Fourth quarter production up 14% Y-o-Y to

Company record 40.9 MBoe/d

Full year pro forma production exceeded high

end of Company guidance(1)

Closed three acquisitions in late 2024 for

aggregate cash consideration of approximately $140 million;

primarily located in the Delaware Basin and immediately accretive

to cash flow per share

Fourth quarter total return of capital of $0.49

per share, comprised of declared cash dividend of $0.41 per share

and an equivalent $0.08 per share in common stock repurchases

Since Falcon merger closed in June 2022,

cumulative return of capital to shareholders has exceeded $840

million, representing nearly 30% of current market

capitalization(2)

Company issues 2025 outlook including

forecasted average daily production of 39.8 MBoe/d (18.5 MBbls/d

oil) at the midpoint, 3% above reported full year 2024 production,

underpinned by consistent, robust activity levels from premier

operators

Sitio Royalties Corp. (NYSE: STR) (“Sitio”, “STR” or the

“Company”) today announced fourth quarter and full year 2024

financial and operating results. In addition, the Company provided

its 2025 outlook. Supplemental slides have been posted to Sitio’s

website, www.sitio.com. A conference call and webcast is planned

for 7:30 a.m. CT / 8:30 a.m. ET on Thursday, February 27, 2025.

Participation details can be found within this release.

FOURTH QUARTER 2024 HIGHLIGHTS

- Achieved record high production in the fourth quarter of 40.9

thousand barrels of oil equivalent per day (“MBoe/d”), up 6%

quarter-over-quarter, attributable to strong performance across the

Company's legacy assets as well as contributions from

acquisitions

- Operators remained active across the Company's assets; 8.3 net

wells were turned-in-line across Sitio's acreage, up 9%

quarter-over-quarter; net line of sight (“LOS”) wells totaled 44.9

as of December 31, 2024

- Closed three high return and cash flow accretive acquisitions

for aggregate cash consideration of approximately $140 million,

which added approximately 3,300 net royalty acres ("NRAs"),

primarily located in the Delaware Basin

- Net income of $19.3 million and Adjusted EBITDA(3) of $141.2

million, up $111.0 million and $6.2 million (or 5%), respectively,

compared to fourth quarter 2023

- Continued to return cash to shareholders and create value on a

per share basis; Sitio to return $0.49 per share of Class A Common

Stock for the fourth quarter, comprised of $0.41 per share cash

dividend (payable March 28, 2025) and an equivalent $0.08 per share

of common stock repurchases

- Repurchased $118.1 million of common stock in 2024; 3%

reduction in total shares outstanding year-over-year; $81.9 million

of authorized repurchases remaining as of December 31, 2024

"We delivered across the board in 2024 with

stronger-than-expected results. Sitio’s fourth quarter production

was up by more than 14% over the prior year, while our share count

decreased 3% year-over-year. Over the course of the year, we closed

on 16 immediately accretive acquisitions totaling about $350

million, with expected returns above our target threshold – another

solid demonstration of our ability to deliver sustainable growth

and capital returns to shareholders,” said CEO Chris Conoscenti.

“The backdrop for 2025 is very similar to early 2024 – operators

remain active on our premium land positions in the Permian, DJ,

Eagle Ford and Williston basins and we continue to see attractive

opportunities to consolidate fragmented minerals ownership. We

remain a uniquely active manager of minerals. Our team will

continue to focus on driving top-line and bottom-line improvements

– enhancing revenue recovery with proprietary technology to audit

and capture missing payments and leveraging our asset management

systems to support our growth as well as meaningful reductions in

Cash G&A per Boe as we scale our minerals position."

FOURTH QUARTER 2024 FINANCIAL RESULTS

Sitio's fourth quarter 2024 average unhedged realized prices

including all expected quality, transportation and demand

adjustments were $69.98 per barrel of oil, $1.42 per Mcf of natural

gas and $18.09 per barrel of natural gas liquids, for a total price

of $39.82 per Boe. During the fourth quarter of 2024, the Company

received $5.2 million in net cash settlements for commodity

derivative contracts and as a result, average hedged realized

prices were $72.09 per barrel of oil, $1.64 per Mcf of natural gas

and $18.09 per barrel of natural gas liquids, for a total price of

$41.20 per Boe.

For the fourth quarter of 2024, consolidated net income was

$19.3 million and Adjusted EBITDA(3) was $141.2 million, up $111.0

million and $6.2 million (or 5%), respectively, compared to fourth

quarter 2023, primarily due to 14% higher production over the same

period.

As of December 31, 2024, the Company had $1.1 billion principal

value of total debt outstanding (comprised of $487.8 million drawn

on Sitio's revolving credit facility and $600.0 million of senior

unsecured notes) and liquidity of $440.5 million, including $3.3

million of cash and $437.2 million of remaining availability under

its $925.0 million credit facility.

2025 OUTLOOK

The table below includes Sitio's financial and operational

guidance for full year 2025 and reflects the Company's expectations

for operator development activity on its acreage. Sitio does not

forecast acquisitions; however, it expects to remain active on the

M&A front given its robust deal pipeline.

Guidance Metric

2024 Full Year Results

2025 Full Year

Guidance

Production

Average daily production (Boe/d)

38,517

38,250

–

41,250

Average daily oil production (Bbls/d)

19,128

17,750

–

19,250

Expenses and Taxes

Cash G&A ($ in millions)(3)

$29.5

$36.5

–

$39.5

Production taxes and other (% of royalty

revenue)

7.6%

7.0%

–

9.0%

Estimated cash taxes ($ in

millions)(4)

$18.1

$26.0

–

$30.0

RETURN OF CAPITAL FRAMEWORK

Sitio is committed to returning capital to shareholders while

maintaining a balanced and durable capital structure. Since

becoming public in 2022, Sitio's cumulative return of capital to

shareholders has exceeded $840 million, including cash dividends

and share repurchases, with more than $330 million attributable to

2024.(2)

Sitio’s Board of Directors declared a cash dividend of $0.41 per

share of Class A Common Stock with respect to the fourth quarter of

2024. The dividend is payable on March 28, 2025 to the stockholders

of record at the close of business on March 14, 2025. During the

fourth quarter of 2024, the Company repurchased an aggregate 0.6

million shares of Class A Common Stock at an average price of

$20.06 per share, representing 11% of fourth quarter 2024

Discretionary Cash Flow(3), or an equivalent $0.08 per share. As of

December 31, 2024, the Company had repurchased a total of 5.1

million of Class A Common Stock shares and Sitio OpCo Partnership

Units, representing approximately 3% of shares outstanding prior to

the Board's authorization of Sitio's $200 million share repurchase

program. The Company had $81.9 million of authorized repurchases

remaining as of December 31, 2024. In total, Sitio will return an

aggregate $0.49 per share of capital for the fourth quarter of

2024, which represents 65% of fourth quarter 2024 Discretionary

Cash Flow.

CONFERENCE CALL INFORMATION

Sitio plans to host a conference call at 8:30 a.m. ET on

Thursday, February 27, 2025. Participants can access the call by

dialing 1-833-470-1428 in the United States, or 1-404-975-4839 in

other locations, with access code 552754, or by webcast at

https://events.q4inc.com/attendee/778319394. Participants may also

pre-register for the event via the following link:

https://www.netroadshow.com/events/login?show=1131dee8&confId=76348.

The conference call, live webcast, and replay can also be accessed

through the Investor Relations section of Sitio’s website at

www.sitio.com.

(1)

Includes production from the DJ Basin

Acquisition as if it was owned on January 1, 2024 (transaction

effective date of 10/1/23); the DJ Basin Acquisition is defined as

the all-cash acquisition of approximately 13,000 NRAs in the DJ

Basin from an undisclosed third party that closed on April 4, 2024.

Refers to Company guidance issued on November 6, 2024.

(2)

Includes dividends declared with

respect to 4Q24 (payable March 28, 2025). Market cap is based on

Sitio's share price as of February 25, 2025 and share count as of

February 24, 2025

(3)

For definitions of non-GAAP financial

measures and reconciliation to their most directly comparable GAAP

financial measures, please see "Non-GAAP financial measures"

(4)

Estimated cash tax guidance range is based

on expectations at NYMEX forward strip pricing on February 26, 2025

and for the assets owned on February 26, 2025. Note: 2024 estimated

cash taxes reflect full utilization of a non-recurring Brigham

merger overpayment credit carryforward

OPERATOR ACTIVITY

The following table summarizes Sitio's net royalty acres, net

average daily production and net LOS wells by basin as of December

31, 2024.

Delaware

Midland

DJ

Eagle

Ford

Williston/Other

Total

Net Royalty

Acres

(normalized to

1/8th royalty equivalent)

As of December 31, 2024

156,543

45,626

41,681

21,047

8,206

273,103

Net Average Daily

Production

(Boe/d)

Three months ended December 31, 2024

20,570

8,353

6,619

4,540

792

40,874

% Oil

47

%

52

%

42

%

47

%

54

%

47

%

Net LOS

Wells

(normalized to

5,000' laterals)

Net spuds

11.3

7.8

4.1

1.0

0.3

24.5

Net permits

11.2

3.9

1.9

3.2

0.2

20.4

Net LOS wells as of December 31, 2024

22.5

11.7

6.0

4.2

0.5

44.9

PROVED RESERVES

The following tables set forth information regarding the

Company’s net ownership interest in estimated quantities of proved

developed and undeveloped oil and natural gas reserves and the

changes therein for each of the periods presented. The reserves

presented herein are based on a reserve report prepared by Sitio

and audited by Cawley, Gillespie & Associates, Inc.

Oil

(MBbls)

Natural Gas

(MMcf)

Natural Gas Liquids

(MBbls)

Total

(MBOE)

Balance as of December 31, 2023

38,832

150,270

21,416

85,293

Revisions

(1,270

)

9,381

863

1,157

Extensions

6,297

22,066

3,132

13,106

Acquisition of reserves

5,209

41,587

6,131

18,271

Production

(7,004

)

(23,360

)

(3,174

)

(14,071

)

Balance as of December 31, 2024

42,064

199,944

28,368

103,756

Proved developed and undeveloped

reserves:

Oil

(MBbls)

Natural Gas

(MMcf)

Natural Gas Liquids

(MBbls)

Total

(MBOE)

Developed as of December 31, 2022

27,407

133,489

15,169

64,824

Undeveloped as of December 31, 2022

7,650

25,953

3,190

15,165

Balance at December 31, 2022

35,057

159,442

18,359

79,989

Developed as of December 31, 2023

30,537

127,170

18,167

69,899

Undeveloped as of December 31, 2023

8,295

23,100

3,249

15,394

Balance at December 31, 2023

38,832

150,270

21,416

85,293

Developed as of December 31, 2024

36,384

179,056

25,368

91,595

Undeveloped as of December 31, 2024

5,680

20,888

3,000

12,161

Balance at December 31, 2024

42,064

199,944

28,368

103,756

COMMODITY DERIVATIVE CONTRACTS

The following table summarizes Sitio's commodity derivative

contracts as of December 31, 2024.

Oil (NYMEX WTI)

1H25

Swaps

Bbl per day

1,100

Weighted Average Price per Bbl

$

74.65

Collars

Bbl per day

2,000

Weighted Average Ceiling Price per Bbl

$

93.20

Weighted Average Floor Price per Bbl

$

60.00

Gas (NYMEX Henry Hub)

1H25

Collars

MMBtu per day

11,600

Weighted Average Ceiling Price per

MMBtu

$

10.34

Weighted Average Floor Price per MMBtu

$

3.31

FINANCIAL RESULTS

Production Data

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Production Data:

Crude oil (MBbls)

1,782

1,558

7,001

6,344

Natural gas (MMcf)

6,749

5,923

23,557

23,136

NGLs (MBbls)

854

746

3,170

2,742

Total (MBOE)(6:1)

3,761

3,291

14,097

12,942

Average daily production (BOE/d)(6:1)

40,874

35,776

38,517

35,457

Average Realized Prices:

Crude oil (per Bbl)

$

69.98

$

77.91

$

75.26

$

75.80

Natural gas (per Mcf)

$

1.42

$

1.40

$

1.02

$

1.77

NGLs (per Bbl)

$

18.09

$

18.72

$

18.99

$

19.21

Combined (per BOE)

$

39.82

$

43.65

$

43.35

$

44.39

Average Realized Prices After Effects

of Derivative Settlements:

Crude oil (per Bbl)

$

72.09

$

80.68

$

76.46

$

78.62

Natural gas (per Mcf)

$

1.64

$

1.66

$

1.33

$

2.06

NGLs (per Bbl)

$

18.09

$

18.72

$

18.99

$

19.21

Combined (per BOE)

$

41.20

$

45.43

$

44.47

$

46.30

Selected Expense Metrics

Three Months Ended December

31,

2024

2023

Production taxes and other

7.5

%

9.8

%

Depreciation, depletion and amortization

($/Boe)

$

21.38

$

20.85

General and administrative ($/Boe)

$

3.69

$

3.60

Cash G&A ($/Boe) (3)

$

1.90

$

1.95

Interest expense, net ($/Boe)

$

5.73

$

6.59

Consolidated Balance Sheets

(In thousands, except par and share

amounts)

December 31,

2024

December 31,

2023

ASSETS

Current assets

Cash and cash equivalents

$

3,290

$

15,195

Accrued revenue and accounts

receivable

123,361

107,347

Prepaid assets

6,760

12,362

Derivative asset

1,811

19,080

Total current assets

135,222

153,984

Property and equipment

Oil and natural gas properties, successful

efforts method:

Unproved properties

2,464,836

2,698,991

Proved properties

2,941,347

2,377,196

Other property and equipment

3,737

3,711

Accumulated depreciation, depletion,

amortization, and impairment

(818,633

)

(498,531

)

Total property and equipment, net

4,591,287

4,581,367

Long-term assets

Long-term derivative asset

—

3,440

Deferred financing costs

8,525

11,205

Operating lease right-of-use asset

5,940

5,970

Other long-term assets

2,746

2,835

Total long-term assets

17,211

23,450

TOTAL ASSETS

$

4,743,720

$

4,758,801

LIABILITIES AND EQUITY

Current liabilities

Accounts payable and accrued expenses

$

46,385

$

30,050

Operating lease liability

1,646

1,725

Total current liabilities

48,031

31,775

Long-term liabilities

Long-term debt

1,078,181

865,338

Deferred tax liability

253,778

259,870

Non-current operating lease liability

5,462

5,394

Other long-term liabilities

1,150

1,150

Total long-term liabilities

1,338,571

1,131,752

Total liabilities

1,386,602

1,163,527

Equity

Class A Common Stock, par value $0.0001

per share; 240,000,000 shares authorized; 83,205,330 and 82,451,397

shares issued and 78,980,516 and 82,451,397 outstanding at December

31, 2024 and December 31, 2023, respectively

8

8

Class C Common Stock, par value $0.0001

per share; 120,000,000 shares authorized; 73,443,992 and 74,965,217

shares issued and 73,391,244 and 74,939,080 outstanding at December

31, 2024 and December 31, 2023, respectively

8

8

Additional paid-in capital

1,710,372

1,796,147

Accumulated deficit

(146,792

)

(187,738

)

Class A Treasury Shares, 4,224,814 and 0

shares at December 31, 2024 and December 31, 2023, respectively

(96,910

)

—

Class C Treasury Shares, 52,748 and 26,137

shares at December 31, 2024 and December 31, 2023, respectively

(1,265

)

(677

)

Noncontrolling interest

1,891,697

1,987,526

Total equity

3,357,118

3,595,274

TOTAL LIABILITIES AND EQUITY

$

4,743,720

$

4,758,801

Consolidated Statements of

Operations

(In thousands, except per share

amounts)

Years Ended December

31,

2024

2023

2022

Revenues:

Oil, natural gas and natural gas liquids

revenues

$

611,070

$

574,542

$

355,430

Lease bonus and other income

13,344

18,814

14,182

Total revenues

624,414

593,356

369,612

Operating expenses:

Management fees to affiliates

—

—

3,241

Depreciation, depletion and

amortization

320,297

291,320

104,511

General and administrative

54,725

49,620

42,299

Production taxes and other

46,383

46,939

25,572

Impairment of oil and gas properties

—

25,617

—

Loss on sale of oil and gas properties

—

144,471

—

Total operating expenses

421,405

557,967

175,623

Net income from operations

203,009

35,389

193,989

Other income (expense):

Interest expense, net

(85,240

)

(93,413

)

(35,499

)

Change in fair value of warrant

liability

—

2,950

3,662

Loss on extinguishment of debt

—

(21,566

)

(11,487

)

Commodity derivatives gains (losses)

(4,905

)

15,199

39,037

Interest rate derivatives gains

—

462

110

Net income (loss) before taxes

112,864

(60,979

)

189,812

Income tax benefit (expense)

(17,935

)

14,284

(5,681

)

Net income (loss)

94,929

(46,695

)

184,131

Net income attributable to Predecessor

—

—

(78,104

)

Net income attributable to temporary

equity

—

—

(90,377

)

Net (income) loss attributable to

noncontrolling interest

(53,983

)

31,159

51

Net income (loss) attributable to Class

A stockholders

$

40,946

$

(15,536

)

$

15,701

Net income (loss) per share of Class A

Common Stock

Basic

$

0.49

$

(0.20

)

$

1.10

Diluted

$

0.49

$

(0.20

)

$

1.10

Weighted average Class A Common Stock

outstanding

Basic

80,621

81,269

13,723

Diluted

80,856

81,269

13,723

Consolidated Statements of Cash

Flows

(In thousands)

Years Ended December

31,

2024

2023

2022

Cash flows from operating

activities:

Net income (loss)

$

94,929

$

(46,695

)

$

184,131

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

Depreciation, depletion and

amortization

320,297

291,320

104,511

Amortization of deferred financing costs

and long-term debt discount

5,259

5,534

6,546

Share-based compensation

23,836

18,867

9,250

Change in fair value of warrant

liability

—

(2,950

)

(3,662

)

Loss on extinguishment of debt

—

21,566

11,487

Impairment of oil and gas properties

—

25,617

—

Commodity derivative (gains) losses

4,905

(15,199

)

(39,037

)

Net cash received for commodity derivative

settlements

15,803

24,613

7,104

Interest rate derivative gains

—

(462

)

(110

)

Net cash received (paid) for interest rate

derivative settlements

—

781

(209

)

Loss on sale of oil and gas properties

—

144,471

—

Deferred tax (benefit) expense

(6,702

)

(42,946

)

1,631

Change in operating assets and

liabilities:

Accrued revenue and accounts

receivable

(16,014

)

33,564

(25,313

)

Prepaid assets

5,666

19,550

(616

)

Other long-term assets

2

2,089

(3,652

)

Accounts payable and accrued expenses

14,231

8,810

(88,558

)

Due to affiliates

—

—

(380

)

Operating lease liabilities and other

long-term liabilities

216

(1,030

)

1,837

Net cash provided by operating

activities

462,428

487,500

164,960

Cash flows from investing

activities:

Acquisition of Falcon, net of cash

—

—

4,484

Acquisition of Brigham, net of cash

—

—

11,054

Predecessor cash not contributed in the

Falcon Merger

—

—

(15,228

)

Purchases of oil and gas properties, net

of post-close adjustments

(329,885

)

(170,545

)

(557,569

)

Proceeds from sale of oil and gas

properties

—

113,298

—

Other, net

(74

)

(2,479

)

(840

)

Net cash used in investing

activities

(329,959

)

(59,726

)

(558,099

)

Cash flows from financing

activities:

Borrowings on credit facilities

474,400

644,500

348,895

Repayments on credit facilities

(263,600

)

(877,500

)

(209,000

)

Issuance of 2026 Senior Notes

—

—

444,500

Repayments on 2026 Senior Notes

—

(438,750

)

(11,250

)

Issuance of 2028 Senior Notes

—

600,000

—

Borrowings on Bridge Loan Facility

—

—

425,000

Repayments on Bridge Loan Facility

—

—

(425,000

)

Debt issuance costs

(598

)

(22,060

)

(24,889

)

Debt extinguishment costs

—

(12,176

)

—

Distributions paid to Temporary Equity

—

—

(115,375

)

Distributions to noncontrolling

interest

(112,421

)

(158,968

)

(13,318

)

Dividends paid to Class A stockholders

(121,272

)

(161,951

)

(18,165

)

Dividend equivalent rights paid

(1,165

)

(1,048

)

(579

)

Repurchases of Class A Common Stock

(95,216

)

—

—

Repurchases of Sitio OpCo Partnership

Units (including associated Class C Common Shares)

(22,141

)

—

—

Cash paid for taxes related to net

settlement of share-based compensation awards

(2,361

)

(3,444

)

—

Deferred initial public offering costs

—

—

(61

)

Other

—

—

(1,180

)

Net cash (used in) provided by

financing activities

(144,374

)

(431,397

)

399,578

Net change in cash and cash

equivalents

(11,905

)

(3,623

)

6,439

Cash and cash equivalents, beginning of

period

15,195

18,818

12,379

Cash and cash equivalents, end of

period

$

3,290

$

15,195

$

18,818

Supplemental disclosure of non-cash

transactions:

Increase (decrease) in current liabilities

for additions to property and equipment:

$

343

$

(12

)

$

(379

)

Oil and gas properties acquired through

issuance of Class C Common Stock and common units in consolidated

subsidiary:

—

70,740

3,348,216

Temporary equity cumulative adjustment to

redemption value:

—

—

706,940

Supplemental disclosure of cash flow

information:

Cash paid for income taxes:

$

3,135

$

9,276

$

1,866

Cash paid for interest expense:

83,074

77,310

29,030

Non-GAAP financial measures

Adjusted EBITDA, Discretionary Cash Flow and Cash G&A are

non-GAAP supplemental financial measures used by our management and

by external users of our financial statements such as investors,

research analysts and others to assess the financial performance of

our assets and their ability to sustain dividends and/or share

repurchases over the long term without regard to financing methods,

capital structure or historical cost basis. Sitio believes that

these non-GAAP financial measures provide useful information to

Sitio's management and external users because they allow for a

comparison of operating performance on a consistent basis across

periods.

We define Adjusted EBITDA as net income (loss) plus (a) interest

expense, (b) provisions for income taxes, (c) depreciation,

depletion and amortization, (d) non-cash share-based compensation

expense, (e) impairment of oil and natural gas properties, (f)

gains or losses on unsettled derivative instruments, (g) change in

fair value of the warrant liability, (h) management fee to

affiliates (i) loss on debt extinguishment, (j) merger-related

transaction costs (k) write off of financing costs and (l) loss on

sale of oil and gas properties.

We define Discretionary Cash Flow for the three months ended

December 31, 2024 as Adjusted EBITDA, less cash and accrued

interest expense and estimated cash taxes.

We define Discretionary Cash Flow for the three months ended

December 31, 2023 as Adjusted EBITDA, less cash and accrued

interest expense and cash taxes. We revised our definition of

Discretionary Cash Flow following this period to reflect our

anticipated accrual of taxes period-to-period due to the runoff of

tax credits associated with the Brigham merger.

We define Cash G&A as general and administrative expense

less (a) non-cash share-based compensation expense, (b)

merger-related transaction costs and (c) rental income.

Merger-related transaction costs for the three and twelve months

ended December 31, 2023 have been recast to conform to the current

period presentation.

These non-GAAP financial measures do not represent and should

not be considered an alternative to, or more meaningful than, their

most directly comparable GAAP financial measures or any other

measure of financial performance presented in accordance with GAAP

as measures of our financial performance. Non-GAAP financial

measures have important limitations as analytical tools because

they exclude some but not all items that affect the most directly

comparable GAAP financial measure. Our computations of Adjusted

EBITDA, Discretionary Cash Flow and Cash G&A may differ from

computations of similarly titled measures of other companies.

This release does not include a reconciliation for 2025E Cash

G&A because certain elements of the comparable GAAP financial

measures are not predictable in this situation, making it

impractical for the Company to forecast.

The following table presents a reconciliation of Adjusted EBITDA

to the most directly comparable GAAP financial measure for the

period indicated (in thousands).

Three Months Ended

December 31,

2024

2023

Net income (loss)

$

19,329

$

(91,716

)

Interest expense, net

21,531

21,678

Income tax (benefit) expense

6,202

(21,168

)

Depreciation, depletion and

amortization

80,401

68,602

Loss on sale of oil and gas properties

—

144,471

EBITDA

$

127,463

$

121,867

Non-cash share-based compensation

expense

6,278

4,393

Losses (gains) on unsettled derivative

instruments

7,254

(12,194

)

Loss on debt extinguishment

—

20,096

Merger-related transaction costs

254

875

Adjusted EBITDA

$

141,249

$

135,037

The following table presents a reconciliation of Discretionary

Cash Flow to the most directly comparable GAAP financial measure

for the period indicated (in thousands).

Three Months Ended

December 31,

2024

2023

Cash flow from operations

$

105,698

$

132,682

Interest expense, net

21,531

21,678

Income tax (benefit) expense

6,202

(21,168

)

Deferred tax benefit

(5,282

)

27,839

Changes in operating assets and

liabilities

14,180

(25,610

)

Amortization of deferred financing costs

and long-term debt discount

(1,334

)

(1,259

)

Merger-related transaction costs

254

875

Adjusted EBITDA

$

141,249

$

135,037

Less:

Cash and accrued interest expense

20,196

19,628

Estimated cash taxes

4,181

8

Discretionary Cash Flow

$

116,872

$

115,401

The following tables present a reconciliation of Cash G&A to

the most directly comparable GAAP financial measure for the periods

indicated (in thousands).

Three Months Ended

December 31,

2024

2023

General and administrative expense

$

13,876

$

11,834

Less:

Non-cash share-based compensation

expense

6,278

4,393

Merger-related transaction costs

254

875

Rental income

185

135

Cash G&A

$

7,159

$

6,431

Year Ended

December 31,

2024

2023

General and administrative expense

$

54,725

$

49,620

Less:

Non-cash share-based compensation

expense

23,836

18,867

Merger-related transaction costs

710

3,970

Rental income

680

512

Cash G&A

$

29,499

$

26,271

About Sitio Royalties Corp.

Sitio is a shareholder returns-driven company focused on

large-scale consolidation of high-quality oil & gas mineral and

royalty interests across premium basins, with a diversified set of

top-tier operators. With a clear objective of generating cash flow

from operations that can be returned to stockholders and

reinvested, Sitio has accumulated over 270,000 NRAs through the

consummation of over 200 acquisitions, as of December 31, 2024.

More information about Sitio is available at www.sitio.com.

Forward-Looking Statements

This news release contains statements that may constitute

“forward-looking statements” for purposes of federal securities

laws. Forward-looking statements include, but are not limited to,

statements that refer to projections, forecasts, or other

characterizations of future events or circumstances, including any

underlying assumptions. The words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intends,” “may,”

“might,” “plan,” “seeks,” “possible,” “potential,” “predict,”

“project,” “prospects,” “guidance,” “outlook,” “should,” “would,”

“will,” and similar expressions may identify forward-looking

statements, but the absence of these words does not mean that a

statement is not forward-looking. These statements include, but are

not limited to, statements about the Company's expected results of

operations, cash flows, financial position and future dividends; as

well as certain future plans, expectations and objectives for the

Company’s operations, including statements about our return of

capital framework, our share repurchase program and its intended

benefits, financial and operational guidance, strategy, synergies,

certain levels of production, future operations, financial

position, prospects, and plans. While forward-looking statements

are based on assumptions and analyses made by us that we believe to

be reasonable under the circumstances, whether actual results and

developments will meet our expectations and predictions depend on a

number of risks and uncertainties that could cause our actual

results, performance, and financial condition to differ materially

from our expectations and predictions. Factors that could

materially impact such forward-looking statements include, but are

not limited to: commodity price volatility, the global economic

uncertainty and market volatility related to changes in U.S. trade

policy, including the imposition of tariffs, slowing growth and

demand, especially from China, the conflict in Ukraine and

associated economic sanctions on Russia, the conflict in the

Israel-Gaza region and continued hostilities in the Middle East

including heightened tensions and conflict with Iran, Lebanon and

Yemen, voluntary production cuts by OPEC+ and others, including any

additional extensions of such voluntary production cuts or the

duration thereof, increased global oil, natural gas and natural gas

liquids supply and those other factors discussed or referenced in

the "Risk Factors" section of Sitio’s Annual Report on Form 10-K

for the year ended December 31, 2024 and other publicly filed

documents with the SEC. Any forward-looking statement made in this

news release speaks only as of the date on which it is made.

Factors or events that could cause actual results to differ may

emerge from time to time, and it is not possible to predict all of

them. Sitio undertakes no obligation to publicly update any

forward-looking statement, whether as a result of new information,

future development, or otherwise, except as may be required by law.

Reserve engineering is a process of estimating underground

accumulations of oil and natural gas that cannot be measured in an

exact way. The accuracy of any oil and gas reserve estimate depends

on the quality of available data, the interpretation of such data,

and price and cost assumptions made by reserve engineers. In

addition, the results of drilling, testing and production

activities may justify revisions of estimates that were made

previously. If significant, such revisions would change the

schedule of any further production and development drilling.

Accordingly, reserve estimates may differ significantly from the

quantities of oil and natural gas that are ultimately

recovered.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250226878178/en/

IR contact: Alyssa Stephens (281) 407-5204

IR@sitio.com

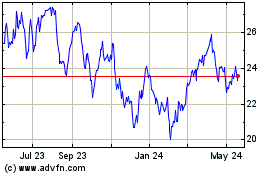

Sitio Royalties (NYSE:STR)

Historical Stock Chart

From Jan 2025 to Feb 2025

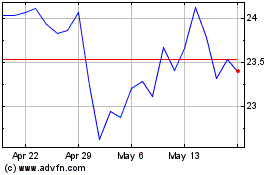

Sitio Royalties (NYSE:STR)

Historical Stock Chart

From Feb 2024 to Feb 2025