UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2024

Commission File Number: 001-40253

Zhihu Inc.

(Registrant’s Name)

18 Xueqing Road

Haidian District,

Beijing 100083

People’s Republic

of China

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Zhihu Inc. |

| |

|

|

|

| |

By |

: |

/s/ Han Wang |

| |

Name |

: |

Han

Wang |

| |

Title |

: |

Chief

Financial Officer |

Date:

October 18, 2024

Exhibit 99.1

Hong

Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement,

make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising

from or in reliance upon the whole or any part of the contents of this announcement.

This

announcement has been prepared pursuant to, and in order to comply with, the Listing Rules and the Codes, and does not constitute

an invitation or offer to acquire, purchase, or subscribe for securities of the Company nor shall there be any sale, purchase, or subscription

for securities of the Company in any jurisdiction in which such offer, solicitation, or sale would be unlawful absent the filing of a

registration statement or the availability of an applicable exemption from registration or other waiver.

Zhihu Inc.

(A company

controlled through weighted voting rights and incorporated in the Cayman Islands with limited liability)

(NYSE: ZH; HKEX: 2390)

ANNOUNCEMENT

PURSUANT

TO RULE 3.8 OF THE TAKEOVERS CODE

This announcement is made by Zhihu

Inc. (the “Company”) pursuant to Rule 3.8 of The Hong Kong Code on Takeovers and Mergers.

Reference is made to (i) the

offer document issued by the Company in connection with the Non-U. S. Offer in accordance with the Codes on September 9, 2024

(the “Offer Document”); (ii) the announcements of the Company pursuant to Rule 3.8 of the Takeovers Code

published on July 23, 2024, August 1, 2024, August 6, 2024, August 28, 2024, September 2, 2024, September 6,

2024, and September 30, 2024; (iii) the announcement of the Company in relation to the poll results of the EGM published on

October 16, 2024; and (iv) the announcement of the Company in relation to the grant of restricted share units pursuant to the

2022 Plan published on October 18, 2024 (the “Grant Announcement”). Unless otherwise defined herein, capitalized

terms used herein shall have the same meanings as those defined in the Offer Document.

UPDATE ON THE NUMBER OF RELEVANT

SECURITIES OF THE COMPANY

The Board wishes to announce

that on October 18, 2024, 948,507 restricted share units were granted pursuant to the 2022 Plan (details of which are set out in

the Grant Announcement), 33,330 options granted under the 2012 Plan have been cancelled pursuant to the 2012 Plan, 335,130 options granted

under the 2012 Plan have lapsed pursuant to the 2012 Plan, 249 restricted shares granted under the 2012 Plan have been cancelled pursuant

to the 2012 Plan, and 1,021,149 restricted share units granted under the 2022 Plan have been cancelled under pursuant to the 2022 Plan.

In addition, 60,903 Bulk Issuance Shares (as defined below) in the form of ADSs were used to settle the exercise or vesting of awards

granted under the 2012 Plan and the 2022 Plan.

Details of all classes of relevant

securities (as defined in Note 4 to Rule 22 of the Takeovers Code) issued by the Company and the numbers of such securities in issue

as of the date of this announcement are as follows:

| (i) | a total of 294,876,364 Shares issued and outstanding, which comprised 277,482,698

Class A Ordinary Shares and 17,393,666 Class B Ordinary Shares issued and outstanding. This total number of issued and

outstanding Shares excludes the Class A Ordinary Shares issued to the depositary for bulk issuance of ADSs reserved for future

issuances upon the exercise or vesting of awards granted under the 2012 Plan and the 2022 Plan (“Bulk Issuance

Shares”), which amounted to 91,587 Class A Ordinary Shares; |

| (ii) | a total of 1,213,756 outstanding options entitling the holders to acquire an aggregate of 1,213,756 Class A Ordinary Shares under

the 2012 Plan; |

| (iii) | a total of 233,088 outstanding restricted shares entitling the holders to acquire an aggregate of 233,088 Class A Ordinary Shares

under the 2012 Plan; and |

| (iv) | a total of 16,654,940 outstanding restricted share units entitling the holders to acquire an aggregate of 16,654,940 Class A

Ordinary Shares under the 2022 Plan. |

As of the date of this announcement,

save as disclosed above, the Company has no other outstanding options, derivatives, warrants, or securities which are convertible or exchangeable

into Shares and the Company has no other relevant securities (as defined in Note 4 to Rule 22 of the Takeovers Code).

DEALING DISCLOSURE

The associates (as defined in

Note 4 to Rule 22 of the Takeovers Code) of the Company are hereby reminded to disclose their dealings in the relevant securities

(as defined in Note 4 to Rule 22 of the Takeovers Code) of the Company under Rule 22 of the Takeovers Code during the Offer

Period.

In accordance with Rule 3.8

of the Takeovers Code, reproduced below is the full text of Note 11 to Rule 22 of the Takeovers Code:

“Responsibilities

of stockbrokers, banks and other intermediaries

Stockbrokers,

banks and others who deal in relevant securities on behalf of clients have a general duty to ensure, so far as they are able, that those

clients are aware of the disclosure obligations attaching to associates of an offeror or the offeree company and other persons under Rule 22

and that those clients are willing to comply with them. Principal traders and dealers who deal directly with investors should, in appropriate

cases, likewise draw attention to the relevant Rules. However, this does not apply when the total value of dealings (excluding stamp duty

and commission) in any relevant security undertaken for a client during any 7 day period is less than $1 million.

This

dispensation does not alter the obligation of principals, associates and other persons themselves to initiate disclosure of their own

dealings, whatever total value is involved.

Intermediaries

are expected to co-operate with the Executive in its dealings enquiries. Therefore, those who deal in relevant securities should appreciate

that stockbrokers and other intermediaries will supply the Executive with relevant information as to those dealings, including identities

of clients, as part of that co-operation.”

WARNING: Shareholders, ADS

holders, and/or potential investors of the Company should therefore exercise caution when dealing in the securities of the Company. Persons

who are in doubt as to the action they should take should consult their licensed securities dealers or registered institutions in securities,

bank managers, solicitors, professional accountants, or other professional advisers.

| |

By order of the board |

| |

Zhihu Inc. |

| |

Yuan Zhou |

| |

Chairman |

Hong Kong, October 18, 2024

As

of the date of this announcement, the board of Directors comprises Mr. Yuan Zhou as an executive Director, Mr. Dahai Li, Mr. Zhaohui

Li, and Mr. Bing Yu as non-executive Directors, and Mr. Hanhui Sam Sun, Ms. Hope Ni, and Mr. Derek Chen as independent

non-executive Directors.

The

Directors jointly and severally accept full responsibility for the accuracy of the information contained in this announcement and confirm,

having made all reasonable enquiries, that to the best of their knowledge, opinions expressed in this announcement have been arrived at

after due and careful consideration and there are no other facts not contained in this announcement, the omission of which would make

any statement in this announcement misleading.

Exhibit 99.2

Hong

Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement,

make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising

from or in reliance upon the whole or any part of the contents of this announcement.

Zhihu

Inc.

(A

company controlled through weighted voting rights and incorporated in the Cayman Islands with limited liability)

(NYSE:

ZH; HKEX: 2390)

GRANT

OF RESTRICTED SHARE UNITS

PURSUANT

TO THE 2022 SHARE INCENTIVE PLAN

On

October 18, 2024, the Company granted an aggregate of 948,507 RSUs to certain eligible participants pursuant to the 2022 Share Incentive

Plan, subject to acceptances of the Grantees as well as the terms and conditions of the 2022 Share Incentive Plan.

On

October 18, 2024, the Company granted an aggregate of 948,507 RSUs to certain eligible participants pursuant to the 2022 Share Incentive

Plan, representing the same number of Class A Ordinary Shares and approximately 0.32% of the total Shares (on a one share one vote

basis) in issue (excluding treasury shares) as at the date of this announcement.

Details of the Grants

The details of the RSUs

granted to the Grantees are as follows:

| Date

of the Grants: |

|

October 18,

2024 |

| |

|

|

| Grantees: |

|

8

employees of the Group, who are eligible participants pursuant to the 2022 Share Incentive Plan |

| |

|

|

| Aggregate

number of RSUs granted: |

|

948,507

RSUs |

| |

|

|

| Purchase

price of the RSUs granted: |

|

US$0.01

per Class A Ordinary Share |

| |

|

|

| Market

price of the Class A Ordinary Shares on the date of the Grants: |

|

HK

$9.25 per Share, for Class A Ordinary Shares traded on the Stock Exchange on October 18, 2024. |

| |

|

|

| |

|

US$3.47

per ADS, for ADSs traded on the New York Stock Exchange on October 17, 2024 (U.S. Eastern Time), being the trading day on the New

York Stock Exchange immediately preceding the date of the Grants. |

| Vesting

period: |

|

As

permitted under the 2022 Share Incentive Plan, the RSUs granted to each of such

employees have a mixed vesting schedule with a total vesting period (i.e. the period between the date of the Grants and the last

vesting date) of 48 months, where the RSUs shall vest by several batches with certain RSUs to be vested within 12 months of the date

of the Grant and the last batch to vest after 12 months of the date of the Grant. |

| |

|

|

| Performance

target: |

|

The

vesting of the RSUs to the Grantees is subject to the achievement of performance

targets. |

| |

|

|

| |

|

The

Company has in place a standardize performance appraisal system to comprehensively evaluate the performance and the contribution

of the Grantees based on a matrix of indicators that vary according to the roles and responsibilities of the Grantees. In the event

of a non-satisfactory rating in the annual performance review, the portion of the RSUs to become vested in such year to the Grantee

shall be void and forfeited. |

| |

|

|

| Clawback

mechanism: |

|

Pursuant

to the terms of the 2022 Share Incentive Plan and the RSU award agreements, if

a Grantee’s termination of service is by reason of cause set out in the 2022 Share Incentive Plan or of misconduct events listed

in the RSU award agreements, the Grantee’s right to the RSUs shall terminate concurrently with the termination of employment

and all unvested RSUs shall immediately become void. In the event of termination of employment however occasioned, the Grantee’s

right to unvested RSUs shall terminate and such RSUs shall be forfeited. |

| |

|

|

Arrangements

for the Group to provide financial assistance to a Grantee to facilitate the purchase

of Shares in relation to such RSUs:

|

|

None

|

REASONS FOR AND BENEFITS OF THE GRANT

The

purpose of the Grants is to (i) promote the success and enhance the value of the Company by linking the personal interests of the

Grantees to those of the Company’s Shareholders and by providing such individuals with an incentive for outstanding performance

to generate superior returns to the Company’s Shareholders, and (ii) provide flexibility to the Company in its ability to

motivate, attract, and retain the services of the Grantees upon whose judgment, interest, and special effort the successful conduct of

the Company’s operation is largely dependent.

To

the best of the Directors’ knowledge, information and belief having made all reasonable enquiries, as at the date of this announcement,

none of the Grantees is (i) a Director, a chief executive, a substantial Shareholder, or an associate of any of them; (ii) a

participant with options and awards granted and to be granted exceeding the 1% individual limit under Rule 17.03D of the Listing

Rules; or (iii) a related entity participant or service provider with options and awards granted and to be granted exceeding 0.1%

of the total issued Shares (excluding treasury shares) in any 12-month period up to and including the date of the Grant. None of the

Grants will be subject to approval by the Shareholders. As of the date of this announcement, the Company did not hold any treasury shares.

NUMBER OF SHARES

AVAILABLE FOR FUTURE GRANT

As

at the date of this announcement and following the above Grants, the number of Class A Ordinary Shares available for future grant

of RSUs under the 2022 Share Incentive Plan was 9,773,325, and the number of Class A Ordinary Shares available for future grant

of options under the 2022 Share Incentive Plan was 13,042,731.

The

2022 Share Incentive Plan was adopted before the amendments to Chapter 17 of the Listing Rules effective on January 1, 2023.

The Company will continue to comply with Chapter 17 (as amended) of the Listing Rules to the extent required by the transitional

arrangements for the 2022 Share Incentive Plan.

DEFINITIONS

In

this announcement, unless the context otherwise requires, the following expressions shall have the following meanings:

| “2022

Share Incentive Plan” |

the

share incentive plan which is a ten-year incentive plan conditionally approved

and adopted by our Company on March 30, 2022 |

| |

|

| “ADS(s)” |

American

Depositary Share(s), each American Depositary Share representing three Class A Ordinary Shares |

| |

|

| “Board” |

the

board of Directors |

| |

|

| “Class A

Ordinary Share(s) |

class

A ordinary share(s) in the share capital of the Company with a par value

of US$0.000125 each, conferring a holder of a class A ordinary share one vote per Share on any resolution tabled at the Company’s

general meeting |

| |

|

| “Class B

Ordinary Share(s)” |

class

B ordinary share(s) of the share capital of the Company with a par value

of US$0.000125 each, conferring weighted voting rights in the Company such that a holder of a class B ordinary share is entitled

to ten votes per Share on any resolution tabled at the Company’s general meeting, save for resolutions with respect to any

Reserved Matters, in which case they shall be entitled to one vote per Share |

| “Company” |

Zhihu

Inc. (“知乎”, formerly known as “Zhihu Technology

Limited”), a company with limited liability incorporated in the Cayman Islands on May 17, 2011 |

| |

|

| “Director(s)” |

the

director(s) of the Company |

| |

|

| “Grant(s)” |

the

grant(s) of 948,507 RSUs to the Grantees pursuant to the 2022 Share Incentive Plan on October 18, 2024 |

| |

|

| “Grantee(s)” |

8

employees of the Group, who are eligible participants under the 2022 Share Incentive

Plan and were granted RSUs under the 2022 Share Incentive Plan on October 18, 2024 |

| |

|

| “Group” |

the

Company, its subsidiaries and its consolidated affiliated entities from time to time |

| |

|

| “HK$” |

Hong

Kong dollars, the lawful currency of Hong Kong |

| |

|

| “Hong

Kong” |

the

Hong Kong Special Administrative Region of the People’s Republic of China |

| |

|

| “Listing

Rules” |

the

Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited |

| |

|

| “Reserved

Matters” |

those

matters resolutions with respect to which each Share is entitled to one vote

at general meetings of the Company pursuant to the articles of association of the Company (as amended from time to time), being:

(i) any amendment to the memorandum of association or articles of association of the Company, including the variation of the

rights attached to any class of shares, (ii) the appointment, election or removal of any independent non- executive Director,

(iii) the appointment or removal of the Company’s auditors, and (iv) the voluntary liquidation or winding-up of the

Company |

| |

|

| “RSU(s)” |

restricted

share unit(s) |

| |

|

| “Share(s)” |

the

Class A Ordinary Share(s) and the Class B Ordinary Share(s) in the share capital of the Company, as the context

so requires |

| |

|

| “Shareholder(s)” |

holder(s) of

the Share(s) |

| |

|

| “Stock

Exchange” |

The

Stock Exchange of Hong Kong Limited |

| |

|

| “subsidiary(ies)” |

has

the meaning ascribed to it under the Listing Rules |

| “substantial

shareholder(s)” |

has

the meaning ascribed to it under the Listing Rules |

| |

|

| “treasury

shares” |

has

the meaning ascribed to it under the Listing Rules |

| |

|

| “weighted

voting right” |

has

the meaning ascribed to it under the Listing Rules |

| |

|

| “%” |

percent |

| |

By Order of the Board |

| |

Zhihu Inc. |

| |

Yuan Zhou |

| |

Chairman |

Hong

Kong, October 18, 2024

As

of the date of this announcement, the Board comprises Mr. Yuan Zhou as an executive director, Mr. Dahai Li, Mr. Zhaohui

Li and Mr. Bing Yu as non-executive directors and Mr. Hanhui Sam Sun, Ms. Hope Ni and Mr. Derek Chen as independent

non-executive directors.

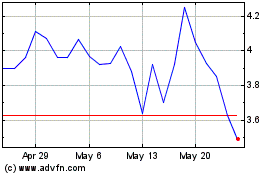

Zhihu (NYSE:ZH)

Historical Stock Chart

From Oct 2024 to Nov 2024

Zhihu (NYSE:ZH)

Historical Stock Chart

From Nov 2023 to Nov 2024