|

Notice Of Exempt Solicitation: (VOLUNTARY SUBMISSION)

NAME OF REGISTRANT: Exxon

Mobil Corporation

NAME OF PERSON RELYING ON EXEMPTION: Majority

Action

ADDRESS OF PERSON RELYING ON EXEMPTION:

PO Box 4831, Silver Spring, MD 20914

Written materials are submitted pursuant to Rule 14a-6(g)(1) promulgated under the

Securities Exchange Act of 1934. Submission is not required of this filer under the terms of the Rule but is made voluntarily.

|

|

Exxon Mobil Corp [NYSE: XOM]:

Due to the company’s FAILURE to:

| ● | Set

a robust net zero by 2050 target that includes its scope 3 greenhouse gas (GHG) emissions

|

| ● | Align

its capital allocation with limiting warming to 1.5°C, and |

| ● | Commit

to conduct all of its lobbying in line with the goals of the Paris Agreement, and its general

opposition to U.S. federal and state climate policy; |

Vote AGAINST:

| ● | Darren

W. Woods, CEO and Chairman (item 1.12), |

| ● | Joseph

L. Hooley, Lead Independent Director (item 1.07), and |

| ● | Susan

K. Avery, Chair of the Environment, Safety and Public Policy Committee (item 1.02) |

The physical and financial risks posed by climate change

to long-term investors are systemic, portfolio-wide, unhedgeable and undiversifiable. Therefore, the actions of companies

that fail to align to limiting warming to 1.5°C pose risks to the financial system as a whole, and to investors’ entire portfolios.

See www.proxyvoting.majorityaction.us for more information regarding Majority Action’s

Proxy Voting for a 1.5°C World initiative and the transformation required in key industries.

Exxon Mobil Corp (Exxon) is the largest oil producer

in the U.S.1 and among the top producers in the world.2 Exxon is one of the 166 target companies

named by Climate Action 100+ as the largest global emitters and “key to driving the global net zero emissions transition.”

Petroleum and fossil gas products, including those used

in transportation, buildings, industrial processes, and electricity production, account for nearly 80% of carbon emissions from the U.S.

energy system.3 In 2021, the International Energy Agency (IEA) released its Net Zero Emissions by 2050 Scenario

(NZE), which sets out a pathway to reduce emissions from the global energy system aligned with limiting warming to 1.5°C. Under the

NZE, fossil fuel use falls dramatically in the next decade, and remaining fossil fuel demand can be met through existing supplies and

infrastructure. Approving new oil and gas fields is incompatible with this pathway.

Failure to set ambitious decarbonization

targets in line with 1.5°C pathways,

and to align companies’ business plans and policy influence to those targets, is a failure of strategy and corporate governance,

for which long-term investors should hold directors accountable. At companies where the production,

processing, sale, and/or consumption of fossil fuels is central to their core business, GHG emissions reductions have profound strategic

implications. The board chair, lead independent director where the position exists, and other board members with climate-related oversight

responsibilities should be held accountable for oversight failures related to decarbonization.

In 2023, we have updated our metrics to more closely

align with the Climate Action 100+ Net Zero Benchmark Indicators for the oil and gas sector, while still focusing on the three

core pillars of target setting, capital allocation, and policy influence. This allows for a more standardized assessment across companies

that is broadly accepted by investors.

Target setting

| Climate Action 100+ Net Zero Benchmark Indicators |

|

| Disclosure Indicator 1.1 |

The company has set an ambition to achieve net zero GHG emissions by 2050 or sooner. |

- |

| |

Disclosure Indicator 1.1A |

The company has made a qualitative net zero GHG emissions ambition statement that explicitly includes at least 95% of its scope 1 and 2 emissions. |

✓ |

| |

Disclosure Indicator 1.1B |

The company’s net zero GHG emissions ambition covers the most relevant scope 3 GHG emissions categories for the company’s sector, where applicable. |

X |

| Disclosure Indicator 3.1 |

The company has set a target for reducing its GHG emissions by between 2026 and 2035 on a clearly defined scope of emissions. |

X |

| Disclosure Indicator 3.2 |

The medium-term (2026 to 2035) GHG reduction target covers at least 95% of scope 1 & 2 emissions and the most relevant scope 3 emissions (where applicable). |

X |

| |

Disclosure Indicator 3.2A |

The company has specified that this target covers at least 95% of its total scope 1 and 2 emissions. |

X |

| |

Disclosure Indicator 3.2B |

If the company has set a scope 3 GHG emissions target, it covers the most relevant scope 3 emissions categories for the company’s sector (for applicable sectors), and the company has published the methodology used to establish any scope 3 target. |

X |

| Disclosure Indicator 3.3 |

The target (or, in the absence of a target, the company’s latest disclosed GHG emissions intensity) is aligned with the goal of limiting global warming to 1.5°C. |

X |

Since setting its net zero by 2050 ambition in 2022, Exxon has not expanded its goal

to include scope 3 emissions;4 this means the company has excluded the emissions generated by the use of the products it

sells. Exxon reported at least 690 million tonnes of scope 3 emissions from petroleum product sales in 2021,5 compared with

113 million

tonnes of scope 1 and 2 (“operational”) net GHG emissions on an equity basis,6

so scope 3 emissions accounted for approximately 86% of the company’s total.7

Exxon has set insufficient medium- and short-term emissions reductions targets: By 2030,

the company expects its plans to lower corporate-wide GHG emissions intensity by 20-30 percent and absolute emissions by 20 percent and

to reduce upstream GHG emissions intensity by 40-50 percent and absolute emissions by 30 percent, all from a 2016 baseline.8

Because Exxon's 'expectations' are not considered commitments as defined by the Climate Action 100+

Net-Zero Company Indicators, the company does not satisfy the indicators related to medium- and short-term targets. The medium-term

target covers 95 percent of scope 1 and 2 emissions, but not the most relevant scope 3 emissions, and the company’s short-term target

(up to 2025)9 does not specify if it covers 95 percent of only scope 1 and 2 emissions, or most relevant scope 3 emissions

as well.10 None of the interim targets are aligned to the goal of limiting warming to 1.5°C.11

Capital allocation

| Climate Action 100+ Net Zero Benchmark Indicators |

| Disclosure Indicator 6.1 |

The company is working to decarbonise its capital expenditures. |

X |

| Disclosure Indicator 6.1A |

The company explicitly commits to align its capital expenditure plans with its long-term GHG reduction target OR to phase out planned expenditure in unabated carbon intensive assets or products. |

X |

|

Disclosure Indicator 6.1B

|

The company explicitly commits to align its capital expenditure plans with the Paris Agreement’s objective of limiting global warming to 1.5° C AND to phase out investment in unabated carbon intensive assets or products. |

X |

| Capital Allocation Alignment Assessment (Carbon Tracker) 1: Company’s Recent Actions |

In the most recent full year (2021), were all the company’s upstream oil and gas CAPEX projects consistent with the IEA’s Beyond 2°C Scenario (B2DS)? |

X |

| Capital Allocation Alignment Assessment (Carbon Tracker) 2: Capex Analysis |

What percentage of the company's potential future (2022-2030) unsanctioned oil and gas CAPEX is inconsistent with the IEA's B2DS? |

73% |

| Capital Allocation Alignment Assessment (Carbon Tracker) 4: Net Zero Analysis |

What is the company’s oil and gas production level in the 2030s (against a 2022 baseline) assuming no new oil and gas projects are sanctioned as stated by the IEA's NZE? |

-44% |

According to the Climate Action 100+ Net Zero Company Benchmark, Exxon has met none of

the disclosure indicators for capital allocation.12 In order to fully meet the criteria of those indicators, the company

would need to commit to aligning future capital expenditures with its long-term GHG reduction target(s) and the Paris Agreement’s

objective of limiting global warming to 1.5°C, and disclose the methodology it uses for such alignment.13

In a memo released by the U.S. House Committee on Oversight and Accountability, the committee

states, “Exxon’s plans to invest in lower carbon initiatives over the next six years represent only 10% to 12.5% of its intended

capital investments—meaning that the vast majority of the company’s planned

investments will be for the continued use of fossil fuels.”14

According to Carbon Tracker data provided through the Climate Action 100+ Net Zero Benchmark,

Exxon’s oil and gas production must fall by 44% from its 2022 level to be aligned with the IEA NZE.15 Despite this,

Carbon Tracker finds that 73% of Exxon’s future potential capex between 2022 and 2030 is outside of the IEA’s B2DS (limiting

warming to 1.75°C, net zero by 2060), let alone the NZE.16 Exxon ranked first among U.S oil and gas producers and sixth

among global producers for resources under development in 2022 (with about 40 percent of that in unconventional sources)17,

and ranked eighth amongst global oil and gas producers for exploration capital expenditure between 2020 to 2022.18

Policy influence

| Climate Action 100+ Net Zero Benchmark Indicators |

| Climate Policy Engagement Alignment (InfluenceMap) 1: Organization Score |

The level of company support for (or opposition to) Paris Agreement-aligned climate policy.19 |

47% |

| Climate Policy Engagement Alignment (InfluenceMap) 2: Relationship Score |

The level of a company’s industry associations’ support for (or opposition to) Paris Agreement-aligned climate policy. |

44% |

According to InfluenceMap, the company received a near-failing D grade for its obstructive

policy engagement.20

As of October 2022, the company had not met the requirements of the Climate Action 100+

Net Zero Company Benchmark for climate policy engagement: the company does not have a Paris Agreement- aligned climate lobbying position

and has neither Paris Agreement-aligned lobbying expectations for its trade associations nor a commitment to ensure that the trade associations

to which it belongs lobby in line with the goals of the Paris Agreement.21

In December 2022, the U.S. House Committee on Oversight and Accountability concluded

its investigation on the role of the fossil fuel industry in promoting decades of climate disinformation and preventing meaningful action

on climate change.22 The investigation focused on “ExxonMobil’s role in contributing to climate change and ExxonMobil’s

role in supporting disinformation or misleading the public to prevent action to address this global crisis.”23

In addition to highlighting how limited the company’s climate investment plans

are24, the investigation concluded the following:

| ● | Fossil fuel entities, including Exxon, have misled the public about their

practices by refusing to comply with the committee’s investigation and targeting journalists who expose this noncompliance. Exxon,

for example, “inappropriately redacted responsive documents from its Board of Directors”.25 |

| ● | In 2015, Exxon falsely accused a journalism student and her instructor

of misrepresenting the company and ethical violations. The student’s work used “historic documents and more recent interviews

and statements from current and former Exxon employees, [to show] that Exxon’s work to prepare its facilities for climate change

belied its public statements downplaying or denying climate science”.26 |

Shareholder Proposals Related to Climate

In addition to voting against Directors Woods, Hooley and Avery, shareholders may wish

to support several climate-related shareholder proposals:

| ● | Sisters of St.Francis Charitable Trust filed a proposal (Item 8) requesting

Exxon issue a report analyzing the reliability of its methane emission disclosures and summarize the outcome of efforts to directly measure

methane emissions, using recognized frameworks such as OGMP; and whether those outcomes suggest a need to alter the company’s actions

to achieve its climate targets.27 |

| ● | Follow This filed a proposal (Item 9) asking Exxon to set a medium-term

reduction target GHG emissions of the use of its energy products (scope 3) consistent with the goal of the Paris Agreement: to limit global

warming to well below 2°C above pre-industrial levels and to pursue efforts to limit the temperature increase to 1.5°C.28 |

| ● | Mercy Investment Services filed a proposal (item 10) seeking a report

evaluating the economic, human, and environmental impacts of a worst-case oil spill from Exxon’s operations offshore of Guyana.

The proposal asked that the report clarify the extent of the company’s cleanup response commitments given the potential for severe

impact on Caribbean economies.29 |

| ● | Andrew Behar filed a proposal (Item 11) requesting that Exxon disclose

a recalculated emissions baseline that excludes the aggregated GHG emissions from material asset divestitures occurring since 2016, the

year Exxon uses to baseline its emissions.30 |

| ● | United Steelworkers filed a proposal (Item 16) asking Exxon to create

a report regarding the social impact on workers and communities from closure or energy transition of the company’s facilities, and

alternatives that can be developed to help mitigate the social impact of such closures or energy transitions.31 |

Conclusion: Exxon has failed to set a robust net zero emissions by

2050 target. The company also must align its future capital allocation and policy influence to limit warming to 1.5°C. Therefore,

we recommend that shareholders vote AGAINST Darren W. Woods, (CEO and Chairman), Joseph L. Hooley (Lead Independent Director), Susan K.

Avery, (Chair of the Environment, Safety and Public Policy Committee), all facing re-election at the company’s annual meeting on

May 31, 2023.

1 Exxon,

“Oil and gas supply” (website), https://corporate.exxonmobil.com/what-we-do/energy-supply, accessed May 5, 2023

2 Urgewald, “Global

Oil & Gas Exit List (GOGEL),” (analysis using GOGEL data), https://gogel.org/ Note: Expenditure is a 3-year average from 2020-2022.

3 U.S. Energy Information

Administration, “Total Energy,” (data browser), https://www.eia.gov/totalenergy/data/browser/index.php?tbl=T11.01#/?f=A&start=1973&end=2019&charted=0-1-13,

accessed May 5, 2023

4 Climate Action 100+,

“Exxon Mobil Corp.,” Company Assessment, https://www.climateaction100.org/company/exxon-mobil-corporation, accessed May 5,

2023

5 Exxon, 2023 Advancing

Climate Solutions Progress Report, December 15, 2022, https://corporate.exxonmobil.com/-/media/global/files/advancing-climate-solutions-progress-report/2023/2023-advancing-climate-solutions-progress-report.pdf,

p. 92

6 Exxon, 2023 Advancing

Climate Solutions Progress Report, p. 90

7 Exxon, 2023 Advancing

Climate Solutions Progress Report, p. 90

Note: This proportion was calculated by dividing

scope 3 emissions by the sum of the net GHG scope 1 and 2 emissions (equity basis) and scope 3 estimates from petroleum sales.

8 Exxon, 2023 Advancing

Climate Solutions Progress Report, p. 6, 12

9 Exxon, 2023 Advancing

Climate Solutions Progress Report, p.88

10 Climate Action 100+,

“Exxon Mobil Corp.”

11 Climate Action 100+,

“Exxon Mobil Corp.”

12 Climate Action 100+,

“Exxon Mobil Corp.”

13 Climate Action 100+,

“Exxon Mobil Corp.”

14 Chairwoman Carolyn

B. Maloney and Chairman Ro Khanna, “Re: Investigation of Fossil Fuel Industry Disinformation,” memo to the Committee on Oversight

and Accountability (formerly the “Committee on Oversight and Reform”) December 9, 2022, https://oversightdemocrats.house.gov/sites/democrats.oversight.house.gov/files/2022-12-09.COR_Supplemental_Memo-Fossil_Fuel_Industry_Disinformation.pdf,

p. 4

15 Climate Action 100+,

Climate Action 100+ Net Zero Company Benchmark, Carbon Tracker data, October 2022, https://www.climateaction100.org/wp-content/uploads/2022/12/Downloadable-Excel_CA100-Benchmark_Dec-2022_CAAA-scores-v1.1.xlsx

16 Climate Action 100+,

Climate Action 100+ Net Zero Company Benchmark, Carbon Tracker data, October 2022, https://www.climateaction100.org/wp-content/uploads/2022/12/Downloadable-Excel_CA100-Benchmark_Dec-2022_CAAA-scores-v1.1.xlsx

17 Urgewald, “Global

Oil & Gas Exit List (GOGEL)” Note: The exact figure is 39.9%, based on analysis using GOGEL. Expenditure is a 3-year average

from 2020-2022.

18 Urgewald, “Global

Oil & Gas Exit List (GOGEL)” Note: Expenditure is a 3-year average from 2020-2022.

19 InfluenceMap, “About

Our Scores,” LobbyMap, https://lobbymap.org/page/About-our-Scores, accessed May 5, 2023 Note: According to InfluenceMap’s

methodology “Organisation Score” and “Relationship Score” (expressed as a percentage from 0 to 100) is a measure

of how supportive or obstructive the company’s or its industry associations’ engagement is with climate policy aligned with

the Paris Agreement, with 0% being fully opposed and 100% being fully supportive.

20 InfluenceMap, “ExxonMobil,”

LobbyMap, https://lobbymap.org/company/Exxon-Mobil/projectlink/Exxon-Mobil-In-Climate-Change, accessed May 4, 2023

21 Climate Action 100+,

“Exxon Mobil Corp.”

22 U.S. House Committee

on Oversight and Accountability (formerly the “Committee on Oversight and Reform), “Oversight Committee Releases New Documents

Showing Big Oil’s Greenwashing Campaign and Failure to Reduce Emissions,” (press release), December 9, 2022, https://oversightdemocrats.house.gov/news/press-releases/oversight-committee-releases-new-documents-showing-big-oil-s-greenwashing

23 U.S. House Committee

on Oversight and Accountability (formerly the “Committee on Oversight and Reform), Letter to Mr. Darren Woods, September 16, 2021,

https://oversightdemocrats.house.gov/sites/democrats.oversight.house.gov/files/2021-09-16.CBM%20Khanna%20to%20Woods-ExxonMobil%20re%20Disinformation%20FINAL%20PDF%20v2.pdf

24 Chairwoman Carolyn

B. Maloney and Chairman Ro Khanna, “Re: Investigation of Fossil Fuel Industry Disinformation,” memo to the Committee on Oversight

and Accountability, p. 4

25 Chairwoman Carolyn

B. Maloney and Chairman Ro Khanna, “Re: Investigation of Fossil Fuel Industry Disinformation,” memo to the Committee on Oversight

and Accountability, p. 3

26 Chairwoman Carolyn

B. Maloney and Chairman Ro Khanna, “Re: Investigation of Fossil Fuel Industry Disinformation,” memo to the Committee on Oversight

and Accountability, p. 24

27 Exxon Mobil Corp.,

2023 Proxy Statement, April 13, 2023, https://ir.exxonmobil.com/static-files/602abfaf-40c8-4ffe-9fe9-84b208a06e01, p. 82

28 Exxon Mobil Corp.,

2023 Proxy Statement, p. 87

29 Exxon Mobil Corp.,

2023 Proxy Statement, p. 87

30 Exxon Mobil Corp.,

2023 Proxy Statement, p. 89

31 Exxon Mobil Corp.,

2023 Proxy Statement, p. 100

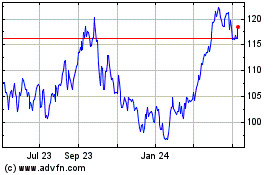

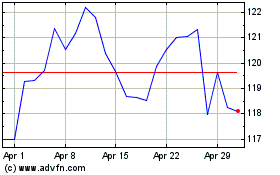

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2023 to Apr 2024