WOLVERINE WORLD WIDE INC /DE/2/19/20250000110471falseFebruary 19, 202500001104712025-02-192025-02-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________

FORM 8-K

________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 19, 2025

________________________________________________

| | |

WOLVERINE WORLD WIDE, INC. |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | | | | | | | |

| Delaware | | 001-06024 | | 38-1185150 |

(State or other jurisdiction of

incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | | | | | | | |

| 9341 Courtland Drive N.E. | , | Rockford | , | Michigan | | 49351 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (616) 866-5500

________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading symbol | Name of each exchange on which registered |

| Common Stock, $1 Par Value | WWW | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On February 19, 2025, Wolverine World Wide, Inc. (the “Company”) issued a press release announcing its financial results for the Company’s fourth quarter of 2024, attached as Exhibit 99.1 to this Current Report on Form 8-K (the “8-K”), which is hereby incorporated by reference. This 8-K and Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| | | | | | | | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

| | | |

| (d) | Exhibits: |

| | | |

| | 99.1 | |

| | | |

| | 104 | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL (included as Exhibit 101). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| Dated: February 19, 2025 | WOLVERINE WORLD WIDE, INC. (Registrant) |

| | |

| | |

| | /s/ Taryn L. Miller |

| | Taryn L. Miller |

| | Chief Financial Officer and Treasurer |

| | | | | |

| 9341 Courtland Drive NE, Rockford, MI 49351 Phone (616) 866-5500 |

FOR IMMEDIATE RELEASE

CONTACT: Alex Wiseman

(616) 863-3974

WOLVERINE WORLDWIDE REPORTS FOURTH QUARTER

AND FISCAL 2024 RESULTS

Company Meets Guidance, Inflects to Growth, and Issues 2025 Outlook

ROCKFORD, Mich., February 19, 2025 – Wolverine World Wide, Inc. (NYSE: WWW) today reported financial results for the fourth quarter and full year 2024 ended December 28, 2024.

“A year ago, we outlined an ambitious turnaround strategy composed of three chapters: stabilization, transformation, and inflection. We shared a plan to meaningfully strengthen the Company's balance sheet, expand profitability, and sequentially improve revenue trends – culminating with an inflection to growth in the final quarter of 2024,” said Chris Hufnagel, President and Chief Executive Officer of Wolverine Worldwide. “I'm pleased to report that we accomplished all of these objectives. In the fourth quarter, we exceeded our expectations for revenue and earnings and inflected to growth as a Company – delivering better-than-anticipated results for 2024. As we begin 2025, our brands are poised to continue to build on our momentum, standing on a much healthier foundation with stronger product pipelines and compelling storytelling. Our team is encouraged by the work we've accomplished together and excited to turn the page."

FINANCIAL HIGHLIGHTS

Financial results for 2024, and comparable results from 2023, in each case, for our ongoing business exclude the impact of Keds, which was sold in February 2023, the U.S. Wolverine Leathers business, which was sold in August 2023, the non-U.S. Wolverine Leathers business, which was sold in December 2023, and the Sperry business, which was sold in January 2024. Tables have been provided in the back of this release showing the impact of these adjustments on financial results for 2024 and 2023.

FOURTH-QUARTER 2024 FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | |

| (in millions) | December 28, 2024 | | December 30, 2023 | Y/Y Change | Constant Currency Change |

| Reported Segment Revenue Results: | | | | | |

| Active Group | | $331.7 | | $341.3 | (2.8)% | (3.2)% |

| Work Group | | $151.1 | | $125.3 | 20.6% | 21.4% |

| Other | | $11.9 | | $60.1 | (80.2)% | (77.4)% |

| Total Revenue | $494.7 | | $526.7 | (6.1)% | (5.8)% |

| Ongoing Total Revenue | $494.7 | | $480.5 | 3.0% | 3.3% |

| Supplemental Revenue Information | | | | |

| Merrell | | $163.4 | | $161.8 | 1.0% | 1.0% |

| Saucony | | $99.6 | | $105.1 | (5.3)% | (5.2)% |

| Wolverine | | $62.4 | | $51.8 | 20.5% | 20.5% |

| Sweaty Betty | | $63.4 | | $67.3 | (5.9)% | (7.9)% |

| | | | | |

| International - Reported | $252.7 | | $267.2 | (5.4)% | |

| International - Ongoing | $252.7 | | $256.0 | (1.3)% | |

| Direct-to-Consumer - Reported | $151.7 | | $186.9 | (18.8)% | |

| Direct-to-Consumer - Ongoing | $151.7 | | $163.2 | (7.0)% | |

| Reported Financial Metrics | | | | | |

| Gross Margin | 44.0% | | 36.6% | 740 bps | |

| Operating Expenses | $177.9 | | $379.9 | (53.2)% | |

| Operating Margin | 8.0% | | (35.5)% | 4,350 bps | |

| Diluted Earnings Per Share | $0.29 | | ($1.15) | 125.2% | |

| Non-GAAP and Ongoing Business Financial Metrics | | | | |

| Adjusted Gross Margin | 44.0% | | 37.8% | 620 bps | |

| Adjusted Operating Expenses | $167.0 | | $195.5 | (14.6)% | |

| Adjusted Operating Margin | 10.2% | | (2.9)% | 1,310 bps | |

| Adjusted Diluted Earnings Per Share | $0.42 | | $(0.26) | 261.5% | |

| Constant Currency Diluted Earnings Per Share | $0.48 | | $(0.26) | 284.6% | |

Gross margin improved significantly due to lower supply chain costs, product costs and lower sales of end-of-life inventory.

Inventory at the end of the quarter was $241 million and was down $133 million or approximately 35.6% compared to the prior year.

Net Debt at the end of the quarter was $496 million, down $246 million or approximately 33.1% compared to the prior year.

FULL-YEAR 2024 FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | |

| (in millions) | December 28, 2024 | | December 30, 2023 | Y/Y Change | Constant Currency Change |

| Reported Segment Revenue Results: | | | | | |

| Active Group | | $1,246.1 | | $1,439.1 | (13.4)% | (13.8)% |

| Work Group | | $455.3 | | $480.6 | (5.3)% | (5.1)% |

| Other | | $53.6 | | $323.2 | (83.4)% | (83.0)% |

| Total Revenue | $1,755.0 | | $2,242.9 | (21.8)% | (21.9)% |

| Ongoing Total Revenue | $1,750.4 | | $1,992.1 | (12.1)% | (12.3)% |

| Supplemental Brand Information | | | | |

| Merrell | | $598.4 | | $675.8 | (11.5)% | (11.5)% |

| Saucony | | $406.5 | | $495.8 | (18.0)% | (18.0)% |

| Wolverine | | $193.1 | | $201.2 | (4.0)% | (4.0)% |

| Sweaty Betty | | $198.9 | | $203.8 | (2.4)% | (4.6)% |

| | | | | |

| International - Reported | $861.6 | | $1,025.0 | (15.9)% | |

| International - Ongoing | $861.0 | | $966.2 | (10.9)% | |

| Direct-to-Consumer - Reported | $483.9 | | $582.4 | (16.9)% | |

| Direct-to-Consumer - Ongoing | $480.8 | | $501.2 | (4.1)% | |

| Reported Financial Metrics: | | | | |

| Gross Margin | 44.5% | | 38.9% | 560 bps | |

| Operating Expenses | $680.5 | | $940.7 | (27.7)% | |

| Operating Margin | 5.8% | | (3.0)% | 880 bps | |

| Diluted Earnings Per Share | $0.58 | | $(0.51) | 213.7% | |

| Non-GAAP and Ongoing Business Financial Metrics | | | | |

| Adjusted Gross Margin | 44.6% | | 39.9% | 470 bps | |

| Adjusted Operating Expenses | $650.5 | | $716.3 | (9.2)% | |

| Adjusted Operating Margin | 7.5% | | 3.9% | 360 bps | |

| Adjusted Diluted Earnings Per Share | $0.91 | | $0.15 | 506.7% | |

| Constant Currency Diluted Earnings Per Share | $1.02 | | $0.15 | 580.0% | |

FULL-YEAR 2025 OUTLOOK

The Company expects to build on the momentum gained in 2024 and make continued progress on its transformation in fiscal year 2025. The outlook for 2025 highlights the strength of our focused portfolio and investments to support our brands and strategic initiatives. Additionally, projections reflect the impact of foreign currency headwinds and a 53rd week, which will affect annual comparisons. A breakdown of these factors can be found in the Investor Presentation on our website.

Comparable results from 2024 for our ongoing business exclude the financial impact of Sperry which was sold in January 2024.

For fiscal year 2025, the Company expects:

•Revenue to be approximately $1.795 to $1.825 billion, representing growth of approximately 2.5% to 4.3% compared to the 2024 ongoing business and constant currency growth of approximately 4.7% to 6.5%.

•Gross margin of approximately 45.5%, up 100 basis points compared to 2024.

•Operating margin to be approximately 7.7%, up 190 basis points compared to 2024 operating margin, and adjusted operating margin to be approximately 8.3%, up 80 basis points compared to 2024 adjusted operating margin for our ongoing business.

•The effective tax rate to be approximately 18.0%.

•Diluted earnings per share in the range of $0.95 to $1.10 and adjusted diluted earnings per share in the range of $1.05 to $1.20. These full-year EPS expectations include an approximate $0.08 negative impact from expected foreign currency exchange rate fluctuations.

•Diluted weighted average shares of approximately 81.5 million.

“2024 was a pivotal year for our 142-year-old Company. While we haven't yet reached our full potential, I'm encouraged by the progress we've made and thankful for our teams and partners around the world," Hufnagel continued. "The most important chapter is the next one, as we drive together to deliver better, more consistent returns for our shareholders."

NON-GAAP FINANCIAL MEASURES

Measures referred to in this release as “adjusted” financial results and the financial results of the "ongoing business" are non-GAAP measures. Adjusted financial results exclude environmental and other related costs net of recoveries, non-cash impairment of long-lived assets, reorganization costs, gain on the sale of businesses, trademarks and long-lived assets, Sperry® store closure costs, costs associated with divestitures and pension costs. The financial results of the ongoing business exclude financial results from the Keds business, Sperry business and Wolverine Leathers business prior to the respective dates of sale of such businesses. Revenue adjusted for divestitures and business model changes excludes financial results from the Keds business, Sperry business and Wolverine Leathers business prior to the respective dates of sale of such businesses and are adjusted to include the impact of business model changes in 2023 (the transition of Hush Puppies North America to a licensing model, Hush Puppies IP sale, and conversion of the China joint ventures to the distributor model) and business model changes in 2024 (the transition of Merrell and Saucony Kids to a licensing model). The Company also presents constant currency information, which is a non-GAAP measure that excludes the impact of fluctuations in foreign currency exchange rates. The Company calculates constant currency basis by converting the current-period local currency financial results using the prior period exchange rates and comparing these adjusted amounts to the Company's current period reported results. The Company believes providing each of these non-GAAP measures provides valuable supplemental information regarding its results of operations, consistent with how the Company evaluates performance.

The Company has provided a reconciliation of each of the above non-GAAP financial measures to the most directly comparable GAAP financial measure. The Company believes these non-GAAP measures provide useful information to both management and investors because they increase the comparability of current period results to prior period results by adjusting for certain items that may not be indicative of core operating results and enable better identification of trends in our business. The adjusted financial results are used by management to, and allow investors to, evaluate the operating performance of the Company on a comparable basis. Management does not, nor should investors, consider such non-GAAP financial measures in isolation from, or as a substitute for, financial information prepared in accordance with GAAP.

EARNINGS CALL INFORMATION

The Company will host a conference call today at 8:30 a.m. ET to discuss these results and current business trends. The conference call will be broadcast live and accessible under the “Investor Relations” tab at www.wolverineworldwide.com. A replay of the conference call will be available on the Company’s website for a period of approximately 30 days.

ABOUT WOLVERINE WORLDWIDE

Founded in 1883, Wolverine World Wide, Inc. (NYSE:WWW) is one of the world’s leading marketers and licensors of branded casual, active lifestyle, work, outdoor sport, athletic, children's and uniform footwear and apparel. The Company's diverse portfolio of highly recognized brands includes Merrell®, Saucony®, Sweaty Betty®, Hush Puppies®, Wolverine®, Chaco®, Bates®, HYTEST®, and Stride Rite®. Wolverine Worldwide is also the global footwear licensee of the popular brands Cat® and Harley-Davidson®. Based in Rockford, Michigan, for more than 140 years, the Company's products are carried by leading retailers in the U.S. and globally in approximately 170 countries and territories. For additional information, please visit our website, www.wolverineworldwide.com.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements, including statements regarding the Company’s turnaround and transformation; the Company's outlook for 2025 including, among others: reported, adjusted and constant currency revenue; reported and adjusted gross margin; reported and adjusted operating margin; reported and adjusted net earnings; effective tax rate; reported and adjusted diluted earnings per share; diluted weighted average shares; as well as statements regarding the strength of the Company’s focused portfolio and investments to support its brands and strategic initiatives. and the effect of currency headwinds. In addition, words such as “estimates,” “anticipates,” “believes,” “forecasts,” “step,” “plans,” “predicts,” “focused,” “projects,” “outlook,” “is likely,” “expects,” “intends,” “should,” “will,” “confident,” variations of such words, and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties, and assumptions (“Risk Factors”) that are difficult to predict with regard to timing, extent, likelihood, and degree of occurrence. Risk Factors include, among others: changes in general economic conditions, employment rates, business conditions, interest rates, tax policies, and other factors affecting consumer spending in the markets and regions in which the Company’s products are sold; the inability for any reason to effectively compete in global footwear, apparel and direct-to-consumer markets; the inability to maintain positive brand images and anticipate, understand and respond to changing footwear and apparel trends and consumer preferences; the inability to effectively manage inventory levels; increases or changes in duties, tariffs, quotas or applicable assessments in countries of import and export; foreign currency exchange rate fluctuations; currency restrictions; supply chain and capacity constraints, production and distribution disruptions, including service interruptions at shipping and receiving ports, reduction in operating hours, labor shortages, and facility closures resulting in production delays at the Company’s manufacturers, quality issues, price increases or other risks associated with foreign sourcing; the cost, including the effect of inflationary pressures, and availability of raw materials, inventories, services and labor for contract manufacturers; changes in relationships with, including the loss of, significant wholesale customers; risks related to the significant investment in, and performance of, the Company’s direct-to-consumer operations; risks related to expansion into new markets and complementary product categories; the impact of seasonality and unpredictable weather conditions; the impact of changes in general economic conditions and/or the credit markets on the Company’s manufacturers, distributors, suppliers, joint venture partners and wholesale customers; changes in the Company’s effective tax rates; failure of licensees or distributors to meet planned annual sales goals or to make timely payments to the Company; the risks of doing business in developing countries, and politically or economically volatile areas; the ability to secure and protect owned intellectual property or use licensed intellectual property; legal compliance and litigation risks, including with respect to with federal, state and local laws and regulations relating to the protection of the environment, environmental remediation and other related costs, and environmental effects on human health; risks of breach of the Company’s databases or other systems, or those of its vendors, which contain certain personal information, payment card data or proprietary information, due to cyberattack or other similar events; strategic actions, including new initiatives and ventures, acquisitions and dispositions, and the Company’s success in integrating acquired businesses, including Sweaty Betty®; risks related to stockholder activism; the risk of impairment to goodwill and other intangibles; the success of the Company's restructuring and realignment initiatives undertaken from time to time; changes in future pension funding requirements and pension expenses; and additional factors discussed in the Company’s reports filed with the Securities and Exchange Commission and exhibits thereto. The foregoing Risk Factors, as well as other existing Risk Factors and new Risk Factors that emerge from time to time, may cause actual results to differ materially from those contained in any forward-looking statements. Given these or other risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results. Furthermore, the Company undertakes no obligation to update, amend, or clarify forward-looking statements whether as a result of new information, future events or otherwise. Any standards of measurement and performance made in reference to our environmental, social, governance and other sustainability plans and goals are developing and based on assumptions, and no assurance can be given that any such plan, initiative, projection, goal, commitment, expectation or prospect can or will be achieved.

# # #

WOLVERINE WORLD WIDE, INC.

CONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS

(Unaudited)

(In millions, except earnings per share)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended | | Fiscal Year Ended |

| December 28,

2024 | | December 30,

2023 | | December 28,

2024 | | December 30,

2023 |

Revenue | $ | 494.7 | | | $ | 526.7 | | | $ | 1,755.0 | | | $ | 2,242.9 | |

Cost of goods sold | 277.0 | | | 333.7 | | | 973.5 | | | 1,370.4 | |

| | | | | | | |

Gross profit | 217.7 | | | 193.0 | | | 781.5 | | | 872.5 | |

Gross margin | 44.0 | % | | 36.6 | % | | 44.5 | % | | 38.9 | % |

| | | | | | | |

Selling, general and administrative expenses | 175.4 | | | 245.4 | | | 690.0 | | | 856.2 | |

| Gain on sale of business, trademarks and long-lived assets | — | | | (12.6) | | | (8.5) | | | (90.4) | |

| Impairment of long-lived assets | — | | | 129.5 | | | 9.3 | | | 185.3 | |

| Environmental and other related costs (income), net of recoveries | 2.5 | | | 17.6 | | | (10.3) | | | (10.4) | |

Operating expenses | 177.9 | | | 379.9 | | | 680.5 | | | 940.7 | |

Operating expenses as a % of revenue | 36.0 | % | | 72.1 | % | | 38.8 | % | | 41.9 | % |

| | | | | | | |

| Operating profit (loss), net | 39.8 | | | (186.9) | | | 101.0 | | | (68.2) | |

Operating margin | 8.0 | % | | (35.5) | % | | 5.8 | % | | (3.0) | % |

| | | | | | | |

Interest expense, net | 9.2 | | | 16.1 | | | 42.7 | | | 63.5 | |

| | | | | | | |

| Other expense (income), net | 2.1 | | | (0.7) | | | (3.3) | | | 2.5 | |

Total other expenses | 11.3 | | | 15.4 | | | 39.4 | | | 66.0 | |

| Earnings (loss) before income taxes | 28.5 | | | (202.3) | | | 61.6 | | | (134.2) | |

| | | | | | | |

| Income tax expense (benefit) | 3.2 | | | (111.7) | | | 10.1 | | | (95.0) | |

Effective tax rate | 10.9 | % | | 55.2 | % | | 16.3 | % | | 70.7 | % |

| | | | | | | |

| Net earnings (loss) | 25.3 | | | (90.6) | | | 51.5 | | | (39.2) | |

| | | | | | | |

| Less: net earnings attributable to noncontrolling interests | 0.7 | | | 0.6 | | | 3.6 | | | 0.4 | |

| Net earnings (loss) attributable to Wolverine World Wide, Inc. | $ | 24.6 | | | $ | (91.2) | | | $ | 47.9 | | | $ | (39.6) | |

| Diluted earnings (loss) per share | $ | 0.29 | | | $ | (1.15) | | | $ | 0.58 | | | $ | (0.51) | |

| | | | | | | |

Supplemental information: | | | | | | | |

| Net earnings (loss) used to calculate diluted earnings (loss) per share | $ | 23.8 | | | $ | (91.4) | | | $ | 46.3 | | | $ | (40.3) | |

| Shares used to calculate diluted earnings (loss) per share | 80.5 | | | 79.5 | | | 80.0 | | | 79.4 | |

| | | | | | | |

WOLVERINE WORLD WIDE, INC.

CONSOLIDATED CONDENSED BALANCE SHEETS

(Unaudited)

(In millions)

| | | | | | | | | | | | | |

| December 28,

2024 | | December 30,

2023 | | |

ASSETS | | | | | |

Cash and cash equivalents | $ | 152.1 | | | $ | 179.0 | | | |

Accounts receivables, net | 209.4 | | | 230.8 | | | |

Inventories, net | 240.6 | | | 373.6 | | | |

| Current assets held for sale | — | | | 160.6 | | | |

Other current assets | 86.4 | | | 81.1 | | | |

Total current assets | 688.5 | | | 1,025.1 | | | |

Property, plant and equipment, net | 89.7 | | | 96.3 | | | |

Lease right-of-use assets | 102.1 | | | 118.2 | | | |

Goodwill and other indefinite-lived intangibles | 597.6 | | | 601.2 | | | |

Other noncurrent assets | 190.9 | | | 222.0 | | | |

Total assets | $ | 1,668.8 | | | $ | 2,062.8 | | | |

| | | | | |

LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | |

Accounts payable and other accrued liabilities | $ | 419.4 | | | $ | 519.7 | | | |

Lease liabilities | 33.7 | | | 34.7 | | | |

Current maturities of long-term debt | 10.0 | | | 10.0 | | | |

| Borrowings under revolving credit agreements | 70.0 | | | 305.0 | | | |

Total current liabilities | 533.1 | | | 869.4 | | | |

Long-term debt | 568.0 | | | 605.8 | | | |

Lease liabilities, noncurrent | 116.0 | | | 132.4 | | | |

Other noncurrent liabilities | 135.2 | | | 155.2 | | | |

Stockholders' equity | 316.5 | | | 300.0 | | | |

Total liabilities and stockholders' equity | $ | 1,668.8 | | | $ | 2,062.8 | | | |

WOLVERINE WORLD WIDE, INC.

CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS

(Unaudited)

(In millions)

| | | | | | | | | | | |

| Fiscal Year Ended |

| December 28,

2024 | | December 30,

2023 |

| OPERATING ACTIVITIES: | | | |

| Net earnings (loss) | $ | 51.5 | | | $ | (39.2) | |

| Adjustments to reconcile net earnings (loss) to net cash provided by operating activities: | | | |

| Depreciation and amortization | 26.2 | | | 35.1 | |

| Deferred income taxes | 21.4 | | | (95.8) | |

| Stock-based compensation expense | 19.1 | | | 15.2 | |

| | | |

| Pension and SERP expense | 0.2 | | | 0.7 | |

| | | |

| | | |

| Impairment of long-lived assets | 9.3 | | | 185.3 | |

| Environmental and other related costs | (13.3) | | | (55.1) | |

| Gain on sale of business, trademarks and long-lived assets | (8.5) | | | (90.4) | |

| Other | (8.4) | | | (2.0) | |

| Changes in operating assets and liabilities | 82.6 | | | 168.0 | |

| Net cash provided by operating activities | 180.1 | | | 121.8 | |

| | | |

| INVESTING ACTIVITIES: | | | |

| | | |

| Additions to property, plant and equipment | (20.2) | | | (14.6) | |

| Proceeds from sale of business, trademarks and long-lived assets, net of cash disposed of | 102.4 | | | 188.9 | |

| | | |

| Proceeds from company-owned insurance policy liquidations | 7.9 | | | — | |

| Other | (3.3) | | | (2.7) | |

| Net cash provided by investing activities | 86.8 | | | 171.6 | |

| | | |

| FINANCING ACTIVITIES: | | | |

| Payments under revolving credit agreements | (619.0) | | | (743.0) | |

| Borrowings under revolving credit agreements | 384.0 | | | 623.0 | |

| Proceeds from company-owned insurance policies | 7.0 | | | — | |

| | | |

| Payments on long-term debt | (39.2) | | | (118.3) | |

| Payments of debt issuance costs | — | | | (0.9) | |

| | | |

| Cash dividends paid | (32.5) | | | (32.6) | |

| | | |

Employee taxes paid under stock-based compensation plans | (2.6) | | | (5.8) | |

| Proceeds from the exercise of stock options | 3.1 | | | 0.1 | |

| Contributions from noncontrolling interests | — | | | 31.2 | |

| | | |

| Net cash used in financing activities | (299.2) | | | (246.3) | |

| | | |

| Effect of foreign exchange rate changes | (0.2) | | | 2.0 | |

| Increase (decrease) in cash and cash equivalents | (32.5) | | | 49.1 | |

| | | |

| Cash and cash equivalents at beginning of the year | 184.6 | | | 135.5 | |

| Cash and cash equivalents at end of the year | $ | 152.1 | | | $ | 184.6 | |

The following tables contain information regarding the non-GAAP financial measures used by the Company in the presentation of its financial results:

WOLVERINE WORLD WIDE, INC.

Q4 2024 RECONCILIATION TABLES

RECONCILIATION OF REPORTED REVENUE TO ADJUSTED

REVENUE ON A CONSTANT CURRENCY BASIS*

(Unaudited)

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP Basis 2024-Q4 | | Foreign Exchange Impact | | Constant Currency Basis 2024-Q4 | | GAAP Basis 2023-Q4 | | Reported Change | | Constant Currency Change |

| REVENUE | | | | | | | | | | | |

| Active Group | $ | 331.7 | | | $ | (1.2) | | | $ | 330.5 | | | $ | 341.3 | | | (2.8) | % | | (3.2) | % |

| Work Group | 151.1 | | | 1.0 | | | 152.1 | | | 125.3 | | | 20.6 | % | | 21.4 | % |

| Other | 11.9 | | | 1.7 | | | 13.6 | | | 60.1 | | | (80.2) | % | | (77.4) | % |

| Total | $ | 494.7 | | | $ | 1.5 | | | $ | 496.2 | | | $ | 526.7 | | | (6.1) | % | | (5.8) | % |

RECONCILIATION OF REPORTED REVENUE

TO ADJUSTED REVENUE*

(Unaudited)

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP Basis | | Divestitures (1) | | | | | | As Adjusted | | | | | | |

| | | | | | | | | | | | | | | |

Revenue - Fiscal 2024 Q4 | $ | 494.7 | | | $ | — | | | | | | | $ | 494.7 | | | | | | | |

| | | | | | | | | | | | | | | |

Revenue - Fiscal 2023 Q4 | $ | 526.7 | | | $ | 46.2 | | | | | | | $ | 480.5 | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

(1)Q4 2023 adjustments reflect results for the Sperry business and Wolverine Leathers business included in the consolidated condensed statement of operations. | | | | |

RECONCILIATION OF REPORTED GROSS MARGIN

TO ADJUSTED GROSS MARGIN *

(Unaudited)

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP Basis | | | | | | Divestitures (2) | | As Adjusted | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Gross Profit - Fiscal 2024 Q4 | $ | 217.7 | | | | | | | $ | — | | | $ | 217.7 | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Gross margin | 44.0 | % | | | | | | | | 44.0 | % | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Gross Profit - Fiscal 2023 Q4 | $ | 193.0 | | | | | | | $ | (11.4) | | | $ | 181.6 | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Gross margin | 36.6 | % | | | | | | | | 37.8 | % | | | | | | | | | | |

| | | | |

(2)Q4 2023 adjustments reflect results for the Sperry business and Wolverine Leathers business included in the consolidated condensed statement of operations. | | | | |

RECONCILIATION OF REPORTED OPERATING EXPENSES

TO ADJUSTED OPERATING EXPENSES*

(Unaudited)

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP Basis | | Adjustment (1) | | | | Divestitures (2) | | As Adjusted | | | | | | |

| | | | | | | | | | | | | | | |

Operating expenses - Fiscal 2024 Q4 | $ | 177.9 | | | $ | (10.9) | | | | | $ | — | | | $ | 167.0 | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Operating expenses - Fiscal 2023 Q4 | $ | 379.9 | | | $ | (168.8) | | | | | $ | (15.6) | | | $ | 195.5 | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

|

(1)Q4 2024 adjustments reflect $8.4 million of reorganization costs and $2.5 million of environmental and other related costs net of recoveries. Q4 2023 adjustments reflect $129.4 million for non-cash impairments of long-lived assets, $31.3 million of reorganization costs, $17.6 million of environmental and other related costs net of recoveries, and $3.1 million of costs associated with divestitures, partially offset by $12.6 million gain on the sale of businesses, trademarks and long-lived assets. | | | | |

(2)Q4 2023 adjustments reflect results for the Sperry business and Wolverine Leathers business included in the consolidated condensed statement of operations. |

RECONCILIATION OF REPORTED OPERATING MARGIN

TO ADJUSTED OPERATING MARGIN*

(Unaudited)

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP Basis | | Adjustments (1) | | | | Divestitures (2) | | As Adjusted | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Operating Profit - Fiscal 2024 Q4 | $ | 39.8 | | | $ | 10.9 | | | | | $ | — | | | $ | 50.7 | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Operating margin | 8.0 | % | | | | | | | | 10.2 | % | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Operating Profit - Fiscal 2023 Q4 | $ | (186.9) | | | $ | 168.8 | | | | | $ | 4.2 | | | $ | (13.9) | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Operating margin | (35.5) | % | | | | | | | | (2.9) | % | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

|

(1)Q4 2024 adjustments reflect $8.4 million of reorganization costs and $2.5 million of environmental and other related costs net of recoveries. Q4 2023 adjustments reflect $129.4 million for non-cash impairments of long-lived assets, $31.3 million of reorganization costs, $17.6 million of environmental and other related costs net of recoveries, and $3.1 million of costs associated with divestitures, partially offset by $12.6 million gain on the sale of businesses, trademarks and long-lived assets. | | | | |

(2)Q4 2023 adjustments reflect results for the Sperry business and Wolverine Leathers business included in the consolidated condensed statement of operations. | | | | |

RECONCILIATION OF REPORTED DILUTED EPS TO ADJUSTED

DILUTED EPS ON A CONSTANT CURRENCY BASIS*

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP Basis | | Adjustments (1) | | Divestitures (2) | | As Adjusted | | Foreign Exchange Impact | | As Adjusted

EPS On a Constant Currency Basis | | | | | | |

| | | | | | | | | | | | | | | | | |

EPS - Fiscal 2024 Q4 | $ | 0.29 | | | $ | 0.13 | | | $ | — | | | $ | 0.42 | | | $ | 0.06 | | | $ | 0.48 | | | | | | | |

| | | | | | | | | | | | | | | | | |

EPS - Fiscal 2023 Q4 | $ | (1.15) | | | $ | 0.85 | | | $ | 0.04 | | | $ | (0.26) | | | | | | | | | | | |

(1)Q4 2024 adjustments reflect reorganization costs, environmental and other related costs net of recoveries, and pension settlement costs. Q4 2023 adjustments reflect non-cash impairments of long-lived assets, reorganization costs, environmental and other related costs net of recoveries, and costs associated with divestitures, partially offset by gain on the sale of businesses, trademarks and long-lived assets and SERP curtailment gain. | | | | | | |

(2)Q4 2023 adjustments reflect results for the Sperry business and Wolverine Leathers business included in the consolidated condensed statement of operations. | | |

2024 FULL-YEAR RECONCILIATION TABLES

RECONCILIATION OF REPORTED REVENUE TO ADJUSTED

REVENUE ON A CONSTANT CURRENCY BASIS*

(Unaudited)

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP Basis 2024 | | Foreign Exchange Impact | | Constant Currency Basis 2024 | | GAAP Basis 2023 | | Reported Change | | Constant Currency Change |

| REVENUE | | | | | | | | | | | |

| Active Group | $ | 1,246.1 | | | (5.1) | | | $ | 1,241.0 | | | $ | 1,439.1 | | | (13.4) | % | | (13.8) | % |

| Work Group | 455.3 | | | 1.0 | | | 456.3 | | | 480.6 | | | (5.3) | % | | (5.1) | % |

| Other | 53.6 | | | 1.3 | | | 54.9 | | | 323.2 | | | (83.4) | % | | (83.0) | % |

| Total | $ | 1,755.0 | | | $ | (2.8) | | | $ | 1,752.2 | | | $ | 2,242.9 | | | (21.8) | % | | (21.9) | % |

RECONCILIATION OF REPORTED REVENUE

TO ADJUSTED REVENUE*

(Unaudited)

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP Basis | | Divestitures (1) | | | | | | As Adjusted | | | | | | |

| | | | | | | | | | | | | | | |

Revenue - Fiscal 2024 | $ | 1,755.0 | | | $ | 4.6 | | | | | | | $ | 1,750.4 | | | | | | | |

| | | | | | | | | | | | | | | |

Revenue - Fiscal 2023 | $ | 2,242.9 | | | $ | 250.8 | | | | | | | $ | 1,992.1 | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

(1)2024 adjustments reflect the Sperry business results included in the consolidated condensed statement of operations. 2023 adjustments reflect the Sperry business, Keds business and Wolverine Leathers business results included in the consolidated condensed statement of operations. | | | | |

RECONCILIATION OF REPORTED GROSS MARGIN

TO ADJUSTED GROSS MARGIN*

(Unaudited)

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP Basis | | Adjustments (1) | | | | Divestitures (2) | | As Adjusted | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Gross Profit - Fiscal 2024 | $ | 781.5 | | | $ | — | | | | | $ | (0.1) | | | $ | 781.4 | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Gross margin | 44.5 | % | | | | | | | | 44.6 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Gross Profit - Fiscal 2023 | $ | 872.5 | | | $ | 0.4 | | | | | $ | (78.8) | | | $ | 794.1 | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Gross margin | 38.9 | % | | | | | | | | 39.9 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

(1)2023 adjustment reflects $0.4 million of costs associated with divestitures. | | | | |

(2)2024 adjustments reflect the Sperry business results included in the consolidated condensed statement of operations. 2023 adjustments reflect the Sperry business, Keds business and Wolverine Leathers business results included in the consolidated condensed statement of operations. | | | | |

RECONCILIATION OF REPORTED OPERATING EXPENSES

TO ADJUSTED OPERATING EXPENSES*

(Unaudited)

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP Basis | | Adjustment (1) | | | | Divestitures (2) | | As Adjusted | | | | | | |

| | | | | | | | | | | | | | | |

| Operating expenses - Fiscal 2024 | $ | 680.5 | | | $ | (19.1) | | | | | $ | (10.9) | | | $ | 650.5 | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Operating expenses - Fiscal 2023 | $ | 940.7 | | | $ | (136.7) | | | | | $ | (87.7) | | | $ | 716.3 | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

|

(1)2024 adjustments reflect $28.6 million of reorganization costs and $9.3 million for non-cash impairments of long-lived assets, partially offset by $8.5 million gain on the sale of businesses, trademarks and long-lived assets and $10.3 million of environmental and other related costs net of recoveries. 2023 adjustments reflect $185.3 million for non-cash impairments of long-lived assets, $47.1 million of reorganization costs, and $5.1 million of costs associated with divestitures, partially offset by $90.4 million gain on the sale of businesses, trademarks and long-lived assets and $10.4 million of environmental and other related costs net of recoveries. | | | | |

(2)2024 adjustments reflect the Sperry business and Wolverine Leathers results included in the consolidated condensed statement of operations. 2023 adjustments reflect the Sperry business, Keds business and Wolverine Leathers business results included in the consolidated condensed statement of operations. | | |

RECONCILIATION OF REPORTED OPERATING MARGIN

TO ADJUSTED OPERATING MARGIN*

(Unaudited)

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP Basis | | Adjustments (1) | | | | Divestitures (2) | | As Adjusted | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Operating Profit (Loss) - Fiscal 2024 | $ | 101.0 | | | $ | 19.1 | | | | | $ | 10.8 | | | $ | 130.9 | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Operating margin | 5.8 | % | | | | | | | | 7.5 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Operating Profit (Loss) - Fiscal 2023 | $ | (68.2) | | | $ | 137.1 | | | | | $ | 8.9 | | | $ | 77.8 | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Operating margin | (3.0) | % | | | | | | | | 3.9 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

(1)2024 adjustments reflect $28.6 million of reorganization costs and $9.3 million for non-cash impairments of long-lived assets, partially offset by $8.5 million gain on the sale of businesses, trademarks and long-lived assets and $10.3 million of environmental and other related costs net of recoveries. 2023 adjustments reflect $185.3 million for non-cash impairments of long-lived assets, $47.1 million of reorganization costs, and $5.5 million of costs associated with divestitures, partially offset by $90.4 million gain on the sale of businesses, trademarks and long-lived assets and $10.4 million of environmental and other related costs net of recoveries. | | | | | | |

(2)2024 adjustments reflect the Sperry business results included in the consolidated condensed statement of operations. 2023 adjustments reflect the Sperry business, Keds business and Wolverine Leathers business results included in the consolidated condensed statement of operations. | | | | |

RECONCILIATION OF REPORTED DILUTED EPS TO ADJUSTED

DILUTED EPS ON A CONSTANT CURRENCY BASIS*

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP Basis | | Adjustments (1) | | Divestitures (2) | | As Adjusted | | Foreign Exchange Impact | | As Adjusted

EPS On a Constant Currency Basis | | |

| | | | | | | | | | | | | |

| EPS - Fiscal 2024 | $ | 0.58 | | | $ | 0.21 | | | $ | 0.12 | | | $ | 0.91 | | | $ | 0.11 | | | $ | 1.02 | | | |

| | | | | | | | | | | | | |

| EPS - Fiscal 2023 | $ | (0.51) | | | $ | 0.57 | | | $ | 0.09 | | | $ | 0.15 | | | | | | | |

(1)2024 adjustments reflect reorganization costs, non-cash impairments of long-lived assets, and pension settlement costs, partially offset by gain on the sale of businesses, trademarks and long-lived assets and environmental and other related costs net of recoveries. 2023 adjustments reflect non-cash impairments of long-lived assets, reorganization costs, costs associated with divestitures, and debt modification costs, partially offset by gain on the sale of businesses, trademarks and long-lived assets, environmental and other related costs net of recoveries, and SERP curtailment gain. | | |

(2)2024 adjustments reflect the Sperry business results included in the consolidated condensed statement of operations. 2023 adjustments reflect the Sperry business, Keds business and Wolverine Leathers business results included in the consolidated condensed statement of operations. | | |

DIVESTITURE

FINANCIAL SUMMARY

(Unaudited)

(In millions, except per share amounts)

In order to provide visibility regarding the financial impact of completed divestitures, the Company has provided additional information within the supplemental table below. The items included in the tables represent amounts that are reflected in the reported fiscal 2024 and 2023 results that are related to businesses the Company has sold. The Company believes providing the following information is helpful to better understand the impact of the divestitures on the Company's ongoing business.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q1 | | Q2 | | Q3 | | Q4 | | 2024

Full-Year |

Revenue - Impact |

Sperry business (1) | $ | 4.1 | | | $ | 0.4 | | | $ | 0.1 | | | $ | — | | | $ | 4.6 |

| | | | | | | | | |

Total Revenue - Impact | $ | 4.1 | | | $ | 0.4 | | | $ | 0.1 | | | $ | — | | | $ | 4.6 | |

| | | | | | | | | |

Operating profit - Impact | | | | | | | | | |

Sperry business (1) | $ | (8.2) | | | $ | (1.2) | | | $ | (0.8) | | | $ | — | | | $ | (10.2) | |

Wolverine Leathers business (2) | (0.6) | | | — | | | — | | | — | | | (0.6) | |

Total Operating profit - Impact | $ | (8.8) | | | $ | (1.2) | | | $ | (0.8) | | | $ | — | | | $ | (10.8) | |

| | | | | | | | | |

Net earnings per share - Impact | $ | (0.10) | | $ | (0.01) | | $ | (0.01) | | $ | — | | $ | (0.12) |

| | | | | | | | | |

| Q1 | | Q2 | | Q3 | | Q4 | | 2023

Full-Year |

Revenue - Impact |

Sperry business (1) | $ | 62.9 | | | $ | 57.4 | | | $ | 46.2 | | | $ | 40.7 | | | $ | 207.2 |

Wolverine Leathers business (2) | 12.5 | | | 10.9 | | | 8.2 | | | 5.5 | | | 37.1 | |

Keds business (3) | 6.5 | | | — | | | — | | | — | | | 6.5 | |

Total Revenue - Impact | $ | 81.9 | | | $ | 68.3 | | | $ | 54.4 | | | $ | 46.2 | | | $ | 250.8 | |

| | | | | | | | | |

Operating profit - Impact | | | | | | | | | |

Sperry business (1) | $ | (2.3) | | | $ | 0.2 | | | $ | (4.0) | | | $ | (4.2) | | | $ | (10.3) | |

Wolverine Leathers business (2) | 1.4 | | | 0.8 | | | 1.1 | | | — | | | 3.3 | |

Keds business (3) | (1.9) | | | — | | | — | | | — | | | (1.9) | |

Total Operating profit - Impact | $ | (2.8) | | | $ | 1.0 | | | $ | (2.9) | | | $ | (4.2) | | | $ | (8.9) | |

| | | | | | | | | |

Net earnings per share - Impact | $ | (0.03) | | $ | 0.01 | | $ | (0.03) | | $ | (0.04) | | $ | (0.09) |

(1) The Sperry® business reflects the revenue and operating profit from sale of Sperry® products through the sale of the Sperry® business effective January 10, 2024. The amounts also include revenue and operating profit associated with Sperry® stores not included in the divestiture which the Company has closed, costs associated with Sperry® employees not included in the divestiture transaction and costs incurred winding down the Sperry® business, including the Sperry® business with joint venture partners, that are not covered by the transition service agreement with the purchaser. The Sperry® business revenue and operating profit did not and will not reoccur after the Company's 2024 third quarter.

(2) The Wolverine Leathers business line item reflects revenue and operating profit from the Wolverine Leathers business that will not reoccur after the Wolverine Leathers business is sold. The Company divested the U.S. Wolverine Leathers business in August 2023 and divested the non-U.S. Wolverine Leathers business in December 2023. The Wolverine Leathers costs incurred in 2024 are associated with employees not included in the divestiture transaction.

(3) The Keds® business line item reflects the revenue and operating profit from sale of Keds® products that will not reoccur after the Company's first period in fiscal 2023 as a result of the sale of the global Keds® business effective February 4, 2023.

For purposes of providing additional information regarding year-over-year revenue comparisons, the below table adjusts 2023 revenue for divestitures and business model changes.

DIVESTITURE AND BUSINESS MODEL CHANGES

RECONCILIATION OF 2023 REPORTED REVENUE

TO ADJUSTED REVENUE*

(Unaudited)

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q1 | | Q2 | | Q3 | | Q4 | | FY | | | | |

| | | | | | | | | | | | | |

| Revenue - Fiscal 2023 | $ | 599.4 | | | $ | 589.1 | | | $ | 527.7 | | | $ | 526.7 | | | $ | 2,242.9 | | | | | |

Adjustment for divestitures (1) | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Leathers | (12.5) | | | (10.9) | | | (8.2) | | | (5.5) | | | (37.1) | | | | | |

| Keds | (6.5) | | | — | | | — | | | — | | | (6.5) | | | | | |

| Sperry | (62.9) | | | (57.4) | | | (46.2) | | | (40.7) | | | (207.2) | | | | | |

| | | | | | | | | | | | | |

Ongoing business (2) | $ | 517.5 | | | $ | 520.8 | | | $ | 473.3 | | | $ | 480.5 | | | $ | 1,992.1 | | | | | |

| | | | | | | | | | | | | |

Adjustments for 2023 business model changes (3) | (13.0) | | | (13.5) | | | (16.9) | | | (13.9) | | | (57.3) | | | | | |

Adjustments for 2024 business model changes (4) | — | | | (6.7) | | | (7.5) | | | (3.3) | | | (17.5) | | | | | |

| | | | | | | | | | | | | |

| Ongoing business adjusted for business model changes | $ | 504.5 | | | $ | 500.6 | | | $ | 448.9 | | | $ | 463.3 | | | $ | 1,917.3 | | | | | |

| | | | | | | | | | | | | |

(1)Divestitures: Keds sold in February 2023, Leathers US sold in August 2023, Leathers non-US sold in December 2023, and Sperry sold in January 2024. |

(2)Ongoing business excludes the impact of the Wolverine Leathers, Keds and Sperry businesses. |

(3)Business model changes occurring in 2023 provided for enhanced comparability, and include the impact of Hush Puppies North America transition to licensing model, Hush Puppies IP sale, and China joint venture converted to distributor model. |

(4)Business model changes occurring in 2024 provided for enhanced comparability, include the impact of Merrell and Saucony Kids transition to licensing model. |

2025 GUIDANCE RECONCILIATION TABLES

RECONCILIATION OF REPORTED GUIDANCE TO ADJUSTED GUIDANCE,

REPORTED DILUTED EPS GUIDANCE TO ADJUSTED DILUTED EPS

GUIDANCE AND SUPPLEMENTAL INFORMATION*

(Unaudited)

(In millions, except earnings per share)

| | | | | | | | | | | | | | | | | | | | | | | |

| GAAP Basis | | Adjustments (1) | | | | As Adjusted | | | | |

| | | | | | | | | | | |

| Revenue - Fiscal 2025 Full Year | $1,795 - $1,825 | | | | | | $1,795 - $1,825 | | | | |

| | | | | | | | | | | |

| Gross Margin - Fiscal 2025 Full Year | 44.5 | % | | | | | | 44.5 | % | | | | |

| | | | | | | | | | | |

| Operating Margin - Fiscal 2025 Full Year | 7.7 | % | | 0.6 | % | | | | 8.3 | % | | | | |

| | | | | | | | | | | |

| Dilutive EPS - Fiscal 2025 Full Year | $0.95 - $1.10 | | $0.10 | | | | $1.05 - $1.20 | | | | |

| | | | | | | | | | | |

| Fiscal 2025 Full Year Supplemental information: | | | | | | | | | | | |

| | | | | | | | | | | |

| Net Earnings | $81 - $93 | | $8 | | | | $89 - $101 | | | | |

| | | | | | | | | | | |

| Net Earnings used to calculate diluted earnings per share | $78 - $90 | | $8 | | | | $86 - $98 | | | | |

| | | | | | | | | | | |

| Shares used to calculate diluted earnings per share | 81.5 | | | | | | 81.5 | | | | |

| | | | | | | | | | | |

(1)2025 adjustments reflect estimated environmental and other related costs net of recoveries and reorganization costs. |

|

*To supplement the consolidated condensed financial statements presented in accordance with Generally Accepted Accounting Principles ("GAAP"), the Company describes what certain financial measures would have been if environmental and other related costs net of recoveries, non-cash impairment of long-lived assets, reorganization costs and gain on the sale of businesses, trademarks and long-lived assets, and pension costs were excluded. The financial results of the ongoing business for 2023 and 2024 exclude financial results from the Sperry business, the Keds business and Wolverine Leathers business. Revenue adjusted for divestitures and business model changes excludes financial results from the Keds business, Sperry business and Wolverine Leathers business prior to the respective dates of sale of such businesses and are adjusted to include the impact of business model changes in 2023 (the transition of Hush Puppies North America to a licensing model, Hush Puppies IP sale, and conversion of the China joint ventures to the distributor model) and business model changes in 2024 (the transition of Merrell and Saucony Kids to a licensing model). The Company believes these non-GAAP measures provide useful information to both management and investors by increasing comparability to the prior period by adjusting for certain items that may not be indicative of the Company's core ongoing operating business results and to better identify trends in the Company's ongoing business. The adjusted financial results are used by management to, and allow investors to, evaluate the operating performance of the Company on a comparable basis

The constant currency presentation, which is a non-GAAP measure, excludes the impact of fluctuations in foreign currency exchange rates. The Company believes providing constant currency information provides valuable supplemental information regarding results of operations, consistent with how the Company evaluates performance. The Company calculates constant currency by converting the current-period local currency financial results using the prior period exchange rates and comparing these adjusted amounts to the Company's current period reported results.

Management does not, nor should investors, consider such non-GAAP financial measures in isolation from, or as a substitution for, financial information prepared in accordance with GAAP. A reconciliation of all non-GAAP measures included in this press release, to the most directly comparable GAAP measures are found in the financial tables above.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

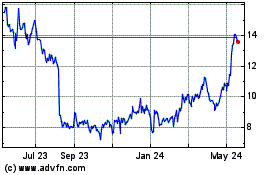

Wolverine World Wide (NYSE:WWW)

Historical Stock Chart

From Jan 2025 to Feb 2025

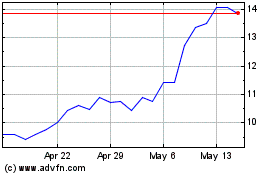

Wolverine World Wide (NYSE:WWW)

Historical Stock Chart

From Feb 2024 to Feb 2025