Euro Sun Announces Closing of Second Tranche of Private Placement

15 December 2022 - 9:00AM

Euro Sun Mining Inc. (TSX: ESM) (“Euro Sun” or the

“Company”) is pleased to announce that it has closed the second

tranche (the “

Second Tranche”) of its previously

announced non-brokered private placement financing (the

“

Offering”). An aggregate of 2,500,000 common

shares (the “

Common Shares”) were sold under the

Second Tranche at a price of C$0.05 per Common Share for aggregate

gross proceeds of approximately C$125,000.

Euro Sun intends to use the proceeds of the

Offering for general corporate purposes. All securities issued in

connection with the Offering are subject to a statutory hold period

of four-months and one day.

The Offering and the closing of the Second

Tranche are subject to certain conditions including, but not

limited to, the receipt of all necessary approvals including the

approval of the Toronto Stock Exchange and the securities

regulatory authorities. No finders’ fees were paid in connection

with the Offering.

Further information:

For further information about Euro Sun Mining,

or the contents of this press release, please contact Investor

Relations at info@eurosunmining.com.

Caution regarding forward-looking

information:

This news release contains "forward-looking

information" within the meaning of applicable Canadian securities

legislation. Generally, but not always, forward-looking information

and statements can be identified by the use of words such as

"plans", "expects", "is expected", "budget", "scheduled",

"estimates", "forecasts", "intends", "anticipates", or "believes"

or the negative connotation thereof or variations of such words and

phrases or state that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be

achieved" or the negative connotation thereof. In particular, this

news release contains forward-looking information pertaining to the

following: the ability of the directors to call and hold the

Meeting, the receipt of shareholder approval for the items of

business at the Meeting, the anticipated date of the Meeting, the

ability to obtain the necessary regulatory authority and approvals

in connection with the Waiver Agreement and the Meeting; and

satisfaction of the conditions of Lind for the waiver of certain

and possible events of default under the CFSA’s and the ability of

the Corporation to not have events of default under the CFA’s when

the waiver expires.

In making the forward-looking information in

this release, Euro Sun has applied certain factors and assumptions

that are based on Euro Sun’s current beliefs as well as assumptions

made by and information currently available to Euro Sun. Although

Euro Sun considers these assumptions to be reasonable based on

information currently available to it, they may prove to be

incorrect, and the forward-looking information in this release are

subject to numerous risks, uncertainties and other factors that may

cause future results to differ materially from those expressed or

implied in such forward-looking information. Such factors include,

among others: the inability to obtain the necessary regulatory

approval of the Toronto Stock Exchange in connection with the

Offering, the Meeting and Waiver Agreement; the occurrence of a

material adverse change, disaster, change of law or other failure

to satisfy the conditions to the Waiver Agreement; the inability of

the Company to apply the use of proceeds from the Offering as

anticipated; the inability to satisfy the conditions to the waiver

by Lind of certain and possible events of default under the CFSA’s;

the existence of an event of default under the CFSA’s after expiry

of the waiver and the inability to obtain a further waiver from

Lind in respect of such events of default under the CSFAs; the

ability of the Company to achieve its corporate objectives or

otherwise advance the progress of Euro Sun; risks related to

management changes including the recruitment and retention of

individuals with the necessary skills and experience; risks related

to the international operations; the timing and content of work

programs; results of exploration activities of mineral properties;

the interpretation of drilling results and other geological data;

the Company's inability to obtain any necessary permits, consents

or authorizations required for its activities; an inability to

predict and counteract the effects of COVID-19 on the business of

the Company, including but not limited to the effects of COVID-19

on the price of commodities, capital market conditions, restriction

on labour and international travel and supply chains; general

market and industry conditions; and those risks set out in the

Company’s public documents filed on SEDAR.

Readers are cautioned not to place undue

reliance on forward-looking information. Euro Sun does not intend,

and expressly disclaims any intention or obligation to, update or

revise any forward-looking information whether as a result of new

information, future events or otherwise, except as required by

law.

The TSX does not accept responsibility for the

adequacy or accuracy of this news release.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

in the United States. The securities have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the “U.S. Securities Act”), or any state securities laws

and may not be offered or sold within the United States or to, or

for the account or benefit of U.S. persons (as defined in

Regulation S under the 1933 Act) absent such registration or an

applicable exemption from such registration requirements.

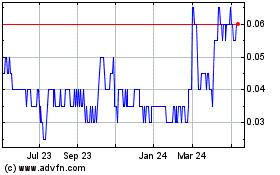

Euro Sun Mining (TSX:ESM)

Historical Stock Chart

From Mar 2024 to Apr 2024

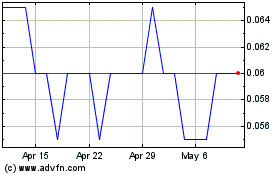

Euro Sun Mining (TSX:ESM)

Historical Stock Chart

From Apr 2023 to Apr 2024