Shell to Join World's Largest LNG Project in Qatar -- Update

05 July 2022 - 10:44PM

Dow Jones News

By Jaime Llinares Taboada

Shell PLC said Tuesday that it has been chosen by QatarEnergy to

participate in the $29 billion North Field East liquefied natural

gas expansion project in Qatar.

The U.K. energy company said it will hold a 25% stake in a

joint-venture company that will own 25% of North Field East.

QatarEnergy will own the remaining 75% of the project to build four

LNG trains with a combined liquefaction capacity of 32 million

metric tons a year.

Last month, Exxon Mobil Corp., TotalEnergies SE and ENI SpA were

also chosen to join the project.

This is the largest project in the history of the LNG industry

and will support the delivery of much-needed gas supplies to market

around the world, Shell said.

North Field East will expand Qatar's annual LNG capacity to 110

million tons by 2026 from the current 77 million tons, placing the

country as the largest LNG producer in the world. The project will

require an investment of $28.75 billion, according to ENI.

"Through its pioneering integration with carbon capture and

storage, this landmark project will help provide LNG the world

urgently needs with a lower carbon footprint," Shell's Chief

Executive Ben van Beurden said.

LNG, which is transported by ship, is viewed as the main option

for Europe to replace pipeline gas imports from Russia. Qatar

traditionally exports most of its LNG to other countries in Asia,

but European buyers willing to pay a premium could result in higher

seaborne deliveries to Europe.

Shares in Shell at 1205 GMT were down 2.3% at 2,153.0 pence.

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

July 05, 2022 08:29 ET (12:29 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

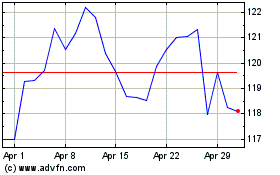

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

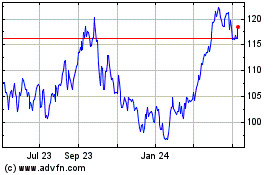

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2023 to Apr 2024