Aptose Biosciences Inc. (NASDAQ:APTO) (TSX:APS), a clinical-stage

company developing highly differentiated therapeutics that target

the underlying mechanisms of cancer, today announced financial

results for the three months and fiscal year ended December 31,

2016 and reported on corporate developments. Unless specified

otherwise, all amounts are in Canadian dollars.

The net loss for the year ended December 31,

2016 was $18.6 million ($1.46 per share) compared with $14.6

million ($1.23 per share) in the year ended December 31, 2015.

Total cash and cash equivalents and investments as of December 31,

2016 were $10.7 million (or $7.9 million US Dollars).

“We began 2017 by reviewing our corporate

strategy and refocusing our resources on CG’806, an oral

first-in-class pan-FLT3/BTK inhibitor we are developing for

patients with FLT3-driven AML and certain B-cell malignancies,”

said William G. Rice, Ph.D., Chairman, President and Chief

Executive Officer. “Preclinical studies with CG‘806 have

demonstrated a unique activity profile which warranted the

prioritization of resources toward advancing its development. We

look forward to reporting on our progress with this

molecule.”

Corporate Highlights

- In January 2017, Aptose announced the prioritization of its

resources toward the development of CG’806, an oral preclinical

compound being developed for patients with FLT3-driven acute

myeloid leukemia (AML) and certain BTK-driven B-cell

malignancies.

- In June 2016, Aptose entered into an exclusive global option

and license agreement with CrystalGenomics, Inc. of South Korea,

focused on the development of CG’806. Aptose is currently

conducting Investigational New Drug (IND) enabling studies, and, if

it exercises its option under the agreement, expects to initiate a

Phase 1 clinical trial in early 2018. The potential option exercise

would likely occur prior to submission of an IND application in the

U.S. Upon exercise of the option, Aptose would own global

rights to develop and commercialize the program outside of Korea

and China.

- Compelling preclinical data have established CG’806 as a potent

and well-differentiated pan-FLT3 inhibitor for AML and a

non-covalent inhibitor of BTK and other oncogenic kinases that

drive certain B-cell derived cancer cells. The compound has

demonstrated tumor elimination in the absence of toxicity in AML

xenograft models.

- Aptose recently developed a new synthetic route to synthesize

greater amounts of CG’806, and is using that route to prepare drug

substance for various preclinical and animal model studies, and for

development of an improved oral formulation. The compound is being

developed as a once-daily oral therapeutic.

- The company has submitted research abstracts to present CG’806

data at the upcoming AACR-Hematologic Malignancies Meeting in May

2017.

- Aptose temporarily delayed clinical activities with APTO-253, a

phase 1 stage compound for AML, in an effort to define the root

cause of recent manufacturing setbacks related to the intravenous

formulation, and to restore the molecule to a state supporting

clinical development and potential partnering. Aptose remains

hopeful in the viability of APTO-253, which effectively inhibits

expression of the c-Myc oncogene, as a potential treatment for

AML.

Financial Results

THREE MONTHS ENDED DECEMBER 31, 2016 AND 2015

(UNAUDITED)

|

(Amounts in 000’s except for per common share data) |

|

Dec 31, 2016 |

|

|

Dec 31, 2015 |

|

| Revenue |

|

$

― |

|

|

$

― |

|

| Research and

development expense |

|

2,550 |

|

|

2,340 |

|

| General

and administrative expense |

|

1,461 |

|

|

2,364 |

|

| Operating

expenses |

|

4,011 |

|

|

4,794 |

|

| Finance expense |

|

− |

|

|

− |

|

| Finance

income |

|

(85 |

) |

|

(273 |

) |

| Net

financing income |

|

(85 |

) |

|

(273 |

) |

|

Net loss |

|

3,926 |

|

|

(4,431 |

) |

|

Basic and diluted net loss per share |

|

$ (0.26 |

) |

|

$ (0.38 |

) |

| |

|

|

|

|

|

|

Aptose’s net loss for the three months ended

December 31, 2016 was $3.9 million ($0.26 per share) compared with

$4.4 million ($0.38 per share) in the same period in the prior

year.

Research and development costs increased to $2.6

million in the three months ended December 31, 2016 compared with

$2.3 million for the three months ended December 2015. Aptose

incurred higher costs for formulation studies and manufacturing

costs for the APTO-253 product in the three months ended December

31, 2016 than in the comparable period, and these were offset by

lower expenses for the contract research organization costs to

manage the study. In addition, in the current period Aptose was

conducting studies related to its CG’806 program following the

licensing of the technology in June 2016.

General and administrative expenses decreased to

$1.5 million in the three months ended December 31, 2016 compared

with $2.4 million in the three months ended December 31, 2015. The

decrease, despite the increased cost of Aptose’s US dollar

expenditures due to the devaluation of the Canadian dollar, is

related to lower stock option compensation and lower consulting

fees related to projects that were active and completed in the

fourth quarter in 2015.

FULL YEAR RESULTS

|

|

|

|

|

|

|

|

|

|

|

Year ended |

|

|

Year

ended |

|

| (amounts in 000's of

Canadian Dollars except for per common share data) |

|

Dec. 31, 2016 |

|

|

Dec.

31, 2015 |

|

|

REVENUE |

|

$ |

- |

|

|

$ |

- |

|

|

EXPENSES |

|

|

|

| Research and

development |

|

|

10,322 |

|

|

|

6,254 |

|

| General

and administrative |

|

|

8,344 |

|

|

|

9,845 |

|

| Operating

expenses |

|

|

18,666 |

|

|

|

16,099 |

|

| Finance expense |

|

|

66 |

|

|

|

43 |

|

| Finance

income |

|

|

(105 |

) |

|

|

(1,556 |

) |

|

Net financing (income) expense |

|

|

(39 |

) |

|

|

(1,473 |

) |

|

Net loss and comprehensive loss for the

period |

|

|

18,627 |

|

|

|

14,626 |

|

|

Basic and diluted loss per common share |

|

$ |

1.46 |

|

|

$ |

1.23 |

|

|

|

|

|

|

| Weighted

average number of common shares |

|

|

12,743 |

|

|

|

11,906 |

|

| |

|

|

|

|

|

|

|

|

RESEARCH AND DEVELOPMENT

Research and development expenses totaled $10.3 million in the

year ended December 31, 2016 compared with $6.3 million in the year

ended December 31, 2015. Research and development costs consist of

the following:

|

|

|

Year ended December 31, 2016 |

|

|

Year ended December 31, 2015 |

|

|

|

|

|

|

|

|

|

Research and Development excluding salaries |

|

$ |

6,442 |

|

$ |

4,046 |

|

CrystalGenomics Option Fee |

|

|

1,294 |

|

|

- |

|

Salaries |

|

|

2,246 |

|

|

1,969 |

|

Stock-based compensation |

|

|

293 |

|

|

210 |

|

Depreciation of equipment |

|

|

47 |

|

|

29 |

|

|

|

$ |

10,322 |

|

$ |

6,254 |

| |

|

|

|

|

|

|

Expenditures for the year ended December 31,

2016 increased significantly over the year ended December 31, 2015

due to the following reasons:

- Research and development activities related to the option fee

for CG’806;

- Costs associated with the LALS/Moffitt collaboration developing

epigenetic single molecule inhibitors of multiple targets,

including the BET proteins, and other kinases for which no

comparable expenses existed in the prior year periods;

- Increased research and clinical operations headcount and

related costs;

- Formulation and manufacturing costs associated with APTO-253

and the root cause analysis of the filter clogging identified in

November 2015; and

- Increased Contract Research Organization costs related to

consultants and advisors as we worked towards returning APTO-253 to

the clinic.

During the year ended December 31, 2016, Aptose

paid US$1.0 million ($1.294 million) to CrystalGenomics for an

option fee related to the CG’806 technology. Should Aptose elect to

exercise the option prior to filing of an IND application with the

FDA, we would pay an additional US$2.0 million in cash or

combination of cash and common shares, and would receive full

development and commercial rights for the program in all

territories outside of Korea and China. No comparable expense

existed in the same period in the prior year.

GENERAL AND ADMINISTRATIVE

General and administrative expenses totaled $8.3

million in the year ended December 31, 2016 compared to $9.8

million in the year ended December 31, 2015. General and

administrative expenses consisted of the following:

|

|

|

Year ended December 31, 2016 |

|

|

Year ended December 31, 2015 |

|

|

|

|

|

|

|

|

|

General and administrative excluding salaries |

|

$ |

3,412 |

|

$ |

4,317 |

|

Salaries |

|

|

3,095 |

|

|

2,859 |

|

Stock-based compensation |

|

|

1,730 |

|

|

2,602 |

|

Depreciation of equipment |

|

|

107 |

|

|

67 |

|

|

|

$ |

8,344 |

|

$ |

9,845 |

| |

|

|

|

|

|

|

General and administrative expenses excluding

salaries, decreased in the year ended December 31, 2016 compared

with the year ended December 31, 2015. The decrease is the result

of lower travel, consulting and legal costs in the current year

related to transactions completed in the prior year as well as

lower press release and filing costs associated with a lower cost

service provider in the current year periods.

Salary charges in the year ended December 31,

2016 increased in comparison with the year ended December 31, 2015

due to additional headcount in the first half of 2016 compared with

the first half of 2015 as well as a higher average CA/US exchange

rate which increased the cost of Aptose’s US denominated salaries

in the first six months of 2016 in comparison with the prior year,

and higher bonus expenses recognized in the current period.

Stock-based compensation decreased in the year

ended December 31, 2016 compared with the year ended December 31,

2015 due to large option grants in April, June and July 2014 which

vested 50% during the first year and therefore contribute to higher

stock-based compensation expense during the first twelve month

period captured in the prior year period.

FINANCE INCOME

Finance income totaled $105 thousand in the year

ended December 31, 2016 compared to $1.5 million in the year ended

December 31, 2015.

Interest income represents interest earned on

Aptose’s cash and cash equivalent and investment balances.

Foreign exchange gains are the result of an increase in the value

of US dollar denominated cash and cash equivalents balances during

such periods due to a depreciation of the Canadian dollar compared

to the US dollar.

About AptoseAptose Biosciences

is a clinical-stage biotechnology company committed to developing

personalized therapies addressing unmet medical needs in oncology.

Aptose is advancing new therapeutics focused on novel cellular

targets on the leading edge of cancer. The company's small molecule

cancer therapeutics pipeline includes products designed to provide

single agent efficacy and to enhance the efficacy of other

anti-cancer therapies and regimens without overlapping toxicities.

For further information, please visit www.aptose.com.

Forward Looking Statements

This press release contains forward-looking

statements within the meaning of Canadian and U.S. securities laws,

including, but not limited to, statements relating to the focus of

resources on CG’806, the potential exercise of option to acquire

the rights on CG’806, the timing for the commencement of clinical

trials, the clinical potential and favorable properties of CG’806,

the clinical potential of APTO-253 and statements relating to the

company’s plans, objectives, expectations and intentions and other

statements including words such as “continue”, “expect”, “intend”,

“will”, “should”, “would”, “may”, and other similar expressions.

Such statements reflect our current views with respect to future

events and are subject to risks and uncertainties and are

necessarily based upon a number of estimates and assumptions that,

while considered reasonable by us are inherently subject to

significant business, economic, competitive, political and social

uncertainties and contingencies. Many factors could cause our

actual results, performance or achievements to be materially

different from any future results, performance or achievements

described in this press release. Such factors could include, among

others: our ability to obtain the capital required for research and

operations; the inherent risks in early stage drug development

including demonstrating efficacy; development time/cost and the

regulatory approval process; the progress of our clinical trials;

our ability to find and enter into agreements with potential

partners; our ability to attract and retain key personnel; changing

market and economic conditions; inability of new manufacturers to

produce acceptable batches of GMP in sufficient quantities;

unexpected manufacturing defects; and other risks detailed from

time-to-time in our ongoing quarterly filings, annual information

forms, annual reports and annual filings with Canadian securities

regulators and the United States Securities and Exchange

Commission.

Should one or more of these risks or

uncertainties materialize, or should the assumptions set out in the

section entitled "Risk Factors" in our filings with Canadian

securities regulators and the United States Securities and Exchange

Commission underlying those forward-looking statements prove

incorrect, actual results may vary materially from those described

herein. These forward-looking statements are made as of the date of

this press release and we do not intend, and do not assume any

obligation, to update these forward-looking statements, except as

required by law. We cannot assure you that such statements will

prove to be accurate as actual results and future events could

differ materially from those anticipated in such statements.

Investors are cautioned that forward-looking statements are not

guarantees of future performance and accordingly investors are

cautioned not to put undue reliance on forward-looking statements

due to the inherent uncertainty therein.

For further information, please contact:

Aptose Biosciences

Greg Chow, CFO

647-479-9828

gchow@aptose.com

SMP Communications

Susan Pietropaolo

201-923-2049

susan@smpcommunications.com

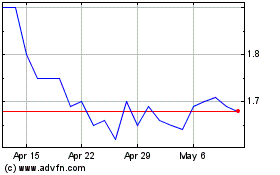

Aptose Biosciences (TSX:APS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Aptose Biosciences (TSX:APS)

Historical Stock Chart

From Nov 2023 to Nov 2024