Additional Proxy Soliciting Materials (definitive) (defa14a)

11 May 2023 - 8:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the

Registrant ☒ Filed by a Party other than the

Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☒ |

Definitive Additional Materials |

| ☐ |

Soliciting Material under § 240.14a-12 |

EXXON MOBIL CORPORATION

(Name of Registrant as Specified In Its Charter)

NOT APPLICABLE

(Name of

Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ |

Fee paid previously with preliminary materials |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules

14a-6(i)(1) and 0-11. |

|

|

|

| Exxon Mobil Corporation 5959 Las Colinas

Boulevard Irving, TX 75039-2298 |

|

Jennifer Driscoll Vice President,

Investor Relations |

|

|

|

|

|

|

|

|

|

May 10, 2023 |

Re: Supplemental Information Related to Item 3 -Advisory Vote to Approve Executive Compensation

Dear Investor,

The 2023 Proxy Statement outlines

ExxonMobil’s executive compensation program, which ties compensation to long-term shareholder value creation and success in a lower-emissions future, and 2022 pay decisions.

At time of filing, 2022 data for compensation benchmark companies was not yet available. The following charts, included on page 59 of the CD&A, have been

updated for the most recent 1 - and 10-year time periods. This also updates all other references to ExxonMobil’s rank percentile in the CD&A.

The evolution of pay during 2020 to 2022 demonstrates the strength of the program; highly performance based, tied to business and individual performance, and

resulting in a greater degree of volatility versus compensation programs of benchmark companies.

2022 Total Direct Compensation, as displayed below, is

reflective of exceptional business results across all performance dimensions.

| |

• |

|

80 percent of the increase is tied to strong stock price performance - $110.84 at 2022 grant, up from $62.82

in 2021 - resulting in a high grant value of long-term awards. Performance shares have uniquely long restriction periods, 50% vests in 5 years and 50% in 10 years from grant date with no acceleration at time of retirement. |

| |

• |

|

20 percent of the increase is tied to earnings. ExxonMobil’s bonus program is based on year-over-year

change in earnings; 2022 reflected a year of record earnings - compared to $0 in 2020. |

For reference, 2021 Total Direct Compensation,

as included in the CD&A at time of filing, was at the 4th percentile of compensation benchmark companies and followed 2020 with bonus suspension and low value of long-term award. Three-year

average Total Direct Compensation of $20.4 million and 3-year average Realized Pay at $10.3 million are within historic range.

Combined 10-year Realized and Unrealized Pay normalizes for different award types and restriction periods.

ExxonMobil’s share-denominated approach coupled with long restriction periods defines the risk/reward profile of stock-based performance awards and results in a greater degree of volatility versus programs common among benchmark companies.

As such, while 1-year Total Direct Compensation is at the 100th

percentile of compensation benchmark companies, 10-year Realized and Unrealized Pay is at the 45th percentile, as demonstrated below.

The relative position on 10-year Realized Pay further underscores the impact of long restriction periods, the longest

across all industries. For more information on the design of the long-term incentive program, please refer to page 52 of the CD&A.

|

|

|

| 10-YEAR COMBINED REALIZED AND UNREALIZED PAY |

|

10-YEAR REALIZED PAY |

|

|

|

|

|

| 1-YEAR TOTAL DIRECT COMPENSATION |

|

10-YEAR TOTAL DIRECT COMPENSATION |

|

|

|

Total Direct Compensation is compensation granted during the year, including salary, current year bonus, and the grant date

fair value of equity awards. Realized Pay is compensation actually received by the CEO during the year, excluding any retirement distributions. Unrealized Pay represents the current value – not the grant date value used for reporting in the

Summary Compensation Table – of outstanding unvested cash and stock-based incentive awards as well as the current market value of unexercised “in the money” stock options granted during the years 2013 through 2022. Award values are

based on target levels of formula-based awards and fiscal year-end 2022 stock prices. See page 66 of the CD&A for more detailed definitions of realized and unrealized pay.

Please read this supplemental information together with the more detailed information included in the CD&A, compensation tables, and narrative on pages 45

through 76 of ExxonMobil’s 2023 Proxy Statement before you cast your vote on Management Resolution Item 3 – Advisory Vote to Approve Executive Compensation.

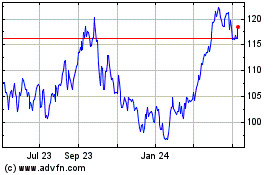

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

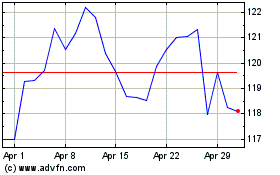

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2023 to Apr 2024