Company Meets Guidance, Inflects to Growth,

and Issues 2025 Outlook

In the final table with first header "2025 GUIDANCE

RECONCILIATION TABLES," the figure in the second row "Gross Margin

- Fiscal 2025 Full Year" in both the first column "GAAP Basis" and

third column "As Adjusted" should be 45.5 % (instead of 44.5

%).

The updated release reads:

WOLVERINE WORLDWIDE REPORTS FOURTH QUARTER

AND FISCAL 2024 RESULTS

Company Meets Guidance, Inflects to Growth,

and Issues 2025 Outlook

Wolverine World Wide, Inc. (NYSE: WWW) today reported financial

results for the fourth quarter and full year 2024 ended December

28, 2024.

“A year ago, we outlined an ambitious turnaround strategy

composed of three chapters: stabilization, transformation, and

inflection. We shared a plan to meaningfully strengthen the

Company's balance sheet, expand profitability, and sequentially

improve revenue trends – culminating with an inflection to growth

in the final quarter of 2024,” said Chris Hufnagel, President and

Chief Executive Officer of Wolverine Worldwide. “I'm pleased to

report that we accomplished all of these objectives. In the fourth

quarter, we exceeded our expectations for revenue and earnings and

inflected to growth as a Company – delivering

better-than-anticipated results for 2024. As we begin 2025, our

brands are poised to continue to build on our momentum, standing on

a much healthier foundation with stronger product pipelines and

compelling storytelling. Our team is encouraged by the work we've

accomplished together and excited to turn the page."

FINANCIAL HIGHLIGHTS

Financial results for 2024, and comparable results from 2023, in

each case, for our ongoing business exclude the impact of Keds,

which was sold in February 2023, the U.S. Wolverine Leathers

business, which was sold in August 2023, the non-U.S. Wolverine

Leathers business, which was sold in December 2023, and the Sperry

business, which was sold in January 2024. Tables have been provided

in the back of this release showing the impact of these adjustments

on financial results for 2024 and 2023.

FOURTH-QUARTER 2024 FINANCIAL HIGHLIGHTS

(in millions)

December 28, 2024

December 30, 2023

Y/Y Change

Constant Currency

Change

Reported Segment Revenue

Results:

Active Group

$331.7

$341.3

(2.8)%

(3.2)%

Work Group

$151.1

$125.3

20.6%

21.4%

Other

$11.9

$60.1

(80.2)%

(77.4)%

Total Revenue

$494.7

$526.7

(6.1)%

(5.8)%

Ongoing Total Revenue

$494.7

$480.5

3.0%

3.3%

Supplemental Revenue

Information

Merrell

$163.4

$161.8

1.0%

1.0%

Saucony

$99.6

$105.1

(5.3)%

(5.2)%

Wolverine

$62.4

$51.8

20.5%

20.5%

Sweaty Betty

$63.4

$67.3

(5.9)%

(7.9)%

International - Reported

$252.7

$267.2

(5.4)%

International - Ongoing

$252.7

$256.0

(1.3)%

Direct-to-Consumer - Reported

$151.7

$186.9

(18.8)%

Direct-to-Consumer - Ongoing

$151.7

$163.2

(7.0)%

Reported Financial Metrics

Gross Margin

44.0%

36.6%

740 bps

Operating Expenses

$177.9

$379.9

(53.2)%

Operating Margin

8.0%

(35.5)%

4,350 bps

Diluted Earnings Per Share

$0.29

($1.15)

125.2%

Non-GAAP and Ongoing Business

Financial Metrics

Adjusted Gross Margin

44.0%

37.8%

620 bps

Adjusted Operating Expenses

$167.0

$195.5

(14.6)%

Adjusted Operating Margin

10.2%

(2.9)%

1,310 bps

Adjusted Diluted Earnings Per Share

$0.42

$(0.26)

261.5%

Constant Currency Diluted Earnings Per

Share

$0.48

$(0.26)

284.6%

Gross margin improved significantly due to lower supply

chain costs, product costs and lower sales of end-of-life

inventory.

Inventory at the end of the quarter was $241 million and

was down $133 million or approximately 35.6% compared to the prior

year.

Net Debt at the end of the quarter was $496 million, down

$246 million or approximately 33.1% compared to the prior year.

FULL-YEAR 2024 FINANCIAL HIGHLIGHTS

(in millions)

December 28, 2024

December 30, 2023

Y/Y Change

Constant Currency

Change

Reported Segment Revenue

Results:

Active Group

$1,246.1

$1,439.1

(13.4)%

(13.8)%

Work Group

$455.3

$480.6

(5.3)%

(5.1)%

Other

$53.6

$323.2

(83.4)%

(83.0)%

Total Revenue

$1,755.0

$2,242.9

(21.8)%

(21.9)%

Ongoing Total Revenue

$1,750.4

$1,992.1

(12.1)%

(12.3)%

Supplemental Brand

Information

Merrell

$598.4

$675.8

(11.5)%

(11.5)%

Saucony

$406.5

$495.8

(18.0)%

(18.0)%

Wolverine

$193.1

$201.2

(4.0)%

(4.0)%

Sweaty Betty

$198.9

$203.8

(2.4)%

(4.6)%

International - Reported

$861.6

$1,025.0

(15.9)%

International - Ongoing

$861.0

$966.2

(10.9)%

Direct-to-Consumer - Reported

$483.9

$582.4

(16.9)%

Direct-to-Consumer - Ongoing

$480.8

$501.2

(4.1)%

Reported Financial

Metrics:

Gross Margin

44.5%

38.9%

560 bps

Operating Expenses

$680.5

$940.7

(27.7)%

Operating Margin

5.8%

(3.0)%

880 bps

Diluted Earnings Per Share

$0.58

$(0.51)

213.7%

Non-GAAP and Ongoing Business

Financial Metrics

Adjusted Gross Margin

44.6%

39.9%

470 bps

Adjusted Operating Expenses

$650.5

$716.3

(9.2)%

Adjusted Operating Margin

7.5%

3.9%

360 bps

Adjusted Diluted Earnings Per Share

$0.91

$0.15

506.7%

Constant Currency Diluted Earnings Per

Share

$1.02

$0.15

580.0%

FULL-YEAR 2025 OUTLOOK

The Company expects to build on the momentum gained in 2024 and

make continued progress on its transformation in fiscal year 2025.

The outlook for 2025 highlights the strength of our focused

portfolio and investments to support our brands and strategic

initiatives. Additionally, projections reflect the impact of

foreign currency headwinds and a 53rd week, which will affect

annual comparisons. A breakdown of these factors can be found in

the Investor Presentation on our website.

Comparable results from 2024 for our ongoing business exclude

the financial impact of Sperry which was sold in January 2024.

For fiscal year 2025, the Company expects:

- Revenue to be approximately $1.795 to $1.825 billion,

representing growth of approximately 2.5% to 4.3% compared to the

2024 ongoing business and constant currency growth of approximately

4.7% to 6.5%.

- Gross margin of approximately 45.5%, up 100 basis points

compared to 2024.

- Operating margin to be approximately 7.7%, up 190 basis

points compared to 2024 operating margin, and adjusted operating

margin to be approximately 8.3%, up 80 basis points compared to

2024 adjusted operating margin for our ongoing business.

- The effective tax rate to be approximately 18.0%.

- Diluted earnings per share in the range of $0.95 to

$1.10 and adjusted diluted earnings per share in the range of $1.05

to $1.20. These full-year EPS expectations include an approximate

$0.08 negative impact from expected foreign currency exchange rate

fluctuations.

- Diluted weighted average shares of approximately 81.5

million.

“2024 was a pivotal year for our 142-year-old Company. While we

haven't yet reached our full potential, I'm encouraged by the

progress we've made and thankful for our teams and partners around

the world," Hufnagel continued. "The most important chapter is the

next one, as we drive together to deliver better, more consistent

returns for our shareholders."

NON-GAAP FINANCIAL MEASURES

Measures referred to in this release as “adjusted” financial

results and the financial results of the "ongoing business" are

non-GAAP measures. Adjusted financial results exclude environmental

and other related costs net of recoveries, non-cash impairment of

long-lived assets, reorganization costs, gain on the sale of

businesses, trademarks and long-lived assets, Sperry® store closure

costs, costs associated with divestitures and pension costs. The

financial results of the ongoing business exclude financial results

from the Keds business, Sperry business and Wolverine Leathers

business prior to the respective dates of sale of such businesses.

Revenue adjusted for divestitures and business model changes

excludes financial results from the Keds business, Sperry business

and Wolverine Leathers business prior to the respective dates of

sale of such businesses and are adjusted to include the impact of

business model changes in 2023 (the transition of Hush Puppies

North America to a licensing model, Hush Puppies IP sale, and

conversion of the China joint ventures to the distributor model)

and business model changes in 2024 (the transition of Merrell and

Saucony Kids to a licensing model). The Company also presents

constant currency information, which is a non-GAAP measure that

excludes the impact of fluctuations in foreign currency exchange

rates. The Company calculates constant currency basis by converting

the current-period local currency financial results using the prior

period exchange rates and comparing these adjusted amounts to the

Company's current period reported results. The Company believes

providing each of these non-GAAP measures provides valuable

supplemental information regarding its results of operations,

consistent with how the Company evaluates performance.

The Company has provided a reconciliation of each of the above

non-GAAP financial measures to the most directly comparable GAAP

financial measure. The Company believes these non-GAAP measures

provide useful information to both management and investors because

they increase the comparability of current period results to prior

period results by adjusting for certain items that may not be

indicative of core operating results and enable better

identification of trends in our business. The adjusted financial

results are used by management to, and allow investors to, evaluate

the operating performance of the Company on a comparable basis.

Management does not, nor should investors, consider such non-GAAP

financial measures in isolation from, or as a substitute for,

financial information prepared in accordance with GAAP.

EARNINGS CALL INFORMATION

The Company will host a conference call today at 8:30 a.m. ET to

discuss these results and current business trends. The conference

call will be broadcast live and accessible under the “Investor

Relations” tab at www.wolverineworldwide.com. A replay of the

conference call will be available on the Company’s website for a

period of approximately 30 days.

ABOUT WOLVERINE WORLDWIDE

Founded in 1883, Wolverine World Wide, Inc. (NYSE:WWW) is one of

the world’s leading marketers and licensors of branded casual,

active lifestyle, work, outdoor sport, athletic, children's and

uniform footwear and apparel. The Company's diverse portfolio of

highly recognized brands includes Merrell®, Saucony®, Sweaty

Betty®, Hush Puppies®, Wolverine®, Chaco®, Bates®, HYTEST®, and

Stride Rite®. Wolverine Worldwide is also the global footwear

licensee of the popular brands Cat® and Harley-Davidson®. Based in

Rockford, Michigan, for more than 140 years, the Company's products

are carried by leading retailers in the U.S. and globally in

approximately 170 countries and territories. For additional

information, please visit our website,

www.wolverineworldwide.com.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements,

including statements regarding the Company’s turnaround and

transformation; the Company's outlook for 2025 including, among

others: reported, adjusted and constant currency revenue; reported

and adjusted gross margin; reported and adjusted operating margin;

reported and adjusted net earnings; effective tax rate; reported

and adjusted diluted earnings per share; diluted weighted average

shares; as well as statements regarding the strength of the

Company’s focused portfolio and investments to support its brands

and strategic initiatives. and the effect of currency headwinds. In

addition, words such as “estimates,” “anticipates,” “believes,”

“forecasts,” “step,” “plans,” “predicts,” “focused,” “projects,”

“outlook,” “is likely,” “expects,” “intends,” “should,” “will,”

“confident,” variations of such words, and similar expressions are

intended to identify forward-looking statements. These statements

are not guarantees of future performance and involve certain risks,

uncertainties, and assumptions (“Risk Factors”) that are difficult

to predict with regard to timing, extent, likelihood, and degree of

occurrence. Risk Factors include, among others: changes in general

economic conditions, employment rates, business conditions,

interest rates, tax policies, and other factors affecting consumer

spending in the markets and regions in which the Company’s products

are sold; the inability for any reason to effectively compete in

global footwear, apparel and direct-to-consumer markets; the

inability to maintain positive brand images and anticipate,

understand and respond to changing footwear and apparel trends and

consumer preferences; the inability to effectively manage inventory

levels; increases or changes in duties, tariffs, quotas or

applicable assessments in countries of import and export; foreign

currency exchange rate fluctuations; currency restrictions; supply

chain and capacity constraints, production and distribution

disruptions, including service interruptions at shipping and

receiving ports, reduction in operating hours, labor shortages, and

facility closures resulting in production delays at the Company’s

manufacturers, quality issues, price increases or other risks

associated with foreign sourcing; the cost, including the effect of

inflationary pressures, and availability of raw materials,

inventories, services and labor for contract manufacturers; changes

in relationships with, including the loss of, significant wholesale

customers; risks related to the significant investment in, and

performance of, the Company’s direct-to-consumer operations; risks

related to expansion into new markets and complementary product

categories; the impact of seasonality and unpredictable weather

conditions; the impact of changes in general economic conditions

and/or the credit markets on the Company’s manufacturers,

distributors, suppliers, joint venture partners and wholesale

customers; changes in the Company’s effective tax rates; failure of

licensees or distributors to meet planned annual sales goals or to

make timely payments to the Company; the risks of doing business in

developing countries, and politically or economically volatile

areas; the ability to secure and protect owned intellectual

property or use licensed intellectual property; legal compliance

and litigation risks, including with respect to with federal, state

and local laws and regulations relating to the protection of the

environment, environmental remediation and other related costs, and

environmental effects on human health; risks of breach of the

Company’s databases or other systems, or those of its vendors,

which contain certain personal information, payment card data or

proprietary information, due to cyberattack or other similar

events; strategic actions, including new initiatives and ventures,

acquisitions and dispositions, and the Company’s success in

integrating acquired businesses, including Sweaty Betty®; risks

related to stockholder activism; the risk of impairment to goodwill

and other intangibles; the success of the Company's restructuring

and realignment initiatives undertaken from time to time; changes

in future pension funding requirements and pension expenses; and

additional factors discussed in the Company’s reports filed with

the Securities and Exchange Commission and exhibits thereto. The

foregoing Risk Factors, as well as other existing Risk Factors and

new Risk Factors that emerge from time to time, may cause actual

results to differ materially from those contained in any

forward-looking statements. Given these or other risks and

uncertainties, investors should not place undue reliance on

forward-looking statements as a prediction of actual results.

Furthermore, the Company undertakes no obligation to update, amend,

or clarify forward-looking statements whether as a result of new

information, future events or otherwise. Any standards of

measurement and performance made in reference to our environmental,

social, governance and other sustainability plans and goals are

developing and based on assumptions, and no assurance can be given

that any such plan, initiative, projection, goal, commitment,

expectation or prospect can or will be achieved.

WOLVERINE WORLD WIDE,

INC.

CONSOLIDATED CONDENSED

STATEMENTS OF OPERATIONS

(Unaudited)

(In millions, except earnings

per share)

Quarter Ended

Fiscal Year Ended

December 28, 2024

December 30, 2023

December 28, 2024

December 30, 2023

Revenue

$

494.7

$

526.7

$

1,755.0

$

2,242.9

Cost of goods sold

277.0

333.7

973.5

1,370.4

Gross profit

217.7

193.0

781.5

872.5

Gross margin

44.0

%

36.6

%

44.5

%

38.9

%

Selling, general and administrative

expenses

175.4

245.4

690.0

856.2

Gain on sale of business, trademarks and

long-lived assets

—

(12.6

)

(8.5

)

(90.4

)

Impairment of long-lived assets

—

129.5

9.3

185.3

Environmental and other related costs

(income), net of recoveries

2.5

17.6

(10.3

)

(10.4

)

Operating expenses

177.9

379.9

680.5

940.7

Operating expenses as a % of revenue

36.0

%

72.1

%

38.8

%

41.9

%

Operating profit (loss), net

39.8

(186.9

)

101.0

(68.2

)

Operating margin

8.0

%

(35.5

)%

5.8

%

(3.0

)%

Interest expense, net

9.2

16.1

42.7

63.5

Other expense (income), net

2.1

(0.7

)

(3.3

)

2.5

Total other expenses

11.3

15.4

39.4

66.0

Earnings (loss) before income taxes

28.5

(202.3

)

61.6

(134.2

)

Income tax expense (benefit)

3.2

(111.7

)

10.1

(95.0

)

Effective tax rate

10.9

%

55.2

%

16.3

%

70.7

%

Net earnings (loss)

25.3

(90.6

)

51.5

(39.2

)

Less: net earnings attributable to

noncontrolling interests

0.7

0.6

3.6

0.4

Net earnings (loss) attributable to

Wolverine World Wide, Inc.

$

24.6

$

(91.2

)

$

47.9

$

(39.6

)

Diluted earnings (loss) per share

$

0.29

$

(1.15

)

$

0.58

$

(0.51

)

Supplemental information:

Net earnings (loss) used to calculate

diluted earnings (loss) per share

$

23.8

$

(91.4

)

$

46.3

$

(40.3

)

Shares used to calculate diluted earnings

(loss) per share

80.5

79.5

80.0

79.4

WOLVERINE WORLD WIDE,

INC.

CONSOLIDATED CONDENSED BALANCE

SHEETS

(Unaudited)

(In millions)

December 28, 2024

December 30, 2023

ASSETS

Cash and cash equivalents

$

152.1

$

179.0

Accounts receivables, net

209.4

230.8

Inventories, net

240.6

373.6

Current assets held for sale

—

160.6

Other current assets

86.4

81.1

Total current assets

688.5

1,025.1

Property, plant and equipment, net

89.7

96.3

Lease right-of-use assets

102.1

118.2

Goodwill and other indefinite-lived

intangibles

597.6

601.2

Other noncurrent assets

190.9

222.0

Total assets

$

1,668.8

$

2,062.8

LIABILITIES AND STOCKHOLDERS'

EQUITY

Accounts payable and other accrued

liabilities

$

419.4

$

519.7

Lease liabilities

33.7

34.7

Current maturities of long-term debt

10.0

10.0

Borrowings under revolving credit

agreements

70.0

305.0

Total current liabilities

533.1

869.4

Long-term debt

568.0

605.8

Lease liabilities, noncurrent

116.0

132.4

Other noncurrent liabilities

135.2

155.2

Stockholders' equity

316.5

300.0

Total liabilities and stockholders'

equity

$

1,668.8

$

2,062.8

WOLVERINE WORLD WIDE,

INC.

CONSOLIDATED CONDENSED

STATEMENTS OF CASH FLOWS

(Unaudited)

(In millions)

Fiscal Year Ended

December 28, 2024

December 30, 2023

OPERATING ACTIVITIES:

Net earnings (loss)

$

51.5

$

(39.2

)

Adjustments to reconcile net earnings

(loss) to net cash provided by operating activities:

Depreciation and amortization

26.2

35.1

Deferred income taxes

21.4

(95.8

)

Stock-based compensation expense

19.1

15.2

Pension and SERP expense

0.2

0.7

Impairment of long-lived assets

9.3

185.3

Environmental and other related costs

(13.3

)

(55.1

)

Gain on sale of business, trademarks and

long-lived assets

(8.5

)

(90.4

)

Other

(8.4

)

(2.0

)

Changes in operating assets and

liabilities

82.6

168.0

Net cash provided by operating

activities

180.1

121.8

INVESTING ACTIVITIES:

Additions to property, plant and

equipment

(20.2

)

(14.6

)

Proceeds from sale of business, trademarks

and long-lived assets, net of cash disposed of

102.4

188.9

Proceeds from company-owned insurance

policy liquidations

7.9

—

Other

(3.3

)

(2.7

)

Net cash provided by investing

activities

86.8

171.6

FINANCING ACTIVITIES:

Payments under revolving credit

agreements

(619.0

)

(743.0

)

Borrowings under revolving credit

agreements

384.0

623.0

Proceeds from company-owned insurance

policies

7.0

—

Payments on long-term debt

(39.2

)

(118.3

)

Payments of debt issuance costs

—

(0.9

)

Cash dividends paid

(32.5

)

(32.6

)

Employee taxes paid under stock-based

compensation plans

(2.6

)

(5.8

)

Proceeds from the exercise of stock

options

3.1

0.1

Contributions from noncontrolling

interests

—

31.2

Net cash used in financing activities

(299.2

)

(246.3

)

Effect of foreign exchange rate

changes

(0.2

)

2.0

Increase (decrease) in cash and cash

equivalents

(32.5

)

49.1

Cash and cash equivalents at beginning of

the year

184.6

135.5

Cash and cash equivalents at end of the

year

$

152.1

$

184.6

The following tables contain information regarding the non-GAAP

financial measures used by the Company in the presentation of its

financial results:

WOLVERINE WORLD WIDE,

INC.

Q4 2024 RECONCILIATION

TABLES

RECONCILIATION OF REPORTED

REVENUE TO ADJUSTED

REVENUE ON A CONSTANT CURRENCY

BASIS*

(Unaudited)

(In millions)

GAAP Basis 2024-Q4

Foreign Exchange

Impact

Constant Currency Basis

2024-Q4

GAAP Basis 2023-Q4

Reported Change

Constant Currency

Change

REVENUE

Active Group

$

331.7

$

(1.2

)

$

330.5

$

341.3

(2.8

)%

(3.2

)%

Work Group

151.1

1.0

152.1

125.3

20.6

%

21.4

%

Other

11.9

1.7

13.6

60.1

(80.2

)%

(77.4

)%

Total

$

494.7

$

1.5

$

496.2

$

526.7

(6.1

)%

(5.8

)%

RECONCILIATION OF REPORTED

REVENUE

TO ADJUSTED REVENUE*

(Unaudited)

(In millions)

GAAP Basis

Divestitures (1)

As Adjusted

Revenue - Fiscal 2024 Q4

$

494.7

$

—

$

494.7

Revenue - Fiscal 2023 Q4

$

526.7

$

46.2

$

480.5

(1)

Q4 2023 adjustments reflect results for

the Sperry business and Wolverine Leathers business included in the

consolidated condensed statement of operations.

RECONCILIATION OF REPORTED

GROSS MARGIN

TO ADJUSTED GROSS MARGIN

*

(Unaudited)

(In millions)

GAAP Basis

Divestitures (2)

As Adjusted

Gross Profit - Fiscal 2024 Q4

$

217.7

$

—

$

217.7

Gross margin

44.0

%

44.0

%

Gross Profit - Fiscal 2023 Q4

$

193.0

$

(11.4

)

$

181.6

Gross margin

36.6

%

37.8

%

(2)

Q4 2023 adjustments reflect results for

the Sperry business and Wolverine Leathers business included in the

consolidated condensed statement of operations.

RECONCILIATION OF REPORTED OPERATING EXPENSES

TO ADJUSTED OPERATING

EXPENSES*

(Unaudited)

(In millions)

GAAP Basis

Adjustment (1)

Divestitures (2)

As Adjusted

Operating expenses - Fiscal 2024 Q4

$

177.9

$

(10.9

)

$

—

$

167.0

Operating expenses - Fiscal 2023 Q4

$

379.9

$

(168.8

)

$

(15.6

)

$

195.5

(1)

Q4 2024 adjustments reflect $8.4

million of reorganization costs and $2.5 million of environmental

and other related costs net of recoveries. Q4 2023 adjustments

reflect $129.4 million for non-cash impairments of long-lived

assets, $31.3 million of reorganization costs, $17.6 million of

environmental and other related costs net of recoveries, and $3.1

million of costs associated with divestitures, partially offset by

$12.6 million gain on the sale of businesses, trademarks and

long-lived assets.

(2)

Q4 2023 adjustments reflect

results for the Sperry business and Wolverine Leathers business

included in the consolidated condensed statement of operations.

RECONCILIATION OF REPORTED

OPERATING MARGIN

TO ADJUSTED OPERATING

MARGIN*

(Unaudited)

(In millions)

GAAP Basis

Adjustments (1)

Divestitures (2)

As Adjusted

Operating Profit - Fiscal 2024 Q4

$

39.8

$

10.9

$

—

$

50.7

Operating margin

8.0

%

10.2

%

Operating Profit - Fiscal 2023 Q4

$

(186.9

)

$

168.8

$

4.2

$

(13.9

)

Operating margin

(35.5

)%

(2.9

)%

(1)

Q4 2024 adjustments reflect $8.4 million of reorganization costs

and $2.5 million of environmental and other related costs net of

recoveries. Q4 2023 adjustments reflect $129.4 million for non-cash

impairments of long-lived assets, $31.3 million of reorganization

costs, $17.6 million of environmental and other related costs net

of recoveries, and $3.1 million of costs associated with

divestitures, partially offset by $12.6 million gain on the sale of

businesses, trademarks and long-lived assets.

(2)

Q4 2023 adjustments reflect results for

the Sperry business and Wolverine Leathers business included in the

consolidated condensed statement of operations.

RECONCILIATION OF REPORTED

DILUTED EPS TO ADJUSTED

DILUTED EPS ON A CONSTANT

CURRENCY BASIS*

(Unaudited)

GAAP Basis

Adjustments (1)

Divestitures (2)

As Adjusted

Foreign Exchange

Impact

As Adjusted

EPS On a Constant Currency

Basis

EPS - Fiscal 2024 Q4

$

0.29

$

0.13

$

—

$

0.42

$

0.06

$

0.48

EPS - Fiscal 2023 Q4

$

(1.15

)

$

0.85

$

0.04

$

(0.26

)

(1)

Q4 2024 adjustments reflect reorganization

costs, environmental and other related costs net of recoveries, and

pension settlement costs. Q4 2023 adjustments reflect non-cash

impairments of long-lived assets, reorganization costs,

environmental and other related costs net of recoveries, and costs

associated with divestitures, partially offset by gain on the sale

of businesses, trademarks and long-lived assets and SERP

curtailment gain.

(2)

Q4 2023 adjustments reflect results for

the Sperry business and Wolverine Leathers business included in the

consolidated condensed statement of operations.

2024 FULL-YEAR RECONCILIATION

TABLES

RECONCILIATION OF

REPORTED REVENUE TO ADJUSTED

REVENUE ON A CONSTANT CURRENCY

BASIS*

(Unaudited)

(In millions)

GAAP Basis 2024

Foreign Exchange

Impact

Constant Currency Basis

2024

GAAP Basis 2023

Reported Change

Constant Currency

Change

REVENUE

Active Group

$

1,246.1

(5.1

)

$

1,241.0

$

1,439.1

(13.4

)%

(13.8

)%

Work Group

455.3

1.0

456.3

480.6

(5.3

)%

(5.1

)%

Other

53.6

1.3

54.9

323.2

(83.4

)%

(83.0

)%

Total

$

1,755.0

$

(2.8

)

$

1,752.2

$

2,242.9

(21.8

)%

(21.9

)%

RECONCILIATION OF REPORTED

REVENUE

TO ADJUSTED REVENUE*

(Unaudited)

(In millions)

GAAP Basis

Divestitures (1)

As Adjusted

Revenue - Fiscal 2024

$

1,755.0

$

4.6

$

1,750.4

Revenue - Fiscal 2023

$

2,242.9

$

250.8

$

1,992.1

(1)

2024 adjustments reflect the Sperry

business results included in the consolidated condensed statement

of operations. 2023 adjustments reflect the Sperry business, Keds

business and Wolverine Leathers business results included in the

consolidated condensed statement of operations.

RECONCILIATION OF REPORTED

GROSS MARGIN

TO ADJUSTED GROSS

MARGIN*

(Unaudited)

(In millions)

GAAP Basis

Adjustments (1)

Divestitures (2)

As Adjusted

Gross Profit - Fiscal 2024

$

781.5

$

—

$

(0.1

)

$

781.4

Gross margin

44.5

%

44.6

%

Gross Profit - Fiscal 2023

$

872.5

$

0.4

$

(78.8

)

$

794.1

Gross margin

38.9

%

39.9

%

(1)

2023 adjustment reflects $0.4 million of

costs associated with divestitures.

(2)

2024 adjustments reflect the Sperry

business results included in the consolidated condensed statement

of operations. 2023 adjustments reflect the Sperry business, Keds

business and Wolverine Leathers business results included in the

consolidated condensed statement of operations.

RECONCILIATION OF REPORTED

OPERATING EXPENSES

TO ADJUSTED OPERATING

EXPENSES*

(Unaudited)

(In millions)

GAAP Basis

Adjustment (1)

Divestitures (2)

As Adjusted

Operating expenses - Fiscal 2024

$

680.5

$

(19.1

)

$

(10.9

)

$

650.5

Operating expenses - Fiscal 2023

$

940.7

$

(136.7

)

$

(87.7

)

$

716.3

(1)

2024 adjustments reflect $28.6 million of

reorganization costs and $9.3 million for non-cash impairments of

long-lived assets, partially offset by $8.5 million gain on the

sale of businesses, trademarks and long-lived assets and $10.3

million of environmental and other related costs net of recoveries.

2023 adjustments reflect $185.3 million for non-cash impairments of

long-lived assets, $47.1 million of reorganization costs, and $5.1

million of costs associated with divestitures, partially offset by

$90.4 million gain on the sale of businesses, trademarks and

long-lived assets and $10.4 million of environmental and other

related costs net of recoveries.

(2)

2024 adjustments reflect the Sperry

business and Wolverine Leathers results included in the

consolidated condensed statement of operations. 2023 adjustments

reflect the Sperry business, Keds business and Wolverine Leathers

business results included in the consolidated condensed statement

of operations.

RECONCILIATION OF

REPORTED OPERATING MARGIN

TO ADJUSTED OPERATING

MARGIN*

(Unaudited)

(In millions)

GAAP Basis

Adjustments (1)

Divestitures (2)

As Adjusted

Operating Profit (Loss) - Fiscal 2024

$

101.0

$

19.1

$

10.8

$

130.9

Operating margin

5.8

%

7.5

%

Operating Profit (Loss) - Fiscal 2023

$

(68.2

)

$

137.1

$

8.9

$

77.8

Operating margin

(3.0

)%

3.9

%

(1)

2024 adjustments reflect $28.6 million of

reorganization costs and $9.3 million for non-cash impairments of

long-lived assets, partially offset by $8.5 million gain on the

sale of businesses, trademarks and long-lived assets and $10.3

million of environmental and other related costs net of recoveries.

2023 adjustments reflect $185.3 million for non-cash impairments of

long-lived assets, $47.1 million of reorganization costs, and $5.5

million of costs associated with divestitures, partially offset by

$90.4 million gain on the sale of businesses, trademarks and

long-lived assets and $10.4 million of environmental and other

related costs net of recoveries.

(2)

2024 adjustments reflect the Sperry

business results included in the consolidated condensed statement

of operations. 2023 adjustments reflect the Sperry business, Keds

business and Wolverine Leathers business results included in the

consolidated condensed statement of operations.

RECONCILIATION OF REPORTED

DILUTED EPS TO ADJUSTED

DILUTED EPS ON A CONSTANT

CURRENCY BASIS*

(Unaudited)

GAAP Basis

Adjustments (1)

Divestitures (2)

As Adjusted

Foreign Exchange

Impact

As Adjusted

EPS On a Constant Currency

Basis

EPS - Fiscal 2024

$

0.58

$

0.21

$

0.12

$

0.91

$

0.11

$

1.02

EPS - Fiscal 2023

$

(0.51

)

$

0.57

$

0.09

$

0.15

(1)

2024 adjustments reflect reorganization

costs, non-cash impairments of long-lived assets, and pension

settlement costs, partially offset by gain on the sale of

businesses, trademarks and long-lived assets and environmental and

other related costs net of recoveries. 2023 adjustments reflect

non-cash impairments of long-lived assets, reorganization costs,

costs associated with divestitures, and debt modification costs,

partially offset by gain on the sale of businesses, trademarks and

long-lived assets, environmental and other related costs net of

recoveries, and SERP curtailment gain.

(2)

2024 adjustments reflect the Sperry

business results included in the consolidated condensed statement

of operations. 2023 adjustments reflect the Sperry business, Keds

business and Wolverine Leathers business results included in the

consolidated condensed statement of operations.

DIVESTITURE FINANCIAL SUMMARY

(Unaudited) (In millions, except per share

amounts)

In order to provide visibility regarding the financial impact of

completed divestitures, the Company has provided additional

information within the supplemental table below. The items included

in the tables represent amounts that are reflected in the reported

fiscal 2024 and 2023 results that are related to businesses the

Company has sold. The Company believes providing the following

information is helpful to better understand the impact of the

divestitures on the Company's ongoing business.

Q1

Q2

Q3

Q4

2024

Full-Year

Revenue - Impact

Sperry business (1)

$

4.1

$

0.4

$

0.1

$

—

$

4.6

Total Revenue - Impact

$

4.1

$

0.4

$

0.1

$

—

$

4.6

Operating profit - Impact

Sperry business (1)

$

(8.2

)

$

(1.2

)

$

(0.8

)

$

—

$

(10.2

)

Wolverine Leathers business (2)

(0.6

)

—

—

—

(0.6

)

Total Operating profit - Impact

$

(8.8

)

$

(1.2

)

$

(0.8

)

$

—

$

(10.8

)

Net earnings per share - Impact

$

(0.10

)

$

(0.01

)

$

(0.01

)

$

—

$

(0.12

)

Q1

Q2

Q3

Q4

2023

Full-Year

Revenue - Impact

Sperry business (1)

$

62.9

$

57.4

$

46.2

$

40.7

$

207.2

Wolverine Leathers business (2)

12.5

10.9

8.2

5.5

37.1

Keds business (3)

6.5

—

—

—

6.5

Total Revenue - Impact

$

81.9

$

68.3

$

54.4

$

46.2

$

250.8

Operating profit - Impact

Sperry business (1)

$

(2.3

)

$

0.2

$

(4.0

)

$

(4.2

)

$

(10.3

)

Wolverine Leathers business (2)

1.4

0.8

1.1

—

3.3

Keds business (3)

(1.9

)

—

—

—

(1.9

)

Total Operating profit - Impact

$

(2.8

)

$

1.0

$

(2.9

)

$

(4.2

)

$

(8.9

)

Net earnings per share - Impact

$

(0.03

)

$

0.01

$

(0.03

)

$

(0.04

)

$

(0.09

)

(1)

The Sperry® business reflects the revenue

and operating profit from sale of Sperry® products through the sale

of the Sperry® business effective January 10, 2024. The amounts

also include revenue and operating profit associated with Sperry®

stores not included in the divestiture which the Company has

closed, costs associated with Sperry® employees not included in the

divestiture transaction and costs incurred winding down the Sperry®

business, including the Sperry® business with joint venture

partners, that are not covered by the transition service agreement

with the purchaser. The Sperry® business revenue and operating

profit did not and will not reoccur after the Company's 2024 third

quarter.

(2)

The Wolverine Leathers business line item

reflects revenue and operating profit from the Wolverine Leathers

business that will not reoccur after the Wolverine Leathers

business is sold. The Company divested the U.S. Wolverine Leathers

business in August 2023 and divested the non-U.S. Wolverine

Leathers business in December 2023. The Wolverine Leathers costs

incurred in 2024 are associated with employees not included in the

divestiture transaction.

(3)

The Keds® business line item reflects the revenue and operating

profit from sale of Keds® products that will not reoccur after the

Company's first period in fiscal 2023 as a result of the sale of

the global Keds® business effective February 4, 2023.

For purposes of providing additional information regarding

year-over-year revenue comparisons, the below table adjusts 2023

revenue for divestitures and business model changes.

DIVESTITURE AND BUSINESS MODEL

CHANGES

RECONCILIATION OF 2023

REPORTED REVENUE

TO ADJUSTED REVENUE*

(Unaudited)

(In millions)

Q1

Q2

Q3

Q4

FY

Revenue - Fiscal 2023

$

599.4

$

589.1

$

527.7

$

526.7

$

2,242.9

Adjustment for divestitures (1)

Leathers

(12.5

)

(10.9

)

(8.2

)

(5.5

)

(37.1

)

Keds

(6.5

)

—

—

—

(6.5

)

Sperry

(62.9

)

(57.4

)

(46.2

)

(40.7

)

(207.2

)

Ongoing business (2)

$

517.5

$

520.8

$

473.3

$

480.5

$

1,992.1

Adjustments for 2023 business model

changes (3)

(13.0

)

(13.5

)

(16.9

)

(13.9

)

(57.3

)

Adjustments for 2024 business model

changes (4)

—

(6.7

)

(7.5

)

(3.3

)

(17.5

)

Ongoing business adjusted for business

model changes

$

504.5

$

500.6

$

448.9

$

463.3

$

1,917.3

(1)

Divestitures: Keds sold in February 2023,

Leathers US sold in August 2023, Leathers non-US sold in December

2023, and Sperry sold in January 2024.

(2)

Ongoing business excludes the impact of

the Wolverine Leathers, Keds and Sperry businesses.

(3)

Business model changes occurring in 2023

provided for enhanced comparability, and include the impact of Hush

Puppies North America transition to licensing model, Hush Puppies

IP sale, and China joint venture converted to distributor

model.

(4)

Business model changes occurring in 2024

provided for enhanced comparability, include the impact of Merrell

and Saucony Kids transition to licensing model.

2025 GUIDANCE RECONCILIATION

TABLES

RECONCILIATION OF REPORTED

GUIDANCE TO ADJUSTED GUIDANCE,

REPORTED DILUTED EPS GUIDANCE

TO ADJUSTED DILUTED EPS

GUIDANCE AND SUPPLEMENTAL

INFORMATION*

(Unaudited)

(In millions, except earnings

per share)

GAAP Basis

Adjustments (1)

As Adjusted

Revenue - Fiscal 2025 Full Year

$1,795 - $1,825

$1,795 - $1,825

Gross Margin - Fiscal 2025 Full Year

45.5 %

45.5 %

Operating Margin - Fiscal 2025 Full

Year

7.7 %

0.6 %

8.3 %

Dilutive EPS - Fiscal 2025 Full Year

$0.95 - $1.10

$0.10

$1.05 - $1.20

Fiscal 2025 Full Year Supplemental

information:

Net Earnings

$81 - $93

$8

$89 - $101

Net Earnings used to calculate diluted

earnings per share

$78 - $90

$8

$86 - $98

Shares used to calculate diluted earnings

per share

81.5

81.5

(1)

2025 adjustments reflect estimated

environmental and other related costs net of recoveries and

reorganization costs.

* To supplement the consolidated condensed financial statements

presented in accordance with Generally Accepted Accounting

Principles ("GAAP"), the Company describes what certain financial

measures would have been if environmental and other related costs

net of recoveries, non-cash impairment of long-lived assets,

reorganization costs and gain on the sale of businesses, trademarks

and long-lived assets, and pension costs were excluded. The

financial results of the ongoing business for 2023 and 2024 exclude

financial results from the Sperry business, the Keds business and

Wolverine Leathers business. Revenue adjusted for divestitures and

business model changes excludes financial results from the Keds

business, Sperry business and Wolverine Leathers business prior to

the respective dates of sale of such businesses and are adjusted to

include the impact of business model changes in 2023 (the

transition of Hush Puppies North America to a licensing model, Hush

Puppies IP sale, and conversion of the China joint ventures to the

distributor model) and business model changes in 2024 (the

transition of Merrell and Saucony Kids to a licensing model). The

Company believes these non-GAAP measures provide useful information

to both management and investors by increasing comparability to the

prior period by adjusting for certain items that may not be

indicative of the Company's core ongoing operating business results

and to better identify trends in the Company's ongoing business.

The adjusted financial results are used by management to, and allow

investors to, evaluate the operating performance of the Company on

a comparable basis

The constant currency presentation, which is a non-GAAP measure,

excludes the impact of fluctuations in foreign currency exchange

rates. The Company believes providing constant currency information

provides valuable supplemental information regarding results of

operations, consistent with how the Company evaluates performance.

The Company calculates constant currency by converting the

current-period local currency financial results using the prior

period exchange rates and comparing these adjusted amounts to the

Company's current period reported results.

Management does not, nor should investors, consider such

non-GAAP financial measures in isolation from, or as a substitution

for, financial information prepared in accordance with GAAP. A

reconciliation of all non-GAAP measures included in this press

release, to the most directly comparable GAAP measures are found in

the financial tables above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250219367570/en/

Alex Wiseman (616) 863-3974

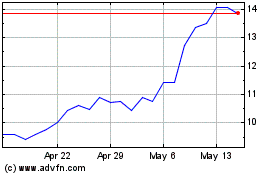

Wolverine World Wide (NYSE:WWW)

Historical Stock Chart

From Jan 2025 to Feb 2025

Wolverine World Wide (NYSE:WWW)

Historical Stock Chart

From Feb 2024 to Feb 2025