, 2024, one percent (1.00%) of the fourth amendment fee will be forgiven and cancelled if $10.0 million of principal has been prepaid by the Company prior to December 31, 2024 and two percent (2.00%) of the fourth amendment fee will be forgiven and cancelled if $20.0 million of principal has been prepaid by the Company prior to December 31, 2024. The Waiver and Amendment also requires a repayment by the Company of $10,000,000 of the outstanding principal balance of the term loans on August 31, 2024 and provides that Blue Torch will be entitled to require the Company to engage an operational advisor reasonably satisfactory to Blue Torch. As of June 30, 2024, the Company had cash, cash equivalents and short-term marketable securities of approximately $46 million.

This estimate of cash, cash equivalents and short-term marketable securities as of June 30, 2024 is preliminary and represents the most recent current information available to Company management. The Company’s condensed consolidated balance sheet as of June 30, 2024 and condensed consolidated statement of cash flows for the six months ended June 30, 2024 are not currently available due to the Company’s ongoing review of (i) accounting practices and procedures with respect to revenue recognition related to certain contracts in its “Space as a Service” business (the “Contracts”) under applicable accounting standards and guidance and (ii) the potential existence of embedded leases of identifiable assets in the Contracts, each as further described in the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on August 27, 2024. The Company is working to issue full financial results as of and for the three and six months ended June 30, 2024 as soon as practicable.

The foregoing description of the Waiver and Amendment is qualified in its entirety by reference to the Waiver and Amendment, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated by reference herein.

Item 2.02. Results of Operations and Financial Condition.

On August 29, 2024, the Company issued a news release announcing the Waiver and Amendment and providing an update on the Company’s cash, cash equivalents and short-term marketable securities as of June 30, 2024.

The information in Item 2.02 of this Current Report on Form 8-K and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth above and referenced under Item 1.01 is hereby incorporated by reference into this Item 2.03.

Forward Looking Statements

This report contains forward-looking statements within the meaning of the federal securities laws, which statements involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or the Company’s anticipated financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “would,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “project,” “potential,” “seek” or “continue” or the negative of these words or other similar terms or expressions that concern the Company’s expectations, strategy, plans or intentions. Forward-looking statements contained in this report include, but are not limited to, statements about the Company’s ability to satisfy the updated covenants and other obligations in the Financing Agreement.

The Company cautions you that the foregoing list may not contain all of the forward-looking statements made in this report. You should not rely upon forward-looking statements as predictions of future events. Factors that may cause future results to differ materially from the Company’s current expectations include, among other things, the Company’s future financial results and any further delay in the filing of required periodic reports. For other risk factors affecting the Company, see “Risk Factors” in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Moreover, the Company operates in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time and it is not possible for the Company to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this report. The Company cannot assure you that the results, events, and circumstances reflected in the forward-looking statements will be achieved or occur, and actual results, events, or circumstances could differ materially from those described in the forward-looking statements.

Neither the Company nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. Moreover, the forward-looking statements made in this report relate only to expectations as of the date on which the statements are made. The Company undertakes no obligation to update any forward-looking statements made in this report to reflect events or circumstances after the date of this report or to reflect new information or the occurrence of unanticipated events, except as required by law. The Company may not actually achieve the plans, intentions or expectations disclosed in the forward-looking statements and you should not place undue reliance on the forward-looking statements.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

Exhibits |

Description |

10.1 |

Waiver and Amendment No. 4 to Financing Agreement, dated as of August 27, 2024, among Spire Global, Inc., Spire Global Subsidiary, Inc., Austin Satellite Design, LLC, Blue Torch Finance LLC and the lenders party thereto. |

99.1 |

News release of Spire Global, Inc. dated August 29, 2024. |

104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

SPIRE GLOBAL, INC. |

|

|

|

|

Date: |

August 29, 2024 |

By: |

/s/ Peter Platzer |

|

|

Name: Title: |

Peter Platzer

Chief Executive Officer |

Exhibit 10.1

Execution Version

WAIVER AND AMENDMENT NO. 4 TO FINANCING AGREEMENT

WAIVER AND AMENDMENT NO. 4 TO FINANCING AGREEMENT (this "Amendment") is entered into as of August 27, 2024, by and among, inter alios, Spire Global, Inc., a Delaware corporation (the “Administrative Borrower”), each Subsidiary party hereto, the Lenders from time to time party hereto, and Blue Torch Finance LLC, a Delaware limited liability company (“Blue Torch”) as administrative agent and collateral agent for the Lenders (in such capacities, the "Agent").

WHEREAS, the Administrative Borrower, the Agent and the Lenders are parties to that certain Financing Agreement, dated as of June 13, 2022 (as amended by that certain Amendment No. 1 to Financing Agreement dated as of March 21, 2023, as amended by that certain Waiver and Amendment No. 2 to Financing Agreement dated as of September 27, 2023, as amended by that certain Amendment No. 3 to Financing Agreement dated as of April 8, 2024, and as further amended, restated, amended and restated, supplemented or otherwise modified from time to time, including pursuant to this Amendment, the "Financing Agreement");

WHEREAS, an Event of Default occurred pursuant to Section 9.01(c) of the Financing Agreement arising as a result of (i) the Leverage Ratio on June 30, 2024 being greater than the ratio required pursuant to Section 7.03(a) of the Financing Agreement and (ii) the failure to deliver the financial statements for the Fiscal Quarter ending June 30, 2024 required pursuant to Section 7.01(a)(ii) of the Financing Agreement ((i) and (ii) above, collectively, the “Specified Events of Default”);

WHEREAS, the Administrative Borrower has requested certain amendments to the Financing Agreement; and

WHEREAS, the Administrative Borrower, the Agent and the Lenders party hereto constituting Required Lenders have agreed to amend the Financing Agreement in certain respects as provided herein and subject to the terms and provisions hereof.

NOW THEREFORE, in consideration of the premises, mutual covenants and recitals herein contained, which are a material term to this Amendment, and intending to be legally bound hereby, the parties hereto agree as follows:

1.Defined Terms. Unless otherwise defined herein, capitalized terms used herein (including in the recitals above) shall have the meanings ascribed to such terms in the Financing Agreement.

2.Waiver and Amendments to Financing Agreement. Subject to the satisfaction of the conditions to effectiveness set forth in Section 4 of this Amendment and in reliance upon the representations and warranties of the Loan Parties set forth in Section 5 of this Amendment, (i) the Required Lenders hereby waive the Specified Events of Default, provided that the Administrative Borrower’s financial statements for the fiscal quarter ending June 30, 2024, are filed with the SEC no later than October 31, 2024, and (ii) the Financing Agreement is hereby amended as follows:

(a)Section 1.01 of the Financing Agreement is amended by inserting the following definition of “Fourth Amendment” in the correct alphabetical order:

“Fourth Amendment” means that certain Amendment No. 4 to Financing Agreement, dated as of August 27, 2024, by and among the Administrative Borrower, each Subsidiary party thereto, the Lenders party thereto constituting Required Lenders, and the Agent.

(b)Section 2.03(b) of the Financing Agreement is amended and restated in its entirety as follows:

(b) $10,000,000 of the outstanding principal amount of the Term Loan shall be due and payable on August 31, 2024. The remaining outstanding principal amount of all Term Loans shall be due and payable on the Final Maturity Date or, if earlier, on the date on which they are declared due and payable pursuant to the terms of this Agreement.

(c)Section 2.06 of the Financing Agreement is amended by inserting the following new Section 2.06(b) at the end thereof:

(b) (i) In consideration of the agreements of the Agents and the Lenders under the Fourth Amendment, in addition to any other fees payable hereunder, the Borrowers agree to pay to the Lenders, on a pro rata basis, a fee equal to three and one-half percent (3.50%) of the aggregate outstanding principal balance of the Term Loans on the effective date of the Fourth Amendment (the “Fourth Amendment Fee”), which Fourth Amendment Fee shall be fully earned and paid-in-kind and added to the principal balance of the Loans on the effective date of the Fourth Amendment, provided that (x) if the termination of this Agreement and the payment in full of all Obligations occurs prior to December 31, 2024, two percent (2.00%) of the Fourth Amendment Fee shall be forgiven and cancelled, and (y) if the termination of this Agreement and the payment in full of all Obligations does not occur prior to December 31, 2024, (A) one percent (1.00%) of the Fourth Amendment Fee shall be forgiven and cancelled if $10,000,000 of the outstanding principal amount of the Term Loan shall have been prepaid (excluding the mandatory prepayment described in Section 2.03(b)) with the proceeds of new equity contributions in cash to the capital of the Administrative Borrower prior to December 31, 2024 or (B) two percent (2.00%) of the Fourth Amendment Fee shall be forgiven and cancelled if $20,000,000 of the outstanding principal amount of the Term Loan shall have been prepaid (excluding the mandatory prepayment described in Section 2.03(b)) with the proceeds of new equity contributions in cash to the capital of the Administrative Borrower prior to December 31, 2024, and (ii) the Borrowers hereby agree that, from and after the effective date of the Fourth Amendment, the aggregate amount of the Fourth Amendment Fee shall accrue interest at a rate per annum equal to the Adjusted Term SOFR for a 3-month Interest Period plus the Applicable Margin, and such interest shall be paid-in-kind and added to the principal balance of the Loans on the last Business Day of each calendar quarter, commencing on the last Business Day of the calendar quarter in which the effective date of the Fourth Amendment occurs; provided, however, that all Obligations attributable to such capitalized Fourth Amendment Fee interest shall be disregarded solely for purposes of testing compliance with any covenant or the calculation of any ratio hereunder,

including the determination or calculation of such test, covenant or ratio (including in connection with Specified Transactions) in accordance with Section 1.08.

(d)Section 7.01(a)(i) is amended and restated in its entirety as follows:

(i) as soon as available, and in any event within 30 days after the end of each fiscal month of the Administrative Borrower and its Subsidiaries commencing with the first full fiscal month ending after the Effective Date, (A) internally prepared consolidated balance sheets, statements of operations and retained earnings and statements of cash flows as at the end of such fiscal month, and for the period commencing at the end of the immediately preceding Fiscal Year and ending with the end of such fiscal month, setting forth in each case in comparative form the figures for the corresponding date or period set forth in (1) beginning with the monthly period ending June 30, 2023 and for each such monthly period thereafter, the financial statements for the immediately preceding Fiscal Year, and (2) beginning with the monthly period ending January 31, 2023, the Projections (within 45 days for months ending as of a Fiscal Quarter end), all in reasonable detail and certified by an Authorized Officer of the Administrative Borrower as fairly presenting, in all material respects, the financial position of the Administrative Borrower and its Subsidiaries as at the end of such fiscal month and the results of operations, retained earnings and cash flows of such Persons for such fiscal month and for such year-to-date period, in accordance with current accounting policies applied in a manner consistent with that of the most recent audited financial statements furnished to the Agents and the Lenders until such time as the Administrative Borrower implements new accounting policies for the revenue recognition of certain services agreements, as further described in (v) below and after the adoption of such policies, in accordance with GAAP and consistent with the New Revenue Recognition Policies (as defined below), subject to the absence of footnotes and normal year-end adjustments, and (B) a report of key performance indicators as set forth on Exhibit F hereto as well as any other key performance indicator reasonably requested by the Administrative Agent;

(e)Section 7.01(a)(v) of the Financing Agreement is amended and restated in its entirety to read as follows:

(v) after the Administrative Borrower and an examiner, auditor or accountant or any nationally recognized rating agency, including but not limited to PricewaterhouseCoopers LLP, create new accounting policies for the revenue recognition of certain space service agreements (the “New Revenue Recognition Policies”), such accounting policies shall thereafter produce adjustments to be incorporated into the requisite restated financial statements in accordance with GAAP and the new Revenue Recognition Policies and upon the request of the Agent, the Administrative Borrower shall deliver any historical updated financial statements to reflect the impact of the New Revenue Recognition Policies.

(f)Section 7.01 of the Financing Agreement is amended by inserting the following new Section 7.01(t) at the end thereof:

(t) Operational Advisor. Upon the Administrative Agent’s request, the Borrower shall engage an operational advisor reasonably satisfactory to the Administrative Agent to provide such services agreed to by the Administrative Agent.

(g)Section 7.03(a) of the Financing Agreement is amended and restated in its entirety as follows:

(a)Leverage Ratio. Permit the Leverage Ratio of the Administrative Borrower and its Subsidiaries as of the last day of any Test Period to be greater than the ratio set forth opposite such date:

|

|

Fiscal Month End |

Leverage Ratio |

July 31, 2024 |

-55.00:1.00 |

August 31, 2024 |

-55.00:1.00 |

September 30, 2024 |

95.00:1.00 |

October 31, 2024 |

95.00:1.00 |

November 30, 2024 |

95.00:1.00 |

December 31, 2024 |

95.00:1.00 |

January 31, 2025 |

10.00:1.00 |

February 28, 2025 |

10.00:1.00 |

March 31, 2025 |

8.00:1.00 |

April 30, 2025 |

8.00:1.00 |

May 31, 2025 |

8.00:1.00 |

June 30, 2025 |

6.50:1.00 |

July 31, 2025 |

6.50:1.00 |

August 31, 2025 |

6.50:1.00 |

September 30, 2025 |

5.50:1.00 |

October 31, 2025 |

5.50:1.00 |

November 30, 2025 |

5.50:1.00 |

December 31, 2025 |

5.00:1.00 |

|

|

January 31, 2026 |

5.00:1.00 |

February 28, 2026 |

5.00:1.00 |

March 31, 2026 |

4.00:1.00 |

April 30, 2026 |

4.00:1.00 |

May 31, 2026 |

4.00:1.00 |

(h)Section 7.03(b) of the Financing Agreement is amended and restated in its entirety as follows:

(b)Total ARR Leverage Ratio. Permit the Total ARR Leverage Ratio of the Administrative Borrower and its Subsidiaries as of the last day of any Test Period to be greater than the ratio set forth opposite such date:

|

|

Fiscal Month End |

Total ARR Leverage Ratio |

July 31, 2024 |

1.10:1.00 |

August 31, 2024 |

1.00:1.00 |

September 30, 2024 |

1.00:1.00 |

October 31, 2024 |

0.90:1.00 |

November 30, 2024 |

0.90:1.00 |

December 31, 2024 |

0.90:1.00 |

3.Continuing Effect; Reaffirmation and Continuation. Except as expressly set forth in Section 2 of this Amendment, nothing in this Amendment shall constitute a modification or alteration of the terms, conditions or covenants of the Financing Agreement or any other Loan Document, or a waiver of any other terms or provisions thereof, and the Financing Agreement and the other Loan Documents shall remain unchanged and shall continue in full force and effect, in each case as amended hereby. The Administrative Borrower hereby ratifies, affirms, acknowledges and agrees that as of the date hereof the Financing Agreement and the other Loan Documents represent the valid, enforceable and collectible obligations of the Administrative Borrower, and further acknowledges that there are no existing claims, defenses, personal or otherwise, or rights of setoff whatsoever with respect to the Financing Agreement or any other Loan Document. The Administrative Borrower hereby agrees that this Amendment in no way acts as a release or relinquishment of the Liens and rights securing payments of the Obligations. The Liens and rights securing payment of the Obligations are hereby ratified and confirmed by the Administrative Borrower in all respects.

4.Conditions to Effectiveness. The effectiveness of the amendments contained in Section 2 of this Amendment are subject to the prior or concurrent satisfaction of each of the following conditions, each in form and substance acceptable to the Agent:

(a)The Agent shall have received a copy of this Amendment (including all Exhibits and attachments hereto), in form reasonably satisfactory to the Agent, executed and delivered by the Administrative Borrower, the Agent and the Lenders;

(b)the representations and warranties set forth in Section 5 of this Amendment shall be true and correct as of the date hereof;

(c)after giving effect to this Amendment, no Default or Event of Default shall have occurred and be continuing on the date hereof; and

(d)the Administrative Borrower shall have paid all reasonable and documented out-of-pocket costs and expenses of the Agent (including reasonable attorneys' fees) incurred in connection with the preparation, negotiation, execution, delivery and administration of this Amendment, and all other instruments or documents provided for herein or delivered or to be delivered hereunder or in connection herewith that have been invoiced on or before the date hereof.

5.Representations and Warranties. In order to induce the Agent and the Lenders to enter into this Amendment, the Administrative Borrower hereby represents and warrants to the Agent and the Lenders on the date hereof that:

(a)all representations and warranties contained in the Financing Agreement and the other Loan Documents are true and correct in all material respects (except that such materiality qualifier shall not be applicable to any representations and warranties that already are qualified or modified by materiality in the text thereof) on and as of the date of this Amendment, after giving effect to this Amendment, as though made on and as of such date (except to the extent that such representations and warranties relate solely to an earlier date, in which case such representations and warranties shall be true and correct in all material respects (except that such materiality qualifier shall not be applicable to any representations and warranties that already are qualified or modified by materiality in the text thereof) as of such earlier date), other than Section 6.01(g) as it relates to failure of any Financial Statements to fairly present in all material respects the financial condition of the Administrative Borrower and its Subsidiaries due to issues disclosed to each Agent and the Lenders that will require the adoption of the New Revenue Recognition Policies and the Specified Events of Default;

(b)after giving effect to this Amendment, no Default or Event of Default has occurred and is continuing on the date of this Amendment; and

(c)this Amendment, and the Financing Agreement as modified hereby, constitute legal, valid and binding obligations of the Administrative Borrower and are enforceable against the Administrative Borrower in accordance with their respective terms, except as enforcement may be limited by equitable principles or by bankruptcy, insolvency, reorganization, moratorium, or similar laws relating to or limiting creditors' rights generally.

(a)Expenses. The Administrative Borrower agrees to pay on demand all expenses of the Agent (including, without limitation, the fees and expenses of outside counsel for the Agent) in connection with the preparation, negotiation, execution, delivery and administration of this Amendment and all other instruments or documents provided for herein or delivered or to be delivered hereunder or in connection herewith. All obligations provided herein shall survive any termination of this Amendment and the Financing Agreement as modified hereby.

(b)Governing Law. THIS AMENDMENT SHALL BE SUBJECT TO THE PROVISIONS REGARDING CHOICE OF LAW AND VENUE, JURY TRIAL WAIVER, AND JUDICIAL REFERENCE SET FORTH IN SECTIONS 12.09, 12.10 AND 12.11 OF THE FINANCING AGREEMENT, AND SUCH PROVISIONS ARE INCORPORATED HEREIN BY THIS REFERENCE, MUTATIS MUTANDIS.

(c)Counterparts. This Amendment may be executed in any number of counterparts and by different parties on separate counterparts, each of which, when executed and delivered, shall be deemed to be an original, and all of which, when taken together, shall constitute but one and the same Amendment. Delivery of an executed counterpart of this Amendment by telefacsimile or other electronic method of transmission shall be equally as effective as delivery of an original executed counterpart of this Amendment. Any party delivering an executed counterpart of this Amendment by telefacsimile or other electronic method of transmission also shall deliver an original executed counterpart of this Amendment but the failure to deliver an original executed counterpart shall not affect the validity, enforceability, and binding effect of this Amendment.

(d)Loan Document. The parties hereto acknowledge and agree that this Amendment is a Loan Document.

[Signature Pages Follow]

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be executed by their respective officers thereunto duly authorized and delivered as of the date first above written.

|

|

|

|

BORROWERS: |

|

|

|

SPIRE GLOBAL, INC. |

|

|

|

By: |

/s/ Peter Platzer |

|

|

Name: Peter Platzer |

|

|

Title: CEO |

|

|

|

GUARANTORS: |

|

|

|

SPIRE GLOBAL SUBSIDIARY, INC. |

|

|

|

By: |

/s/ Peter Platzer |

|

|

Name: Peter Platzer |

|

|

Title: CEO |

|

AUSTIN SATELLITE DESIGN, LLC |

|

|

|

By: |

/s/ Peter Platzer |

|

|

Name: Peter Platzer |

|

|

Title: CEO |

[Signature Page to Amendment No. 4 (Spire)]

|

|

|

|

|

|

COLLATERAL AGENT AND ADMINISTRATIVE AGENT: BLUE TORCH FINANCE LLC |

|

|

|

|

|

By: |

/s/ Kevin Genda |

|

|

Name: Kevin Genda |

|

|

Title: Authorized Signatory |

LENDERS:

BTC HOLDINGS SC FUND LLC

By: Blue Torch Credit Opportunities SC Master Fund LP, its sole member

By: Blue Torch Credit Opportunities SC GP LLC, its general partner

By: KPG BTC Management LLC, its sole member

By: _/s/ Kevin Genda_____________________

Kevin Genda

Managing Member

BTC HOLDINGS FUND II LLC

By: Blue Torch Credit Opportunities Fund II LP, its sole member

By: Blue Torch Credit Opportunities GP II LLC, its general partner

By: KPG BTC Management LLC, its sole member

By:_/s/ Kevin Genda_____________________

Kevin Genda

Managing Member

BTC OFFSHORE HOLDINGS FUND II-B LLC

By: Blue Torch Offshore Credit Opportunities Master Fund II LP,

Its Sole Member

By: Blue Torch Offshore Credit Opportunities GP II LLC

Its General Partner

By: KPG BTC Management LLC, its sole member

By: _/s/ Kevin Genda____________________

Kevin Genda

Managing Member

[Signature Page to Amendment No. 4 (Spire)]

BTC OFFSHORE HOLDINGS FUND II-C LLC

By: Blue Torch Offshore Credit Opportunities Master Fund II LP, its sole member

By: Blue Torch Offshore Credit Opportunities GP II LLC, its general partner

By: KPG BTC Management LLC, its sole member

By: _/s/ Kevin Genda____________________

Kevin Genda

Managing Member

BTC HOLDINGS KRS FUND LLC

By: Blue Torch Credit Opportunities KRS Fund LP, its sole member

By: Blue Torch Credit Opportunities KRS GP LLC, its general partner

By: KPG BTC Management LLC, its sole member

By: _/s/ Kevin Genda ___________________

Kevin Genda

Managing Member

BTC HOLDINGS SBAF FUND LLC

By: Blue Torch Credit Opportunities SBAF Fund LP, its sole member

By: Blue Torch Credit Opportunities SBAF GP LLC, its general partner

By: KPG BTC Management LLC, its sole member

By: _/s/ Kevin Genda____________________

Kevin Genda

Managing Member

BLUE TORCH CREDIT OPPORTUNITIES FUND III LP

By: Blue Torch Credit Opportunities GP III LLC, its

general partner

By: KPG BTC Management LLC, its sole member

By: _/s/ Kevin Genda____________________

Kevin Genda

Managing Member

[Signature Page to Amendment No. 4 (Spire)]

BTC OFFSHORE HOLDINGS FUND III LLC

By: Blue Torch Offshore Credit Opportunities Master Fund III LP, its Sole Member

By: Blue Torch Offshore Credit Opportunities GP III LLC, its General Partner

By: KPG BTC Management LLC, its managing member

By: _/s/ Kevin Genda_____________________

Kevin Genda

Managing Member

[Signature Page to Amendment No. 4 (Spire)]

Spire Global Signs Waiver and Amendment to Financing Agreement with Blue Torch Capital

VIENNA, Va., August 29, 2024 — On August 27, 2024, Spire Global, Inc. (NYSE: SPIR) (“Spire” or the “Company”) entered into a waiver and amendment to its current financing agreement with Blue Torch Capital.

The waiver and amendment:

•waives events of default under the financing agreement arising out of the maximum debt to EBITDA leverage ratio on June 30, 2024 being greater than the required ratio and the failure to deliver the financial statements for the fiscal quarter ended June 30, 2024;

•amends the financial covenants to provide immediate covenant relief from the leverage ratios in the financing agreement;

•provides for an amendment fee, which is 3.5% of the aggregate outstanding principal balance of the term loans on the effective date of the waiver and amendment and shall be paid-in-kind and added to the principal balance of the term loans; and

•allows for a reduction in the amendment fee under certain refinance or pre-payment scenarios.

The waiver and amendment also requires the Company to make a $10 million payment toward the outstanding principal balance of the term loans under the financing agreement on August 31, 2024. As of June 30, 2024, the Company had cash, cash equivalents and short-term marketable securities of approximately $46 million.

This estimate of cash, cash equivalents and short-term marketable securities as of June 30, 2024 is preliminary and represents the most recent current information available to Company management. The Company’s condensed consolidated balance sheet as of June 30, 2024 and condensed consolidated statement of cash flows for the six months ended June 30, 2024 are not currently available due to the Company’s ongoing review of (i) accounting practices and procedures with respect to revenue recognition related to certain contracts in its “Space as a Service” business (the “Contracts”) under applicable accounting standards and guidance and (ii) the potential existence of embedded leases of identifiable assets in the Contracts, each as further described in the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on August 27, 2024. The Company is working to issue full financial results as of and for the three and six months ended June 30, 2024 as soon as practicable.

About Spire Global, Inc.

Spire (NYSE: SPIR) is a global provider of space-based data, analytics and space services, offering unique datasets and powerful insights about Earth so that organizations can make decisions with confidence in a rapidly changing world. Spire builds, owns, and operates a fully deployed satellite constellation that observes the Earth in real time using radio frequency technology. The data acquired by Spire’s satellites provides global weather intelligence, ship and plane movements, and spoofing and jamming detection to better predict how their patterns impact economies, global security, business operations and the environment. Spire also offers Space as a Service solutions that empower customers to leverage its established infrastructure to put their business in space. Spire has nine offices across the U.S., Canada, UK, Luxembourg, Germany and Singapore. To learn more, visit spire.com.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the federal securities laws, which statements involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or the Company’s anticipated financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “would,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “project,” “potential,” “seek” or “continue” or the negative of these words or other similar terms or expressions that concern the Company’s expectations, strategy, plans or intentions. Forward-looking statements contained in this press release include, but are not limited to, statements about the Company’s ability to satisfy the updated covenants and other obligations in the financing agreement.

The Company cautions you that the foregoing list may not contain all of the forward-looking statements made in this press release. You should not rely upon forward-looking statements as predictions of future events. Factors that may cause future results to differ materially from the Company’s current expectations include, among other things, the Company’s future financial results and any further delay in the filing of required periodic reports. For other risk factors affecting the Company, see “Risk Factors” in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Moreover, the Company operates in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time and it is not possible for the Company to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this press release. The Company cannot assure you that the results, events, and circumstances reflected in the forward-looking statements will be achieved or occur, and actual results, events, or circumstances could differ materially from those described in the forward-looking statements.

Neither the Company nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. Moreover, the forward-looking statements made in this press release relate only to expectations as of the date on which the statements are made. The Company undertakes no obligation to update any forward-looking statements made in this press release to reflect events or circumstances after the date of this press release or to reflect new information or the occurrence of unanticipated events, except as required by law. The Company may not actually achieve the plans, intentions or expectations disclosed in the forward-looking statements and you should not place undue reliance on the forward-looking statements.

Contacts

For media:

Kristina Spychalski

Head of Communications

Comms@Spire.com

For investors:

Benjamin Hackman

Head of Investor Relations

Benjamin.Hackman@Spire.com

v3.24.2.u1

Document And Entity Information

|

Aug. 27, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 27, 2024

|

| Entity Registrant Name |

SPIRE GLOBAL, INC.

|

| Entity Central Index Key |

0001816017

|

| Entity Emerging Growth Company |

true

|

| Securities Act File Number |

001-39493

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

85-1276957

|

| Entity Address, Address Line One |

8000 Towers Crescent Drive

|

| Entity Address, Address Line Two |

Suite 1100

|

| Entity Address, City or Town |

Vienna

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

22182

|

| City Area Code |

(202)

|

| Local Phone Number |

301-5127

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(b) Security |

Class A common stock, par value of $0.0001 per share

|

| Trading Symbol |

SPIR

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

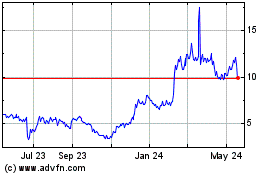

Spire Global (NYSE:SPIR)

Historical Stock Chart

From Aug 2024 to Sep 2024

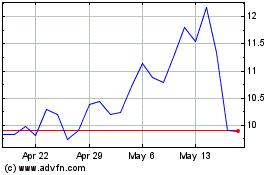

Spire Global (NYSE:SPIR)

Historical Stock Chart

From Sep 2023 to Sep 2024