Amended Statement of Beneficial Ownership (3/a)

08 April 2023 - 7:54AM

Edgar (US Regulatory)

FORM 3

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INITIAL STATEMENT OF BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0104

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

BCC EnVen Investments (S), L.P. |

2. Date of Event Requiring Statement (MM/DD/YYYY)

2/13/2023

|

3. Issuer Name and Ticker or Trading Symbol

TALOS ENERGY INC. [TALO]

|

|

(Last)

(First)

(Middle)

200 CLARENDON STREET |

4. Relationship of Reporting Person(s) to Issuer (Check all applicable)

_____ Director ___X___ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Street)

BOSTON, MA 02116

(City)

(State)

(Zip)

| 5. If Amendment, Date Original Filed(MM/DD/YYYY)

2/22/2023

| 6. Individual or Joint/Group Filing(Check Applicable Line)

___ Form filed by One Reporting Person

_X_ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Beneficially Owned

|

1.Title of Security

(Instr. 4) | 2. Amount of Securities Beneficially Owned

(Instr. 4) | 3. Ownership Form: Direct (D) or Indirect (I)

(Instr. 5) | 4. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Common Stock | 15509182 (1)(2)(3) | I | See FN (1)(2)(3)(4)(5)(6) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 4) | 2. Date Exercisable and Expiration Date

(MM/DD/YYYY) | 3. Title and Amount of Securities Underlying Derivative Security

(Instr. 4) | 4. Conversion or Exercise Price of Derivative Security | 5. Ownership Form of Derivative Security: Direct (D) or Indirect (I)

(Instr. 5) | 6. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Explanation of Responses: |

| (1) | Bain Capital Credit Managed Account (E), L.P. directly holds 1,437,872 shares of Common Stock ("Shares"). Bain Capital Credit Managed Account (PSERS), L.P. directly holds 207,382 Shares. Bain Capital Distressed & Special Situations 2013 (AIV I), L.P. directly holds 3,607,477 Shares. Bain Capital Distressed & Special Situations 2013 (B), L.P. directly holds 425,945 Shares. Bain Capital Distressed & Special Situations 2016 (A), L.P. directly holds 1,298,868 Shares. Bain Capital Distressed & Special Situations 2016 (F), L.P. directly holds 1,131,519 Shares. Sankaty Credit Opportunities IV, L.P. directly holds 1,129,580 Shares. BCC EnVen Investments (2016), L.P. directly holds 2,170,800 Shares. (cont'd) |

| (2) | BCC EnVen Investments (S), L.P. directly holds 622,157 Shares. With respect to the each of the entities listed in footnote 1, (the "BCCM Holders"), Bain Capital Credit Member, LLC ("BCCM") may be deemed to have voting and dispositive power of the aggregate 12,031,600 shares of Common Stock directly held by the BCCM Holders. |

| (3) | BCC EnVen Investments (2013), L.P. ("BCC EnVen 2013") directly holds 2,875,746 shares of Common Stock. Bain Capital Credit Member II, LLC ("BCCM II") is the GP of BCC EnVen 2013. BCCM II may be deemed to have voting and dispositive power over 2,875,746 shares of Common Stock held by BCC EnVen 2013. |

| (4) | Bain Capital Credit, LP ("BCC") serves as investment manager to various client accounts, and, in this capacity, has voting and dispositive power over 601,836 shares of Common Stock directly held in such managed accounts. |

| (5) | Each Reporting Person, BCCM, BCCM Holder, BCC, and BCC EnVen 2013 disclaim beneficial ownership of the reported securities except to the extent of such person's pecuniary interest therein, and the filing of this Form 3 shall not be deemed an admission by any of the foregoing of beneficial ownership of such shares for the purposes of Section 16 or for any other purpose. |

| (6) | Due to the limitations of the electronic filing system certain Reporting Persons are filing a separate Form 3. |

Remarks:

The Form 3 filed on February 22, 2023 is being amended and restated in its entirety to correct the amount of reported securities which were inadvertently overstated due to an administrative error. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

BCC EnVen Investments (S), L.P.

200 CLARENDON STREET

BOSTON, MA 02116 |

| X |

|

|

BCC EnVen Investments (2013), L.P.

200 CLARENDON STREET

BOSTON, MA 02116 |

| X |

|

|

Bain Capital Credit, LP

200 CLARENDON STREET

BOSTON, MA 02116 |

| X |

|

|

Signatures

|

| BCC EnVen Investments (S), L.P., By: BCC EnVen Investments GP (S), LLC, its general partner, By: Bain Capital Credit Member, LLC, its managing member, /s/ Michael Treisman, Partner and General Counsel | | 4/7/2023 |

| **Signature of Reporting Person | Date |

| BCC EnVen Investments (2013), L.P , By: BCC EnVen Investments GP (2013), LLC, its general partner, By: Bain Capital Credit Member II, LLC, its general partner, /s/ Michael Treisman, Partner and General Counsel | | 4/7/2023 |

| **Signature of Reporting Person | Date |

| Bain Capital Credit, LP, /s/ Michael Treisman, Partner and General Counsel | | 4/7/2023 |

| **Signature of Reporting Person | Date |

| Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly. |

| * | If the form is filed by more than one reporting person, see Instruction 5(b)(v). |

| ** | Intentional misstatements or omissions of facts constitute Federal Criminal Violations. See 18 U.S.C. 1001 and 15 U.S.C. 78ff(a). |

| Note: | File three copies of this Form, one of which must be manually signed. If space is insufficient, see Instruction 6 for procedure. |

| Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

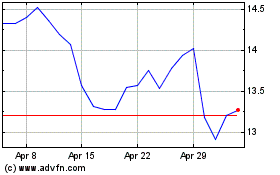

Talos Energy (NYSE:TALO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Talos Energy (NYSE:TALO)

Historical Stock Chart

From Apr 2023 to Apr 2024