Enbridge Plans C$3.3 Billion in Investments, Targets Earnings Growth

02 March 2023 - 12:18AM

Dow Jones News

By Robb M. Stewart

Enbridge Inc. plans more than 3 billion Canadian dollars (US$2.2

billion) in fresh investments and acquisitions to strengthen its

energy infrastructure and help drive earnings growth in the coming

years.

Ahead of a meeting with investors, the multinational pipeline

and energy company said it would make C$3.3 billion in investments

that would grow its backlog to C$17 billion across each of its

business areas and 15 projects.

The secured capital program would help drive projected per-share

earnings growth at an average annual rate of 4% to 6% over the 2022

to 2025 planning period, with expected growth of about 5% after

that, the Calgary, Alberta, company said.

The proposed investment includes adding C$2.4 billion of new gas

transmission modernization and utility capital to Enbridge's

secured capital program, the company said.

Greg Ebel, Enbridge's president and chief executive, said the

company's financial position has never been stronger and Enbridge

expects to continue to have about C$6 billion of annual investment

capacity, the majority of which will be targeted toward

utility-like investments within the four core businesses. He said

the company would maintain the flexibility for other activities,

such as "tuck-in" acquisitions and returning additional capital to

shareholders.

Enbridge said it is negotiations with shippers for incremental

contract capacity on the Flanagan South Pipeline system.

The company said it will proceed with the construction of the

Enbridge Houston Oil Terminal for an initial capital cost of C$240

million. The terminal, located adjacent to the terminus of the

Seaway Pipeline, will provide shippers with a storage terminal

primarily focused on heavy crude.

As well, Enbridge said it has entered into a definitive

agreement with Brookfield Infrastructure Partners and Crestwood

Equity Partners LP to buy Tres Palacios Holdings LLC for US$335

million. Tres Palacios is located in the U.S. Gulf Coast region and

its natural gas infrastructure serves Texas gas-fired power

generation and increasing liquefied natural gas exports, as well as

growing need in Mexico.

Enbridge said it also is acquiring a 10% stake in Divert Inc., a

food-waste management company expanding into renewable natural gas

to help food retailers manage waste more sustainably, for US$80

million. The agreement includes further investment opportunities to

develop wasted-food-to-RNG projects across the U.S., it said.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

March 01, 2023 08:03 ET (13:03 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

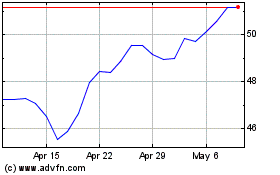

Enbridge (TSX:ENB)

Historical Stock Chart

From Mar 2024 to Apr 2024

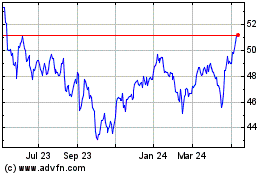

Enbridge (TSX:ENB)

Historical Stock Chart

From Apr 2023 to Apr 2024