Crescendo Partners, a Large Shareholder of Canaccord Genuity Issues Open Letter to Canaccord Special Committee Chair

11 March 2023 - 7:54AM

Crescendo Partners, a New York City based investment firm that

beneficially owns a sizable position in the common stock of

Canaccord Genuity Group, Inc.,(TSX: CF), today, issued an open

letter to Canaccord’s Chair of the Special Committee, Jill Denham,

regarding the proposal to take the company private.

The full text of the letter follows:

Crescendo Partners777 3rdAvenue37thFloorNew York,

NY 10017(212)-319-7676

March 10th, 2023

Ms. Jill Denham Chair of the Special Committee

Canaccord Genuity 609 Granville Street Suite 2200 Vancouver, Canada

V7Y 1H2

Dear Jill,

Crescendo Partners and its affiliates

(“Crescendo”) are large shareholders of Canaccord Genuity

(“Canaccord” or “the Company”). I write to you to address the

current untenable position in which the Special Committee and

Canaccord now find themselves. My viewpoint is informed by my

recent experience of being a board member of Canaccord and by my

extensive experience in the capital markets in Canada and the

United States.

I believe Canaccord is not well suited to continue

being a public company. Despite efforts over the last 15 years to

lessen the cyclicality of the business, no long-term shareholder

value has been created. The ideal time to have sold the company was

at the peak of the last cycle, but the rest of the board rejected

exploring that path when I had proposed it.

Now the shareholders are being offered a very

substantial premium to the trading price of the stock over the last

several months. I believe there is an immediate opportunity for the

Special Committee and the Management Group proposing to buy the

Company to reach an agreement on an improved price.

The Management Group’s position that they are only

buyers and not sellers make it virtually impossible for any other

buyer to purchase such a people intensive business. You have hired

Barclays to explore the sale of Canaccord or parts of the Company.

In my opinion, simply selling a part of the business is unlikely to

create a significant premium to the current trading price of the

stock.

On Tuesday, Skky Capital Corporation Limited

(“Skky”), requisitioned a shareholder meeting to remove the members

of the Special Committee and add two new directors. So now the

Management Group, with its takeover bid and through the actions of

Skky, and the Special Committee, each has a threat of

drastic action on the table. You’ll probably be able to postpone

the shareholder meeting until July, resulting in this mess

continuing for the next four months and causing untold damage to

Canaccord and its business. In order to avoid this scenario, I

strongly suggest that the Special Committee reach an agreement with

the Management Group in the near term on an improved bid. I would

expect that if both of you are creative and flexible, a price in

excess of $11.25 is achievable.

If an agreement is not reached and the Special

Committee ends up causing there to be no transaction, Crescendo

intends to support the new slate at the requisitioned meeting.

Yours truly,

Eric Rosenfeld

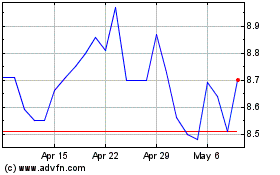

Canaccord Genuity (TSX:CF)

Historical Stock Chart

From Mar 2024 to Apr 2024

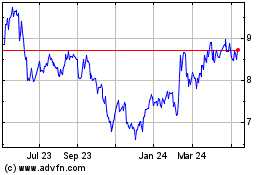

Canaccord Genuity (TSX:CF)

Historical Stock Chart

From Apr 2023 to Apr 2024